Matrix Partners China

-

DATABASE (848)

-

ARTICLES (524)

Founded in 2016, Wave Ventures is a student-run Nordic investor supported by VC partners, angel investors and tech founders as advisors. Based in Helsinki, the VC provides pre-seed and early-stage funding to promote startup innovations for future generations. Its current portfolio of 17 startups includes participation in the SEK 2m pre-seed round of Swedish power-bank sharing startup Brick Technology in March 2021 and seed funding of German co-working space proprietor Twostay in January 2021.

Founded in 2016, Wave Ventures is a student-run Nordic investor supported by VC partners, angel investors and tech founders as advisors. Based in Helsinki, the VC provides pre-seed and early-stage funding to promote startup innovations for future generations. Its current portfolio of 17 startups includes participation in the SEK 2m pre-seed round of Swedish power-bank sharing startup Brick Technology in March 2021 and seed funding of German co-working space proprietor Twostay in January 2021.

Founder of PreAngel Fund, an early-stage investment firm with over RMB 300 million under management. Since 2011, PreAngel has invested in 260+ startups from China and the US. Leo Wang has over 14 years of experience in mobile, telecommunication and internet industries.

Founder of PreAngel Fund, an early-stage investment firm with over RMB 300 million under management. Since 2011, PreAngel has invested in 260+ startups from China and the US. Leo Wang has over 14 years of experience in mobile, telecommunication and internet industries.

Beijing Shengtong Zhixing Education Technology Co., Ltd.

Founded in 2017, Beijing Shengtong Zhixing Education Technology Co., Ltd., is a wholly-owned subsidiary of Beijing Shengtong Printing Co., Ltd. It has invested in several STEM education startups in China. In 2016, it acquired Roborobo, a robot coding training company.

Founded in 2017, Beijing Shengtong Zhixing Education Technology Co., Ltd., is a wholly-owned subsidiary of Beijing Shengtong Printing Co., Ltd. It has invested in several STEM education startups in China. In 2016, it acquired Roborobo, a robot coding training company.

Boyu Capital is a China-focused investment firm with offices in Beijing and Hong Kong. It manages tens of billions of US dollars and is one of the largest private equity investment firm in China, and mainly invests in sectors of consumer and retail, financial services, healthcare, media and technology.Boyu Capital was founded in 2011 by the late Ma Xuezheng (died in September 2019), former senior vice-president and financial director of Lenovo Group and managing director and partner of TPG, and Zhang Zixin (Louis Cheung), former general manager of Ping An Insurance. Boyu Capital's first chairman of the board was Jiang Zhicheng (Alvin Jiang), the grandson of former Chinese president Jiang Zemin.

Boyu Capital is a China-focused investment firm with offices in Beijing and Hong Kong. It manages tens of billions of US dollars and is one of the largest private equity investment firm in China, and mainly invests in sectors of consumer and retail, financial services, healthcare, media and technology.Boyu Capital was founded in 2011 by the late Ma Xuezheng (died in September 2019), former senior vice-president and financial director of Lenovo Group and managing director and partner of TPG, and Zhang Zixin (Louis Cheung), former general manager of Ping An Insurance. Boyu Capital's first chairman of the board was Jiang Zhicheng (Alvin Jiang), the grandson of former Chinese president Jiang Zemin.

Passion Capital is an early stage venture capital firm that has been involved in several large European technology exits, such as QXL/Tradus, Ricardo.de and Last.fm. The partners include Robert Dighero, Eileen Burbidge and Stefan Glaenzer who believe that the passion and ability of the founders are critical keys to success. Passion Capital has a hub for activities in White Bear Yard in London and invests in digital media and technology companies.

Passion Capital is an early stage venture capital firm that has been involved in several large European technology exits, such as QXL/Tradus, Ricardo.de and Last.fm. The partners include Robert Dighero, Eileen Burbidge and Stefan Glaenzer who believe that the passion and ability of the founders are critical keys to success. Passion Capital has a hub for activities in White Bear Yard in London and invests in digital media and technology companies.

