portugal's

-

DATABASE (436)

-

ARTICLES (523)

Founder and general manager of Xrush

Zhou graduated from Southwest University of Political Science & Law with a bachelors in Law in 2010 and received an MBA degree from The University of Hong Kong in 2019. He worked for a market consultancy firm for seven years, working his way up from project supervisor to general manager of the company. He founded Xrush in 2016.

Zhou graduated from Southwest University of Political Science & Law with a bachelors in Law in 2010 and received an MBA degree from The University of Hong Kong in 2019. He worked for a market consultancy firm for seven years, working his way up from project supervisor to general manager of the company. He founded Xrush in 2016.

Beta-i was established in 2010 as a Portuguese accelerator, incubator and event organizer to boost the Portuguese tech ecosystem. Beta-i is well-known for organizing some of Portugal's most successful accelerators and the annual tech startup event Lisbon Investment Summit. In 2019, it made its first investment in a startup Didimo by joining the seed round for the 3D digital twin designer platform.The company's best known acceleration program Lisbon Challenge is a twice yearly event open to all tech sectors, attracting around 10 participants based in Portugal and overseas. Its two-month programs have accelerated more than 200 startups, with about 75% coming from abroad. Beta-i also organizes the international energy accelerator Free Electrons, with EDP as one of its sponsors. Free Electrons has already accelerated 27 startups and is now running its third edition with 15 startups, five of which are Portugal-based. All the selected participants will have the chance to work for one year with at least one of the 10 global energy utilities that form the Free Electrons consortium. Another Beta-i event is The Journey, the first accelerator in Portugal dedicated to tourism tech startups from all over the world. Launched in partnership with the government's Portugal Tourism in 2017, the Lisbon-based program is part of the national Tourism 4.0 plan. The five-month program is now in its third edition and gives successful applicants the opportunity to develop pilot projects with Portuguese companies like the Vila Galé hotel chain, Barraqueiro transport company and Parques de Sintra, a UNESCO World Heritage site.

Beta-i was established in 2010 as a Portuguese accelerator, incubator and event organizer to boost the Portuguese tech ecosystem. Beta-i is well-known for organizing some of Portugal's most successful accelerators and the annual tech startup event Lisbon Investment Summit. In 2019, it made its first investment in a startup Didimo by joining the seed round for the 3D digital twin designer platform.The company's best known acceleration program Lisbon Challenge is a twice yearly event open to all tech sectors, attracting around 10 participants based in Portugal and overseas. Its two-month programs have accelerated more than 200 startups, with about 75% coming from abroad. Beta-i also organizes the international energy accelerator Free Electrons, with EDP as one of its sponsors. Free Electrons has already accelerated 27 startups and is now running its third edition with 15 startups, five of which are Portugal-based. All the selected participants will have the chance to work for one year with at least one of the 10 global energy utilities that form the Free Electrons consortium. Another Beta-i event is The Journey, the first accelerator in Portugal dedicated to tourism tech startups from all over the world. Launched in partnership with the government's Portugal Tourism in 2017, the Lisbon-based program is part of the national Tourism 4.0 plan. The five-month program is now in its third edition and gives successful applicants the opportunity to develop pilot projects with Portuguese companies like the Vila Galé hotel chain, Barraqueiro transport company and Parques de Sintra, a UNESCO World Heritage site.

China's largest seed fund, ZhenFund was set up in 2011 by Xu Xiaoping (Bob Xu), Wang Qiang (Victor Wang) and Sequoia Capital China. The original ZhenFund (or ZhenFund 1.0) was founded in 2006 when Xu began investing as an angel investor, after the New Oriental Education & Technology Group he co-founded went public on NYSE. ZhenFund's notable investments include Jumei, Jiayuan, LightInTheBox, Miyabaobei, Meicai and 17zuoye, among the more than 300 startups it has betted on.

China's largest seed fund, ZhenFund was set up in 2011 by Xu Xiaoping (Bob Xu), Wang Qiang (Victor Wang) and Sequoia Capital China. The original ZhenFund (or ZhenFund 1.0) was founded in 2006 when Xu began investing as an angel investor, after the New Oriental Education & Technology Group he co-founded went public on NYSE. ZhenFund's notable investments include Jumei, Jiayuan, LightInTheBox, Miyabaobei, Meicai and 17zuoye, among the more than 300 startups it has betted on.

Founded in 2006, AdMaster is a Chinese digital marketing monitoring company. The company offers media auditing, optimization consulting, audience analysis, public opinion monitoring, among other services. Its online ad measurement technology tracks over 5bn impressions every day on computers, smartphones, tablets and smart TVs. AdMaster owns the largest server cluster in the Chinese advertising industry. The company's clients include well-known foreign and domestic brands such as P&G, Coca Cola, Robust and Wahaha.

