Google Glass

-

DATABASE (68)

-

ARTICLES (110)

Co-founder and CTO of Zen Video

Huang Jian obtained his doctoral degree in Computer Science from Pennsylvania State University. He was the tech head at Google Shopping. While working at Microsoft Research, he participated in the development of the Web N-gram services. His research focuses on Natural Language Processing (NLP) and machine learning.

Huang Jian obtained his doctoral degree in Computer Science from Pennsylvania State University. He was the tech head at Google Shopping. While working at Microsoft Research, he participated in the development of the Web N-gram services. His research focuses on Natural Language Processing (NLP) and machine learning.

Horizons Ventures is a Hong Kong-based venture capital firm that manages the personal investments of Li Ka-shing, one of Hong Kong’s richest businessmen. Horizons’ investments cover a wide range of tech, media, and telecommunications companies. Standouts include artificial intelligence company DeepMind (acquired by Google in 2014), plant-based meat replacement makers Impossible Foods, and video conferencing software Zoom. It has also backed consumer-facing businesses like Atomo Coffee in Australia, Kopi Kenangan in Indonesia, and US-based distilled spirits company Endless West.

Horizons Ventures is a Hong Kong-based venture capital firm that manages the personal investments of Li Ka-shing, one of Hong Kong’s richest businessmen. Horizons’ investments cover a wide range of tech, media, and telecommunications companies. Standouts include artificial intelligence company DeepMind (acquired by Google in 2014), plant-based meat replacement makers Impossible Foods, and video conferencing software Zoom. It has also backed consumer-facing businesses like Atomo Coffee in Australia, Kopi Kenangan in Indonesia, and US-based distilled spirits company Endless West.

Singapore-based VC Jungle Ventures set up its SeedPlus fund in 2016. The SGD 25m fund is backed by a diverse range of investors including Eight Roads, Infocomm Investments, Accel Partners, RNT Associates, SGInnovate and Cisco. A fund run by Jungle Ventures partner and Indian tycoon Ratan Tata has also contributed to SeedPlus.Early-stage investments of SGD 0.5–1m are available for startups in Southeast Asia. The fund also provides hands-on expertise and support services, including resources from partners like Google SEA and PwC Singapore.

Singapore-based VC Jungle Ventures set up its SeedPlus fund in 2016. The SGD 25m fund is backed by a diverse range of investors including Eight Roads, Infocomm Investments, Accel Partners, RNT Associates, SGInnovate and Cisco. A fund run by Jungle Ventures partner and Indian tycoon Ratan Tata has also contributed to SeedPlus.Early-stage investments of SGD 0.5–1m are available for startups in Southeast Asia. The fund also provides hands-on expertise and support services, including resources from partners like Google SEA and PwC Singapore.

One of Silicon Valley's most prestigious venture capital firms, Sequoia Capital, was established in 1972. Sequoia’s investment thesis leads them to invest primarily in early-stage companies, but they have also invested in Series F rounds and beyond. As a former venture capital firm, it has also made exits from major internet companies, such as Google, Apple, Nvidia, and GitHub. Sequoia Capital operates divisions in Israel, Hong Kong and Mainland China. It also acquired India-based VC Westbridge to form Sequoia Capital India.

One of Silicon Valley's most prestigious venture capital firms, Sequoia Capital, was established in 1972. Sequoia’s investment thesis leads them to invest primarily in early-stage companies, but they have also invested in Series F rounds and beyond. As a former venture capital firm, it has also made exits from major internet companies, such as Google, Apple, Nvidia, and GitHub. Sequoia Capital operates divisions in Israel, Hong Kong and Mainland China. It also acquired India-based VC Westbridge to form Sequoia Capital India.

Facebook is a social networking platform founded by Mark Zuckerberg and partners in 2004. It is listed on the NASDAQ exchange under ticker code FB. Throughout its development it has acquired various complementary social media and networking services, such as Instagram and WhatsApp.As an investor, Facebook has invested in a wide range of companies. It invested in and later acquired virtual reality headset developers Oculus, and also invested in e-commerce enabler Meesho. In 2020, it joined Google, Tencent and other major tech investors as an investor in Gojek.

