Women in Tech

-

DATABASE (994)

-

ARTICLES (811)

Founded over 110 years ago from several small agricultural cooperative banks, the Dutch commercial banking group Rabobank has over 10m customers across 47 countries. The banking group’s Rabo Investments vehicle manages Rabo Ventures with a €120m fund investing globally in early-stage fintech and agtech startups. There is also a €30m fund-of-funds to partner with leading VCs in other funding rounds like the $12m funding round of Dutch e-scooter company GO Sharing.The Rabobank Food & Agri Innovation Fund specializes in supporting enterprises involved in creating sustainable solutions for diverse food and agricultural sectors including livestock farms. Rabo F&A Innovation Fund currently has 11 agri-foodtech startups in its portfolio, including participation in a $12m Series A round of Vence, US-based virtual fencing tech company for livestock management.

Founded over 110 years ago from several small agricultural cooperative banks, the Dutch commercial banking group Rabobank has over 10m customers across 47 countries. The banking group’s Rabo Investments vehicle manages Rabo Ventures with a €120m fund investing globally in early-stage fintech and agtech startups. There is also a €30m fund-of-funds to partner with leading VCs in other funding rounds like the $12m funding round of Dutch e-scooter company GO Sharing.The Rabobank Food & Agri Innovation Fund specializes in supporting enterprises involved in creating sustainable solutions for diverse food and agricultural sectors including livestock farms. Rabo F&A Innovation Fund currently has 11 agri-foodtech startups in its portfolio, including participation in a $12m Series A round of Vence, US-based virtual fencing tech company for livestock management.

Kaszek Ventures is an Argentinian VC co-founded in 2011 by Hernan Kazah and Nicolas Szekasy, both hailing from Latin America’s e-commerce success story MercadoLibre. Starting with $95m, the VC made its first investment in Brazilian fintech, Nubank. The VC now has over 159 investments and has managed 21 exits. It mainly focuses on B2C solutions, mobile, healthcare technology, retail and media.The most recent Kaszek investment is in Latin America’s leading crypto platform Bitso, co-leading Bitso’s $62m Series B round with QED Investors. Managing partner Szekasy has also joined Bitso’s board. Existing shareholders Coinbase Ventures and Pantera Capital joined the Bitso round.In 2019, Kaszek raised two new funds securing a total of $600m to invest in later-growth stage companies to tap into Latin America’s rapidly maturing tech ecosystems. The rollout of 4G has also helped to speed up the adoption of new technologies across the region, according to Kazah.

Kaszek Ventures is an Argentinian VC co-founded in 2011 by Hernan Kazah and Nicolas Szekasy, both hailing from Latin America’s e-commerce success story MercadoLibre. Starting with $95m, the VC made its first investment in Brazilian fintech, Nubank. The VC now has over 159 investments and has managed 21 exits. It mainly focuses on B2C solutions, mobile, healthcare technology, retail and media.The most recent Kaszek investment is in Latin America’s leading crypto platform Bitso, co-leading Bitso’s $62m Series B round with QED Investors. Managing partner Szekasy has also joined Bitso’s board. Existing shareholders Coinbase Ventures and Pantera Capital joined the Bitso round.In 2019, Kaszek raised two new funds securing a total of $600m to invest in later-growth stage companies to tap into Latin America’s rapidly maturing tech ecosystems. The rollout of 4G has also helped to speed up the adoption of new technologies across the region, according to Kazah.

Ajaib’s online wealth management tool brings personalized mutual fund investing to the masses, potentially mobilizing billions of investable assets across Southeast Asia.

Ajaib’s online wealth management tool brings personalized mutual fund investing to the masses, potentially mobilizing billions of investable assets across Southeast Asia.

VNV Global was originally founded as Vostok Nafta in 1996, with its first investment in Russia. The investment vehicle initially focused on investments in agriculture and natural resources, but began to diversify into early consumer internet companies like Avito and Tinkoff Bank. Shares were listed on NASDAQ OMX and the VC pivoted to high-growth tech investments in 2007. In 2015, the name was changed to Vostok New Ventures and shortened to VNV Global in 2020 to reflect its international strategy to expand outside Europe.The mid-cap NASDAQ Stockholm exchange-listed VNV mainly invests in mobility, medtech and marketplaces. It currently has 31 startups in its portfolio and six exits managed to date. Recent investments led by VNV include the $43m Series B funding of London-based food waste app OLIO in September 2021 and the $1.6m seed round of Vietnamese dating app Fika in October 2021.

