New Zealand

-

DATABASE (383)

-

ARTICLES (695)

Adrian Cheng Chi-kong is a third generation heir to HK billionaire Cheng Yu-tung.Adrian Cheng Chi-kong founded K11 brand in 2008, and became Executive Vice-Chairman at New World Development in 2015.Besides traditional retail, he invests in more areas such as food, fashion, technology.He founded C Ventures to invest in the businesses that focus on millennials. C Ventures has invested in Moda Operandi, an American fashion startup, Flont, luxury jewelry rental service, among others.He invested in American AI startup ObEN and Chinese cooking video platform Daydaycook, etc, through K11.He also invested in Aibee, Hua Medicine and Xiaohongshu as individual investor.

Adrian Cheng Chi-kong is a third generation heir to HK billionaire Cheng Yu-tung.Adrian Cheng Chi-kong founded K11 brand in 2008, and became Executive Vice-Chairman at New World Development in 2015.Besides traditional retail, he invests in more areas such as food, fashion, technology.He founded C Ventures to invest in the businesses that focus on millennials. C Ventures has invested in Moda Operandi, an American fashion startup, Flont, luxury jewelry rental service, among others.He invested in American AI startup ObEN and Chinese cooking video platform Daydaycook, etc, through K11.He also invested in Aibee, Hua Medicine and Xiaohongshu as individual investor.

Founded in 2015, Xin Ding Capital makes equity, pre-IPO and overseas investments. It also provides consultation services to startups in the biomedicine, new energy vehicle, chip and semiconductor manufacturing and artificial intelligence sectors that want to get listed on the National Equities Exchange and Quotations, a Chinese over-the-counter system for trading shares of public limited companies. As of May 2018, Xin Ding Capital has invested nearly RMB 2 billion in over 30 projects.

Founded in 2015, Xin Ding Capital makes equity, pre-IPO and overseas investments. It also provides consultation services to startups in the biomedicine, new energy vehicle, chip and semiconductor manufacturing and artificial intelligence sectors that want to get listed on the National Equities Exchange and Quotations, a Chinese over-the-counter system for trading shares of public limited companies. As of May 2018, Xin Ding Capital has invested nearly RMB 2 billion in over 30 projects.

Founded in 1999 in Santiago de Compostela, XesGalicia SGEIC SA is 100% owned by the Galician Institute for Economic Promotion (Igape). The VC supports Spanish startups through seed funding, early ventures and growth capital investments. It usually invests between €60,000 and €200,000 in each enterprise, with temporary acquisition of minority stakes. The firm focuses on the biotech, telecommunications, energy and environment sectors. In 2014, it was involved in the creation of the Galician Network of Business Angels to facilitate the collaboration of private and public fund investors to nurture innovative projects and applications of new technologies.

Founded in 1999 in Santiago de Compostela, XesGalicia SGEIC SA is 100% owned by the Galician Institute for Economic Promotion (Igape). The VC supports Spanish startups through seed funding, early ventures and growth capital investments. It usually invests between €60,000 and €200,000 in each enterprise, with temporary acquisition of minority stakes. The firm focuses on the biotech, telecommunications, energy and environment sectors. In 2014, it was involved in the creation of the Galician Network of Business Angels to facilitate the collaboration of private and public fund investors to nurture innovative projects and applications of new technologies.

CEO and Founder of Didimo

Argentinian-born Verónica Costa Orvalho is a veteran in animation technology. In 2016, she became the CEO and founder of Didimo that was inspired by an earlier venture Face In Motion, established in 2007 to focus on cinematic quality and animation production of faces. Orvalho won the award for the AI and virtual reality category at a Women Startup Challenge event held in New York in 2017. Orvalho has a long academic track record in related fields, beginning with a first degree in Software Engineering from the University of Belgrano in Buenos Aires. She moved to Barcelona and obtained a master's degree in Videogame Design and Development at University Pompeu Fabra where she continued to work on creating a facial animation system “For CG Films”. She later completed her PhD at the Polytechnic University of Catalonia with her thesis: Fast and Reusable Facial Rigging and Animation to develop an application that could speed up the traditional “slowing rigging” process. She has worked at Ericsson as a systems analyst and was a producer at the Argentinian film company Patagonik Film Group that helped to produce the Oscar-winning movie El hijo de la novia. She worked for four years as the founder of Panorama Consulting, a consultancy focusing on developing systems for the medical, logistics and entertainment industries. Since 2003, she has lectured in different institutions, including Porto University's Porto Interactive Center as its specialist in facial animation since 2008.

