Grow Asia

-

DATABASE (182)

-

ARTICLES (391)

CMO and co-founder of Tezign

Guo was named a Global Shaper by the World Economic Forum in 2014 and was on Forbes’ 2017 30 Under 30 Asia list. A graduate of the China Central Academy of Fine Arts, she has organized art exhibitions in countries such as Italy, Spain and Germany.

Guo was named a Global Shaper by the World Economic Forum in 2014 and was on Forbes’ 2017 30 Under 30 Asia list. A graduate of the China Central Academy of Fine Arts, she has organized art exhibitions in countries such as Italy, Spain and Germany.

CTO and Co-founder of Jeff

Adrian Lorenzo Alonso is a Spanish computer engineer and co-founder/CTO of Mr. Jeff, an online dry cleaning and laundry service with a presence in Europe, Asia and Latin America.He previously worked as CTO in www.thefoodpoint.com, a B2B food market.

Adrian Lorenzo Alonso is a Spanish computer engineer and co-founder/CTO of Mr. Jeff, an online dry cleaning and laundry service with a presence in Europe, Asia and Latin America.He previously worked as CTO in www.thefoodpoint.com, a B2B food market.

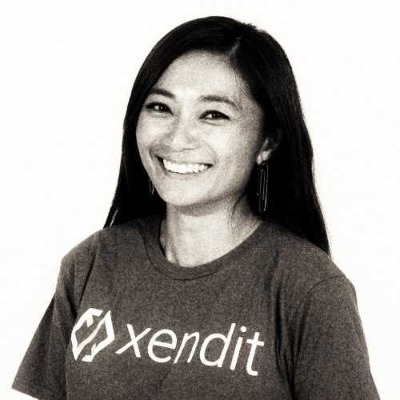

COO and co-founder of Xendit

Tessa Wijaya joined Indonesian fintech Xendit as co-founder and COO in 2016, a year after the payment gateway startup graduated from the Y Combinator program and launched its platform in Indonesia.Wijaya obtained a master’s in philosophy from the University of Sydney in 2006 after graduating from Syracuse University’s Maxwell School of Citizenship and Public Affairs in 2003. She returned to Indonesia and worked as a corporate development officer for over three years. In 2010, she became an analyst at Principia Management Group and Fairways Investment Group, both being Southeast Asia-focused investment firms. In 2013, Wijaya went on to work as an associate at Singapore-based investment firm Mizuho Asia Partners for over three years before joining Xendit back in Jakarta.

Tessa Wijaya joined Indonesian fintech Xendit as co-founder and COO in 2016, a year after the payment gateway startup graduated from the Y Combinator program and launched its platform in Indonesia.Wijaya obtained a master’s in philosophy from the University of Sydney in 2006 after graduating from Syracuse University’s Maxwell School of Citizenship and Public Affairs in 2003. She returned to Indonesia and worked as a corporate development officer for over three years. In 2010, she became an analyst at Principia Management Group and Fairways Investment Group, both being Southeast Asia-focused investment firms. In 2013, Wijaya went on to work as an associate at Singapore-based investment firm Mizuho Asia Partners for over three years before joining Xendit back in Jakarta.

Founded in 2010, East Ventures is a venture capital firm with offices in Indonesia, Japan and USA. Today, the company has invested in over 150 companies across Asia, mainly Southeast Asia and Japan, and the USA. Its ticket size ranges from US$100,000 to US$500,000.

Founded in 2010, East Ventures is a venture capital firm with offices in Indonesia, Japan and USA. Today, the company has invested in over 150 companies across Asia, mainly Southeast Asia and Japan, and the USA. Its ticket size ranges from US$100,000 to US$500,000.

Verlinvest is the investment diversification vehicle of the de Spoelberch family, the Belgian noble house, which founded the AB InBev beverage conglomerate. Founded in 1995, it currently manages over €1.6bn in assets across multiple geographies, including Europe, India, Southeast Asia and Latin America. Aside from investing in various F&B brands like Vita Coco (coconut water), F&B Asia (which operates various restaurant franchise brands in Southeast Asia) and Glaceau Vitamin Water, it has also backed e-commerce businesses like Global Fashion Group and Lazada, as well as Indian edtech platform Byju’s.