Facebook is a social networking platform founded by Mark Zuckerberg and partners in 2004. It is listed on the NASDAQ exchange under ticker code FB. Throughout its development it has acquired various complementary social media and networking services, such as Instagram and WhatsApp.As an investor, Facebook has invested in a wide range of companies. It invested in and later acquired virtual reality headset developers Oculus, and also invested in e-commerce enabler Meesho. In 2020, it joined Google, Tencent and other major tech investors as an investor in Gojek.

Co-founder and CEO of Line Health

Coding since he was 15, Diogo Ortega worked as a freelance software developer while reading a business degree at the University of London. He had previously studied Audiovisual and Multimedia Technologies at the Polytechnic Institute of Lisbon.Ortega worked for six years at TAP Air Portugal until 2014 when he co-founded Line Health as CEO. He was the CEO. The healthtech was dissolved in 2018 and he eventually moved to the US to work for WW (formerly Weight Watchers) as a product manager. Currently based in San Francisco, he is working as a product manager at Google.

Coding since he was 15, Diogo Ortega worked as a freelance software developer while reading a business degree at the University of London. He had previously studied Audiovisual and Multimedia Technologies at the Polytechnic Institute of Lisbon.Ortega worked for six years at TAP Air Portugal until 2014 when he co-founded Line Health as CEO. He was the CEO. The healthtech was dissolved in 2018 and he eventually moved to the US to work for WW (formerly Weight Watchers) as a product manager. Currently based in San Francisco, he is working as a product manager at Google.

Serial entrepreneur Bernardo Hernández entered the tech startup scene with his first internet venture idealista.com that has now transformed into a leading real estate platform in Spain. Since then, he has invested in well-known names in the Spanish digital market like Spain’s popular social network Tuenti, local free classified ads Wallapop and on-demand delivery app Glovo. Hernández was awarded an honorary doctorate from the Universidad Camilo José Cela from Madrid when he was the Product Management director at Google in 2010. In September 2017, he became the executive chairman at Citibox.

Serial entrepreneur Bernardo Hernández entered the tech startup scene with his first internet venture idealista.com that has now transformed into a leading real estate platform in Spain. Since then, he has invested in well-known names in the Spanish digital market like Spain’s popular social network Tuenti, local free classified ads Wallapop and on-demand delivery app Glovo. Hernández was awarded an honorary doctorate from the Universidad Camilo José Cela from Madrid when he was the Product Management director at Google in 2010. In September 2017, he became the executive chairman at Citibox.

David Boronat is an internet enthusiast, with over 20 years of professional experience in the market. He is a mentor and advisor to tech startups in Spain and Latin America. He is passionate about digital strategies, UX and web analytics. Based in Mexico and the US, Boronat is currently managing two of his own businesses. In 2000, he became the CEO and founder of Multiplica, an international performance consultancy agency. In 2005, he founded Metriplica, a partner agency of Google Analytics, IBM, ComScore and Omniture. Metriplica offers digital measurement and data mining services.

David Boronat is an internet enthusiast, with over 20 years of professional experience in the market. He is a mentor and advisor to tech startups in Spain and Latin America. He is passionate about digital strategies, UX and web analytics. Based in Mexico and the US, Boronat is currently managing two of his own businesses. In 2000, he became the CEO and founder of Multiplica, an international performance consultancy agency. In 2005, he founded Metriplica, a partner agency of Google Analytics, IBM, ComScore and Omniture. Metriplica offers digital measurement and data mining services.

With a special interest in enterprise tech, Silicon Valley-based Omega Venture Partners has 25 startups in its portfolio and, to date, has invested from pre-seed to Series E stages. It has managed eight exits to date. Its most recent investments were in the 2020 $55m Series B round of US-based small business management platform ZenBusiness and in the February 2021 $50m Series B round of US voice transcription software Otter.ai. The investor boasts an extensive network of major corporations as advisors and partners including Google, Microsoft, Amazon, IBM, SAP and CitiGroup.

