E-commerce

This function is exclusive for Premium subscribers

-

DATABASE (251)

-

ARTICLES (146)

Founded in Beijing in May 2015, Chunxiao Capital mainly invests in angel/seed to Series B funding rounds. With staff of 22, the VC has invested in over 50 companies by March 2019. Investments include technology innovations in fintech, big data and AI. Other investment sectors involve corporate services, Industry 4.0, B2B and SaaS for industrial enterprises and consumer-oriented businesses like retail, sports, maternal and infant care.In May 2019, the Asset Management Association of China revoked Chunxiao's private equity certification due to links with five online P2P lending firms facing default problems.

Founded in Beijing in May 2015, Chunxiao Capital mainly invests in angel/seed to Series B funding rounds. With staff of 22, the VC has invested in over 50 companies by March 2019. Investments include technology innovations in fintech, big data and AI. Other investment sectors involve corporate services, Industry 4.0, B2B and SaaS for industrial enterprises and consumer-oriented businesses like retail, sports, maternal and infant care.In May 2019, the Asset Management Association of China revoked Chunxiao's private equity certification due to links with five online P2P lending firms facing default problems.

Founded in Beijing in 2012, Ying Capital specializes in private equity investment in manufacturing in China. It has branch offices in Suzhou and Shenzhen. The firm mainly invests in the applications of intelligent technology, IoT and robots in manufacturing. It also has interests in supply chains, automobiles, electronics, new energy, textiles and garments.

Founded in Beijing in 2012, Ying Capital specializes in private equity investment in manufacturing in China. It has branch offices in Suzhou and Shenzhen. The firm mainly invests in the applications of intelligent technology, IoT and robots in manufacturing. It also has interests in supply chains, automobiles, electronics, new energy, textiles and garments.

Founded in October 2013, JD Finance was renamed as JD Digits in November 2018. The fintech arm of Chinese e-commerce giant JD.com focuses on applying digital technology, artificial intelligence and IoT in five sectors: finance, smart cities, agriculture, campus development and marketing.The company manages five sub-brands: JD Finance, JD iCity, JD Agriculture, JD Shaodongjia, and JD MO Media. In September 2017, a joint venture was established with Central Group, one of Thailand’s biggest retailers. In December 2017, JD Digits also started operating an AI lab in Silicon Valley.

Founded in October 2013, JD Finance was renamed as JD Digits in November 2018. The fintech arm of Chinese e-commerce giant JD.com focuses on applying digital technology, artificial intelligence and IoT in five sectors: finance, smart cities, agriculture, campus development and marketing.The company manages five sub-brands: JD Finance, JD iCity, JD Agriculture, JD Shaodongjia, and JD MO Media. In September 2017, a joint venture was established with Central Group, one of Thailand’s biggest retailers. In December 2017, JD Digits also started operating an AI lab in Silicon Valley.

Incorporated as Composite Capital Management (HK) Limited, the VC was founded in Hong Kong in January 2016 by David Ma who was a former partner at Hillhouse Capital Group that specializes in China-tech investments. Ma was at Hillhouse for seven years before founding Composite Capital that now manages total assets valued at RMB 3bn.

Incorporated as Composite Capital Management (HK) Limited, the VC was founded in Hong Kong in January 2016 by David Ma who was a former partner at Hillhouse Capital Group that specializes in China-tech investments. Ma was at Hillhouse for seven years before founding Composite Capital that now manages total assets valued at RMB 3bn.

Founded in Beijing in 2015, Frees Fund is an asset management company with a portfolio valued at RMB 3.6bn. Frees primarily invests in early-stage startups in diverse sectors including fintech, education, healthcare, entertainment, hardware, intelligent manufacturing and SaaS. The VC is incorporated as Shanghai Ziyou Investment Management Co Ltd.

Founded in Beijing in 2015, Frees Fund is an asset management company with a portfolio valued at RMB 3.6bn. Frees primarily invests in early-stage startups in diverse sectors including fintech, education, healthcare, entertainment, hardware, intelligent manufacturing and SaaS. The VC is incorporated as Shanghai Ziyou Investment Management Co Ltd.

GF Qianhe is an equity investment company launched by GF Securities in May 2012. Incorporated as Guangfa Qianhe Investments Co Ltd, with a registered capital of RMB 500m, the company was one of the earliest alternative investment companies to gain approval from the Securities Commission of China. As of late 2018, GF Qianhe has invested in 86 equity-related projects, among which four have gone public. By the end of 2014, its total investment value reached almost RMB 2bn and revenues of over RMB 340m.

