Retail

This function is exclusive for Premium subscribers

-

DATABASE (95)

-

ARTICLES (84)

Sandeep Aggarwal is a serial entrepreneur with an MBA from Washington University at St. Louis, USA. He worked at Microsoft and Citibank before returning to India in 2011 to establish ShopClues, India’s first online managed marketplace and the country’s fifth unicorn in the consumer internet sector . In 2014, he also founded an automotive e-commerce site Droom, where he currently serves as CEO. He recently became an angel investor and plans to invest US$3 million in 2017.

Sandeep Aggarwal is a serial entrepreneur with an MBA from Washington University at St. Louis, USA. He worked at Microsoft and Citibank before returning to India in 2011 to establish ShopClues, India’s first online managed marketplace and the country’s fifth unicorn in the consumer internet sector . In 2014, he also founded an automotive e-commerce site Droom, where he currently serves as CEO. He recently became an angel investor and plans to invest US$3 million in 2017.

Part of the larger Sonae Group of companies, Sonae IM was launched in 2015 and is the corporate venture arm for tech-based investments. Since their launch, they have backed various companies particularly in the retail technology sector. These include StyleSage (fashion tech in predictive analytics) and InovRetail (demand forecasting for retailers).

Part of the larger Sonae Group of companies, Sonae IM was launched in 2015 and is the corporate venture arm for tech-based investments. Since their launch, they have backed various companies particularly in the retail technology sector. These include StyleSage (fashion tech in predictive analytics) and InovRetail (demand forecasting for retailers).

With a total investment portfolio of €2 million across six companies, Dueto invests primarily in infotech startups. One of its co-founders, João Ranito, was a former partner at Novabase SA, a Portuguese IT company that went public in 2000.

With a total investment portfolio of €2 million across six companies, Dueto invests primarily in infotech startups. One of its co-founders, João Ranito, was a former partner at Novabase SA, a Portuguese IT company that went public in 2000.

Plug and Play, the world’s largest startup accelerator, is a seed and early-stage investment firm. Based in Silicon Valley, Plug and Play invests in more than 160 of the 5,000 startups it reviews every year and runs industry-specific accelerator programs to help the startups it funds grow faster.

Plug and Play, the world’s largest startup accelerator, is a seed and early-stage investment firm. Based in Silicon Valley, Plug and Play invests in more than 160 of the 5,000 startups it reviews every year and runs industry-specific accelerator programs to help the startups it funds grow faster.

Founded in 2012, ClearVue Partners focuses on the consumer sector, e.g., new retail, lifestyle, health and wellness and digital consumption. ClearVue Partners typically invests US$10–50 million in growth-stage startups. Investment deals are spearheaded by a team with experience in the US and Greater China and an advisory group of recognized businessmen from the consumer industry. Its headquarters is in Shanghai.

Founded in 2012, ClearVue Partners focuses on the consumer sector, e.g., new retail, lifestyle, health and wellness and digital consumption. ClearVue Partners typically invests US$10–50 million in growth-stage startups. Investment deals are spearheaded by a team with experience in the US and Greater China and an advisory group of recognized businessmen from the consumer industry. Its headquarters is in Shanghai.

Founded in 1996, Index Ventures is a venture capital firm based in London, Jersey, Geneva and San Francisco. It has 35,000 employees worldwide working to manage a portfolio of 160 companies across 24 countries.

Founded in 1996, Index Ventures is a venture capital firm based in London, Jersey, Geneva and San Francisco. It has 35,000 employees worldwide working to manage a portfolio of 160 companies across 24 countries.

Openspace Ventures (formerly NSI Ventures)

Originally formed in 2014 as NSI Ventures, Openspace Ventures makes investments in technology companies based in Southeast Asia. Led by Shane Chesson and Hian Goh, Openspace Ventures used to be a part of Northstar Group, a private equity firm primarily invested in the financial services, retail, energy and telecom sectors. In 2018, Chesson and Goh took NSI Ventures independent and rebranded it as Openspace Ventures. They still maintain links with Northstar, with Northstar managing partner Patrick Goh becoming senior advisor to Openspace.

