Conector Startup Accelerator

-

DATABASE (609)

-

ARTICLES (703)

HATCH is an aquaculture-tech-focused accelerator program initiated by the aquaculture-focused seed VC investor Alimentos Ventures to help related startups reach commercialization and access further funding. Its inaugural program was held in Bergen, Norway, followed by a second batch in Cork, Ireland. Successful applicants get €50,000 cash and possible subsequent funding, plus free office space for up to 12 months in either of HATCH's offices in Bergen and Singapore. Its international partners include food corporates, state entities and aquaculture groups.

HATCH is an aquaculture-tech-focused accelerator program initiated by the aquaculture-focused seed VC investor Alimentos Ventures to help related startups reach commercialization and access further funding. Its inaugural program was held in Bergen, Norway, followed by a second batch in Cork, Ireland. Successful applicants get €50,000 cash and possible subsequent funding, plus free office space for up to 12 months in either of HATCH's offices in Bergen and Singapore. Its international partners include food corporates, state entities and aquaculture groups.

Allianz X is the venture capital arm of Allianz Group. Its investments primarily focus on insurance, healthcare and finance-related tech startups, such as American Well, BIMA (micro-insurance company) and Simplesurance. However, it recently made investments in Indonesian ride-hailing startup Gojek as well as the Drone Racing League, a startup that promotes drone racing as an emerging sport.

Allianz X is the venture capital arm of Allianz Group. Its investments primarily focus on insurance, healthcare and finance-related tech startups, such as American Well, BIMA (micro-insurance company) and Simplesurance. However, it recently made investments in Indonesian ride-hailing startup Gojek as well as the Drone Racing League, a startup that promotes drone racing as an emerging sport.

Launched in 2007, Seedcamp is Europe’s first seed fund and accelerator. Founded by 30 European investors, it focuses on pre-seed and seed stage startups. It has backed nearly 200 companies, producing one unicorn. About 90% of its portfolio have raised further funding of about US$350 million.The company typically invests in one of three ways:€75,000 for 7% of equityFull access to the Seedcamp Platform for 3% warrantsUp to €200,000 in seed funding

Launched in 2007, Seedcamp is Europe’s first seed fund and accelerator. Founded by 30 European investors, it focuses on pre-seed and seed stage startups. It has backed nearly 200 companies, producing one unicorn. About 90% of its portfolio have raised further funding of about US$350 million.The company typically invests in one of three ways:€75,000 for 7% of equityFull access to the Seedcamp Platform for 3% warrantsUp to €200,000 in seed funding

DFS Lab is a fintech-centric incubator/accelerator company with a focus on emerging markets. Supported by a US$4.8 million grant from the Gates Foundation, many of the portfolio companies provide fintech products and also help to improve the financial literacy education for people in developing countries. About 50% of the startups are run by female co-founders and 73% originate from the emerging markets.

DFS Lab is a fintech-centric incubator/accelerator company with a focus on emerging markets. Supported by a US$4.8 million grant from the Gates Foundation, many of the portfolio companies provide fintech products and also help to improve the financial literacy education for people in developing countries. About 50% of the startups are run by female co-founders and 73% originate from the emerging markets.

Founded in 2018, Oslo-based Katapult Ocean is the first investor focused entirely on oceantech and related startups. The VC also operates a three-month accelerator and has invested in 32 startups from 17 countries worldwide.The VC typically invests at the seed or pre-seed level but in July 2020 it completed its first Series A round of $8.5m investment in Chilean social enterprise Betterfly. Other recent investments include the pre-seed rounds of US foodtech GreenCover and Dutch offshore solar tech SolarDuck.

Founded in 2018, Oslo-based Katapult Ocean is the first investor focused entirely on oceantech and related startups. The VC also operates a three-month accelerator and has invested in 32 startups from 17 countries worldwide.The VC typically invests at the seed or pre-seed level but in July 2020 it completed its first Series A round of $8.5m investment in Chilean social enterprise Betterfly. Other recent investments include the pre-seed rounds of US foodtech GreenCover and Dutch offshore solar tech SolarDuck.

Triputra Group is an Indonesian conglomerate with businesses in agriculture, manufacturing, trading and mining. It also runs a pension fund and a charitable foundation. The conglomerate was founded in 1998 by Theodore Permadi Rachmat, the former CEO of the Astra Group. It is a recent entrant in the startup investing scene; in 2018, it invested in retail startup Warung Pintar and fishery automation company eFishery.

