Draper Venture Network

-

DATABASE (580)

-

ARTICLES (337)

UK-based venture capital firm Notion Capital was established in 2009 by SaaS firm MessageLabs founders Stephen Chandler and Jos White. MessageLabs was sold to Symantec for US$700 million the year before. Notion focuses on European enterprise software startups and has about US$350 million under management. The company has invested in 50 startups with a special emphasis on SaaS and Cloud-based applications. It has managed 10 exits to date including Adbrain and NewVoiceMedia. Its recent investments include GoCardless' Series E round, debt financing for DueDil and in Vortexa's Series A round.

UK-based venture capital firm Notion Capital was established in 2009 by SaaS firm MessageLabs founders Stephen Chandler and Jos White. MessageLabs was sold to Symantec for US$700 million the year before. Notion focuses on European enterprise software startups and has about US$350 million under management. The company has invested in 50 startups with a special emphasis on SaaS and Cloud-based applications. It has managed 10 exits to date including Adbrain and NewVoiceMedia. Its recent investments include GoCardless' Series E round, debt financing for DueDil and in Vortexa's Series A round.

Plug and Play Tech Center is a startup accelerator and venture fund based in Silicon Valley, USA. It invests in over 100 startups every year, from pre-product to Series A, including Dropbox and Lending Club.The VC launched its first accelerator program in Indonesia in February 2017, in partnership with Indonesia’s Gan Kapital. Since then, the program has provided mentorship and US$50,000 funding to each of the 11 startups selected from the ASEAN region including Astronaut Technologies. Other corporate partners include Astra International, BNI, Bank BTN and Sinar Mas.

Plug and Play Tech Center is a startup accelerator and venture fund based in Silicon Valley, USA. It invests in over 100 startups every year, from pre-product to Series A, including Dropbox and Lending Club.The VC launched its first accelerator program in Indonesia in February 2017, in partnership with Indonesia’s Gan Kapital. Since then, the program has provided mentorship and US$50,000 funding to each of the 11 startups selected from the ASEAN region including Astronaut Technologies. Other corporate partners include Astra International, BNI, Bank BTN and Sinar Mas.

Vynn Capital LP was founded in early 2018 by former Gobi Partners vice president Victor Chua and Darren Chua from Singapore. Victor joined Gobi in 2015 and was on Forbes’ 30 under 30 Asia list 2017: Finance and Venture Capital.The Malaysian VC, with plans to raise a maiden fund of US$40 million, will focus on financing collaborations among large corporates, SMEs and innovative startups in the ASEAN region including Myanmar. It will invest in 15 to 30 companies. with seed funds ranging from US$300,000 to US$500,000 and Series A of US$1 million.

Vynn Capital LP was founded in early 2018 by former Gobi Partners vice president Victor Chua and Darren Chua from Singapore. Victor joined Gobi in 2015 and was on Forbes’ 30 under 30 Asia list 2017: Finance and Venture Capital.The Malaysian VC, with plans to raise a maiden fund of US$40 million, will focus on financing collaborations among large corporates, SMEs and innovative startups in the ASEAN region including Myanmar. It will invest in 15 to 30 companies. with seed funds ranging from US$300,000 to US$500,000 and Series A of US$1 million.

Ideabox Ventures is a VC launched by Indonesian telecoms Indosat Ooredoo, Kejora Ventures and Mountain Partners SEA in November 2016. The VC was an addition to the existing annual accelerator Ideabox program that had nurtured startups like Dealoka, Pawoon and Wobe. More venture capital is expected to come from new partnerships with global institutions in Asia, Europe and North America. Early stage or pre-Series A funding of up to US$500,000 will be awarded to each startup, as well as strategic commercial consultancy and support services to boost the expansion of the VC’s portfolio firms.

Ideabox Ventures is a VC launched by Indonesian telecoms Indosat Ooredoo, Kejora Ventures and Mountain Partners SEA in November 2016. The VC was an addition to the existing annual accelerator Ideabox program that had nurtured startups like Dealoka, Pawoon and Wobe. More venture capital is expected to come from new partnerships with global institutions in Asia, Europe and North America. Early stage or pre-Series A funding of up to US$500,000 will be awarded to each startup, as well as strategic commercial consultancy and support services to boost the expansion of the VC’s portfolio firms.

