Gateway 49

-

DATABASE (11)

-

ARTICLES (30)

Johan Tahardi is one of the co-founders of MailTarget, a SaaS company that helps SMEs automate email-based marketing. He is also an angel investor and advisor to Infra Digital Nusantara, a new payment gateway that digitizes school fee and apartment bill payments.

Johan Tahardi is one of the co-founders of MailTarget, a SaaS company that helps SMEs automate email-based marketing. He is also an angel investor and advisor to Infra Digital Nusantara, a new payment gateway that digitizes school fee and apartment bill payments.

Founded in 2015, Mandiri Capital Indonesia (MCI) is the venture capital arm of Bank Mandiri, Indonesia’s largest bank. With the full weight of the Mandiri assets, network and knowhow at its disposal, MCI positions itself as a gateway for fintech firms looking to tap into Indonesia’s vast market potential. It also hosts Mandiri Digital Incubator and StartupBerbagi (Startups Share) to help SMEs go digital by connecting them to startups that can provide free services.

Founded in 2015, Mandiri Capital Indonesia (MCI) is the venture capital arm of Bank Mandiri, Indonesia’s largest bank. With the full weight of the Mandiri assets, network and knowhow at its disposal, MCI positions itself as a gateway for fintech firms looking to tap into Indonesia’s vast market potential. It also hosts Mandiri Digital Incubator and StartupBerbagi (Startups Share) to help SMEs go digital by connecting them to startups that can provide free services.

Central Capital Ventura is backed by Bank Central Asia (BCA), one of Indonesia's largest banks. The venture capital firm is focused on identifying and investing in fintech and other technologies that can potentially support BCA's own businesses and service ecosystem. Central Capital Venture has backed Indonesian microlending company JULO and Singapore payments processing company Wallex. It has also invested in Gerbang Pembayaran Nasional (GPN), Indonesia's new national card-based payment gateway system.

Central Capital Ventura is backed by Bank Central Asia (BCA), one of Indonesia's largest banks. The venture capital firm is focused on identifying and investing in fintech and other technologies that can potentially support BCA's own businesses and service ecosystem. Central Capital Venture has backed Indonesian microlending company JULO and Singapore payments processing company Wallex. It has also invested in Gerbang Pembayaran Nasional (GPN), Indonesia's new national card-based payment gateway system.

Medigo simplifies digitization for hospitals, meeting their operational and business needs; brings patients closer to their healthcare providers, with easy access to medical, insurance records.

Medigo simplifies digitization for hospitals, meeting their operational and business needs; brings patients closer to their healthcare providers, with easy access to medical, insurance records.

Co-founder of Xendit

Vivek Ahuja graduated from the United States Naval Academy with a Quantitative Economics degree in 2008. He went on to receive training for nuclear engineering and submarine officer roles in the US Navy, serving on the nuclear submarine USS Michigan for three years. He left the US Navy in 2013 to pursue an MBA at the University of California, Berkeley. Ahuja was briefly involved as a co-founder of payments gateway Xendit, but left the startup to join fintech company Affirm Inc in 2015.

Vivek Ahuja graduated from the United States Naval Academy with a Quantitative Economics degree in 2008. He went on to receive training for nuclear engineering and submarine officer roles in the US Navy, serving on the nuclear submarine USS Michigan for three years. He left the US Navy in 2013 to pursue an MBA at the University of California, Berkeley. Ahuja was briefly involved as a co-founder of payments gateway Xendit, but left the startup to join fintech company Affirm Inc in 2015.

Co-founder and CTO of Akseleran

Rassel Pratomo is a software and web engineer with over eight years of experience. He started work in 2011 as a network engineer at Artha Mitra Interdata, a solutions integrator company. In the following years, he worked at various companies and spent the longest time at AppsFoundry developing web services and payment gateway systems. In 2016, he joined Ivan Tambunan, William Tambunan and Christopher Gultom in developing Akseleran, an equity crowdlending startup that would later become a P2P productive lending platform. After joining as technical lead, he later became CTO of Akseleran in 2017, a little after Akseleran launched its service.

Rassel Pratomo is a software and web engineer with over eight years of experience. He started work in 2011 as a network engineer at Artha Mitra Interdata, a solutions integrator company. In the following years, he worked at various companies and spent the longest time at AppsFoundry developing web services and payment gateway systems. In 2016, he joined Ivan Tambunan, William Tambunan and Christopher Gultom in developing Akseleran, an equity crowdlending startup that would later become a P2P productive lending platform. After joining as technical lead, he later became CTO of Akseleran in 2017, a little after Akseleran launched its service.