Argentinian-born Verónica Costa Orvalho is a veteran in animation technology. In 2016, she became the CEO and founder of Didimo that was inspired by an earlier venture Face In Motion, established in 2007 to focus on cinematic quality and animation production of faces. Orvalho won the award for the AI and virtual reality category at a Women Startup Challenge event held in New York in 2017. Orvalho has a long academic track record in related fields, beginning with a first degree in Software Engineering from the University of Belgrano in Buenos Aires. She moved to Barcelona and obtained a master's degree in Videogame Design and Development at University Pompeu Fabra where she continued to work on creating a facial animation system “For CG Films”. She later completed her PhD at the Polytechnic University of Catalonia with her thesis: Fast and Reusable Facial Rigging and Animation to develop an application that could speed up the traditional “slowing rigging” process. She has worked at Ericsson as a systems analyst and was a producer at the Argentinian film company Patagonik Film Group that helped to produce the Oscar-winning movie El hijo de la novia. She worked for four years as the founder of Panorama Consulting, a consultancy focusing on developing systems for the medical, logistics and entertainment industries. Since 2003, she has lectured in different institutions, including Porto University's Porto Interactive Center as its specialist in facial animation since 2008.

Toyota Motor Corporation (Toyota) started as a division of the Toyoda Automatic Loom Works in 1933, and established as an independent in 1937. As of December 2019, it ranked tenth largest company in the world by revenue. An established multinational automotive manufacturer, Toyota has invested in startups working on everything from online marketing to cybersecurity, placing an focus on new-generation mobility services. In 2019, it invested $600m in Chinese ride-hailing giant Didi Chuxing, and founded a joint venture to offer car maintenance, insurance and finance services to ride-hailing drivers. Also that year, Toyota invested $500m in Uber for self-driving cars. In early 2020, the auto giant invested $400 in the self-driving startup Pony.ai. Before the investment, the two had already partnered to test self-driving cars on public roads in China.

Toyota Motor Corporation (Toyota) started as a division of the Toyoda Automatic Loom Works in 1933, and established as an independent in 1937. As of December 2019, it ranked tenth largest company in the world by revenue. An established multinational automotive manufacturer, Toyota has invested in startups working on everything from online marketing to cybersecurity, placing an focus on new-generation mobility services. In 2019, it invested $600m in Chinese ride-hailing giant Didi Chuxing, and founded a joint venture to offer car maintenance, insurance and finance services to ride-hailing drivers. Also that year, Toyota invested $500m in Uber for self-driving cars. In early 2020, the auto giant invested $400 in the self-driving startup Pony.ai. Before the investment, the two had already partnered to test self-driving cars on public roads in China.

Lakestar is an international VC firm headquartered in Zurich. Founded in 2012 by Klaus Hommels, the VC has been an active early-stage investor since 2000. Its first fund was established in 2013 to invest in fast-growing tech startups across Europe and the US like Skype, Spotify, Facebook and Airbnb. The firm has offices in Zurich, Berlin, London, New York and Hong Kong with total investments of more than €1bn. Amid the Covid-19 pandemic in February 2020, Lakestar managed to raise a total of $735m for early and growth stage funds to be invested mainly in Europe. One-third of the funds will be designated to early-stage investments and two-thirds to growth-stage companies to drive international expansion. Part of the capital will also be used to strengthen the leadership team.

Lakestar is an international VC firm headquartered in Zurich. Founded in 2012 by Klaus Hommels, the VC has been an active early-stage investor since 2000. Its first fund was established in 2013 to invest in fast-growing tech startups across Europe and the US like Skype, Spotify, Facebook and Airbnb. The firm has offices in Zurich, Berlin, London, New York and Hong Kong with total investments of more than €1bn. Amid the Covid-19 pandemic in February 2020, Lakestar managed to raise a total of $735m for early and growth stage funds to be invested mainly in Europe. One-third of the funds will be designated to early-stage investments and two-thirds to growth-stage companies to drive international expansion. Part of the capital will also be used to strengthen the leadership team.

