Alpha JWC Ventures

-

DATABASE (307)

-

ARTICLES (218)

Zhenzhen Sun is a veteran investor who has worked in prestigious firms like Morgan Stanley and JP Morgan. After leaving JP Morgan in 2009, she worked for Chinese real estate developer LL Land. She left in 2013 to join PreAngel Partners, an angel investment fund. She recently joined Proxima Ventures, a China-based VC that invests in healthcare technology.

Zhenzhen Sun is a veteran investor who has worked in prestigious firms like Morgan Stanley and JP Morgan. After leaving JP Morgan in 2009, she worked for Chinese real estate developer LL Land. She left in 2013 to join PreAngel Partners, an angel investment fund. She recently joined Proxima Ventures, a China-based VC that invests in healthcare technology.

Aqua-Spark is a Netherlands-based fund that supports aquaculture businesses around the world, with the vision to create profitable aquaculture ventures that can help to restore ocean ecosystems that have been damaged by overfishing. Its portfolio covers a wide range of enterprises, ranging from low-cost fish farms in Madagascar to biotechs and high tech aquaculture companies.

Aqua-Spark is a Netherlands-based fund that supports aquaculture businesses around the world, with the vision to create profitable aquaculture ventures that can help to restore ocean ecosystems that have been damaged by overfishing. Its portfolio covers a wide range of enterprises, ranging from low-cost fish farms in Madagascar to biotechs and high tech aquaculture companies.

Global Investment Fund (GIF) is an impact investment fund supporting new ventures that are solving social problems in the developing world. Besides investing through debt, equity investments and SAFE (simple agreement for future equity) contracts, GIF also disburses grants for social enterprises. It invests in various sectors, including agriculture and aquaculture, health, education, water and fintech.

Global Investment Fund (GIF) is an impact investment fund supporting new ventures that are solving social problems in the developing world. Besides investing through debt, equity investments and SAFE (simple agreement for future equity) contracts, GIF also disburses grants for social enterprises. It invests in various sectors, including agriculture and aquaculture, health, education, water and fintech.

Ataria Ventures is an early stage fund that offers predominantly Latin American investors and corporations access to technology startups in Israel and Silicon Valley. It has invested in more than 30 startups across a variety of industries and sectors, including Artificial Intelligence, Big Data, Virtual Reality, foodtech, agritech, consumer, and health.

Ataria Ventures is an early stage fund that offers predominantly Latin American investors and corporations access to technology startups in Israel and Silicon Valley. It has invested in more than 30 startups across a variety of industries and sectors, including Artificial Intelligence, Big Data, Virtual Reality, foodtech, agritech, consumer, and health.

Ellipsis Technologies provides startups with strategic, commercial, financial and operational advising. It identifies new seed ventures from IT and e-commerce startups, offering mentoring and investing (direct and sweat equity). It also helps SME and big corporations in their digital transformation. Its founder and CEO is Marc Costacela, one of Atomian’s advisors.

Ellipsis Technologies provides startups with strategic, commercial, financial and operational advising. It identifies new seed ventures from IT and e-commerce startups, offering mentoring and investing (direct and sweat equity). It also helps SME and big corporations in their digital transformation. Its founder and CEO is Marc Costacela, one of Atomian’s advisors.

Lippo Digital Ventures was the corporate venture arm of Indonesian conglomerate Lippo Group, founded by Indonesian billionaire and banker Mochtar Riady. In 2015, the company reincarnated as Venturra Capital, a US$150 million fund focusing on technology firms in Indonesia and Southeast Asia.

Lippo Digital Ventures was the corporate venture arm of Indonesian conglomerate Lippo Group, founded by Indonesian billionaire and banker Mochtar Riady. In 2015, the company reincarnated as Venturra Capital, a US$150 million fund focusing on technology firms in Indonesia and Southeast Asia.

Crevisse Partners is a South Korean investor and venture builder with an impact focus. Its name stands for “Creative, Visionary and Social Entrepreneurs”. Originally incorporated in 2004, Crevisse claims to be the first impact investor in Korea, even before such terms became commonplace. The company strives to develop businesses in sectors “where the market principle wasn’t working”.Crevisse has internally incubated a number of companies in South Korea, such as reusable drinking cup company BringYourCup, sustainable forestry firm Forest Trust, and fundraising service DONUS. Crevisse Ventures is the company’s dedicated VC arm that manages a $20m fund and a number of blended finance funds through collaborations with government agencies and financial institutions. In particular, Crevisse Ventures focuses on startups that solve problems in four major areas: urban communities; climate and energy; education and welfare; as well as jobs and economic growth.

