European Commission

-

DATABASE (124)

-

ARTICLES (236)

SFund, aka Guangzhou Industrial Investment Fund Management Co Ltd, was established in March 2013 by the Guangzhou Municipal Government to boost industrial upgrading in the city. Its business covers government fund management, private equity investment and venture capital investment.In July 2018, SFund became a subsidiary of Guangzhou City Construction Investment Group. The decision was made by the Guangzhou Municipal Government and the State-owned Assets Supervision and Administration Commission of the State Council.SFund has set up seven funds, managing total assets worth RMB 139bn. It has invested in 343 companies, 13 of which have become public-listed.

SFund, aka Guangzhou Industrial Investment Fund Management Co Ltd, was established in March 2013 by the Guangzhou Municipal Government to boost industrial upgrading in the city. Its business covers government fund management, private equity investment and venture capital investment.In July 2018, SFund became a subsidiary of Guangzhou City Construction Investment Group. The decision was made by the Guangzhou Municipal Government and the State-owned Assets Supervision and Administration Commission of the State Council.SFund has set up seven funds, managing total assets worth RMB 139bn. It has invested in 343 companies, 13 of which have become public-listed.

Co-founder of Therapixal

Pierre Fillard is Chief Science Officer and co-founder of Therapixel, creator of AI-powered breast cancer screening and diagnosis software MammoScreen. At Therapixel, he previously held the positions of CEO and CTO. Before founding Therapixel, Fillard was a senior research scientist at INRIA (National Institute for Research in Digital Science and Technology), where he focused on medical imaging and image processing. He has also been a visiting lecturer at CPE Lyon, a research associate at the French Alternative Energies and Atomic Agencies Commission, a PhD candidate at INRIA, and a research assistant at the University of North Carolina. He has a diploma from the HEC School of Management, a master’s in science, mathematics and computer science from the Université Jean Monnet Saint-Etienne and a degree in engineering, computer science, and applied mathematics from the Ecole Supérieure de Chimie Physique Electronique de Lyon.

Pierre Fillard is Chief Science Officer and co-founder of Therapixel, creator of AI-powered breast cancer screening and diagnosis software MammoScreen. At Therapixel, he previously held the positions of CEO and CTO. Before founding Therapixel, Fillard was a senior research scientist at INRIA (National Institute for Research in Digital Science and Technology), where he focused on medical imaging and image processing. He has also been a visiting lecturer at CPE Lyon, a research associate at the French Alternative Energies and Atomic Agencies Commission, a PhD candidate at INRIA, and a research assistant at the University of North Carolina. He has a diploma from the HEC School of Management, a master’s in science, mathematics and computer science from the Université Jean Monnet Saint-Etienne and a degree in engineering, computer science, and applied mathematics from the Ecole Supérieure de Chimie Physique Electronique de Lyon.

Finch Capital is formerly known as Orange Growth Capital. Operating from their offices in Amsterdam, London and Singapore, they invest in European and Southeast Asian early-stage companies that have already generated revenue. They are "thematic investors", focusing on enabling technological innovation for the finance services sector.

Finch Capital is formerly known as Orange Growth Capital. Operating from their offices in Amsterdam, London and Singapore, they invest in European and Southeast Asian early-stage companies that have already generated revenue. They are "thematic investors", focusing on enabling technological innovation for the finance services sector.

Founder, CEO of CO2 Revolution

Juan Carlos Sesma Fraguas (b. 1983) is Founder and CEO of CO2 Revolution, based in Melida, near Tudela, Navarre, Spain. He established the company in May 2018, after two years spent developing intelligent seeds, known as 'Iseeds', that he also patented. Before setting up CO2 Revolution, he worked in logistics and management at Aldi, El Corte Inglés and the International Meal Company. He previously completed an MBA at the European Forum School of Business of Navarre.

Juan Carlos Sesma Fraguas (b. 1983) is Founder and CEO of CO2 Revolution, based in Melida, near Tudela, Navarre, Spain. He established the company in May 2018, after two years spent developing intelligent seeds, known as 'Iseeds', that he also patented. Before setting up CO2 Revolution, he worked in logistics and management at Aldi, El Corte Inglés and the International Meal Company. He previously completed an MBA at the European Forum School of Business of Navarre.

