lippo's

-

DATABASE (339)

-

ARTICLES (486)

Serena Ventures is a venture capital investment firm founded by professional tennis player and businesswoman Serena Williams. The company focuses on early-stage companies founded by young, diverse teams. Since it was founded in 2014, it has invested in more than 30 companies with a cumulative market cap of $12b. Coffee brand Kopi Kenangan is its first investment in the Indonesian market. Serena Ventures has invested in notable companies like plant-based meat maker Impossible Foods, cryptocurrency exchange Coinbase, as well as Serena Williams’ own fashion label, S by Serena.

Serena Ventures is a venture capital investment firm founded by professional tennis player and businesswoman Serena Williams. The company focuses on early-stage companies founded by young, diverse teams. Since it was founded in 2014, it has invested in more than 30 companies with a cumulative market cap of $12b. Coffee brand Kopi Kenangan is its first investment in the Indonesian market. Serena Ventures has invested in notable companies like plant-based meat maker Impossible Foods, cryptocurrency exchange Coinbase, as well as Serena Williams’ own fashion label, S by Serena.

Cheers Capital Partners is a PE investment firm focusing on early- and growth-stage investment in internet, IT, culture & media and consumption & retail sectors.

Cheers Capital Partners is a PE investment firm focusing on early- and growth-stage investment in internet, IT, culture & media and consumption & retail sectors.

Spain’s fastest-growing car-as-a-service startup, now acquired by the Renault Group, is profit-making and operates across Spain, France and Italy, with 10,000+ subscribers.

Spain’s fastest-growing car-as-a-service startup, now acquired by the Renault Group, is profit-making and operates across Spain, France and Italy, with 10,000+ subscribers.

H&M’s first shop was founded 74 years ago in Sweden by Erling Persson under the name “Hennes”, Swedish for "hers" since the shop was selling only women's apparel. In 1968, Persson expanded into menswear by acquiring Swedish retailer Mauritz Widforss. Hence the rebranding of the company into Hennes & Mauritz (H&M). In 1974, H&M was listed on the Stockholm Stock Exchange. Since then, H&M has expanding internationally opening its first store in London and the rest of Europe and also to the US in early 2000.In 2008, the company also moved into the home furnishings segment and launched H&M Home stores worldwide. The fashion chain can now be found across Europe, the US, Asia and the Middle East. The group expanded further by acquiring fast-fashion brands like Weekday, Monki and Cheap Monday. In April 2021, H&M Group announced a collaboration with textile cleantech Infinited Fiber to launch proof-of-concept denim created wholly from regenerated textile waste as part of its commitment to use only recycled or sustainably sourced materials by 2030.

H&M’s first shop was founded 74 years ago in Sweden by Erling Persson under the name “Hennes”, Swedish for "hers" since the shop was selling only women's apparel. In 1968, Persson expanded into menswear by acquiring Swedish retailer Mauritz Widforss. Hence the rebranding of the company into Hennes & Mauritz (H&M). In 1974, H&M was listed on the Stockholm Stock Exchange. Since then, H&M has expanding internationally opening its first store in London and the rest of Europe and also to the US in early 2000.In 2008, the company also moved into the home furnishings segment and launched H&M Home stores worldwide. The fashion chain can now be found across Europe, the US, Asia and the Middle East. The group expanded further by acquiring fast-fashion brands like Weekday, Monki and Cheap Monday. In April 2021, H&M Group announced a collaboration with textile cleantech Infinited Fiber to launch proof-of-concept denim created wholly from regenerated textile waste as part of its commitment to use only recycled or sustainably sourced materials by 2030.

SEEDS Capital is the investment arm of Enterprise Singapore supporting locally based startups that have innovative technologies and global market potential. Sectors of focus include advanced manufacturing & engineering, health & biomedical sciences, urban sustainability & solutions, fintech, artificial intelligence and agritech. SEEDS currently works with more than 500 deep tech startups, and over 40 incubators, accelerators and venture capital firms.

SEEDS Capital is the investment arm of Enterprise Singapore supporting locally based startups that have innovative technologies and global market potential. Sectors of focus include advanced manufacturing & engineering, health & biomedical sciences, urban sustainability & solutions, fintech, artificial intelligence and agritech. SEEDS currently works with more than 500 deep tech startups, and over 40 incubators, accelerators and venture capital firms.