GF Qianhe is an equity investment company launched by GF Securities in May 2012. Incorporated as Guangfa Qianhe Investments Co Ltd, with a registered capital of RMB 500m, the company was one of the earliest alternative investment companies to gain approval from the Securities Commission of China. As of late 2018, GF Qianhe has invested in 86 equity-related projects, among which four have gone public. By the end of 2014, its total investment value reached almost RMB 2bn and revenues of over RMB 340m.

RiverHill Fund is a VC fund launched by one of Alibaba's founders Simon Xie (Xie Shihuang) in Hangzhou in 2014. With Alibaba as its biggest limited partner, RiverHill primarily invests in angel/seed and Series A funding rounds in sectors like AI, big data, O2O retail, entertainment and online education.

RiverHill Fund is a VC fund launched by one of Alibaba's founders Simon Xie (Xie Shihuang) in Hangzhou in 2014. With Alibaba as its biggest limited partner, RiverHill primarily invests in angel/seed and Series A funding rounds in sectors like AI, big data, O2O retail, entertainment and online education.

CAS Star was established in September 2013 in Xi’an by several VC firms and the Xi’an Institute of Optics and Precision Mechanics of Chinese Academy of Sciences. The high-tech startup incubator has also set up a RMB 5.2bn Xike Angel fund to specialize in the commercialization of the high-tech research projects. To date, Xike Angel has a portfolio of more than 230 startups with a total value of RMB 20bn.

CAS Star was established in September 2013 in Xi’an by several VC firms and the Xi’an Institute of Optics and Precision Mechanics of Chinese Academy of Sciences. The high-tech startup incubator has also set up a RMB 5.2bn Xike Angel fund to specialize in the commercialization of the high-tech research projects. To date, Xike Angel has a portfolio of more than 230 startups with a total value of RMB 20bn.

Founded in 1907 and currently headquartered in Atlanta, Georgia, US, United Parcel Service (UPS) is the world's largest package and document delivery company in revenue and volume. It is also a global provider of specialized transportation and logistics services. UPS serves more than 220 countries and territories worldwide. In 2018, the company generated US$71.8bn in revenue and had a net income of about US$4.8bn with 481,000 employees. It invests in transportation-related companies.

Founded in 1907 and currently headquartered in Atlanta, Georgia, US, United Parcel Service (UPS) is the world's largest package and document delivery company in revenue and volume. It is also a global provider of specialized transportation and logistics services. UPS serves more than 220 countries and territories worldwide. In 2018, the company generated US$71.8bn in revenue and had a net income of about US$4.8bn with 481,000 employees. It invests in transportation-related companies.

Greycroft is a New York-based VC, established in 2006, that currently has 113 companies in its portfolio. It has interests in multiple sectors but a preference for A.I. and Big Data technologies underpinning them. It has managed 35 exits to date including Farfetch and Huffington Post. Its recent investments include in the US$60m Series C financing round of multilingual AI-driven translation platform Unbabel and in the US$22m Series A round of Kheiron, a breast cancer-detecting health tech.

Greycroft is a New York-based VC, established in 2006, that currently has 113 companies in its portfolio. It has interests in multiple sectors but a preference for A.I. and Big Data technologies underpinning them. It has managed 35 exits to date including Farfetch and Huffington Post. Its recent investments include in the US$60m Series C financing round of multilingual AI-driven translation platform Unbabel and in the US$22m Series A round of Kheiron, a breast cancer-detecting health tech.

Founded by former IDG Capital partner Zhang Suyang in May 2016, the Shanghai-based VC firm invests mainly in early-stage startups working on tech innovations and healthcare. Total assets under management exceed RMB 2.2bn.

Founded by former IDG Capital partner Zhang Suyang in May 2016, the Shanghai-based VC firm invests mainly in early-stage startups working on tech innovations and healthcare. Total assets under management exceed RMB 2.2bn.

Everbright New Economy USD Fund

Launched in 2018, Everbright New Economy USD Fund (New Economy Fund) is under the umbrella of China Everbright, a Hong Kong-listed financial conglomerate. The New Economy Fund started from an inaugural fund of US$483m, with US$150m from Bahrain-based asset manager Investcorp. It invests mainly in the e-commerce, smart retail and artificial intelligence sectors. In November 2019, China Everbright and Investcorp announced they will co-manage Investcorp New Economy Fund I and explore the opportunity to establish a successor private equity fund, jointly managed by the two parties, that will target China’s tech sector.

