University incubators

-

DATABASE (964)

-

ARTICLES (261)

Yangtze Delta Region Institute of Tsinghua University, Zhejiang

Yangtze Delta Region Research Institute of Tsinghua University, Zhejiang was co-founded by the provincial government of Zhejiang and Tsinghua University in 2003 for tech transfer. It has set up over 50 R&D platforms in the areas of life sciences, digital creativity, information technology and ecological environment and 11 offshore incubators in the US, UK, Germany and Australia. The institute manages over RMB 7.5bn of assets and also makes investments through its sub-funds with a total size of more than RMB 10bn. So far, it has incubated and invested in over 2,500 companies, 35 of whom have gone public or been acquired by listed companies.

Yangtze Delta Region Research Institute of Tsinghua University, Zhejiang was co-founded by the provincial government of Zhejiang and Tsinghua University in 2003 for tech transfer. It has set up over 50 R&D platforms in the areas of life sciences, digital creativity, information technology and ecological environment and 11 offshore incubators in the US, UK, Germany and Australia. The institute manages over RMB 7.5bn of assets and also makes investments through its sub-funds with a total size of more than RMB 10bn. So far, it has incubated and invested in over 2,500 companies, 35 of whom have gone public or been acquired by listed companies.

The Stanford Management Company (SMC) invests through the Merged Pool that oversees the majority of its investable assets. Its portfolio includes diverse equity-oriented strategies: domestic and foreign public equities (27%), real estate (8%), natural resources (7%) and private equity (30%). Private equity is maintained at 30% of the Merged Pool based on its risk-return criteria. The Merged Pool was valued at $29.6 bn as of June 30, 2019.The private equity division operates through selected external partners for early and later-stage investments. According to the university’s latest investment report, the SMC is working to improve its investment portfolio that has become over diversified during the last four years, making it difficult to maintain quality and drive superior returns. The number of active partners has been reduced to 75 including 37 new ones added in the last four years. The new partners have generated a net internal rate of return of 29.3% over the last four years.

The Stanford Management Company (SMC) invests through the Merged Pool that oversees the majority of its investable assets. Its portfolio includes diverse equity-oriented strategies: domestic and foreign public equities (27%), real estate (8%), natural resources (7%) and private equity (30%). Private equity is maintained at 30% of the Merged Pool based on its risk-return criteria. The Merged Pool was valued at $29.6 bn as of June 30, 2019.The private equity division operates through selected external partners for early and later-stage investments. According to the university’s latest investment report, the SMC is working to improve its investment portfolio that has become over diversified during the last four years, making it difficult to maintain quality and drive superior returns. The number of active partners has been reduced to 75 including 37 new ones added in the last four years. The new partners have generated a net internal rate of return of 29.3% over the last four years.

A pioneer of China's IT industry, Zhu Min founded Cybernaut in 2005. To date, the firm has invested over $10bn in Chinese technology companies through 70 funds, in addition to another $10bn jointly managed with its partners outside China. Cybernaut also has about 20 startup incubators (Cybernaut Internet+) across China. Zhu studied at Stanford University in the 1980s and founded web conference solutions provider WebEx Communications Inc., which went public on NASDAQ in 2000, before being sold to Cisco for $3.2bn.

A pioneer of China's IT industry, Zhu Min founded Cybernaut in 2005. To date, the firm has invested over $10bn in Chinese technology companies through 70 funds, in addition to another $10bn jointly managed with its partners outside China. Cybernaut also has about 20 startup incubators (Cybernaut Internet+) across China. Zhu studied at Stanford University in the 1980s and founded web conference solutions provider WebEx Communications Inc., which went public on NASDAQ in 2000, before being sold to Cisco for $3.2bn.

WA4STEAM is a not-for-profit organization that provides seed capital with an investment focus on supporting women with projects and ideas applicable to STEAM sectors (Science, Technology, Engineering, Arts/Architecture and Mathematics).The association is composed of women with backgrounds and experiences in biosciences, mathematics, finance, engineering, law, accounting and coaching. It offers significant support to the founders during the early stages of the startup cycle.WA4STEAM cooperates with a network of co-investors, VC funds, family offices, accelerators and incubators. It also collaborates with university associations and science and technology parks that back and leverage the portfolio of companies.

