Cell-based leather

-

DATABASE (856)

-

ARTICLES (601)

Maylis Chevalier is an executive director, mentor and angel investor in Spanish tech startups. She’s currently the Director of Innovation and Digital Product at Vocento, a Madrid-based media broadcaster.She was the Spanish country manager for Ligatus, a programmatic marketing solutions company. She was also an executive in the editorial and business development departments of media companies such as Gruner + Jahr GmbH and Axel Springer SE.

Maylis Chevalier is an executive director, mentor and angel investor in Spanish tech startups. She’s currently the Director of Innovation and Digital Product at Vocento, a Madrid-based media broadcaster.She was the Spanish country manager for Ligatus, a programmatic marketing solutions company. She was also an executive in the editorial and business development departments of media companies such as Gruner + Jahr GmbH and Axel Springer SE.

Established in 2002, Hong Kong Stock Exchange-listed NWS Holdings’ main businesses are in infrastructure and service. Its main shareholder is New World Development. Henry Cheng currently serves as chairman and executive director of NWS Holdings. He is the eldest son of Dr Cheng Yu-tung, the founder of New World Development, a Hong Kong-based conglomerate engaged in property development, infrastructure and services.

Established in 2002, Hong Kong Stock Exchange-listed NWS Holdings’ main businesses are in infrastructure and service. Its main shareholder is New World Development. Henry Cheng currently serves as chairman and executive director of NWS Holdings. He is the eldest son of Dr Cheng Yu-tung, the founder of New World Development, a Hong Kong-based conglomerate engaged in property development, infrastructure and services.

GoHub Ventures is the Valencia-based corporate venture capital arm of Global Omnium, a company specialised in water management. The firm invests in the seed and scale-up phases with a ticket size between €500,000 - €3m.The comnpany has so far invested €11m until 2020 and is mostly backing deep tech startups working in AI, big data, 3D, IoT and robotics and cybersecurity sectors.

GoHub Ventures is the Valencia-based corporate venture capital arm of Global Omnium, a company specialised in water management. The firm invests in the seed and scale-up phases with a ticket size between €500,000 - €3m.The comnpany has so far invested €11m until 2020 and is mostly backing deep tech startups working in AI, big data, 3D, IoT and robotics and cybersecurity sectors.

Enlightened Hospitality Investments (EHI)

Enlightened Hospitality Investments (EHI) is a New York-based growth fund launched by Danny Meyer and his Union Square Hospitality Group (USHG). The fund leverages USHG's network of chefs, IT, marketers, and industry experts.Active since the early ’90s, it currently has $220m under management. To date, EHI has made eight investments bringing technology into the hospitality sector through companies operating in the food and beverage space.

Enlightened Hospitality Investments (EHI) is a New York-based growth fund launched by Danny Meyer and his Union Square Hospitality Group (USHG). The fund leverages USHG's network of chefs, IT, marketers, and industry experts.Active since the early ’90s, it currently has $220m under management. To date, EHI has made eight investments bringing technology into the hospitality sector through companies operating in the food and beverage space.

Co-founder, CEO of Bodyswaps

Christophe Mallet is the French co-founder and CEO of UK-based VR edtech for soft-skills training Bodyswaps, where he has worked since its founding in 2019. Prior to this, he was CEO and co-founder at VR marketing agency Somewhere Else from 2016 before the agency pivoted to training and skills development and became the basis of Bodyswaps’ product offer. The agency had clients such as Adidas, for which Somewhere Else produced an interactive VR in-store promotional tool that was deployed in over 100 locations in China, Europe and the US and was nominated for a VR Award and an Immersive Perspective award. Mallet also co-founded another VR agency Exheb, forerunner to Somewhere Else in 2014.For almost six years before that, Mallet worked in social media and digital strategy management at Carve Consulting in London, a digital agency helping organisations to become social businesses. Mallet also co-founded a music label, Ubermax Records, in 2011.Mallet holds two master’s degrees: Science in Management and Business from the HEC School of Management in Paris, and International Business and Management from Vienna University of Economics and Management.