Launched in 2018, Everbright New Economy USD Fund (New Economy Fund) is under the umbrella of China Everbright, a Hong Kong-listed financial conglomerate. The New Economy Fund started from an inaugural fund of US$483m, with US$150m from Bahrain-based asset manager Investcorp. It invests mainly in the e-commerce, smart retail and artificial intelligence sectors. In November 2019, China Everbright and Investcorp announced they will co-manage Investcorp New Economy Fund I and explore the opportunity to establish a successor private equity fund, jointly managed by the two parties, that will target China’s tech sector.

A major competitor of Douyin (Chinese version of TikTok), the short-video platform Kuaishou was launched in March 2011. The company currently has 262.4m daily active users for its app. Over 2.6m pieces of short videos are uploaded everyday by its users. Kuaishou went public in Hong Kong in February 2021.

A major competitor of Douyin (Chinese version of TikTok), the short-video platform Kuaishou was launched in March 2011. The company currently has 262.4m daily active users for its app. Over 2.6m pieces of short videos are uploaded everyday by its users. Kuaishou went public in Hong Kong in February 2021.

Didac Lee is a Spanish entrepreneur and angel investor of Chinese descent. Lee focuses on investments in Spanish startups with recent participation in seed rounds of e-sports training program Gamestry and life management tool Eelp!Based in Barcelona, he has also established 15 companies including co-founding Galdana Ventures, a VC with interests in the US, Asia, Israel and Europe. Galdana has a portfolio of 30 companies with total investments worth US$1bn. Other companies include Tradeinn online sports stores and Inspirit business incubator. The serial entrepreneur is also a board member of Barcelona FC.

Didac Lee is a Spanish entrepreneur and angel investor of Chinese descent. Lee focuses on investments in Spanish startups with recent participation in seed rounds of e-sports training program Gamestry and life management tool Eelp!Based in Barcelona, he has also established 15 companies including co-founding Galdana Ventures, a VC with interests in the US, Asia, Israel and Europe. Galdana has a portfolio of 30 companies with total investments worth US$1bn. Other companies include Tradeinn online sports stores and Inspirit business incubator. The serial entrepreneur is also a board member of Barcelona FC.

UK-based Portuguese unicorn Farfetch is a global omni-channel marketplace for luxury fashion, ranging from established brands to cult and emerging designers. Entrepreneur José Neves started the company in 2007 to enable small designers and fashion retailers to become global players through a single online marketplace. Farfetch participated in the 2019 seed investment round for Didimo, a Portuguese 3D digital twin animation production startup based in Porto.

UK-based Portuguese unicorn Farfetch is a global omni-channel marketplace for luxury fashion, ranging from established brands to cult and emerging designers. Entrepreneur José Neves started the company in 2007 to enable small designers and fashion retailers to become global players through a single online marketplace. Farfetch participated in the 2019 seed investment round for Didimo, a Portuguese 3D digital twin animation production startup based in Porto.

Southeast Asian startups to keep riding digitalization, IPO boom, investors say

O2O business models and growing interest in ESG are also key themes, as regional startups gain $4.4bn of funding in first half of 2021

South Summit 2021: Lessons in expanding to Asia from experts on the ground

Cast aside your Eurocentric mindsets, China-based SOSV’s Oscar Ramos and Brinc’s Heriberto Saldivar tell startups, why they should expand to the region, and how best to do it

Smart Agrifood Summit 2021: A global innovation ecosystem is needed to catch up with other sectors

Investors from SVG Ventures/THRIVE, Pinduoduo and others agree that players must join forces to boost agrifood tech investment, internationally and across the value chain

Taronga Ventures takes RealTechX to Singapore; plans Japan, US growth

The Australian proptech investor to focus on ESG in its acceleration program, including women under-representation and site safety