As the Korean conglomerate’s gateway to deep tech startups and innovation, Samsung NEXT covers product development, investment, M&A and partnerships in a single entity to complement Samsung’s hardware business. Outside of South Korea, Samsung NEXT has offices in Berlin, Tel Aviv and in the US in New York, San Francisco, and Silicon Valley. Its portfolio currently includes 55 companies with recent investments including in Series A rounds for Tetrate, Brodmann17 and RapidDeploy, as well as Healthy.io's Series B. It has managed 13 exits to date, including LoopPay, Automated Insights and EyeVerify. The VC was established in 2013.

As the Korean conglomerate’s gateway to deep tech startups and innovation, Samsung NEXT covers product development, investment, M&A and partnerships in a single entity to complement Samsung’s hardware business. Outside of South Korea, Samsung NEXT has offices in Berlin, Tel Aviv and in the US in New York, San Francisco, and Silicon Valley. Its portfolio currently includes 55 companies with recent investments including in Series A rounds for Tetrate, Brodmann17 and RapidDeploy, as well as Healthy.io's Series B. It has managed 13 exits to date, including LoopPay, Automated Insights and EyeVerify. The VC was established in 2013.

Based in the Netherlands, Prosus is a global investor in consumer tech and Internet companies. It is a subsidiary of South African tech investment company Naspers. In August 2021 the two companies completed a cross-holding agreement in which Naspers owns 57% of Prosus while Prosus owns 49% of Naspers. The two companies share a single board.Prosus is the largest shareholder in Chinese tech giant Tencent and Russian tech platform Mail.ru. Meanwhile, its venture division invests in a variety of fintech, food delivery, and other consumer tech companies. In Indonesia, it has invested in Bibit, a stock and mutual funds investment platform, as well as fishery trading and community development startup Aruna. It has also invested in edtech platforms like Indian executive learning platform Eruditus, and US-based coding education company SoloLearn.

Based in the Netherlands, Prosus is a global investor in consumer tech and Internet companies. It is a subsidiary of South African tech investment company Naspers. In August 2021 the two companies completed a cross-holding agreement in which Naspers owns 57% of Prosus while Prosus owns 49% of Naspers. The two companies share a single board.Prosus is the largest shareholder in Chinese tech giant Tencent and Russian tech platform Mail.ru. Meanwhile, its venture division invests in a variety of fintech, food delivery, and other consumer tech companies. In Indonesia, it has invested in Bibit, a stock and mutual funds investment platform, as well as fishery trading and community development startup Aruna. It has also invested in edtech platforms like Indian executive learning platform Eruditus, and US-based coding education company SoloLearn.

COO and co-founder of Xendit

Tessa Wijaya joined Indonesian fintech Xendit as co-founder and COO in 2016, a year after the payment gateway startup graduated from the Y Combinator program and launched its platform in Indonesia.Wijaya obtained a master’s in philosophy from the University of Sydney in 2006 after graduating from Syracuse University’s Maxwell School of Citizenship and Public Affairs in 2003. She returned to Indonesia and worked as a corporate development officer for over three years. In 2010, she became an analyst at Principia Management Group and Fairways Investment Group, both being Southeast Asia-focused investment firms. In 2013, Wijaya went on to work as an associate at Singapore-based investment firm Mizuho Asia Partners for over three years before joining Xendit back in Jakarta.

Tessa Wijaya joined Indonesian fintech Xendit as co-founder and COO in 2016, a year after the payment gateway startup graduated from the Y Combinator program and launched its platform in Indonesia.Wijaya obtained a master’s in philosophy from the University of Sydney in 2006 after graduating from Syracuse University’s Maxwell School of Citizenship and Public Affairs in 2003. She returned to Indonesia and worked as a corporate development officer for over three years. In 2010, she became an analyst at Principia Management Group and Fairways Investment Group, both being Southeast Asia-focused investment firms. In 2013, Wijaya went on to work as an associate at Singapore-based investment firm Mizuho Asia Partners for over three years before joining Xendit back in Jakarta.

