portugal's

-

DATABASE (436)

-

ARTICLES (523)

The independent VC arm of Legend Holdings, Legend Capital currently manages several USD funds and RMB funds with over RMB 26 billion in assets under management. It focuses on early- and expansion-stage investment and has invested in over 300 companies as of 2016, of which more than 40 were exited via IPO, and around 40 were exits through M&A.

The independent VC arm of Legend Holdings, Legend Capital currently manages several USD funds and RMB funds with over RMB 26 billion in assets under management. It focuses on early- and expansion-stage investment and has invested in over 300 companies as of 2016, of which more than 40 were exited via IPO, and around 40 were exits through M&A.

Established in 2007, Hongkun Yirun Investment is an investment management firm under Hongkun Group. It has invested in over 50 enterprises, more than 10 of which have been listed. Assets under management have exceeded RMB 10 billion. Hongkun Yirun Investment targets emerging industries and focuses on asset management, private equity investment, M&A and internet finance.

Established in 2007, Hongkun Yirun Investment is an investment management firm under Hongkun Group. It has invested in over 50 enterprises, more than 10 of which have been listed. Assets under management have exceeded RMB 10 billion. Hongkun Yirun Investment targets emerging industries and focuses on asset management, private equity investment, M&A and internet finance.

China Renaissance offers private placement advisory, M&A advisory, securities underwriting, research, sales and trading, investment management and other financial services. It has clients in mainland China, Hong Kong and the United States as well as offices in Shanghai, Beijing, Hong Kong and New York. China Renaissance has facilitated more than 300 private financial transactions collectively valued at over US$20 billion.

China Renaissance offers private placement advisory, M&A advisory, securities underwriting, research, sales and trading, investment management and other financial services. It has clients in mainland China, Hong Kong and the United States as well as offices in Shanghai, Beijing, Hong Kong and New York. China Renaissance has facilitated more than 300 private financial transactions collectively valued at over US$20 billion.

Jonathan Neman is a co-founder and co-CEO of USA healthy-eating restaurant franchise Sweetgreen. As co-CEO, he has managed the salad chain since opening its first outlet in 2007, raising more than $470m in VC funding in the process. Neman is also an investor in various F&B startups, such as frozen food maker EatPops and Indonesian coffee chain Kopi Kenangan.

Jonathan Neman is a co-founder and co-CEO of USA healthy-eating restaurant franchise Sweetgreen. As co-CEO, he has managed the salad chain since opening its first outlet in 2007, raising more than $470m in VC funding in the process. Neman is also an investor in various F&B startups, such as frozen food maker EatPops and Indonesian coffee chain Kopi Kenangan.

Zhongke Turing (CASTuring) was jointly set up by the Chinese Academy of Sciences’ Institution of Computing Technology, the Beijing Municipal Science & Technology Commission and private VC firms, including Pioneer Investment, in 2019. It provides seed funding and incubation services to businesses from emerging industries deemed as strategically important, including but not limited to chipmaking, artificial intelligence, the Internet of Things and big data.

Zhongke Turing (CASTuring) was jointly set up by the Chinese Academy of Sciences’ Institution of Computing Technology, the Beijing Municipal Science & Technology Commission and private VC firms, including Pioneer Investment, in 2019. It provides seed funding and incubation services to businesses from emerging industries deemed as strategically important, including but not limited to chipmaking, artificial intelligence, the Internet of Things and big data.

Co-founder and CTO of PrivyID

Guritno Adi Saputra graduated from Institut Sains & Teknologi AKPRIND, Indonesia with a bachelor's in Information Technology. Between 2013 and 2015, he was a web developer at Yogyakarta technology consultancy firm IndonesiaJogja Info Service and INDigital. Guritno is co-founder and CTO of digital signature startup PrivyID.

Guritno Adi Saputra graduated from Institut Sains & Teknologi AKPRIND, Indonesia with a bachelor's in Information Technology. Between 2013 and 2015, he was a web developer at Yogyakarta technology consultancy firm IndonesiaJogja Info Service and INDigital. Guritno is co-founder and CTO of digital signature startup PrivyID.

Founded in 2015, Hovione Capital is a VC firm from Portugal specializing in the health sector, with a focus on seed/early-stage investments in healthcare and medtech businesses. It currently manages €5 million in investment assets across its portfolio of three companies.

Founded in 2015, Hovione Capital is a VC firm from Portugal specializing in the health sector, with a focus on seed/early-stage investments in healthcare and medtech businesses. It currently manages €5 million in investment assets across its portfolio of three companies.

Co-founder and CEO of Talkdesk

Software engineer and entrepreneur Tiago Paiva holds a master’s degree in Network and Telecommunications from the Technical University of Lisbon. Previous to Talkdesk, he was a developer at Procter & Gamble. With co-founder and former classmate Cristina Fonseca, Paiva initially developed Talkdesk as a prototype at a Twilio-hosted hackathon.