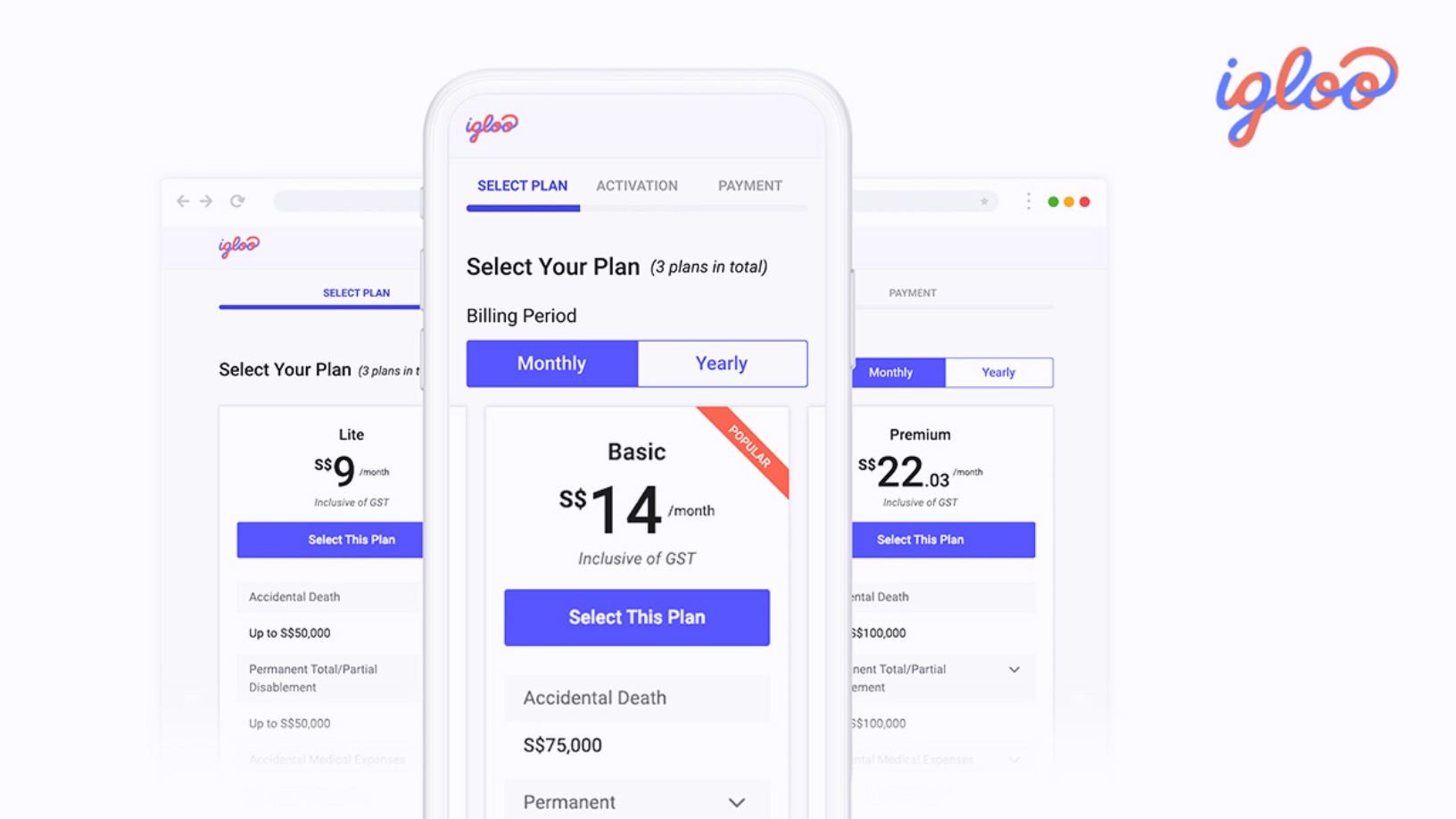

From delivery riders to MSMEs, Igloo aims to make insurance more accessible

Expanding from its origins in e-commerce insurance, Igloo seeks growth in credit insurance and income protection for middle-income groups in Southeast Asia

