Singularity University

-

DATABASE (960)

-

ARTICLES (252)

The Stanford Management Company (SMC) invests through the Merged Pool that oversees the majority of its investable assets. Its portfolio includes diverse equity-oriented strategies: domestic and foreign public equities (27%), real estate (8%), natural resources (7%) and private equity (30%). Private equity is maintained at 30% of the Merged Pool based on its risk-return criteria. The Merged Pool was valued at $29.6 bn as of June 30, 2019.The private equity division operates through selected external partners for early and later-stage investments. According to the university’s latest investment report, the SMC is working to improve its investment portfolio that has become over diversified during the last four years, making it difficult to maintain quality and drive superior returns. The number of active partners has been reduced to 75 including 37 new ones added in the last four years. The new partners have generated a net internal rate of return of 29.3% over the last four years.

The Stanford Management Company (SMC) invests through the Merged Pool that oversees the majority of its investable assets. Its portfolio includes diverse equity-oriented strategies: domestic and foreign public equities (27%), real estate (8%), natural resources (7%) and private equity (30%). Private equity is maintained at 30% of the Merged Pool based on its risk-return criteria. The Merged Pool was valued at $29.6 bn as of June 30, 2019.The private equity division operates through selected external partners for early and later-stage investments. According to the university’s latest investment report, the SMC is working to improve its investment portfolio that has become over diversified during the last four years, making it difficult to maintain quality and drive superior returns. The number of active partners has been reduced to 75 including 37 new ones added in the last four years. The new partners have generated a net internal rate of return of 29.3% over the last four years.

CEO of Exovite

Juan Monzón Fabregat is a Spanish entrepreneur, angel investor and marketer. He is the co-founder of tech innovation company Meraki Codes and Exovite, where he is CEO. For three years, Monzón helmed Health Valencia 2.0, an organization which seeks to bring technological innovation to the health sector. He has completed courses at the Sloan School of Management and Singularity University.

Juan Monzón Fabregat is a Spanish entrepreneur, angel investor and marketer. He is the co-founder of tech innovation company Meraki Codes and Exovite, where he is CEO. For three years, Monzón helmed Health Valencia 2.0, an organization which seeks to bring technological innovation to the health sector. He has completed courses at the Sloan School of Management and Singularity University.

Yangtze Delta Region Institute of Tsinghua University, Zhejiang

Yangtze Delta Region Research Institute of Tsinghua University, Zhejiang was co-founded by the provincial government of Zhejiang and Tsinghua University in 2003 for tech transfer. It has set up over 50 R&D platforms in the areas of life sciences, digital creativity, information technology and ecological environment and 11 offshore incubators in the US, UK, Germany and Australia. The institute manages over RMB 7.5bn of assets and also makes investments through its sub-funds with a total size of more than RMB 10bn. So far, it has incubated and invested in over 2,500 companies, 35 of whom have gone public or been acquired by listed companies.

Yangtze Delta Region Research Institute of Tsinghua University, Zhejiang was co-founded by the provincial government of Zhejiang and Tsinghua University in 2003 for tech transfer. It has set up over 50 R&D platforms in the areas of life sciences, digital creativity, information technology and ecological environment and 11 offshore incubators in the US, UK, Germany and Australia. The institute manages over RMB 7.5bn of assets and also makes investments through its sub-funds with a total size of more than RMB 10bn. So far, it has incubated and invested in over 2,500 companies, 35 of whom have gone public or been acquired by listed companies.

After a decade of technology and capability development, Alén Space's proprietary nanosatellites offer a faster, cheaper way to meet the growing demand for new Space applications.

After a decade of technology and capability development, Alén Space's proprietary nanosatellites offer a faster, cheaper way to meet the growing demand for new Space applications.

Founder and CEO of Prelo

Fransiska Hadiwidjana is a young technopreneur and coder. The graduate in Informatics Engineering is a co-founder of AugMI Labs in USA that won the Thomson Reuters Data Prize at the MIT US$100K Entrepreneurship Competition in 2013. Fransiska had also worked as an IT intern at Microsoft and the Office of the President of Indonesia. She also participated at a Silicon Valley think tank at the Singularity University before graduating from the Institut Teknologi Bandung in 2012. She went on to establish Prelo, an online marketplace for secondhand goods in 2015.