WA4STEAM is a not-for-profit organization that provides seed capital with an investment focus on supporting women with projects and ideas applicable to STEAM sectors (Science, Technology, Engineering, Arts/Architecture and Mathematics).The association is composed of women with backgrounds and experiences in biosciences, mathematics, finance, engineering, law, accounting and coaching. It offers significant support to the founders during the early stages of the startup cycle.WA4STEAM cooperates with a network of co-investors, VC funds, family offices, accelerators and incubators. It also collaborates with university associations and science and technology parks that back and leverage the portfolio of companies.

CMO and Co-founder of Tuvalum

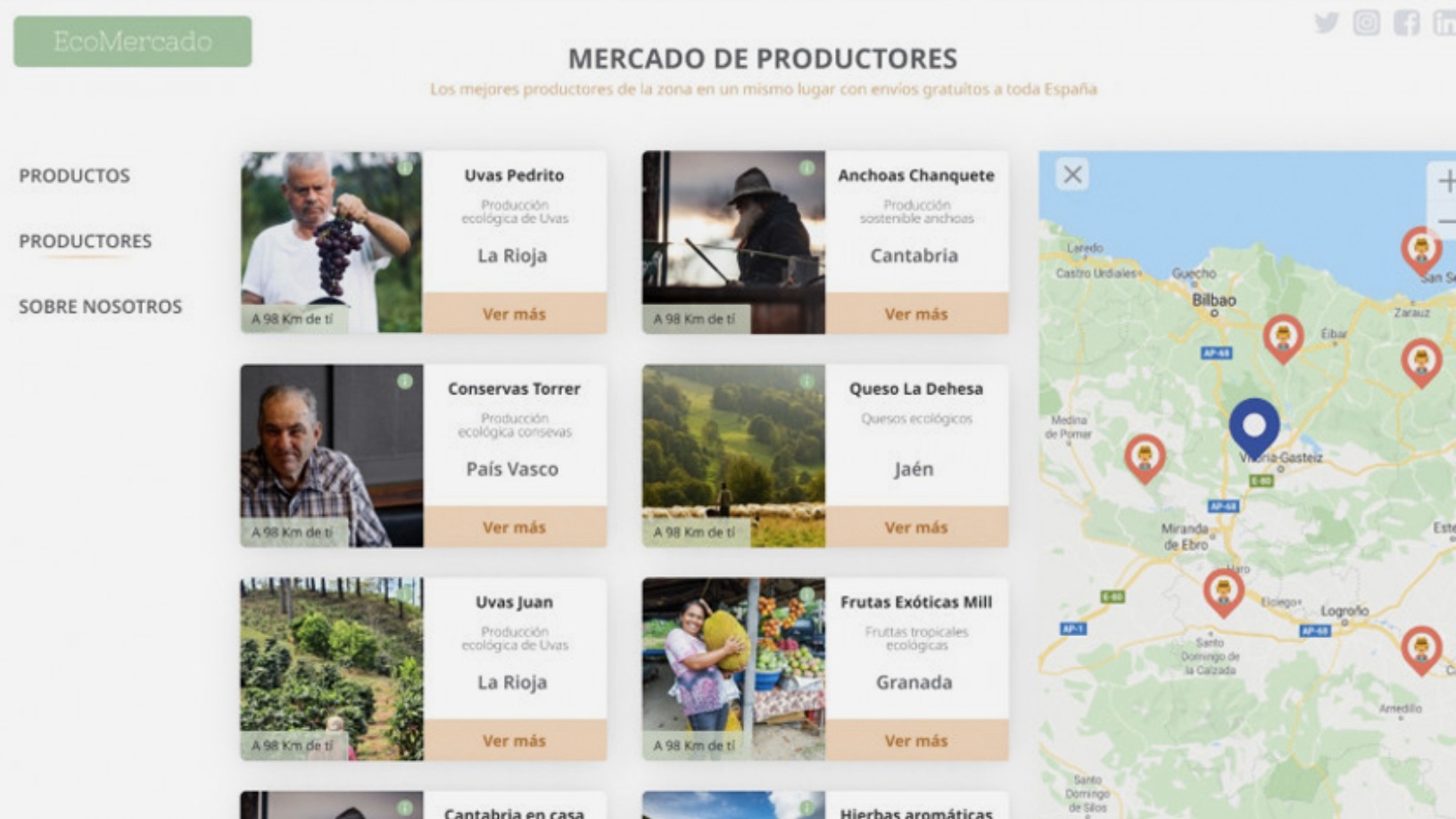

In October 2014, Ismael Labrador became the CMO and co-founder of Tuvalum, a web marketplace for second-hand bikes and accessories. Over the years, he has gained a wide range of work experience in e-commerce, inbound marketing, product management, data-driven and customer-centered analytics. The journalism graduate has also specialized in social media and community management in collaboration with renowned digital agencies in Spain. Currently based in Valencia, Ismael is also a mentor and advisor at various business schools and incubators like Demium Startups that is also an investor in Tuvalum.

In October 2014, Ismael Labrador became the CMO and co-founder of Tuvalum, a web marketplace for second-hand bikes and accessories. Over the years, he has gained a wide range of work experience in e-commerce, inbound marketing, product management, data-driven and customer-centered analytics. The journalism graduate has also specialized in social media and community management in collaboration with renowned digital agencies in Spain. Currently based in Valencia, Ismael is also a mentor and advisor at various business schools and incubators like Demium Startups that is also an investor in Tuvalum.

SEEDS Capital is the investment arm of Enterprise Singapore supporting locally based startups that have innovative technologies and global market potential. Sectors of focus include advanced manufacturing & engineering, health & biomedical sciences, urban sustainability & solutions, fintech, artificial intelligence and agritech. SEEDS currently works with more than 500 deep tech startups, and over 40 incubators, accelerators and venture capital firms.