CEO and co-founder of Xendit

Moses Lo comes from an entrepreneurial family, his father acquired a failing business in Australia and turned it into a successful company. The family business inspired Lo to start his own fashion business in Australia after graduating in finance and commerce at the University of New South Wales in 2010.Lo initially gained work experience as an analyst in 2008 as part of his undergraduate finance and commerce programs in Australia. In 2011, he became an associate at the Boston Consulting Group in Australia. After two years, he was promoted to senior associate but left BCG in 2013 to focus on his menswear ventures until 2014.Lo decided to get first-hand tech startup experience in the Silicon Valley, working at Amazon while completing an MBA program at the University of California, Berkeley. In 2015, he decided to established a P2P payments platform Xendit in Indonesia. The platform has since pivoted into a payment gateway service and became a unicorn in 2021, with Lo as CEO based in California and Jakarta. He was also featured in Forbes’ 30 Under 30 list for Asian figures in finance and venture capital in 2016.

Moses Lo comes from an entrepreneurial family, his father acquired a failing business in Australia and turned it into a successful company. The family business inspired Lo to start his own fashion business in Australia after graduating in finance and commerce at the University of New South Wales in 2010.Lo initially gained work experience as an analyst in 2008 as part of his undergraduate finance and commerce programs in Australia. In 2011, he became an associate at the Boston Consulting Group in Australia. After two years, he was promoted to senior associate but left BCG in 2013 to focus on his menswear ventures until 2014.Lo decided to get first-hand tech startup experience in the Silicon Valley, working at Amazon while completing an MBA program at the University of California, Berkeley. In 2015, he decided to established a P2P payments platform Xendit in Indonesia. The platform has since pivoted into a payment gateway service and became a unicorn in 2021, with Lo as CEO based in California and Jakarta. He was also featured in Forbes’ 30 Under 30 list for Asian figures in finance and venture capital in 2016.

Goat Capital is a venture capital fund was set up by video livestreamer Justin.tv and Twitch co-founder Justin Kan and Robin Chan, also an angel investor and entrepreneur. Chan met Kan while working at Verizon Wireless when Justin.tv was being launched. Both have since become private investors for over 10 years, with early investments including Twitter, Xiaomi, Bird, Uber and Square. Established in September 2020, the fund’s name was inspired by the goat because good startup founders need to be agile and resilient to survive and be successful, according to Kan.Kan was also an early investor of Indonesian payment gateway Xendit before Goat Capital joined Xendit’s $150m Series C round in September 2021. Goat Capital’s portfolio includes corporate credit card startup Kodo, Indian neobank Bueno Finance, carbon capture developers Holy Grail and web development tool Spore. The hybrid incubator and VC fund has already secured $25m and aims to raise a total of $40m to invest in diverse sectors like digital health, e-commerce, robotics, climate change and gaming entertainment. Funding per startup would range from $500,000 to $3m.

Goat Capital is a venture capital fund was set up by video livestreamer Justin.tv and Twitch co-founder Justin Kan and Robin Chan, also an angel investor and entrepreneur. Chan met Kan while working at Verizon Wireless when Justin.tv was being launched. Both have since become private investors for over 10 years, with early investments including Twitter, Xiaomi, Bird, Uber and Square. Established in September 2020, the fund’s name was inspired by the goat because good startup founders need to be agile and resilient to survive and be successful, according to Kan.Kan was also an early investor of Indonesian payment gateway Xendit before Goat Capital joined Xendit’s $150m Series C round in September 2021. Goat Capital’s portfolio includes corporate credit card startup Kodo, Indian neobank Bueno Finance, carbon capture developers Holy Grail and web development tool Spore. The hybrid incubator and VC fund has already secured $25m and aims to raise a total of $40m to invest in diverse sectors like digital health, e-commerce, robotics, climate change and gaming entertainment. Funding per startup would range from $500,000 to $3m.

ChainGo is using Ethereum to boost the €2.7-trillion logistics sector

Co-founders Andres Garrido and Jordan Sorensen are using Ethereum to help the unwieldy ocean freight industry to become more efficient, transparent and secure through the blockchain's decentralized system.

Spanish business angel Carlos Blanco is betting big bucks on local startups

The serial investor learnt the tricks of the trade early at Barcelona’s flea market

IONIC AI: Human-centric technology that enhances mobile phone performance

Giving new life to old mobile phones and upgrading cheaper ones, IONIC AI's tech also keeps gamers' phones cool for longer usage

Choose from over 10,000 mental health therapists at Yidianling

Startup's 24/7 services will include AI-powered chatbots to help more Chinese cope with mental health issues, amid lack of therapists

Wahyoo wins seed funding in push to upgrade Indonesia's street food sector

It's launching a B2C app and an integrated POS system in 2019 to boost street food sales and hawkers' productivity, CEO Peter Shearer tells CompassList