Founded in 1813 as a small grain-trading firm in Arlon, France (now Belgium), Continental Grain Company (CGC) is now headquartered in New York. It has operations in 10 countries and employs over 13,500 people worldwide. Business activities include animal feeds, aquaculture and meat production.Besides interests in the food, agribusiness and commodities sectors, CGC also manages different asset classes like private equity, listed securities and venture capital. Its investment portfolio includes more than 30 food and agribusiness companies, ranging from early-stage ventures to established market leaders across the US, China and Latin America.CGC Asia mainly invests in feed milling, animal husbandry, meat production and processing businesses in the region. Direct investments are made through Continental Capital Limited in China, focusing on high‐growth food and agribusiness firms.

Founded in 1813 as a small grain-trading firm in Arlon, France (now Belgium), Continental Grain Company (CGC) is now headquartered in New York. It has operations in 10 countries and employs over 13,500 people worldwide. Business activities include animal feeds, aquaculture and meat production.Besides interests in the food, agribusiness and commodities sectors, CGC also manages different asset classes like private equity, listed securities and venture capital. Its investment portfolio includes more than 30 food and agribusiness companies, ranging from early-stage ventures to established market leaders across the US, China and Latin America.CGC Asia mainly invests in feed milling, animal husbandry, meat production and processing businesses in the region. Direct investments are made through Continental Capital Limited in China, focusing on high‐growth food and agribusiness firms.

Founded in Sydney in 2004, Artesian Capital Management (Australia) Pty Ltd is a global alternative investment management firm specialized in public and private debt, venture capital and impact investment strategies. The VC was a spin-off from ANZ Banking Group’s capital markets business, backed by ANZ Private Equity. Artesian’s founding partners Jeremy Colless, Matthew Clunies-Ross and John McCartney bought ANZ’s stake in 2005.Today, Artesian has international offices in New York, London, Singapore, Jakarta and Shanghai. Its China VC Fund was launched in 2017 and the firm also has plans for a Southeast Asia VC Fund. The alternative investment firm currently manages multiple funds including Australian VC Fund 2, High Impact Green Debt Fund, GrainInnovate and Women Economic Empowerment Fund.

Founded in Sydney in 2004, Artesian Capital Management (Australia) Pty Ltd is a global alternative investment management firm specialized in public and private debt, venture capital and impact investment strategies. The VC was a spin-off from ANZ Banking Group’s capital markets business, backed by ANZ Private Equity. Artesian’s founding partners Jeremy Colless, Matthew Clunies-Ross and John McCartney bought ANZ’s stake in 2005.Today, Artesian has international offices in New York, London, Singapore, Jakarta and Shanghai. Its China VC Fund was launched in 2017 and the firm also has plans for a Southeast Asia VC Fund. The alternative investment firm currently manages multiple funds including Australian VC Fund 2, High Impact Green Debt Fund, GrainInnovate and Women Economic Empowerment Fund.

Crowdcube Capital Ltd is an equity crowdfunding platform established by Darren Westlake and Luke Lang in 2011. The company is authorized and regulated by the Financial Conduct Authority (FCA) in the UK. Over the past decade, Crowdcube’s 1.1m users have invested over £1bn. The company became profitable in the second half of 2020. In June 2021, CEO Westlake announced the upcoming launch of secondary marketplace Cubex, dubbed the community IPO. Crowdcube started out as an early-stage crowdfunding platform like Kickstarter and Indiegogo. The platform earns commissions from successful fundraising campaigns. Investors of the funded companies can also buy and sell shares through the platform. In 2018, Crowdcube introduced a new investor fee at 1.5% of the total investment, capped at £250.

Crowdcube Capital Ltd is an equity crowdfunding platform established by Darren Westlake and Luke Lang in 2011. The company is authorized and regulated by the Financial Conduct Authority (FCA) in the UK. Over the past decade, Crowdcube’s 1.1m users have invested over £1bn. The company became profitable in the second half of 2020. In June 2021, CEO Westlake announced the upcoming launch of secondary marketplace Cubex, dubbed the community IPO. Crowdcube started out as an early-stage crowdfunding platform like Kickstarter and Indiegogo. The platform earns commissions from successful fundraising campaigns. Investors of the funded companies can also buy and sell shares through the platform. In 2018, Crowdcube introduced a new investor fee at 1.5% of the total investment, capped at £250.