Verlinvest is the investment diversification vehicle of the de Spoelberch family, the Belgian noble house, which founded the AB InBev beverage conglomerate. Founded in 1995, it currently manages over €1.6bn in assets across multiple geographies, including Europe, India, Southeast Asia and Latin America. Aside from investing in various F&B brands like Vita Coco (coconut water), F&B Asia (which operates various restaurant franchise brands in Southeast Asia) and Glaceau Vitamin Water, it has also backed e-commerce businesses like Global Fashion Group and Lazada, as well as Indian edtech platform Byju’s.

CEO and co-founder of TurtleTree Labs

Cheese connoisseur, Lin Fengru, was unable to find milk that allowed her to make high-quality cheese. During her search around dairy farms in Asia, she realized that the poor quality of the milk was due to animal hygiene issues and the use of antibiotics and hormones on cows. The lack of quality dairy milk options inspired her to co-found TurtleTree Labs in January 2019 to create milk using stem cells.Lin graduated in information systems management and marketing in 2011 at Singapore Management University (SMU). In 2011, she joined Collis Asia as an account manager and left in 2014 to work at Salesforce in sales and business development. She joined Google Singapore in 2018 and worked as a territory account manager for Google Cloud Platform until June 2019. In 2020, she completed an MIT course in the science and business of biotechnology.

Cheese connoisseur, Lin Fengru, was unable to find milk that allowed her to make high-quality cheese. During her search around dairy farms in Asia, she realized that the poor quality of the milk was due to animal hygiene issues and the use of antibiotics and hormones on cows. The lack of quality dairy milk options inspired her to co-found TurtleTree Labs in January 2019 to create milk using stem cells.Lin graduated in information systems management and marketing in 2011 at Singapore Management University (SMU). In 2011, she joined Collis Asia as an account manager and left in 2014 to work at Salesforce in sales and business development. She joined Google Singapore in 2018 and worked as a territory account manager for Google Cloud Platform until June 2019. In 2020, she completed an MIT course in the science and business of biotechnology.

Founded in 2011, Unitus Impact is a venture capital firm focusing on impact investments in Southeast Asia and India. With offices in Bangalore, Ho Chi Minh city and San Francisco, the VC will soon be renamed as Patamar Capital. It currently invests in scalable businesses that aim to improve the livelihoods of the poor in Asia.

Founded in 2011, Unitus Impact is a venture capital firm focusing on impact investments in Southeast Asia and India. With offices in Bangalore, Ho Chi Minh city and San Francisco, the VC will soon be renamed as Patamar Capital. It currently invests in scalable businesses that aim to improve the livelihoods of the poor in Asia.

Ventek Ventures is a venture capital firm based in Los Angeles, USA. It focuses on tech investments, particularly in USA, China and Southeast Asia. Seekmi, its first foray in Southeast Asia, joins Ventek’s existing stable of East Asian investments including coding for kids codeSpark, crowdfunding academy ganfund, restaurant cloud services provider Foodomo and mobile creative suite Kdan.

Ventek Ventures is a venture capital firm based in Los Angeles, USA. It focuses on tech investments, particularly in USA, China and Southeast Asia. Seekmi, its first foray in Southeast Asia, joins Ventek’s existing stable of East Asian investments including coding for kids codeSpark, crowdfunding academy ganfund, restaurant cloud services provider Foodomo and mobile creative suite Kdan.

Founder and CEO of SEE of SEE

Founder and CEO of SEE. Wan Xucheng (b. 1989) previously worked for Tencent, and created products including YingYongBao and Mobile Manager attracting hundreds of millions of users. He owns 13 personal international invention patents. Wan created the world’s leading blockchain technology platform back in 2014 and 2015, and set up SEE in 2015. He was listed in Forbes 30 Under 30 Asia in 2017.

Founder and CEO of SEE. Wan Xucheng (b. 1989) previously worked for Tencent, and created products including YingYongBao and Mobile Manager attracting hundreds of millions of users. He owns 13 personal international invention patents. Wan created the world’s leading blockchain technology platform back in 2014 and 2015, and set up SEE in 2015. He was listed in Forbes 30 Under 30 Asia in 2017.

