Hardware

This function is exclusive for Premium subscribers

-

DATABASE (85)

-

ARTICLES (140)

Established in 1995 by Sean O'Sullivan, SOSV is a venture capital firm with six attached accelerator programs. Upon receiving investment from SOSV, portfolio companies join one of the accelerator programs that best suits their products. The accelerators are: Chinaccelerator, focused on the Chinese market; Indie Bio, supporting biotechnology and life sciences companies; Food-X, for food-tech and agriculture-focused companies; dlab, which supports startups exploring blockchain and decentralized tech; HAX, for IoT, robotics and other hardware-focused startups; and MOX, an accelerator specializing in mobile platforms and technologies. SOSV, along with the O'Sullivan Foundation, has also provided support for education initiatives such as Khan Academy and CoderDojo (which teaches coding skills to youth).

Established in 1995 by Sean O'Sullivan, SOSV is a venture capital firm with six attached accelerator programs. Upon receiving investment from SOSV, portfolio companies join one of the accelerator programs that best suits their products. The accelerators are: Chinaccelerator, focused on the Chinese market; Indie Bio, supporting biotechnology and life sciences companies; Food-X, for food-tech and agriculture-focused companies; dlab, which supports startups exploring blockchain and decentralized tech; HAX, for IoT, robotics and other hardware-focused startups; and MOX, an accelerator specializing in mobile platforms and technologies. SOSV, along with the O'Sullivan Foundation, has also provided support for education initiatives such as Khan Academy and CoderDojo (which teaches coding skills to youth).

Xiyee Assets was founded in 2016 and is headquartered in Beijing. The firm is involved in private equity investment, M&A, restructuring, real estate and disposal of non-performing assets. It mainly invests in sectors such as advanced manufacturing, new energy, environmental protection, medtech and healthcare.

Xiyee Assets was founded in 2016 and is headquartered in Beijing. The firm is involved in private equity investment, M&A, restructuring, real estate and disposal of non-performing assets. It mainly invests in sectors such as advanced manufacturing, new energy, environmental protection, medtech and healthcare.

Rothenberg Ventures is a Silicon Valley VC, also previously known as Frontier Technology Venture Capital. Based in San Francisco, the VC was also a spin-off from River Ecosystem. Founded with seed capital of $5m raised by Mike Rothenberg in 2012, the firm has invested in more than 100 startups in VR/AR, AI, machine learning, drones, robotics and space. In 2016, the VC and its founder were investigated by the US Securities and Exchange Commission. In 2018, Rothenberg himself and the VC were charged with fraud. Rothenberg has resigned from the firm and agreed to be barred from the brokerage and investment advisory business for five years. The SEC is seeking $18.8m disgorgement penalties and $9m civil penalty plus $3.7m pre-judgement interest.

Rothenberg Ventures is a Silicon Valley VC, also previously known as Frontier Technology Venture Capital. Based in San Francisco, the VC was also a spin-off from River Ecosystem. Founded with seed capital of $5m raised by Mike Rothenberg in 2012, the firm has invested in more than 100 startups in VR/AR, AI, machine learning, drones, robotics and space. In 2016, the VC and its founder were investigated by the US Securities and Exchange Commission. In 2018, Rothenberg himself and the VC were charged with fraud. Rothenberg has resigned from the firm and agreed to be barred from the brokerage and investment advisory business for five years. The SEC is seeking $18.8m disgorgement penalties and $9m civil penalty plus $3.7m pre-judgement interest.

Founded in 2007 in Shanghai, CTC Capital currently has branches in Beijing, Suzhou and Taipei. The company invests in both US dollars and RMB and has three funds under its management. It mainly targets the TMT, clean energy and consumer product sectors. Half of its management team have many years experience working in Taiwan’s semiconductor industry. In 2019, CTC Capital set up the Guodiao Guoxin Zhixin Fund to invest in the semiconductor integrated circuit sector.

Founded in 2007 in Shanghai, CTC Capital currently has branches in Beijing, Suzhou and Taipei. The company invests in both US dollars and RMB and has three funds under its management. It mainly targets the TMT, clean energy and consumer product sectors. Half of its management team have many years experience working in Taiwan’s semiconductor industry. In 2019, CTC Capital set up the Guodiao Guoxin Zhixin Fund to invest in the semiconductor integrated circuit sector.