Software engineer and entrepreneur Tiago Paiva holds a master’s degree in Network and Telecommunications from the Technical University of Lisbon. Previous to Talkdesk, he was a developer at Procter & Gamble. With co-founder and former classmate Cristina Fonseca, Paiva initially developed Talkdesk as a prototype at a Twilio-hosted hackathon.

Portuguese serial entrepreneur and angel investor, Carlos Oliveira is formerly the Secretary of State for Entrepreneurship, Competitiveness and Innovation in Portugal. He is also one of the 15 members of the European Commission's high-level group of innovators tasked with the creation of the European Innovation Council.In 2000, Oliveira founded a mobile services startup MobiComp and worked as its CEO until 2008 when he sold the company to Microsoft. He has also founded and invested in several startups, including StudentFinance fintech's €1.15m seed round. He is currently the executive president of the José Neves Foundation, set up by Farfetch founder José Neves to invest and transform Portugal into a knowledge economy.

Portuguese serial entrepreneur and angel investor, Carlos Oliveira is formerly the Secretary of State for Entrepreneurship, Competitiveness and Innovation in Portugal. He is also one of the 15 members of the European Commission's high-level group of innovators tasked with the creation of the European Innovation Council.In 2000, Oliveira founded a mobile services startup MobiComp and worked as its CEO until 2008 when he sold the company to Microsoft. He has also founded and invested in several startups, including StudentFinance fintech's €1.15m seed round. He is currently the executive president of the José Neves Foundation, set up by Farfetch founder José Neves to invest and transform Portugal into a knowledge economy.

LC Ventures is a Lisbon-based VC specializing in pre-seed and seed investments, mainly in Portugal-based startups and with a focus on promoting regional growth. Established in 2015, it has €11.5m under management in three funds, two which are exclusive to Portuguese startups. It has invested in more than 40 companies to date. Recently it has invested in Botcliq, a blockchain e-marketplace for wild fish trading, and in Finnish cleantech company Solved. It also participated in the €2m Series A round of Portuguese online tech employment agency in March 2020.Its investment portfolio currently includes 32 tech startups, a majority of which are based in Portugal.

LC Ventures is a Lisbon-based VC specializing in pre-seed and seed investments, mainly in Portugal-based startups and with a focus on promoting regional growth. Established in 2015, it has €11.5m under management in three funds, two which are exclusive to Portuguese startups. It has invested in more than 40 companies to date. Recently it has invested in Botcliq, a blockchain e-marketplace for wild fish trading, and in Finnish cleantech company Solved. It also participated in the €2m Series A round of Portuguese online tech employment agency in March 2020.Its investment portfolio currently includes 32 tech startups, a majority of which are based in Portugal.

China Science & Merchants Investment Management Group (CSC)

Founded in 2000, Shan Xiangshuang's private equity outfit China Science & Merchants Investment Management Group (CSC) has about US$10 billion under management. It has an extensive network in China and built relationships with more than 1,000 LPs. Dubbed "China's Schwarzman," Shan set up CSC with RMB 600,000. The company went public on China's New Third Board (NEEQ) in 2015, where it raised almost US$2 billion.

Founded in 2000, Shan Xiangshuang's private equity outfit China Science & Merchants Investment Management Group (CSC) has about US$10 billion under management. It has an extensive network in China and built relationships with more than 1,000 LPs. Dubbed "China's Schwarzman," Shan set up CSC with RMB 600,000. The company went public on China's New Third Board (NEEQ) in 2015, where it raised almost US$2 billion.

Lin Hai majored in Materials Science and Engineering at Tsinghua University and holds an EMBA from China Europe International Business School (CEIBS). He co-founded A8 Digital Music in 2000, which later became one of the largest digital music platforms in China. Lin is currently the secretary-general of CEIBS Alumni Mobile Club’ southern offices and the president of Shenzhen Nanshan Cultural & Creative Industry Association.

Lin Hai majored in Materials Science and Engineering at Tsinghua University and holds an EMBA from China Europe International Business School (CEIBS). He co-founded A8 Digital Music in 2000, which later became one of the largest digital music platforms in China. Lin is currently the secretary-general of CEIBS Alumni Mobile Club’ southern offices and the president of Shenzhen Nanshan Cultural & Creative Industry Association.

Founded in 2007 under the Chinese Fortune 500 company DunAn Group, the investment group manages total fund of RMB 6 billion today, with successful investment in 77 Chinese startups across multiple sectors including healthcare, advanced manufacturing, energy & cleantech, etc. It was nominated for “Top 10 Zhengjiang Investment Group” for seven years in a row and was awarded for “Chinese VC of Best Potential” in 2016 – 2017 by thecapital.com.cn.