Wu received his bachelor's in Tourism Management from Nanjing University in 1995. His background is in e-commerce. Wu was one of the original founders of Luoji Siwei, but he left the company in 2013. His current business venture is Context Lab, a corporate services platform. Wu participated in Kuaipeilian's seed funding round.

Wu received his bachelor's in Tourism Management from Nanjing University in 1995. His background is in e-commerce. Wu was one of the original founders of Luoji Siwei, but he left the company in 2013. His current business venture is Context Lab, a corporate services platform. Wu participated in Kuaipeilian's seed funding round.

Silicon Valley Future Capital is a venture capital firm that invests primarily in early stage and growth stage companies with disruptive technologies or innovative business models. Founding partner Dr. Hong Miao used to be managing partner of CLI Ventures, senior VP of CheerLand Investment Group, executive president of the CL Institute of Innovation, and chairman of Zen Water Capital in Silicon Valley. The firm invests primarily in innovations in high-tech, including artificial intelligence, machine learning, big data, cloud computing, robotics, life science, biotech, precision medicine and other disruptive technologies.

Silicon Valley Future Capital is a venture capital firm that invests primarily in early stage and growth stage companies with disruptive technologies or innovative business models. Founding partner Dr. Hong Miao used to be managing partner of CLI Ventures, senior VP of CheerLand Investment Group, executive president of the CL Institute of Innovation, and chairman of Zen Water Capital in Silicon Valley. The firm invests primarily in innovations in high-tech, including artificial intelligence, machine learning, big data, cloud computing, robotics, life science, biotech, precision medicine and other disruptive technologies.

The Alexa Fund provides up to $200 million in venture capital funding to fuel voice technology innovation. It is focused on how voice technology can improve customers’ lives, from early-stage pre-revenue companies to established brands. Areas of particular interest include: hardware products that would benefit from the Alexa Voice Service; skills that deliver new abilities to Alexa-enabled devices through the Alexa Skills Kit; and new contributions to the science behind voice technology, including text to speech, natural language understanding, automatic speech recognition, artificial intelligence and hardware component design.

The Alexa Fund provides up to $200 million in venture capital funding to fuel voice technology innovation. It is focused on how voice technology can improve customers’ lives, from early-stage pre-revenue companies to established brands. Areas of particular interest include: hardware products that would benefit from the Alexa Voice Service; skills that deliver new abilities to Alexa-enabled devices through the Alexa Skills Kit; and new contributions to the science behind voice technology, including text to speech, natural language understanding, automatic speech recognition, artificial intelligence and hardware component design.

B Capital Group is best known as the venture capital firm co-founded by Eduardo Saverin, co-founder of Facebook. Its investment thesis focuses on connecting highly innovative and agile startups with major corporates that are in need of innovation and have the resources to innovate. As such, B Capital has a special interest in B2B companies that have great potential to disrupt critical industries. This includes startups that are disrupting healthcare and biotechnology, as well as finance and insurance. B Capital has also supported some notable B2C companies, including coffee chain Kopi Kenangan and used car marketplace Carro.

B Capital Group is best known as the venture capital firm co-founded by Eduardo Saverin, co-founder of Facebook. Its investment thesis focuses on connecting highly innovative and agile startups with major corporates that are in need of innovation and have the resources to innovate. As such, B Capital has a special interest in B2B companies that have great potential to disrupt critical industries. This includes startups that are disrupting healthcare and biotechnology, as well as finance and insurance. B Capital has also supported some notable B2C companies, including coffee chain Kopi Kenangan and used car marketplace Carro.

Formerly known as Google Ventures, GV is the investment arm of Alphabet Inc. Although Alphabet is its sole limited partner, the VC operates independently from Google. It invests in seed, venture and growth-stage funding rounds with more than 300 companies in its portfolio worth over $5bn. Headquartered in California’s Mountain View, GV has offices in San Francisco, Boston, New York and London. The VC has been actively involved in Silicon Valley’s investment rounds for prominent startups like Uber, Slack, Ripple, Impossible Foods, Lime and Medium.

Formerly known as Google Ventures, GV is the investment arm of Alphabet Inc. Although Alphabet is its sole limited partner, the VC operates independently from Google. It invests in seed, venture and growth-stage funding rounds with more than 300 companies in its portfolio worth over $5bn. Headquartered in California’s Mountain View, GV has offices in San Francisco, Boston, New York and London. The VC has been actively involved in Silicon Valley’s investment rounds for prominent startups like Uber, Slack, Ripple, Impossible Foods, Lime and Medium.

