Draper Venture Network

-

DATABASE (580)

-

ARTICLES (337)

bp ventures is an investment arm of the energy group BP with an annual venture investment budget between $150m and $200m. The group invests in new energy solutions, with over 30 startups’ investments in its portfolio supporting BP’s core business in oil and gas.bp ventures has increasingly invested over the past years in carbon-management technologies, low-carbon products, and advanced mobility through EV charging companies like the Chinese Shanghai PowerShare Tech and the California-based FreeWire Technologies.

bp ventures is an investment arm of the energy group BP with an annual venture investment budget between $150m and $200m. The group invests in new energy solutions, with over 30 startups’ investments in its portfolio supporting BP’s core business in oil and gas.bp ventures has increasingly invested over the past years in carbon-management technologies, low-carbon products, and advanced mobility through EV charging companies like the Chinese Shanghai PowerShare Tech and the California-based FreeWire Technologies.

American financial services company Capital Group was established in 1931. As one of the world’s oldest investment management firms, it has over $2tn assets under management. Major known investments include arms and aerospace firm BAE Systems and British American Tobacco. In 1992, Capital Group established Capital Group Private Markets, which specializes in alternative private equity and venture capital investments. This organization has invested in companies like ride-hailing firms Gojek and Didi Chuxing, Philippines media conglomerate ABS-CBN, and more.

American financial services company Capital Group was established in 1931. As one of the world’s oldest investment management firms, it has over $2tn assets under management. Major known investments include arms and aerospace firm BAE Systems and British American Tobacco. In 1992, Capital Group established Capital Group Private Markets, which specializes in alternative private equity and venture capital investments. This organization has invested in companies like ride-hailing firms Gojek and Didi Chuxing, Philippines media conglomerate ABS-CBN, and more.

Passion Capital is an early stage venture capital firm that has been involved in several large European technology exits, such as QXL/Tradus, Ricardo.de and Last.fm. The partners include Robert Dighero, Eileen Burbidge and Stefan Glaenzer who believe that the passion and ability of the founders are critical keys to success. Passion Capital has a hub for activities in White Bear Yard in London and invests in digital media and technology companies.

Passion Capital is an early stage venture capital firm that has been involved in several large European technology exits, such as QXL/Tradus, Ricardo.de and Last.fm. The partners include Robert Dighero, Eileen Burbidge and Stefan Glaenzer who believe that the passion and ability of the founders are critical keys to success. Passion Capital has a hub for activities in White Bear Yard in London and invests in digital media and technology companies.

Jointly managed by Fondo de Fondos and Sun Mountain Capital, Mexico Ventures leads venture capital strategies in Mexico and USA. The VC offers solutions to add value to diverse business portfolios. Starting with minimum investments of US$1 million, the firm has interests in companies and other funds. It is based at the offices of the Mexican Capital Investment Corporation in Mexico City and also has operations in Santa Fe and New Mexico.

Jointly managed by Fondo de Fondos and Sun Mountain Capital, Mexico Ventures leads venture capital strategies in Mexico and USA. The VC offers solutions to add value to diverse business portfolios. Starting with minimum investments of US$1 million, the firm has interests in companies and other funds. It is based at the offices of the Mexican Capital Investment Corporation in Mexico City and also has operations in Santa Fe and New Mexico.

Founded in 2005, Fortune Link focuses on private equity investment. Its founder, Kan Zhidong was also the founder of Shenzhen Capital Group, one of the first few venture capitalists in China. As at March 2018, it had set up a number of funds and managed over 20 investment teams.With over RMB 30bn worth of assets under its management, Fortune Link mainly invests in sectors including TMT, environmental protection, advanced material, healthcare, high tech industries, culture and media.

Founded in 2005, Fortune Link focuses on private equity investment. Its founder, Kan Zhidong was also the founder of Shenzhen Capital Group, one of the first few venture capitalists in China. As at March 2018, it had set up a number of funds and managed over 20 investment teams.With over RMB 30bn worth of assets under its management, Fortune Link mainly invests in sectors including TMT, environmental protection, advanced material, healthcare, high tech industries, culture and media.

