Matrix Partners China

-

DATABASE (848)

-

ARTICLES (524)

Headquartered in Shanghai, FC Capital was founded in 2017 to focus on investments in China and the US. The VC mainly invests in medtech sectors like biotechnology, medical devices, medical services and health-related consumer products.

Headquartered in Shanghai, FC Capital was founded in 2017 to focus on investments in China and the US. The VC mainly invests in medtech sectors like biotechnology, medical devices, medical services and health-related consumer products.

Partner of Zhenfund, Wang Qiang (b.1962) co-founded this TMT-focused seed fund with his longtime friend and partner Xu Xiaoping, in collaboration with Sequoia Capital China, in 2011. The angel investor also co-founded NYSE-listed New Oriental Education & Technology Group, where he was executive vice president in charge of teaching and training at Beijing New Oriental School, and Industry vice-president and group chairman. A leading specialist in English-language education in China, Wang has lectured at the English department of Peking University and served as senior consultant to the English channel of China National Radio. He majored in English language and literature at Peking University and holds a master's degree in computer science from the State University of New York. Wang is a lover and collector of antiquarian books.

Partner of Zhenfund, Wang Qiang (b.1962) co-founded this TMT-focused seed fund with his longtime friend and partner Xu Xiaoping, in collaboration with Sequoia Capital China, in 2011. The angel investor also co-founded NYSE-listed New Oriental Education & Technology Group, where he was executive vice president in charge of teaching and training at Beijing New Oriental School, and Industry vice-president and group chairman. A leading specialist in English-language education in China, Wang has lectured at the English department of Peking University and served as senior consultant to the English channel of China National Radio. He majored in English language and literature at Peking University and holds a master's degree in computer science from the State University of New York. Wang is a lover and collector of antiquarian books.

NewMargin Ventures is a venture capital management firm in China focused on the IT, sustainable growth technology, biomedicine and high margin manufacturing sectors. Its Chinese investors include China Foundation of Science & Technology for Development (a joint venture between the National Development and Reform Commission, the Ministry of Commerce and Chinese Academy of Sciences) and Shanghai Alliance Investment Co. (an investment firm founded by Jiang Mianheng, son of the former Chinese President Jiang Zemin); and its foreign investors include GIC, Kerry Group, K.Wah Group, SUNeVision, JAFCO, Motorola and Alcatel. NewMargin Ventures has invested more than US$1.7 billion in 160 companies, including 40 IPOs.

NewMargin Ventures is a venture capital management firm in China focused on the IT, sustainable growth technology, biomedicine and high margin manufacturing sectors. Its Chinese investors include China Foundation of Science & Technology for Development (a joint venture between the National Development and Reform Commission, the Ministry of Commerce and Chinese Academy of Sciences) and Shanghai Alliance Investment Co. (an investment firm founded by Jiang Mianheng, son of the former Chinese President Jiang Zemin); and its foreign investors include GIC, Kerry Group, K.Wah Group, SUNeVision, JAFCO, Motorola and Alcatel. NewMargin Ventures has invested more than US$1.7 billion in 160 companies, including 40 IPOs.

Started in 2008 by Joe Zhou (Zhou Zhixiong), one of the founders of Kleiner Perkins Caufield & Byers' China fund, Keytone Ventures primarily invests in high-growth companies in the cleantech, media, hi-tech and consumer sectors.

Started in 2008 by Joe Zhou (Zhou Zhixiong), one of the founders of Kleiner Perkins Caufield & Byers' China fund, Keytone Ventures primarily invests in high-growth companies in the cleantech, media, hi-tech and consumer sectors.

One of the earliest VC/PE firms in China, Shenzhen GTJA Investment focuses on the healthcare/biotech industry. It manages about RMB 10 billion and has invested in more than 100 companies since its inception in 2001.

