Home Credit

-

DATABASE (136)

-

ARTICLES (315)

Founded in Boston in 2019, Transformation is entirely dedicated to healthcare disruption, predominently focuses on US investments and typically invests $10-30m per startup. It currently has 22 companies in its portfolio. Its most recent investments include in the June 2021 $85m Series C round of Portuguese home physiotherapy tech solution SWORD Health, the world’s fastest-growing musculoskeletal solution, and, the same month, in the $21m Series D round of Protenus, the US’ leading healthcare compliance analytics firm.

Founded in Boston in 2019, Transformation is entirely dedicated to healthcare disruption, predominently focuses on US investments and typically invests $10-30m per startup. It currently has 22 companies in its portfolio. Its most recent investments include in the June 2021 $85m Series C round of Portuguese home physiotherapy tech solution SWORD Health, the world’s fastest-growing musculoskeletal solution, and, the same month, in the $21m Series D round of Protenus, the US’ leading healthcare compliance analytics firm.

Co-founder and CEO of Kostoom

Putry Yuliastutik got the idea to start Kostoom after watching her mother struggling to make ends meet, as a skilled seamstress working from home. She left Bigalia to set up Kostoom to help other homeworkers like her mother. Bigalia was a heavy equipment supply business that was established by Putry and her husband Indra Rukasyah in 2015. Putry graduated in Mathematics at the University of Indonesia in 2011, while working as a graphic designer at a creative digital startup iP Logo Design. She was also a co-founder and branding consultant at iP Logo in Jakarta until December 2013.

Putry Yuliastutik got the idea to start Kostoom after watching her mother struggling to make ends meet, as a skilled seamstress working from home. She left Bigalia to set up Kostoom to help other homeworkers like her mother. Bigalia was a heavy equipment supply business that was established by Putry and her husband Indra Rukasyah in 2015. Putry graduated in Mathematics at the University of Indonesia in 2011, while working as a graphic designer at a creative digital startup iP Logo Design. She was also a co-founder and branding consultant at iP Logo in Jakarta until December 2013.

With a fast-rising middle class and over 50% of the population under age 30, Bobobobo is Indonesia’s first trendy luxury lifestyle e-boutique, targeting savvy millennials.

With a fast-rising middle class and over 50% of the population under age 30, Bobobobo is Indonesia’s first trendy luxury lifestyle e-boutique, targeting savvy millennials.

Founded by Xiaomi’s Lei Jun, this incubator-investor gets first-mover access to bright business ideas and talent with its startup cafes in China’s “north Silicon Valley”.

Founded by Xiaomi’s Lei Jun, this incubator-investor gets first-mover access to bright business ideas and talent with its startup cafes in China’s “north Silicon Valley”.

This e-retailer taps into the influence of internet celebrities to persuade young viewers to buy cosmetics and other goods.

This e-retailer taps into the influence of internet celebrities to persuade young viewers to buy cosmetics and other goods.

AISpeech’s voice recognition technology has been widely applied by Alibaba, Tencent and other top companies in smart home, automotive and robotics products.

AISpeech’s voice recognition technology has been widely applied by Alibaba, Tencent and other top companies in smart home, automotive and robotics products.

Kuaidiniao streamlines logistics and express services with its free API platform with which users can access services from 418 logistics service providers.

Kuaidiniao streamlines logistics and express services with its free API platform with which users can access services from 418 logistics service providers.

Currently valued at $20bn, Chinese social-commerce platform Xiaohongshu has over 300m users, most of whom are females from big cities with high purchasing power.

Currently valued at $20bn, Chinese social-commerce platform Xiaohongshu has over 300m users, most of whom are females from big cities with high purchasing power.

Bryan McEire of Spotahome

Bryan McEire was born in Costa Rica but spent most of his life in Spain and Belgium. The CTO of Spotahome has computer and software engineering degrees from Universidad Autonoma de Madrid and Université Libre de Bruxelles.Together with CEO Artacho, McEire tried to raise funds for Spotahome during the early days. However, investors were not interested and both went separate ways for a while. Artacho returned from London and approached McEire to revive Spotahome with new audiovisual viewings by home checkers. He had previously worked in the business intelligence, infrastructure and real estate sectors.