Fransiska Hadiwidjana is a young technopreneur and coder. The graduate in Informatics Engineering is a co-founder of AugMI Labs in USA that won the Thomson Reuters Data Prize at the MIT US$100K Entrepreneurship Competition in 2013. Fransiska had also worked as an IT intern at Microsoft and the Office of the President of Indonesia. She also participated at a Silicon Valley think tank at the Singularity University before graduating from the Institut Teknologi Bandung in 2012. She went on to establish Prelo, an online marketplace for secondhand goods in 2015.

CEO and co-founder of X1 Wind / PivotBuoy

Trained in mechanical engineering, Alex Raventos graduated from the MIT-Portugal’s Executive Master’s program focused on sustainable energy systems. In 2017 he joined the prestigious Global Solution Program led by Singularity University at NASA Research Park in Mountain View, California, where talents meet to develop innovative technology and groundbreaking solutions that address the greatest challenges for humanity today.Raventos has gained significant experience as head of economics and project coordinator in companies in the energy sector such as WavEC Offshore Renewables and Bluewater.In 2014 he founded Inn2Grid, consulting companies in renewable energy and focused on ocean energy technologies. Since 2017 he has been CEO and co-founder of X1 Wind, a Barcelona-based startup developing a downwind turbine technology to reduce the Levelized Cost of Energy (LCOE) in offshore wind plants.

Trained in mechanical engineering, Alex Raventos graduated from the MIT-Portugal’s Executive Master’s program focused on sustainable energy systems. In 2017 he joined the prestigious Global Solution Program led by Singularity University at NASA Research Park in Mountain View, California, where talents meet to develop innovative technology and groundbreaking solutions that address the greatest challenges for humanity today.Raventos has gained significant experience as head of economics and project coordinator in companies in the energy sector such as WavEC Offshore Renewables and Bluewater.In 2014 he founded Inn2Grid, consulting companies in renewable energy and focused on ocean energy technologies. Since 2017 he has been CEO and co-founder of X1 Wind, a Barcelona-based startup developing a downwind turbine technology to reduce the Levelized Cost of Energy (LCOE) in offshore wind plants.

A co-founder and angel investor of HomeRun, Cheng Xiaohua graduated with a major in Automation at Changsha Railway University in 1983. The university is now known as Railway Campus, Central South University. From 1984 to 1988, he spent his postgraduate years at Graduate School, University of Chinese Academy of Sciences and earned a master’s degree in Automation. He co-founded Netac with Deng Guoshun in 1999 and became the chairman in September 2010.

A co-founder and angel investor of HomeRun, Cheng Xiaohua graduated with a major in Automation at Changsha Railway University in 1983. The university is now known as Railway Campus, Central South University. From 1984 to 1988, he spent his postgraduate years at Graduate School, University of Chinese Academy of Sciences and earned a master’s degree in Automation. He co-founded Netac with Deng Guoshun in 1999 and became the chairman in September 2010.

Founded by Li Shujun, the former CFO of Shengda, in 2006, Trustbridge Partners is a venture capital and private equity firm focusing on growth-stage and expansion-stage investments in Chinese companies in new energy, environmental protection, new materials, new media, retailing, healthcare, education, e-commerce, etc. The sources of its funds come mainly from university foundations in the US (such as Columbia University, Stanford University, New York University), world-renowned investment firms (Temasek Holdings, Kerry Group, etc.), and private investors.

Founded by Li Shujun, the former CFO of Shengda, in 2006, Trustbridge Partners is a venture capital and private equity firm focusing on growth-stage and expansion-stage investments in Chinese companies in new energy, environmental protection, new materials, new media, retailing, healthcare, education, e-commerce, etc. The sources of its funds come mainly from university foundations in the US (such as Columbia University, Stanford University, New York University), world-renowned investment firms (Temasek Holdings, Kerry Group, etc.), and private investors.

