European Space Agency

-

DATABASE (279)

-

ARTICLES (375)

CMO and co-founder of agroSingularity

In 2019, Daniel Andreu Acosta became the CMO and co-founder of agroSingularity, a Murcia-based startup producing natural powder ingredients from discarded agricultural by-products.He has over 10 years of experience in sales and marketing. He was also a managing partner at FuelUp Business Factory, a business boutique specializing in high-tech solutions for retail and customer intelligence. Acosta is also a guest professor at the European Business Factory and the Catholic University of Murcia.

In 2019, Daniel Andreu Acosta became the CMO and co-founder of agroSingularity, a Murcia-based startup producing natural powder ingredients from discarded agricultural by-products.He has over 10 years of experience in sales and marketing. He was also a managing partner at FuelUp Business Factory, a business boutique specializing in high-tech solutions for retail and customer intelligence. Acosta is also a guest professor at the European Business Factory and the Catholic University of Murcia.

CEO and Co-founder of Solatom

Miguel Frasquet Herraiz is passionate about the energy sector, having worked for six years on projects in China, the UAE and several European countries, as well as four years at the CTAER (Advanced Technology Centre for Renewable Energy) as an engineer and solar R&D coordinator. In 2016, Frasquet co-founded Solatom based on his PhD thesis and is currently the CEO of the startup that develops solar concentrators for industrial applications.

Miguel Frasquet Herraiz is passionate about the energy sector, having worked for six years on projects in China, the UAE and several European countries, as well as four years at the CTAER (Advanced Technology Centre for Renewable Energy) as an engineer and solar R&D coordinator. In 2016, Frasquet co-founded Solatom based on his PhD thesis and is currently the CEO of the startup that develops solar concentrators for industrial applications.

Established in 2006, European private equity firm Vitruvian Partners focuses on asset-light companies in its targeted sectors. The firm has a successful track record with more than 85 transactions completed. Vitruvian Partners invests £25 million to over £150 million in companies typically valued at £50 million to over £500 million.

Established in 2006, European private equity firm Vitruvian Partners focuses on asset-light companies in its targeted sectors. The firm has a successful track record with more than 85 transactions completed. Vitruvian Partners invests £25 million to over £150 million in companies typically valued at £50 million to over £500 million.

Salut Monràs is Wealth Manager and CEO of Valra Finances, S.L., a family holding company with financial assets and investments in Biotech, AI, Fintech and real estate. She has broad experience in communication, production and design and is passionate about aesthetics and creativity. She is a mother of three and a former international model, professor and entrepreneur. She is general manager of Lorda, S.L., model agent and booker for Francina Modelling Agency and is also founder of Mother Studio and co-founder and commercial director of HELMUTANDCO. She has a degree in Graphic Design from the Ramon Llull University.

Salut Monràs is Wealth Manager and CEO of Valra Finances, S.L., a family holding company with financial assets and investments in Biotech, AI, Fintech and real estate. She has broad experience in communication, production and design and is passionate about aesthetics and creativity. She is a mother of three and a former international model, professor and entrepreneur. She is general manager of Lorda, S.L., model agent and booker for Francina Modelling Agency and is also founder of Mother Studio and co-founder and commercial director of HELMUTANDCO. She has a degree in Graphic Design from the Ramon Llull University.

Ocean Link is a private equity firm that mainly invests in consumer goods, tourism and TMT sectors in China. It currently manages two USD funds and one RMB fund. It has offices in Shanghai, Beijing and Hong Kong. The limited partners include Chinese and global corporates, financial institutions, sovereign wealth funds and family offices. China’s largest online travel agency Trip.com and international private equity firm General Atlantic are strategic partners.In April 2020, Ocean Link proposed to acquire all of the outstanding ordinary shares of the Chinese online classifieds marketplace 58.com. The NYSE-listed company is in the process of evaluating the proposal.

Ocean Link is a private equity firm that mainly invests in consumer goods, tourism and TMT sectors in China. It currently manages two USD funds and one RMB fund. It has offices in Shanghai, Beijing and Hong Kong. The limited partners include Chinese and global corporates, financial institutions, sovereign wealth funds and family offices. China’s largest online travel agency Trip.com and international private equity firm General Atlantic are strategic partners.In April 2020, Ocean Link proposed to acquire all of the outstanding ordinary shares of the Chinese online classifieds marketplace 58.com. The NYSE-listed company is in the process of evaluating the proposal.