CMO and co-founder of agroSingularity

In 2019, Daniel Andreu Acosta became the CMO and co-founder of agroSingularity, a Murcia-based startup producing natural powder ingredients from discarded agricultural by-products.He has over 10 years of experience in sales and marketing. He was also a managing partner at FuelUp Business Factory, a business boutique specializing in high-tech solutions for retail and customer intelligence. Acosta is also a guest professor at the European Business Factory and the Catholic University of Murcia.

In 2019, Daniel Andreu Acosta became the CMO and co-founder of agroSingularity, a Murcia-based startup producing natural powder ingredients from discarded agricultural by-products.He has over 10 years of experience in sales and marketing. He was also a managing partner at FuelUp Business Factory, a business boutique specializing in high-tech solutions for retail and customer intelligence. Acosta is also a guest professor at the European Business Factory and the Catholic University of Murcia.

CEO and Co-founder of Solatom

Miguel Frasquet Herraiz is passionate about the energy sector, having worked for six years on projects in China, the UAE and several European countries, as well as four years at the CTAER (Advanced Technology Centre for Renewable Energy) as an engineer and solar R&D coordinator. In 2016, Frasquet co-founded Solatom based on his PhD thesis and is currently the CEO of the startup that develops solar concentrators for industrial applications.

Miguel Frasquet Herraiz is passionate about the energy sector, having worked for six years on projects in China, the UAE and several European countries, as well as four years at the CTAER (Advanced Technology Centre for Renewable Energy) as an engineer and solar R&D coordinator. In 2016, Frasquet co-founded Solatom based on his PhD thesis and is currently the CEO of the startup that develops solar concentrators for industrial applications.

Established in 2006, European private equity firm Vitruvian Partners focuses on asset-light companies in its targeted sectors. The firm has a successful track record with more than 85 transactions completed. Vitruvian Partners invests £25 million to over £150 million in companies typically valued at £50 million to over £500 million.

Established in 2006, European private equity firm Vitruvian Partners focuses on asset-light companies in its targeted sectors. The firm has a successful track record with more than 85 transactions completed. Vitruvian Partners invests £25 million to over £150 million in companies typically valued at £50 million to over £500 million.

Frontline Ventures is a London-based VC firm that typically invests in early-stage B2B companies with the bulk of funding going toward European companies seeking a U.S. expansion. The current Fund II, worth €60 million, closed in 2016 and they are looking to make investments of between €200,000 and €3 million each.

Frontline Ventures is a London-based VC firm that typically invests in early-stage B2B companies with the bulk of funding going toward European companies seeking a U.S. expansion. The current Fund II, worth €60 million, closed in 2016 and they are looking to make investments of between €200,000 and €3 million each.

Founded in October 2015, Pagoda Investment is a private equity firm focusing on TMT, consumer products, healthcare and education. Its key investors include Queensland Investment Corporation Limited, a Queensland-based Australian VC, and some European-based family funds as well as pension funds, with a total of RMB 5bn under management.

Founded in October 2015, Pagoda Investment is a private equity firm focusing on TMT, consumer products, healthcare and education. Its key investors include Queensland Investment Corporation Limited, a Queensland-based Australian VC, and some European-based family funds as well as pension funds, with a total of RMB 5bn under management.

Samos Investments is a private equity investor that works with venture funds and other investors based in Europe and USA. It focuses on European startups that have high growth potential. Its portfolio includes companies in fintech, energy, natural resources, e-commerce, retail and digital media.

Samos Investments is a private equity investor that works with venture funds and other investors based in Europe and USA. It focuses on European startups that have high growth potential. Its portfolio includes companies in fintech, energy, natural resources, e-commerce, retail and digital media.

Phitrust Partenaires is a France-based investment fund focused on social businesses in Europe and Asia.In Europe, the company acts as a VC firm dedicated to impact investing. Its investment vehicle contributes €150,000 to €800,000 to support projects that address social needs. Phitrust Partenaires also works in partnership with prominent European social funds.

Phitrust Partenaires is a France-based investment fund focused on social businesses in Europe and Asia.In Europe, the company acts as a VC firm dedicated to impact investing. Its investment vehicle contributes €150,000 to €800,000 to support projects that address social needs. Phitrust Partenaires also works in partnership with prominent European social funds.