Horizons Ventures is a Hong Kong-based venture capital firm that manages the personal investments of Li Ka-shing, one of Hong Kong’s richest businessmen. Horizons’ investments cover a wide range of tech, media, and telecommunications companies. Standouts include artificial intelligence company DeepMind (acquired by Google in 2014), plant-based meat replacement makers Impossible Foods, and video conferencing software Zoom. It has also backed consumer-facing businesses like Atomo Coffee in Australia, Kopi Kenangan in Indonesia, and US-based distilled spirits company Endless West.

Horizons Ventures is a Hong Kong-based venture capital firm that manages the personal investments of Li Ka-shing, one of Hong Kong’s richest businessmen. Horizons’ investments cover a wide range of tech, media, and telecommunications companies. Standouts include artificial intelligence company DeepMind (acquired by Google in 2014), plant-based meat replacement makers Impossible Foods, and video conferencing software Zoom. It has also backed consumer-facing businesses like Atomo Coffee in Australia, Kopi Kenangan in Indonesia, and US-based distilled spirits company Endless West.

Enagás Emprende, part of the Spanish Transmission System Operator (TS) Enagás, is an investment venture backing and accelerating technology-based startups in their scale-up phase. Its portfolio investment mainly includes companies providing renewable gases, green hydrogen, and biomethane, but also sustainable mobility and energy efficiency. With 50 years of experience in energy infrastructures across Spain, the US, Mexico, Chile, Peru, Albania, Greece and Italy, Enagás provides its portfolio startups with mentoring and expertise acting as investors, clients and industry partners.

Enagás Emprende, part of the Spanish Transmission System Operator (TS) Enagás, is an investment venture backing and accelerating technology-based startups in their scale-up phase. Its portfolio investment mainly includes companies providing renewable gases, green hydrogen, and biomethane, but also sustainable mobility and energy efficiency. With 50 years of experience in energy infrastructures across Spain, the US, Mexico, Chile, Peru, Albania, Greece and Italy, Enagás provides its portfolio startups with mentoring and expertise acting as investors, clients and industry partners.

Archipelago Next is an investor based in Spain’s Canary Islands and owned by prominent local companies. It has a non-sectorial focus on startups based in the archipelago and in Africa and is the Canary Islands’ only venture builder. It currently has 20 startups in its portfolio. Its most recent investments were €520,000 in a seed funding round in 2021 of Valencian accessibility hardware and app for the deaf, Visualfy and €260,000 in the 2021 seed round of AI-powered crop prediction agtech RawData.

Archipelago Next is an investor based in Spain’s Canary Islands and owned by prominent local companies. It has a non-sectorial focus on startups based in the archipelago and in Africa and is the Canary Islands’ only venture builder. It currently has 20 startups in its portfolio. Its most recent investments were €520,000 in a seed funding round in 2021 of Valencian accessibility hardware and app for the deaf, Visualfy and €260,000 in the 2021 seed round of AI-powered crop prediction agtech RawData.

Hong Kong-based Unicorn Capital Partners was founded in 2015 by Tommy Yip, former partner of Emerald Hill Capital Partners.Unicorn is a leading FoF platform that focuses on venture capital fund and direct investment opportunities in China and Asia. It mainly invests in technology, media, telecommunications and healthcare. By December 2019, Unicorn had $800m in assets under management. It also raised over $350m for its fourth fund.

Hong Kong-based Unicorn Capital Partners was founded in 2015 by Tommy Yip, former partner of Emerald Hill Capital Partners.Unicorn is a leading FoF platform that focuses on venture capital fund and direct investment opportunities in China and Asia. It mainly invests in technology, media, telecommunications and healthcare. By December 2019, Unicorn had $800m in assets under management. It also raised over $350m for its fourth fund.

Founded in 2010, WestSummit Capital is a US-focused, growth-stage venture capital fund with a strong presence in Silicon Valley, Beijing, Hong Kong and Dublin. It has a total of over $400m under management, and invests in the mobile, internet, cloud computing, big data and IoT sectors. In 2013, it participated in a Series C $20m investment in Twitch, the world's leading video platform and community for gamers, which was acquired by Amazon in August 2014 for close to $1bn.

