Draper Venture Network

-

DATABASE (580)

-

ARTICLES (337)

Founded in 2015 in Limassol in Cyprus, Caspian Venture Capital Partners has at least six companies in its portfolio. Its last disclosed investment was in 2017 when it participated in sustainable transportation and magnetic levitation firm Hyperloop’s $135m Series B round. Prior to that, in 2015 it invested in US-based Diamond Foundry, the world’s first certified carbon-neutral lab-produced diamond manufacturer.

Founded in 2015 in Limassol in Cyprus, Caspian Venture Capital Partners has at least six companies in its portfolio. Its last disclosed investment was in 2017 when it participated in sustainable transportation and magnetic levitation firm Hyperloop’s $135m Series B round. Prior to that, in 2015 it invested in US-based Diamond Foundry, the world’s first certified carbon-neutral lab-produced diamond manufacturer.

Founder and CEO of Pengyoufan

A former senior executive at Standard Chartered Bank and HP, Wang Huawei went on to set up his own business in internet investment/wealth management information services, Weitouhuirong (Beijing) Network Technology; and subsequently, P2P financing-social networking app Pengyoufan.

A former senior executive at Standard Chartered Bank and HP, Wang Huawei went on to set up his own business in internet investment/wealth management information services, Weitouhuirong (Beijing) Network Technology; and subsequently, P2P financing-social networking app Pengyoufan.

Founder of NYSE-listed Chinese online classifieds/marketplace giant 58.com, Yao Jinbo graduated from China Ocean University in 1999 with dual degrees in computer science and chemistry. He founded 58.com in 2005. He has experience in network marketing, network channel development and domain name strategy. Yao also co-founded Xueda Education Group.

Founder of NYSE-listed Chinese online classifieds/marketplace giant 58.com, Yao Jinbo graduated from China Ocean University in 1999 with dual degrees in computer science and chemistry. He founded 58.com in 2005. He has experience in network marketing, network channel development and domain name strategy. Yao also co-founded Xueda Education Group.

The Venture City is a tech accelerator with international growth hubs. The VC was established in 2017 by former Facebook executive Laura González-Estéfani with co-founder Clara Bullrich from Guggenheim Partners Latin America/LJ Partnership.The ecosystem accelerator is data-driven and has diverse interests in AI, healthtech, cybersecurity, SaaS, marketplaces, fintech, blockchain and VR. It also provides the full A-Z package of expertise to support startups that have the potential to scale internationally, especially in LatAm, Asia and Africa.

The Venture City is a tech accelerator with international growth hubs. The VC was established in 2017 by former Facebook executive Laura González-Estéfani with co-founder Clara Bullrich from Guggenheim Partners Latin America/LJ Partnership.The ecosystem accelerator is data-driven and has diverse interests in AI, healthtech, cybersecurity, SaaS, marketplaces, fintech, blockchain and VR. It also provides the full A-Z package of expertise to support startups that have the potential to scale internationally, especially in LatAm, Asia and Africa.

China Merchants Venture, a subsidiary of China Merchants Group, was founded in November 2015. It is headquartered in Shenzhen and has opened offices in Beijing, Hong Kong, Israel and Silicon Valley. The company invests in finance, real estate, logistics, transportation, healthcare, AI, among other industries. Of the RMB 5 bn capital under its management, RMB 2bn is earmarked for a fund of funds (FOF) and the other RMB 3 bn for direct investment. As of April 2019, the FOF has invested in 28 early and growth stage funds, and directly invested in over 50 startups.

China Merchants Venture, a subsidiary of China Merchants Group, was founded in November 2015. It is headquartered in Shenzhen and has opened offices in Beijing, Hong Kong, Israel and Silicon Valley. The company invests in finance, real estate, logistics, transportation, healthcare, AI, among other industries. Of the RMB 5 bn capital under its management, RMB 2bn is earmarked for a fund of funds (FOF) and the other RMB 3 bn for direct investment. As of April 2019, the FOF has invested in 28 early and growth stage funds, and directly invested in over 50 startups.

Founder and CEO of Mogoroom

Ma Xiaojun has 10+ years of experience in real estate, having founded Hengjia Real Estate in Shanghai and a holiday accommodation venture (Lvjiawang) in Sanya, Hainan, managing over 300 units.

Ma Xiaojun has 10+ years of experience in real estate, having founded Hengjia Real Estate in Shanghai and a holiday accommodation venture (Lvjiawang) in Sanya, Hainan, managing over 300 units.

Market leader Tuhu offers quality tires, auto aftermarket services and much more–at low prices, 24-hour online ordering and installation at its nationwide partner garages.