VNV Global was originally founded as Vostok Nafta in 1996, with its first investment in Russia. The investment vehicle initially focused on investments in agriculture and natural resources, but began to diversify into early consumer internet companies like Avito and Tinkoff Bank. Shares were listed on NASDAQ OMX and the VC pivoted to high-growth tech investments in 2007. In 2015, the name was changed to Vostok New Ventures and shortened to VNV Global in 2020 to reflect its international strategy to expand outside Europe.The mid-cap NASDAQ Stockholm exchange-listed VNV mainly invests in mobility, medtech and marketplaces. It currently has 31 startups in its portfolio and six exits managed to date. Recent investments led by VNV include the $43m Series B funding of London-based food waste app OLIO in September 2021 and the $1.6m seed round of Vietnamese dating app Fika in October 2021.

Founded by pioneering tech investor Ozi Amanat in 2015, K2 Global is a venture capital firm based in Silicon Valley and Singapore. Amanat, who moved to Singapore in 2012, is one of Twitter’s early backers, raising $25m to invest in the social media startup that later went public in 2013. The Harvard graduate in psychology and economics also invested in Uber, Spotify and Alibaba during his career as a venture capitalist. Amanat is the chief investment officer of K2 VC, K2 Global and Singapore-based Spice Global controlled by Indian billionaire B K Modi.In 2017, K2 also announced a $183m VC fund focusing on early-stage startups that aim to address global challenges. The majority of K2 limited partners are based outside the US in countries like Australia, Japan, Singapore, Hong Kong and Indonesia.

Founded by pioneering tech investor Ozi Amanat in 2015, K2 Global is a venture capital firm based in Silicon Valley and Singapore. Amanat, who moved to Singapore in 2012, is one of Twitter’s early backers, raising $25m to invest in the social media startup that later went public in 2013. The Harvard graduate in psychology and economics also invested in Uber, Spotify and Alibaba during his career as a venture capitalist. Amanat is the chief investment officer of K2 VC, K2 Global and Singapore-based Spice Global controlled by Indian billionaire B K Modi.In 2017, K2 also announced a $183m VC fund focusing on early-stage startups that aim to address global challenges. The majority of K2 limited partners are based outside the US in countries like Australia, Japan, Singapore, Hong Kong and Indonesia.

Sonicboom's data-over-sound technology allows transmission and acquisition of data to and from smart mobile devices without internet connectivity, helping retail-space operators understand consumer behavior.

Sonicboom's data-over-sound technology allows transmission and acquisition of data to and from smart mobile devices without internet connectivity, helping retail-space operators understand consumer behavior.

One of Indonesia’s first beauty blogs, FDN is a leading social-commerce site today for beauty enthusiasts to discover, review, discuss and shop beauty products.

One of Indonesia’s first beauty blogs, FDN is a leading social-commerce site today for beauty enthusiasts to discover, review, discuss and shop beauty products.

Based in New York City, Lerer Hippeau mainly invests in seed and early-stage startups based in the US. Founded in 2010 by managing partners Kenneth Lerer, Ben Lerer and Eric Hippeau, the VC operates several funds offering initial investments of $1m per startup. Kenneth Lerer is the co-founder of Huffington Post and longtime chairman of BuzzFeed. Hippeau was the CEO of Huffington Post and ex-managing partner of Softbank Capital that invested in Huffington Post.Its 400+ startups also get support for business growth by tapping into tech ecosystems like New York, San Francisco and Los Angeles. Its 80+ exits include Giphy (GIF) that was acquired by Facebook and home-fitness studio Mirror acquired by Lululemon. However, the IPO by portfolio company Bed-in-a-box online retailer Casper was below market expectations. The loss-making e-commerce unicorn went public at $12 a share in February 2020, closing at $13.50 on its first day out, for a market capitalization of less than half the $1.1 billion Casper was valued at in a private funding round in 2019.

