Funding Society

-

DATABASE (209)

-

ARTICLES (568)

Founded in 1999 in Santiago de Compostela, XesGalicia SGEIC SA is 100% owned by the Galician Institute for Economic Promotion (Igape). The VC supports Spanish startups through seed funding, early ventures and growth capital investments. It usually invests between €60,000 and €200,000 in each enterprise, with temporary acquisition of minority stakes. The firm focuses on the biotech, telecommunications, energy and environment sectors. In 2014, it was involved in the creation of the Galician Network of Business Angels to facilitate the collaboration of private and public fund investors to nurture innovative projects and applications of new technologies.

Founded in 1999 in Santiago de Compostela, XesGalicia SGEIC SA is 100% owned by the Galician Institute for Economic Promotion (Igape). The VC supports Spanish startups through seed funding, early ventures and growth capital investments. It usually invests between €60,000 and €200,000 in each enterprise, with temporary acquisition of minority stakes. The firm focuses on the biotech, telecommunications, energy and environment sectors. In 2014, it was involved in the creation of the Galician Network of Business Angels to facilitate the collaboration of private and public fund investors to nurture innovative projects and applications of new technologies.

Founded in 2011 in Leipzig, Monkfish Equity offers a hands-off investment approach, providing funding of €0.5m–€2m to enterprises across market segments in Germany, other European countries and the US.The firm is run by the co-founders of travel and hotel platform Trivago. Monkfish’s portfolio of 12 companies mainly comprises businesses in the B2C markets. Investments include the $54m Series B round of Austrian marketplace Refurbed in August 2021 and the €8m Series A round of Inne, a German fertility-tracking platform in October 2019.

Founded in 2011 in Leipzig, Monkfish Equity offers a hands-off investment approach, providing funding of €0.5m–€2m to enterprises across market segments in Germany, other European countries and the US.The firm is run by the co-founders of travel and hotel platform Trivago. Monkfish’s portfolio of 12 companies mainly comprises businesses in the B2C markets. Investments include the $54m Series B round of Austrian marketplace Refurbed in August 2021 and the €8m Series A round of Inne, a German fertility-tracking platform in October 2019.

Armed with Asian and European experience, Miguel Amaro co-founded Uniplaces in 2011. He earned his bachelor’s degree in Finance from the University of Nottingham, and took a course in Chinese Studies at East China Normal University. He obtained his master’s in Management, with a concentration in Global Entrepreneurship, from Babson Graduate School. Amaro also spent two months as an analyst at Grameen Bank in Dhaka, Bangladesh. While developing Uniplaces, he was an entrepreneur-in-residence at Picvic Labs (France), Zhejiang University Innovation Institute (China) and Osram (United States). Amaro is currently part of the World Economic Forum’s Global Shapers. As an investor, to date, he has only invested in Portuguese healthy food service EatTasty and part funding the company's angel, pre-seed and seed rounds, with undisclosed investments.

Armed with Asian and European experience, Miguel Amaro co-founded Uniplaces in 2011. He earned his bachelor’s degree in Finance from the University of Nottingham, and took a course in Chinese Studies at East China Normal University. He obtained his master’s in Management, with a concentration in Global Entrepreneurship, from Babson Graduate School. Amaro also spent two months as an analyst at Grameen Bank in Dhaka, Bangladesh. While developing Uniplaces, he was an entrepreneur-in-residence at Picvic Labs (France), Zhejiang University Innovation Institute (China) and Osram (United States). Amaro is currently part of the World Economic Forum’s Global Shapers. As an investor, to date, he has only invested in Portuguese healthy food service EatTasty and part funding the company's angel, pre-seed and seed rounds, with undisclosed investments.

Diego Ballesteros is one of Spain's most prominent serial entrepreneurs and business angels, backing some of the most successful acquisitions in Spain and Latin America. He made his first disclosed investment in 2016, as an angel investor of Spanish femtech WOOM’s pre-seed and seed funding rounds. He is currently the sole founder of Bewe SaaS for beauty and wellness professionals.Ballesteros started his first enterprise in 1997, an online classified ads platform Ocioteca.com and also MundoSalud that was acquired by Sanitas of Bupa Group. Cabify and co-investments with Seaya Ventures also form part of his investment portfolio. One of his biggest successes is on-demand food delivery platform SinDelantal with operations in Spain and Mexico. In 2013, the Spanish delivery company was acquired by Just Eat that later also bought the Mexican company in 2015.