CTO and co-founder of Carbo Culture

US native Christopher Carstens graduated in mechanical engineering in 2002 at the University of California, Berkeley. He started his career as a technology analyst at The Spark Group in San Francisco.In 2004, the engineer co-founded Solid Gas Technologies to build a methane hydrate production system. Carstens also founded Homeland Fuels to construct a bioreactor using ethanol. He exited both companies in 2006 and went to work at World Waste Technologies in California as project manager and engineer. In 2012, he started working at Graphene Technologies as R&D engineer.In 2013, he joined an innovation accelerator program at Singularity University where he met Finnish participant Henrietta Moon. They co-founded Finnish startup Carbo Culture in 2016 with Carstens as CTO based at the California plant.The serial entrepreneur and inventor also founded Hydrate Dynamics as CTO in 2015 to develop gas storage and transportation facilities using clathrate hydrates technology. In 2018, he was appointed by the US Department of Energy to be a member of the Methane Hydrate Advisory Committee until January 2020.

US native Christopher Carstens graduated in mechanical engineering in 2002 at the University of California, Berkeley. He started his career as a technology analyst at The Spark Group in San Francisco.In 2004, the engineer co-founded Solid Gas Technologies to build a methane hydrate production system. Carstens also founded Homeland Fuels to construct a bioreactor using ethanol. He exited both companies in 2006 and went to work at World Waste Technologies in California as project manager and engineer. In 2012, he started working at Graphene Technologies as R&D engineer.In 2013, he joined an innovation accelerator program at Singularity University where he met Finnish participant Henrietta Moon. They co-founded Finnish startup Carbo Culture in 2016 with Carstens as CTO based at the California plant.The serial entrepreneur and inventor also founded Hydrate Dynamics as CTO in 2015 to develop gas storage and transportation facilities using clathrate hydrates technology. In 2018, he was appointed by the US Department of Energy to be a member of the Methane Hydrate Advisory Committee until January 2020.

CEO and co-founder of Carbo Culture

Finnish native Pia Henrietta Moon, has been a scout leader since 2003. Her first job was in event management and tourism operations in India for Sunset Getaways & Insta tourism in 2007. While studying at the University of Economics and Business in Vienna, she met American engineer Christopher Carstens in 2013 at a global solutions innovation program organized by Singularity University in California. She left university in 2014 and co-founded Carbo Culture as CEO in 2016 with Carstens as CTO.In 2016, Moon also joined the electronics company Yleiselektroniikka as a board member, the youngest person in Finland to hold such a position in a listed company. Moon also founded edtech startup Mehackit in 2013 and became its chairwoman for four years. She exited both companies in 2018 to focus on running Carbo Culture.While at university, Moon also worked for over two years at Rails Girls, a not-for-profit for women in tech. In Finland, she joined the student entrepreneurship society in 2011 and completed an internship in 2010 at the Ministry for Foreign Affairs of Finland. In 2015, she joined the World Economic Forum’s Global Shapers youth community initiative in Helsinki.

Finnish native Pia Henrietta Moon, has been a scout leader since 2003. Her first job was in event management and tourism operations in India for Sunset Getaways & Insta tourism in 2007. While studying at the University of Economics and Business in Vienna, she met American engineer Christopher Carstens in 2013 at a global solutions innovation program organized by Singularity University in California. She left university in 2014 and co-founded Carbo Culture as CEO in 2016 with Carstens as CTO.In 2016, Moon also joined the electronics company Yleiselektroniikka as a board member, the youngest person in Finland to hold such a position in a listed company. Moon also founded edtech startup Mehackit in 2013 and became its chairwoman for four years. She exited both companies in 2018 to focus on running Carbo Culture.While at university, Moon also worked for over two years at Rails Girls, a not-for-profit for women in tech. In Finland, she joined the student entrepreneurship society in 2011 and completed an internship in 2010 at the Ministry for Foreign Affairs of Finland. In 2015, she joined the World Economic Forum’s Global Shapers youth community initiative in Helsinki.

Mari Elka Pangestu is the first female Chinese Indonesian to hold a cabinet position. She was the Minister of Trade from 2004 to 2011 and the Minister of Tourism from 2011 to 2014. She holds a doctorate in Economics from the University of California, USA. Returning to academia at the University of Indonesia, the professor is also part of the Indonesian network of angel investors ANGIN.