Crevisse Partners is a South Korean investor and venture builder with an impact focus. Its name stands for “Creative, Visionary and Social Entrepreneurs”. Originally incorporated in 2004, Crevisse claims to be the first impact investor in Korea, even before such terms became commonplace. The company strives to develop businesses in sectors “where the market principle wasn’t working”.Crevisse has internally incubated a number of companies in South Korea, such as reusable drinking cup company BringYourCup, sustainable forestry firm Forest Trust, and fundraising service DONUS. Crevisse Ventures is the company’s dedicated VC arm that manages a $20m fund and a number of blended finance funds through collaborations with government agencies and financial institutions. In particular, Crevisse Ventures focuses on startups that solve problems in four major areas: urban communities; climate and energy; education and welfare; as well as jobs and economic growth.

Geniee is an adtech company which has developed its own supply-side platform (SSP), demand-side platform (DSP) and data management platform (DMP). It was founded in 2012 with venture funding from GREE Ventures. In 2015, it received Series D funding from Fenox Venture Capital. So far it has invested in Adskom and AdPushup, both of which are adtech companies.

Geniee is an adtech company which has developed its own supply-side platform (SSP), demand-side platform (DSP) and data management platform (DMP). It was founded in 2012 with venture funding from GREE Ventures. In 2015, it received Series D funding from Fenox Venture Capital. So far it has invested in Adskom and AdPushup, both of which are adtech companies.

Kinara is a venture capital fund based in Indonesia. Established in 2011, it focuses on impact investments that include supporting inclusive economy initiatives and eco-friendly ventures such as Greeneration. Kinara has been managing Indonesia’s first business impact acceleration program that has produced 11 enterprises in the food security sector since 2016. Other priority sectors are microfinance, clean tech, agriculture and fisheries.

Kinara is a venture capital fund based in Indonesia. Established in 2011, it focuses on impact investments that include supporting inclusive economy initiatives and eco-friendly ventures such as Greeneration. Kinara has been managing Indonesia’s first business impact acceleration program that has produced 11 enterprises in the food security sector since 2016. Other priority sectors are microfinance, clean tech, agriculture and fisheries.

Founded in Shanghai in 2002, Pre IPO is a private equity investor targeting pre-IPO startups in China. It specializes in sectors like consumer products, medicine, edtech, eco-friendly technology, advanced manufacturing and agriculture. The firm also participates in M&A ventures and risk investments in high-tech, new media and IT.

Founded in Shanghai in 2002, Pre IPO is a private equity investor targeting pre-IPO startups in China. It specializes in sectors like consumer products, medicine, edtech, eco-friendly technology, advanced manufacturing and agriculture. The firm also participates in M&A ventures and risk investments in high-tech, new media and IT.

AddVentures is the venture capital arm of the Siamese Cement Group (SCG), a Thai conglomerate of businesses. The VC focuses on industrial and B2B startups. Besides backing startups, it has also invested in Vertex Ventures (Temasek's venture arm) and the B2B-focused Wavemaker Partners. AddVentures offers the opportunity for its portfolio companies to build synergies with SCG companies and other long-term partnership schemes.

AddVentures is the venture capital arm of the Siamese Cement Group (SCG), a Thai conglomerate of businesses. The VC focuses on industrial and B2B startups. Besides backing startups, it has also invested in Vertex Ventures (Temasek's venture arm) and the B2B-focused Wavemaker Partners. AddVentures offers the opportunity for its portfolio companies to build synergies with SCG companies and other long-term partnership schemes.

Established as an asset management company in 2017, Chasestone Capital has launched major funds in real estate, private equity, consumer finance and securities investment. The company completed its Series A funding round in September 2017 with backing from well-known investors such as Orient Capital, SBCVC, Cowin Capital, Bridge Capital, GIG and Tsing Ventures.

Established as an asset management company in 2017, Chasestone Capital has launched major funds in real estate, private equity, consumer finance and securities investment. The company completed its Series A funding round in September 2017 with backing from well-known investors such as Orient Capital, SBCVC, Cowin Capital, Bridge Capital, GIG and Tsing Ventures.