With a special interest in enterprise tech, Silicon Valley-based Omega Venture Partners has 25 startups in its portfolio and, to date, has invested from pre-seed to Series E stages. It has managed eight exits to date. Its most recent investments were in the 2020 $55m Series B round of US-based small business management platform ZenBusiness and in the February 2021 $50m Series B round of US voice transcription software Otter.ai. The investor boasts an extensive network of major corporations as advisors and partners including Google, Microsoft, Amazon, IBM, SAP and CitiGroup.

Charles Xue Biqun (b. 1953), alias Xue Manzi, is a popular Chinese-American billionaire venture capitalist and angel investor with over 10 million followers on Weibo. He studied foreign relations at the University of California, Berkeley. His most famous deal to date is his US$250,000 investment in Unitech in the early 1990s, which later became UTStarcom. The company went public in 2000, reaching a post-IPO value of over US$5 billion. He was also chairman of 8848.com (the earliest Chinese e-commerce network). Xue has invested in many internet startups in China, including PCPOP, Autohome, Xueqiu, CreatyChina, Community001 and 265.com (bought by Google).

Charles Xue Biqun (b. 1953), alias Xue Manzi, is a popular Chinese-American billionaire venture capitalist and angel investor with over 10 million followers on Weibo. He studied foreign relations at the University of California, Berkeley. His most famous deal to date is his US$250,000 investment in Unitech in the early 1990s, which later became UTStarcom. The company went public in 2000, reaching a post-IPO value of over US$5 billion. He was also chairman of 8848.com (the earliest Chinese e-commerce network). Xue has invested in many internet startups in China, including PCPOP, Autohome, Xueqiu, CreatyChina, Community001 and 265.com (bought by Google).

London-based financial services company Octopus Investments was founded in 2000. Since then, the firm has grown to a 500-strong company that manages £6 billion on behalf of more than 50,000 investors. It is part of Octopus Group. The VC firm has offices in New York, Singapore and Shanghai, besides London and has invested in 200 companies to date, almost half of them as the lead investor. It has seen 27 exits among its portfolio companies, including acquisitions by Microsoft, Amazon, and Google, with notable divested companies including Graze, Adbrain, SwiftKey and Zoopla.

London-based financial services company Octopus Investments was founded in 2000. Since then, the firm has grown to a 500-strong company that manages £6 billion on behalf of more than 50,000 investors. It is part of Octopus Group. The VC firm has offices in New York, Singapore and Shanghai, besides London and has invested in 200 companies to date, almost half of them as the lead investor. It has seen 27 exits among its portfolio companies, including acquisitions by Microsoft, Amazon, and Google, with notable divested companies including Graze, Adbrain, SwiftKey and Zoopla.

Abanlex is a Spanish law firm specialized in data protection and innovation technology. The firm has a team of cybersecurity consultants, technology lawyers, university professors and marketing specialists. Abanlex is well-known for its 2014 victory over Google in the 'Right to be forgotten' case, in which the European Court of Justice established the legal basis of responsibility of search engines concerning data and links appearing when searching for a specific name.Since 2011, Abanlex has been dedicated to defending blockchain project at national and European level, and has provided legal representation to companies in the legal-tech sector.

Abanlex is a Spanish law firm specialized in data protection and innovation technology. The firm has a team of cybersecurity consultants, technology lawyers, university professors and marketing specialists. Abanlex is well-known for its 2014 victory over Google in the 'Right to be forgotten' case, in which the European Court of Justice established the legal basis of responsibility of search engines concerning data and links appearing when searching for a specific name.Since 2011, Abanlex has been dedicated to defending blockchain project at national and European level, and has provided legal representation to companies in the legal-tech sector.

Global technology investment firm Atomico was set up in 2006 by Skype co-founder Niklas Zennström. Since then, it has made over 140 investments with a focus on the European market. Atomico’s team of investors includes founders of six billion-dollar companies, and operational leaders at companies such as Skype, Google, Uber, Facebook and Spotify. The London-based investment company has managed 27 exits to date including Supercell, Fab, the Climate Corporation and Rovio Entertainment. Its recent investments include in Peakon's Series B, AccuRx's Series A and in Graphcore and Clutter's Series D rounds.