Founded in 2008 and headquartered in Xiamen, Fujian Province, Meitu is a public company traded at HK Stock Exchange.Its products include photo-editing and sharing software Meitu Xiuxiu(MeituPic), short video app Meipai, apps focusing on oversea users AirBrush and BeautyPlus, etc. (https://corp.meitu.com/news/news/110.html) It reported having a MAU of 3320 million adding up all its apps in 2018. (https://wallstreetcn.com/articles/3497467)It used to have a smartphone line but has announced to shut down the line. Meitu let Xiaomi handle its development and sale and it got a commission.

Founded in 2008 and headquartered in Xiamen, Fujian Province, Meitu is a public company traded at HK Stock Exchange.Its products include photo-editing and sharing software Meitu Xiuxiu(MeituPic), short video app Meipai, apps focusing on oversea users AirBrush and BeautyPlus, etc. (https://corp.meitu.com/news/news/110.html) It reported having a MAU of 3320 million adding up all its apps in 2018. (https://wallstreetcn.com/articles/3497467)It used to have a smartphone line but has announced to shut down the line. Meitu let Xiaomi handle its development and sale and it got a commission.

Co-founder and CEO of Beonprice

Rubén Sánchez Martín majored in Computer Engineering at the University of Salamanca and has an MBA from the European Business School in Madrid. In 2017, he joined the Endeavor Scaling Entrepreneurial Ventures program with Harvard Business School.Based in Salamanca, he is the founding partner of Socio that has been operating two women-only fitness centers Curves since 2006. In 2009, he established Chocolat Factory. While running the businesses, Sánchez had been working at IT group GPM Innovación since 1998. He left GPM and closed down his chocolate delicatessen in 2012 to focus on Beonprice as co-founder and CEO.

Rubén Sánchez Martín majored in Computer Engineering at the University of Salamanca and has an MBA from the European Business School in Madrid. In 2017, he joined the Endeavor Scaling Entrepreneurial Ventures program with Harvard Business School.Based in Salamanca, he is the founding partner of Socio that has been operating two women-only fitness centers Curves since 2006. In 2009, he established Chocolat Factory. While running the businesses, Sánchez had been working at IT group GPM Innovación since 1998. He left GPM and closed down his chocolate delicatessen in 2012 to focus on Beonprice as co-founder and CEO.

Co-founder and CEO of Waynabox

In 2014, Pau Sendra graduated in Aeronautical Engineering at Universitat Politècnica de Catalunya (UPC), where he worked as a research assistant for one academic year. He studied for one year at the Aeronautical Business School ITAérea in 2012, working there for almost two years until June 2014. He holds a private pilot license from the European Aviation Safety Agency.The 20-year old Sendra brainstormed the idea of surprise citybreaks “Wayna” while on holiday with two friends in 2013. Since then, Sendra has received several entrepreneurial awards, winning the Young Entrepreneurs National Contest in 2015.

In 2014, Pau Sendra graduated in Aeronautical Engineering at Universitat Politècnica de Catalunya (UPC), where he worked as a research assistant for one academic year. He studied for one year at the Aeronautical Business School ITAérea in 2012, working there for almost two years until June 2014. He holds a private pilot license from the European Aviation Safety Agency.The 20-year old Sendra brainstormed the idea of surprise citybreaks “Wayna” while on holiday with two friends in 2013. Since then, Sendra has received several entrepreneurial awards, winning the Young Entrepreneurs National Contest in 2015.

CXO and co-founder of Gestoos

Germán León is an experienced UX/UI innovator and investor who is the Chief Experience Officer (CXO) and co-founder of Gestoos, a gesture recognition startup. Before establishing Gestoos, León was the European director of Oblong Industries, the firm that developed the technology used in the Steven Spielberg movie Minority Report. León had also co-founded Imersivo, the first customer recognition company that connects online shoppers to physical retail stores.

Germán León is an experienced UX/UI innovator and investor who is the Chief Experience Officer (CXO) and co-founder of Gestoos, a gesture recognition startup. Before establishing Gestoos, León was the European director of Oblong Industries, the firm that developed the technology used in the Steven Spielberg movie Minority Report. León had also co-founded Imersivo, the first customer recognition company that connects online shoppers to physical retail stores.