Triputra Group is an Indonesian conglomerate with businesses in agriculture, manufacturing, trading and mining. It also runs a pension fund and a charitable foundation. The conglomerate was founded in 1998 by Theodore Permadi Rachmat, the former CEO of the Astra Group. It is a recent entrant in the startup investing scene; in 2018, it invested in retail startup Warung Pintar and fishery automation company eFishery.

Yang Dengfeng is the co-founder and CEO of online-to-offline pet services startup Zhuazhua.

Yang Dengfeng is the co-founder and CEO of online-to-offline pet services startup Zhuazhua.

Founded in Nairobi in 2017, Chandaria Capital invests in African tech and non-tech startups across market segments. It currently has 13 companies in its portfolio. Recent investments include Kenyan diagnostics medtech startup Ilhara Health’s $3.8m Series A round in 2020 and $735,000 seed funding in 2019. The VC has also joined the seed investment round for Kenyan food and beverage startup Savannah Brand in 2019.

Founded in Nairobi in 2017, Chandaria Capital invests in African tech and non-tech startups across market segments. It currently has 13 companies in its portfolio. Recent investments include Kenyan diagnostics medtech startup Ilhara Health’s $3.8m Series A round in 2020 and $735,000 seed funding in 2019. The VC has also joined the seed investment round for Kenyan food and beverage startup Savannah Brand in 2019.

InnovationRCA is the Royal College of Art’s center for entrepreneurship and commercialization. It supports RCA students, alumni and employees looking to turn their ideas into new businesses. The center was established in 2004 and is based in London.The centre’s activities include providing startup incubation and acceleration services to potential RCA spin-offs. This includes coaching and business mentoring based on RCA’s design-led, user-centric approach, as well as intellectual property advice and support. In addition, the center offers access to office and workshop space, as well as funding. InnovationRCA runs its own angel investor network, AngelClubRCA. It has also partnered with a UK-based VC, Venrex Investment Management, to improve RCA startups’ access to private funding. In addition, the centre conducts programmes for external entrepreneurs and organisations looking to promote innovation and entrepreneurship worldwide.McKinsey has called InnovationRCA a “world-class spinout incubator", praising its work as a "significant driver of entrepreneurial growth” along with its ”impressive results". In July 2019, the UK Business Angels Association also named InnovationRCA its Accelerator of the Year.

InnovationRCA is the Royal College of Art’s center for entrepreneurship and commercialization. It supports RCA students, alumni and employees looking to turn their ideas into new businesses. The center was established in 2004 and is based in London.The centre’s activities include providing startup incubation and acceleration services to potential RCA spin-offs. This includes coaching and business mentoring based on RCA’s design-led, user-centric approach, as well as intellectual property advice and support. In addition, the center offers access to office and workshop space, as well as funding. InnovationRCA runs its own angel investor network, AngelClubRCA. It has also partnered with a UK-based VC, Venrex Investment Management, to improve RCA startups’ access to private funding. In addition, the centre conducts programmes for external entrepreneurs and organisations looking to promote innovation and entrepreneurship worldwide.McKinsey has called InnovationRCA a “world-class spinout incubator", praising its work as a "significant driver of entrepreneurial growth” along with its ”impressive results". In July 2019, the UK Business Angels Association also named InnovationRCA its Accelerator of the Year.

Startupbootcamp Commerce Amsterdam

Startupbootcamp Commerce Amsterdam is part of the Startupbootcamp accelerator global group that was originally founded in Denmark in 2010. The Commerce Amsterdam programs are dedicated to early-stage startups in the e-commerce and retail verticals. They help founders during the MVP development phase and provide mentoring support across logistics solutions, fraud security, AI, big data, advertising, marketing and sales.The programs are based in a co-working space in Amsterdam and founders receive €15,000 to cover their living expenses in the city during the three-month period of intense mentorship, masterclasses and pitching opportunities.

Startupbootcamp Commerce Amsterdam is part of the Startupbootcamp accelerator global group that was originally founded in Denmark in 2010. The Commerce Amsterdam programs are dedicated to early-stage startups in the e-commerce and retail verticals. They help founders during the MVP development phase and provide mentoring support across logistics solutions, fraud security, AI, big data, advertising, marketing and sales.The programs are based in a co-working space in Amsterdam and founders receive €15,000 to cover their living expenses in the city during the three-month period of intense mentorship, masterclasses and pitching opportunities.

Angels Capital is an investment vehicle created by Juan Roig as part of the Marina of Companies network in Valencia. Its mission is to grow startups within the Lanzadera accelerator, as well as external projects that facilitate the creation of a strong entrepreneurial ecosystem in Valencia. Angels Capital has 13 current investment projects, seven of which it is lead investor in and, since 2014, it has invested €15.5 million in capital. Recent investments include a €1 million venture round for cloud-based workflow platform SheetGo, and €360,000 in seed funding for bank aggregation system Afterbanks.