One of the earliest VC/PE firms in China, Shenzhen GTJA Investment focuses on the healthcare/biotech industry. It manages about RMB 10 billion and has invested in more than 100 companies since its inception in 2001.

Founder and CEO of Sharkpark

Zhang Yongqi was the first in China to sell books and training programs for IELTS (International English Language Testing System), the world’s most popular English language test. He went on to set up Global Education & Technology Group, which ran 450 IELTS centers in 60 cities and listed on Nasdaq. Zhang sold the company in 2011 to the Pearson Group for US$294 million. The former Honeywell agent is now highly influential in education and training. He is a member of the Beijing Democratic League.

Zhang Yongqi was the first in China to sell books and training programs for IELTS (International English Language Testing System), the world’s most popular English language test. He went on to set up Global Education & Technology Group, which ran 450 IELTS centers in 60 cities and listed on Nasdaq. Zhang sold the company in 2011 to the Pearson Group for US$294 million. The former Honeywell agent is now highly influential in education and training. He is a member of the Beijing Democratic League.

Co-founder and CEO of Trio.AI

Co-founder and CEO of Trio.AI. Wang, who received his doctorate in Computer Science from University College London, has a decade of experience in the fields of intelligent interaction, machine learning, domain-specific dialogue systems and multi-turn dialogues. Acting in a leading role, he helped established Toshiba’s first-generation dialogue system in 2010.After returning to China in 2015, he worked at Baidu as a decision maker for its Xiaodu robot project, now known as DuerOS.

Co-founder and CEO of Trio.AI. Wang, who received his doctorate in Computer Science from University College London, has a decade of experience in the fields of intelligent interaction, machine learning, domain-specific dialogue systems and multi-turn dialogues. Acting in a leading role, he helped established Toshiba’s first-generation dialogue system in 2010.After returning to China in 2015, he worked at Baidu as a decision maker for its Xiaodu robot project, now known as DuerOS.

Co-founder and Head of Research of Wide Eyes

Long Long Yu graduated from the University of Siena in Italy with a degree in Software Engineering, later specializing in Computer Vision and AI at the Autonomous University of Barcelona. In 2013, he co-founded Wide Eyes, a visual search engine for the fashion and retail industry, where he is its head of research. His technical interests include biometric pattern analysis, visual object tracking, machine learning and object detection. Originally from China, Yu speaks Chinese, Italian, Spanish and English.

Long Long Yu graduated from the University of Siena in Italy with a degree in Software Engineering, later specializing in Computer Vision and AI at the Autonomous University of Barcelona. In 2013, he co-founded Wide Eyes, a visual search engine for the fashion and retail industry, where he is its head of research. His technical interests include biometric pattern analysis, visual object tracking, machine learning and object detection. Originally from China, Yu speaks Chinese, Italian, Spanish and English.

Co-founder of Ximalaya

Before co-founding Ximalaya with Yu Jianjun, Chen Xiaoyu worked as an investment director at one of Thailand's largest conglomerates, Charoen Pokphand Group, in its China office. There, she supervised the Group’s investments in internet startups. With seed funding from the Group in 2009, Chen and Yu Jianjun founded their first startup, Na Li Shi Jie, building online virtual city maps. Though the business failed after two years, they utilised the rich experience they gained and founded the much more successful Ximalaya in 2012.

Before co-founding Ximalaya with Yu Jianjun, Chen Xiaoyu worked as an investment director at one of Thailand's largest conglomerates, Charoen Pokphand Group, in its China office. There, she supervised the Group’s investments in internet startups. With seed funding from the Group in 2009, Chen and Yu Jianjun founded their first startup, Na Li Shi Jie, building online virtual city maps. Though the business failed after two years, they utilised the rich experience they gained and founded the much more successful Ximalaya in 2012.

The venture capital arm of media conglomerate Hearst Corporation, Hearst Ventures made its first investment in 1995 and now conducts all stage investments, with focuses on media and technology startups mainly in the US, China and Europe.