SEEDS Capital is the investment arm of Enterprise Singapore supporting locally based startups that have innovative technologies and global market potential. Sectors of focus include advanced manufacturing & engineering, health & biomedical sciences, urban sustainability & solutions, fintech, artificial intelligence and agritech. SEEDS currently works with more than 500 deep tech startups, and over 40 incubators, accelerators and venture capital firms.

After a decade of technology and capability development, Alén Space's proprietary nanosatellites offer a faster, cheaper way to meet the growing demand for new Space applications.

After a decade of technology and capability development, Alén Space's proprietary nanosatellites offer a faster, cheaper way to meet the growing demand for new Space applications.

Founded in 1992, Danish state investor Vaekstfonden is a growth fund that has financed more than 9,200 Danish tech and non-tech startups with total funding of 33.8bn Danish krone ($1=6.35DKK, or about €5.8bn), mostly at pre-seed and seed levels. The investor also manages funds from the Danish Ministry of Business, state grants, ordinary loans and green investments. Startup investments are normally carried out in cooperation with other public bodies such as innovation incubators.

Founded in 1992, Danish state investor Vaekstfonden is a growth fund that has financed more than 9,200 Danish tech and non-tech startups with total funding of 33.8bn Danish krone ($1=6.35DKK, or about €5.8bn), mostly at pre-seed and seed levels. The investor also manages funds from the Danish Ministry of Business, state grants, ordinary loans and green investments. Startup investments are normally carried out in cooperation with other public bodies such as innovation incubators.

Established in 2015, Innohub Capital offers comprehensive services for early-stage startups, including incubation, entrepreneurial training, marketing, etc. It operates incubators and manages funds that focus on seed funding in China, New Zealand and Australia. Innohub Capital has created the world's first service platform for startups operating an O2O model. Founder and Chairman Xu Hongbo is an expert in mobile internet and an evangelist of blockchain in China. Innohub Capital has invested in more than 60 companies so far.

Established in 2015, Innohub Capital offers comprehensive services for early-stage startups, including incubation, entrepreneurial training, marketing, etc. It operates incubators and manages funds that focus on seed funding in China, New Zealand and Australia. Innohub Capital has created the world's first service platform for startups operating an O2O model. Founder and Chairman Xu Hongbo is an expert in mobile internet and an evangelist of blockchain in China. Innohub Capital has invested in more than 60 companies so far.