Founded in 2006, AdMaster is a Chinese digital marketing monitoring company. The company offers media auditing, optimization consulting, audience analysis, public opinion monitoring, among other services. Its online ad measurement technology tracks over 5bn impressions every day on computers, smartphones, tablets and smart TVs. AdMaster owns the largest server cluster in the Chinese advertising industry. The company's clients include well-known foreign and domestic brands such as P&G, Coca Cola, Robust and Wahaha.

Patrick Walujo is the co-founder of Indonesian hedge fund Northstar Group. He had previously worked at Goldman, Sachs & Co. in London and New York before moving to Tokyo to join Pacific Capital Group. Ever since establishing Northstar Group in 2003, Patrick has overseen acquisitions and investments in notable Indonesian enterprises, including minimarket chain Alfamart, movie theater franchise Blitz Megaplex (now CGV Blitz after an investment from Korea's CJ CGV chain) and Equator Securities.

Patrick Walujo is the co-founder of Indonesian hedge fund Northstar Group. He had previously worked at Goldman, Sachs & Co. in London and New York before moving to Tokyo to join Pacific Capital Group. Ever since establishing Northstar Group in 2003, Patrick has overseen acquisitions and investments in notable Indonesian enterprises, including minimarket chain Alfamart, movie theater franchise Blitz Megaplex (now CGV Blitz after an investment from Korea's CJ CGV chain) and Equator Securities.

Founded in 2019, Wens Capital is an independent business unit responsible for investment and M&A under Guangdong Wens Food Group which went public on Shenzhen Stock Exchange in 2015. Through two subsidiaries Wens Investment and Wens Equity Investment, it currently manages about RMB 10bn worth of assets and has invested in more than 50 companies. It mainly invests in military projects and companies from sectors of environmental protection, healthcare and TMT.

Founded in 2019, Wens Capital is an independent business unit responsible for investment and M&A under Guangdong Wens Food Group which went public on Shenzhen Stock Exchange in 2015. Through two subsidiaries Wens Investment and Wens Equity Investment, it currently manages about RMB 10bn worth of assets and has invested in more than 50 companies. It mainly invests in military projects and companies from sectors of environmental protection, healthcare and TMT.

Based in San Francisco, SV Angel was founded in 2009 by Ron Conway, one of Silicon Valley’s super-angels. The firm was originally Conway’s personal investment vehicle that was later turned into a VC with initial investment capital of $10m from external investors.The firm typically invests in early-seed stage rounds, supporting portfolio companies in M&A, business development and financing. Investments include US unicorns like Dropbox, Slack, Pinterest and Airbnb.

Based in San Francisco, SV Angel was founded in 2009 by Ron Conway, one of Silicon Valley’s super-angels. The firm was originally Conway’s personal investment vehicle that was later turned into a VC with initial investment capital of $10m from external investors.The firm typically invests in early-seed stage rounds, supporting portfolio companies in M&A, business development and financing. Investments include US unicorns like Dropbox, Slack, Pinterest and Airbnb.

Evonik Venture Capital is the investment arm of Evonik Industries AG, a chemicals specialty provider in Germany. The firm also has offices in the US and China.With a fund size of €250m, Evonik has made more than 30 investments since 2012. The VC mainly invests in sectors such as nutrition & care, specialty additives and smart materials. Its portfolio includes early to growth stage startups, with investments of €15m per portfolio company.

Evonik Venture Capital is the investment arm of Evonik Industries AG, a chemicals specialty provider in Germany. The firm also has offices in the US and China.With a fund size of €250m, Evonik has made more than 30 investments since 2012. The VC mainly invests in sectors such as nutrition & care, specialty additives and smart materials. Its portfolio includes early to growth stage startups, with investments of €15m per portfolio company.

Founded in 1972, Kleiner Perkins, formerly Kleiner Perkins Caufield & Byers (KPCB) is one of the world’s largest venture capital firms.The firm has raised $10bn through 20 venture funds and four growth funds and has invested in over 850 companies worldwide. Its China advisory team was founded in 2007 with a fund of $360m. It has invested in many of China’s star enterprises, including one of the country’s largest e-commerce platform JD.com.

Founded in 1972, Kleiner Perkins, formerly Kleiner Perkins Caufield & Byers (KPCB) is one of the world’s largest venture capital firms.The firm has raised $10bn through 20 venture funds and four growth funds and has invested in over 850 companies worldwide. Its China advisory team was founded in 2007 with a fund of $360m. It has invested in many of China’s star enterprises, including one of the country’s largest e-commerce platform JD.com.

