Venture City

-

DATABASE (487)

-

ARTICLES (346)

Founded in 1996, Index Ventures is a venture capital firm based in London, Jersey, Geneva and San Francisco. It has 35,000 employees worldwide working to manage a portfolio of 160 companies across 24 countries.

Founded in 1996, Index Ventures is a venture capital firm based in London, Jersey, Geneva and San Francisco. It has 35,000 employees worldwide working to manage a portfolio of 160 companies across 24 countries.

Established as a venture capital firm in 2014, Ultrabuttonwood Capital has invested in over 50 startups in diverse sectors like entertainment, education, fintech, telecommunications, big data and artificial intelligence.

Established as a venture capital firm in 2014, Ultrabuttonwood Capital has invested in over 50 startups in diverse sectors like entertainment, education, fintech, telecommunications, big data and artificial intelligence.

500 Startups is a global venture capital seed fund and startup accelerator based in Silicon Valley.

500 Startups is a global venture capital seed fund and startup accelerator based in Silicon Valley.

The Mirae Asset Financial Group started in 1997 with Mirae Asset Global Investment and Mirae Asset Capital. The group's business interests focus on asset and wealth management, investments, and insurance. It has also invested in a range of companies, from logistics firm Shadowfax to AmazeVR. In 2018, it established a joint venture with Naver Corporation, one of South Korea's leading tech companies, and set up the Asia Growth Fund with $940m committed to VC investing in the region. The joint venture has backed Southeast Asian ride-hailing giant Grab, Indonesian e-commerce platform Bukalapak, and Singapore-based credit scoring firm FinAccel.

The Mirae Asset Financial Group started in 1997 with Mirae Asset Global Investment and Mirae Asset Capital. The group's business interests focus on asset and wealth management, investments, and insurance. It has also invested in a range of companies, from logistics firm Shadowfax to AmazeVR. In 2018, it established a joint venture with Naver Corporation, one of South Korea's leading tech companies, and set up the Asia Growth Fund with $940m committed to VC investing in the region. The joint venture has backed Southeast Asian ride-hailing giant Grab, Indonesian e-commerce platform Bukalapak, and Singapore-based credit scoring firm FinAccel.

Kejora is a stage agnostic venture capital firm that focuses in investments in Southeast Asia. Since established in 2008, Kejora has expanded to three offices in Singapore, Philippines and Indonesia. It is headquartered in Jakarta, Indonesia.

Kejora is a stage agnostic venture capital firm that focuses in investments in Southeast Asia. Since established in 2008, Kejora has expanded to three offices in Singapore, Philippines and Indonesia. It is headquartered in Jakarta, Indonesia.

NEEQ-listed NewMargin Capital is a venture capital management firm founded in 2011 by the team of NewMargin Ventures. It focuses on early-stage companies in the TMT, energy efficiency and healthcare sectors.

NEEQ-listed NewMargin Capital is a venture capital management firm founded in 2011 by the team of NewMargin Ventures. It focuses on early-stage companies in the TMT, energy efficiency and healthcare sectors.

COO and co-founder of iLoF

Mehak Mumtaz grew up in Pakistan and decided to study biochemistry when she saw her brother suffering from an unknown learning disability. Her parents, both medical doctors, could not get an accurate diagnosis for their son. In her search to understand the molecular mechanisms behind diseases, she applied to study at the University of Oxford. In 2008, she was granted the Reach Oxford Scholarship and graduated with a master’s in biochemistry in 2012. In 2015, the St Hilda’s alumna worked as an undergraduate tutor at Oxford while completing a PhD in pathology, specializing in oncology and cancer biology.In 2018, she worked on a rare cancer project as EIT Health Business Innovation fellow for a year. She left academia and joined a three-month bioentrepreneur bootcamp in Munich and a one-month Lev8 Woman Program at her alma mater’s Oxford Foundry. She joined EY-Parthenon in London as a strategy consultant in April 2019.In 2019, Mumtaz also met the iLoF co-founding team at the EIT Health Wild Card venture-building program. iLoF is a medtech startup that focuses on personalized medicine through the use of AI and photonics to create optical fingerprints in a cloud-based library to gather and manages disease biomarkers and biological profiles.She joined iLoF as COO and co-founder in December 2019 and left her full-time consultancy role at EY in March 2020.