Security Trading Oy is a Finnish investment company located in Helsinki generating a turnover of $125m in sales. The firm recently invested in the biotech material startup Infinited Fiber, along with Adidas and Invest FWD A/S, which is BESTSELLER’s investment arm for sustainable fashion. Security Trading Oy was part of the Kone Corporation group that was re-organized by the Herlin family, with Antti Herlin as the controlling shareholder in 2005.

Security Trading Oy is a Finnish investment company located in Helsinki generating a turnover of $125m in sales. The firm recently invested in the biotech material startup Infinited Fiber, along with Adidas and Invest FWD A/S, which is BESTSELLER’s investment arm for sustainable fashion. Security Trading Oy was part of the Kone Corporation group that was re-organized by the Herlin family, with Antti Herlin as the controlling shareholder in 2005.

For rich Chinese wanting to acquire nice things and good taste, glamorous lifestyle editor Wendy can help with her online magazine, e-store and offline events.

For rich Chinese wanting to acquire nice things and good taste, glamorous lifestyle editor Wendy can help with her online magazine, e-store and offline events.

Investisseurs & Partenaires (I&P)

Set up in 2002 by Patrice Hoppenot 15 years after he founded European investment fund BC Partners, Investisseurs & Partenaires (I&P) is an impact investor seeking to help SMEs prosper in Africa and create sustainable jobs and income there. With about €210m raised to date, I&P finances SMEs, startups and regional investment funds in Africa through equity participation and loans, as well as through microfinance institutions. Its I&P Acceleration Technologies focuses on digital startups with €2.5m of funding to be invested in 10–15 startups in 2020–2023. To date, I&P has supported more than 100 capital-funded companies and 20 companies benefiting from subsidized acceleration programs. I&P has about 100 staff based in Paris, Washington D.C. and in seven African offices (Burkina Faso, Cameroon, Côte d'Ivoire, Ghana, Madagascar, Niger and Senegal).

Set up in 2002 by Patrice Hoppenot 15 years after he founded European investment fund BC Partners, Investisseurs & Partenaires (I&P) is an impact investor seeking to help SMEs prosper in Africa and create sustainable jobs and income there. With about €210m raised to date, I&P finances SMEs, startups and regional investment funds in Africa through equity participation and loans, as well as through microfinance institutions. Its I&P Acceleration Technologies focuses on digital startups with €2.5m of funding to be invested in 10–15 startups in 2020–2023. To date, I&P has supported more than 100 capital-funded companies and 20 companies benefiting from subsidized acceleration programs. I&P has about 100 staff based in Paris, Washington D.C. and in seven African offices (Burkina Faso, Cameroon, Côte d'Ivoire, Ghana, Madagascar, Niger and Senegal).

Market leader Tuhu offers quality tires, auto aftermarket services and much more–at low prices, 24-hour online ordering and installation at its nationwide partner garages.

Market leader Tuhu offers quality tires, auto aftermarket services and much more–at low prices, 24-hour online ordering and installation at its nationwide partner garages.

Guangdong China Science & Merchants Capital Management

Founded in 2009, Guangdong China Science & Merchants Capital Management is a subsidiary of China Science & Merchants Investment (Fund) Management, with the support of the Guangdong government. It invests in pre-IPO companies, regional leading enterprises and fast-growing innovative startups.

Founded in 2009, Guangdong China Science & Merchants Capital Management is a subsidiary of China Science & Merchants Investment (Fund) Management, with the support of the Guangdong government. It invests in pre-IPO companies, regional leading enterprises and fast-growing innovative startups.

Marieta del Rivero is a successful female entrepreneur with over 25 years of experience in leading companies in the world of information and communications technology, mobility and digital services. She graduated from the IESE Business School and has an executive degree in Digital Business Strategy from Columbia University.Currently, the president of the International Women´s Forum Spain, she is also the president of Seeliger and Conde media group. Del Rivero is also an independent non-executive director at Cellnex Telecom, the main European infrastructure operator for wireless communication and Gestamp, an international group that manufactures metal automotive components.