Founded in 2007 under the Chinese Fortune 500 company DunAn Group, the investment group manages total fund of RMB 6 billion today, with successful investment in 77 Chinese startups across multiple sectors including healthcare, advanced manufacturing, energy & cleantech, etc. It was nominated for “Top 10 Zhengjiang Investment Group” for seven years in a row and was awarded for “Chinese VC of Best Potential” in 2016 – 2017 by thecapital.com.cn.

Founded in 2003, Hina Group is an investment bank that provides financial consulting services. It has helped more than 180 companies close their funding and perform M&As. The total value of these transactions is US$56 billion. Hina Group oversaw Alibaba’s acquisition of Ele.me and the merger Qunar.com and Ctrip. Hina Group manages over RMB 10 billion. It has invested in unicorns such as Hujiang.com and Youbao.

Founded in 2003, Hina Group is an investment bank that provides financial consulting services. It has helped more than 180 companies close their funding and perform M&As. The total value of these transactions is US$56 billion. Hina Group oversaw Alibaba’s acquisition of Ele.me and the merger Qunar.com and Ctrip. Hina Group manages over RMB 10 billion. It has invested in unicorns such as Hujiang.com and Youbao.

Taking venture capital to the next level of “Peace, Love and Seed funding”, Nordic Makers is a hands-on seed stage investor with business experience in the Nordic countries and abroad. The firm is founded and managed by serial entrepreneurs who are passionate about building and scaling tech companies for future M&A strategic planning and collaborations.

Taking venture capital to the next level of “Peace, Love and Seed funding”, Nordic Makers is a hands-on seed stage investor with business experience in the Nordic countries and abroad. The firm is founded and managed by serial entrepreneurs who are passionate about building and scaling tech companies for future M&A strategic planning and collaborations.

Tuvalum: Fast-growing vertical marketplace for used quality bikes

Banking on organic reach, Tuvalum has set its sights on a €40 billion market

Chic by Choice: From Forbes' 30 Under 30 to insolvency

Lack of cashflow was the main reason for the demise of Chic by Choice, Europe's leading luxury dress rental e-store

In Portugal tourism tech gets disrupted, in time for post-Covid-19 era

As Portugal reopens to tourists early next month, the sector is banking on a new generation of tourism tech startups to enable safety and reassure visitors

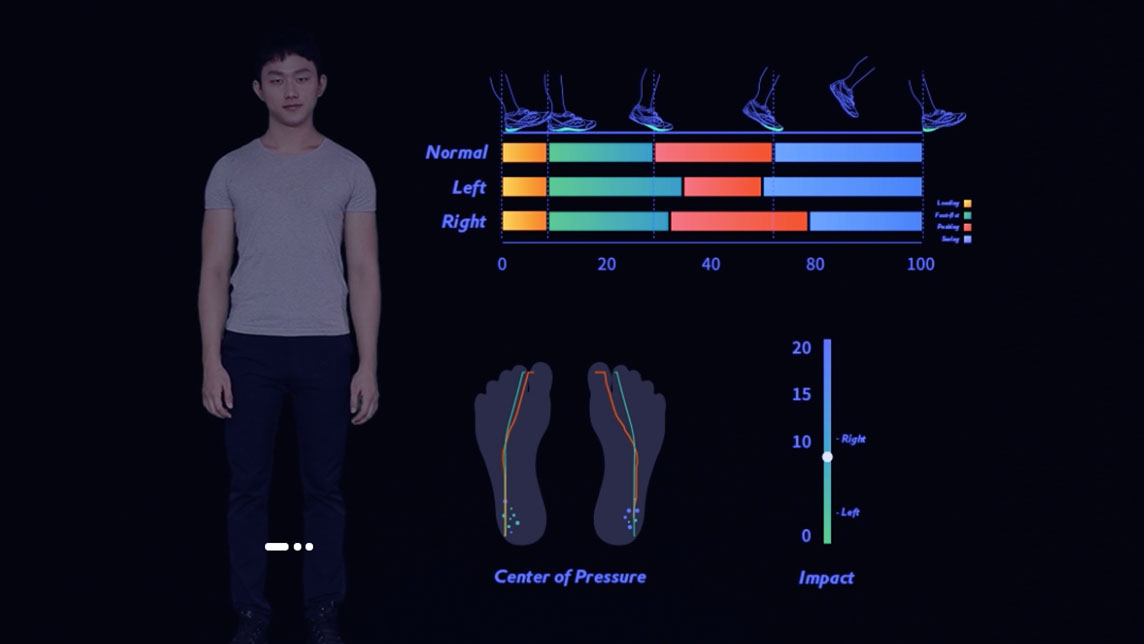

Sennotech offers affordable gait analysis on a mobile phone

Sennotech’s smart gait analysis system helps users choose comfy shoes, improve sports performance and foot health, and facilitate rehabilitation training

