👉🏿 acc6.top 👈🏿 获得会员资格 LinkedIn 帐户

-

DATABASE (104)

-

ARTICLES (239)

Founded in 2007 under the Chinese Fortune 500 company DunAn Group, the investment group manages total fund of RMB 6 billion today, with successful investment in 77 Chinese startups across multiple sectors including healthcare, advanced manufacturing, energy & cleantech, etc. It was nominated for “Top 10 Zhengjiang Investment Group” for seven years in a row and was awarded for “Chinese VC of Best Potential” in 2016 – 2017 by thecapital.com.cn.

Founded in 2007 under the Chinese Fortune 500 company DunAn Group, the investment group manages total fund of RMB 6 billion today, with successful investment in 77 Chinese startups across multiple sectors including healthcare, advanced manufacturing, energy & cleantech, etc. It was nominated for “Top 10 Zhengjiang Investment Group” for seven years in a row and was awarded for “Chinese VC of Best Potential” in 2016 – 2017 by thecapital.com.cn.

Silicon Valley-based Almaz Capital was co-founded in 2008 as a bridge VC fund by Alexander Galitsky, a serial techpreneur and former senior executive at the Soviet Space Agency and Defense Industry. Almaz also has an office in Berlin and partners with interests in the UK, Poland and Ukraine. The global fund has invested in over 30 startups and managed 15 exits within its portfolio.Recent investments in 2021 include co-leading the $54m Series B round of Refurbed with Evli Growth Partners in August. Almaz was also the lead investor for the $6m funding round for US-based precision audio software Sonarworks in July.

Silicon Valley-based Almaz Capital was co-founded in 2008 as a bridge VC fund by Alexander Galitsky, a serial techpreneur and former senior executive at the Soviet Space Agency and Defense Industry. Almaz also has an office in Berlin and partners with interests in the UK, Poland and Ukraine. The global fund has invested in over 30 startups and managed 15 exits within its portfolio.Recent investments in 2021 include co-leading the $54m Series B round of Refurbed with Evli Growth Partners in August. Almaz was also the lead investor for the $6m funding round for US-based precision audio software Sonarworks in July.

As online video dominates the Internet, NPAW's AI-powered business intelligence solutions give media companies an edge in understanding, serving and retaining their customers.

As online video dominates the Internet, NPAW's AI-powered business intelligence solutions give media companies an edge in understanding, serving and retaining their customers.

Founder and CEO of HijUp

Former MARS Indonesia and GTZ researcher Diajeng Lestari holds a Social & Political Science degree from the University of Indonesia. Her husband is Achmad Zaky, the founder of Indonesian startup BukaLapak. Diajeng was born in 1986.

Former MARS Indonesia and GTZ researcher Diajeng Lestari holds a Social & Political Science degree from the University of Indonesia. Her husband is Achmad Zaky, the founder of Indonesian startup BukaLapak. Diajeng was born in 1986.

Founder and CEO of Zaihui

Xie graduated from Carnegie Mellon University in 2012 with a master’s in Computer Science. Upon graduation, he was invited by famous angel investor Hadi Partovi to join startup project Fivestars, which would become the leading customer loyalty solutions provider in the United States. In 2015, Xie returned to China and adapted the Fivestars model to his own startup, Zaihui. Within just one week of his return, Zaihui raised millions of dollars from top Chinese investors.

Xie graduated from Carnegie Mellon University in 2012 with a master’s in Computer Science. Upon graduation, he was invited by famous angel investor Hadi Partovi to join startup project Fivestars, which would become the leading customer loyalty solutions provider in the United States. In 2015, Xie returned to China and adapted the Fivestars model to his own startup, Zaihui. Within just one week of his return, Zaihui raised millions of dollars from top Chinese investors.

Set up in 2012 by Jackie Chen (Chen Liang) and Sebastian Kübler, who together with Raymond Lei (Lei Yang) founded Taishan Invest AG, one of China's first angel funds. TXD Ventures is an early-stage investor focusing on Chinese consumer startups, particularly online- and/or mobile-based. Its investments range from RMB 1 million to RMB 6 million.

Set up in 2012 by Jackie Chen (Chen Liang) and Sebastian Kübler, who together with Raymond Lei (Lei Yang) founded Taishan Invest AG, one of China's first angel funds. TXD Ventures is an early-stage investor focusing on Chinese consumer startups, particularly online- and/or mobile-based. Its investments range from RMB 1 million to RMB 6 million.