Angels Capital is an investment vehicle created by Juan Roig as part of the Marina of Companies network in Valencia. Its mission is to grow startups within the Lanzadera accelerator, as well as external projects that facilitate the creation of a strong entrepreneurial ecosystem in Valencia. Angels Capital has 13 current investment projects, seven of which it is lead investor in and, since 2014, it has invested €15.5 million in capital. Recent investments include a €1 million venture round for cloud-based workflow platform SheetGo, and €360,000 in seed funding for bank aggregation system Afterbanks.

Founded in 2016, Goldacre is a real-estate focused investor with a £2bn asset management business as part of the Noé Group, investing in British, EU and Israeli startups in that segment. It also operates the intensive proptech accelerator RElab with three editions to date, each time investing £100,000 in participating startups. The company does not divulge its full portfolio details but its most recent investments include in the summer 2020 a $9m Series A round of Israeli sustainable concrete tech ECOncrete and in the $7.8m June 2020 Series A round of Spanish hyperloop engineer Zeleros.

Founded in 2016, Goldacre is a real-estate focused investor with a £2bn asset management business as part of the Noé Group, investing in British, EU and Israeli startups in that segment. It also operates the intensive proptech accelerator RElab with three editions to date, each time investing £100,000 in participating startups. The company does not divulge its full portfolio details but its most recent investments include in the summer 2020 a $9m Series A round of Israeli sustainable concrete tech ECOncrete and in the $7.8m June 2020 Series A round of Spanish hyperloop engineer Zeleros.

Headquartered in San Francisco, Golden Gate Ventures aims to connect the startup ecosystem in Southeast Asia with Silicon Valley. It was established in 2011.

Headquartered in San Francisco, Golden Gate Ventures aims to connect the startup ecosystem in Southeast Asia with Silicon Valley. It was established in 2011.

Zhejiang Jinke Venture Capital

Founded in 2000, Zhejiang Jinke Venture Capital is a private venture capital enterprise. It specializes in capital investment, capital management, real estate investment and startup investment.

Founded in 2000, Zhejiang Jinke Venture Capital is a private venture capital enterprise. It specializes in capital investment, capital management, real estate investment and startup investment.

FIWARE Accelerator: More open source ecosystem than accelerator

The European open source initiative to boost smart infrastructures and solutions is calling for new participants to join its unique acceleration ecosystem

Capaball: Empowering employees to upskill in tech as more businesses digitalize

The Spanish edtech platform for Fortune 500 clients and professionals is focused on developing new markets in Latin America

Carlos Guerrero: The legal guardian of tech startups

The lawyer and investor dives deep in the Spanish startup ecosystem, supporting young tech companies with both financial and specialized legal support

HOOP Carpool: Graduates bootstrap ride-sharing app to facilitate sustainable commuting

South Summit Malaga (Smart Mobility Encounters) winners Nathan Lehoucq and Andrea García Torrijos discuss their ride-sharing app for consumers and corporates

HeyGo's shattered dreams: Promising P2P classified services platform failed to scale

With 96,000 monthly active users, classified services app HeyGo grew in user numbers, but not revenue. It soon declared bankruptcy

Big Idea Ventures Founder Andrew D Ive: Asia will lead cell-based meat innovation

In a wide-ranging interview, the managing general partner of the US- and Singapore-based foodtech investor also expounds on his goal to extend sustainability to the rest of the food sector, combining good returns with doing good

US non-profit investor New Energy Nexus seeks to kickstart Indonesia’s clean energy sectors

With a “patient capital” approach to investments and a variety of programs, New Energy Nexus hopes to show that startups can lead the way in renewables and smart energy

Portugal oceantech II: Single-minded efforts to build an ecosystem of international reference

With dedicated accelerators and investment programs, supported by the EU’s vote of confidence, Portugal appears on track to lead in oceantech

WOOM: Spanish fertility femtech gets €2m funding to expand into new B2B2C markets

AI fertility app WOOM has also created an English-language version to reach more users in North America, Europe and Asia

TheVentures founders launch Singapore VC to drive deals in Southeast Asia

The Korean Viki co-founders return to Singapore as venture builders and investors, offering South Korean partnerships and “CTO-as-a-service” in Southeast Asia

Accelerating Asia bets on unicorn wave from MSME digitalization, logistics

The investor-accelerator’s sixth batch will start accepting applications in December, with greater ESG focus and a pledge to donate 1% of profit on investments to charity

