Manufacturing

This function is exclusive for Premium subscribers

-

DATABASE (39)

-

ARTICLES (41)

Stanley Ventures / Stanley Black & Decker

Founded in 1843, Connecticut-based Stanley Black & Decker, is one of the oldest US manufacturing companies. It has acquired tons of organizations in recent decades and invests in a very selected number of startups. Its most recent disclosed tech startup investments via its VC arm Stanley Ventures were in the 2021 $1.8m seed round of Spain’s Triditive, and in the 2019 undisclosed investment round of Argentinian field operations software Iguana Fix.

Founded in 1843, Connecticut-based Stanley Black & Decker, is one of the oldest US manufacturing companies. It has acquired tons of organizations in recent decades and invests in a very selected number of startups. Its most recent disclosed tech startup investments via its VC arm Stanley Ventures were in the 2021 $1.8m seed round of Spain’s Triditive, and in the 2019 undisclosed investment round of Argentinian field operations software Iguana Fix.

SEEDS Capital is the investment arm of Enterprise Singapore supporting locally based startups that have innovative technologies and global market potential. Sectors of focus include advanced manufacturing & engineering, health & biomedical sciences, urban sustainability & solutions, fintech, artificial intelligence and agritech. SEEDS currently works with more than 500 deep tech startups, and over 40 incubators, accelerators and venture capital firms.

SEEDS Capital is the investment arm of Enterprise Singapore supporting locally based startups that have innovative technologies and global market potential. Sectors of focus include advanced manufacturing & engineering, health & biomedical sciences, urban sustainability & solutions, fintech, artificial intelligence and agritech. SEEDS currently works with more than 500 deep tech startups, and over 40 incubators, accelerators and venture capital firms.

Zhan Investment was founded in 2015 in Guangzhou.

Beyond Investing is a Geneva-based firm investing in early-stage venture capital and equity growth startups mainly in European developed markets. With average investments of €200,000, the firm’s core investment strategy focuses on sustainability with an investment period lasting 5–10 years.The impact investor targets innovative startups involved in vegan, cruelty-free and plant-based alternatives; biotechnologies, foodtech, new materials, clothing and lifestyle sectors. Successful portfolio foodtechs include Mosa Meat, BlueNalu and Shiok Meats.With a team of vegan finance professionals in the US and Europe, Beyond Investing listed the first US Vegan Climate ETF (VEGN) on the New York Stock Exchange in September 2019. The ETF tracks Beyond Investing’s US Vegan Climate Index which covers an index of 495 of the largest-capitalization companies in the US stock market. The ethical investment option aims to exclude stocks in companies with activities that are not aligned with its vegan-themed, cruelty-free and fossil-fuel-free investing ethos.

Beyond Investing is a Geneva-based firm investing in early-stage venture capital and equity growth startups mainly in European developed markets. With average investments of €200,000, the firm’s core investment strategy focuses on sustainability with an investment period lasting 5–10 years.The impact investor targets innovative startups involved in vegan, cruelty-free and plant-based alternatives; biotechnologies, foodtech, new materials, clothing and lifestyle sectors. Successful portfolio foodtechs include Mosa Meat, BlueNalu and Shiok Meats.With a team of vegan finance professionals in the US and Europe, Beyond Investing listed the first US Vegan Climate ETF (VEGN) on the New York Stock Exchange in September 2019. The ETF tracks Beyond Investing’s US Vegan Climate Index which covers an index of 495 of the largest-capitalization companies in the US stock market. The ethical investment option aims to exclude stocks in companies with activities that are not aligned with its vegan-themed, cruelty-free and fossil-fuel-free investing ethos.

BACKED VC is primarily a seed-stage funder based in London and founded in 2015 that selects its investments based on the founding team rather than on market-based decisions. It typically invests from €0.5m to €2.5m per round and, to date, has invested in 45 startups with two exits so far. Its most recent investments include in the March 2021 £5m Series A round of British legal digitization platform Legl and in the February 2021 £2.7m seed round of UK-based cellular fat producer Hoxton Farms.

