Cell-based leather

-

DATABASE (856)

-

ARTICLES (601)

Established in 2014, WOW Aceleradora is a startup accelerator based in Porto Alegre, Brazil. It has invested over BR$8 million (US$2.1 million) through its network of 170 angel investors, specializing in tech companies.

Established in 2014, WOW Aceleradora is a startup accelerator based in Porto Alegre, Brazil. It has invested over BR$8 million (US$2.1 million) through its network of 170 angel investors, specializing in tech companies.

Korelya Capital is a Paris-based VC firm that backs startups during their growth stage, focusing on cross-border investments between Asia and Europe. The firm's investment portfolio of €200m includes unicorns like Glovo and GetYourGuide.

Korelya Capital is a Paris-based VC firm that backs startups during their growth stage, focusing on cross-border investments between Asia and Europe. The firm's investment portfolio of €200m includes unicorns like Glovo and GetYourGuide.

In September 2003, Chen Weixing started studying at the College of Civil Engineering and Architecture, Zhejiang University. The civil engineer founded the web game developer FunCity Inc during his third college year in August 2006. In June 2012, he launched the taxi app Kuaidadi in Hangzhou. In September 2012, he invested in Hangzhou Enniu Network Technology Co Ltd, the parent company of 51 Credit Card Manager, China's largest credit card service based on monthly active users. He also founded online insurance company Weiease Technology in April 2014. In May 2018, he launched the blockchain-based taxi app VV Share.

In September 2003, Chen Weixing started studying at the College of Civil Engineering and Architecture, Zhejiang University. The civil engineer founded the web game developer FunCity Inc during his third college year in August 2006. In June 2012, he launched the taxi app Kuaidadi in Hangzhou. In September 2012, he invested in Hangzhou Enniu Network Technology Co Ltd, the parent company of 51 Credit Card Manager, China's largest credit card service based on monthly active users. He also founded online insurance company Weiease Technology in April 2014. In May 2018, he launched the blockchain-based taxi app VV Share.

LEVO Capital is a US venture capital firm that focuses on seed investment for utility-based tech companies. Founded by real estate entrepreneur Weston Marcum, the VC has exited digital wallet fintech Evenly that was sold to Square.Based in his birthplace Louisville in Kentucky, Marcum built a successful real estate investment and management company Atlas Properties that later became the Atlas group of companies. The Furman University business graduate began investing in SMEs and tech startups through Levo Capital in 2011. Many of Levo's ventures, including downtown cafes, are also tenants in buildings owned by Marcum's Atlas group.

LEVO Capital is a US venture capital firm that focuses on seed investment for utility-based tech companies. Founded by real estate entrepreneur Weston Marcum, the VC has exited digital wallet fintech Evenly that was sold to Square.Based in his birthplace Louisville in Kentucky, Marcum built a successful real estate investment and management company Atlas Properties that later became the Atlas group of companies. The Furman University business graduate began investing in SMEs and tech startups through Levo Capital in 2011. Many of Levo's ventures, including downtown cafes, are also tenants in buildings owned by Marcum's Atlas group.

Founded in 2013 and based in Silicon Valley, AgFunder invests in agrifood tech startups globally with the mission of “investing in technologies to rapidly transform our food and agriculture system.” The VC firm has already built a global ecosystem of 85,000+ members and subscribers, which helps grow and scale its portfolio companies. It recently established the New Carnivore fund to invest in startups working to create animal-free protein alternatives including plant-based meat and cultured meat. In 2019, AgFunder and the Australian agrifood accelerator Rocket Seeder co-launched GROW Impact Accelerator in Singapore to accelerate seed and Series A agritech startups from Southeast Asia.

Founded in 2013 and based in Silicon Valley, AgFunder invests in agrifood tech startups globally with the mission of “investing in technologies to rapidly transform our food and agriculture system.” The VC firm has already built a global ecosystem of 85,000+ members and subscribers, which helps grow and scale its portfolio companies. It recently established the New Carnivore fund to invest in startups working to create animal-free protein alternatives including plant-based meat and cultured meat. In 2019, AgFunder and the Australian agrifood accelerator Rocket Seeder co-launched GROW Impact Accelerator in Singapore to accelerate seed and Series A agritech startups from Southeast Asia.