HATCH is an aquaculture-tech-focused accelerator program initiated by the aquaculture-focused seed VC investor Alimentos Ventures to help related startups reach commercialization and access further funding. Its inaugural program was held in Bergen, Norway, followed by a second batch in Cork, Ireland. Successful applicants get €50,000 cash and possible subsequent funding, plus free office space for up to 12 months in either of HATCH's offices in Bergen and Singapore. Its international partners include food corporates, state entities and aquaculture groups.

HATCH is an aquaculture-tech-focused accelerator program initiated by the aquaculture-focused seed VC investor Alimentos Ventures to help related startups reach commercialization and access further funding. Its inaugural program was held in Bergen, Norway, followed by a second batch in Cork, Ireland. Successful applicants get €50,000 cash and possible subsequent funding, plus free office space for up to 12 months in either of HATCH's offices in Bergen and Singapore. Its international partners include food corporates, state entities and aquaculture groups.

Enagás Emprende, part of the Spanish Transmission System Operator (TS) Enagás, is an investment venture backing and accelerating technology-based startups in their scale-up phase. Its portfolio investment mainly includes companies providing renewable gases, green hydrogen, and biomethane, but also sustainable mobility and energy efficiency. With 50 years of experience in energy infrastructures across Spain, the US, Mexico, Chile, Peru, Albania, Greece and Italy, Enagás provides its portfolio startups with mentoring and expertise acting as investors, clients and industry partners.

Enagás Emprende, part of the Spanish Transmission System Operator (TS) Enagás, is an investment venture backing and accelerating technology-based startups in their scale-up phase. Its portfolio investment mainly includes companies providing renewable gases, green hydrogen, and biomethane, but also sustainable mobility and energy efficiency. With 50 years of experience in energy infrastructures across Spain, the US, Mexico, Chile, Peru, Albania, Greece and Italy, Enagás provides its portfolio startups with mentoring and expertise acting as investors, clients and industry partners.

Founded in 2015 by former vice president of Tencent and GM of Tencent M&A, Richard Peng (Peng Zhijian), and former vice GM of Tencent M&A, Kurt Xu, Genesis Capital specializes in growth stage investment of internet startups in China and the US.

Founded in 2015 by former vice president of Tencent and GM of Tencent M&A, Richard Peng (Peng Zhijian), and former vice GM of Tencent M&A, Kurt Xu, Genesis Capital specializes in growth stage investment of internet startups in China and the US.

Cathay Innovation invests in small to medium-sized companies with the potential to rapidly grow internationally. By 2016, Cathay Innovation had conducted 59 investments, with a total investment of €514 million. It has offices in France, China, the US and Germany, with €1.2 billion under management.

Cathay Innovation invests in small to medium-sized companies with the potential to rapidly grow internationally. By 2016, Cathay Innovation had conducted 59 investments, with a total investment of €514 million. It has offices in France, China, the US and Germany, with €1.2 billion under management.

Wang Gang is an angel investor and a former senior director at Alibaba. His investments are concentrated in the internet, mobile internet and e-commerce sectors, in over 70 companies to date in both China and the US; including Didi, Uucars (formerly Uuzuche), ofo and Huajuan.

Wang Gang is an angel investor and a former senior director at Alibaba. His investments are concentrated in the internet, mobile internet and e-commerce sectors, in over 70 companies to date in both China and the US; including Didi, Uucars (formerly Uuzuche), ofo and Huajuan.

Founded in 1990, Macrolink Group is now a large-scale modernized group with businesses in real estate, mining, petroleum, chemical, investment, finance and other industries. It has 90+ wholly owned subsidiaries, holding subsidiaries and sharing subsidiaries, operating in 20+ provinces in China and 40+ countries overseas.

Founded in 1990, Macrolink Group is now a large-scale modernized group with businesses in real estate, mining, petroleum, chemical, investment, finance and other industries. It has 90+ wholly owned subsidiaries, holding subsidiaries and sharing subsidiaries, operating in 20+ provinces in China and 40+ countries overseas.