Mari Elka Pangestu is the first female Chinese Indonesian to hold a cabinet position. She was the Minister of Trade from 2004 to 2011 and the Minister of Tourism from 2011 to 2014. She holds a doctorate in Economics from the University of California, USA. Returning to academia at the University of Indonesia, the professor is also part of the Indonesian network of angel investors ANGIN.

GU Ventures is the Swedish venture capital agency of University of Gothenburg. The VC also runs incubator programs to support tech and science-related projects within the university and its alumni network.Founded in 1995, GU has backed more than 150 companies and projects, including 30 exits and 11 filed IPOs. According to the firm, 87% of its portfolio companies are contributing to the sustainable development goals set by the UN.

GU Ventures is the Swedish venture capital agency of University of Gothenburg. The VC also runs incubator programs to support tech and science-related projects within the university and its alumni network.Founded in 1995, GU has backed more than 150 companies and projects, including 30 exits and 11 filed IPOs. According to the firm, 87% of its portfolio companies are contributing to the sustainable development goals set by the UN.

Stanford Graduate School of Business

Launched in 2015, the Stanford GSB Impact Fund invests globally in innovators and tech startups whether connected with the university or not and within the area of social impact in seven market segments: education, energy and the environment, fintech, food and agriculture, justice, healthcare, and urban development. The university-owned fund invests from the pre-seed to Series A rounds and makes investments mostly from January to April. It currently has 11 startups in its portfolio.

Launched in 2015, the Stanford GSB Impact Fund invests globally in innovators and tech startups whether connected with the university or not and within the area of social impact in seven market segments: education, energy and the environment, fintech, food and agriculture, justice, healthcare, and urban development. The university-owned fund invests from the pre-seed to Series A rounds and makes investments mostly from January to April. It currently has 11 startups in its portfolio.

Armed with Asian and European experience, Miguel Amaro co-founded Uniplaces in 2011. He earned his bachelor’s degree in Finance from the University of Nottingham, and took a course in Chinese Studies at East China Normal University. He obtained his master’s in Management, with a concentration in Global Entrepreneurship, from Babson Graduate School. Amaro also spent two months as an analyst at Grameen Bank in Dhaka, Bangladesh. While developing Uniplaces, he was an entrepreneur-in-residence at Picvic Labs (France), Zhejiang University Innovation Institute (China) and Osram (United States). Amaro is currently part of the World Economic Forum’s Global Shapers. As an investor, to date, he has only invested in Portuguese healthy food service EatTasty and part funding the company's angel, pre-seed and seed rounds, with undisclosed investments.

Armed with Asian and European experience, Miguel Amaro co-founded Uniplaces in 2011. He earned his bachelor’s degree in Finance from the University of Nottingham, and took a course in Chinese Studies at East China Normal University. He obtained his master’s in Management, with a concentration in Global Entrepreneurship, from Babson Graduate School. Amaro also spent two months as an analyst at Grameen Bank in Dhaka, Bangladesh. While developing Uniplaces, he was an entrepreneur-in-residence at Picvic Labs (France), Zhejiang University Innovation Institute (China) and Osram (United States). Amaro is currently part of the World Economic Forum’s Global Shapers. As an investor, to date, he has only invested in Portuguese healthy food service EatTasty and part funding the company's angel, pre-seed and seed rounds, with undisclosed investments.

Veteran Portuguese investor Diamantino Costa, aka Dino, is the founder and managing partner of DCVentures and Ganexa Capital. He is also the chairman and CEO of Intelligent Sensing Anywhere (ISA), an IoT firm in energy, oil and gas. He is a former chairman of the Portuguese Aerospace Industry Association (PEMAS).Costa has a master’s in Computer Science from the University of Coimbra. He co-founded and exited Critical Software, one of Portugal’s first startups. The business application development company has its roots at the University of Coimbra and secured NASA as its first client.

Veteran Portuguese investor Diamantino Costa, aka Dino, is the founder and managing partner of DCVentures and Ganexa Capital. He is also the chairman and CEO of Intelligent Sensing Anywhere (ISA), an IoT firm in energy, oil and gas. He is a former chairman of the Portuguese Aerospace Industry Association (PEMAS).Costa has a master’s in Computer Science from the University of Coimbra. He co-founded and exited Critical Software, one of Portugal’s first startups. The business application development company has its roots at the University of Coimbra and secured NASA as its first client.