Next Big is a business incubator located in the "Silicon Valley of China", known as Zhongguancun. It offers a full range of incubation services for internet entrepreneurs. Next Big group is affiliated with 3W, an internet-focused service platform initiated by 180 top entrepreneurs and investors from the Internet industry, such as Xu Xiaoping and Zeng Liqing. These organizations are focused on the field of internet knowledge exchange and business services.

Next Big is a business incubator located in the "Silicon Valley of China", known as Zhongguancun. It offers a full range of incubation services for internet entrepreneurs. Next Big group is affiliated with 3W, an internet-focused service platform initiated by 180 top entrepreneurs and investors from the Internet industry, such as Xu Xiaoping and Zeng Liqing. These organizations are focused on the field of internet knowledge exchange and business services.

Founder, CEO and CTO of Zhen Robotics

Founder, CEO and CTO of Zhen Robotics. An expert in AI and robotics, Liu Zhiyong used to work at Alibaba as the technical leader of its AI program “Wall-e Super Brain.” He has a master’s degree in Machine Learning and Robotics from Tsinghua University. He pursued a doctoral degree in Computer Science at ETH Zurich but never finished. He has also performed research in AI and robotics at Imperial College London. He has published more than ten papers in top journals and owns several invention patents.

Founder, CEO and CTO of Zhen Robotics. An expert in AI and robotics, Liu Zhiyong used to work at Alibaba as the technical leader of its AI program “Wall-e Super Brain.” He has a master’s degree in Machine Learning and Robotics from Tsinghua University. He pursued a doctoral degree in Computer Science at ETH Zurich but never finished. He has also performed research in AI and robotics at Imperial College London. He has published more than ten papers in top journals and owns several invention patents.

Founded by Chen Xiaohong, Tiger Global's former China managing partner, H Capital is a venture capital firm focused on China internet firms. The team also includes DCM co-founder Lu Rong (Ruby Lu).

Founded by Chen Xiaohong, Tiger Global's former China managing partner, H Capital is a venture capital firm focused on China internet firms. The team also includes DCM co-founder Lu Rong (Ruby Lu).

The VC arm of Tsinghua University, THG Ventures was founded in 2015. It is managed by the investment team from the state-owned Tsinghua Holdings Ltd., which has specialized in venture capital investments since 1999 and is one of the first China teams focused on RMB investment. The team also founded TusPark Incubator and TusPark Ventures.

The VC arm of Tsinghua University, THG Ventures was founded in 2015. It is managed by the investment team from the state-owned Tsinghua Holdings Ltd., which has specialized in venture capital investments since 1999 and is one of the first China teams focused on RMB investment. The team also founded TusPark Incubator and TusPark Ventures.

Founder and CEO of UrbanIndo

Silicon Valley highflier Arip Tirta left a top job in 2011 to develop a big data and analytics property platform in Indonesia. He was based in Palo Alto, California for more than seven years and was a director of Investment Analysis and Strategy at a leading venture debt provider Hercules Technology Growth Capital.Armed with a bachelor’s in Mathematics of Computation from UCLA in 2002 and a master’s in Scientific Computing and Computational Mathematics from Stanford University in 2004, Arip found it frustrating to find a property in Indonesia, so he started UrbanIndo.

Silicon Valley highflier Arip Tirta left a top job in 2011 to develop a big data and analytics property platform in Indonesia. He was based in Palo Alto, California for more than seven years and was a director of Investment Analysis and Strategy at a leading venture debt provider Hercules Technology Growth Capital.Armed with a bachelor’s in Mathematics of Computation from UCLA in 2002 and a master’s in Scientific Computing and Computational Mathematics from Stanford University in 2004, Arip found it frustrating to find a property in Indonesia, so he started UrbanIndo.

Founder, CEO and Chairman of Momo

From Hunan to Beijing, in 17 years Tang Yan has transformed from being a riotous youth from a working-class family to the CEO of Momo, China’s top social networking app worth US$7.9 billion.Prior to founding Momo Technology, he was the chief editor of Netease from 2003 to 2011.Tang is now the CEO and chairman of Momo. He was named by Fortune magazine to its “40 Under 40” list of the most powerful business elites under the age of 40 in October 2014.