The venture capital arm of media conglomerate Hearst Corporation, Hearst Ventures made its first investment in 1995 and now conducts all stage investments, with focuses on media and technology startups mainly in the US, China and Europe.

Founded by Mark Mai and Tim Draper in 2005, VenturesLab is the first internet-business incubator in China. To date it has incubated and invested in about 100 internet-related companies including Mr Food, Yunchou, Yuanchuangpai, Xiaoxianliang and Weitoutiao.

Founded by Mark Mai and Tim Draper in 2005, VenturesLab is the first internet-business incubator in China. To date it has incubated and invested in about 100 internet-related companies including Mr Food, Yunchou, Yuanchuangpai, Xiaoxianliang and Weitoutiao.

Founded in 2016, Shanjin Capital is a PE fund manager approved by the Asset Management Association of China. With a focus on new energy and emerging technologies, the firm mainly invests in clean energy, connected vehicles, medtech and healthcare.

Founded in 2016, Shanjin Capital is a PE fund manager approved by the Asset Management Association of China. With a focus on new energy and emerging technologies, the firm mainly invests in clean energy, connected vehicles, medtech and healthcare.

Founded in 1996, LB Investment (formerly LG Venture Investment) is supported by LG, the Korean conglomerate, and developing into a private equity fund investment company. It focuses on venture investments in Korea and China, and investments in medium and large companies.

Founded in 1996, LB Investment (formerly LG Venture Investment) is supported by LG, the Korean conglomerate, and developing into a private equity fund investment company. It focuses on venture investments in Korea and China, and investments in medium and large companies.

Founded in 2015, iResearch Capital is an investment fund of iResearch Group, one of the first consulting companies on internet research and analytics in China. It focuses on investment in marketing, big data, corporate services and new media companies.

Founded in 2015, iResearch Capital is an investment fund of iResearch Group, one of the first consulting companies on internet research and analytics in China. It focuses on investment in marketing, big data, corporate services and new media companies.

Founded by Wu Shichun in 2014, Plum Ventures is an internet-focused angel fund managing three RMB funds. Plum Ventures is listed among the top 10 angel investment firms in China, with each investment of RMB 2 million to 5 million.

Founded by Wu Shichun in 2014, Plum Ventures is an internet-focused angel fund managing three RMB funds. Plum Ventures is listed among the top 10 angel investment firms in China, with each investment of RMB 2 million to 5 million.

In a nascent market, one-year-old Starfield has brought its offerings to around 3,000 F&B outlets and generated RMB 10m in revenue

Intracity delivery startup Fengxiansheng takes on the Middle East

Backed by the most popular online shopping platform in the Middle East, Hangzhou's No. 1 intracity delivery startup Fengxiansheng (“Mr Wind”) is expanding to the region

Dao Foods: Grooming and betting on China's rising alternative protein startups

How can businesses involve Chinese consumers in the environmental cause, even if it isn’t a priority for them? For that, the impact investor-incubator Dao Foods has got its philosophy-led strategy figured out