Market leader Tuhu offers quality tires, auto aftermarket services and much more–at low prices, 24-hour online ordering and installation at its nationwide partner garages.

Catalan Finance Institute (ICF)

Owned by the Catalan Government, the Catalan Finance Institute (ICF) is a public institution that offers a range of financing solutions, including loans and venture capital. ICF aims to boost private angel and seed investments within the Catalan entrepreneurial ecosystem, while diversifying its investment sources. In 2012, ICF started investing in early-stage startups based in the Catalan territory, providing equity loans of between €50,000 and €200,000. It also participates in syndicated funding within a network of Catalan business angels.

Owned by the Catalan Government, the Catalan Finance Institute (ICF) is a public institution that offers a range of financing solutions, including loans and venture capital. ICF aims to boost private angel and seed investments within the Catalan entrepreneurial ecosystem, while diversifying its investment sources. In 2012, ICF started investing in early-stage startups based in the Catalan territory, providing equity loans of between €50,000 and €200,000. It also participates in syndicated funding within a network of Catalan business angels.

EIT InnoEnergy, an initiative of the European Institute of Innovation and Technology (EI), offers startup entrepreneurs support in growing and scaling their businesses. It focuses on innovative clean-tech projects, offering mentorships and industry expertise through seed funding and an accelerator program. The network consists of 15 European clean-tech venture capitalists and 15 research institutes. To date, it has supported over 200 European startups working on initiatives aimed at boosting the prevalence of sustainable energy in the market.

EIT InnoEnergy, an initiative of the European Institute of Innovation and Technology (EI), offers startup entrepreneurs support in growing and scaling their businesses. It focuses on innovative clean-tech projects, offering mentorships and industry expertise through seed funding and an accelerator program. The network consists of 15 European clean-tech venture capitalists and 15 research institutes. To date, it has supported over 200 European startups working on initiatives aimed at boosting the prevalence of sustainable energy in the market.

Founded in Silicon Valley in 2000 by Kate Mitchell and Rory O'Driscoll, Scale Venture Partners invests in 75% early revenue and 25% growth stage companies, with an average initial investment of US$8 million. It's mainly interested in startups that disrupt the workplace and it usually invests between US$5-25 million per funding round. It has invested in more than 200 companies to date and was the lead investor in more than 80 investments. Scale has managed 62 exits to date including DocuSign, Box, HubSpot, Exact Target and Realm. Its recent investments include in Keep Truckin, Pantheon and PubNub's Series D rounds.

Founded in Silicon Valley in 2000 by Kate Mitchell and Rory O'Driscoll, Scale Venture Partners invests in 75% early revenue and 25% growth stage companies, with an average initial investment of US$8 million. It's mainly interested in startups that disrupt the workplace and it usually invests between US$5-25 million per funding round. It has invested in more than 200 companies to date and was the lead investor in more than 80 investments. Scale has managed 62 exits to date including DocuSign, Box, HubSpot, Exact Target and Realm. Its recent investments include in Keep Truckin, Pantheon and PubNub's Series D rounds.

Founder and CEO of Xiachufang

Beijing Institute of Clothing Technology graduate; a former product manager at popular social network Douban, and one of its earliest designers. UGC expert and core member of UCDChina (User-Centered Design China), a community bringing in design/research methods from overseas.

Beijing Institute of Clothing Technology graduate; a former product manager at popular social network Douban, and one of its earliest designers. UGC expert and core member of UCDChina (User-Centered Design China), a community bringing in design/research methods from overseas.

A UNESCO partner and the world’s largest online language-learning platform, supporting 72 languages, Talkmate helps users master speaking a new language in 200 hours.

A UNESCO partner and the world’s largest online language-learning platform, supporting 72 languages, Talkmate helps users master speaking a new language in 200 hours.

CEO and co-founder of Zensei

David Martín-Corral is an industrial engineer with a PhD in Mathematical Engineering, focusing on complex systems, viral computing and machine learning.He has worked as an associate lecturer teaching classes in social network analysis, digital health and data visualization, and in R programming for top-notch Spanish universities such as CIFF Business School, the IE Business School and Carlos III University in Madrid.Martín-Corral was also the founder of Polibot, the popular chatbot for Telegram and Facebook. In 2018, he co-founded Zensei with Carlos Hernando, a virtual clinic app aimed at preventing and assisting users in their management of respiratory problems. Both founders are currently mentoring startups as part of the Tetuan Valley Network.