Originally formed in 2014 as NSI Ventures, Openspace Ventures makes investments in technology companies based in Southeast Asia. Led by Shane Chesson and Hian Goh, Openspace Ventures used to be a part of Northstar Group, a private equity firm primarily invested in the financial services, retail, energy and telecom sectors. In 2018, Chesson and Goh took NSI Ventures independent and rebranded it as Openspace Ventures. They still maintain links with Northstar, with Northstar managing partner Patrick Goh becoming senior advisor to Openspace.

Daocin Capital was established in 2015 by Wu Bin, a founding shareholder of NYSE-listed e-commerce site VIP.com. In 2017, Daocin Capital was listed among China's top 30 new equity investment institutions by Zero2IPO Group, a Chinese entrepreneurial and investment services platform.

Daocin Capital was established in 2015 by Wu Bin, a founding shareholder of NYSE-listed e-commerce site VIP.com. In 2017, Daocin Capital was listed among China's top 30 new equity investment institutions by Zero2IPO Group, a Chinese entrepreneurial and investment services platform.

Founded in 2004, Polaris Capital Group is a Japanese private equity fund management firm. Since its inception, Polaris has invested in about 30 Japanese companies. It completed the fourth round of fundraising for its Polaris Private Equity Fund IV in April 2017, during which it raised JPY 75 billion. The new fund will invest in Japanese companies in the manufacturing sector with globally competitive technologies/patents as well as companies with strong brands or unique business models in the consumer goods, retail and logistics sectors.

Founded in 2004, Polaris Capital Group is a Japanese private equity fund management firm. Since its inception, Polaris has invested in about 30 Japanese companies. It completed the fourth round of fundraising for its Polaris Private Equity Fund IV in April 2017, during which it raised JPY 75 billion. The new fund will invest in Japanese companies in the manufacturing sector with globally competitive technologies/patents as well as companies with strong brands or unique business models in the consumer goods, retail and logistics sectors.

Established in 2015, Innohub Capital offers comprehensive services for early-stage startups, including incubation, entrepreneurial training, marketing, etc. It operates incubators and manages funds that focus on seed funding in China, New Zealand and Australia. Innohub Capital has created the world's first service platform for startups operating an O2O model. Founder and Chairman Xu Hongbo is an expert in mobile internet and an evangelist of blockchain in China. Innohub Capital has invested in more than 60 companies so far.

Established in 2015, Innohub Capital offers comprehensive services for early-stage startups, including incubation, entrepreneurial training, marketing, etc. It operates incubators and manages funds that focus on seed funding in China, New Zealand and Australia. Innohub Capital has created the world's first service platform for startups operating an O2O model. Founder and Chairman Xu Hongbo is an expert in mobile internet and an evangelist of blockchain in China. Innohub Capital has invested in more than 60 companies so far.

Alpha Startups was founded by Xu Siqing, former managing director of WI Harper China, and Jiang Yameng, former co-managing partner of Sinovation Ventures. It offers customized services to each project in which it invests. Alpha Startups provides the startups it invests in with three to six months of free workspace and helps them receive follow-on financing.

Alpha Startups was founded by Xu Siqing, former managing director of WI Harper China, and Jiang Yameng, former co-managing partner of Sinovation Ventures. It offers customized services to each project in which it invests. Alpha Startups provides the startups it invests in with three to six months of free workspace and helps them receive follow-on financing.

Foresee Capital was set up as the asset management division of Phoenix Finance, an investment platform under Hong Kong-based Phoenix Television, in 2014. In 2017, it became the independent firm Beijing Foresee Asset Management Co., Ltd. As of Q1 2018, assets under management have exceeded RMB 69.5 billion, including fixed-income investment, real estate equity, private equity and overseas investment.

Foresee Capital was set up as the asset management division of Phoenix Finance, an investment platform under Hong Kong-based Phoenix Television, in 2014. In 2017, it became the independent firm Beijing Foresee Asset Management Co., Ltd. As of Q1 2018, assets under management have exceeded RMB 69.5 billion, including fixed-income investment, real estate equity, private equity and overseas investment.