Based in New York City, Lerer Hippeau mainly invests in seed and early-stage startups based in the US. Founded in 2010 by managing partners Kenneth Lerer, Ben Lerer and Eric Hippeau, the VC operates several funds offering initial investments of $1m per startup. Kenneth Lerer is the co-founder of Huffington Post and longtime chairman of BuzzFeed. Hippeau was the CEO of Huffington Post and ex-managing partner of Softbank Capital that invested in Huffington Post.Its 400+ startups also get support for business growth by tapping into tech ecosystems like New York, San Francisco and Los Angeles. Its 80+ exits include Giphy (GIF) that was acquired by Facebook and home-fitness studio Mirror acquired by Lululemon. However, the IPO by portfolio company Bed-in-a-box online retailer Casper was below market expectations. The loss-making e-commerce unicorn went public at $12 a share in February 2020, closing at $13.50 on its first day out, for a market capitalization of less than half the $1.1 billion Casper was valued at in a private funding round in 2019.

The first cycling helmet with a neck-protecting airbag activated by sensors and algorithm-refined software.

The first cycling helmet with a neck-protecting airbag activated by sensors and algorithm-refined software.

Indonesia’s most popular OTA, Traveloka is an easy-to-use source of cheap regional flights and accommodation for the fast-rising Indonesian and Southeast Asian middle class.

Indonesia’s most popular OTA, Traveloka is an easy-to-use source of cheap regional flights and accommodation for the fast-rising Indonesian and Southeast Asian middle class.

On-demand automotive services with high-level maintenance capabilities (rare in the sector), cheap parts, reliable service in a market used to price opacity, irregular standards.

On-demand automotive services with high-level maintenance capabilities (rare in the sector), cheap parts, reliable service in a market used to price opacity, irregular standards.

Xinwei’s home-delivered prepped meal kits are an easy, economical way to whip up a gourmet western meal at home using fresh, quality ingredients and seasonings.

Xinwei’s home-delivered prepped meal kits are an easy, economical way to whip up a gourmet western meal at home using fresh, quality ingredients and seasonings.

Founded in 2013 by Ramanan Raghavendran and John Kim, Amasia is a venture capital investment firm based in San Francisco and Singapore. The VC promotes environmental and sustainable innovations that help to reduce consumption, boost recycling and upcycling. Eco-investments include Finch, Treedots and Joro. Finch provides information about a product’s environmental impact to consumers while TreeDots connects grocery suppliers directly with businesses and households. Joro advises users on actionable steps to reduce their carbon footprints.Amasia primarily invests in startups from seed stage up to Series B, but it has also participated in later-stage investments. The VC also aims to encourage conventional offline businesses to go online and optimize supply chain activities. In October 2020, Amasia participated in a $100m Series E round raised by Dialpad, a remote working communication software firm. In September 2021, the VC took a stake in Indonesian fintech Xendit’s $150m Series C round. Tokopedia also joined the Amasia stable in 2016 when the e-commerce platform became Indonesia’s first tech unicorn after the $147m funding round.Other investments include Super, a social commerce platform that improves FMCG distribution to tier-2 and tier-3 cities in Indonesia, online education firm SkillShare and Rainforest Life that acquires and aggregates direct-to-consumer e-commerce brands.

Founded in 2013 by Ramanan Raghavendran and John Kim, Amasia is a venture capital investment firm based in San Francisco and Singapore. The VC promotes environmental and sustainable innovations that help to reduce consumption, boost recycling and upcycling. Eco-investments include Finch, Treedots and Joro. Finch provides information about a product’s environmental impact to consumers while TreeDots connects grocery suppliers directly with businesses and households. Joro advises users on actionable steps to reduce their carbon footprints.Amasia primarily invests in startups from seed stage up to Series B, but it has also participated in later-stage investments. The VC also aims to encourage conventional offline businesses to go online and optimize supply chain activities. In October 2020, Amasia participated in a $100m Series E round raised by Dialpad, a remote working communication software firm. In September 2021, the VC took a stake in Indonesian fintech Xendit’s $150m Series C round. Tokopedia also joined the Amasia stable in 2016 when the e-commerce platform became Indonesia’s first tech unicorn after the $147m funding round.Other investments include Super, a social commerce platform that improves FMCG distribution to tier-2 and tier-3 cities in Indonesia, online education firm SkillShare and Rainforest Life that acquires and aggregates direct-to-consumer e-commerce brands.