Founder and CEO of Talkmate

A former investment banker, Wen Ronghui holds an MBA from Peking University. Before founding Talkmate, Wen spent five years in education both as a university lecturer and as a principal of a Beijing language school owned by Nasdaq-listed China Bilingual Technology & Education Group. Prior to that, he was an investment banker for eight years, taking more than 10 companies public.

A former investment banker, Wen Ronghui holds an MBA from Peking University. Before founding Talkmate, Wen spent five years in education both as a university lecturer and as a principal of a Beijing language school owned by Nasdaq-listed China Bilingual Technology & Education Group. Prior to that, he was an investment banker for eight years, taking more than 10 companies public.

Co-founder and CEO of Mobike

Marketing specialist Wang Xiaofeng was Uber’s former General Manager of Shanghai area and a former marketing general manager at Tencent SOSO. He also spent nine years at P&G China, before joining Google as its first staff in the Shanghai office, where he built Google’s advertising channels in East China. He joined Mobike as co-founder and CEO in late 2015.

Marketing specialist Wang Xiaofeng was Uber’s former General Manager of Shanghai area and a former marketing general manager at Tencent SOSO. He also spent nine years at P&G China, before joining Google as its first staff in the Shanghai office, where he built Google’s advertising channels in East China. He joined Mobike as co-founder and CEO in late 2015.

President and Co-founder of Xpeng Motors

After graduating from Tsinghua University in 2008 with a bachelor’s degree in Automotive Engineering, Xia worked as head of R&D of a new energy control system at the GAC Automotive Engineering Institute. In 2014, he co-founded Xpeng Motors.

After graduating from Tsinghua University in 2008 with a bachelor’s degree in Automotive Engineering, Xia worked as head of R&D of a new energy control system at the GAC Automotive Engineering Institute. In 2014, he co-founded Xpeng Motors.

CPO and Co-founder of Xiaoe Tech

Wang Lianghu graduated from the Chinese University of Hong Kong with a master's degree in 2011. He then joined Tencent and worked as a T3-level engineer. During his four years at Tencent, he focused on the design and R&D of Qzone (a Myspace-like blogging platform). After leaving Tencent, he co-founded Xiaoe Tech in 2016.

Wang Lianghu graduated from the Chinese University of Hong Kong with a master's degree in 2011. He then joined Tencent and worked as a T3-level engineer. During his four years at Tencent, he focused on the design and R&D of Qzone (a Myspace-like blogging platform). After leaving Tencent, he co-founded Xiaoe Tech in 2016.

Founded in 2006 by executives from the People’s Bank of China, the China Securities Regulatory Commission, commercial banks, brokerages, insurance companies, funds and other financial institutions, Sensegain Asset Management has AUM (assets under management) of RMB 69 billion. It focuses on private equity, venture capital investment, M&A, market value management for public companies and public equity investment. Sensegain has 150+ FTEs with strong financial backgrounds and a broad range of industry expertise.

Founded in 2006 by executives from the People’s Bank of China, the China Securities Regulatory Commission, commercial banks, brokerages, insurance companies, funds and other financial institutions, Sensegain Asset Management has AUM (assets under management) of RMB 69 billion. It focuses on private equity, venture capital investment, M&A, market value management for public companies and public equity investment. Sensegain has 150+ FTEs with strong financial backgrounds and a broad range of industry expertise.

Kinesys Group is an Indonesian VC founded in 2019 by startup ecosystem builder Yansen Kamto. The company made their debut investment in new retail F&B startup Wahyoo. They have also backed sweet-drinks chain Goola and online learning center Zenius. While the company has made at least five investments in Indonesian companies, they have not closed their first fund, for which they targeted to reach $20m. Kinesys targets seed rounds, contributing ticket sizes averaging around $500,000 per startup.

Kinesys Group is an Indonesian VC founded in 2019 by startup ecosystem builder Yansen Kamto. The company made their debut investment in new retail F&B startup Wahyoo. They have also backed sweet-drinks chain Goola and online learning center Zenius. While the company has made at least five investments in Indonesian companies, they have not closed their first fund, for which they targeted to reach $20m. Kinesys targets seed rounds, contributing ticket sizes averaging around $500,000 per startup.