Christophe Mallet is the French co-founder and CEO of UK-based VR edtech for soft-skills training Bodyswaps, where he has worked since its founding in 2019. Prior to this, he was CEO and co-founder at VR marketing agency Somewhere Else from 2016 before the agency pivoted to training and skills development and became the basis of Bodyswaps’ product offer. The agency had clients such as Adidas, for which Somewhere Else produced an interactive VR in-store promotional tool that was deployed in over 100 locations in China, Europe and the US and was nominated for a VR Award and an Immersive Perspective award. Mallet also co-founded another VR agency Exheb, forerunner to Somewhere Else in 2014.For almost six years before that, Mallet worked in social media and digital strategy management at Carve Consulting in London, a digital agency helping organisations to become social businesses. Mallet also co-founded a music label, Ubermax Records, in 2011.Mallet holds two master’s degrees: Science in Management and Business from the HEC School of Management in Paris, and International Business and Management from Vienna University of Economics and Management.

CEO and founder of SOURCE Global (formerly Zero Mass Water)

Cody Frieson is the US founder and CEO of SOURCE Global (formerly Zero Mass Water), the first off-grid drinking water production tech based on solar-powered panels. The Arizona State University Fulton Engineering School professor of innovation invented the Hydropanel, the key to SOURCE’s technology, and continues to teach part-time at the university. He is also a fellow at both the NGO Aspen Institute, which is committed to realizing a free, just and equitable society, and also at Unreasonable – an entity composed of entrepreneurs, institutions and investors dedicated to “discover profit in solving global problems.”Frieson was also previously founder, president and CTO of rechargeable zinc battery startup Fluidic Energy, another of his inventions, where he worked from 2007 to 2013, when it was acquired and became NantEnergy. In 2019, Freison won the Lemelson-MIT Student Prize for innovations to benefit the world – the US’ most prestigious student innovation award with a $500,000 prize. Frieson holds a PhD in Materials Science and Engineering from The Massachusetts Institute of Technology (MIT).

Cody Frieson is the US founder and CEO of SOURCE Global (formerly Zero Mass Water), the first off-grid drinking water production tech based on solar-powered panels. The Arizona State University Fulton Engineering School professor of innovation invented the Hydropanel, the key to SOURCE’s technology, and continues to teach part-time at the university. He is also a fellow at both the NGO Aspen Institute, which is committed to realizing a free, just and equitable society, and also at Unreasonable – an entity composed of entrepreneurs, institutions and investors dedicated to “discover profit in solving global problems.”Frieson was also previously founder, president and CTO of rechargeable zinc battery startup Fluidic Energy, another of his inventions, where he worked from 2007 to 2013, when it was acquired and became NantEnergy. In 2019, Freison won the Lemelson-MIT Student Prize for innovations to benefit the world – the US’ most prestigious student innovation award with a $500,000 prize. Frieson holds a PhD in Materials Science and Engineering from The Massachusetts Institute of Technology (MIT).

New York-based VC firm Union Square Ventures (USV) was established in 2004 and has invested in more than 100 companies to date. It manages US$1.7bn in assets across nine funds. The most recent, totaling US$450m in commitments, was launched in 2019. USV invests across multiple sectors and all stages of investment. Its specific interest, however, is in businesses derived from academic theses. USV is a prolific investor: recent investments include blockchain-based gaming company Dapper Labs' US$11m Series A round and B2B loan marketplace C2FO's US$200m Series G round.

New York-based VC firm Union Square Ventures (USV) was established in 2004 and has invested in more than 100 companies to date. It manages US$1.7bn in assets across nine funds. The most recent, totaling US$450m in commitments, was launched in 2019. USV invests across multiple sectors and all stages of investment. Its specific interest, however, is in businesses derived from academic theses. USV is a prolific investor: recent investments include blockchain-based gaming company Dapper Labs' US$11m Series A round and B2B loan marketplace C2FO's US$200m Series G round.