Co-founder and CEO of Dorabot

After a brief career in banking, Spencer Deng co-founded the logistics robotics startup Dorabot and became its CEO. The economics graduate from Sun Yat-sen University was an associate at JP Morgan before joining UPS, where he rose to become a manager for the Asia-Pacific region. He joined Dorabot in 2015, and was featured in Forbes China’s 30 Under 30 in 2017 and 2018.

After a brief career in banking, Spencer Deng co-founded the logistics robotics startup Dorabot and became its CEO. The economics graduate from Sun Yat-sen University was an associate at JP Morgan before joining UPS, where he rose to become a manager for the Asia-Pacific region. He joined Dorabot in 2015, and was featured in Forbes China’s 30 Under 30 in 2017 and 2018.

Norfund is the sovereign investment fund of Norway, established by the parliament in 1997 and owned by the Ministry of Foreign Affairs. The company has committed NOK 28.4bn in investments into 170 projects in developing countries as of 2020. Norfund has regional offices in Thailand, Costa Rica, Kenya, Mozambique and Ghana to support its activities in Asia, Africa and Latin America. In Asia, its core investment targets are Indonesia, Cambodia, Laos, Vietnam, Myanmar, Bangladesh and Sri Lanka. Norfund primarily invests in three key areas: clean energy, agriculture and fintech. The fund has invested in solar power projects and various food companies in India and various African countries. In Asia, Norfund has invested in Amartha, an Indonesian P2P lending fintech company providing loans to women-led microbusinesses. Norfund also invests in other venture funds, such as Southeast Asia-focused Openspace Ventures Fund III, to expand and diversify their portfolio.

Norfund is the sovereign investment fund of Norway, established by the parliament in 1997 and owned by the Ministry of Foreign Affairs. The company has committed NOK 28.4bn in investments into 170 projects in developing countries as of 2020. Norfund has regional offices in Thailand, Costa Rica, Kenya, Mozambique and Ghana to support its activities in Asia, Africa and Latin America. In Asia, its core investment targets are Indonesia, Cambodia, Laos, Vietnam, Myanmar, Bangladesh and Sri Lanka. Norfund primarily invests in three key areas: clean energy, agriculture and fintech. The fund has invested in solar power projects and various food companies in India and various African countries. In Asia, Norfund has invested in Amartha, an Indonesian P2P lending fintech company providing loans to women-led microbusinesses. Norfund also invests in other venture funds, such as Southeast Asia-focused Openspace Ventures Fund III, to expand and diversify their portfolio.

Speedinvest is a pan-European, early-stage venture capital firm with offices in Vienna, Munich, San Francisco, Berlin, London and Paris. The firm helps startups grow internationally. Its raised its third and latest fund of €190m in Feburary 2020, bringing total AUM to over €400m. Each investment ticket size starts from €50,000 and goes up to €1.5m. Founded by Austrian Oliver Holle, a former entrepreneur who founded his business in the 2000s and went on to work another tech startup in Silicon Valley. With conviction that "European founders can win big in the Valley and beyond,” Rolle started Speedinvest with a €10m fund in 2011.The firm mainly invests in pan-European fintech startups, digital health, consumer tech, B2B SaaS and deep tech startups.

Speedinvest is a pan-European, early-stage venture capital firm with offices in Vienna, Munich, San Francisco, Berlin, London and Paris. The firm helps startups grow internationally. Its raised its third and latest fund of €190m in Feburary 2020, bringing total AUM to over €400m. Each investment ticket size starts from €50,000 and goes up to €1.5m. Founded by Austrian Oliver Holle, a former entrepreneur who founded his business in the 2000s and went on to work another tech startup in Silicon Valley. With conviction that "European founders can win big in the Valley and beyond,” Rolle started Speedinvest with a €10m fund in 2011.The firm mainly invests in pan-European fintech startups, digital health, consumer tech, B2B SaaS and deep tech startups.

The Craftory is a London-based investment house with a satellite office in San Francisco. Founded in 2018 by retail and media industry veterans Ernesto Schmitt and Ellio Leoni Sceti, the firm has made seven investments in various consumer goods brands. Sceti is also the chairman of London-based family VC firm LSG Holdings, with his brother Patrick as the MD.The Craftory’s $375m fund specializes in building a new investment house of consumer brands, hence its name from the words, “craft" and “factory.” It mainly offers permanent and growth capital to consumer packaged goods (CPG) brands. The Craftory supports CPG challenger brands to help them to grow from “craft” businesses to sustainable, mass CPG brands, offering consumers better choices for everyday products.