Marieta del Rivero is a successful female entrepreneur with over 25 years of experience in leading companies in the world of information and communications technology, mobility and digital services. She graduated from the IESE Business School and has an executive degree in Digital Business Strategy from Columbia University.Currently, the president of the International Women´s Forum Spain, she is also the president of Seeliger and Conde media group. Del Rivero is also an independent non-executive director at Cellnex Telecom, the main European infrastructure operator for wireless communication and Gestamp, an international group that manufactures metal automotive components.

Danish asset management company Maj Invest was established in 2005. Based in Copenhagen, it is owned by the management, employees and Danish institutional investors, PKA, Realdania and PBU. Its main businesses are in asset management and private equity. It recently ventured into the financial services sector with Maj Bank.In 2009, Maj Invest launched into international private equity activities, with offices in Singapore, Indonesia’s Jakarta,Vietnam’s Ho Chi Minh City and Lima in Peru. Its Maj Invest Equity Southeast Asia II K/S, worth US$90 million, is still looking for new investment opportunities in the region.

Danish asset management company Maj Invest was established in 2005. Based in Copenhagen, it is owned by the management, employees and Danish institutional investors, PKA, Realdania and PBU. Its main businesses are in asset management and private equity. It recently ventured into the financial services sector with Maj Bank.In 2009, Maj Invest launched into international private equity activities, with offices in Singapore, Indonesia’s Jakarta,Vietnam’s Ho Chi Minh City and Lima in Peru. Its Maj Invest Equity Southeast Asia II K/S, worth US$90 million, is still looking for new investment opportunities in the region.

The state-backed, Shanghai-based media and entertainment investment group controlled by media mogul Li Ruigang has made its name and fortune in China's most lucrative industries: media & entertainment, Internet & mobile, sport & lifestyle. CMC's portfolio includes Star China, IMAX China, Flagship Entertainment, Oriental DreamWorks, TVB, Whaley Technologies, Imagine Entertainment, Shaw Brothers, Caixin, Gewara, and more. Li, who started out as a lifestyle TV reporter, set up CMC in 2009 with a RMB 2 billion fund.

The state-backed, Shanghai-based media and entertainment investment group controlled by media mogul Li Ruigang has made its name and fortune in China's most lucrative industries: media & entertainment, Internet & mobile, sport & lifestyle. CMC's portfolio includes Star China, IMAX China, Flagship Entertainment, Oriental DreamWorks, TVB, Whaley Technologies, Imagine Entertainment, Shaw Brothers, Caixin, Gewara, and more. Li, who started out as a lifestyle TV reporter, set up CMC in 2009 with a RMB 2 billion fund.

Founded in 2015 by former vice president of Tencent and GM of Tencent M&A, Richard Peng (Peng Zhijian), and former vice GM of Tencent M&A, Kurt Xu, Genesis Capital specializes in growth stage investment of internet startups in China and the US.

Founded in 2015 by former vice president of Tencent and GM of Tencent M&A, Richard Peng (Peng Zhijian), and former vice GM of Tencent M&A, Kurt Xu, Genesis Capital specializes in growth stage investment of internet startups in China and the US.

SigmaRail is the Google Maps for railway professionals, offering advanced mapping and engineering consultancy services to aid in resource management, surveillance and maintenance.

SigmaRail is the Google Maps for railway professionals, offering advanced mapping and engineering consultancy services to aid in resource management, surveillance and maintenance.

A new unicorn rises as OVO's $1bn valuation confirmed

The Lippo Group subsidiary continues to grow in strength as it battles for market share with Gojek’s e-wallet and others

Amidst a flurry of funding from overseas, local players urge a review of startup ownership rules in Indonesia

Venturra Capital's Raditya Pramana: Bear market "very close now"

In an interview, the Indonesian VC firm's newest partner also charts out the course for their new fund, Venturra Discovery

Indonesian local crafts marketplace Qlapa shuts down

Series A funding failed to keep startup afloat as business remains unprofitable, regional heavyweights close in

E-wallet unicorn OVO’s future in question amid Lippo's divestment, talk of DANA merger

As even the conglomerate giant feels the pain of OVO's aggressive cash-burning, should digital payments players rethink their strategy to gain market share, beyond the usual discounts and subsidies?