Diego Ballesteros is one of Spain's most prominent serial entrepreneurs and business angels, backing some of the most successful acquisitions in Spain and Latin America. He made his first disclosed investment in 2016, as an angel investor of Spanish femtech WOOM’s pre-seed and seed funding rounds. He is currently the sole founder of Bewe SaaS for beauty and wellness professionals.Ballesteros started his first enterprise in 1997, an online classified ads platform Ocioteca.com and also MundoSalud that was acquired by Sanitas of Bupa Group. Cabify and co-investments with Seaya Ventures also form part of his investment portfolio. One of his biggest successes is on-demand food delivery platform SinDelantal with operations in Spain and Mexico. In 2013, the Spanish delivery company was acquired by Just Eat that later also bought the Mexican company in 2015.

Maniv Mobility is an Israel-based venture capitalist firm, focused mainly on mobility, automotive, transportation and logistic solutions. The fund is backed by venture arms of BMW, Hyundai, LG Electronics, the Renault-Nissan-Mitsubishi Alliance, Shell and Valeo amongst others. Headquartered in Isreal, in Tel Aviv a city that is growing in the mobility space with an increasing number of automotive venture arms.Maniv Mobility operates since 2016 with an initial funding capital of $44mn and a further capital injection in 2019 of $100mn. With an international investment portfolio and global ambitions, the firm has built over the years strategic partners in Europe, North America, Israel looking for long term expansion in Asian markets.The company has been within the VCs that backed Drive.ai, the autonomous vehicle startup later acquired by Apple.

Maniv Mobility is an Israel-based venture capitalist firm, focused mainly on mobility, automotive, transportation and logistic solutions. The fund is backed by venture arms of BMW, Hyundai, LG Electronics, the Renault-Nissan-Mitsubishi Alliance, Shell and Valeo amongst others. Headquartered in Isreal, in Tel Aviv a city that is growing in the mobility space with an increasing number of automotive venture arms.Maniv Mobility operates since 2016 with an initial funding capital of $44mn and a further capital injection in 2019 of $100mn. With an international investment portfolio and global ambitions, the firm has built over the years strategic partners in Europe, North America, Israel looking for long term expansion in Asian markets.The company has been within the VCs that backed Drive.ai, the autonomous vehicle startup later acquired by Apple.

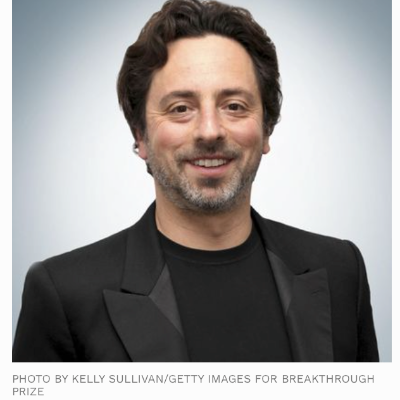

Russian-born Sergey Brin is the co-founder of Google and was the president of Google's parent company, Alphabet Inc, until stepping down in 2019. Brin is the world's ninth-richest person with a personal fortune of $86.5bn. His investments include OccamzRazor in 2019, a machine learning medtech platform supporting research into Parkinson’s Disease. In 2015, he contributed undisclosed funding to his former Stanford classmate Martin Roscheisen’s US-based firm Diamond Foundry, the first certified carbon-neutral lab-produced diamond manufacturer.no non copyrighted pic for use

Russian-born Sergey Brin is the co-founder of Google and was the president of Google's parent company, Alphabet Inc, until stepping down in 2019. Brin is the world's ninth-richest person with a personal fortune of $86.5bn. His investments include OccamzRazor in 2019, a machine learning medtech platform supporting research into Parkinson’s Disease. In 2015, he contributed undisclosed funding to his former Stanford classmate Martin Roscheisen’s US-based firm Diamond Foundry, the first certified carbon-neutral lab-produced diamond manufacturer.no non copyrighted pic for use

Cambridge Enterprise Venture Partners

A Cambridge-based investor, founded in 2006, that exists to support spin-off companies created at the city’s university with an emphasis on social impact. It currently has 57 companies in its portfolio, almost entirely in the areas of life and physical sciences, which have, in total, raised over £2bn in further investment and grant funding.Its most recent investments include in the June 2021 £3m seed round of Gallium Nitride semiconductor engineering company Porotech and in the January 2021 $20m Series A round of quantum computing innovators Riverlane.