Founded in 1997 in London, Amadeus has invested in more than 130 companies, has over 40 employees and has raised over $1bn to date. The investor focuses on early-stage UK-based companies, although it has also invested in later-stage European and developing market startups. In August 2021, it announced a $150m upcoming investment drive in Brazil. Amadeus currently has 54 portfolio companies. Its recent investments include the June 2021 £20m Series A investment round of UK-based XYZ Reality that employs holograms in construction tech. In May 2021, it led the $4.8m investment in the cryptography lifecycle management platform Cryptosense.

Founded in 1997 in London, Amadeus has invested in more than 130 companies, has over 40 employees and has raised over $1bn to date. The investor focuses on early-stage UK-based companies, although it has also invested in later-stage European and developing market startups. In August 2021, it announced a $150m upcoming investment drive in Brazil. Amadeus currently has 54 portfolio companies. Its recent investments include the June 2021 £20m Series A investment round of UK-based XYZ Reality that employs holograms in construction tech. In May 2021, it led the $4.8m investment in the cryptography lifecycle management platform Cryptosense.

Founded in 2007, the Shenzhen-based CDF Capital runs a RMB 4.2 billion PE fund for investments in new materials, new IT, consumer, cleantech and healthcare tech sectors. It has backed over 120 companies to date.

Founded in 2007, the Shenzhen-based CDF Capital runs a RMB 4.2 billion PE fund for investments in new materials, new IT, consumer, cleantech and healthcare tech sectors. It has backed over 120 companies to date.

Founded by former IDG Capital partner Zhang Suyang in May 2016, the Shanghai-based VC firm invests mainly in early-stage startups working on tech innovations and healthcare. Total assets under management exceed RMB 2.2bn.

Founded by former IDG Capital partner Zhang Suyang in May 2016, the Shanghai-based VC firm invests mainly in early-stage startups working on tech innovations and healthcare. Total assets under management exceed RMB 2.2bn.

UMG Indonesia is a subsidiary of the Myanmar-based UMG conglomerate that was founded in 1998. The Indonesian company is a hardware and machine distributor, with property interests in Indonesia. In 2017, UMG provided seed funding to fishery tech startup Aruna.

UMG Indonesia is a subsidiary of the Myanmar-based UMG conglomerate that was founded in 1998. The Indonesian company is a hardware and machine distributor, with property interests in Indonesia. In 2017, UMG provided seed funding to fishery tech startup Aruna.

Founded in 2014, Frankfurt-based CommerzVentures operates as the VC arm of Commerzbank AG. The firm invests mainly in early- and growth-stage startups from Series A onward. Its portfolio features fintech companies such as PayKey and Marqeta.

Founded in 2014, Frankfurt-based CommerzVentures operates as the VC arm of Commerzbank AG. The firm invests mainly in early- and growth-stage startups from Series A onward. Its portfolio features fintech companies such as PayKey and Marqeta.

Monk’s Hill Ventures is an investment company that builds on the partnership of entrepreneurs who have built and backed global companies based in Silicon Valley and Asia. The firm’s investors are driven to help Southeast Asian companies to expand globally.

Monk’s Hill Ventures is an investment company that builds on the partnership of entrepreneurs who have built and backed global companies based in Silicon Valley and Asia. The firm’s investors are driven to help Southeast Asian companies to expand globally.

Headquartered in Murcia, Spain, Aurorial is part of e-commerce group PcComponentes. Aurorial focuses on Spanish-based startups at the seed capital stage, investing between €50,000 and €100,000 with other funds and experienced business angels.

Headquartered in Murcia, Spain, Aurorial is part of e-commerce group PcComponentes. Aurorial focuses on Spanish-based startups at the seed capital stage, investing between €50,000 and €100,000 with other funds and experienced business angels.

Los Riscos de Pedrique is family-owned investment fund and business consultancy based in Madrid, Spain. Established in 2014, the company has assets valued at €35 million and is run by Maria del Valle de la Riva.