New Ventures Innovation: Prasetiya Mulya University takes on student entrepreneurship

To prepare a new generation of startup founders, Prasetiya Mulya University combines theoretical education with real-life exposure to the startup world

Beyond ride-hailing: Gojek, Grab and all their friends

Now that Grab and Go-Jek are in a faceoff on a regional scale, here's a look at how Southeast Asia's two biggest unicorns – and their investors – could be shaping the local digital economies and startup ecosystems

QRIS: Will the new QR code standard rewrite Indonesia’s e-payments scene?

Enabling interoperability, the QRIS seeks to level the playing field until now dominated by GoPay and OVO – disruption that could go beyond the e-wallets scene

MBiz: Working toward the "tipping point" of e-procurement mainstreaming

Trusted by multinationals and conglomerates, Mbiz wants to take e-procurement mainstream by also working with municipal governments

With universal QR code, Indonesia achieves e-payment harmony

The move to standardize Indonesia's QR code is expected to unify the country's cashless payments system and lift tens of thousands of small merchants into the payments mainstream

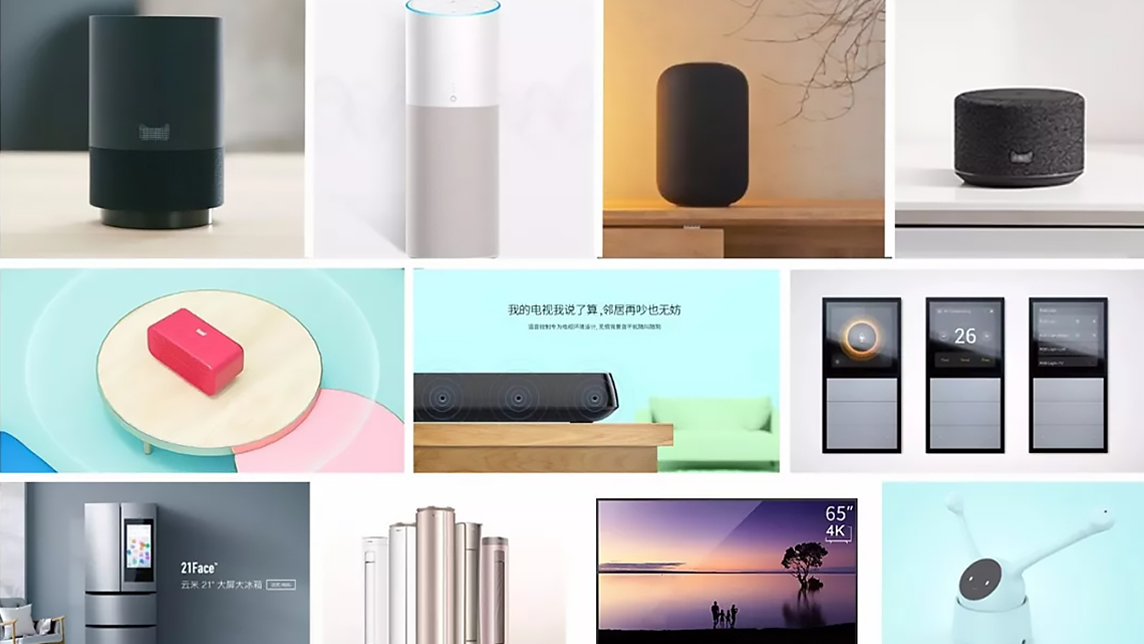

This voice technology startup empowers both developers and machines

AISpeech shifted its business from education to IoT but has always remained focused on voice interaction between humans and machines

UBTECH: CES robotics star wants to bring humanoid robots to every family

UBTECH’s next-generation bipedal robot recently made an impressive global debut, and the startup’s founder has once again become the focus of attention

Tuvalum: Fast-growing vertical marketplace for used quality bikes

Banking on organic reach, Tuvalum has set its sights on a €40 billion market

How Xiaomi founder Lei Jun became a billionaire by pursuing passion, not fortune

From young man deconstructing and rebuilding smartphones at Kingsoft to top of the smartphone world as founder and chair of Xiaomi, Lei has always let his interests lead the way

Bukalapak CEO under fire for tweet about Indonesia’s R&D budget

Achmad Zaky is the latest top startup executive to get embroiled in a politically charged social media storm

Sorry, we couldn’t find any matches for“lippo's”.