David Martín-Corral is an industrial engineer with a PhD in Mathematical Engineering, focusing on complex systems, viral computing and machine learning.He has worked as an associate lecturer teaching classes in social network analysis, digital health and data visualization, and in R programming for top-notch Spanish universities such as CIFF Business School, the IE Business School and Carlos III University in Madrid.Martín-Corral was also the founder of Polibot, the popular chatbot for Telegram and Facebook. In 2018, he co-founded Zensei with Carlos Hernando, a virtual clinic app aimed at preventing and assisting users in their management of respiratory problems. Both founders are currently mentoring startups as part of the Tetuan Valley Network.

Steve Christian is the co-founder of Indonesian entertainment website KapanLagi.com. Launched in 2003 with a five-member team, KapanLagi.com has grown to an over 500-employee company and merged with Fimela Network in 2014 to create the Kapan Lagi Network (KLN). KLN has a monthly readership of 40 million.

Steve Christian is the co-founder of Indonesian entertainment website KapanLagi.com. Launched in 2003 with a five-member team, KapanLagi.com has grown to an over 500-employee company and merged with Fimela Network in 2014 to create the Kapan Lagi Network (KLN). KLN has a monthly readership of 40 million.

Headquartered in Madrid with satellite offices in Barcelona, London, Seattle and New York, Alma Mundi is a venture fund that aims to connect Spanish and Latin American entrepreneurs. Alma Mundi’s investments range between €500,000 and €5 million.Alma Mundi offers its investee companies direct access to a global network of investors and industry experts in leading technology ecosystems. Called the Mundi Club, the group comprises over 700 members from 41 cities worldwide. The group’s board members include advisers and executives from Merck, Havas, PepsiCo, Carrefour, Nestlé and HP.

Headquartered in Madrid with satellite offices in Barcelona, London, Seattle and New York, Alma Mundi is a venture fund that aims to connect Spanish and Latin American entrepreneurs. Alma Mundi’s investments range between €500,000 and €5 million.Alma Mundi offers its investee companies direct access to a global network of investors and industry experts in leading technology ecosystems. Called the Mundi Club, the group comprises over 700 members from 41 cities worldwide. The group’s board members include advisers and executives from Merck, Havas, PepsiCo, Carrefour, Nestlé and HP.

Vottun: The "WordPress for blockchain" seeks US expansion, investors

Seeking Series A funding this year, the agnostic SaaS opens blockchain's wealth of possibilities to businesses unfamiliar with the technology