Mehak Mumtaz grew up in Pakistan and decided to study biochemistry when she saw her brother suffering from an unknown learning disability. Her parents, both medical doctors, could not get an accurate diagnosis for their son. In her search to understand the molecular mechanisms behind diseases, she applied to study at the University of Oxford. In 2008, she was granted the Reach Oxford Scholarship and graduated with a master’s in biochemistry in 2012. In 2015, the St Hilda’s alumna worked as an undergraduate tutor at Oxford while completing a PhD in pathology, specializing in oncology and cancer biology.In 2018, she worked on a rare cancer project as EIT Health Business Innovation fellow for a year. She left academia and joined a three-month bioentrepreneur bootcamp in Munich and a one-month Lev8 Woman Program at her alma mater’s Oxford Foundry. She joined EY-Parthenon in London as a strategy consultant in April 2019.In 2019, Mumtaz also met the iLoF co-founding team at the EIT Health Wild Card venture-building program. iLoF is a medtech startup that focuses on personalized medicine through the use of AI and photonics to create optical fingerprints in a cloud-based library to gather and manages disease biomarkers and biological profiles.She joined iLoF as COO and co-founder in December 2019 and left her full-time consultancy role at EY in March 2020.

Founded in 2014, Giant Innovation Capital is a venture capital fund by Giant Interactive Group, an online game developer and operator listed on the NYSE. It focuses on early stage investing in Internet startups.

Founded in 2014, Giant Innovation Capital is a venture capital fund by Giant Interactive Group, an online game developer and operator listed on the NYSE. It focuses on early stage investing in Internet startups.

Founded in 2011 by Wang Xiao, a member of the Baidu founding team, Unity Ventures is a venture capital firm in China that focuses on early-stage companies in the internet and mobile internet sectors.

Founded in 2011 by Wang Xiao, a member of the Baidu founding team, Unity Ventures is a venture capital firm in China that focuses on early-stage companies in the internet and mobile internet sectors.

Founded in 2006, the Silicon Valley-based venture capital firm was one of the earliest to focus on seed investing. It has around US$1.3 billion under management and has backed more than 700 founders.

Founded in 2006, the Silicon Valley-based venture capital firm was one of the earliest to focus on seed investing. It has around US$1.3 billion under management and has backed more than 700 founders.

Tianxing Capital is a venture capital management company that was founded in 2012. It has invested in over 500 enterprises so far. Its investment focuses are media, healthcare, energy conservation, environmental protection, high-end manufacturing, etc.

Tianxing Capital is a venture capital management company that was founded in 2012. It has invested in over 500 enterprises so far. Its investment focuses are media, healthcare, energy conservation, environmental protection, high-end manufacturing, etc.

Founded in Shenzhen in 2013, Topsailing Capital is mainly involved in venture capital and private equity funding of diverse industry sectors like culture, entertainment, big data, intelligent manufacturing, agriculture, environmental protection and medicine.

Founded in Shenzhen in 2013, Topsailing Capital is mainly involved in venture capital and private equity funding of diverse industry sectors like culture, entertainment, big data, intelligent manufacturing, agriculture, environmental protection and medicine.

The venture capital arm of semiconductor and telecom equipment giant Qualcomm is a San-Diego investor focusing on VR, robotics, IoT, cloud and digital health companies in the US, Europe, Israel, China, Korea and India.

The venture capital arm of semiconductor and telecom equipment giant Qualcomm is a San-Diego investor focusing on VR, robotics, IoT, cloud and digital health companies in the US, Europe, Israel, China, Korea and India.

Founded in 2011, Tokyo-based venture capital firm GREE Ventures focuses on investing in early stage (pre-Series A and Series A) internet and mobile companies. The firm invests in Japan, Southeast Asia, and other geographies within Asia.