The Craftory is a London-based investment house with a satellite office in San Francisco. Founded in 2018 by retail and media industry veterans Ernesto Schmitt and Ellio Leoni Sceti, the firm has made seven investments in various consumer goods brands. Sceti is also the chairman of London-based family VC firm LSG Holdings, with his brother Patrick as the MD.The Craftory’s $375m fund specializes in building a new investment house of consumer brands, hence its name from the words, “craft" and “factory.” It mainly offers permanent and growth capital to consumer packaged goods (CPG) brands. The Craftory supports CPG challenger brands to help them to grow from “craft” businesses to sustainable, mass CPG brands, offering consumers better choices for everyday products.

Co-founder of PopBox Asia

Greta Bunawan is a co-founder of smart locker startup PopBox Asia. Prior to establishing the venture, she worked at convention space organizer PT Jakarta International Expo as a marketing venue manager.Greta graduated from Universitas Pelita Harapan with a bachelor’s in Psychology and earned an MBA from IPMI Business School.

Greta Bunawan is a co-founder of smart locker startup PopBox Asia. Prior to establishing the venture, she worked at convention space organizer PT Jakarta International Expo as a marketing venue manager.Greta graduated from Universitas Pelita Harapan with a bachelor’s in Psychology and earned an MBA from IPMI Business School.

Singapore, the place to start and grow a cellular agriculture startup

A country that imports over 90% of its food supply, Singapore has turned to foodtech, including cellular agriculture, to safeguard food security, supported by proactive regulators

TreeFrog Therapeutics: Mimicking how stem cells grow in the human body

The French biotech’s proprietory technology to cultivate pluripotent stem cells in a 3D environment can be scaled to mass-produce high-quality cells to treat diseases such as Parkinson’s

Future Food Asia 2021: Regenerative agriculture in Asia

The unique challenges facing regenerative agriculture in Asia require solutions different from those in the West, presenting opportunities for microfinancing and impact investment

China B2B startups still have much room to grow in a trillion-RMB market

Investors favor enterprise tech startups amid slowing deal flow, still foresee strong growth despite competition from tech giants

South Summit 2021: Lessons in expanding to Asia from experts on the ground

Cast aside your Eurocentric mindsets, China-based SOSV’s Oscar Ramos and Brinc’s Heriberto Saldivar tell startups, why they should expand to the region, and how best to do it

Singrow to start selling Singapore-grown strawberries in March, plans $15m Series A this year

Singrow also plans to offer locally grown produce across Southeast Asia, starting with strawberries farmed in energy-efficient greenhouses

Future Food Asia 2021: Potential of pulses in the alt-protein space

Asia presents a unique opportunity for pulses as people in the region, who traditionally fractionated pulses for starch, now see protein as a useful byproduct

String Bio: Asia's first startup to harness methane gas for protein production

Using bacteria to turn the harmful greenhouse gas into a purer form of protein, String Bio is raising Series B funding to scale production