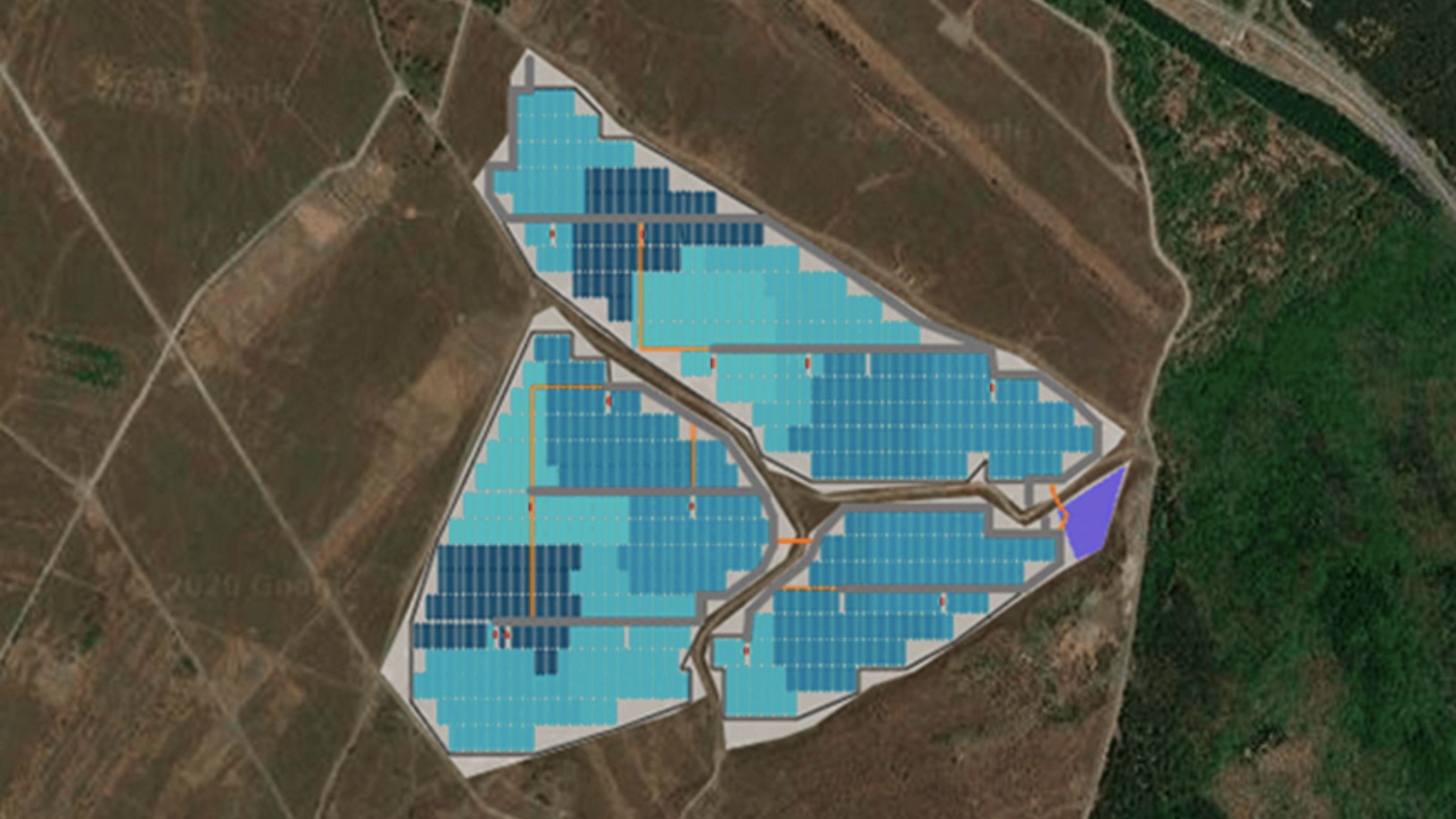

RatedPower: Creating solar power plant designs in minutes

The Spanish startup is helping solar plants expand exponentially worldwide and revolutionizing the sector with its automated software

Startup shutdown: Some takeaways from BlackGarlic’s demise

Meal subscription service BlackGarlic shut down in July, blaming the high costs of customer acquisition and retention. Here’s a look at why the Blue Apron copy couldn't satisfy the Indonesian market’s palate

Lawtech startup Reclamador.es takes negligent companies to task

Reclamador.es’ team of top-notch lawyers has seen a 98% success rate in their fight for consumers’ rights, though scaling up has been difficult

Chinese DIY robotics startup Makeblock enters the classroom

Present in more than 140 countries, this ambitious startup is taking global STEM education by storm

Sorry, we couldn’t find any matches for“Conector Startup Accelerator”.