Illumina Accelerator

-

DATABASE (78)

-

ARTICLES (131)

Ship2B is an accelerator and investor for social impact startups and spin-offs. It acts principally in three sectors: health tech, social tech for vulnerable groups and climate technology. It also fosters networking alliances between startups and large companies, and has a network of high-level mentors available to assist startups.To date, Ship2B has invested €40m in 146 startups and spin-offs.

Ship2B is an accelerator and investor for social impact startups and spin-offs. It acts principally in three sectors: health tech, social tech for vulnerable groups and climate technology. It also fosters networking alliances between startups and large companies, and has a network of high-level mentors available to assist startups.To date, Ship2B has invested €40m in 146 startups and spin-offs.

Beta-i was established in 2010 as a Portuguese accelerator, incubator and event organizer to boost the Portuguese tech ecosystem. Beta-i is well-known for organizing some of Portugal's most successful accelerators and the annual tech startup event Lisbon Investment Summit. In 2019, it made its first investment in a startup Didimo by joining the seed round for the 3D digital twin designer platform.The company's best known acceleration program Lisbon Challenge is a twice yearly event open to all tech sectors, attracting around 10 participants based in Portugal and overseas. Its two-month programs have accelerated more than 200 startups, with about 75% coming from abroad. Beta-i also organizes the international energy accelerator Free Electrons, with EDP as one of its sponsors. Free Electrons has already accelerated 27 startups and is now running its third edition with 15 startups, five of which are Portugal-based. All the selected participants will have the chance to work for one year with at least one of the 10 global energy utilities that form the Free Electrons consortium. Another Beta-i event is The Journey, the first accelerator in Portugal dedicated to tourism tech startups from all over the world. Launched in partnership with the government's Portugal Tourism in 2017, the Lisbon-based program is part of the national Tourism 4.0 plan. The five-month program is now in its third edition and gives successful applicants the opportunity to develop pilot projects with Portuguese companies like the Vila Galé hotel chain, Barraqueiro transport company and Parques de Sintra, a UNESCO World Heritage site.

Beta-i was established in 2010 as a Portuguese accelerator, incubator and event organizer to boost the Portuguese tech ecosystem. Beta-i is well-known for organizing some of Portugal's most successful accelerators and the annual tech startup event Lisbon Investment Summit. In 2019, it made its first investment in a startup Didimo by joining the seed round for the 3D digital twin designer platform.The company's best known acceleration program Lisbon Challenge is a twice yearly event open to all tech sectors, attracting around 10 participants based in Portugal and overseas. Its two-month programs have accelerated more than 200 startups, with about 75% coming from abroad. Beta-i also organizes the international energy accelerator Free Electrons, with EDP as one of its sponsors. Free Electrons has already accelerated 27 startups and is now running its third edition with 15 startups, five of which are Portugal-based. All the selected participants will have the chance to work for one year with at least one of the 10 global energy utilities that form the Free Electrons consortium. Another Beta-i event is The Journey, the first accelerator in Portugal dedicated to tourism tech startups from all over the world. Launched in partnership with the government's Portugal Tourism in 2017, the Lisbon-based program is part of the national Tourism 4.0 plan. The five-month program is now in its third edition and gives successful applicants the opportunity to develop pilot projects with Portuguese companies like the Vila Galé hotel chain, Barraqueiro transport company and Parques de Sintra, a UNESCO World Heritage site.

SC Ventures is the venture capital arm of Standard Chartered Bank. The company serves as a platform from which Standard Chartered can identify innovative technologies in banking and financial services, and invest in the companies that build these technologies and business models. Besides investments, SC Ventures also operates an accelerator program named eXellerator and an internal venture builder unit. As an investor, SC Ventures focuses on Series B+ rounds, with each investment at the $1-5m range.

SC Ventures is the venture capital arm of Standard Chartered Bank. The company serves as a platform from which Standard Chartered can identify innovative technologies in banking and financial services, and invest in the companies that build these technologies and business models. Besides investments, SC Ventures also operates an accelerator program named eXellerator and an internal venture builder unit. As an investor, SC Ventures focuses on Series B+ rounds, with each investment at the $1-5m range.

EIT InnoEnergy, an initiative of the European Institute of Innovation and Technology (EI), offers startup entrepreneurs support in growing and scaling their businesses. It focuses on innovative clean-tech projects, offering mentorships and industry expertise through seed funding and an accelerator program. The network consists of 15 European clean-tech venture capitalists and 15 research institutes. To date, it has supported over 200 European startups working on initiatives aimed at boosting the prevalence of sustainable energy in the market.