Co-founder of EatTasty

E-commerce specialist Orlando Lopes held various positions at women’s accessories brand Parfois, before joining marketing and advertising agency BySide as an account manager. At BySide, he met Rui Costa, and the two eventually co-founded food delivery startup EatTasty.

E-commerce specialist Orlando Lopes held various positions at women’s accessories brand Parfois, before joining marketing and advertising agency BySide as an account manager. At BySide, he met Rui Costa, and the two eventually co-founded food delivery startup EatTasty.

Frontline Ventures is a London-based VC firm that typically invests in early-stage B2B companies with the bulk of funding going toward European companies seeking a U.S. expansion. The current Fund II, worth €60 million, closed in 2016 and they are looking to make investments of between €200,000 and €3 million each.

Frontline Ventures is a London-based VC firm that typically invests in early-stage B2B companies with the bulk of funding going toward European companies seeking a U.S. expansion. The current Fund II, worth €60 million, closed in 2016 and they are looking to make investments of between €200,000 and €3 million each.

With about US$20 billion under management worldwide, New York-headquartered Tiger Global Management was founded in 2000 with US$25 million by billionaire Charles "Chase“ Coleman. Part private equity manager, part hedge fund manager, Tiger Global is known for its big bets on tech startups, including some of today's leading names Facebook, LinkedIn, Zynga and Uber.

With about US$20 billion under management worldwide, New York-headquartered Tiger Global Management was founded in 2000 with US$25 million by billionaire Charles "Chase“ Coleman. Part private equity manager, part hedge fund manager, Tiger Global is known for its big bets on tech startups, including some of today's leading names Facebook, LinkedIn, Zynga and Uber.

HATCH is an aquaculture-tech-focused accelerator program initiated by the aquaculture-focused seed VC investor Alimentos Ventures to help related startups reach commercialization and access further funding. Its inaugural program was held in Bergen, Norway, followed by a second batch in Cork, Ireland. Successful applicants get €50,000 cash and possible subsequent funding, plus free office space for up to 12 months in either of HATCH's offices in Bergen and Singapore. Its international partners include food corporates, state entities and aquaculture groups.

HATCH is an aquaculture-tech-focused accelerator program initiated by the aquaculture-focused seed VC investor Alimentos Ventures to help related startups reach commercialization and access further funding. Its inaugural program was held in Bergen, Norway, followed by a second batch in Cork, Ireland. Successful applicants get €50,000 cash and possible subsequent funding, plus free office space for up to 12 months in either of HATCH's offices in Bergen and Singapore. Its international partners include food corporates, state entities and aquaculture groups.

Co-founder and CTO of GoWork

Donny Tandianus is a co-founder of coworking space GoWork. After GoWork's merger with Rework, Donny became the company's CTO. Before establishing GoWork in 2016, Donny worked for nine years as a director at MagicBox, an advertising company specializing in outdoor advertisements. Donny holds a bachelor's degree in Computer Science from the University of Western Australia and attended the Business and Management program at the University of Melbourne.

Donny Tandianus is a co-founder of coworking space GoWork. After GoWork's merger with Rework, Donny became the company's CTO. Before establishing GoWork in 2016, Donny worked for nine years as a director at MagicBox, an advertising company specializing in outdoor advertisements. Donny holds a bachelor's degree in Computer Science from the University of Western Australia and attended the Business and Management program at the University of Melbourne.

CTO of Alén Space

Alberto González Muíño is co-founder and CTO of Alén Space, joining the company in 2017. He is responsible for systems design, integration, testing and operations, having led several nanosatellites missions himself. González studied telecommunications at Spain's Vigo University, joining its Aerospace Group upon graduation, where he worked for more than 11 years. He was previously also a project manager at the Aerospace Innovation Center in Galicia until July 2018.

Alberto González Muíño is co-founder and CTO of Alén Space, joining the company in 2017. He is responsible for systems design, integration, testing and operations, having led several nanosatellites missions himself. González studied telecommunications at Spain's Vigo University, joining its Aerospace Group upon graduation, where he worked for more than 11 years. He was previously also a project manager at the Aerospace Innovation Center in Galicia until July 2018.

Founded in October 2015, Pagoda Investment is a private equity firm focusing on TMT, consumer products, healthcare and education. Its key investors include Queensland Investment Corporation Limited, a Queensland-based Australian VC, and some European-based family funds as well as pension funds, with a total of RMB 5bn under management.