Cambridge Enterprise Venture Partners

A Cambridge-based investor, founded in 2006, that exists to support spin-off companies created at the city’s university with an emphasis on social impact. It currently has 57 companies in its portfolio, almost entirely in the areas of life and physical sciences, which have, in total, raised over £2bn in further investment and grant funding.Its most recent investments include in the June 2021 £3m seed round of Gallium Nitride semiconductor engineering company Porotech and in the January 2021 $20m Series A round of quantum computing innovators Riverlane.

A Cambridge-based investor, founded in 2006, that exists to support spin-off companies created at the city’s university with an emphasis on social impact. It currently has 57 companies in its portfolio, almost entirely in the areas of life and physical sciences, which have, in total, raised over £2bn in further investment and grant funding.Its most recent investments include in the June 2021 £3m seed round of Gallium Nitride semiconductor engineering company Porotech and in the January 2021 $20m Series A round of quantum computing innovators Riverlane.

Suzhou Wujiang Orient State-Owned Capital Investment Management

Suzhou Wujiang Orient State-Owned Capital Investment Management is a state-owned company established in 2001 in Suzhou with the mission to facilitate industrial development in Wujiang District, Suzhou. It currently manages assets worth over RMB 20bn. It’s also the limited partner of some renowned VC funds including Source Code Capital, Legend Capital, Kinzon Capital and Oriza Holdings. As of May 2021, three of its portfolio companies and 27 of its sub-funds had gone public.While making investments in companies, the investor is more focused on attracting investment firms in Wujiang to offer support to them. Beyond that, it’s also committed to supporting small-sized early-stage startups, so as to bring new blood for industrial development in the region.

Suzhou Wujiang Orient State-Owned Capital Investment Management is a state-owned company established in 2001 in Suzhou with the mission to facilitate industrial development in Wujiang District, Suzhou. It currently manages assets worth over RMB 20bn. It’s also the limited partner of some renowned VC funds including Source Code Capital, Legend Capital, Kinzon Capital and Oriza Holdings. As of May 2021, three of its portfolio companies and 27 of its sub-funds had gone public.While making investments in companies, the investor is more focused on attracting investment firms in Wujiang to offer support to them. Beyond that, it’s also committed to supporting small-sized early-stage startups, so as to bring new blood for industrial development in the region.

Bo Shao graduated with a Harvard degree in Physics and Electrical Engineering in 1995 and worked at the Boston Consulting Group for almost two years until 1997. After obtaining an MBA from Harvard in 1999, he started EachNet in China. The e-commerce platform was acquired by eBay in 2003 for US$225m and Bo went on to other ventures like Babytree and Parent Lab Inc.Based in San Francisco, the angel investor became a founding partner of Matrix Partners China in 2008. He focuses on early-stage investments in the internet, e-commerce and new media sectors.

Bo Shao graduated with a Harvard degree in Physics and Electrical Engineering in 1995 and worked at the Boston Consulting Group for almost two years until 1997. After obtaining an MBA from Harvard in 1999, he started EachNet in China. The e-commerce platform was acquired by eBay in 2003 for US$225m and Bo went on to other ventures like Babytree and Parent Lab Inc.Based in San Francisco, the angel investor became a founding partner of Matrix Partners China in 2008. He focuses on early-stage investments in the internet, e-commerce and new media sectors.

The Craftory is a London-based investment house with a satellite office in San Francisco. Founded in 2018 by retail and media industry veterans Ernesto Schmitt and Ellio Leoni Sceti, the firm has made seven investments in various consumer goods brands. Sceti is also the chairman of London-based family VC firm LSG Holdings, with his brother Patrick as the MD.The Craftory’s $375m fund specializes in building a new investment house of consumer brands, hence its name from the words, “craft" and “factory.” It mainly offers permanent and growth capital to consumer packaged goods (CPG) brands. The Craftory supports CPG challenger brands to help them to grow from “craft” businesses to sustainable, mass CPG brands, offering consumers better choices for everyday products.