Beyond Investing is a Geneva-based firm investing in early-stage venture capital and equity growth startups mainly in European developed markets. With average investments of €200,000, the firm’s core investment strategy focuses on sustainability with an investment period lasting 5–10 years.The impact investor targets innovative startups involved in vegan, cruelty-free and plant-based alternatives; biotechnologies, foodtech, new materials, clothing and lifestyle sectors. Successful portfolio foodtechs include Mosa Meat, BlueNalu and Shiok Meats.With a team of vegan finance professionals in the US and Europe, Beyond Investing listed the first US Vegan Climate ETF (VEGN) on the New York Stock Exchange in September 2019. The ETF tracks Beyond Investing’s US Vegan Climate Index which covers an index of 495 of the largest-capitalization companies in the US stock market. The ethical investment option aims to exclude stocks in companies with activities that are not aligned with its vegan-themed, cruelty-free and fossil-fuel-free investing ethos.

Beyond Investing is a Geneva-based firm investing in early-stage venture capital and equity growth startups mainly in European developed markets. With average investments of €200,000, the firm’s core investment strategy focuses on sustainability with an investment period lasting 5–10 years.The impact investor targets innovative startups involved in vegan, cruelty-free and plant-based alternatives; biotechnologies, foodtech, new materials, clothing and lifestyle sectors. Successful portfolio foodtechs include Mosa Meat, BlueNalu and Shiok Meats.With a team of vegan finance professionals in the US and Europe, Beyond Investing listed the first US Vegan Climate ETF (VEGN) on the New York Stock Exchange in September 2019. The ETF tracks Beyond Investing’s US Vegan Climate Index which covers an index of 495 of the largest-capitalization companies in the US stock market. The ethical investment option aims to exclude stocks in companies with activities that are not aligned with its vegan-themed, cruelty-free and fossil-fuel-free investing ethos.

US-French private equity company L Catterton is based in Greenwich, USA, with 17 offices around the world and over $28bn of equity capital. It mostly invests in the consumer industry as well as real estate and technology startups.Founded in 1989 and currently led by co-CEOs Michael Chu and Scott Dahnke, in 2016, L Catterton partnered with the LVMH Group and Groupe Arnault combining Catterton's operations with LVMH and Groupe Arnault's real estate and private equity operations across Europe Asia, and North America. The partnership formed the largest global consumer-focused private equity firm yet the 31st largest private equity firm in the world. L Catterton holds majority stakes in companies like Birkenstock, Crystal Jade, Bliss, John Hardy amongst others; it also invests in technology startups in their growth and hyper-growth phases. Most notable investments include Aleph Farms, ClassPass, and more recently the plant-based products manufacturer NotCo. Its latest growth fund, L Catterton Growth IV, targets an investment range of $10m–$75m in North America and Europe.

US-French private equity company L Catterton is based in Greenwich, USA, with 17 offices around the world and over $28bn of equity capital. It mostly invests in the consumer industry as well as real estate and technology startups.Founded in 1989 and currently led by co-CEOs Michael Chu and Scott Dahnke, in 2016, L Catterton partnered with the LVMH Group and Groupe Arnault combining Catterton's operations with LVMH and Groupe Arnault's real estate and private equity operations across Europe Asia, and North America. The partnership formed the largest global consumer-focused private equity firm yet the 31st largest private equity firm in the world. L Catterton holds majority stakes in companies like Birkenstock, Crystal Jade, Bliss, John Hardy amongst others; it also invests in technology startups in their growth and hyper-growth phases. Most notable investments include Aleph Farms, ClassPass, and more recently the plant-based products manufacturer NotCo. Its latest growth fund, L Catterton Growth IV, targets an investment range of $10m–$75m in North America and Europe.

Founded in London in 1998, Kreos Capital is a pioneer growth debt provider. Kreos has completed over 630 deals worth over €3bn in pan-European countries and Israel. The Kreos Capital Group of companies and various funds are regulated by the Jersey Financial Services Commission.Kreos currently has 102 companies in its portfolio and has managed over 200 exits. Investee Riskified, an Israeli e-commerce fraud protection company, was listed on the NYSE at a $3.3bn valuation in August 2021. Kreos also joined recent investments in 2021 including the $54m Series B round of Austrian refurbished electronics goods marketplace Refurbed and the €9.5m round of Berlin-based HRtech expertlead.