From Hunan to Beijing, in 17 years Tang Yan has transformed from being a riotous youth from a working-class family to the CEO of Momo, China’s top social networking app worth US$7.9 billion.Prior to founding Momo Technology, he was the chief editor of Netease from 2003 to 2011.Tang is now the CEO and chairman of Momo. He was named by Fortune magazine to its “40 Under 40” list of the most powerful business elites under the age of 40 in October 2014.

Zhongguancun Longmen Investment

Investing in hi-tech IT, advanced manufacturing and biotechnology sectors – key pillars of China’s innovation-focused economy since 2017 – the Beijing government-backed Beijing Zhongguancun Longmen Investment manages about RMB 10bn via its first fund of the same name. The firm is founded and led by Xu Jinghong, former Chairman of Tsinghua Holdings, the investment and tech/R&D transfer arm of China’s most prestigious science and research university, whose R&D capacity was ranked in the third place of China’s top 500 enterprises in 2018. The LPs of the fund include social security funds, Beijing’s municipal government and the Haidian District government. Its portfolio enterprises are generally ranked in the top three of their respective industries. Among them, Qi An Xin Technology, which is listed in Shanghai and one of China’s biggest cybersecurity companies; Joy Wing Mao, one of China’s major fruits supply chain companies. In October of 2020, it invested RMB 100m into Beijing Immunochina Pharmaceutical, which develops innovative gene and cell therapies for curing malignant tumors. Longmen also provides mentoring and other expertise and support to its investee startups, especially those that plan to seek public listing.

Investing in hi-tech IT, advanced manufacturing and biotechnology sectors – key pillars of China’s innovation-focused economy since 2017 – the Beijing government-backed Beijing Zhongguancun Longmen Investment manages about RMB 10bn via its first fund of the same name. The firm is founded and led by Xu Jinghong, former Chairman of Tsinghua Holdings, the investment and tech/R&D transfer arm of China’s most prestigious science and research university, whose R&D capacity was ranked in the third place of China’s top 500 enterprises in 2018. The LPs of the fund include social security funds, Beijing’s municipal government and the Haidian District government. Its portfolio enterprises are generally ranked in the top three of their respective industries. Among them, Qi An Xin Technology, which is listed in Shanghai and one of China’s biggest cybersecurity companies; Joy Wing Mao, one of China’s major fruits supply chain companies. In October of 2020, it invested RMB 100m into Beijing Immunochina Pharmaceutical, which develops innovative gene and cell therapies for curing malignant tumors. Longmen also provides mentoring and other expertise and support to its investee startups, especially those that plan to seek public listing.

UTour Group was set up in 2005 providing outbound tourism and related services, including offshore finance, immigration services, overseas study services etc.

UTour Group was set up in 2005 providing outbound tourism and related services, including offshore finance, immigration services, overseas study services etc.

Established in 2000. With RMB 15 billion under management, Fortune Capital focuses on companies in the TMT, consumer goods & services, modern agriculture and cleantech sectors. It has invested in about 300 startups including Qingke, Hammerhead Sharks, StoreMax and NTS Technology.

Established in 2000. With RMB 15 billion under management, Fortune Capital focuses on companies in the TMT, consumer goods & services, modern agriculture and cleantech sectors. It has invested in about 300 startups including Qingke, Hammerhead Sharks, StoreMax and NTS Technology.