Founded in 2012, BAIC Capital is the investment arm of China's state-owned carmaker, BAIC Group. Headquartered in Beijing, it has branches in six cities across China and has two subsidiaries in Frankfurt and Silicon Valley. It currently manages over 40 funds, worth RMB 30bn. With a focus on connected cars and mobility services, it has invested in more than 100 companies including EV manufacturer BAIC BJEV, battery manufacturer and technology company CATL and ride-hailing giant Didi Chuxing.

Founded in 2012, BAIC Capital is the investment arm of China's state-owned carmaker, BAIC Group. Headquartered in Beijing, it has branches in six cities across China and has two subsidiaries in Frankfurt and Silicon Valley. It currently manages over 40 funds, worth RMB 30bn. With a focus on connected cars and mobility services, it has invested in more than 100 companies including EV manufacturer BAIC BJEV, battery manufacturer and technology company CATL and ride-hailing giant Didi Chuxing.

Creandum invests in early-stage technology firms in the consumer internet, software and hardware sectors. The firm has grown from having 10 startups in its portfolio and an advisory team scattered across Sweden in 2007, to being headquartered in Stockholm with offices in Berlin, San Francisco and Guernsey and a total five funds raised worth over €700m. It's most recent fund raised €265m in 2019 and will ofcus on European startups. The company was the lead investor in more than a third of its almost 150 investments to date and was Spotify's first institutional investor. The most recent investments include in Spanish HR SaaS Factorial's €15m Series A round and in German tax assistant app Taxfix's US$65m Series C round.

Creandum invests in early-stage technology firms in the consumer internet, software and hardware sectors. The firm has grown from having 10 startups in its portfolio and an advisory team scattered across Sweden in 2007, to being headquartered in Stockholm with offices in Berlin, San Francisco and Guernsey and a total five funds raised worth over €700m. It's most recent fund raised €265m in 2019 and will ofcus on European startups. The company was the lead investor in more than a third of its almost 150 investments to date and was Spotify's first institutional investor. The most recent investments include in Spanish HR SaaS Factorial's €15m Series A round and in German tax assistant app Taxfix's US$65m Series C round.

Horizons Ventures is a Hong Kong-based venture capital firm that manages the personal investments of Li Ka-shing, one of Hong Kong’s richest businessmen. Horizons’ investments cover a wide range of tech, media, and telecommunications companies. Standouts include artificial intelligence company DeepMind (acquired by Google in 2014), plant-based meat replacement makers Impossible Foods, and video conferencing software Zoom. It has also backed consumer-facing businesses like Atomo Coffee in Australia, Kopi Kenangan in Indonesia, and US-based distilled spirits company Endless West.

Horizons Ventures is a Hong Kong-based venture capital firm that manages the personal investments of Li Ka-shing, one of Hong Kong’s richest businessmen. Horizons’ investments cover a wide range of tech, media, and telecommunications companies. Standouts include artificial intelligence company DeepMind (acquired by Google in 2014), plant-based meat replacement makers Impossible Foods, and video conferencing software Zoom. It has also backed consumer-facing businesses like Atomo Coffee in Australia, Kopi Kenangan in Indonesia, and US-based distilled spirits company Endless West.

Rice Bank was founded by two former Alibaba executives in 2014. The VC mainly invests in early-stage startups across the sectors of mobile internet, digital entertainment, media, intelligent hardware and cloud computing.

Rice Bank was founded by two former Alibaba executives in 2014. The VC mainly invests in early-stage startups across the sectors of mobile internet, digital entertainment, media, intelligent hardware and cloud computing.

BayWa Venture GmbH is a subsidiary company of BayWa AG, the German agriculture, energy and construction conglomerate.Putting digitalization at the core of its agriculture strategy, the company is looking to expand its core business into digital services within the existing businesses. It is investigating new digital business models and stand-alone concepts through collaboration with emerging startups focusing on cutting-edge technologies in the agrifood tech space.BayWa started to invest in startups in 2012 mainly focused on online customer management, services and sales platforms. In 2015, the company purchased Farm Facts, a German farm management SaaS and in 2017 invested in Abundant Robotics, a US-based automated harvest company. One of the firms’ most recent investments has been Evja, an Italian startup developing precision farming hardware based on advanced agronomic models and machine learning technology.