Founded in London in 1998, Kreos Capital is a pioneer growth debt provider. Kreos has completed over 630 deals worth over €3bn in pan-European countries and Israel. The Kreos Capital Group of companies and various funds are regulated by the Jersey Financial Services Commission.Kreos currently has 102 companies in its portfolio and has managed over 200 exits. Investee Riskified, an Israeli e-commerce fraud protection company, was listed on the NYSE at a $3.3bn valuation in August 2021. Kreos also joined recent investments in 2021 including the $54m Series B round of Austrian refurbished electronics goods marketplace Refurbed and the €9.5m round of Berlin-based HRtech expertlead.

MNC Media Investment started out as Linktone, a China-based media company that was acquired in 2008 by Indonesia’s MNC group that is owned by business tycoon and politician Hary Tanoesoedibjo. Linktone was rebranded as MNC Media Investment Ltd in 2014 to focus on various entertainment and marketing products, as well as other media services. Its shares are also listed on the Australian Stock Exchange and quoted on the OTC Markets Group’s OTC Pink.

MNC Media Investment started out as Linktone, a China-based media company that was acquired in 2008 by Indonesia’s MNC group that is owned by business tycoon and politician Hary Tanoesoedibjo. Linktone was rebranded as MNC Media Investment Ltd in 2014 to focus on various entertainment and marketing products, as well as other media services. Its shares are also listed on the Australian Stock Exchange and quoted on the OTC Markets Group’s OTC Pink.

Set up in 2012 by Jackie Chen (Chen Liang) and Sebastian Kübler, who together with Raymond Lei (Lei Yang) founded Taishan Invest AG, one of China's first angel funds. TXD Ventures is an early-stage investor focusing on Chinese consumer startups, particularly online- and/or mobile-based. Its investments range from RMB 1 million to RMB 6 million.

Set up in 2012 by Jackie Chen (Chen Liang) and Sebastian Kübler, who together with Raymond Lei (Lei Yang) founded Taishan Invest AG, one of China's first angel funds. TXD Ventures is an early-stage investor focusing on Chinese consumer startups, particularly online- and/or mobile-based. Its investments range from RMB 1 million to RMB 6 million.

Since its acquisition by US-based internet giant IAC in 2003, Expedia Inc has quickly transformed into a worldwide travel group with stakes in SilverRail, Hotels.com, Trivago, HomeAway, Orbitz, Travelocity, Mobiata travel apps and long-term China partner eLong.Expedia.com was originally launched in 1996 as Microsoft’s pioneering online travel booking venture to help consumers to search for the best travel deals and book tickets at the best prices.

Since its acquisition by US-based internet giant IAC in 2003, Expedia Inc has quickly transformed into a worldwide travel group with stakes in SilverRail, Hotels.com, Trivago, HomeAway, Orbitz, Travelocity, Mobiata travel apps and long-term China partner eLong.Expedia.com was originally launched in 1996 as Microsoft’s pioneering online travel booking venture to help consumers to search for the best travel deals and book tickets at the best prices.

Utrust (Guangdong Yuecai Venture Capital Co., Ltd.) was founded in 1995. It is a wholly owned subsidiary of Guangdong Yuecai Investment Co., Ltd., which is authorized by the Guangdong government to manage state-owned capital. With the support of the government of Guangdong province, Utrust invests in many Guangdong-based companies. By the end of December 2017, Utrust had managed capital of over RMB 4.3 billion with assets exceeding RMB 900 million.

Utrust (Guangdong Yuecai Venture Capital Co., Ltd.) was founded in 1995. It is a wholly owned subsidiary of Guangdong Yuecai Investment Co., Ltd., which is authorized by the Guangdong government to manage state-owned capital. With the support of the government of Guangdong province, Utrust invests in many Guangdong-based companies. By the end of December 2017, Utrust had managed capital of over RMB 4.3 billion with assets exceeding RMB 900 million.