Los Riscos de Pedrique is family-owned investment fund and business consultancy based in Madrid, Spain. Established in 2014, the company has assets valued at €35 million and is run by Maria del Valle de la Riva.

Centro para el Desarollo Tecnológico Industrial (CDTI) is a Spanish government startup accelerator under the Ministry of Science, Education and Universities. Based in Madrid, it has invested in 13 startups since 2015, predominantly focusing on scientific enterprises.

Centro para el Desarollo Tecnológico Industrial (CDTI) is a Spanish government startup accelerator under the Ministry of Science, Education and Universities. Based in Madrid, it has invested in 13 startups since 2015, predominantly focusing on scientific enterprises.

Ruan Xiaoxun founded data security service provider Esafenet in January 2003 and served as its chairman until October 2015. He is currently a board member at Esafenet and also the chairman of Beijing-based blockchain company DeepSec.

Ruan Xiaoxun founded data security service provider Esafenet in January 2003 and served as its chairman until October 2015. He is currently a board member at Esafenet and also the chairman of Beijing-based blockchain company DeepSec.

Qorium: Lab-grown premium leather for the future of luxury

The Dutch biotech startup co-founded by cell-based meat pioneer Mark Post is targeting the luxury goods market with its “clean leather” sheets made from cultivating bovine skin cells, and plans to raise up to €100m

Beyond Leather Materials: Turning apples into alt-leather for sustainable fashion

Through its Leap brand, the Danish startup cuts food waste by turning apples junked in cider factories into affordable vegan leather for the $100bn leather market

Eco-friendly vegan leather from recycled waste, made in Indonesia

In the battle for ethical consumer dollars, mass production of vegan leather by startups like Mycotech and Bell Society, could be the game-changer for the fashion industry

Biomilq: Creating cell-based mothers’ milk in a lab

With the aim of helping women struggling to breastfeed, Bill Gates-backed Biomilq is disrupting the $45bn baby formula industry developing lab-grown breast milk from mammary epithelial cells

Meatable: Cell-based meat startup secures $47m Series A for scalable technology

The Dutch startup offers a pioneering technology for quickly scaling cell-based meat production while eliminating the need for animal-derived growth media

Big Idea Ventures Founder Andrew D Ive: Asia will lead cell-based meat innovation

In a wide-ranging interview, the managing general partner of the US- and Singapore-based foodtech investor also expounds on his goal to extend sustainability to the rest of the food sector, combining good returns with doing good

Meatable joins Royal DSM to create growth media specific for cell-based meat tech

The R&D between the biotech startup and fellow Dutch nutrition conglomerate could help scale and drive the commercial viability of lab-grown meat

TreeFrog Therapeutics: Mimicking how stem cells grow in the human body

The French biotech’s proprietory technology to cultivate pluripotent stem cells in a 3D environment can be scaled to mass-produce high-quality cells to treat diseases such as Parkinson’s

TurtleTree Labs: Creating sustainable mammalian milk alternatives from stem cells

Founder’s search for high-quality dairy milk led to the creation in a lab of naturally occurring ingredients found in human milk for supply to dairy milk and infant formula businesses

Cubiq Foods: Bioreactor farms producing the food of tomorrow

Growing appetite for meat alternatives expected to fuel demand for Cubiq’s low calorie, Omega 3-enriched lab-grown fats

Cocuus: Industrial-scale solutions to design and print food

This Spanish startup is pioneering industrial-scale 3D food printing using inkjet and laser technology that prints up to 30 times faster with eye-catching food designs

Indonesian local crafts marketplace Qlapa shuts down

Series A funding failed to keep startup afloat as business remains unprofitable, regional heavyweights close in

Singapore, the place to start and grow a cellular agriculture startup

A country that imports over 90% of its food supply, Singapore has turned to foodtech, including cellular agriculture, to safeguard food security, supported by proactive regulators