Founded in 2010, WestSummit Capital is a US-focused, growth-stage venture capital fund with a strong presence in Silicon Valley, Beijing, Hong Kong and Dublin. It has a total of over $400m under management, and invests in the mobile, internet, cloud computing, big data and IoT sectors. In 2013, it participated in a Series C $20m investment in Twitch, the world's leading video platform and community for gamers, which was acquired by Amazon in August 2014 for close to $1bn.

The Chinese affiliate of top Silicon Valley venture capital firm Sequoia Capital was founded in 2005 by Neil Shen (Shen Nanpeng), a co-founder of Ctrip, China's largest travel booking site. With more than US$6 billion under management in 2015, the firm has invested in more than 300 startups in China, including some of the country's biggest brands: Alibaba, JD.com, Didi, DJI, Sina and Qihoo 360. Sequoia, together with China Broadband Capital, also helped to bring to China LinkedIn and AirBnB, companies that both have invested in.

The Chinese affiliate of top Silicon Valley venture capital firm Sequoia Capital was founded in 2005 by Neil Shen (Shen Nanpeng), a co-founder of Ctrip, China's largest travel booking site. With more than US$6 billion under management in 2015, the firm has invested in more than 300 startups in China, including some of the country's biggest brands: Alibaba, JD.com, Didi, DJI, Sina and Qihoo 360. Sequoia, together with China Broadband Capital, also helped to bring to China LinkedIn and AirBnB, companies that both have invested in.

Media Digital Ventures is the first Spanish Cross-Media fund focusing on Media for Equity. It holds multichannel advertising assets across major media sectors. Based in Barcelona, MDV also creates multimedia and advertising campaigns for scaling high-growth startups in return for equity.MDV is co-founded by Gerard Olivé and Miguel Vicente. Both are serial entrepreneurs, investors and co-founders of Antai Venture Builder, Wallapop, Deliberry and Chicplace. Vicente, who exited LetsBonus which he founded in 2009, is also the president of Barcelona Tech City.

Media Digital Ventures is the first Spanish Cross-Media fund focusing on Media for Equity. It holds multichannel advertising assets across major media sectors. Based in Barcelona, MDV also creates multimedia and advertising campaigns for scaling high-growth startups in return for equity.MDV is co-founded by Gerard Olivé and Miguel Vicente. Both are serial entrepreneurs, investors and co-founders of Antai Venture Builder, Wallapop, Deliberry and Chicplace. Vicente, who exited LetsBonus which he founded in 2009, is also the president of Barcelona Tech City.

Daniel Romy is the CEO of Investments at Media Digital Ventures, the first media fund dedicated to Media for Equity in Spain. With assets valued at €35 million, MDV supports startups through powerful marketing campaigns in return for equity. Romy is experienced in venture capital and crowdfunding, having worked as COO for three years at The Crowd Angel, a leading equity crowdfunding platform. He is also a member of the investment committee of Inveready First II SCR that manages assets worth €20 million.

Daniel Romy is the CEO of Investments at Media Digital Ventures, the first media fund dedicated to Media for Equity in Spain. With assets valued at €35 million, MDV supports startups through powerful marketing campaigns in return for equity. Romy is experienced in venture capital and crowdfunding, having worked as COO for three years at The Crowd Angel, a leading equity crowdfunding platform. He is also a member of the investment committee of Inveready First II SCR that manages assets worth €20 million.

B4Motion is a Spanish venture capital fund led by Sebastian Canadell and supported by a board of advisors who have varied expertise in visual media production, mobile strategy, product design and law. B4Motion is focused on mobility-related technologies, including autonomous driving systems, Internet-of-Things (IoT) applications for transport as well as on-demand logistics, car sharing, parking and valet services. B4Motion invests across all funding stages from seed through Series D and IPO in the Spanish and Latin American markets.