BayWa Venture GmbH is a subsidiary company of BayWa AG, the German agriculture, energy and construction conglomerate.Putting digitalization at the core of its agriculture strategy, the company is looking to expand its core business into digital services within the existing businesses. It is investigating new digital business models and stand-alone concepts through collaboration with emerging startups focusing on cutting-edge technologies in the agrifood tech space.BayWa started to invest in startups in 2012 mainly focused on online customer management, services and sales platforms. In 2015, the company purchased Farm Facts, a German farm management SaaS and in 2017 invested in Abundant Robotics, a US-based automated harvest company. One of the firms’ most recent investments has been Evja, an Italian startup developing precision farming hardware based on advanced agronomic models and machine learning technology.

Bright Success Capital Ltd is a Hong Kong-based family office founded by Hilton Tam who has previously worked at Seagate Technology and Cisco Systems. He specializes in R&D, supply chain processes and consumer electronics manufacturing. Successful investments include Flixibus and N26. The VC manages a portfolio of companies involved in manufacturing and supply chains specifically for hardware components, medical devices, drones and consumer robotics. Its investment focus covers diverse sectors like robotics, fintech, healthcare, enterprise software and deep tech.

Bright Success Capital Ltd is a Hong Kong-based family office founded by Hilton Tam who has previously worked at Seagate Technology and Cisco Systems. He specializes in R&D, supply chain processes and consumer electronics manufacturing. Successful investments include Flixibus and N26. The VC manages a portfolio of companies involved in manufacturing and supply chains specifically for hardware components, medical devices, drones and consumer robotics. Its investment focus covers diverse sectors like robotics, fintech, healthcare, enterprise software and deep tech.

Founded by Zhang Yiming in 2012, ByteDance is currently the world’s most valuable startup, worth over $100bn by May 2020. It owns quite a number of popular apps including the news aggregator Jinri Toutiao and short video platforms such as Douyin and its overseas version TikTok.ByteDance is also an active investor in China’s startup ecosystem. With a focus on education and gaming, it also invests in sectors of media, enterprise tech, education, gaming, finance, real estate, artificial intelligence and hardware. As of mid-2020, it had invested in 89 companies.

Founded by Zhang Yiming in 2012, ByteDance is currently the world’s most valuable startup, worth over $100bn by May 2020. It owns quite a number of popular apps including the news aggregator Jinri Toutiao and short video platforms such as Douyin and its overseas version TikTok.ByteDance is also an active investor in China’s startup ecosystem. With a focus on education and gaming, it also invests in sectors of media, enterprise tech, education, gaming, finance, real estate, artificial intelligence and hardware. As of mid-2020, it had invested in 89 companies.

Green Innovations is an impact fund that invests in large-scale projects addressing global sustainability challenges, focusing on the agriculture, biotechnology, education, energy, housing and water sectors. It is headed by Angola-based Portuguese businessman Jorge Marques, and linked to Israeli group Mitrelli. Green Innovations took control of Biocant, Portugal’s biggest biotech park, in a privatization move in 2017–2018. Green Innovations's stable of companies includes Green Biotech, created to invest in biotechnology in Portugal, and Green Services Innovations, linked to the exploration of phosphates in Congo.Its recent investments include in the June 2021 $85m Series C round and February 2021 $25m Series B of Portuguese home physiotherapy tech solution SWORD Health, the world’s fastest-growing musculoskeletal solution.

Green Innovations is an impact fund that invests in large-scale projects addressing global sustainability challenges, focusing on the agriculture, biotechnology, education, energy, housing and water sectors. It is headed by Angola-based Portuguese businessman Jorge Marques, and linked to Israeli group Mitrelli. Green Innovations took control of Biocant, Portugal’s biggest biotech park, in a privatization move in 2017–2018. Green Innovations's stable of companies includes Green Biotech, created to invest in biotechnology in Portugal, and Green Services Innovations, linked to the exploration of phosphates in Congo.Its recent investments include in the June 2021 $85m Series C round and February 2021 $25m Series B of Portuguese home physiotherapy tech solution SWORD Health, the world’s fastest-growing musculoskeletal solution.

Founded in 1980, INELCOM is a large Spanish manufacturing company that specializes in hardware, including microelectronics, optoelectronics and digital signal processors. It does not typically invest in tech startups, and, to date, its only declared investment has been in Valencian accessibility hardware and app for the deaf, Visualfy, to which it has contributed pre-seed and seed funding rounds totalling just over €3m. It is the startup’s industrial partner and manufactures its hardware.

Founded in 1980, INELCOM is a large Spanish manufacturing company that specializes in hardware, including microelectronics, optoelectronics and digital signal processors. It does not typically invest in tech startups, and, to date, its only declared investment has been in Valencian accessibility hardware and app for the deaf, Visualfy, to which it has contributed pre-seed and seed funding rounds totalling just over €3m. It is the startup’s industrial partner and manufactures its hardware.