Wei Venture Capital is a VC fund jointly launched in November 2010 by Sina Corporation, Sequoia Capital China, IDG Capital, Sinovation Ventures, YF Capital and DFJ Dragon Fund. Sina contributed half of Wei's RMB 200m fund, with the other five partners contributing RMB 20m each. The fund is managed by Beijing Weimeng Innovation Venture Capital Management Co Ltd.

Wei Venture Capital is a VC fund jointly launched in November 2010 by Sina Corporation, Sequoia Capital China, IDG Capital, Sinovation Ventures, YF Capital and DFJ Dragon Fund. Sina contributed half of Wei's RMB 200m fund, with the other five partners contributing RMB 20m each. The fund is managed by Beijing Weimeng Innovation Venture Capital Management Co Ltd.

Ping An is China's second largest insurer, with over US$645 billion worth of assets (2015).

Ping An is China's second largest insurer, with over US$645 billion worth of assets (2015).

Founded in 2012, Purple Orange’s objective is to support the transition away from animals in the food chain, supporting early-stage food and biotech companies across the globe with a focus on alternative proteins and cellular agriculture. It currently has 12 startups from different nations in its portfolio. Its most recently disclosed investments have been in the December 2020 pre-seed round of Chinese cultured meat startup CellX and in the November 2020 $500,000 pre-seed round of Swedish plant-based food vending startup VEAT.

Founded in 2012, Purple Orange’s objective is to support the transition away from animals in the food chain, supporting early-stage food and biotech companies across the globe with a focus on alternative proteins and cellular agriculture. It currently has 12 startups from different nations in its portfolio. Its most recently disclosed investments have been in the December 2020 pre-seed round of Chinese cultured meat startup CellX and in the November 2020 $500,000 pre-seed round of Swedish plant-based food vending startup VEAT.

Alpha JWC Ventures bets on Indonesian fintech, analytics startups for big impact

A commitment to mentoring and supporting its portfolio companies also lies at the core of its business

Cautiously opportunistic: How Indonesian VCs are riding out the Covid-19 crisis

Indonesian VCs on how they are doing deals during Covid-19, and their advice to startups, from how to cut costs to M&A

F&B supplier STOQO collapses, a casualty of Covid-19 restaurant closures in Indonesia

A once promising startup, STOQO's woes reflect the challenges faced by the local F&B industry, which is finding new ways to stay afloat

Healthy eating: The Southeast Asian startups making it a breeze

From meal plans to novel ingredients, agriculture and foodtech startups in the region are developing new ways to improve nutrition without sacrificing taste

Indonesian edtechs attract funding even as students head back to school

With services that complement and support conventional schools at a fraction of offline tuition cost, edtech companies are likely to continue growing