Based in London, CPT Capital is the venture arm of private equity pioneer Jeremy Coller's private family office. Coller is the founder of Europe’s first private equity for secondaries in 1990. The British philanthropist has also established several business schools and the Jeremy Coller Foundation that aims to eliminate factory farming. In 2017, CPT Capital was founded to disrupt the food industry with investments in the alt-protein sector to create the “future of food and materials” like plant-based, recombinant and cell-cultured proteins.

Based in London, CPT Capital is the venture arm of private equity pioneer Jeremy Coller's private family office. Coller is the founder of Europe’s first private equity for secondaries in 1990. The British philanthropist has also established several business schools and the Jeremy Coller Foundation that aims to eliminate factory farming. In 2017, CPT Capital was founded to disrupt the food industry with investments in the alt-protein sector to create the “future of food and materials” like plant-based, recombinant and cell-cultured proteins.

Established in 1977, Matrix Partners is an American venture capital firm with offices in San Francisco and Cambridge in the US, as well as in Shanghai, Beijing, Mumbai and Bangalore, and has invested in prominent companies like Apple and FedEx. It participates in all stages of investment and, to date, has invested over US$4 billion and has over US$4 billion currently under management. The company has invested in more than 500 companies and was lead investor in over 150. It has seen more than 100 exits. Recent investments include US$11 million in Brightback Series A and in Klook's Series D.

Established in 1977, Matrix Partners is an American venture capital firm with offices in San Francisco and Cambridge in the US, as well as in Shanghai, Beijing, Mumbai and Bangalore, and has invested in prominent companies like Apple and FedEx. It participates in all stages of investment and, to date, has invested over US$4 billion and has over US$4 billion currently under management. The company has invested in more than 500 companies and was lead investor in over 150. It has seen more than 100 exits. Recent investments include US$11 million in Brightback Series A and in Klook's Series D.

Led by co-founder and Managing Partner Alexandre Barbosa, Faber Ventures is a pan-European venture capital firm with offices in Lisbon and London. It was founded in 2012 with VCs Caixa Capital and Shilling Capital Partners investors in Faber Ventures.The firm works alongside founders from idea to market, either as co-founders or angel investors, and typically continues to support the startup as seed co-investors. Faber Ventures also supports startups at the seed stage with financial investment and hands-on mentorship. The company has invested in 19 startups to date in varied sectors and managed two exits, Glitter and Gleam.

Led by co-founder and Managing Partner Alexandre Barbosa, Faber Ventures is a pan-European venture capital firm with offices in Lisbon and London. It was founded in 2012 with VCs Caixa Capital and Shilling Capital Partners investors in Faber Ventures.The firm works alongside founders from idea to market, either as co-founders or angel investors, and typically continues to support the startup as seed co-investors. Faber Ventures also supports startups at the seed stage with financial investment and hands-on mentorship. The company has invested in 19 startups to date in varied sectors and managed two exits, Glitter and Gleam.

Jesus Monleon started his professional career in the financial sector, but left soon after to become an entrepreneur. He founded eMagister.com, a consulting firm dedicated to the IT management market. He also established Offerum that is now part of Groupalia. Another venture Glamourum was acquired by JolieBox in 2012. He is currently a leading advisor and business angel within the Spanish startup ecosystem. In 2008, he co-founded the famous Spanish accelerator SeedRocket. Together with several other investors, he also set up a €12-million fund to establish SeedRocket 4Founders Capital in 2017.

Jesus Monleon started his professional career in the financial sector, but left soon after to become an entrepreneur. He founded eMagister.com, a consulting firm dedicated to the IT management market. He also established Offerum that is now part of Groupalia. Another venture Glamourum was acquired by JolieBox in 2012. He is currently a leading advisor and business angel within the Spanish startup ecosystem. In 2008, he co-founded the famous Spanish accelerator SeedRocket. Together with several other investors, he also set up a €12-million fund to establish SeedRocket 4Founders Capital in 2017.

Founded in 2017 by the ex-CEO of Credit Suisse bank Gaël de Boissard, 2B Capital is venture capital firm based in London. Its first investment in CrowdProcess Inc and the startup's James risk management platform was as part of a US$2.7-million seed funding in August 2017. The VC primarily invests in fintech and structured credit and mezzanine lending to the new lenders and challenger banks.