A co-founder and angel investor of HomeRun, Cheng Xiaohua graduated with a major in Automation at Changsha Railway University in 1983. The university is now known as Railway Campus, Central South University. From 1984 to 1988, he spent his postgraduate years at Graduate School, University of Chinese Academy of Sciences and earned a master’s degree in Automation. He co-founded Netac with Deng Guoshun in 1999 and became the chairman in September 2010.

A co-founder and angel investor of HomeRun, Cheng Xiaohua graduated with a major in Automation at Changsha Railway University in 1983. The university is now known as Railway Campus, Central South University. From 1984 to 1988, he spent his postgraduate years at Graduate School, University of Chinese Academy of Sciences and earned a master’s degree in Automation. He co-founded Netac with Deng Guoshun in 1999 and became the chairman in September 2010.

Founded by Li Shujun, the former CFO of Shengda, in 2006, Trustbridge Partners is a venture capital and private equity firm focusing on growth-stage and expansion-stage investments in Chinese companies in new energy, environmental protection, new materials, new media, retailing, healthcare, education, e-commerce, etc. The sources of its funds come mainly from university foundations in the US (such as Columbia University, Stanford University, New York University), world-renowned investment firms (Temasek Holdings, Kerry Group, etc.), and private investors.

Founded by Li Shujun, the former CFO of Shengda, in 2006, Trustbridge Partners is a venture capital and private equity firm focusing on growth-stage and expansion-stage investments in Chinese companies in new energy, environmental protection, new materials, new media, retailing, healthcare, education, e-commerce, etc. The sources of its funds come mainly from university foundations in the US (such as Columbia University, Stanford University, New York University), world-renowned investment firms (Temasek Holdings, Kerry Group, etc.), and private investors.

Mari Elka Pangestu is the first female Chinese Indonesian to hold a cabinet position. She was the Minister of Trade from 2004 to 2011 and the Minister of Tourism from 2011 to 2014. She holds a doctorate in Economics from the University of California, USA. Returning to academia at the University of Indonesia, the professor is also part of the Indonesian network of angel investors ANGIN.

Mari Elka Pangestu is the first female Chinese Indonesian to hold a cabinet position. She was the Minister of Trade from 2004 to 2011 and the Minister of Tourism from 2011 to 2014. She holds a doctorate in Economics from the University of California, USA. Returning to academia at the University of Indonesia, the professor is also part of the Indonesian network of angel investors ANGIN.

GU Ventures is the Swedish venture capital agency of University of Gothenburg. The VC also runs incubator programs to support tech and science-related projects within the university and its alumni network.Founded in 1995, GU has backed more than 150 companies and projects, including 30 exits and 11 filed IPOs. According to the firm, 87% of its portfolio companies are contributing to the sustainable development goals set by the UN.

GU Ventures is the Swedish venture capital agency of University of Gothenburg. The VC also runs incubator programs to support tech and science-related projects within the university and its alumni network.Founded in 1995, GU has backed more than 150 companies and projects, including 30 exits and 11 filed IPOs. According to the firm, 87% of its portfolio companies are contributing to the sustainable development goals set by the UN.

Stanford Graduate School of Business

Launched in 2015, the Stanford GSB Impact Fund invests globally in innovators and tech startups whether connected with the university or not and within the area of social impact in seven market segments: education, energy and the environment, fintech, food and agriculture, justice, healthcare, and urban development. The university-owned fund invests from the pre-seed to Series A rounds and makes investments mostly from January to April. It currently has 11 startups in its portfolio.

Launched in 2015, the Stanford GSB Impact Fund invests globally in innovators and tech startups whether connected with the university or not and within the area of social impact in seven market segments: education, energy and the environment, fintech, food and agriculture, justice, healthcare, and urban development. The university-owned fund invests from the pre-seed to Series A rounds and makes investments mostly from January to April. It currently has 11 startups in its portfolio.

Armed with Asian and European experience, Miguel Amaro co-founded Uniplaces in 2011. He earned his bachelor’s degree in Finance from the University of Nottingham, and took a course in Chinese Studies at East China Normal University. He obtained his master’s in Management, with a concentration in Global Entrepreneurship, from Babson Graduate School. Amaro also spent two months as an analyst at Grameen Bank in Dhaka, Bangladesh. While developing Uniplaces, he was an entrepreneur-in-residence at Picvic Labs (France), Zhejiang University Innovation Institute (China) and Osram (United States). Amaro is currently part of the World Economic Forum’s Global Shapers. As an investor, to date, he has only invested in Portuguese healthy food service EatTasty and part funding the company's angel, pre-seed and seed rounds, with undisclosed investments.