Transformed from the well-established state-owned Govtor Capital in 1992, Addor Capital is one of the most influential investment institutions in China today. It manages more than RMB 75 billion, and has set up more than 70 different investment funds, backing more than 650 startups.

Transformed from the well-established state-owned Govtor Capital in 1992, Addor Capital is one of the most influential investment institutions in China today. It manages more than RMB 75 billion, and has set up more than 70 different investment funds, backing more than 650 startups.

Tipping Point Capital was established by Huang Shengli, former managing director of China Renaissance and founder of Modian.com, a crowdfunding website for gaming projects. The core team has over 40 years of experience in the internet industry, investment banking and M&As.

Tipping Point Capital was established by Huang Shengli, former managing director of China Renaissance and founder of Modian.com, a crowdfunding website for gaming projects. The core team has over 40 years of experience in the internet industry, investment banking and M&As.

Qianhai Fund of Funds (Qianhai FoF)

Headquartered in Shenzhen, Qianhai FoF was founded in 2015 with Shenzhen Capital Group as its only institutional partner. It is China's biggest FoF, with RMB 21.5bn in capital under management. Qianhai FoF is the largest single fundraising venture capital and private equity investment fund in China.

Headquartered in Shenzhen, Qianhai FoF was founded in 2015 with Shenzhen Capital Group as its only institutional partner. It is China's biggest FoF, with RMB 21.5bn in capital under management. Qianhai FoF is the largest single fundraising venture capital and private equity investment fund in China.

Co-founder and CEO of Tiaoguoshi

The author of the earliest book on the online-to-offline (O2O) business model in China “Theory of O2O Evolution”, and an iResearch columnist, Yu Jinhua was an independent scholar before joining fresh fruit business Tiaoguoshi in May 2014, and transforming it into a roaring O2O success. He also once served as general manager, independent brands, at beauty e-retailer Lefeng.com, and vice-president of D&S Media Group, as well as created PR firm REBRAND. Aka Banzhuandayu, his online moniker, Yu was born in the 1970s and is married to fellow Tiaoguoshi co-founder Xiao Hongtao.

The author of the earliest book on the online-to-offline (O2O) business model in China “Theory of O2O Evolution”, and an iResearch columnist, Yu Jinhua was an independent scholar before joining fresh fruit business Tiaoguoshi in May 2014, and transforming it into a roaring O2O success. He also once served as general manager, independent brands, at beauty e-retailer Lefeng.com, and vice-president of D&S Media Group, as well as created PR firm REBRAND. Aka Banzhuandayu, his online moniker, Yu was born in the 1970s and is married to fellow Tiaoguoshi co-founder Xiao Hongtao.

In a nascent market, one-year-old Starfield has brought its offerings to around 3,000 F&B outlets and generated RMB 10m in revenue

Intracity delivery startup Fengxiansheng takes on the Middle East

Backed by the most popular online shopping platform in the Middle East, Hangzhou's No. 1 intracity delivery startup Fengxiansheng (“Mr Wind”) is expanding to the region

Dao Foods: Grooming and betting on China's rising alternative protein startups

How can businesses involve Chinese consumers in the environmental cause, even if it isn’t a priority for them? For that, the impact investor-incubator Dao Foods has got its philosophy-led strategy figured out