Founded in October 2015, Pagoda Investment is a private equity firm focusing on TMT, consumer products, healthcare and education. Its key investors include Queensland Investment Corporation Limited, a Queensland-based Australian VC, and some European-based family funds as well as pension funds, with a total of RMB 5bn under management.

Established in 2000. With RMB 15 billion under management, Fortune Capital focuses on companies in the TMT, consumer goods & services, modern agriculture and cleantech sectors. It has invested in about 300 startups including Qingke, Hammerhead Sharks, StoreMax and NTS Technology.

Established in 2000. With RMB 15 billion under management, Fortune Capital focuses on companies in the TMT, consumer goods & services, modern agriculture and cleantech sectors. It has invested in about 300 startups including Qingke, Hammerhead Sharks, StoreMax and NTS Technology.

Fidelity China Special Situations PLC

Founded in 2010, Fidelity China Special Situations PLC (FCSS) is managed by Dale Nicholls who has worked at Fidelity International since 1996. Listed on the FTSE 250 Index, FCSS is said to be the UK’s largest China-focused investment trust with access to Fidelity's investment research resources and investment licenses in China.Focusing on companies that are most likely to benefit from China’s growth and changing economy, FCSS has invested in over 100 businesses in the country. Besides technology, it is also seeking opportunities in the consumer space and healthcare.

Founded in 2010, Fidelity China Special Situations PLC (FCSS) is managed by Dale Nicholls who has worked at Fidelity International since 1996. Listed on the FTSE 250 Index, FCSS is said to be the UK’s largest China-focused investment trust with access to Fidelity's investment research resources and investment licenses in China.Focusing on companies that are most likely to benefit from China’s growth and changing economy, FCSS has invested in over 100 businesses in the country. Besides technology, it is also seeking opportunities in the consumer space and healthcare.

HGI Finaves China is initiated by HGI Capital, a Hong Kong-based investment fund, and CEIBS, a business school established under an agreement between China’s trade ministry and the European Commission. It makes seed/angel round as well as Series A investments in the TMT, culture and creative, and consumer-related sectors in China.

HGI Finaves China is initiated by HGI Capital, a Hong Kong-based investment fund, and CEIBS, a business school established under an agreement between China’s trade ministry and the European Commission. It makes seed/angel round as well as Series A investments in the TMT, culture and creative, and consumer-related sectors in China.

New Food Invest: Opportunities in the European alt-protein space

With a record €2.4bn investment in 2019, Europe’s foodtech sector appears poised for continued growth, but startups, corporations, governments and even universities can do more, experts say

Alén Space: Nanosatellite company targets contracts of over €2 million by 2020

Alén Space seeks funding of €1.5 million to accelerate plans to win a share of the global market of 2,600 small satellites to be launched by 2023

Amid Covid-19 gloom, some bright spots in Portugal's tech startup scene

Despite a recession and doubling of the unemployment rate forecast this year, it's not all bad news for the Portuguese tech ecosystem