Tuvalum: Fast-growing vertical marketplace for used quality bikes

Banking on organic reach, Tuvalum has set its sights on a €40 billion market

Chic by Choice: From Forbes' 30 Under 30 to insolvency

Lack of cashflow was the main reason for the demise of Chic by Choice, Europe's leading luxury dress rental e-store

In Portugal tourism tech gets disrupted, in time for post-Covid-19 era

As Portugal reopens to tourists early next month, the sector is banking on a new generation of tourism tech startups to enable safety and reassure visitors

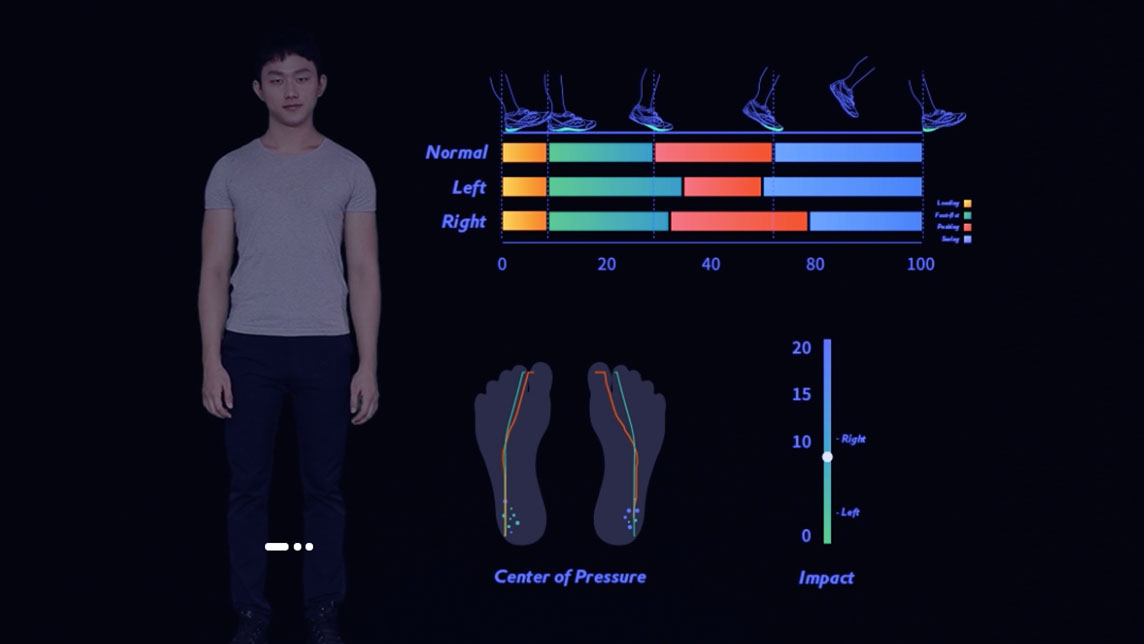

Sennotech offers affordable gait analysis on a mobile phone

Sennotech’s smart gait analysis system helps users choose comfy shoes, improve sports performance and foot health, and facilitate rehabilitation training

Harnessing its innovative startups, Portugal builds a better cleantech ecosystem

With help from government and private-sector initiatives, Portuguese cleantech startups are playing an ever-increasing role in helping the country meet its energy challenges while cutting harmful greenhouse gases

Shilling Capital Partners: Growing Portuguese tech businesses from seed

An early mover, the influential angel investing firm is accelerating local techs into Brazil and globally

James, an AI-powered tool for faster, more accurate credit risk assessment

Capable of analyzing over 7,000 types of data, the award-winning credit risk tool for financial institutions is also quick to install and roll out

Amid Covid-19 gloom, some bright spots in Portugal's tech startup scene

Despite a recession and doubling of the unemployment rate forecast this year, it's not all bad news for the Portuguese tech ecosystem

Xhockware's YouBeep app for speedy checkout, higher customer spending

Besides cutting checkout time to under 1 minute, this in-store shopping app also has other bright ideas: targeted marketing, allergy warnings, even wine-pairing tips

AddVolt: Taking the diesel out of cold-chain transport to make it cleaner, more efficient

The Porto-based startup is winning over the refrigerated goods transportation industry in Europe with the world's first renewable energy plug-in electrical system for the sector

Jungle.ai: Tapping data and AI to prevent outages and breakdowns

Forewarned is forearmed. Performance predictions by Jungle.ai can help save billions of dollars and hours of frustration caused by sudden power failures

Bdeo: Using video intelligence to automate, speed up insurance claims handling and payouts

Insurtech SaaS Bdeo lets insurers process 70% of motor and property claims without human staff; targets Series A close by year-end

Beonprice’s RMS sets the right price for every single hotel room 24/7

Ranked as 5th best RMS platform globally, Beonprice uses AI to stay ahead of competitors

Portugal oceantech II: Single-minded efforts to build an ecosystem of international reference

With dedicated accelerators and investment programs, supported by the EU’s vote of confidence, Portugal appears on track to lead in oceantech

Omniflow gets €2 million boost for its solar-, wind-powered IoT street lights

Thanks to Portugal's Omniflow, renewable energy street lamps doubling up as Wi-Fi hotspots, e-chargers and traffic monitors may soon be ubiquitous street furniture in tomorrow's smart cities

Sorry, we couldn’t find any matches for“portugal's”.