BACKED VC is primarily a seed-stage funder based in London and founded in 2015 that selects its investments based on the founding team rather than on market-based decisions. It typically invests from €0.5m to €2.5m per round and, to date, has invested in 45 startups with two exits so far. Its most recent investments include in the March 2021 £5m Series A round of British legal digitization platform Legl and in the February 2021 £2.7m seed round of UK-based cellular fat producer Hoxton Farms.

Redview Capital was founded in 2016 by Yu Jianming, Managing Partner and co-founder of New Horizon Capital. It is a private equity fund focused on sectors of advanced manufacturing, clean energy, new materials, consumer products and retail. Redview Capital currently has $560m in assets under management.

Redview Capital was founded in 2016 by Yu Jianming, Managing Partner and co-founder of New Horizon Capital. It is a private equity fund focused on sectors of advanced manufacturing, clean energy, new materials, consumer products and retail. Redview Capital currently has $560m in assets under management.

With New Hope Group, one of China’s biggest agriculture and food businesses, as its cornerstone investor, HosenCare Brothers had operated as a PE arm within the group for nearly a decade. In 2017, it began to operate under its current name. It currently manages assets worth more than RMB 3bn, and mainly invests in sectors of medtech, healthcare, biotechnology and smart manufacturing.

With New Hope Group, one of China’s biggest agriculture and food businesses, as its cornerstone investor, HosenCare Brothers had operated as a PE arm within the group for nearly a decade. In 2017, it began to operate under its current name. It currently manages assets worth more than RMB 3bn, and mainly invests in sectors of medtech, healthcare, biotechnology and smart manufacturing.

Country Garden Venture Capital

Founded in 2019, Country Garden Venture Capital is the corporate venturing arm of Chinese real estate developer Country Garden. With its parent company as the cornerstone investor, it is focused on certain sectors of the supply chain, namely, technology, healthcare and consumption. As of March 2021, Country Garden Venture Capital has invested around RMB 10bn in over 50 companies with an average return above 80%. Among them, 15 have achieved unicorn status ($1bn in valuation), while four have successfully gone public.

Founded in 2019, Country Garden Venture Capital is the corporate venturing arm of Chinese real estate developer Country Garden. With its parent company as the cornerstone investor, it is focused on certain sectors of the supply chain, namely, technology, healthcare and consumption. As of March 2021, Country Garden Venture Capital has invested around RMB 10bn in over 50 companies with an average return above 80%. Among them, 15 have achieved unicorn status ($1bn in valuation), while four have successfully gone public.

Royal Golden Eagle (RGE) is an industrial group owned by Indonesian tycoon Sukanto Tanoto. It employs 60,000 people worldwide with assets worth over $20bn. Tanoto started his business empire in 1967 as a supplier of spare parts to oil and construction companies in Indonesia. He went on to invest in oil palm plantations in 1979. Since 1985, his group companies have been managing 30,000 acres of oil palm trees each year across a total land area of 160,000 hectares.Headquartered in Singapore, RGE has interests in diverse sectors like paper palm oil, viscose, asset management, real estate, construction and energy. RGE owns the world’s largest viscose producer Sateri, Asia Pacific Rayon and energy firm Pacific Oil & Gas. It is also the owner of the Asia Pacific Resources International Holdings Limited (APRIL), one of the world’s largest pulp and paper mills. The Rainforest Action Network and other NGOs like Greenpeace and the WWF have put considerable pressure on the RGE group’s unsustainable operations such as the destruction of rainforests by APRIL. In 2019, RGE announced plans to invest $200m in cellulosic textile fiber research and development over a period of 10 years. Projects will include the scaling up of proven clean technology in fiber manufacturing, bringing pilot-scale production to commercial scale and R&D in emerging frontier solutions.