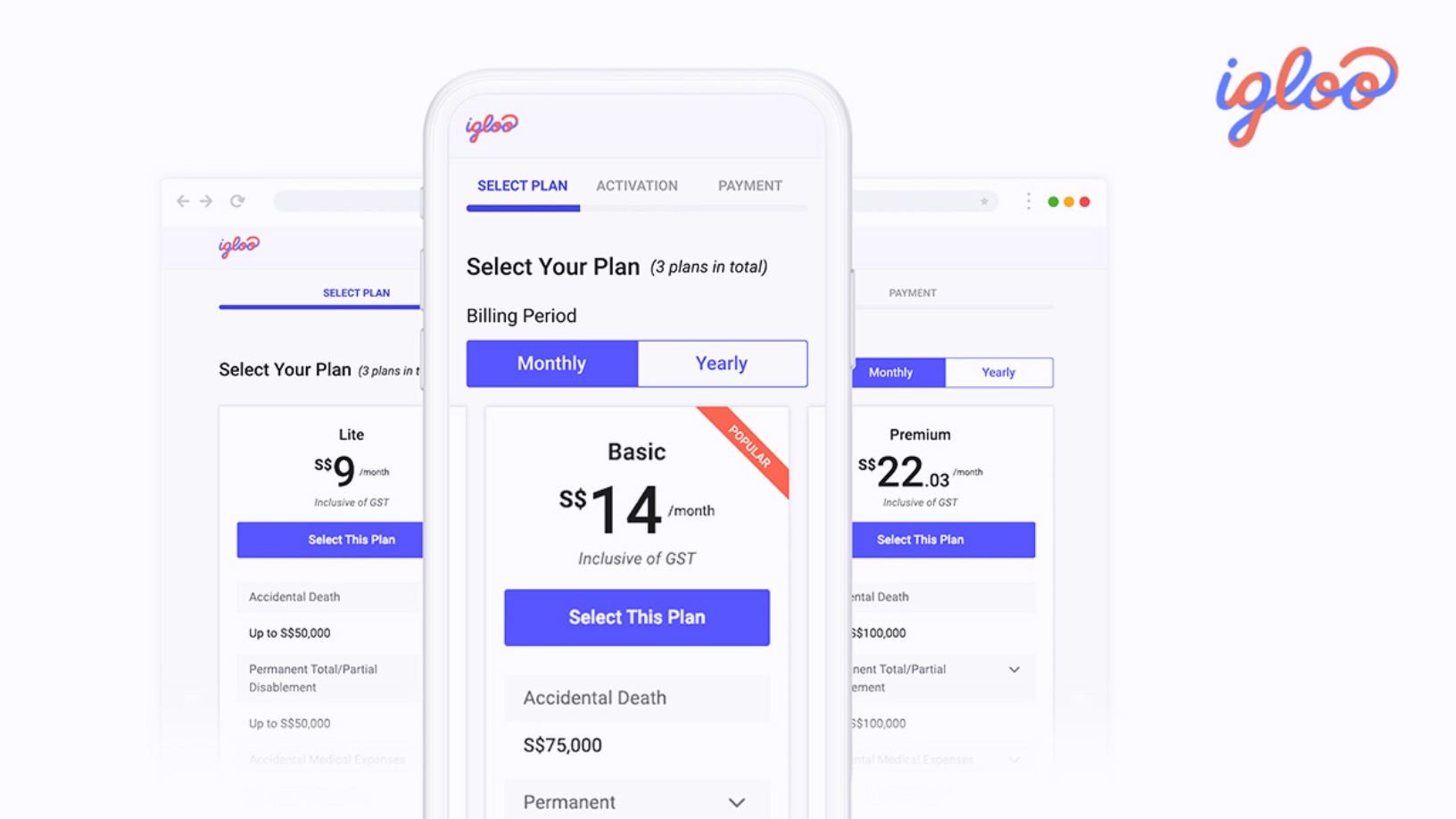

From delivery riders to MSMEs, Igloo aims to make insurance more accessible

Expanding from its origins in e-commerce insurance, Igloo seeks growth in credit insurance and income protection for middle-income groups in Southeast Asia

ID Capital CEO & founder Isabelle Decitre, an early mover investing in Asian agrifood startups

An early backer of Ynsect, one of the best-funded insect protein startups to date, Decitre sees growing interest in agrifood tech startups, but notes they still need to offer exit opportunities

Accelerating Asia's Amra Naidoo: We’re at an inflection point in Southeast Asia

Accelerating Asia’s co-founder Amra Naidoo reveals how the program adapts its curriculum to meet startups’ needs and the challenges accelerator programs face during the pandemic

SWITCH Singapore: Race in agrifood tech as a solution to feeding 10bn people

While the potential gains are huge, giving tech solutions to farmers, especially smallholders in developing countries, remains a work in progress

Future Food Asia 2021: Fireside chat with Green Monday's David Yeung

For Chinese startup Green Monday, it’s important to resonate with different local audiences by adapting to local culture and dietary habits and continuously fine-tuning existing products

From Porto to Phnom Penh: Last2Ticket expands to Asia

Their first stop is Cambodia, where tourism-related ticketing is big business yet underserved by technology. Emilía Simões, founder and CEO of the Portuguese e-ticketing startup, tells us more

Future Food Asia 2021 announces finalists for $100,000 prize

Ten startups from agrifood tech and cleantech sectors will pitch during the five-day conference, are also eligible for two more prizes from sponsors Cargill and Thai Wah

Sorry, we couldn’t find any matches for“Grow Asia”.