B4Motion is a Spanish venture capital fund led by Sebastian Canadell and supported by a board of advisors who have varied expertise in visual media production, mobile strategy, product design and law. B4Motion is focused on mobility-related technologies, including autonomous driving systems, Internet-of-Things (IoT) applications for transport as well as on-demand logistics, car sharing, parking and valet services. B4Motion invests across all funding stages from seed through Series D and IPO in the Spanish and Latin American markets.

SPH Media Fund is a S$100 million venture capital fund set up by government-backed listed group, Singapore Press Holdings Limited.The fund invests in early growth technology companies globally. Although the fund is stage agnostic, most of the portfolio companies are at Series A or later. The size of the investment depends on the needs of the startup. A typical ticket size is between S$1 million and S$2 million, with possible bigger amounts of up to S$5 million per round.

SPH Media Fund is a S$100 million venture capital fund set up by government-backed listed group, Singapore Press Holdings Limited.The fund invests in early growth technology companies globally. Although the fund is stage agnostic, most of the portfolio companies are at Series A or later. The size of the investment depends on the needs of the startup. A typical ticket size is between S$1 million and S$2 million, with possible bigger amounts of up to S$5 million per round.

Vottun: The "WordPress for blockchain" seeks US expansion, investors

Seeking Series A funding this year, the agnostic SaaS opens blockchain's wealth of possibilities to businesses unfamiliar with the technology

