agritech

-

DATABASE (24)

-

ARTICLES (56)

Co-founder, CEO of Lluvia Sólida (Solid Rain)

Leonardo Rico Fernandez is CEO and co-founder of Mexican biotech startup Lluvia Sólida, a water retention solution for drought conditions, where he has worked since he re-founded it in 2017. He used the same name of a company he founded in 2012 and ran with a different team, which was dissolved in 2016. He is the son of the inventor of the technology, Sergio Rico Velasco, and was instrumental in positioning the product’s use from residual waste water treatment to agritech. Rico previously worked in a private school, Indo-American College, in Tlalnepantla in the State of Mexico City as a systems administrator. He graduated as an engineer in Electrical Systems from Monterrey University, Mexico City campus.

Leonardo Rico Fernandez is CEO and co-founder of Mexican biotech startup Lluvia Sólida, a water retention solution for drought conditions, where he has worked since he re-founded it in 2017. He used the same name of a company he founded in 2012 and ran with a different team, which was dissolved in 2016. He is the son of the inventor of the technology, Sergio Rico Velasco, and was instrumental in positioning the product’s use from residual waste water treatment to agritech. Rico previously worked in a private school, Indo-American College, in Tlalnepantla in the State of Mexico City as a systems administrator. He graduated as an engineer in Electrical Systems from Monterrey University, Mexico City campus.

Co-founder of investment and consultancy firm SYSTEMIQ Jeremy Oppenheim invests individually in early-stage cleantech and agritech ventures. He used to be a senior partner at global consultancy McKinsey, where he worked extensively with multilateral development banks, the United Nations and developing nations' governments to set up resource-sustainability projects. From 2013-14, Oppenheim was the program director of the New Climate Economy project, an initiative of the Global Commission on Economy and Climate that identified practical actions and policy options to maximize opportunities associated with climate change. The experience helped propel him into cleantech and agtech investing.

Co-founder of investment and consultancy firm SYSTEMIQ Jeremy Oppenheim invests individually in early-stage cleantech and agritech ventures. He used to be a senior partner at global consultancy McKinsey, where he worked extensively with multilateral development banks, the United Nations and developing nations' governments to set up resource-sustainability projects. From 2013-14, Oppenheim was the program director of the New Climate Economy project, an initiative of the Global Commission on Economy and Climate that identified practical actions and policy options to maximize opportunities associated with climate change. The experience helped propel him into cleantech and agtech investing.

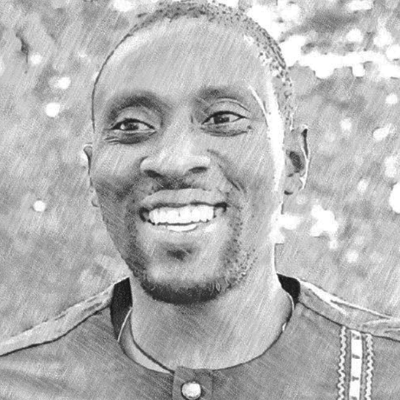

CTO and co-founder of AgroCenta (Holdings)

Michael Ocansey graduated in accounting and IT from Regent University of Science and Technology in Dansoman, Ghana. From 2005 to 2010, Ocansey worked as a lead web developer at Ghanaian digital development agency Esoko in Accra, where he met business development executive Francis Obirikorang. Ocansey also worked as a contract web developer for software developer Origo in San Diego for two years until 2013.In 2015, Ocansey and Obirikorang co-founded Swappaholics Holdings in British Virgin Islands. He worked for one year as CTO for the online marketplace that allows users to “barter” or exchange products, skills and services.In January 2016, Ocansey and Obirikorang established AgroCenta (Holdings) Limited in Mauritius. The agritech startup set up its first office in Accra to provide an e-commerce platform, supply-chain and fintech services to smallholder farmers in Ghana.