Sony is a Japanese multinational conglomerate established in 1946. It has a high number of acquisitions, investing in more than 20 tech startups and companies manufacturing technology products. It also has a seed investment fund, Seed Acceleration Program, launched in April 2014 to promote ideas that are beyond existing business categories and develop them for commercialization.

Sony is a Japanese multinational conglomerate established in 1946. It has a high number of acquisitions, investing in more than 20 tech startups and companies manufacturing technology products. It also has a seed investment fund, Seed Acceleration Program, launched in April 2014 to promote ideas that are beyond existing business categories and develop them for commercialization.

Mastercard, established in 1966, has made 12 acquisitions to date and has a special interest in secure payment systems and different technologies associated with their implementation. It has a special interest in secure payment systems and different technologies associated with their implementation. Since launch in early 2014, MasterCard Start Path, the company’s effort to support innovative early stage startups around the world, has partnered with over 40 startups across the globe in areas including biometrics, big data, wearable technology, beacons, B2B payments, and logistics.

Mastercard, established in 1966, has made 12 acquisitions to date and has a special interest in secure payment systems and different technologies associated with their implementation. It has a special interest in secure payment systems and different technologies associated with their implementation. Since launch in early 2014, MasterCard Start Path, the company’s effort to support innovative early stage startups around the world, has partnered with over 40 startups across the globe in areas including biometrics, big data, wearable technology, beacons, B2B payments, and logistics.

MIWA Technologies: Reducing food waste and packaging with smart refill vending system

MIWA’s solution lets consumers buy exact refill quantities in personalized containers, eradicating need for single-use plastics throughout the supply chain

Bukalapak to raise IDR 21tn in Indonesia's biggest IPO yet

Although trailing rivals Tokopedia and Shopee in market share, Bukalapak cut its losses last year and will be Indonesia’s first unicorn to go public

Node: Fighting deforestation with fashionable footwear from agricultural waste

Using patented technology developed with Indonesia’s Ministry of Agriculture, Node turns farm waste and plant materials into biodegradable vegan footwear and shoe components to help fight deforestation.

Les Nouveaux Affineurs: Disrupting centuries-old French cheese culture

Backed by Michelin-star chefs and investors, Les Noveaux Affineurs is gearing up to be a global player in the billion-dollar vegan cheese market

ScentRealm: Digitally reproducing scents on demand

Unlike colors and sounds, scents are hard to code and digitalize. ScentRealm has not only done it, but has also opened its scent editor and database to the public

Kathy Xu stays ahead of the curve in China's VC scene

Dubbed “Queen of VC” in China, Xu has spotted great companies that others were not quite interested in, like Chinese online retail giant JD.com

Indonesian unicorn Traveloka aims for US listing via SPAC

The online travel aggregator reported revenue drops and layoffs in 2020 but became profitable late last year, led by recoveries in Vietnam and Thailand

Bizhare equity crowdfunding attracts over 50,000 retail investors, starts secondary trading

A partner of the Indonesia Central Securities Depository, Bizhare also lowered minimum investment amounts, implemented scripless trading and handpicked businesses on its platform

Koinpack tackles Indonesia's sachet waste problem with refillable bottles

Partnering with FMCG companies, Koinpack is making small amounts of household consumables available to lower-income groups without using traditional sachet packaging