Royal Golden Eagle (RGE) is an industrial group owned by Indonesian tycoon Sukanto Tanoto. It employs 60,000 people worldwide with assets worth over $20bn. Tanoto started his business empire in 1967 as a supplier of spare parts to oil and construction companies in Indonesia. He went on to invest in oil palm plantations in 1979. Since 1985, his group companies have been managing 30,000 acres of oil palm trees each year across a total land area of 160,000 hectares.Headquartered in Singapore, RGE has interests in diverse sectors like paper palm oil, viscose, asset management, real estate, construction and energy. RGE owns the world’s largest viscose producer Sateri, Asia Pacific Rayon and energy firm Pacific Oil & Gas. It is also the owner of the Asia Pacific Resources International Holdings Limited (APRIL), one of the world’s largest pulp and paper mills. The Rainforest Action Network and other NGOs like Greenpeace and the WWF have put considerable pressure on the RGE group’s unsustainable operations such as the destruction of rainforests by APRIL. In 2019, RGE announced plans to invest $200m in cellulosic textile fiber research and development over a period of 10 years. Projects will include the scaling up of proven clean technology in fiber manufacturing, bringing pilot-scale production to commercial scale and R&D in emerging frontier solutions.

Europe ramps up development of local EV battery sector in race to zero emissions

Startups, automakers jostle or unite to ride the fast-growing EV battery market, as the EU pumps billions into developing its own value chain, to cut reliance on imports

Sequoia China Seed Fund: Growing an era of deep-tech startups

Managing Partner Neil Shen wants to help deep-tech and enterprise tech startups get investments more easily, across quantum computing, semiconductors, synthetic biology and more

Verkor: Accelerating low‑carbon battery production in France

French startup Verkor aims to raise up to €1.3bn by the end of next year to finance its first Gigafactory producing sustainable lithium-ion batteries for the European market

South Summit 2021: Lessons in expanding to Asia from experts on the ground

Cast aside your Eurocentric mindsets, China-based SOSV’s Oscar Ramos and Brinc’s Heriberto Saldivar tell startups, why they should expand to the region, and how best to do it

Linptech: Smart home devices powered by movement

The first in China to tap kinetic energy to control smart home devices, Linptech has seen its wireless, battery-free products used in smart homes, and even at the Tokyo Olympics

Viezo: Vibration energy harvesting to power sensors and IoT devices

Disrupting the battery market, Viezo’s proprietary technology, PolyFilm, can also boost operational efficiency and slash maintenance costs of sensors and IoT devices

Kryha: Enabling big businesses' green practices with blockchain

Kryha’s blockchain systems help companies trace the movement and transformation of resources among multiple stakeholders without exposing sensitive information

COMY Energy: Closing the plastic waste loop with chemical recycling

The Chinese startup transforms plastic wastes to virgin-quality recycled products without releasing toxic gas or pollution and is attracting interest from petrochemical giants and waste management companies

SWITCH Singapore: Sustainability startups see growing demand from corporates

Sophie’s BioNutrients, Ubiik and Intello Labs also note new trends in technology and supply chain arising from the Covid-19 pandemic, across the food, manufacturing and e-commerce sectors