Founded in 2011, Tokyo-based venture capital firm GREE Ventures focuses on investing in early stage (pre-Series A and Series A) internet and mobile companies. The firm invests in Japan, Southeast Asia, and other geographies within Asia.

Headquartered in Zhengzhou, China Reform TUS Fund is China's first capital management fund. Jointly backed by state-level venture capital funds, top Chinese universities and the provincial government, it invests primarily in new energy, healthcare and information technology.

Headquartered in Zhengzhou, China Reform TUS Fund is China's first capital management fund. Jointly backed by state-level venture capital funds, top Chinese universities and the provincial government, it invests primarily in new energy, healthcare and information technology.

Turning Singapore into an Edible Garden City

Urban agriculture startup Edible Garden City embraces new tech for intensive, space-saving farming while staying true to its community-driven values

Faraday Venture Partners’ MP Gonzalo Tradacete: “We are actively looking for startups”

Amid the Covid-19 slump, Faraday Venture Partners' CIO and MP shares his expectations for startup investments and favored sectors, the measures his firm has taken so far to help investees ride out the crisis, and more.

Swanlaab Venture Factory: €40 million funding chest to give power to the people

The female co-founder of Swanlaab Venture Factory believes that diversity enriches decision-making and drives performance. CompassList recently caught up with Verónica Trapa Díaz-Obregón to find out what's in store for Spain's first Israeli-backed VC fund

Jakarta Smart City seeks startup solutions for life in post-Covid “new normal”

From collaborative working to cyberbullying, these startups will soon work with Indonesia’s first smart city agency

Zhongzheng Information: Big data and fully integrated services for smart office buildings

Joining the Microsoft for Startups program will boost Zhongzheng's R&D and business expansion in China