Harnessing its innovative startups, Portugal builds a better cleantech ecosystem

With help from government and private-sector initiatives, Portuguese cleantech startups are playing an ever-increasing role in helping the country meet its energy challenges while cutting harmful greenhouse gases

Shilling Capital Partners: Growing Portuguese tech businesses from seed

An early mover, the influential angel investing firm is accelerating local techs into Brazil and globally

James, an AI-powered tool for faster, more accurate credit risk assessment

Capable of analyzing over 7,000 types of data, the award-winning credit risk tool for financial institutions is also quick to install and roll out

Amid Covid-19 gloom, some bright spots in Portugal's tech startup scene

Despite a recession and doubling of the unemployment rate forecast this year, it's not all bad news for the Portuguese tech ecosystem

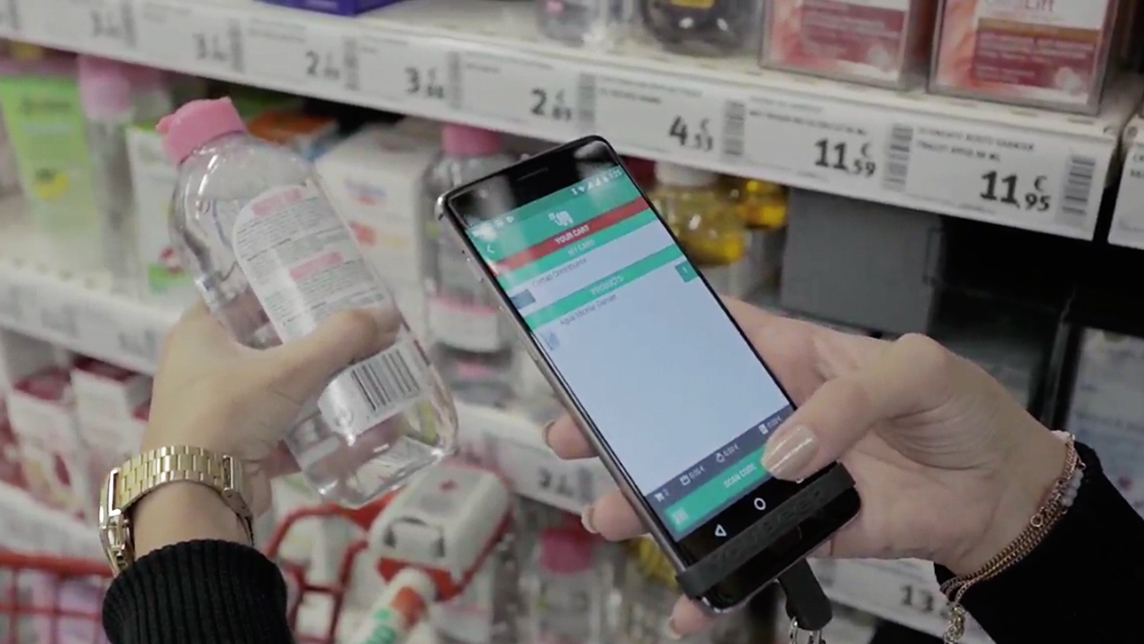

Xhockware's YouBeep app for speedy checkout, higher customer spending

Besides cutting checkout time to under 1 minute, this in-store shopping app also has other bright ideas: targeted marketing, allergy warnings, even wine-pairing tips

AddVolt: Taking the diesel out of cold-chain transport to make it cleaner, more efficient

The Porto-based startup is winning over the refrigerated goods transportation industry in Europe with the world's first renewable energy plug-in electrical system for the sector

Jungle.ai: Tapping data and AI to prevent outages and breakdowns

Forewarned is forearmed. Performance predictions by Jungle.ai can help save billions of dollars and hours of frustration caused by sudden power failures

Bdeo: Using video intelligence to automate, speed up insurance claims handling and payouts

Insurtech SaaS Bdeo lets insurers process 70% of motor and property claims without human staff; targets Series A close by year-end

Beonprice’s RMS sets the right price for every single hotel room 24/7

Ranked as 5th best RMS platform globally, Beonprice uses AI to stay ahead of competitors

Portugal oceantech II: Single-minded efforts to build an ecosystem of international reference

With dedicated accelerators and investment programs, supported by the EU’s vote of confidence, Portugal appears on track to lead in oceantech

Omniflow gets €2 million boost for its solar-, wind-powered IoT street lights

Thanks to Portugal's Omniflow, renewable energy street lamps doubling up as Wi-Fi hotspots, e-chargers and traffic monitors may soon be ubiquitous street furniture in tomorrow's smart cities

Sorry, we couldn’t find any matches for“portugal's”.