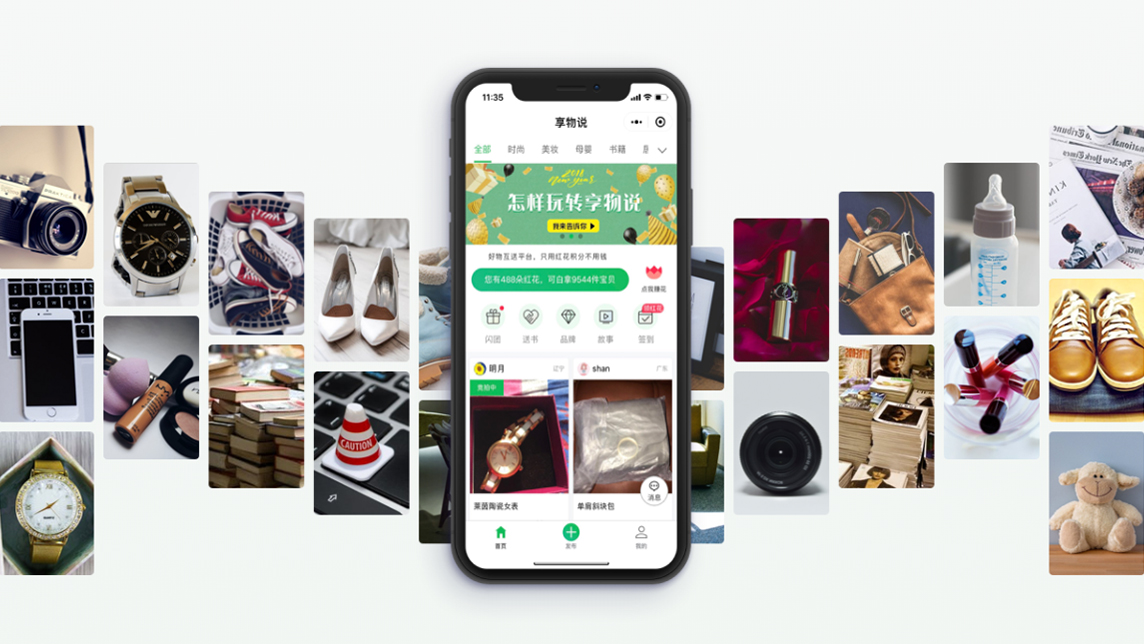

Xiangwushuo’s platform finds a new home for secondhand goods

This WeChat mini program doesn’t yet have a monetization strategy, but has still received over US$110 million in funding in one year

Gago Inc: Satellite data agritech startup ramps up growth with financial sector solutions

Founded by former NASA scientists, Gago began as a data solution to improve China’s traditionally low-yielding and inefficient smallholder-based farming sector

In China, coding education for children is in demand – but investors are wary

Coding lessons are most wanted by Chinese parents for their kids after English tuition, so hundreds of coding edtech startups have joined the fray

Chinese startups feel the chill of capital winter as VC activities slow

The goods news is investors still have plenty of money. They just become more cautious when making investment decisions

Taronga Ventures takes RealTechX to Singapore; plans Japan, US growth

The Australian proptech investor to focus on ESG in its acceleration program, including women under-representation and site safety

Dai Wei and his Ofo: Fighting till the last act?

How the college student who founded a global bike-sharing sensation also led it to the verge of bankruptcy through a string of mistakes

AltStory: Putting the audience in the director's chair

The Chinese startup has taken interactivity to another level by letting TV and movie viewers decide where the action goes, and how it all ends.

“Sniper investor” Zhu Xiaohu: GSR Ventures chief’s slow but steady way of spotting future unicorns

Known for his conservative investing in China’s often-euphoric tech startup scene, Zhu Xiaohu has caught unicorns like Didi Chuxing while making a profitable exit from Ofo just before it sank

Shilling Capital Partners: Growing Portuguese tech businesses from seed

An early mover, the influential angel investing firm is accelerating local techs into Brazil and globally

Indonesian insurtech Qoala survives pandemic with new partners and products

Acquisition of Thai insurtech FairDee to spearhead expansion into Southeast Asia, building on earlier entry into Malaysia and Vietnam and a Covid-19 travel insurance product at home

Atomian: The powerful cognitive software that thinks, works like the human brain

Combining natural language processing with big data, Atomian enables easy, quick and real-time access to information in databases and documents

Faraday Venture Partners’ MP Gonzalo Tradacete: “We are actively looking for startups”

Amid the Covid-19 slump, Faraday Venture Partners' CIO and MP shares his expectations for startup investments and favored sectors, the measures his firm has taken so far to help investees ride out the crisis, and more.

Sorry, we couldn’t find any matches for“Matrix Partners China”.