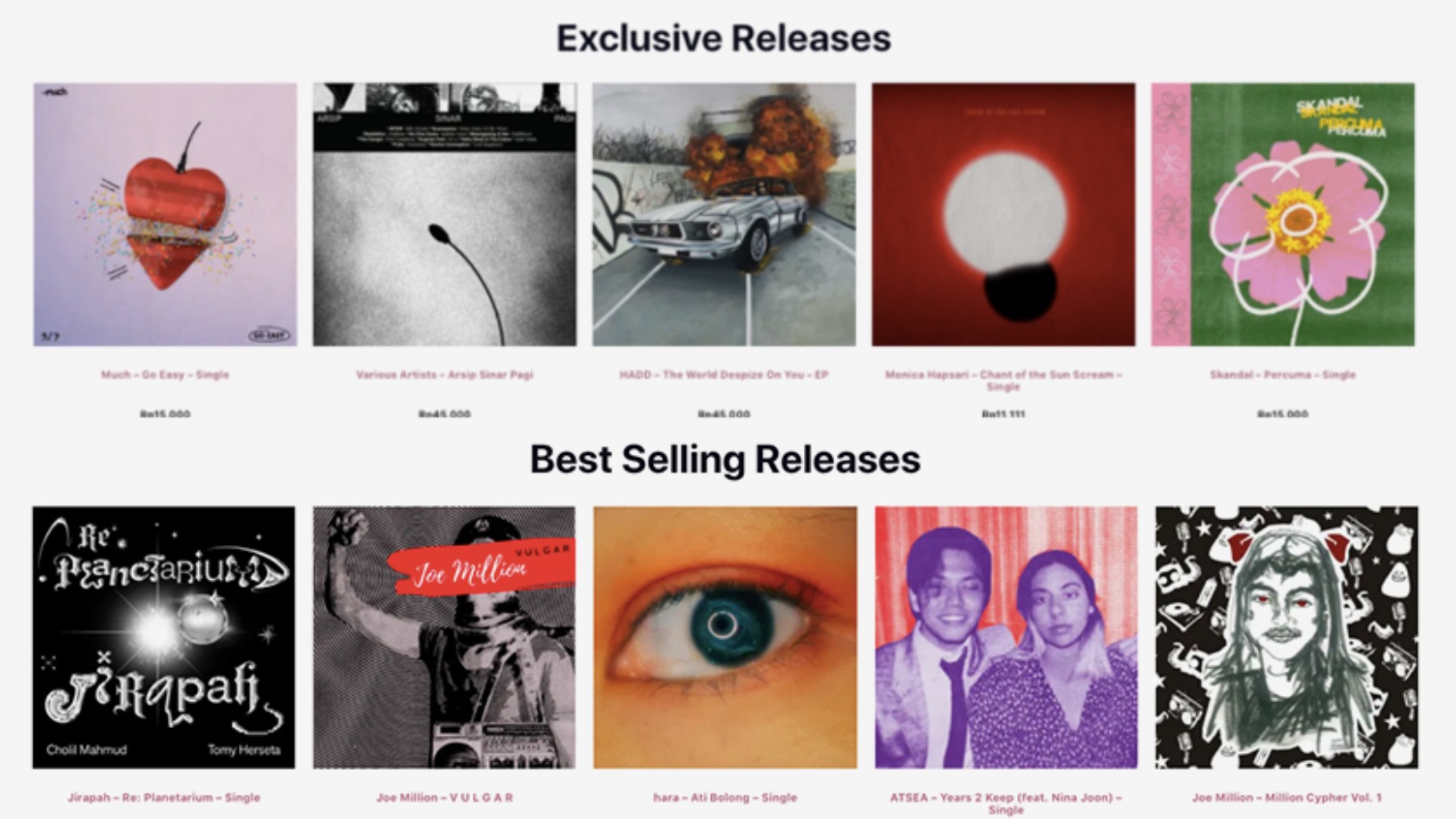

The Store Front: Striving to disrupt streaming with just rewards for musicians

Dubbing itself “the most equitable store around,” The Store Front aims to provide the fairest possible digital sales platform for musicians

Indonesia 2021 outlook: VCs "cautiously optimistic" on Southeast Asia's largest country

Investors expect Indonesian startups to regain their growth opportunities when the economy reopens with the Covid-19 vaccine rollout, even as some online living and working habits have stuck