StudentFinance: AI screening software matches students to IT courses and jobs

StudentFinance also offers "Study now, pay later" model, making IT courses financially accessible while helping companies overcome skilled tech talent shortage

Coronavirus: Portuguese startups pitch in as nation battles pandemic

More than 120 startups join the #tech4COVID19 initiative, offering the public free medical help, meals for the vulnerable, online education and more

DORM: New-generation housing for Indonesia’s tech-savvy, community-driven students

Combining online features with offline services, DORM goes way beyond what the market typically offers in student accommodation

Clear Plate: Anti-food waste AI that rewards the diners who finish their food

Taking little steps to make a big difference in fighting food waste, Clear Plate engages with digital natives to spread the message

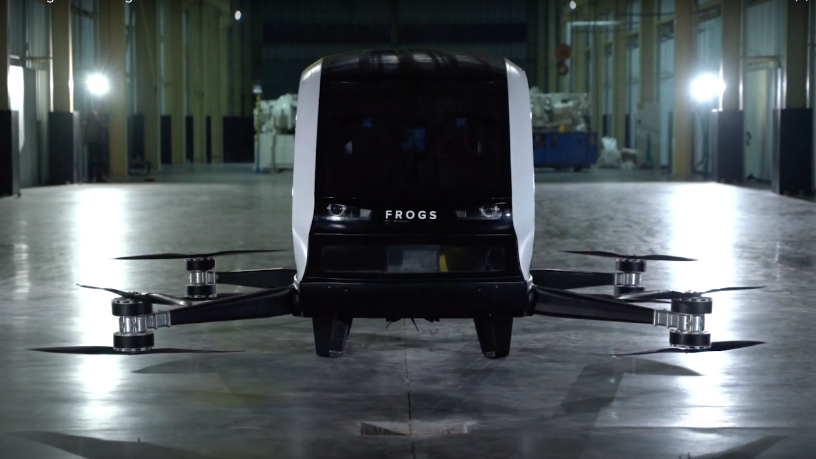

FROGS: Overcoming challenges to launch Indonesia's first drone-taxi for daily commutes

The Yogyakarta-based startup backed by UMG Idealab seeks more technical resources to launch Indonesia's first homegrown “flying taxi,” after the success of its agritech drones

HeartGenetics: Using genetic data and AI to improve predictive health outcomes

Amid growing demand for personalized health and wellness solutions, the Portuguese startup is seeking €2m to expand to Germany and the UK

Nucaps Nanotechnology: New encapsulation tech for nutritional and pharmaceutical sectors

Nucaps Nanotechnology is growing through a mix of accelerating market penetration and continuous R&D

Lluvia Sólida: An economic lifeline for farmers in drier, unpredictable climate conditions

Reducing the need for watering by up to 90%, this Mexican startup’s polymer-based water retention technology is a potential game-changer for farming worldwide

Kathy Xu stays ahead of the curve in China's VC scene

Dubbed “Queen of VC” in China, Xu has spotted great companies that others were not quite interested in, like Chinese online retail giant JD.com

Futuralga: Circular economy model to turn seaweed into biodegradable plastic alternative

A Cádiz-based young startup is winning accolades for its eco-friendly bioplastic made from seaweed washed ashore

Infraspeak to raise up to €12m in Series A funding to accelerate European expansion

CEO Felipe Ávila da Costa discusses his rapidly growing facilities management platform that's helping airports, malls and hospitals run smoothly from Brazil to Mozambique

Traveloka CTO Derianto Kusuma resigns

The co-founder cites a changing ecosystem and company direction for his decision, while hinting at a new venture

Capaball: Empowering employees to upskill in tech as more businesses digitalize

The Spanish edtech platform for Fortune 500 clients and professionals is focused on developing new markets in Latin America

Smart Agrifood Summit: Investors on key focuses and outlook in European agrifood

From boosting public-private funds to grow more European scale-ups, to improving the investment ecosystem, key investors at the Smart Agrifood Summit offer their take on how the EU agrifood sector could go a longer way

Bob Xu, one of China's first and most successful angel investors

Known for his whimsical investment style, Xu has caught a number of unicorns

Sorry, we couldn’t find any matches for“Singularity University”.