The Craftory is a London-based investment house with a satellite office in San Francisco. Founded in 2018 by retail and media industry veterans Ernesto Schmitt and Ellio Leoni Sceti, the firm has made seven investments in various consumer goods brands. Sceti is also the chairman of London-based family VC firm LSG Holdings, with his brother Patrick as the MD.The Craftory’s $375m fund specializes in building a new investment house of consumer brands, hence its name from the words, “craft" and “factory.” It mainly offers permanent and growth capital to consumer packaged goods (CPG) brands. The Craftory supports CPG challenger brands to help them to grow from “craft” businesses to sustainable, mass CPG brands, offering consumers better choices for everyday products.

Based in Sao Paulo, Maya Capital was co-founded in 2018 by Lara Lemann and Mônica Saggioro. The VC manages two funds that invest in early-stage startups in Latin America. The first is worth $26m and the second raised $15m in October 2020. Half of the amount raised will be invested in new startups, while the balance will fund Series A rounds of portfolio startups.Together with co-investors like Kaszek Ventures and Y Combinator, the VC has invested in 25 startups in Brazil, Chile, Colombia and Mexico. Investments include plant-based foodtech NotCo, the car-rental operator Kovi and online education platform Trybe. Maya aims to increase its portfolio to 35 startups, focusing on post-Covid opportunities in diverse sectors like health, finance, mobility and logistics.

Based in Sao Paulo, Maya Capital was co-founded in 2018 by Lara Lemann and Mônica Saggioro. The VC manages two funds that invest in early-stage startups in Latin America. The first is worth $26m and the second raised $15m in October 2020. Half of the amount raised will be invested in new startups, while the balance will fund Series A rounds of portfolio startups.Together with co-investors like Kaszek Ventures and Y Combinator, the VC has invested in 25 startups in Brazil, Chile, Colombia and Mexico. Investments include plant-based foodtech NotCo, the car-rental operator Kovi and online education platform Trybe. Maya aims to increase its portfolio to 35 startups, focusing on post-Covid opportunities in diverse sectors like health, finance, mobility and logistics.

Andrew McCollum is CEO of television streaming service Philo and was also one of its earliest investors. Prior to that, he was one of the co-founders of Facebook. He served as an entrepreneur in residence at two of Philo’s investors, the US-based VC firms New Enterprise Associates and Flybridge Partners, and is also an early-stage angel investor himself.His last disclosed investments were in 2015, in US-based unicorn Diamond Foundry, the first certified carbon-neutral lab-produced diamond manufacturer, as well as in breastfeeding app Moxxly’s undisclosed seed round prior to it being acquired by Medela.

Andrew McCollum is CEO of television streaming service Philo and was also one of its earliest investors. Prior to that, he was one of the co-founders of Facebook. He served as an entrepreneur in residence at two of Philo’s investors, the US-based VC firms New Enterprise Associates and Flybridge Partners, and is also an early-stage angel investor himself.His last disclosed investments were in 2015, in US-based unicorn Diamond Foundry, the first certified carbon-neutral lab-produced diamond manufacturer, as well as in breastfeeding app Moxxly’s undisclosed seed round prior to it being acquired by Medela.

Cogo: Tech that helps you cut your real-time carbon footprint through daily choices

Currently operating in New Zealand, Australia and the UK, Cogo is raising $20m to bring its emissions tracking technology to companies and consumers in Asia, Europe and the US

Vence: Virtual fencing for sustainable livestock rearing

The startup uses GPS and AI algorithms to create virtual fences that work with animal collars for more efficient management of livestock and grasslands

Tiger Brokers, a Chinese online brokerage for trading foreign stocks, announces US IPO

The Jim Rogers-backed fintech startup wants to raise US$150 million as it sees growing demand from younger Chinese investors

FluroSat: Combining satellite imagery and farm data to predict crop issues

This year’s Future of Food Asia winner offers a crop management software that can be used with existing agritech platforms, adding value with machine learning, and is even used for sustainability reporting

Bound4Blue taps aeronautical technology for sustainable shipping solutions

Bound4Blue's wind-assisted vessel propulsion saves 40% on fuel costs in a €200bn market; eyes European, Asian expansion