Founded in 2017 by the ex-CEO of Credit Suisse bank Gaël de Boissard, 2B Capital is venture capital firm based in London. Its first investment in CrowdProcess Inc and the startup's James risk management platform was as part of a US$2.7-million seed funding in August 2017. The VC primarily invests in fintech and structured credit and mezzanine lending to the new lenders and challenger banks.

M12 is the venture capital arm of Microsoft, formerly known as Microsoft Ventures, founded in 2016 to invest in Series A rounds and beyond. M12 has invested in more than 70 startups to date and has managed four exits, all of them acquisitions: Comfy, Figure Eight, Bonsai and Frame. M12 is especially interested in enterprise software and its biggest investment to date was US$114 in Outreach's Series D round. It has also invested recently in Nautilus Labs' Series A and Onfido's Series C.The VC also awards a US$4 million Female Founders prize to boost the participation of women in tech.

M12 is the venture capital arm of Microsoft, formerly known as Microsoft Ventures, founded in 2016 to invest in Series A rounds and beyond. M12 has invested in more than 70 startups to date and has managed four exits, all of them acquisitions: Comfy, Figure Eight, Bonsai and Frame. M12 is especially interested in enterprise software and its biggest investment to date was US$114 in Outreach's Series D round. It has also invested recently in Nautilus Labs' Series A and Onfido's Series C.The VC also awards a US$4 million Female Founders prize to boost the participation of women in tech.

Vottun: The "WordPress for blockchain" seeks US expansion, investors

Seeking Series A funding this year, the agnostic SaaS opens blockchain's wealth of possibilities to businesses unfamiliar with the technology