Global technology investment firm Atomico was set up in 2006 by Skype co-founder Niklas Zennström. Since then, it has made over 140 investments with a focus on the European market. Atomico’s team of investors includes founders of six billion-dollar companies, and operational leaders at companies such as Skype, Google, Uber, Facebook and Spotify. The London-based investment company has managed 27 exits to date including Supercell, Fab, the Climate Corporation and Rovio Entertainment. Its recent investments include in Peakon's Series B, AccuRx's Series A and in Graphcore and Clutter's Series D rounds.

Microsoft is a US-based technology company that focuses on software products and services. Its Windows operating system is one of the most widely used in the world, and it is also a leader in the video games industry thanks to its Xbox video game platform. In the corporate world, it is best known for its Azure cloud computing services. It is one of the most valuable companies in the world alongside rival Apple, social media network Facebook, and internet giant Google. Microsoft is an active investor in the technology industry. It invests through its main business entity, as well as through subsidiaries such as M12, formerly known as Microsoft Ventures.

Microsoft is a US-based technology company that focuses on software products and services. Its Windows operating system is one of the most widely used in the world, and it is also a leader in the video games industry thanks to its Xbox video game platform. In the corporate world, it is best known for its Azure cloud computing services. It is one of the most valuable companies in the world alongside rival Apple, social media network Facebook, and internet giant Google. Microsoft is an active investor in the technology industry. It invests through its main business entity, as well as through subsidiaries such as M12, formerly known as Microsoft Ventures.

Chief Strategist, CTO and co-founder of TurtleTree Labs

Max Rye graduated in computer science at the University of California, Davis, in 2001. Currently based in Berkeley, Rye has worked in the IT industry for over 15 years. He was the CEO of Royal IT from 2003 to 2018 in California. He was also a senior information technology specialist at Mahler Enterprises from 2011 to 2018.In 2019, he set up TurtleTree Labs in Singapore with Lin Fengru whom he had previously met at a Google conference. He became the CTO of TurtleTree Labs with Lin as CEO. In January 2020, he was appointed chief strategist based at the company’s office in San Francisco. In December 2020, he and Lin also co-founded TurtleTree Scientific in Singapore.

Max Rye graduated in computer science at the University of California, Davis, in 2001. Currently based in Berkeley, Rye has worked in the IT industry for over 15 years. He was the CEO of Royal IT from 2003 to 2018 in California. He was also a senior information technology specialist at Mahler Enterprises from 2011 to 2018.In 2019, he set up TurtleTree Labs in Singapore with Lin Fengru whom he had previously met at a Google conference. He became the CTO of TurtleTree Labs with Lin as CEO. In January 2020, he was appointed chief strategist based at the company’s office in San Francisco. In December 2020, he and Lin also co-founded TurtleTree Scientific in Singapore.

Neosentec: Open source SaaS helping enterprises create customized AR experiences

Neosentec has created an open source SaaS for businesses to offer customized AR experiences

Biel Glasses: A pioneering solution for low vision sufferers

Biel Glasses offers a life-changing technology for people with low vision, a condition that is seven times more common than blindness

Situm Technologies: The Google Maps for indoors, where GPS fails

It uses AI and mobile robotics to create high-precision, low-cost indoor location tech that integrates data processed from multiple radio and inertial sensors

Alex Deans, youth creator of wearable tech for the blind, discusses the inventing process

He started with just CA$100 worth of GPS shields and wires at aged 12. Now the 20-year-old student is readying to take his iAid navigation device for the visually impaired to market

Future Food Asia 2021: Potential of pulses in the alt-protein space

Asia presents a unique opportunity for pulses as people in the region, who traditionally fractionated pulses for starch, now see protein as a useful byproduct

Once the darling of investors, unmanned shelf startups are going through a hard time in China