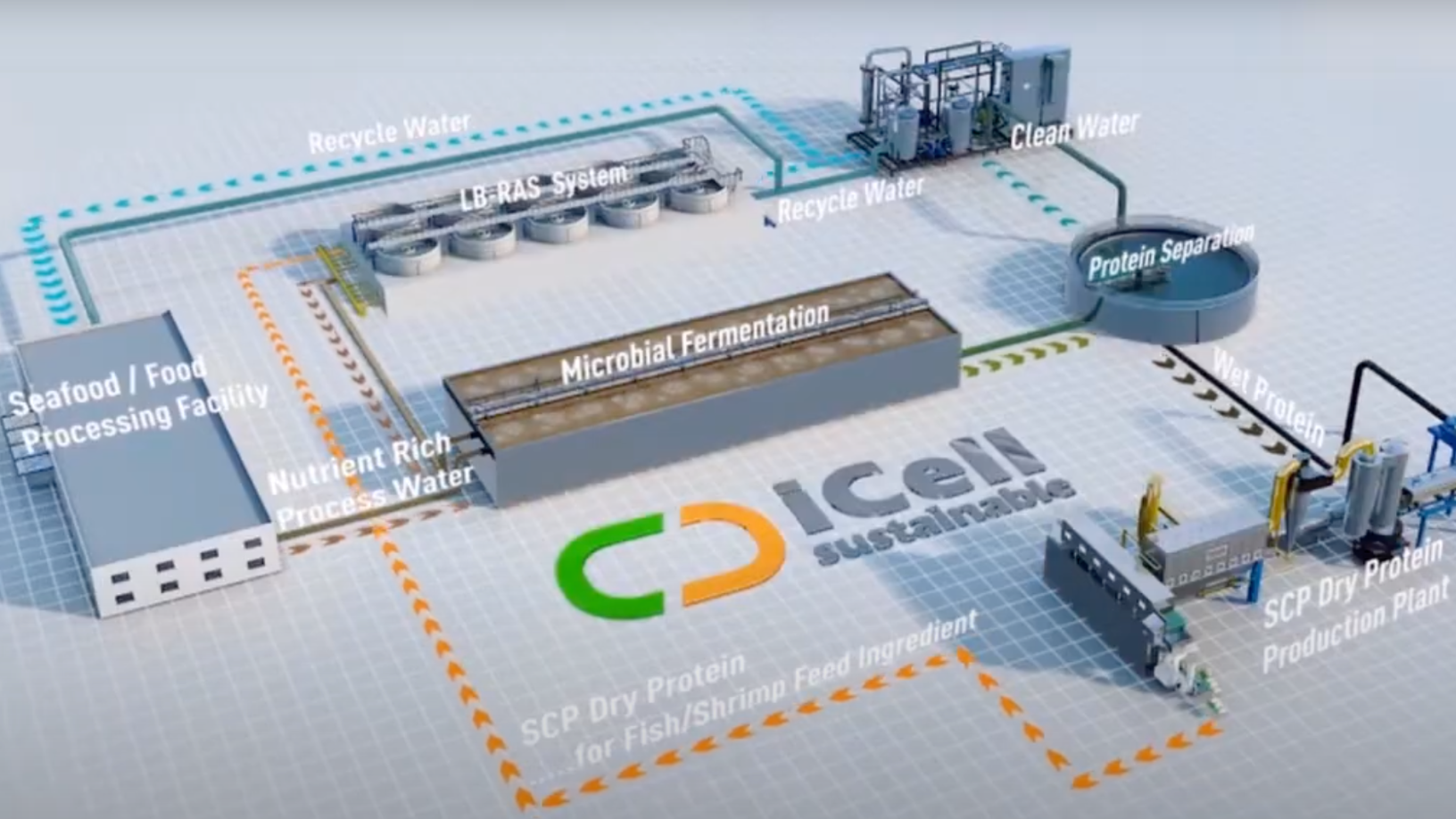

iCell: Upcycling nutrients from wastewater

Hong Kong-based iCell Sustainable Nutrition makes single-cell proteins with wastewater from food and beverage factories, generating revenue and purifying the water for safe discharge or reuse

IXON: Preserving food without canning or freezing

Chinese foodtech IXON aims to disrupt global cold chain logistics with its novel food preparation and packaging solution that keeps food fresh at room temperature for years

Bygen: Turning waste into activated carbon

Australian startup Bygen is offering agribusinesses more reasons to upcycle waste sustainably into a lucrative product with its eco-friendly process to make activated carbon