EIT InnoEnergy, an initiative of the European Institute of Innovation and Technology (EI), offers startup entrepreneurs support in growing and scaling their businesses. It focuses on innovative clean-tech projects, offering mentorships and industry expertise through seed funding and an accelerator program. The network consists of 15 European clean-tech venture capitalists and 15 research institutes. To date, it has supported over 200 European startups working on initiatives aimed at boosting the prevalence of sustainable energy in the market.

HATCH is an aquaculture-tech-focused accelerator program initiated by the aquaculture-focused seed VC investor Alimentos Ventures to help related startups reach commercialization and access further funding. Its inaugural program was held in Bergen, Norway, followed by a second batch in Cork, Ireland. Successful applicants get €50,000 cash and possible subsequent funding, plus free office space for up to 12 months in either of HATCH's offices in Bergen and Singapore. Its international partners include food corporates, state entities and aquaculture groups.

HATCH is an aquaculture-tech-focused accelerator program initiated by the aquaculture-focused seed VC investor Alimentos Ventures to help related startups reach commercialization and access further funding. Its inaugural program was held in Bergen, Norway, followed by a second batch in Cork, Ireland. Successful applicants get €50,000 cash and possible subsequent funding, plus free office space for up to 12 months in either of HATCH's offices in Bergen and Singapore. Its international partners include food corporates, state entities and aquaculture groups.

Launched in 2007, Seedcamp is Europe’s first seed fund and accelerator. Founded by 30 European investors, it focuses on pre-seed and seed stage startups. It has backed nearly 200 companies, producing one unicorn. About 90% of its portfolio have raised further funding of about US$350 million.The company typically invests in one of three ways:€75,000 for 7% of equityFull access to the Seedcamp Platform for 3% warrantsUp to €200,000 in seed funding

Launched in 2007, Seedcamp is Europe’s first seed fund and accelerator. Founded by 30 European investors, it focuses on pre-seed and seed stage startups. It has backed nearly 200 companies, producing one unicorn. About 90% of its portfolio have raised further funding of about US$350 million.The company typically invests in one of three ways:€75,000 for 7% of equityFull access to the Seedcamp Platform for 3% warrantsUp to €200,000 in seed funding

DFS Lab is a fintech-centric incubator/accelerator company with a focus on emerging markets. Supported by a US$4.8 million grant from the Gates Foundation, many of the portfolio companies provide fintech products and also help to improve the financial literacy education for people in developing countries. About 50% of the startups are run by female co-founders and 73% originate from the emerging markets.

DFS Lab is a fintech-centric incubator/accelerator company with a focus on emerging markets. Supported by a US$4.8 million grant from the Gates Foundation, many of the portfolio companies provide fintech products and also help to improve the financial literacy education for people in developing countries. About 50% of the startups are run by female co-founders and 73% originate from the emerging markets.

Founded in 2018, Oslo-based Katapult Ocean is the first investor focused entirely on oceantech and related startups. The VC also operates a three-month accelerator and has invested in 32 startups from 17 countries worldwide.The VC typically invests at the seed or pre-seed level but in July 2020 it completed its first Series A round of $8.5m investment in Chilean social enterprise Betterfly. Other recent investments include the pre-seed rounds of US foodtech GreenCover and Dutch offshore solar tech SolarDuck.

Founded in 2018, Oslo-based Katapult Ocean is the first investor focused entirely on oceantech and related startups. The VC also operates a three-month accelerator and has invested in 32 startups from 17 countries worldwide.The VC typically invests at the seed or pre-seed level but in July 2020 it completed its first Series A round of $8.5m investment in Chilean social enterprise Betterfly. Other recent investments include the pre-seed rounds of US foodtech GreenCover and Dutch offshore solar tech SolarDuck.

Ideabox Ventures is a VC launched by Indonesian telecoms Indosat Ooredoo, Kejora Ventures and Mountain Partners SEA in November 2016. The VC was an addition to the existing annual accelerator Ideabox program that had nurtured startups like Dealoka, Pawoon and Wobe. More venture capital is expected to come from new partnerships with global institutions in Asia, Europe and North America. Early stage or pre-Series A funding of up to US$500,000 will be awarded to each startup, as well as strategic commercial consultancy and support services to boost the expansion of the VC’s portfolio firms.

Ideabox Ventures is a VC launched by Indonesian telecoms Indosat Ooredoo, Kejora Ventures and Mountain Partners SEA in November 2016. The VC was an addition to the existing annual accelerator Ideabox program that had nurtured startups like Dealoka, Pawoon and Wobe. More venture capital is expected to come from new partnerships with global institutions in Asia, Europe and North America. Early stage or pre-Series A funding of up to US$500,000 will be awarded to each startup, as well as strategic commercial consultancy and support services to boost the expansion of the VC’s portfolio firms.