Iomob: Universal mobility app to help people find best route from A to B

Rapid growth in MaaS will boost revenue to over €1m by 2020 for Spanish transport app Iomob

VUE Vlog: Short-video editing app wants to be China’s Instagram of vlogs

From starting as a short-video editing tool to a vlogging community today, VUE is talking to potential advertisers to help its vloggers make money

Halal Local: Companion for the faithful

Indonesian app lets Muslims travel fuss-free, without sacrificing their religious values

COMY Energy: Closing the plastic waste loop with chemical recycling

The Chinese startup transforms plastic wastes to virgin-quality recycled products without releasing toxic gas or pollution and is attracting interest from petrochemical giants and waste management companies

Node: Fighting deforestation with fashionable footwear from agricultural waste

Using patented technology developed with Indonesia’s Ministry of Agriculture, Node turns farm waste and plant materials into biodegradable vegan footwear and shoe components to help fight deforestation.

Taronga Ventures takes RealTechX to Singapore; plans Japan, US growth

The Australian proptech investor to focus on ESG in its acceleration program, including women under-representation and site safety

OLIO: Zero food waste app expands with new product categories, going global

Recent $43m Series B funding will let sustainability app more than triple hiring, add homemade products and household goods to product listings

Raw Data: Bringing new predictability to harvests

Spanish ML, big data startup helps farmers perfect wine and fruit production in a fast-growing precision agtech sector

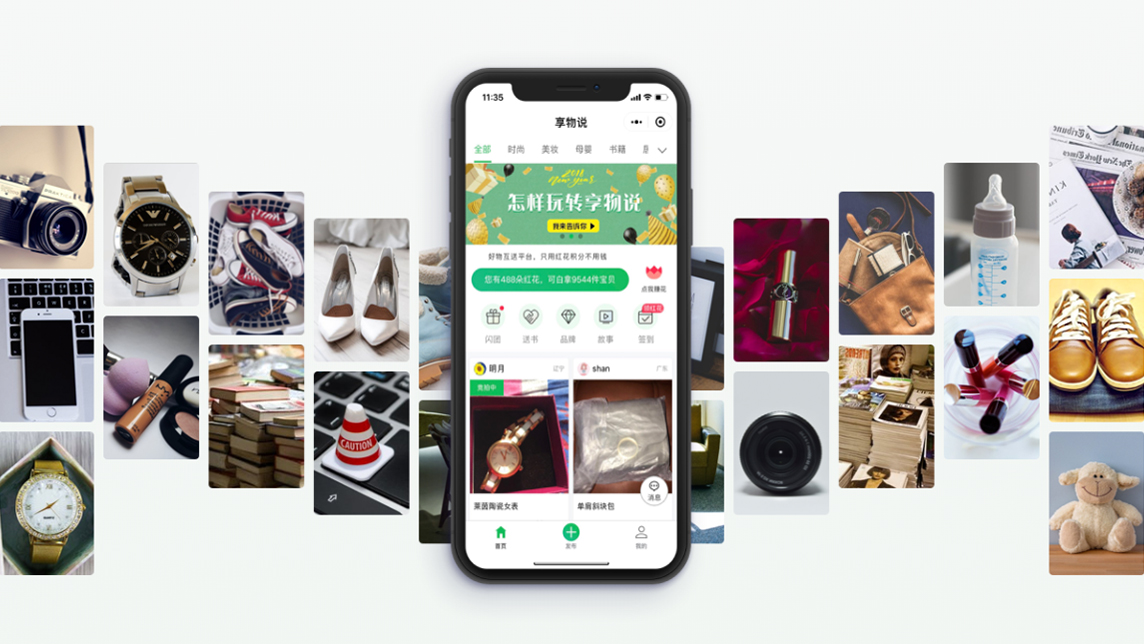

Xiangwushuo’s platform finds a new home for secondhand goods

This WeChat mini program doesn’t yet have a monetization strategy, but has still received over US$110 million in funding in one year

A new unicorn rises as OVO's $1bn valuation confirmed

The Lippo Group subsidiary continues to grow in strength as it battles for market share with Gojek’s e-wallet and others

Sorry, we couldn’t find any matches for“New Zealand”.