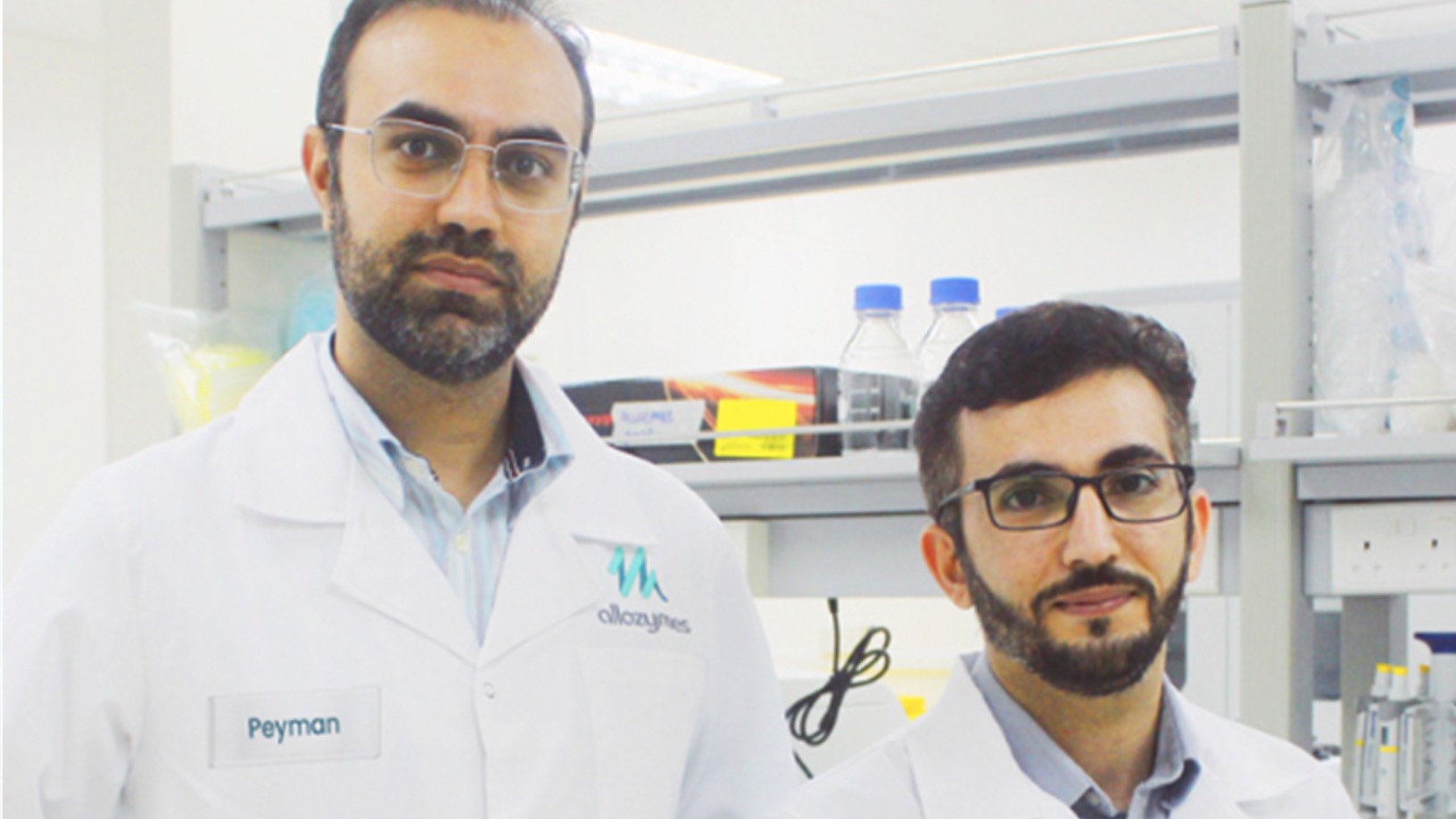

Allozymes wants to supercharge manufacturing with engineered enzymes

The Future Food Asia 2021 award winner speeds up enzyme engineering from years to months, is already attracting clients and has just raised $5m seed funding

Behind Indonesia's recent EV push

EV prices in Indonesia are still high and there are concerns about infrastructure, but serious policymaking and private sector support can boost consumer adoption

Future Food Asia 2021: Two winners take home $100,000 each

Agrifood startups, corporations and investors urged to collaborate and take action, tackling challenges in nutrition and climate change