Capricorn Investment Group is one of the world’s largest mission-aligned investment companies, managing more than $6bn in multi-asset class portfolios for families, foundations and institutional investors. Notably, it manages the investment portfolio of Jeff Skoll, the first President of eBay, and his charitable organization. The company has offices in Silicon Valley and New York. It has invested in 63 companies to date, many aimed at tackling key challenges facing our world today. It has managed 14 exits to date, including Tesla. Its main focus is on technology and sustainability, with a particular interest in deeptech, aerospace, transport, agtech, healthcare and energy. The firm’s most recent disclosed investments were in May 2021, via participation in the $100m Series B round of Canadian quantum computing startup Xanadu and the $28m Series B round of US geothermal tech company Fervo Energy.

Capricorn Investment Group is one of the world’s largest mission-aligned investment companies, managing more than $6bn in multi-asset class portfolios for families, foundations and institutional investors. Notably, it manages the investment portfolio of Jeff Skoll, the first President of eBay, and his charitable organization. The company has offices in Silicon Valley and New York. It has invested in 63 companies to date, many aimed at tackling key challenges facing our world today. It has managed 14 exits to date, including Tesla. Its main focus is on technology and sustainability, with a particular interest in deeptech, aerospace, transport, agtech, healthcare and energy. The firm’s most recent disclosed investments were in May 2021, via participation in the $100m Series B round of Canadian quantum computing startup Xanadu and the $28m Series B round of US geothermal tech company Fervo Energy.

Women entrepreneurs get ahead faster in Portugal

Still a long way to go for equality, but female founders in Portugal have made significant headstarts as tech innovators

In Spain, women are busy launching startups

Official data show women-led startups are on the rise in Spain. We take you to some of the biggest names in the game

Girls in Tech Indonesia: Inspiring the geek in every girl

Girls in Tech Indonesia aims to put the country's women at the forefront of its tech and startup world

Patamar Capital’s impact investing: On preferred business model, backing women, Mapan

The pioneer in impact investing in Asia gives us the lowdown on its investment criteria, its new focus on women entrepreneurs and related sectors, how it helps its portfolio companies and more

WOOM: Spanish fertility femtech gets €2m funding to expand into new B2B2C markets

AI fertility app WOOM has also created an English-language version to reach more users in North America, Europe and Asia

South Summit 2021: Martin Varavsky, Leandro Sigman on post-Covid healthcare trends

Serial entrepreneur Martin Varavsky and Insud Pharma Chairman Leandro Sigman share their thoughts and projections on the future of health tech

Beatriz González: Seaya Ventures head and Spanish tech VC trailblazer

From Cabify to Glovo, the only woman to head a Spanish VC firm has backed some of the country’s most successful startups to date

In Indonesia, Ramadan goes hi-tech

From consumption to charity, tech startups have come to play a key role in Ramadan traditions in Indonesia

Didimo: Creator of "digital humans" secures €6.2m in seed funding

Portuguese startup Didimo aims to humanize online interactions with its disruptive 3D technology

Du'Anyam: Empowering rural women to work independently and learn financial planning skills

Du’Anyam had to cancel bulk orders to survive the Covid-19 downturn, pivoting to B2C online sales, until the tourism and hospitality sectors recover

GeoDB: Empowering consumers through monetizing their digital data

Consumers and businesses, and not just tech giants, should tap the value of big data too, says blockchain-based data trading platform GeoDB, which has raised £5.5m since 2018

Teliman: Driver-centered mobility model assisting Malian development

The startup addresses a basic necessity with its on-demand ride-hailing services while supporting the personal and economic progress of its drivers, including empowering women