A Cambridge-based investor, founded in 2006, that exists to support spin-off companies created at the city’s university with an emphasis on social impact. It currently has 57 companies in its portfolio, almost entirely in the areas of life and physical sciences, which have, in total, raised over £2bn in further investment and grant funding.Its most recent investments include in the June 2021 £3m seed round of Gallium Nitride semiconductor engineering company Porotech and in the January 2021 $20m Series A round of quantum computing innovators Riverlane.

Gerard Olivé is a serial entrepreneur based in Barcelona. He is currently the co-CEO and co-founder of Antai Venture Builder, in charge of a multimillion-euro advertising inventory. He graduated in Audiovisual Communications at Barcelona's Ramon Llull University. As an angel investor, Olivé made his first disclosed investment in 2016 when he participated in the pre-seed and subsequent seed funding rounds of Spanish femtech WOOM. He founded BeRepublic, a strategic consulting firm specializing in digital businesses in southern Europe and Latin America. In 2015, he co-founded BeAgency, an interactive marketing agency with offices in Barcelona and Madrid. He is also a co-founder and mentor of Connector Startup Accelerator. He has also co-founded startups like Wallapop, Glovo, CornerJob, Deliberry, Shoppiday, Shopery, BePretty, Mascoteros, Marmota, Havet, Prontopiso, Medox and Trendier.

Gerard Olivé is a serial entrepreneur based in Barcelona. He is currently the co-CEO and co-founder of Antai Venture Builder, in charge of a multimillion-euro advertising inventory. He graduated in Audiovisual Communications at Barcelona's Ramon Llull University. As an angel investor, Olivé made his first disclosed investment in 2016 when he participated in the pre-seed and subsequent seed funding rounds of Spanish femtech WOOM. He founded BeRepublic, a strategic consulting firm specializing in digital businesses in southern Europe and Latin America. In 2015, he co-founded BeAgency, an interactive marketing agency with offices in Barcelona and Madrid. He is also a co-founder and mentor of Connector Startup Accelerator. He has also co-founded startups like Wallapop, Glovo, CornerJob, Deliberry, Shoppiday, Shopery, BePretty, Mascoteros, Marmota, Havet, Prontopiso, Medox and Trendier.

Founded in Beijing in May 2015, Chunxiao Capital mainly invests in angel/seed to Series B funding rounds. With staff of 22, the VC has invested in over 50 companies by March 2019. Investments include technology innovations in fintech, big data and AI. Other investment sectors involve corporate services, Industry 4.0, B2B and SaaS for industrial enterprises and consumer-oriented businesses like retail, sports, maternal and infant care.In May 2019, the Asset Management Association of China revoked Chunxiao's private equity certification due to links with five online P2P lending firms facing default problems.

Founded in Beijing in May 2015, Chunxiao Capital mainly invests in angel/seed to Series B funding rounds. With staff of 22, the VC has invested in over 50 companies by March 2019. Investments include technology innovations in fintech, big data and AI. Other investment sectors involve corporate services, Industry 4.0, B2B and SaaS for industrial enterprises and consumer-oriented businesses like retail, sports, maternal and infant care.In May 2019, the Asset Management Association of China revoked Chunxiao's private equity certification due to links with five online P2P lending firms facing default problems.

Owen van Natta was formerly COO of Facebook and CEO of MySpace, and also previously held senior positions in Amazon and Zynga. He is an angel investor, founder of 415 LLC as well as a founding partner of tech-focused VC firm Prefix Capital, and has invested in a number of startups to date. His disclosed investments include participation in the March 2017 $800,000 seed round of Irish water regulatory platform SwiftComply and the November 2015 undisclosed funding round of US-based unicorn Diamond Foundry, the first certified carbon-neutral lab-produced diamond manufacturer. No pic on SM

Owen van Natta was formerly COO of Facebook and CEO of MySpace, and also previously held senior positions in Amazon and Zynga. He is an angel investor, founder of 415 LLC as well as a founding partner of tech-focused VC firm Prefix Capital, and has invested in a number of startups to date. His disclosed investments include participation in the March 2017 $800,000 seed round of Irish water regulatory platform SwiftComply and the November 2015 undisclosed funding round of US-based unicorn Diamond Foundry, the first certified carbon-neutral lab-produced diamond manufacturer. No pic on SM

Mark Goldstein is an angel investor, fundraiser and entrepreneur. He is the founder of Bad Ass Advisors, a matchmaking service for startups and advisors, and also started 12 companies, including back office solutions provider BackOps. Goldstein is best-known for being the private investment manager of Marc Benioff, the billionaire CEO, chairman and founder of Salesforce and owner of Time magazine. With his wife Kristen Koh Goldstein, he operates Marc Benioff's private investment vehicle Efficient Capacity, which invests in two to three early-stage startups a month. He is also an angel investor and participated in a funding round of Diamond Foundry, the first carbon-neutral producer of lab-grown diamonds.