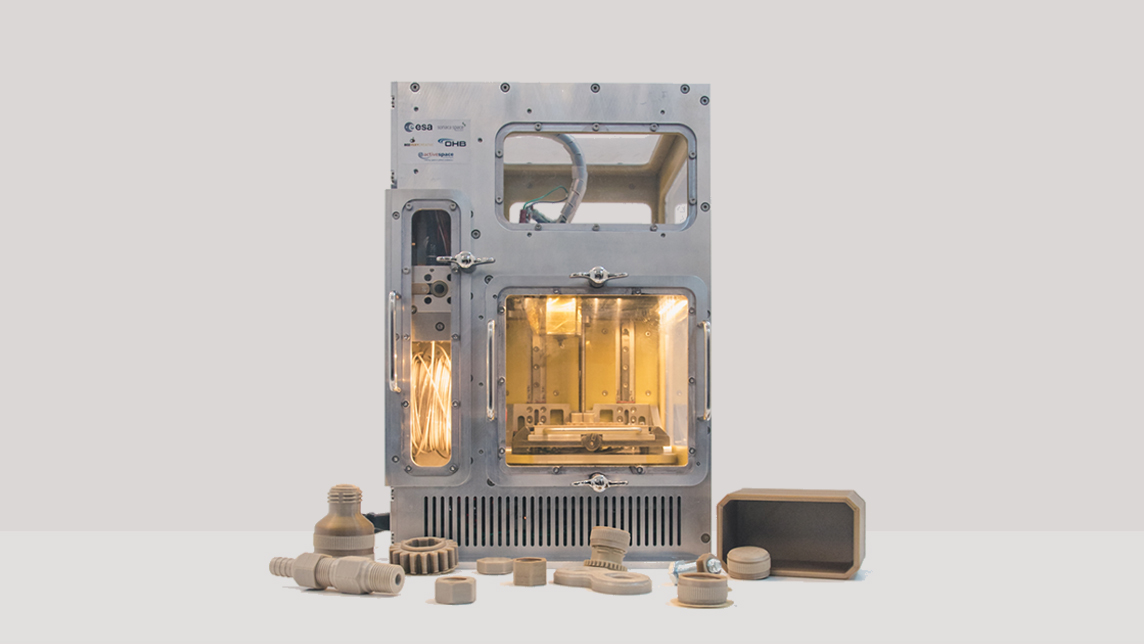

BEEVERYCREATIVE: Taking 3D printing from classrooms into Outer Space

Innovative 3D printing for daily use from a picturesque fishing village in Portugal.

Drone Hopper: Firefighters of the future

A senior Airbus engineer from Spain has developed heavy-duty autonomous drones to quell wildfires safely

FuVeX: Long-range hybrid-technology drones for multiple business uses

With its innovative hybrid helicopter and airplane technology, FuVeX is poised to take full advantage of the business opportunities afforded by new European regulations governing long-range drones

Zero 2 Infinity: Multibillion-euro business line launches into near space

Europe's only near space player using balloon technology targets high demand in a lucrative market, including space tourism

Bound4Blue taps aeronautical technology for sustainable shipping solutions

Bound4Blue's wind-assisted vessel propulsion saves 40% on fuel costs in a €200bn market; eyes European, Asian expansion

Catalonia: Spain's fast-rising robotics hub and next opportunity

With the robotics sector on the rise in Catalonia, expect to see more growth ahead, driving opportunities in related segments, especially services

HEMAV: World’s leading drone services company for agriculture

Now a global leader known for its industry-targeted software, HEMAV has expanded to 15 countries, working with utilities, farms and public bodies

Singapore, the place to start and grow a cellular agriculture startup

A country that imports over 90% of its food supply, Singapore has turned to foodtech, including cellular agriculture, to safeguard food security, supported by proactive regulators

AlphaBeats: a 10-minute music playlist to de-stress your brain using biofeedback

With the exclusive rights to Philips’s neurofeedback technology, Alphabeats has developed an app to offer and enhance relaxation using a person’s favorite music

Circular economy: Discarded goods get a new lease of life in Spain

From e-chargers inside phone booths, recycling chatbots to refurbished stadium seats from Atlético Madrid, the offbeat magic of the circular economy is fast becoming a lucrative business in Spain

Psquared: Providing flexible workplaces to help early-stage startups

The Barcelona-based startup converts a variety of buildings to hybrid office spaces for flexible work brought about by Covid-19, includes a reservations system to manage desk and meeting spaces

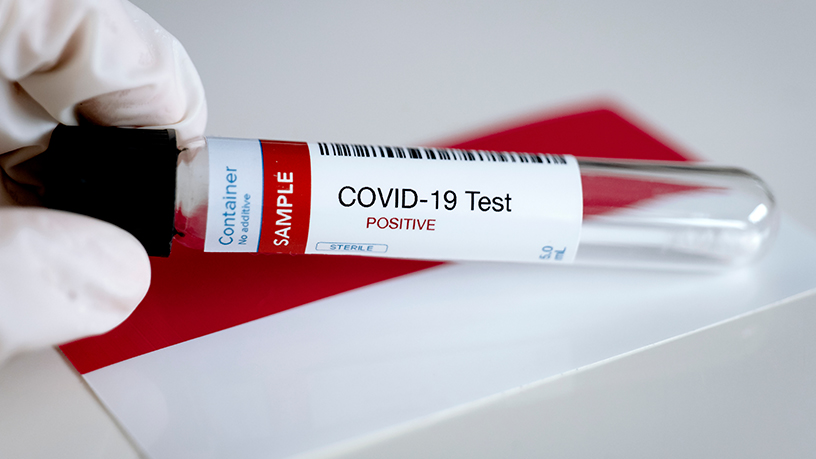

East Ventures raises funds, teams up with state agency to produce Covid-19 tests for Indonesia

East Ventures investee Nusantics has been working with state researchers to produce the prototype; expects mass production of the test kits soon

Sorry, we couldn’t find any matches for“European Space Agency”.