Startups are being forced to transform their business models to survive

Auara: Social enterprise and environmental sustainability in a bottle

Auara, with its 100% recycled-plastic mineral water bottles, aims to reduce its manufacturing carbon footprint while helping the most water-stressed citizens

Forget Instacart. Now you can get groceries from the vending machine downstairs

A Beijing startup has created a faster way for customers to purchase milk and eggs – just pop downstairs, buy from its smart vending machine and pay by smartphone

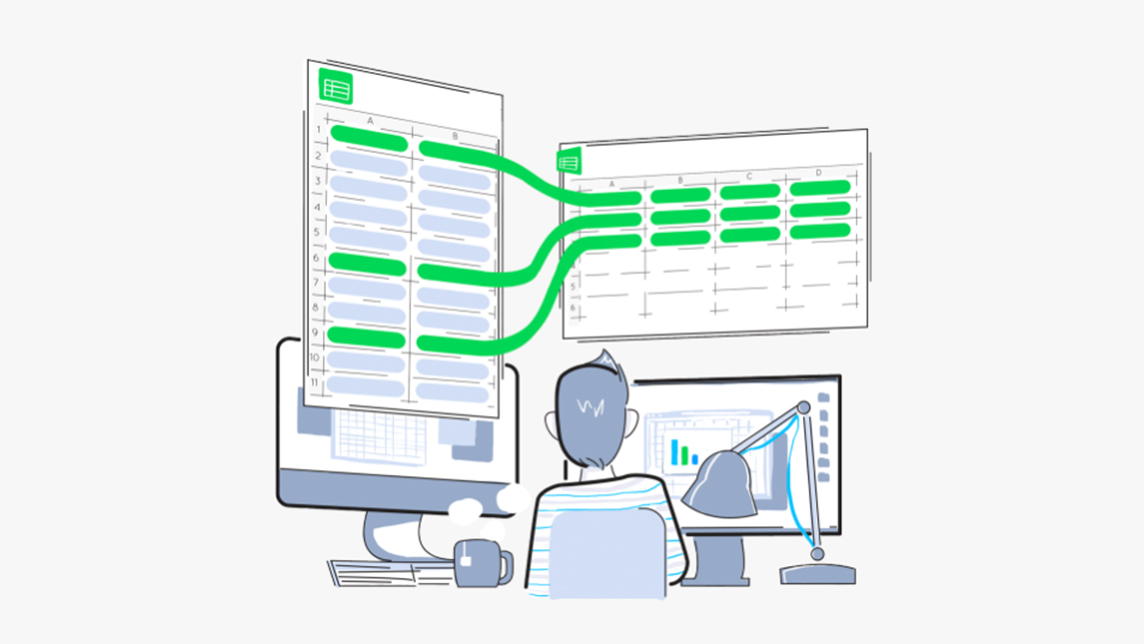

Sheetgo: Easy and secure cloud-powered spreadsheet data at your fingertips

Named Most Scalable Product at South Summit 2018, Sheetgo turns spreadsheets into data clouds for business users around the world

This EV maker caters to young consumers by making driving easier and more fun

Amongst all the players in China’s EV market, Xpeng Motors still stands out

Luo Yonghao: Maverick founder who gave Smartisan its allure, but couldn't build a winner

The Smartisan founder and internet celebrity is making a comeback with live commerce, after failing to sell enough smartphones at his own company

China's recycling startups seek cost-effective ways to make waste management profitable

The high costs of smart garbage bins and automation to sort out recycling have created new headaches for homes and offices

Coding edtech platform Dicoding fulfills market demand for tech professionals

Dicoding wants to remedy the shortfall in Indonesian tech professionals and prepare them for the global industry

AEInnova: Energy harvester to generate €10 million revenue, plans Series A

A whopping 70% of our energy generated gets lost as waste heat. A Spanish startup has developed innovative solutions to collect the waste heat that industry literally throws away and convert it into electricity

Already helping over 1,000 corporates like Alibaba and JD.com manage and lower their carbon emissions, Carbonstop is ready to do more when China’s carbon trading starts next year

Sorry, we couldn’t find any matches for“Google Glass”.