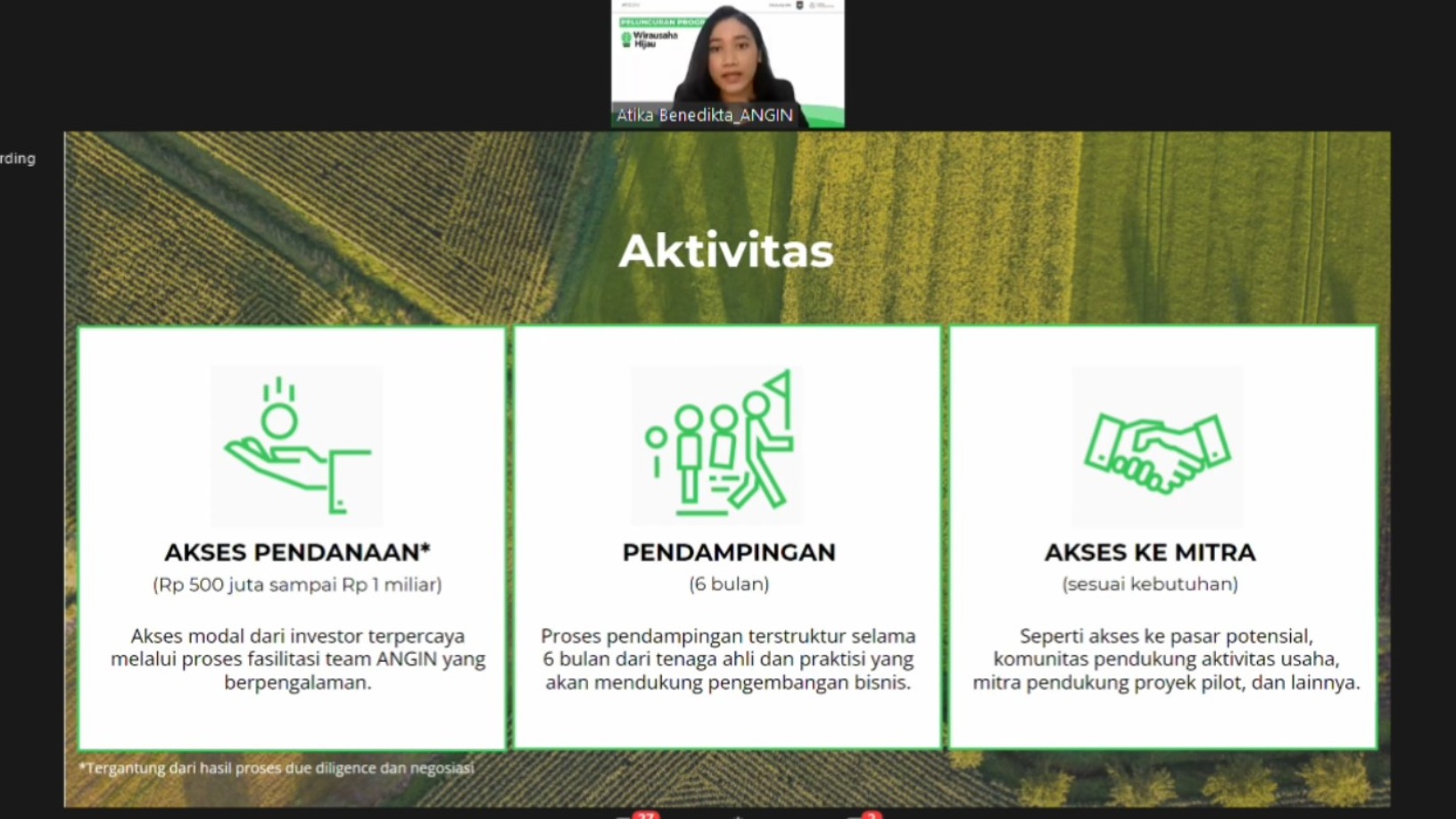

Indonesian angel investor network ANGIN launches agrifood incubator

Program targets ESG investment and builds on the strong potential of Indonesia’s agriculture sector, which kept growing despite the Covid-19 pandemic

Faraday Venture Partners’ MP Gonzalo Tradacete: “We are actively looking for startups”

Amid the Covid-19 slump, Faraday Venture Partners' CIO and MP shares his expectations for startup investments and favored sectors, the measures his firm has taken so far to help investees ride out the crisis, and more.

The charm of Jike: From search engine to popular social network

App's success shows enthusiasm for a personalized, community-based content and search platform, emulated even by Tencent

Swanlaab Venture Factory: €40 million funding chest to give power to the people

The female co-founder of Swanlaab Venture Factory believes that diversity enriches decision-making and drives performance. CompassList recently caught up with Verónica Trapa Díaz-Obregón to find out what's in store for Spain's first Israeli-backed VC fund

Medigo teams up with Indonesian Medical Association to launch primary care clinic network

Medigo aims to support healthcare operators with its clinic management SaaS, booking and medical records app for patients and more

Early Charm Ventures: Taking research from the labs to the real world

Instead of investing money, the venture studio gets hands-on, co-running companies with top scientists and their cutting-edge research

Beyond ride-hailing: Gojek, Grab and all their friends

Now that Grab and Go-Jek are in a faceoff on a regional scale, here's a look at how Southeast Asia's two biggest unicorns – and their investors – could be shaping the local digital economies and startup ecosystems

For your X-ray records, just check the cloud

A Chinese startup has built a digital medical image library on the cloud, bringing ease and cost savings to patients, doctors and hospitals countrywide

TheVentures founders launch Singapore VC to drive deals in Southeast Asia

The Korean Viki co-founders return to Singapore as venture builders and investors, offering South Korean partnerships and “CTO-as-a-service” in Southeast Asia

As Veniam’s “Internet of Moving Things” keeps growing, autonomous vehicles are next

The Portuguese startup is going places with its mesh networking technology, but that’s “just the beginning”, says Veniam founder and CEO João Barros. He talks to CompassList about partnering automakers to design self-driving cars, raising a new round of funding in 2018, and more

Carlos Guerrero: The legal guardian of tech startups

The lawyer and investor dives deep in the Spanish startup ecosystem, supporting young tech companies with both financial and specialized legal support

Indonesia launches national pitch competition HighPitch 2020 to re-energize its startup ecosystem

With 43 VC investors so far joining as judges and mentors, HighPitch 2020 aims to reconnect investors with young startups across the country amid Covid-19

Nuuk, the cooler box poised to disrupt cold chain logistics

Barcelona-based startup Groenlandia Tech has developed a smart cooler box to track and monitor biological samples, providing an extra layer of security and control during transport

AlphaBeats: a 10-minute music playlist to de-stress your brain using biofeedback

With the exclusive rights to Philips’s neurofeedback technology, Alphabeats has developed an app to offer and enhance relaxation using a person’s favorite music

Sorry, we couldn’t find any matches for“Draper Venture Network”.