GoHub Ventures is the Valencia-based corporate venture capital arm of Global Omnium, a company specialised in water management. The firm invests in the seed and scale-up phases with a ticket size between €500,000 - €3m.The comnpany has so far invested €11m until 2020 and is mostly backing deep tech startups working in AI, big data, 3D, IoT and robotics and cybersecurity sectors.

GoHub Ventures is the Valencia-based corporate venture capital arm of Global Omnium, a company specialised in water management. The firm invests in the seed and scale-up phases with a ticket size between €500,000 - €3m.The comnpany has so far invested €11m until 2020 and is mostly backing deep tech startups working in AI, big data, 3D, IoT and robotics and cybersecurity sectors.

Founded in 2008, Newfund Capital is a Paris-based VC firm investing in pre-seed, seed and follow-up rounds with fundings between $300,000 and $2m in startups based in Europe and North America. To date, it has $260m worth of assets under management, mostly subscribed by entrepreneurs and family offices. The firm has also started a NAEH fund of $100,000 in the Nouvelle Aquitaine region. Newfund Capital describes the NAEH fund as a risky mutual fund that will take minority stakes in unlisted companies.

Founded in 2008, Newfund Capital is a Paris-based VC firm investing in pre-seed, seed and follow-up rounds with fundings between $300,000 and $2m in startups based in Europe and North America. To date, it has $260m worth of assets under management, mostly subscribed by entrepreneurs and family offices. The firm has also started a NAEH fund of $100,000 in the Nouvelle Aquitaine region. Newfund Capital describes the NAEH fund as a risky mutual fund that will take minority stakes in unlisted companies.

Europe ramps up development of local EV battery sector in race to zero emissions

Startups, automakers jostle or unite to ride the fast-growing EV battery market, as the EU pumps billions into developing its own value chain, to cut reliance on imports

SWITCH Singapore 2021: Driving renewable energy impact through better business models

Startups need to communicate the business benefits of green solutions to their customers, rather than just pitching the hi-tech

SWITCH Singapore 2021: How startups, corporates and government can co-create smart cities

The next generation of adaptive spaces will harness big data, deep tech and analytics to respond intelligently to both changing environments and human needs, says an expert panel

BeeHero: Agritech for bee health and better crop pollination

Combining AI, smart sensors and the world’s largest bee database, BeeHero accurately predicts disorders in colonies, helping beekeepers reduce the mortality rate of bees vital for crop pollination

Forget solar panels and batteries, Bioo wants to scale soil bioelectricity generation

Improving on NASA’s microbial fuel cell tech, Bioo hopes to boost crop efficiency and transform the way urbanites live, in future green cities powered by plants

South Summit 2021: Lessons in expanding to Asia from experts on the ground

Cast aside your Eurocentric mindsets, China-based SOSV’s Oscar Ramos and Brinc’s Heriberto Saldivar tell startups, why they should expand to the region, and how best to do it

Smart Agrifood Summit 2021: A global innovation ecosystem is needed to catch up with other sectors

Investors from SVG Ventures/THRIVE, Pinduoduo and others agree that players must join forces to boost agrifood tech investment, internationally and across the value chain

ARTICARES: Personalized, more affordable arm rehab therapy at home

Using adaptive AI, its H-Man robot works like an occupational therapist, assessing patient’s performance and adjusting the complexity of training tasks in real time

Forward Fooding: Ranking the world's agrifood startups on success and sustainability

The collaborative platform has opened applications for its FoodTech500 global ranking of agrifood startups; counts over 7,000 startups and scaleups mapped so far

Linptech: Smart home devices powered by movement

The first in China to tap kinetic energy to control smart home devices, Linptech has seen its wireless, battery-free products used in smart homes, and even at the Tokyo Olympics

Sequoia Capital China holds steady with investments in healthcare, biotech and green economy

China’s most active investor increases bets on sectors beyond the consumer internet and edtech recently hurt by regulatory clampdown

MIWA Technologies: Reducing food waste and packaging with smart refill vending system

MIWA’s solution lets consumers buy exact refill quantities in personalized containers, eradicating need for single-use plastics throughout the supply chain