Startupbootcamp Commerce Amsterdam

Startupbootcamp Commerce Amsterdam is part of the Startupbootcamp accelerator global group that was originally founded in Denmark in 2010. The Commerce Amsterdam programs are dedicated to early-stage startups in the e-commerce and retail verticals. They help founders during the MVP development phase and provide mentoring support across logistics solutions, fraud security, AI, big data, advertising, marketing and sales.The programs are based in a co-working space in Amsterdam and founders receive €15,000 to cover their living expenses in the city during the three-month period of intense mentorship, masterclasses and pitching opportunities.

Startupbootcamp Commerce Amsterdam is part of the Startupbootcamp accelerator global group that was originally founded in Denmark in 2010. The Commerce Amsterdam programs are dedicated to early-stage startups in the e-commerce and retail verticals. They help founders during the MVP development phase and provide mentoring support across logistics solutions, fraud security, AI, big data, advertising, marketing and sales.The programs are based in a co-working space in Amsterdam and founders receive €15,000 to cover their living expenses in the city during the three-month period of intense mentorship, masterclasses and pitching opportunities.

Founded in 2011, StartUp Health is a New-York based accelerator. Chaired by former Time Warner CEO Jerry Levin, the platform is reputed to have the world’s largest portfolio of digital health companies spanning 12 countries. StartUp Health also runs the StartUp Health Academy, StartUp Health Network, StartUp Health Ventures and StartUp Health Media. Investment partners include Novartis, Ping An Group, Otsuka, Chiesi Group, Masimo and GuideWell, all of whom contributed to the US$31-million StartUp Health Transformer Fund II in 2018. StartUp Health has managed 15 exits and invested in more than 250 companies.

Founded in 2011, StartUp Health is a New-York based accelerator. Chaired by former Time Warner CEO Jerry Levin, the platform is reputed to have the world’s largest portfolio of digital health companies spanning 12 countries. StartUp Health also runs the StartUp Health Academy, StartUp Health Network, StartUp Health Ventures and StartUp Health Media. Investment partners include Novartis, Ping An Group, Otsuka, Chiesi Group, Masimo and GuideWell, all of whom contributed to the US$31-million StartUp Health Transformer Fund II in 2018. StartUp Health has managed 15 exits and invested in more than 250 companies.

Angels Capital is an investment vehicle created by Juan Roig as part of the Marina of Companies network in Valencia. Its mission is to grow startups within the Lanzadera accelerator, as well as external projects that facilitate the creation of a strong entrepreneurial ecosystem in Valencia. Angels Capital has 13 current investment projects, seven of which it is lead investor in and, since 2014, it has invested €15.5 million in capital. Recent investments include a €1 million venture round for cloud-based workflow platform SheetGo, and €360,000 in seed funding for bank aggregation system Afterbanks.

Angels Capital is an investment vehicle created by Juan Roig as part of the Marina of Companies network in Valencia. Its mission is to grow startups within the Lanzadera accelerator, as well as external projects that facilitate the creation of a strong entrepreneurial ecosystem in Valencia. Angels Capital has 13 current investment projects, seven of which it is lead investor in and, since 2014, it has invested €15.5 million in capital. Recent investments include a €1 million venture round for cloud-based workflow platform SheetGo, and €360,000 in seed funding for bank aggregation system Afterbanks.

Founded in 2016, Goldacre is a real-estate focused investor with a £2bn asset management business as part of the Noé Group, investing in British, EU and Israeli startups in that segment. It also operates the intensive proptech accelerator RElab with three editions to date, each time investing £100,000 in participating startups. The company does not divulge its full portfolio details but its most recent investments include in the summer 2020 a $9m Series A round of Israeli sustainable concrete tech ECOncrete and in the $7.8m June 2020 Series A round of Spanish hyperloop engineer Zeleros.

Founded in 2016, Goldacre is a real-estate focused investor with a £2bn asset management business as part of the Noé Group, investing in British, EU and Israeli startups in that segment. It also operates the intensive proptech accelerator RElab with three editions to date, each time investing £100,000 in participating startups. The company does not divulge its full portfolio details but its most recent investments include in the summer 2020 a $9m Series A round of Israeli sustainable concrete tech ECOncrete and in the $7.8m June 2020 Series A round of Spanish hyperloop engineer Zeleros.