Impact investing: Spanish startups with a cause and the ecosystem backing them

As more thought and money go into socially and environmentally responsible projects, Spanish entrepreneurs, investors and big businesses are following suit

Europe ramps up development of local EV battery sector in race to zero emissions

Startups, automakers jostle or unite to ride the fast-growing EV battery market, as the EU pumps billions into developing its own value chain, to cut reliance on imports

MatMap: Making the construction sector more sustainable

Alicante-based startup MatMap gives a second lease of life to used construction materials that account for almost a third of EU waste

AEInnova: Energy harvester to generate €10 million revenue, plans Series A

A whopping 70% of our energy generated gets lost as waste heat. A Spanish startup has developed innovative solutions to collect the waste heat that industry literally throws away and convert it into electricity

StudentFinance: AI screening software matches students to IT courses and jobs

StudentFinance also offers "Study now, pay later" model, making IT courses financially accessible while helping companies overcome skilled tech talent shortage

Smart Agrifood Summit: Investors on key focuses and outlook in European agrifood

From boosting public-private funds to grow more European scale-ups, to improving the investment ecosystem, key investors at the Smart Agrifood Summit offer their take on how the EU agrifood sector could go a longer way

Bound4Blue’s aeronautical tech propels first sustainable shipping vessel in the Pacific

Winning €5m fresh funding, Bound4Blue also scores with its EC-backed pilot, the first of its kind, offering new possibilities to cargo vessels seeking sustainable transportation

For equality in education, Odilo brings books in the cloud free to millions worldwide

The "Amazon for digital content" Spanish edtech startup delivers virtual libraries and classrooms to kids and adults worldwide

Sweden's imogo pioneers eco-friendly dye spraying system

The startup’s dyeing and finishing solutions convert the most resource-consuming parts of textile value chains into sustainable processes, with virtually no wastewater and using less energy and chemicals

New Food Invest: Opportunities in the European alt-protein space

With a record €2.4bn investment in 2019, Europe’s foodtech sector appears poised for continued growth, but startups, corporations, governments and even universities can do more, experts say

South Summit 2021: European seed investment is booming post-Covid

Investors from The Fund, Northzone and Pale Blue Dot highlight climate change, consumer credit and business tools as hot areas to follow

2gether: The world's first crypto-collaborative financial platform

Banking on the opportunities afforded by blockchain, 2gether is owned by its customers who get commission-free financial services in euros and cryptocurrency

Backed by pharmas, doctors, medtech startup DyCare is expanding fast across Europe

Its remote musculoskeletal rehabilitation and monitoring system sets to improve rehabilitation outcomes in an overtaxed sector

IP Buoys: Mooring 4.0 smart buoys to protect marine ecosystems

Save the Posidonia! That’s the call from enterprising sailors who, with their startup IP Buoys, have found a way to protect the seagrass and marine life from the damaging impact of nautical tourism

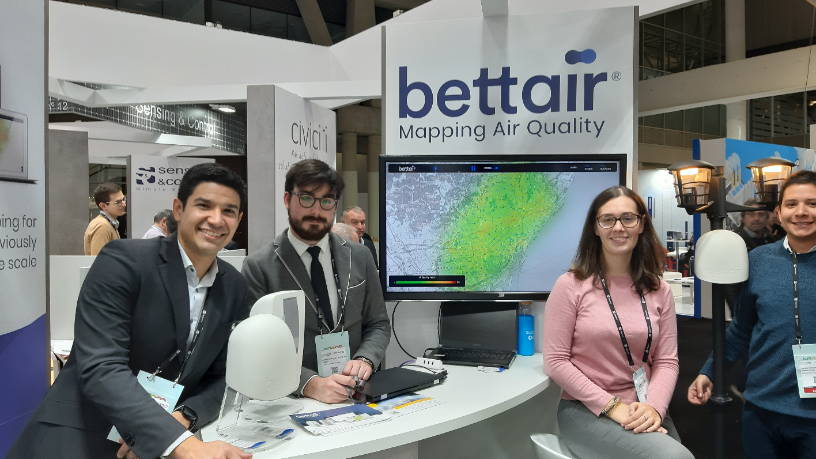

Bettair's air pollution monitoring system for cities promises over 90% accuracy

Combining smart sensors, AI and machine learning, Barcelona-based Bettair has developed a unique, affordable PaaS to accurately measure pollution levels in urban areas

Sorry, we couldn’t find any matches for“European Commission”.