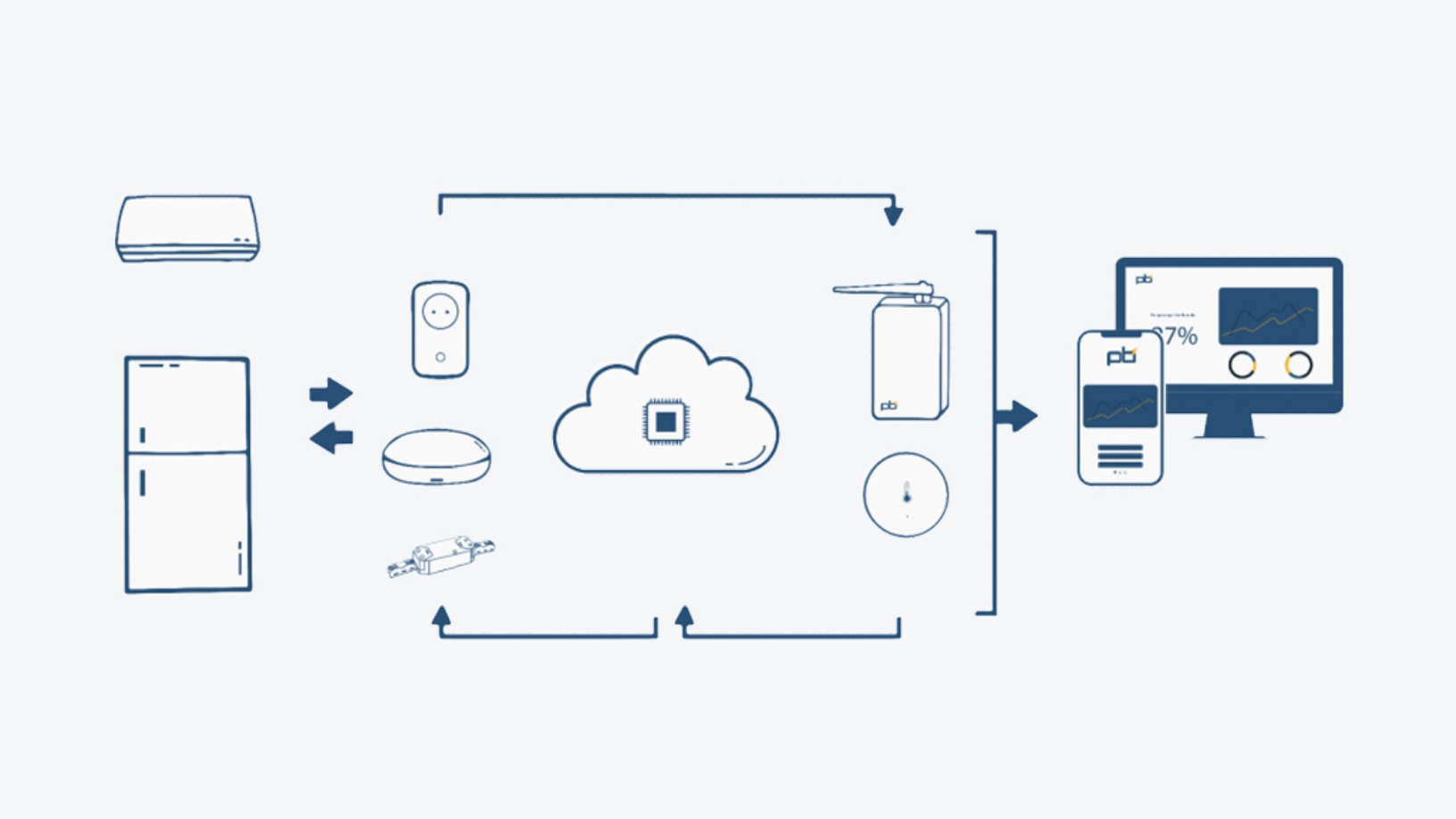

Powerbrain: Saving energy and cutting emissions for SMEs, with none of the fuss

Already profitable within a year of running, Powerbrain is raising funds to protect its IPs and enter new verticals in Indonesia’s energy management business

New sectors, strategies come into play as investors respond to China's Big Tech curbs

Amid the crackdown on China’s tech giants, some investors are sussing out less risky sectors, while heavyweights like BlackRock and Fidelity stay in for the long haul

Viezo: Vibration energy harvesting to power sensors and IoT devices

Disrupting the battery market, Viezo’s proprietary technology, PolyFilm, can also boost operational efficiency and slash maintenance costs of sensors and IoT devices

Search instead for portugal, b2b, hospitality