Michael Ocansey graduated in accounting and IT from Regent University of Science and Technology in Dansoman, Ghana. From 2005 to 2010, Ocansey worked as a lead web developer at Ghanaian digital development agency Esoko in Accra, where he met business development executive Francis Obirikorang. Ocansey also worked as a contract web developer for software developer Origo in San Diego for two years until 2013.In 2015, Ocansey and Obirikorang co-founded Swappaholics Holdings in British Virgin Islands. He worked for one year as CTO for the online marketplace that allows users to “barter” or exchange products, skills and services.In January 2016, Ocansey and Obirikorang established AgroCenta (Holdings) Limited in Mauritius. The agritech startup set up its first office in Accra to provide an e-commerce platform, supply-chain and fintech services to smallholder farmers in Ghana.

Tenaya Capital was originally founded in 1995 as Lehman Brothers Venture Partners. In 2009, following Lehman's bankruptcy, Tenaya was spun off into an independent company, with HarbourVest Partners acquired their existing investments. Since then, Tenaya has invested in some major tech companies, including event ticketing company Eventbrite, early fashion e-commerce firm Zappos, and Uber competitor Lyft. They have so far made two investments into Indonesian companies: agritech e-commerce platform TaniHub, and “Uber-for-logistics” company Kargo Technologies. Tenaya typically invests in Series B and Series C rounds, although they have gone into Series A and later rounds as well.

Tenaya Capital was originally founded in 1995 as Lehman Brothers Venture Partners. In 2009, following Lehman's bankruptcy, Tenaya was spun off into an independent company, with HarbourVest Partners acquired their existing investments. Since then, Tenaya has invested in some major tech companies, including event ticketing company Eventbrite, early fashion e-commerce firm Zappos, and Uber competitor Lyft. They have so far made two investments into Indonesian companies: agritech e-commerce platform TaniHub, and “Uber-for-logistics” company Kargo Technologies. Tenaya typically invests in Series B and Series C rounds, although they have gone into Series A and later rounds as well.

Founded in 2013 and based in Silicon Valley, AgFunder invests in agrifood tech startups globally with the mission of “investing in technologies to rapidly transform our food and agriculture system.” The VC firm has already built a global ecosystem of 85,000+ members and subscribers, which helps grow and scale its portfolio companies. It recently established the New Carnivore fund to invest in startups working to create animal-free protein alternatives including plant-based meat and cultured meat. In 2019, AgFunder and the Australian agrifood accelerator Rocket Seeder co-launched GROW Impact Accelerator in Singapore to accelerate seed and Series A agritech startups from Southeast Asia.

Founded in 2013 and based in Silicon Valley, AgFunder invests in agrifood tech startups globally with the mission of “investing in technologies to rapidly transform our food and agriculture system.” The VC firm has already built a global ecosystem of 85,000+ members and subscribers, which helps grow and scale its portfolio companies. It recently established the New Carnivore fund to invest in startups working to create animal-free protein alternatives including plant-based meat and cultured meat. In 2019, AgFunder and the Australian agrifood accelerator Rocket Seeder co-launched GROW Impact Accelerator in Singapore to accelerate seed and Series A agritech startups from Southeast Asia.

Shell Foundation is the not-for-profit investment arm of the global energy giant Shell. Based in London, the foundation was set up in 2000 to invest in social and environmental impact companies, including startups with the potential to reach out to over 10m low-income consumers and achieve financial viability within 10 years. The foundation mainly invests at the pre-seed and seed funding stage and currently has 77 startups in its portfolio. In January 2021, it joined the $790,000 seed round of African agritech social enterprise AgroCenta and also gave a $350,000 grant to sustainable mobility platform Easy Matatu in Uganda.

Shell Foundation is the not-for-profit investment arm of the global energy giant Shell. Based in London, the foundation was set up in 2000 to invest in social and environmental impact companies, including startups with the potential to reach out to over 10m low-income consumers and achieve financial viability within 10 years. The foundation mainly invests at the pre-seed and seed funding stage and currently has 77 startups in its portfolio. In January 2021, it joined the $790,000 seed round of African agritech social enterprise AgroCenta and also gave a $350,000 grant to sustainable mobility platform Easy Matatu in Uganda.