Armed with Asian and European experience, Miguel Amaro co-founded Uniplaces in 2011. He earned his bachelor’s degree in Finance from the University of Nottingham, and took a course in Chinese Studies at East China Normal University. He obtained his master’s in Management, with a concentration in Global Entrepreneurship, from Babson Graduate School. Amaro also spent two months as an analyst at Grameen Bank in Dhaka, Bangladesh. While developing Uniplaces, he was an entrepreneur-in-residence at Picvic Labs (France), Zhejiang University Innovation Institute (China) and Osram (United States). Amaro is currently part of the World Economic Forum’s Global Shapers. As an investor, to date, he has only invested in Portuguese healthy food service EatTasty and part funding the company's angel, pre-seed and seed rounds, with undisclosed investments.

For Indonesia’s gig workers, Sampingan provides side jobs that matter

Besides helping businesses gather data and scale at a bargain, Sampingan wants to help its workers level up and perform more complex tasks

Shilling Capital Partners: Growing Portuguese tech businesses from seed

An early mover, the influential angel investing firm is accelerating local techs into Brazil and globally

Its latest project, Cattlechain, is an IoT-blockchain solution for farms to meet the EU's animal welfare standards, fulfilling consumers' demand for sustainable farming and food traceability

Mi Terro turns milk waste into eco-friendly clothing and packaging

With food giants like Danone, Arla and Dole as partners, US-Sino startup Mi Terro plans to extend its technology to plant-based food waste like soy to get plastic and fiber alternatives

Plant on Demand: Helping small-scale organic farmers to thrive, sustainably

Plant on Demand will soon deploy product PODX’s “prescriptive” analytics to boost organic farmers’ productivity and prices, by optimizing future crop yields to match seasonal sales trends

Quant Group makes personal loans safer, easier in China

Using big data and AI, Chinese fintech startup Quant Group simplifies and accelerates loan processing, and assures monetary security for financial institutions

Innovate big or go home: logistics unicorn YH Global eyes “Belt and Road” gold

The world’s first logistics firm to become a unicorn at Series A is a model of innovation in China. More overseas growth is next

Biomede: Harnessing plants’ natural attributes to decontaminate soil

The Lyon-based startup says using plants to remove harmful metals from the earth is a sustainable, cost-effective green alternative to decontaminate soil in agricultural or urban environments

This voice technology startup empowers both developers and machines

AISpeech shifted its business from education to IoT but has always remained focused on voice interaction between humans and machines