Stella Maris Partners is a venture capital fund based in San Pedro Garza García, Mexico with a focus on the education, healthcare and financial services sectors. It invests in Mexican and foreign startups looking to expand to Mexico and Latin America. The firm was founded by Armando Badillo in 2012 and has four other managing partners, Angel Alvarez Cadaveico, Guillermo Zambrano Martinez, Jesus O. Lanza Losa and Marcelo Antonio Benitez Akbo.

Stella Maris Partners is a venture capital fund based in San Pedro Garza García, Mexico with a focus on the education, healthcare and financial services sectors. It invests in Mexican and foreign startups looking to expand to Mexico and Latin America. The firm was founded by Armando Badillo in 2012 and has four other managing partners, Angel Alvarez Cadaveico, Guillermo Zambrano Martinez, Jesus O. Lanza Losa and Marcelo Antonio Benitez Akbo.

Qorium: Lab-grown premium leather for the future of luxury

The Dutch biotech startup co-founded by cell-based meat pioneer Mark Post is targeting the luxury goods market with its “clean leather” sheets made from cultivating bovine skin cells, and plans to raise up to €100m

Beyond Leather Materials: Turning apples into alt-leather for sustainable fashion

Through its Leap brand, the Danish startup cuts food waste by turning apples junked in cider factories into affordable vegan leather for the $100bn leather market

Eco-friendly vegan leather from recycled waste, made in Indonesia

In the battle for ethical consumer dollars, mass production of vegan leather by startups like Mycotech and Bell Society, could be the game-changer for the fashion industry

Biomilq: Creating cell-based mothers’ milk in a lab

With the aim of helping women struggling to breastfeed, Bill Gates-backed Biomilq is disrupting the $45bn baby formula industry developing lab-grown breast milk from mammary epithelial cells

Meatable: Cell-based meat startup secures $47m Series A for scalable technology

The Dutch startup offers a pioneering technology for quickly scaling cell-based meat production while eliminating the need for animal-derived growth media

Big Idea Ventures Founder Andrew D Ive: Asia will lead cell-based meat innovation

In a wide-ranging interview, the managing general partner of the US- and Singapore-based foodtech investor also expounds on his goal to extend sustainability to the rest of the food sector, combining good returns with doing good

Meatable joins Royal DSM to create growth media specific for cell-based meat tech

The R&D between the biotech startup and fellow Dutch nutrition conglomerate could help scale and drive the commercial viability of lab-grown meat

TreeFrog Therapeutics: Mimicking how stem cells grow in the human body

The French biotech’s proprietory technology to cultivate pluripotent stem cells in a 3D environment can be scaled to mass-produce high-quality cells to treat diseases such as Parkinson’s

TurtleTree Labs: Creating sustainable mammalian milk alternatives from stem cells

Founder’s search for high-quality dairy milk led to the creation in a lab of naturally occurring ingredients found in human milk for supply to dairy milk and infant formula businesses

Cubiq Foods: Bioreactor farms producing the food of tomorrow

Growing appetite for meat alternatives expected to fuel demand for Cubiq’s low calorie, Omega 3-enriched lab-grown fats

Cocuus: Industrial-scale solutions to design and print food

This Spanish startup is pioneering industrial-scale 3D food printing using inkjet and laser technology that prints up to 30 times faster with eye-catching food designs

Indonesian local crafts marketplace Qlapa shuts down

Series A funding failed to keep startup afloat as business remains unprofitable, regional heavyweights close in

Singapore, the place to start and grow a cellular agriculture startup

A country that imports over 90% of its food supply, Singapore has turned to foodtech, including cellular agriculture, to safeguard food security, supported by proactive regulators