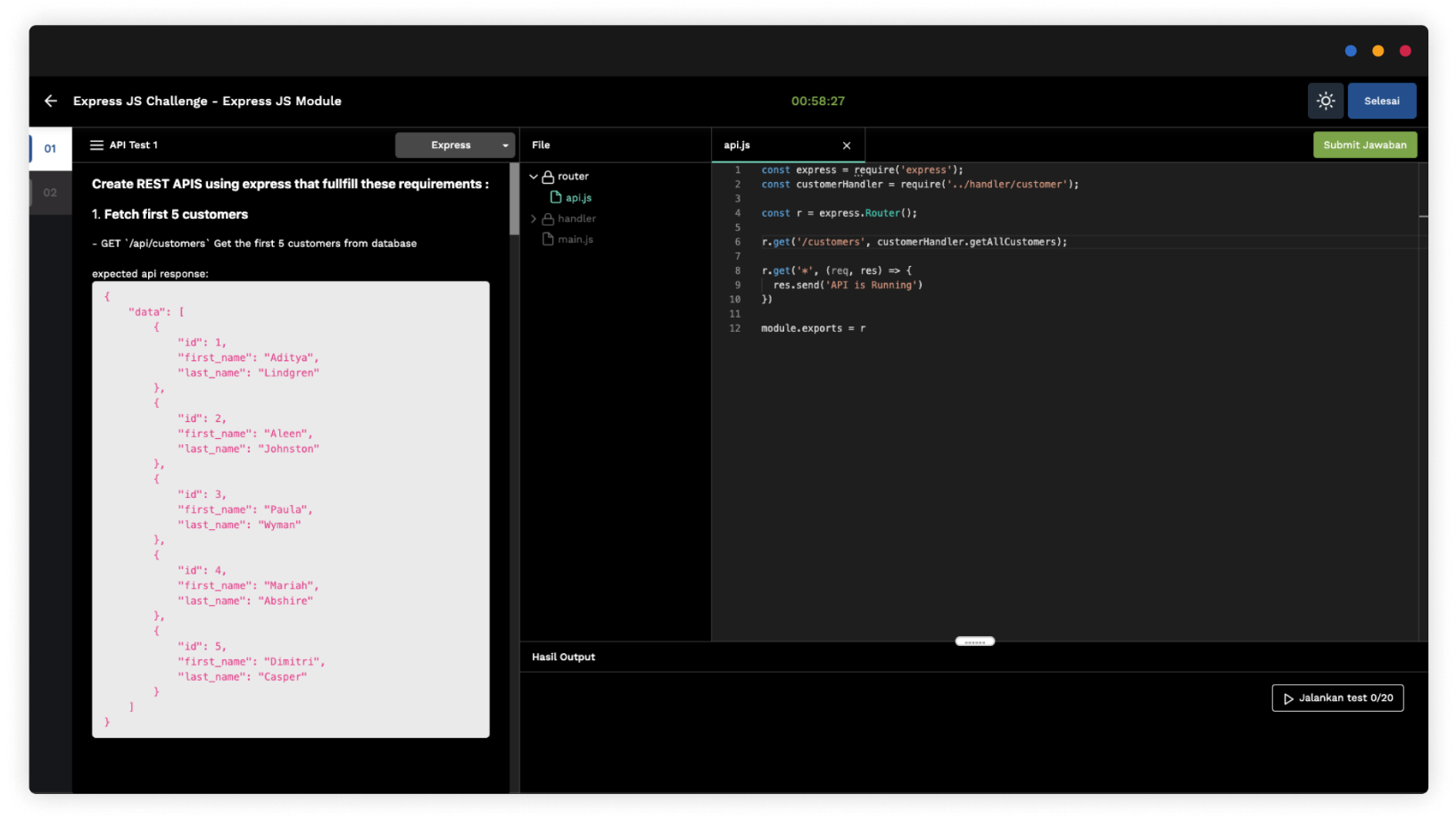

Algobash: SaaS for more effective IT hiring in Indonesia

With its remote assessment and automated interview platform, Algobash seeks faster, fairer and more inclusive recruitment and training of coders, to support tech growth in Indonesia

MENA and Du’Anyam: How two Indonesian social enterprises are tackling Covid-19 challenges

The call to help women in rural communities has become more urgent as social enterprises struggle to survive the current crisis

Cecilia Tham: the power of shifting paradigms

The embodiment of unconventional thinking and creativity, this female entrepreneur from Hong Kong has been pioneering social transformation within Barcelona's startup ecosystem since 2011

Sorry, we couldn’t find any matches for“Women in Tech”.