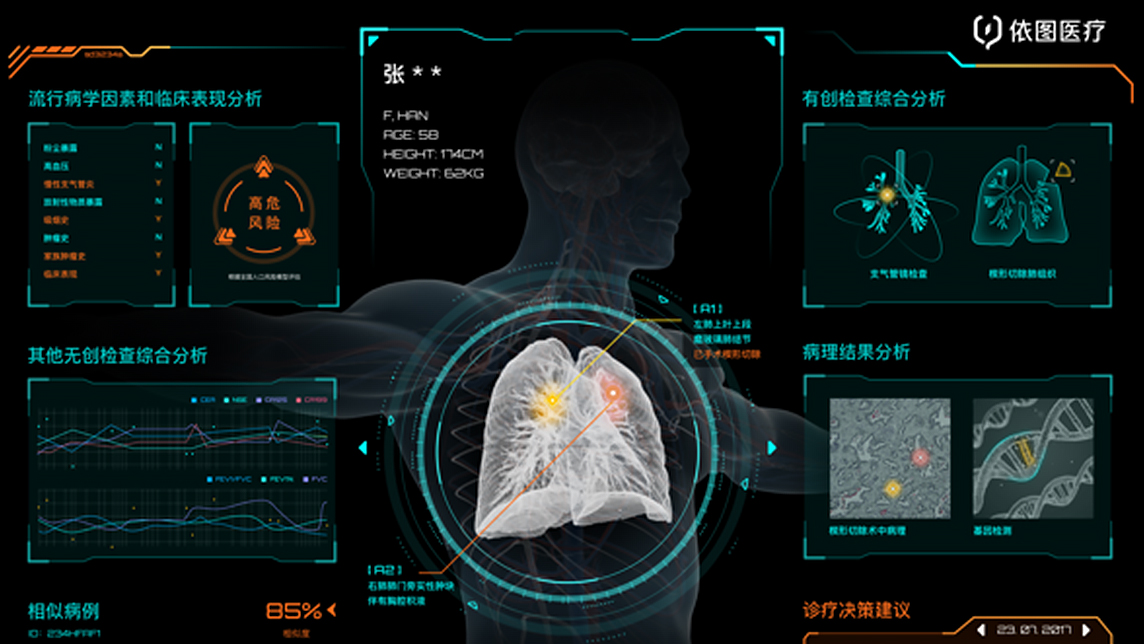

YITU takes smart healthcare to the next level

AI programs developed by this Chinese medtech startup provide more accurate diagnoses by reading medical images in conjunction with patients’ medical records

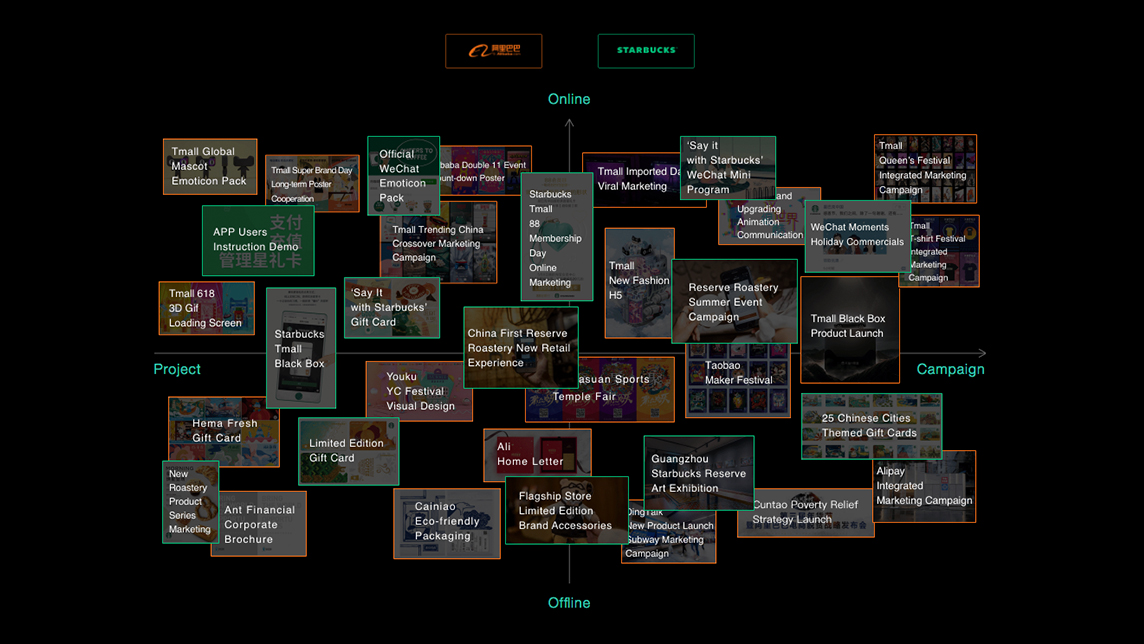

Tezign, where design meets technology

By building a bridge between creative talents and enterprises, this Chinese startup is providing designers with more work opportunities

Haishen Tech: Scan image and find your product in one second

Haishen Tech's AI vending machines will revive unmanned retail economy and tap into growing on-demand consumerism worldwide

Ruangguru cracks business model as it reaches 13 million student users

Holding pole position as Indonesia's popular tutoring services app, Ruangguru is revving up to expand into the lucrative corporate training sector

The rising Indonesian edtech star wants to help high-school dropouts earn their diploma and learn the relevant skills to find a job – with an innovative solution lauded at this year’s MIT Solve Challenge

Ajaib targets millennials with easy-to-use investment app

Y Combinator alumnus Ajaib recently acquired a local brokerage to add stock trading to its products

Sorry, we couldn’t find any matches for“University incubators”.