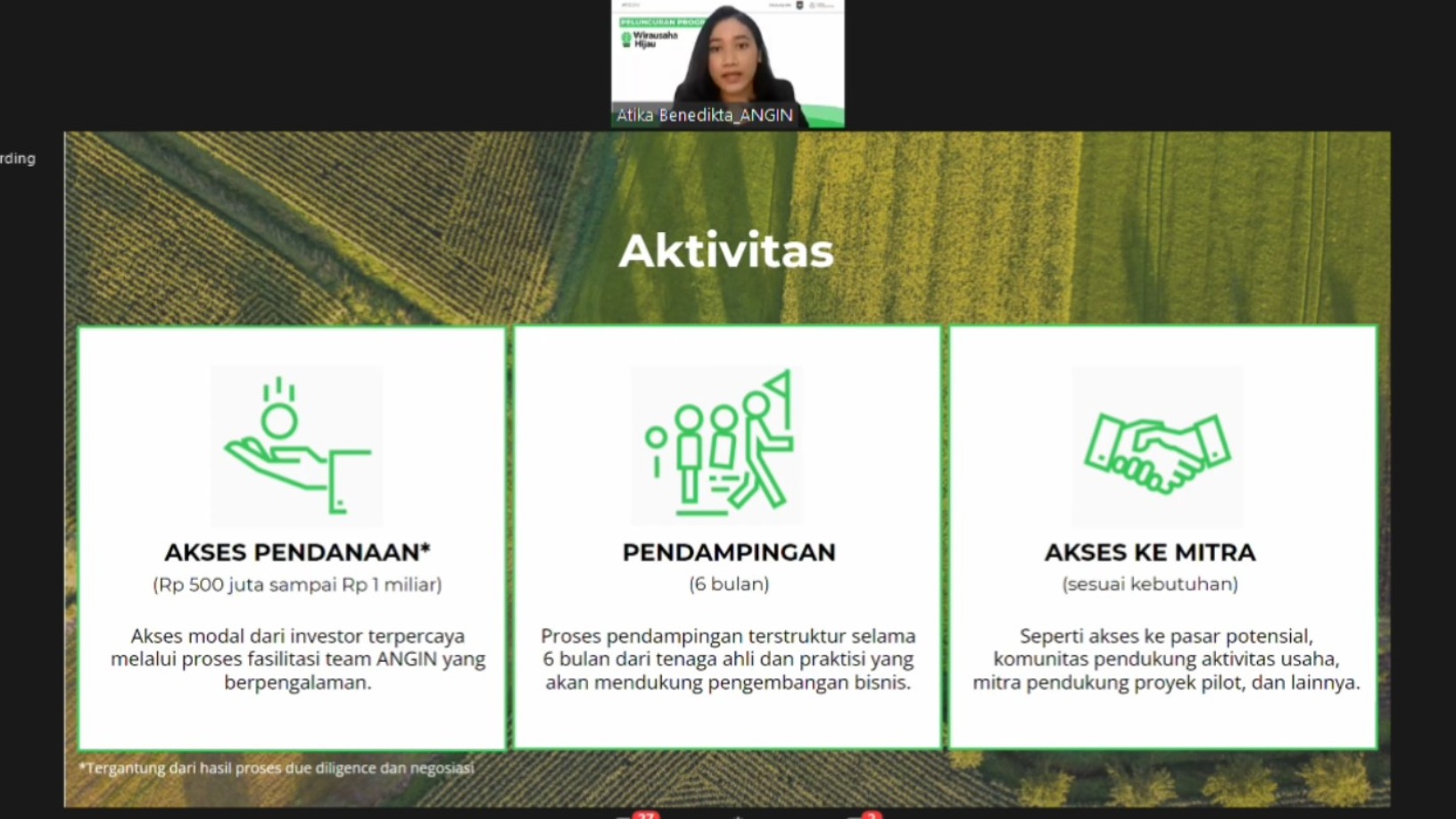

Indonesian angel investor network ANGIN launches agrifood incubator

Program targets ESG investment and builds on the strong potential of Indonesia’s agriculture sector, which kept growing despite the Covid-19 pandemic

Faraday Venture Partners’ MP Gonzalo Tradacete: “We are actively looking for startups”

Amid the Covid-19 slump, Faraday Venture Partners' CIO and MP shares his expectations for startup investments and favored sectors, the measures his firm has taken so far to help investees ride out the crisis, and more.

The charm of Jike: From search engine to popular social network

App's success shows enthusiasm for a personalized, community-based content and search platform, emulated even by Tencent

Swanlaab Venture Factory: €40 million funding chest to give power to the people

The female co-founder of Swanlaab Venture Factory believes that diversity enriches decision-making and drives performance. CompassList recently caught up with Verónica Trapa Díaz-Obregón to find out what's in store for Spain's first Israeli-backed VC fund

Medigo teams up with Indonesian Medical Association to launch primary care clinic network

Medigo aims to support healthcare operators with its clinic management SaaS, booking and medical records app for patients and more

Early Charm Ventures: Taking research from the labs to the real world

Instead of investing money, the venture studio gets hands-on, co-running companies with top scientists and their cutting-edge research

Beyond ride-hailing: Gojek, Grab and all their friends

Now that Grab and Go-Jek are in a faceoff on a regional scale, here's a look at how Southeast Asia's two biggest unicorns – and their investors – could be shaping the local digital economies and startup ecosystems

For your X-ray records, just check the cloud

A Chinese startup has built a digital medical image library on the cloud, bringing ease and cost savings to patients, doctors and hospitals countrywide

TheVentures founders launch Singapore VC to drive deals in Southeast Asia

The Korean Viki co-founders return to Singapore as venture builders and investors, offering South Korean partnerships and “CTO-as-a-service” in Southeast Asia

As Veniam’s “Internet of Moving Things” keeps growing, autonomous vehicles are next

The Portuguese startup is going places with its mesh networking technology, but that’s “just the beginning”, says Veniam founder and CEO João Barros. He talks to CompassList about partnering automakers to design self-driving cars, raising a new round of funding in 2018, and more

Carlos Guerrero: The legal guardian of tech startups

The lawyer and investor dives deep in the Spanish startup ecosystem, supporting young tech companies with both financial and specialized legal support

Indonesia launches national pitch competition HighPitch 2020 to re-energize its startup ecosystem

With 43 VC investors so far joining as judges and mentors, HighPitch 2020 aims to reconnect investors with young startups across the country amid Covid-19

Nuuk, the cooler box poised to disrupt cold chain logistics

Barcelona-based startup Groenlandia Tech has developed a smart cooler box to track and monitor biological samples, providing an extra layer of security and control during transport

AlphaBeats: a 10-minute music playlist to de-stress your brain using biofeedback

With the exclusive rights to Philips’s neurofeedback technology, Alphabeats has developed an app to offer and enhance relaxation using a person’s favorite music

Sorry, we couldn’t find any matches for“Draper Venture Network”.