Singapore's government-owned investor has a net portfolio value of just over S$300bn, with assets mainly in Asia and Singapore. In recent years it has begun investing in internet and tech companies in emerging markets, including in neighboring Indonesia and other Asian countries.As a state investor, Temasek aligns its investment portfolio and goals with areas that are relevant to Singapore’s national agenda. For example, to mitigate and reduce the effects of climate change, Temasek has set a commitment to reduce the carbon emissions of its portfolio companies, and invest in companies providing decarbonization solutions. It is also investing in biotechnology, medical technology, agritech and foodtech companies, which are some new focus areas in Singapore’s industrial development.

Singapore's government-owned investor has a net portfolio value of just over S$300bn, with assets mainly in Asia and Singapore. In recent years it has begun investing in internet and tech companies in emerging markets, including in neighboring Indonesia and other Asian countries.As a state investor, Temasek aligns its investment portfolio and goals with areas that are relevant to Singapore’s national agenda. For example, to mitigate and reduce the effects of climate change, Temasek has set a commitment to reduce the carbon emissions of its portfolio companies, and invest in companies providing decarbonization solutions. It is also investing in biotechnology, medical technology, agritech and foodtech companies, which are some new focus areas in Singapore’s industrial development.

Based in Brussels, Astanor Ventures is an impact investor specializing in foodtech, agritech and blue ocean economy with focus on the environment and sustainability. Founded in 2017 by Eric Archambeau and George Coelho, Astanor has invested in more than 20 startups in Europe and the US. Archambeau and Coelho launched Balderton Capital in Europe and were early investors in Spotify, Betfair and LoveFilm.Astanor invests according to the principles for responsible investment (PRI), prioritizing technology-led solutions that connect the value chain, innovate on nutrition and accelerate regenerative agriculture. In November 2020, the firm closed fundraising for its $325m Global Impact Fund focused on food and agriculture technology that comply with the UN’s 17 sustainable development goals (SDGs).

Based in Brussels, Astanor Ventures is an impact investor specializing in foodtech, agritech and blue ocean economy with focus on the environment and sustainability. Founded in 2017 by Eric Archambeau and George Coelho, Astanor has invested in more than 20 startups in Europe and the US. Archambeau and Coelho launched Balderton Capital in Europe and were early investors in Spotify, Betfair and LoveFilm.Astanor invests according to the principles for responsible investment (PRI), prioritizing technology-led solutions that connect the value chain, innovate on nutrition and accelerate regenerative agriculture. In November 2020, the firm closed fundraising for its $325m Global Impact Fund focused on food and agriculture technology that comply with the UN’s 17 sustainable development goals (SDGs).

London-based Sustainability Ventures is one of the UK’s leading early-stage investors in Cleantech. It comprises a group of successful entrepreneurs with a track record in building and investing in high-growth start-ups. It has created Europe’s largest ecosystem for cleantech and sustainability startups, as a business founder and investor, provider of accelerator and support services and provider of shared workspaces. Active since 2011, Sustainability Ventures has raised £250m in total equity funds to date. Its focus is on agritech and food, building technology, circular economy, future energy and mobility. It has established 10 companies, invested in 30 and supported the development of over 250 more enterprises as of 2021 and aims to develop 1,000 sustainable startups by 2025.

London-based Sustainability Ventures is one of the UK’s leading early-stage investors in Cleantech. It comprises a group of successful entrepreneurs with a track record in building and investing in high-growth start-ups. It has created Europe’s largest ecosystem for cleantech and sustainability startups, as a business founder and investor, provider of accelerator and support services and provider of shared workspaces. Active since 2011, Sustainability Ventures has raised £250m in total equity funds to date. Its focus is on agritech and food, building technology, circular economy, future energy and mobility. It has established 10 companies, invested in 30 and supported the development of over 250 more enterprises as of 2021 and aims to develop 1,000 sustainable startups by 2025.