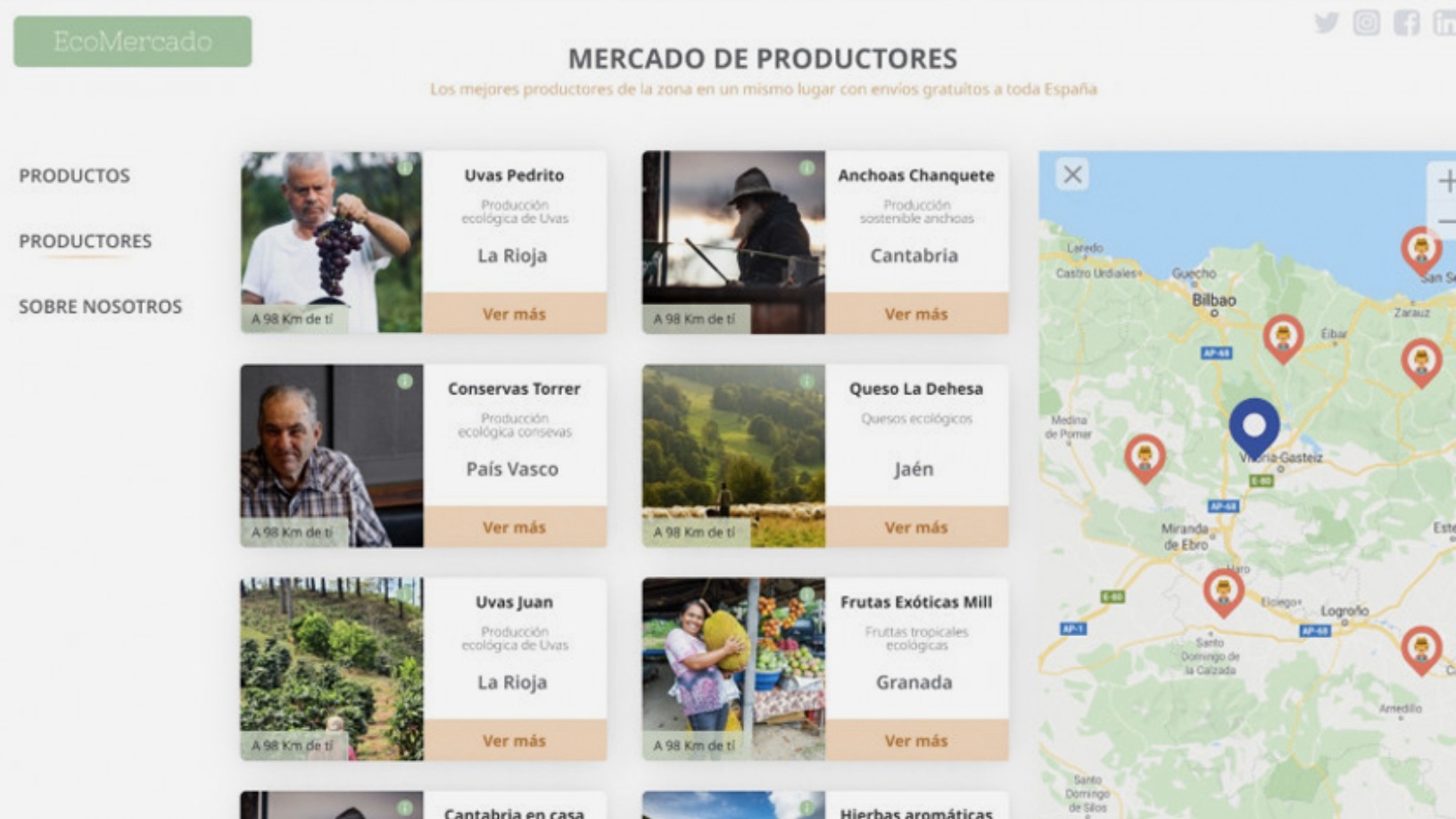

Plant on Demand: Helping small-scale organic farmers to thrive, sustainably

Plant on Demand will soon deploy product PODX’s “prescriptive” analytics to boost organic farmers’ productivity and prices, by optimizing future crop yields to match seasonal sales trends

Oimo: Biodegradable marine-based bioplastics for environmentally friendly food packaging

Its pellets already work well in current factory machinery, so Oimo wants to scale when the EU’s ban on single-use plastics kicks in next year

BukuWarung: Accounting-payments app targets Indonesia's 60m MSMEs

BukuWarung’s easy-to-use 6MB app designed for lower-end smartphones gets boost from Covid-19-accelerated digitalization

Indonesian B2B e-procurement platforms: Disrupting long-standing practices

Indonesia’s B2B e-commerce players are winning over corporate clients with education and government support, growing a market forecast to be worth $13.4bn by 2023