Mark Goldstein is an angel investor, fundraiser and entrepreneur. He is the founder of Bad Ass Advisors, a matchmaking service for startups and advisors, and also started 12 companies, including back office solutions provider BackOps. Goldstein is best-known for being the private investment manager of Marc Benioff, the billionaire CEO, chairman and founder of Salesforce and owner of Time magazine. With his wife Kristen Koh Goldstein, he operates Marc Benioff's private investment vehicle Efficient Capacity, which invests in two to three early-stage startups a month. He is also an angel investor and participated in a funding round of Diamond Foundry, the first carbon-neutral producer of lab-grown diamonds.

San Francisco-based BOND is a spinoff of Kleiner Perkins and its original digital growth fund. BOND was launched in 2019, investing across market segments and geographies. To date, it has raised two funds totaling $3.3bn and currently has 32 portfolio companies. Its recent investments include Portuguese home physiotherapy tech SWORD, the world’s fastest-growing musculoskeletal solution, in June 2021 in a $85m Series C funding round; and co-leading the July 2021 $50m Series B round of US fungi-based alt-protein startup Meati Foods.

San Francisco-based BOND is a spinoff of Kleiner Perkins and its original digital growth fund. BOND was launched in 2019, investing across market segments and geographies. To date, it has raised two funds totaling $3.3bn and currently has 32 portfolio companies. Its recent investments include Portuguese home physiotherapy tech SWORD, the world’s fastest-growing musculoskeletal solution, in June 2021 in a $85m Series C funding round; and co-leading the July 2021 $50m Series B round of US fungi-based alt-protein startup Meati Foods.

Marinya Capital is the family office ofJohn B Fairfax from the Australian Fairfax family, who originally established Fairfax Media, a large media company. Marinya largely invests in property and agricultural businesses but has also made at least two investments in tech startups and in an Australian VC. Its most recent disclosed investments were in the $4.7m July 2021 seed funding round of NovoNutrients, the US-based biotech producer of alt-protein using fermentation and CO2 and other emissions, and in the $55m Series B round of Australia’s premier plant-based brand v2food in 2020.

Marinya Capital is the family office ofJohn B Fairfax from the Australian Fairfax family, who originally established Fairfax Media, a large media company. Marinya largely invests in property and agricultural businesses but has also made at least two investments in tech startups and in an Australian VC. Its most recent disclosed investments were in the $4.7m July 2021 seed funding round of NovoNutrients, the US-based biotech producer of alt-protein using fermentation and CO2 and other emissions, and in the $55m Series B round of Australia’s premier plant-based brand v2food in 2020.

CEMEX Ventures is the investment arm of global Mexican cement giant CEMEX and was established in 2017 with offices in Mexico, Spain, Colombia and China. It focuses exclusively on tech and non-tech solutions to painpoints in the construction sector. Every year, together with global management consultant Boston Consulting Group and startup monitoring platform Tracxn, it names its 50 Most Promising Startups in the Construction Ecosystem, investing in a few of the companies cited. It currently has 12 companies in its portfolio.Its most recent investments have included an undisclosed contribution to the funding round of US soil marketplace Soil Connect in 4Q 2020 and in the $1.7m July 2020 Series A round of US recycling company Arqlite.

CEMEX Ventures is the investment arm of global Mexican cement giant CEMEX and was established in 2017 with offices in Mexico, Spain, Colombia and China. It focuses exclusively on tech and non-tech solutions to painpoints in the construction sector. Every year, together with global management consultant Boston Consulting Group and startup monitoring platform Tracxn, it names its 50 Most Promising Startups in the Construction Ecosystem, investing in a few of the companies cited. It currently has 12 companies in its portfolio.Its most recent investments have included an undisclosed contribution to the funding round of US soil marketplace Soil Connect in 4Q 2020 and in the $1.7m July 2020 Series A round of US recycling company Arqlite.