Founded in 2012 in Geneva, Seedstars is one of the world’s largest accelerators with programs operating globally including Seedstars Global Startup Competition for emerging economies and seed-stage investors. Seedstars is also an investor, focusing on supporting startups founded in emerging economies across market segments. Its portfolio of 60 companies includes startups from its accelerator programs and participation in the $30,000 pre-seed round for Mexican loan fintech DB Menos. It is also one of two impact investors backing the $530,000 seed funding round for Bangladeshi cloud-kitchen and delivery startup Kludio.

Founded in 2012 in Geneva, Seedstars is one of the world’s largest accelerators with programs operating globally including Seedstars Global Startup Competition for emerging economies and seed-stage investors. Seedstars is also an investor, focusing on supporting startups founded in emerging economies across market segments. Its portfolio of 60 companies includes startups from its accelerator programs and participation in the $30,000 pre-seed round for Mexican loan fintech DB Menos. It is also one of two impact investors backing the $530,000 seed funding round for Bangladeshi cloud-kitchen and delivery startup Kludio.

DG Incubation was founded in 2009 as the investment arm of Japanese internet company Digital Garage Group. The firm invests through its Open Network Lab Seed Accelerator Program for its seed-stage portfolio, and through DG Incubation for its early-to-late stage portfolio. DG Incubation gives foundation support to early-stage startups, such as problem identification. For later-stage startups, the firm gives data and analysis and supports the recruitment process, among others. It has offices in Tokyo, Kamakura (Japan) and San Francisco. It has invested in 98 companies to date and has seen 23 exits including companies like Facebook, Twitter and LinkedIn.

DG Incubation was founded in 2009 as the investment arm of Japanese internet company Digital Garage Group. The firm invests through its Open Network Lab Seed Accelerator Program for its seed-stage portfolio, and through DG Incubation for its early-to-late stage portfolio. DG Incubation gives foundation support to early-stage startups, such as problem identification. For later-stage startups, the firm gives data and analysis and supports the recruitment process, among others. It has offices in Tokyo, Kamakura (Japan) and San Francisco. It has invested in 98 companies to date and has seen 23 exits including companies like Facebook, Twitter and LinkedIn.

Yali Bio: Recreating a juicy steak in plant-based alternatives

Founded by the former head of Impossible Foods’ pilot plant, this Bay Area genomics and foodtech startup is one of the first to engineer a better fat for plant-based meat

FIWARE Accelerator: More open source ecosystem than accelerator

The European open source initiative to boost smart infrastructures and solutions is calling for new participants to join its unique acceleration ecosystem

Sequoia Capital China holds steady with investments in healthcare, biotech and green economy

China’s most active investor increases bets on sectors beyond the consumer internet and edtech recently hurt by regulatory clampdown

Big Idea Ventures Founder Andrew D Ive: Asia will lead cell-based meat innovation

In a wide-ranging interview, the managing general partner of the US- and Singapore-based foodtech investor also expounds on his goal to extend sustainability to the rest of the food sector, combining good returns with doing good

Portugal oceantech II: Single-minded efforts to build an ecosystem of international reference

With dedicated accelerators and investment programs, supported by the EU’s vote of confidence, Portugal appears on track to lead in oceantech

US non-profit investor New Energy Nexus seeks to kickstart Indonesia’s clean energy sectors

With a “patient capital” approach to investments and a variety of programs, New Energy Nexus hopes to show that startups can lead the way in renewables and smart energy

WOOM: Spanish fertility femtech gets €2m funding to expand into new B2B2C markets

AI fertility app WOOM has also created an English-language version to reach more users in North America, Europe and Asia

TheVentures founders launch Singapore VC to drive deals in Southeast Asia

The Korean Viki co-founders return to Singapore as venture builders and investors, offering South Korean partnerships and “CTO-as-a-service” in Southeast Asia

Accelerating Asia bets on unicorn wave from MSME digitalization, logistics

The investor-accelerator’s sixth batch will start accepting applications in December, with greater ESG focus and a pledge to donate 1% of profit on investments to charity