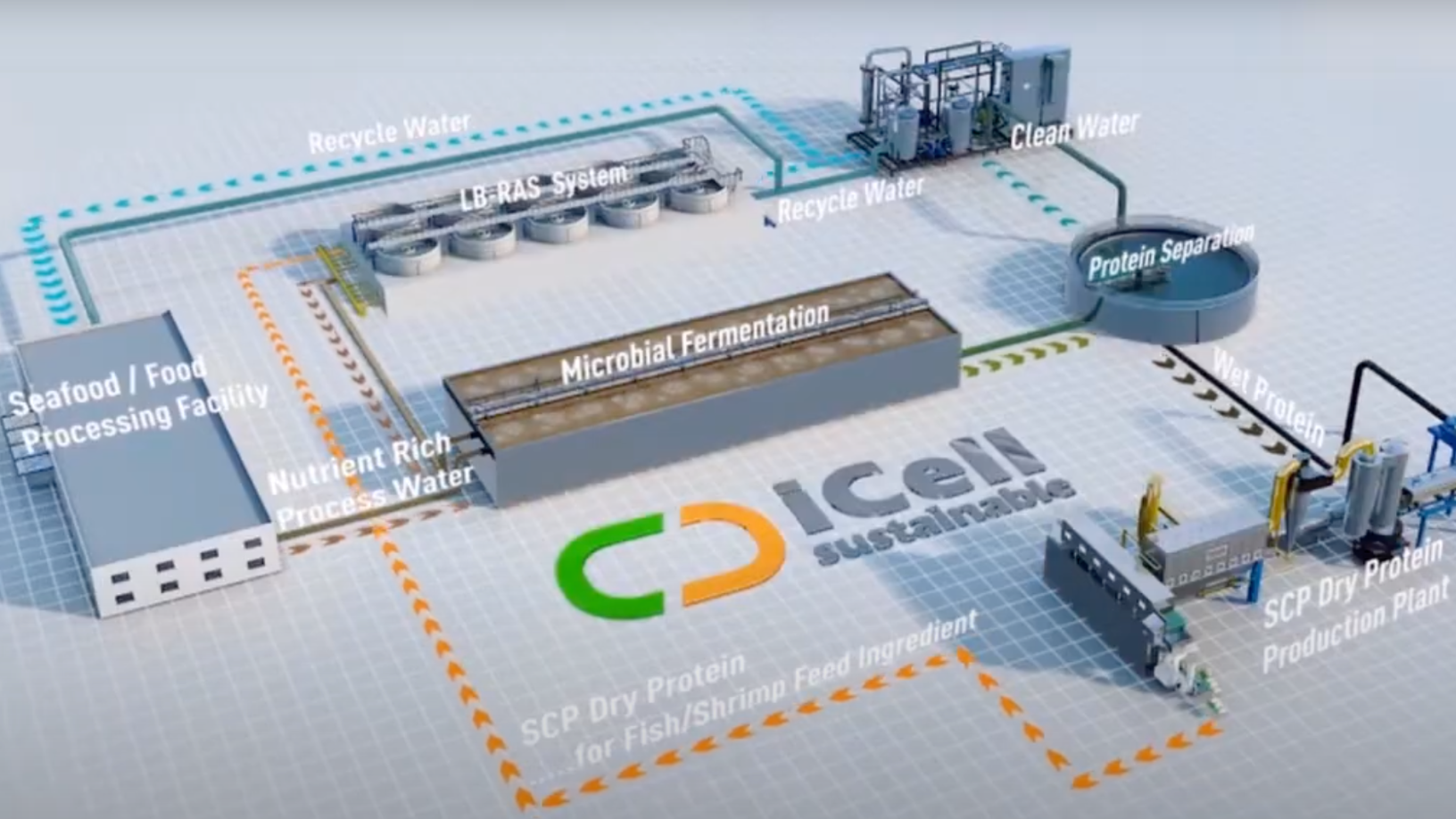

iCell: Upcycling nutrients from wastewater

Hong Kong-based iCell Sustainable Nutrition makes single-cell proteins with wastewater from food and beverage factories, generating revenue and purifying the water for safe discharge or reuse

Because Animals: Pioneering cultured meat for pets

The biotech startup is disrupting the pet food processing industry with cell-based food to minimize environmental “pawprints” and promote animal welfare

Sorry, we couldn’t find any matches for“Cell-based leather”.