Investisseurs & Partenaires (I&P)

Set up in 2002 by Patrice Hoppenot 15 years after he founded European investment fund BC Partners, Investisseurs & Partenaires (I&P) is an impact investor seeking to help SMEs prosper in Africa and create sustainable jobs and income there. With about €210m raised to date, I&P finances SMEs, startups and regional investment funds in Africa through equity participation and loans, as well as through microfinance institutions. Its I&P Acceleration Technologies focuses on digital startups with €2.5m of funding to be invested in 10–15 startups in 2020–2023. To date, I&P has supported more than 100 capital-funded companies and 20 companies benefiting from subsidized acceleration programs. I&P has about 100 staff based in Paris, Washington D.C. and in seven African offices (Burkina Faso, Cameroon, Côte d'Ivoire, Ghana, Madagascar, Niger and Senegal).

Set up in 2002 by Patrice Hoppenot 15 years after he founded European investment fund BC Partners, Investisseurs & Partenaires (I&P) is an impact investor seeking to help SMEs prosper in Africa and create sustainable jobs and income there. With about €210m raised to date, I&P finances SMEs, startups and regional investment funds in Africa through equity participation and loans, as well as through microfinance institutions. Its I&P Acceleration Technologies focuses on digital startups with €2.5m of funding to be invested in 10–15 startups in 2020–2023. To date, I&P has supported more than 100 capital-funded companies and 20 companies benefiting from subsidized acceleration programs. I&P has about 100 staff based in Paris, Washington D.C. and in seven African offices (Burkina Faso, Cameroon, Côte d'Ivoire, Ghana, Madagascar, Niger and Senegal).

Eco-friendly vegan leather from recycled waste, made in Indonesia

In the battle for ethical consumer dollars, mass production of vegan leather by startups like Mycotech and Bell Society, could be the game-changer for the fashion industry

Crowde-funding Indonesia's fields

Agritech startup Crowde offers retail investors direct access to Indonesia’s US$25 billion agricultural sector, transforming the way traditional farmers fund, run and grow their businesses

Traveloka CTO Derianto Kusuma resigns

The co-founder cites a changing ecosystem and company direction for his decision, while hinting at a new venture

Koiki: Delivering social advancement, one parcel at a time

Social enterprise startup Koiki seeks to reduce the carbon footprint of e-commerce deliveries and provide jobs for Spain's most vulnerable people

Sequoia Capital China holds steady with investments in healthcare, biotech and green economy

China’s most active investor increases bets on sectors beyond the consumer internet and edtech recently hurt by regulatory clampdown

Can AI make ethical decisions? Ethyka by Acuilae wants to train AI systems to reason like humans

Ethyka, an AI training module, sets the ethical principles and conditioning for AI systems in applications ranging from chatbots to autonomous cars

Alex Sicart: Democratizing the Internet with blockchain

The 20-year-old tech wiz and blockchain advocate is seeking a digital revolution where decentralized systems will empower societies

Clarity AI uses machine learning and data analytics to effectively assess and score environmental, social and governance performance of companies and investment portfolios

Refurbed: Electronics recycling marketplace gets $54m for EU consolidation, overseas expansion

Consumers can reduce their carbon footprints by shifting toward a circular economy, become carbon-neutral by planting one tree with every purchase from Refurbed

Indonesian P2P lending platform Investree expands to the Philippines

With local partner Filinvest Development Corporation, Investree Philippines will support the country’s SMEs with its lending-based crowdfunding platform

Southeast Asian startups to keep riding digitalization, IPO boom, investors say

O2O business models and growing interest in ESG are also key themes, as regional startups gain $4.4bn of funding in first half of 2021

Wallbox’s bumper funding boosts Spain’s EV charging sector

Wallbox’s generic EV charging systems are sold in 40 countries, including the US and China; attracting major backers like Seaya Ventures, Spanish utility Iberdrola and US VC Endeavor

Already helping over 1,000 corporates like Alibaba and JD.com manage and lower their carbon emissions, Carbonstop is ready to do more when China’s carbon trading starts next year

FIWARE Accelerator: More open source ecosystem than accelerator

The European open source initiative to boost smart infrastructures and solutions is calling for new participants to join its unique acceleration ecosystem

“Good thing about my style. Some like it, some hate it but everybody recognizes it.” @sofíabenjumea

Outspoken with a hands-on management style, Sofía Benjumea is a force to reckon with at Google’s Campus Madrid

Sorry, we couldn’t find any matches for“Funding Society”.