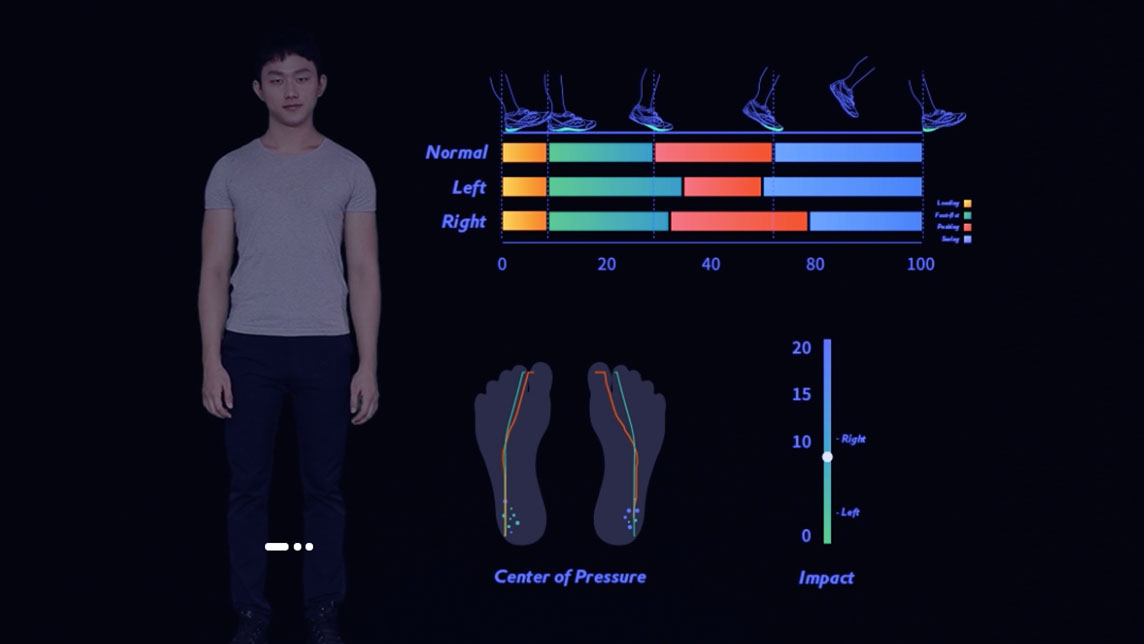

Sennotech offers affordable gait analysis on a mobile phone

Sennotech’s smart gait analysis system helps users choose comfy shoes, improve sports performance and foot health, and facilitate rehabilitation training

For crop pest control, McFly does all the thinking

Chinese agtech startup McFly deploys data-driven crop health and pesticide monitoring systems so farmers get higher-quality yields and less wastage

The summer LinkedIn got pummeled in China

Or how the startup Maimai cracked Chinese professional networking

Bailian.ai: Using Internet big data, AI to help corporates acquire customers

Previously, a salesperson who got five or six customer leads was considered fortunate. Now, using Bailian.ai, thousands, or even millions, of leads can be found at once

Smartvel helps travel brands understand customers' interests to boost their experiences

Smartvel lets travel brands profile their customers and offer them personalized, up-to-date content as more travelers demand unique vacation experiences

Traveloka CTO Derianto Kusuma resigns

The co-founder cites a changing ecosystem and company direction for his decision, while hinting at a new venture

Indonesia's HighPitch 2020: VC investors on Medan startups, deal-sourcing during Covid

Healthcare-focused edtech Appskep and e-grocer Pasar20 win regional pitch competition for Sumatra; judging VCs share their new perspectives gained on local problems and startups from outside Greater Jakarta, and more

HighPitch: E-grocery marketplace Pasar20 and healthcare edtech Appskep top the Medan chapter

Representing Sumatra’s startup ecosystem in the national finals later in November, Pasar20 and Appskep have ambitious expansion plans in store

HighPitch 2020: In conversation with top winners and UMG Idealab head Kiwi Aliwarga

Goers, Izy and CekLab demonstrated quick thinking when adapting their businesses to the pandemic, a capability they will need to stay competitive post-Covid

Gojek acquires Indonesian POS startup Moka, gains greater share of SME fintech market

Deal reportedly worth $120m will add Moka's network of over 30,000 merchants to Gojek's reach

Viezo: Vibration energy harvesting to power sensors and IoT devices

Disrupting the battery market, Viezo’s proprietary technology, PolyFilm, can also boost operational efficiency and slash maintenance costs of sensors and IoT devices

SingularCover: Spanish SME insurance sector disruptor is Virtual South Summit winner

AI-honed personalization is proving successful in the underserved SME insurtech vertical

Kryha: Enabling big businesses' green practices with blockchain

Kryha’s blockchain systems help companies trace the movement and transformation of resources among multiple stakeholders without exposing sensitive information

Alberto Gómez, Spain's blockchain evangelist

Alberto Gómez Toribio has been pioneering blockchain technology in Spain since 2013. He convinced the Bank of Spain to authorize capital raising with cryptocurrency and built the world's first decentralized Bitcoin exchange

UPDATED - Coronavirus: Indonesian startups launch tracking and healthcare tools, financial support

Amid a weak public health system, Indonesia's startups try to plug the gap with healthcare and monitoring tech solutions, while edtech and other online platforms see surge in demand amid social distancing

Sorry, we couldn’t find any matches for“👉🏿 acc6.top 👈🏿 获得会员资格 LinkedIn 帐户”.