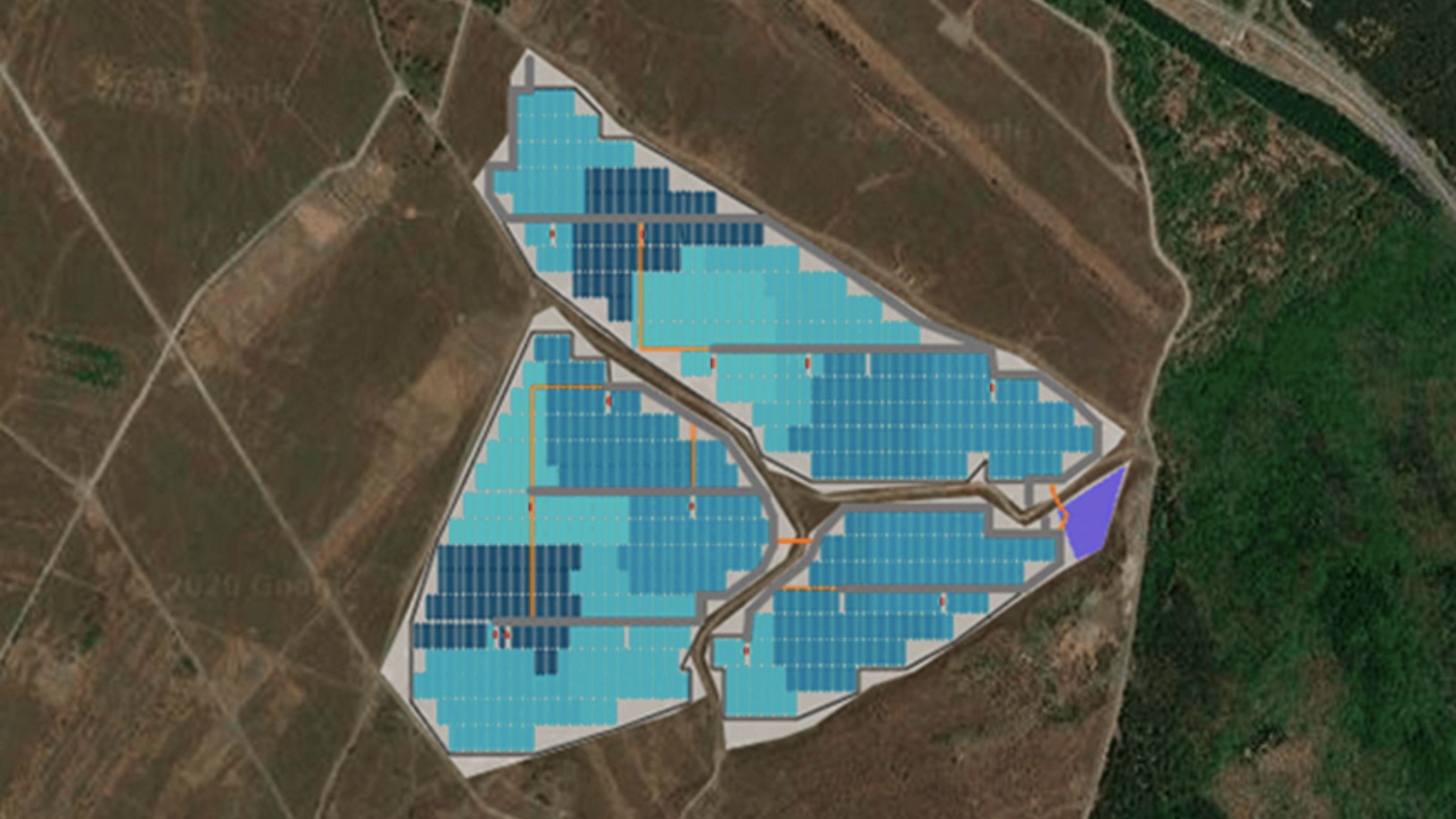

RatedPower: Creating solar power plant designs in minutes

The Spanish startup is helping solar plants expand exponentially worldwide and revolutionizing the sector with its automated software

Alias Robotics: Award-winning cyber security pioneer reduces “clear and present danger” of robots

As machines become integral parts of daily life, Alias Robotics offers humans a way to solve the ever-increasing potential risks of robots

Knokcare: Telemedicine app connects you to doctors in 30 minutes

Seeking funding of over €1m, Portugal’s digital healthcare pioneer is expanding its SaaS to tap new markets in Europe, Africa and Latin America

Taronga Ventures takes RealTechX to Singapore; plans Japan, US growth

The Australian proptech investor to focus on ESG in its acceleration program, including women under-representation and site safety

HighPitch 2020: Goers wins Indonesia's national startup competition

Event ticketing startup Goers gains new revenue streams with pivot to helping leisure spots go online; hotel SaaS Izy and on-demand medical testing service CekLab also in top three

SWITCH Singapore: Race in agrifood tech as a solution to feeding 10bn people

While the potential gains are huge, giving tech solutions to farmers, especially smallholders in developing countries, remains a work in progress

Sorry, we couldn’t find any matches for“Illumina Accelerator”.