With a new focus on smart clinics, healthcare SaaS startup Medigo offers Covid-19 testing

A pivot to revenue-sharing and partnerships to provide Covid-19 testing has given Medigo a fighting chance, with a new funding round on the cards

UPDATE: Indonesian mPOS startup Cashlez raises IDR 85bn from IPO in May

Cashlez is the first fintech company to list on the Indonesia Stock Exchange; will spend over 60% of proceeds to acquire payments company in toll road market

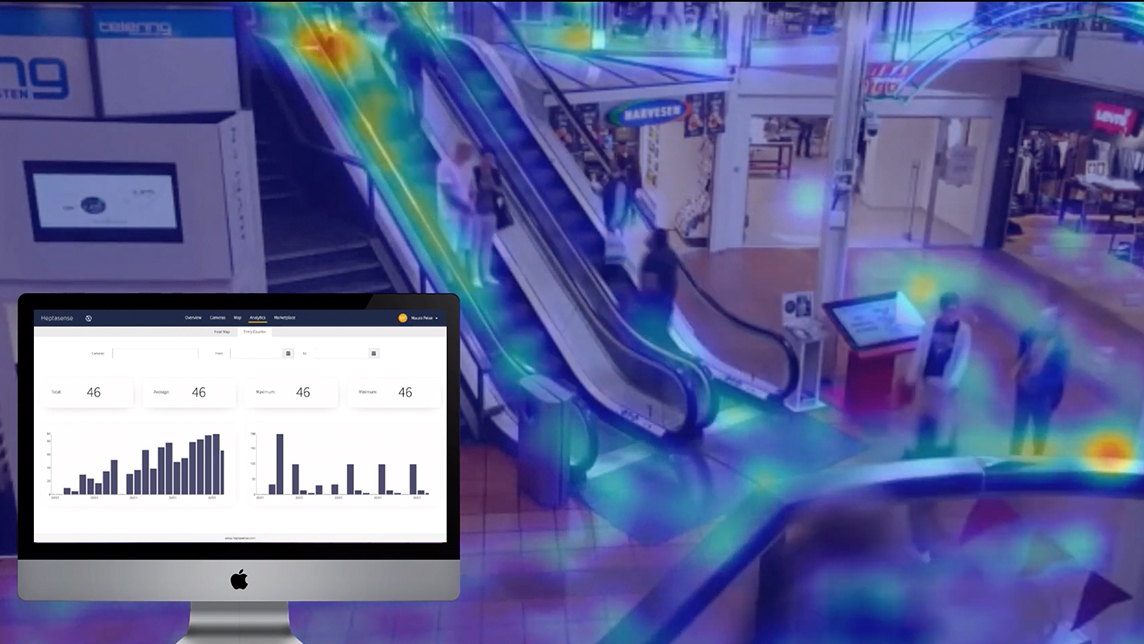

Heptasense wins trust at a time of (lax) global surveillance

There may be some 700 million surveillance cameras running worldwide in today's age of global security threats, yet 98% of them are unmonitored. A Lisbon-based startup is promising real-time response and greater reliability in security tech

Good Startup: Alt-protein products can be better than real meat

The investor of Eat Just, Ripple Foods and more expects its portfolio companies will exit in the next four to six years, mostly through acquisition

Civiclytics is a Covid-19 information crowdsourcing and sharing platform supported by the Inter-American Development Bank, as Citibeats reports increased demand for its data analytics and actionable insights

Indogen Capital on exits, helping foreign startups succeed in Indonesia

Indogen Capital's Managing Partner Chandra Firmanto sheds some light on the VC's partnerships and exits to date, from Venteny to Spacemob

Indonesian P2P lending platform Investree expands to the Philippines

With local partner Filinvest Development Corporation, Investree Philippines will support the country’s SMEs with its lending-based crowdfunding platform

Gojek acquires Indonesian POS startup Moka, gains greater share of SME fintech market

Deal reportedly worth $120m will add Moka's network of over 30,000 merchants to Gojek's reach

Raising $50m second fund, Indogen Capital seeks more international partners and exits

Cooperation is key to Indogen's investment thesis, as it looks to help more foreign VCs and their portfolio startups find success in Southeast Asia's biggest market

Medigo, a long-awaited solution for Indonesia healthcare to go digital

Winning seed funding from Venturra Capital, Medigo seeks to help Indonesian hospitals make the transition into digital administration. We spoke to co-founders Harya Bimo and Faizal Rahman to find out more

- 1

- 2

Sorry, we couldn’t find any matches for“Gateway 49”.