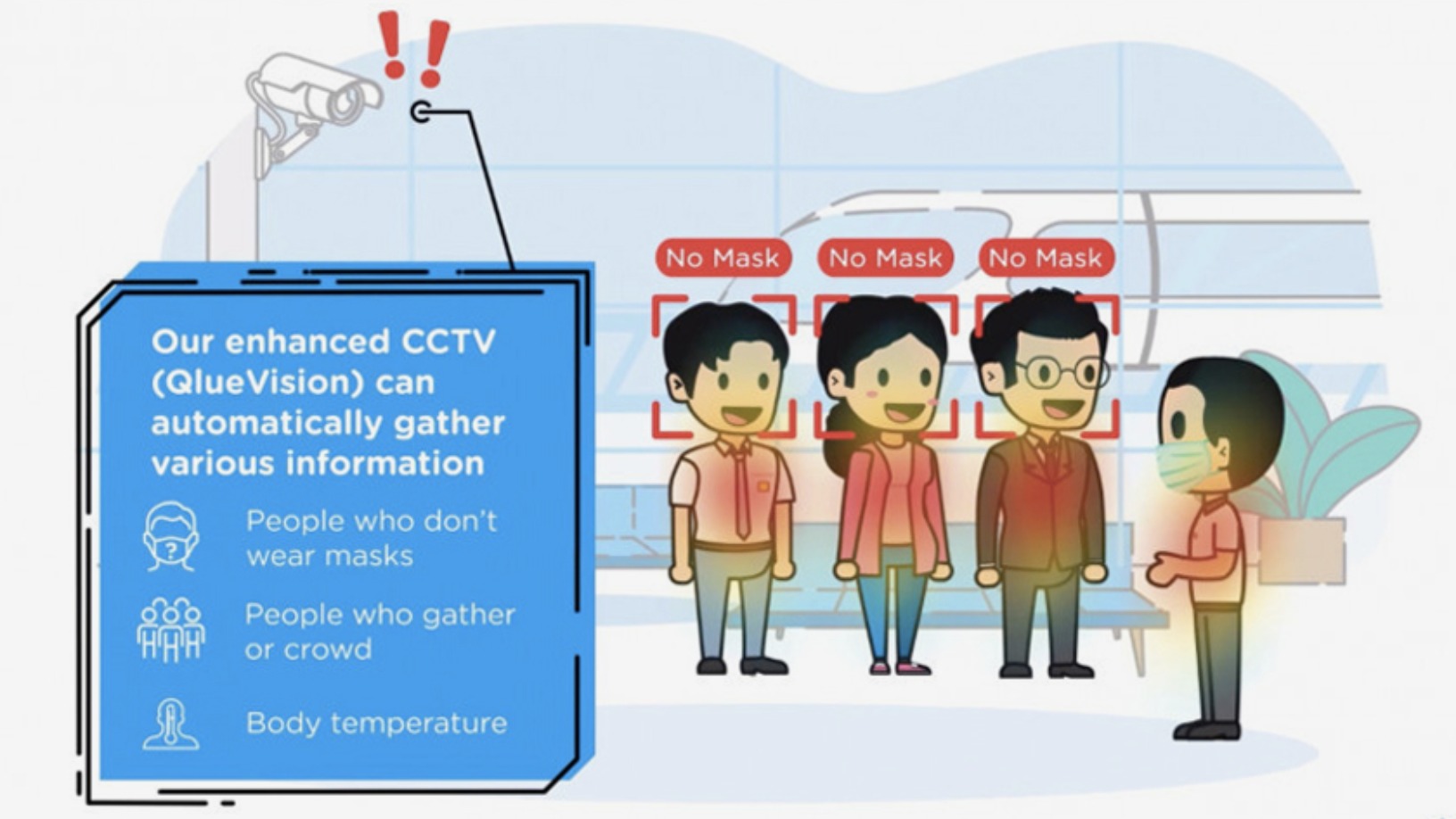

Interview with Qlue CEO: "We didn't know what a smart city should look like"

Co-founder and CEO of Qlue, Indonesia's largest "smart city" company, Rama Raditya explains how citizen involvement – not high-tech – is the true innovation of smart cities and the agent for change; plus how his startup has grown from partnering governments to businesses, and more

Beyond ride-hailing: Gojek, Grab and all their friends

Now that Grab and Go-Jek are in a faceoff on a regional scale, here's a look at how Southeast Asia's two biggest unicorns – and their investors – could be shaping the local digital economies and startup ecosystems

EXCLUSIVE: Qlue raising Series B funding, "confident" of turning profitable in 2020

Qlue is also targeting more enterprise clients as it expands overseas and improved accountability and management practices

EXCLUSIVE: Mexico’s Trendier invests in Chicfy as part of €1 million deal

Spain's most popular secondhand fashion marketplace and media darling gets lifeline as it struggles financially to stay afloat

Indonesian smart city tech leader Qlue thrives amid Covid-19 with thermal scanner and B2G refocus

Plans to tilt its client portfolio toward B2B work are delayed as Qlue returns to its B2G roots

Haoqipei: Connecting China's vast B2B auto parts market

Haoqipei not only connects buyers and sellers with a B2B trading platform, it also uses big data to build trust and relationships in a highly fragmented market

As Veniam’s “Internet of Moving Things” keeps growing, autonomous vehicles are next

The Portuguese startup is going places with its mesh networking technology, but that’s “just the beginning”, says Veniam founder and CEO João Barros. He talks to CompassList about partnering automakers to design self-driving cars, raising a new round of funding in 2018, and more

TheVentures founders launch Singapore VC to drive deals in Southeast Asia

The Korean Viki co-founders return to Singapore as venture builders and investors, offering South Korean partnerships and “CTO-as-a-service” in Southeast Asia

4YFN: Investment booms across Europe during pandemic

Speaking at the recent 4YFN conference, prolific European startup investor Mattias Ljungman provided a highly optimistic assessment of the continent's current ecosystem strength and climate for seed funding

For equality in education, Odilo brings books in the cloud free to millions worldwide

The "Amazon for digital content" Spanish edtech startup delivers virtual libraries and classrooms to kids and adults worldwide

Sorry, we couldn’t find any matches for“Venture City”.