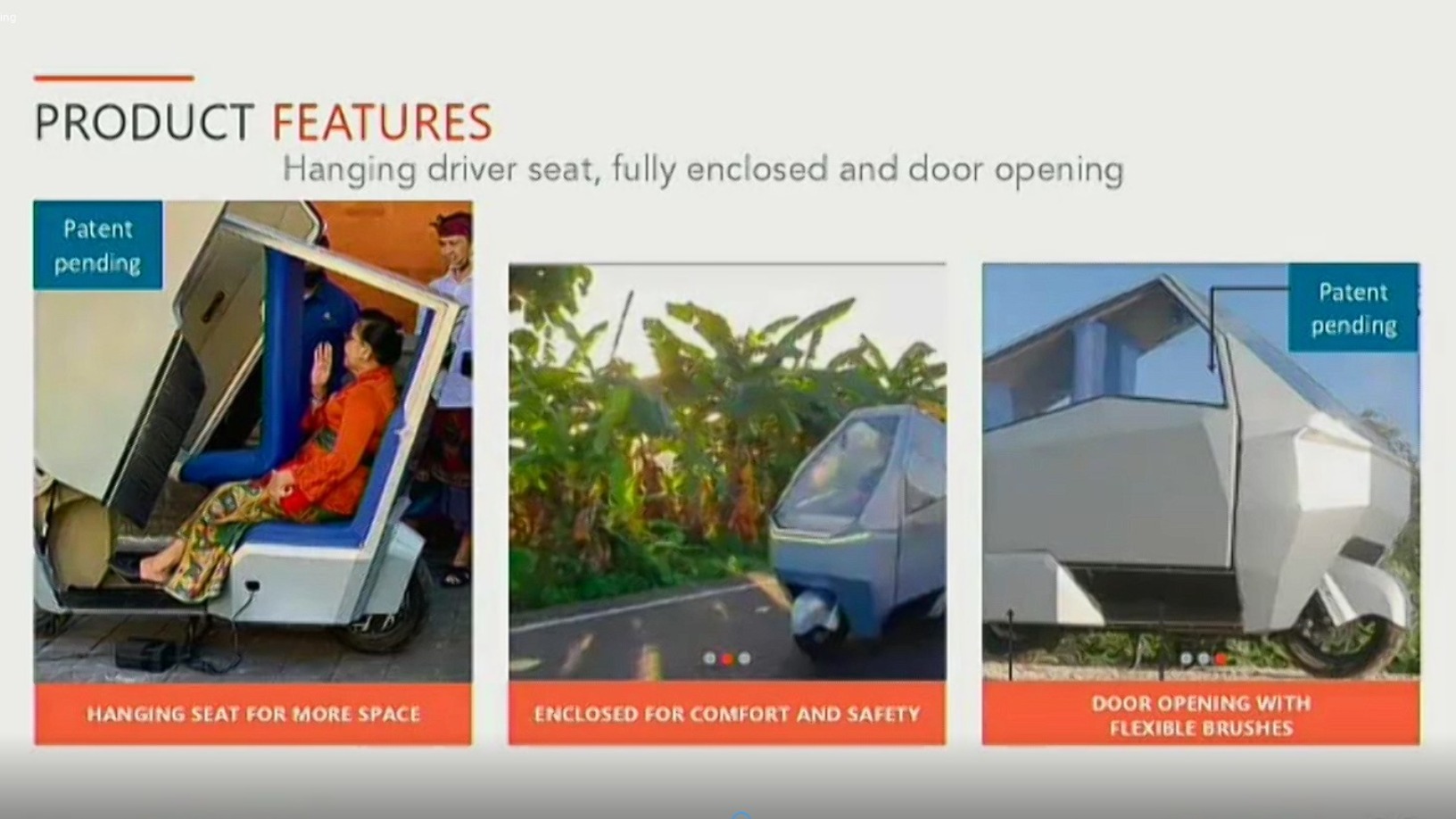

HighPitch 2020: Hydroponics, EV startups PanenBali and Manouv represent Denpasar chapter

Renewable energy and sustainability focuses impress investors, who also caution startups about competitors from outside their region

Kopi Kenangan serves up an addictive blend of rapid expansion and profitability

Its recent $109m Series B infusion boosts the Indonesian startup's confidence for sustainability and regional expansion despite the current Covid-19 slowdown

Indonesia launches national pitch competition HighPitch 2020 to re-energize its startup ecosystem

With 43 VC investors so far joining as judges and mentors, HighPitch 2020 aims to reconnect investors with young startups across the country amid Covid-19

Ajaib targets millennials with easy-to-use investment app

Y Combinator alumnus Ajaib recently acquired a local brokerage to add stock trading to its products

Indonesia's Rata offers customized aligners for quicker teeth straightening

Founded by two dentists, Alpha JWC Ventures-backed Rata seeks to offer an affordable alternative to conventional braces by tapping AI in orthodontics

Evermos is Indonesia's version of social commerce – and it's Sharia-compliant, too

Evermos targets the resale market, encouraging students and housewives to earn extra income by promoting products on their social media and WhatsApp networks

No dine-in, no problem: Hangry’s cloud kitchens thrive amid Covid-19

Learning from global F&B franchises has helped Hangry expand rapidly, maintain quality and set expansion goals despite the pandemic

Agritech from Myanmar to Indonesia and beyond: Interview with Jefry Pratama, UMG Idealab

UMG, the Myanmar-based conglomerate, looks to Indonesia for investment and inspiration, with agritech and drones among its focuses

Cecilia Tham: the power of shifting paradigms

The embodiment of unconventional thinking and creativity, this female entrepreneur from Hong Kong has been pioneering social transformation within Barcelona's startup ecosystem since 2011

Tokopedia gets hacked, 91m customer records for sale on the dark web

Tokopedia is investigating the breach, and users should change their passwords as soon as possible

Sorry, we couldn’t find any matches for“Alpha JWC Ventures”.