- 1

- 2

European agritech is the new global focus, as startup investments nearly doubled in 2019

Last year, European agritech surpassed China for the first time in investments received, with openings in multiple subsectors from big data to blockchain

Agritech from Myanmar to Indonesia and beyond: Interview with Jefry Pratama, UMG Idealab

UMG, the Myanmar-based conglomerate, looks to Indonesia for investment and inspiration, with agritech and drones among its focuses

MSMB: From university research to agritech ecosystem

The Indonesian startup is moving beyond sensors to build technologies for livestock tracking and fish farming

Indonesia agritech startup HARA goes on the blockchain

What began as a way to help farmers make data-driven decisions has unexpectedly expanded into blockchain. How does HARA plan to use this technology to improve outcomes in agriculture?

Crowde-funding Indonesia's fields

Agritech startup Crowde offers retail investors direct access to Indonesia’s US$25 billion agricultural sector, transforming the way traditional farmers fund, run and grow their businesses

8villages is one of the first agritech startups in Indonesia, and the social media for farmers has since expanded into e-commerce and agriculture data collection

Shrimp-farming data made easy: Interview with JALA’s CEO Liris Maduningtyas

Indonesian agritech startup JALA managed to overcome the hurdles caused by lack of experience after participating in accelerator programs. It is now taking the next steps to better products

Future Food Asia by ID Capital: Introducing Asia's agrifood startups to the world

More than a meeting of startups and investors, the conference showcases ID Capital’s investment thesis and Big Ag’s support for agrifood tech in the world’s most populous region

Smart Agrifood Summit 2021: A global innovation ecosystem is needed to catch up with other sectors

Investors from SVG Ventures/THRIVE, Pinduoduo and others agree that players must join forces to boost agrifood tech investment, internationally and across the value chain

BeeHero: Agritech for bee health and better crop pollination

Combining AI, smart sensors and the world’s largest bee database, BeeHero accurately predicts disorders in colonies, helping beekeepers reduce the mortality rate of bees vital for crop pollination

Yudha Kartohadiprodjo wants to empower Indonesian farmers

Kartohadiprodjo founded Karsa, an agritech social media startup, to arm farmers with better knowledge and information sharing

CloudYoung: Smart agritech for every process, from farm to table

CloudYoung covers the entire production chain, from cutting costs and pesticide use in its smart greenhouses to connecting farmers with buyers in e-commerce

Xtrem Biotech, an agritech startup from Granada, seeks global expansion

With its research roots in the University of Granada, Xtrem Biotech was named one of the world's most innovative agtech spin-offs by accelerator TERRA Food & AgTech

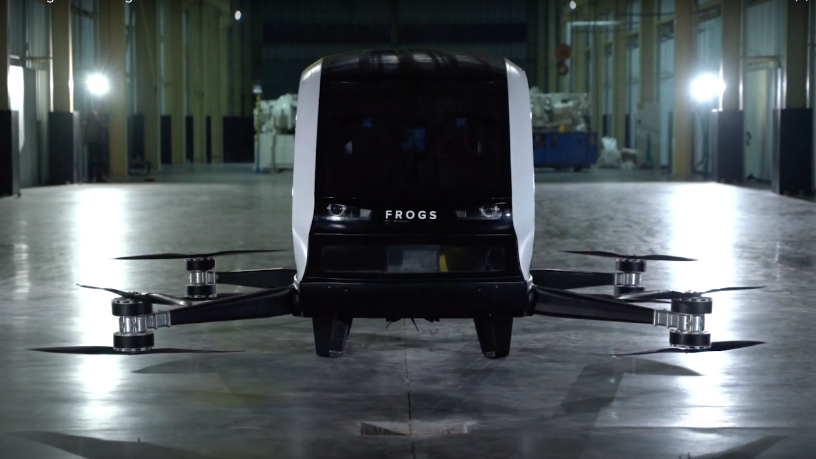

FROGS: Overcoming challenges to launch Indonesia's first drone-taxi for daily commutes

The Yogyakarta-based startup backed by UMG Idealab seeks more technical resources to launch Indonesia's first homegrown “flying taxi,” after the success of its agritech drones

Start with the little things: 5 Indonesian social impact startups

From providing student loans to empowering marginalized groups and farmers, these Indonesian startups are revitalizing local communities

Sorry, we couldn’t find any matches for“agritech”.