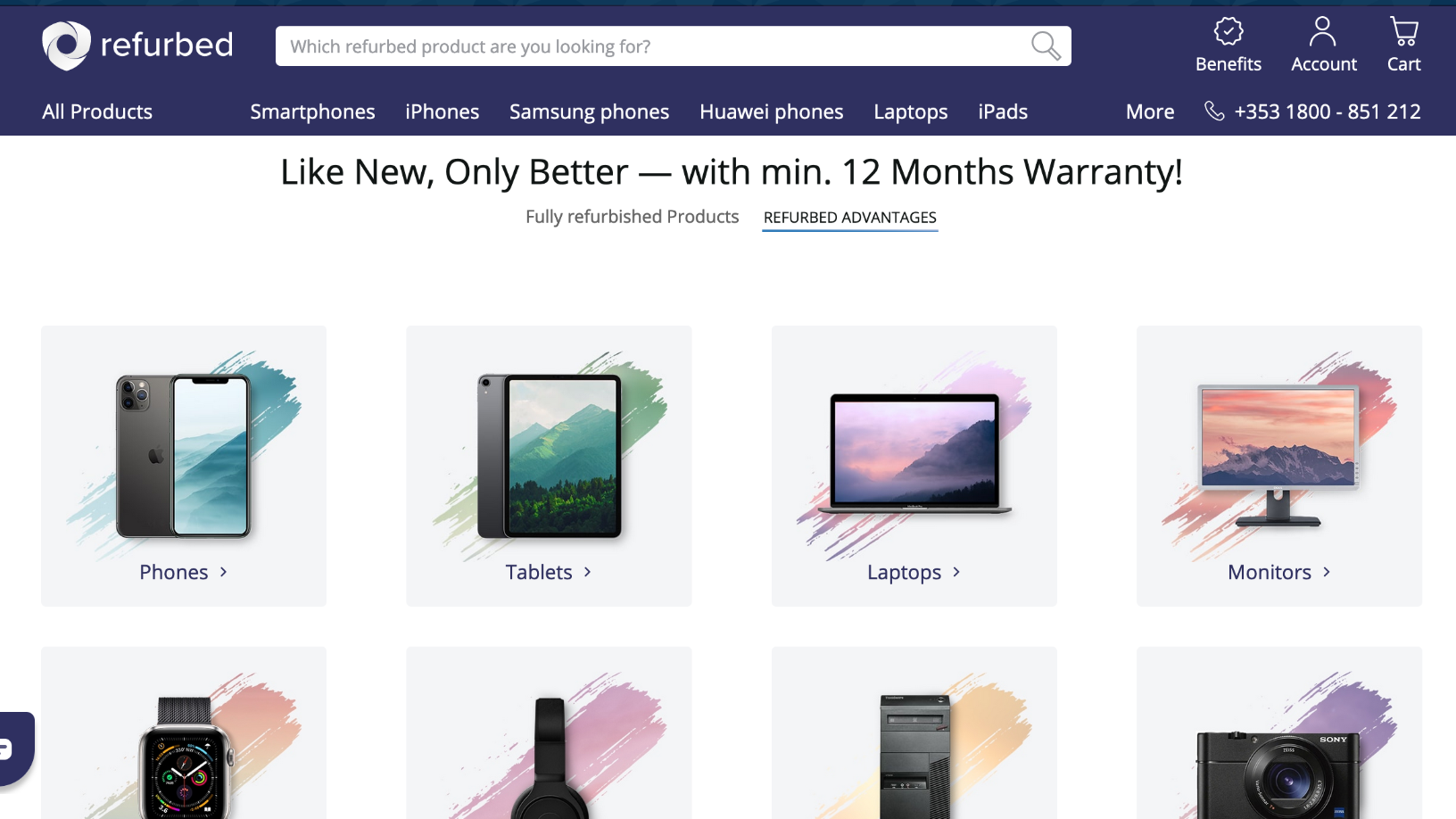

Refurbed: Electronics recycling marketplace gets $54m for EU consolidation, overseas expansion

Consumers can reduce their carbon footprints by shifting toward a circular economy, become carbon-neutral by planting one tree with every purchase from Refurbed

New sectors, strategies come into play as investors respond to China's Big Tech curbs

Amid the crackdown on China’s tech giants, some investors are sussing out less risky sectors, while heavyweights like BlackRock and Fidelity stay in for the long haul

Petit Pli: Origami-inspired clothes that still fit, even after the body has grown

Founded by a young aeronautical engineer, Petit Pli produces stylish, sustainable pleated garments made from recycled plastic that expand up to seven sizes

Indogen Capital eyes new growth fund of $100m as foreign tech investors stay keen on Indonesia

With its Japanese investment partner Striders, Indogen plans to boost growth-stage funding in Indonesia and open doors for portfolio companies to new markets in East Asia

Scoobic: Nifty electric three-wheelers for last-mile deliveries

Traveling up to 100 km on a single battery charge, Scoobic’s EVs, with delivery capacities of vans, is a sustainable solution to traffic jams and parking restrictions

Bukalapak to raise IDR 21tn in Indonesia's biggest IPO yet

Although trailing rivals Tokopedia and Shopee in market share, Bukalapak cut its losses last year and will be Indonesia’s first unicorn to go public

Because Animals: Pioneering cultured meat for pets

The biotech startup is disrupting the pet food processing industry with cell-based food to minimize environmental “pawprints” and promote animal welfare

AgroCenta: Providing market access and credit to African smallholder farmers

AgroCenta’s platforms empower Ghanaian subsistence farmers, especially women, boosting productivity and sales with e-payments, micro-credits and insurance, and direct connections to buyers, cutting out the intermediaries

Gojek and Tokopedia merge to form GoTo

The new entity, now Indonesia’s largest tech group, plans to go public in Indonesia and the US, targeting a $40bn valuation

Accelerating Asia's Amra Naidoo: We’re at an inflection point in Southeast Asia

Accelerating Asia’s co-founder Amra Naidoo reveals how the program adapts its curriculum to meet startups’ needs and the challenges accelerator programs face during the pandemic