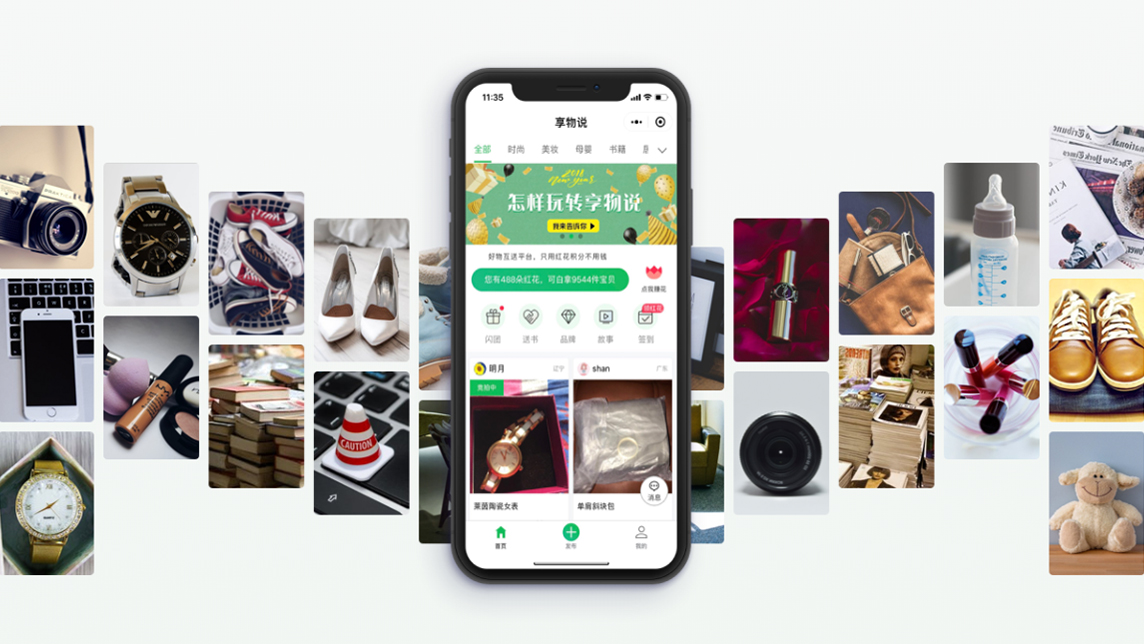

Xiangwushuo’s platform finds a new home for secondhand goods

This WeChat mini program doesn’t yet have a monetization strategy, but has still received over US$110 million in funding in one year

Gago Inc: Satellite data agritech startup ramps up growth with financial sector solutions

Founded by former NASA scientists, Gago began as a data solution to improve China’s traditionally low-yielding and inefficient smallholder-based farming sector

In China, coding education for children is in demand – but investors are wary

Coding lessons are most wanted by Chinese parents for their kids after English tuition, so hundreds of coding edtech startups have joined the fray

Chinese startups feel the chill of capital winter as VC activities slow

The goods news is investors still have plenty of money. They just become more cautious when making investment decisions

Taronga Ventures takes RealTechX to Singapore; plans Japan, US growth

The Australian proptech investor to focus on ESG in its acceleration program, including women under-representation and site safety

Dai Wei and his Ofo: Fighting till the last act?

How the college student who founded a global bike-sharing sensation also led it to the verge of bankruptcy through a string of mistakes

AltStory: Putting the audience in the director's chair

The Chinese startup has taken interactivity to another level by letting TV and movie viewers decide where the action goes, and how it all ends.

“Sniper investor” Zhu Xiaohu: GSR Ventures chief’s slow but steady way of spotting future unicorns

Known for his conservative investing in China’s often-euphoric tech startup scene, Zhu Xiaohu has caught unicorns like Didi Chuxing while making a profitable exit from Ofo just before it sank

Shilling Capital Partners: Growing Portuguese tech businesses from seed

An early mover, the influential angel investing firm is accelerating local techs into Brazil and globally

Indonesian insurtech Qoala survives pandemic with new partners and products

Acquisition of Thai insurtech FairDee to spearhead expansion into Southeast Asia, building on earlier entry into Malaysia and Vietnam and a Covid-19 travel insurance product at home

Atomian: The powerful cognitive software that thinks, works like the human brain

Combining natural language processing with big data, Atomian enables easy, quick and real-time access to information in databases and documents

Faraday Venture Partners’ MP Gonzalo Tradacete: “We are actively looking for startups”

Amid the Covid-19 slump, Faraday Venture Partners' CIO and MP shares his expectations for startup investments and favored sectors, the measures his firm has taken so far to help investees ride out the crisis, and more.

Sorry, we couldn’t find any matches for“Matrix Partners China”.