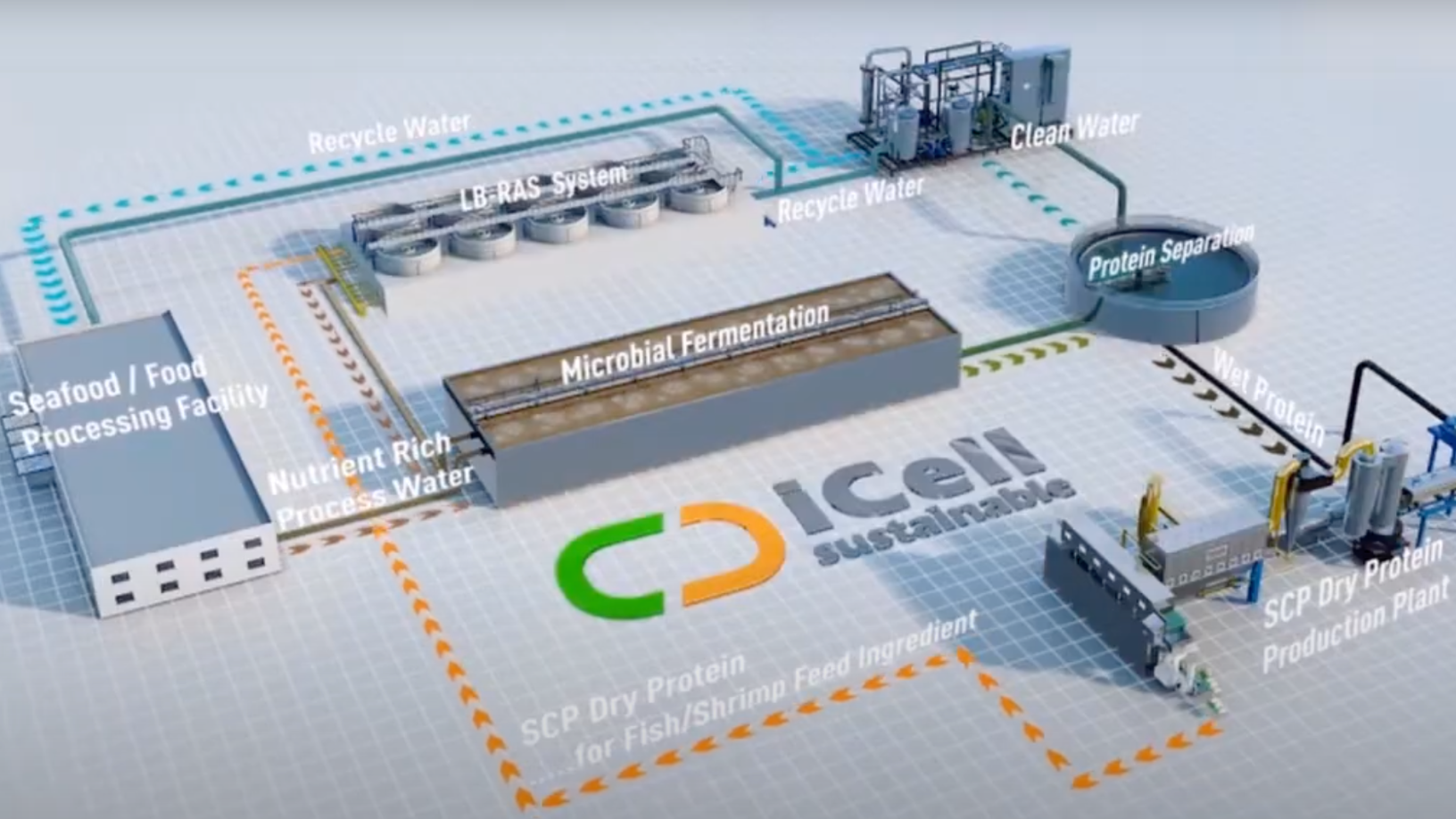

iCell: Upcycling nutrients from wastewater

Hong Kong-based iCell Sustainable Nutrition makes single-cell proteins with wastewater from food and beverage factories, generating revenue and purifying the water for safe discharge or reuse

Because Animals: Pioneering cultured meat for pets

The biotech startup is disrupting the pet food processing industry with cell-based food to minimize environmental “pawprints” and promote animal welfare

Sorry, we couldn’t find any matches for“Cell-based leather”.