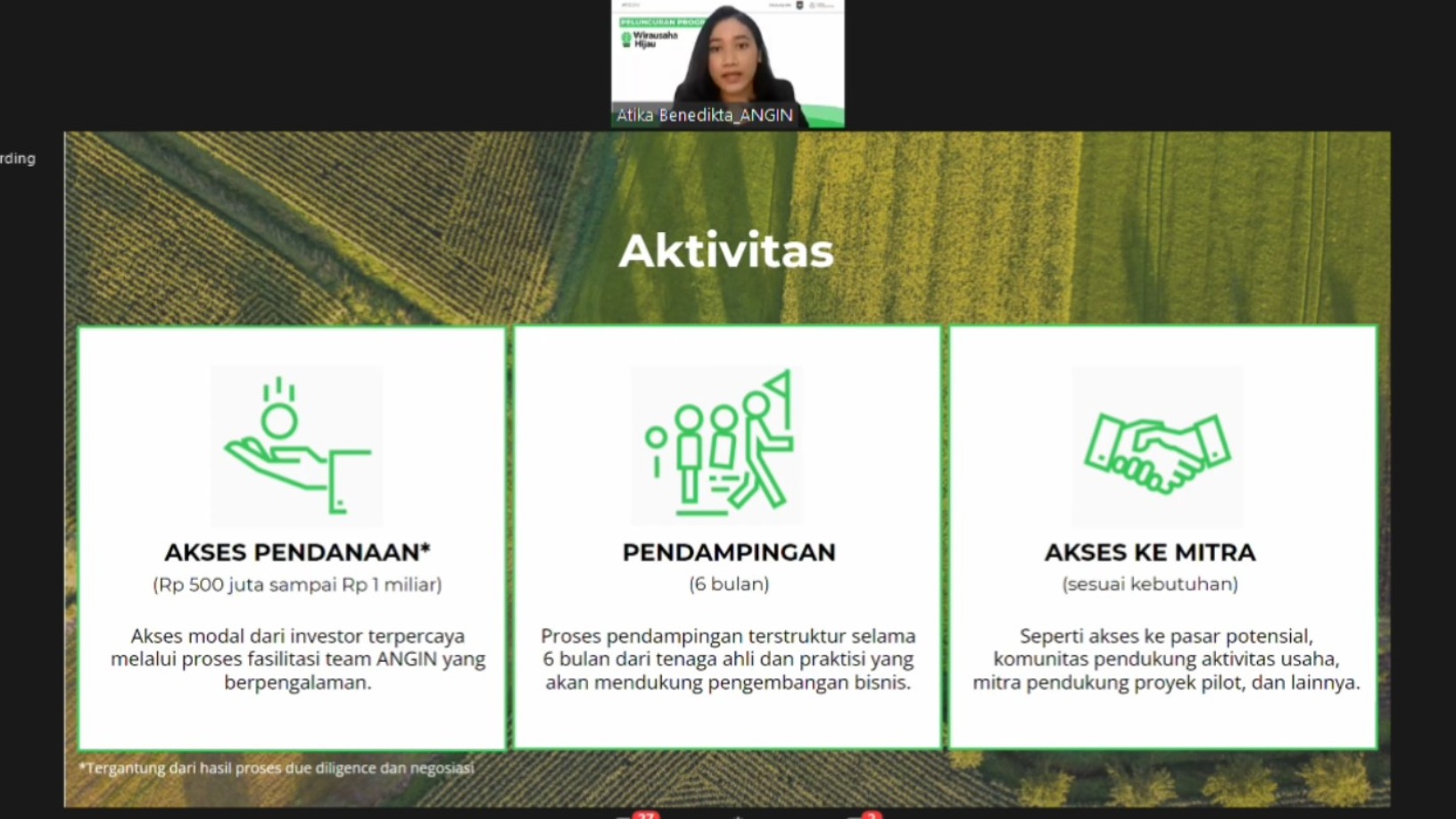

Indonesian angel investor network ANGIN launches agrifood incubator

Program targets ESG investment and builds on the strong potential of Indonesia’s agriculture sector, which kept growing despite the Covid-19 pandemic

Faraday Venture Partners’ MP Gonzalo Tradacete: “We are actively looking for startups”

Amid the Covid-19 slump, Faraday Venture Partners' CIO and MP shares his expectations for startup investments and favored sectors, the measures his firm has taken so far to help investees ride out the crisis, and more.

The charm of Jike: From search engine to popular social network

App's success shows enthusiasm for a personalized, community-based content and search platform, emulated even by Tencent

Swanlaab Venture Factory: €40 million funding chest to give power to the people

The female co-founder of Swanlaab Venture Factory believes that diversity enriches decision-making and drives performance. CompassList recently caught up with Verónica Trapa Díaz-Obregón to find out what's in store for Spain's first Israeli-backed VC fund

Medigo teams up with Indonesian Medical Association to launch primary care clinic network

Medigo aims to support healthcare operators with its clinic management SaaS, booking and medical records app for patients and more

Early Charm Ventures: Taking research from the labs to the real world

Instead of investing money, the venture studio gets hands-on, co-running companies with top scientists and their cutting-edge research

Beyond ride-hailing: Gojek, Grab and all their friends

Now that Grab and Go-Jek are in a faceoff on a regional scale, here's a look at how Southeast Asia's two biggest unicorns – and their investors – could be shaping the local digital economies and startup ecosystems

For your X-ray records, just check the cloud

A Chinese startup has built a digital medical image library on the cloud, bringing ease and cost savings to patients, doctors and hospitals countrywide

TheVentures founders launch Singapore VC to drive deals in Southeast Asia

The Korean Viki co-founders return to Singapore as venture builders and investors, offering South Korean partnerships and “CTO-as-a-service” in Southeast Asia

As Veniam’s “Internet of Moving Things” keeps growing, autonomous vehicles are next

The Portuguese startup is going places with its mesh networking technology, but that’s “just the beginning”, says Veniam founder and CEO João Barros. He talks to CompassList about partnering automakers to design self-driving cars, raising a new round of funding in 2018, and more

Carlos Guerrero: The legal guardian of tech startups

The lawyer and investor dives deep in the Spanish startup ecosystem, supporting young tech companies with both financial and specialized legal support

Indonesia launches national pitch competition HighPitch 2020 to re-energize its startup ecosystem

With 43 VC investors so far joining as judges and mentors, HighPitch 2020 aims to reconnect investors with young startups across the country amid Covid-19

Nuuk, the cooler box poised to disrupt cold chain logistics

Barcelona-based startup Groenlandia Tech has developed a smart cooler box to track and monitor biological samples, providing an extra layer of security and control during transport

AlphaBeats: a 10-minute music playlist to de-stress your brain using biofeedback

With the exclusive rights to Philips’s neurofeedback technology, Alphabeats has developed an app to offer and enhance relaxation using a person’s favorite music

Sorry, we couldn’t find any matches for“Draper Venture Network”.