Bryan McEire was born in Costa Rica but spent most of his life in Spain and Belgium. The CTO of Spotahome has computer and software engineering degrees from Universidad Autonoma de Madrid and Université Libre de Bruxelles.Together with CEO Artacho, McEire tried to raise funds for Spotahome during the early days. However, investors were not interested and both went separate ways for a while. Artacho returned from London and approached McEire to revive Spotahome with new audiovisual viewings by home checkers. He had previously worked in the business intelligence, infrastructure and real estate sectors.

Vesalius Biocapital III is a €70 million fund that invests in medtech, e-health initiatives and drug development in Europe. It was launched in 2017 by Luxembourg-based Vesalius Biocapital, a life sciences venture capital firm founded in 2007. Preceding Vesalius Biocapital III were Vesalius Biocapital I, with €76 million under management and Vesalius Biocapital II, which has €78 million invested; both funds have 11 portfolio companies each.Its recent investments include in Portuguese home physiotherapy tech solution SWORD Health's 2021 $25m Series B and in the 2020 $9m second phase of its Series A round as well as in the 2020 €22m Series B round of German biotech Topas Therapeutics.

Vesalius Biocapital III is a €70 million fund that invests in medtech, e-health initiatives and drug development in Europe. It was launched in 2017 by Luxembourg-based Vesalius Biocapital, a life sciences venture capital firm founded in 2007. Preceding Vesalius Biocapital III were Vesalius Biocapital I, with €76 million under management and Vesalius Biocapital II, which has €78 million invested; both funds have 11 portfolio companies each.Its recent investments include in Portuguese home physiotherapy tech solution SWORD Health's 2021 $25m Series B and in the 2020 $9m second phase of its Series A round as well as in the 2020 €22m Series B round of German biotech Topas Therapeutics.

Profitable Estay has built a leading brand in online booking of short-term luxury home rentals and services for travelers; with property management, upgrading for homeowners.

Profitable Estay has built a leading brand in online booking of short-term luxury home rentals and services for travelers; with property management, upgrading for homeowners.

Founder and CEO of Ayibang

Former staff of Sogou, Yahoo and Qihoo 360, in browser development.Graduate of Huazhong University of Science and Technology (class of 2007), with master’s in computer studies. Founded Ayibang, China’s most popular home services app (by user activity), in 2013.

Former staff of Sogou, Yahoo and Qihoo 360, in browser development.Graduate of Huazhong University of Science and Technology (class of 2007), with master’s in computer studies. Founded Ayibang, China’s most popular home services app (by user activity), in 2013.

Founded in Boston in 1946, Fidelity is one of the world’s largest asset managers, with more than 25m household investors and 22,000 corporates using its services. It has invested in more than 100 companies across market segments, investment rounds and geographies and managed numerous IPOs, including Twilio, Reddit, and Peloton. Its most recent investments include injecting $200m in March 2021 into US-based unicorn Diamond Foundry, the first certified carbon-neutral lab-produced diamond manufacturer. In the same month, it also participated in the $29m Series B round for US asset management fintech player Ethic.

Founded in Boston in 1946, Fidelity is one of the world’s largest asset managers, with more than 25m household investors and 22,000 corporates using its services. It has invested in more than 100 companies across market segments, investment rounds and geographies and managed numerous IPOs, including Twilio, Reddit, and Peloton. Its most recent investments include injecting $200m in March 2021 into US-based unicorn Diamond Foundry, the first certified carbon-neutral lab-produced diamond manufacturer. In the same month, it also participated in the $29m Series B round for US asset management fintech player Ethic.

Green Innovations is an impact fund that invests in large-scale projects addressing global sustainability challenges, focusing on the agriculture, biotechnology, education, energy, housing and water sectors. It is headed by Angola-based Portuguese businessman Jorge Marques, and linked to Israeli group Mitrelli. Green Innovations took control of Biocant, Portugal’s biggest biotech park, in a privatization move in 2017–2018. Green Innovations's stable of companies includes Green Biotech, created to invest in biotechnology in Portugal, and Green Services Innovations, linked to the exploration of phosphates in Congo.Its recent investments include in the June 2021 $85m Series C round and February 2021 $25m Series B of Portuguese home physiotherapy tech solution SWORD Health, the world’s fastest-growing musculoskeletal solution.

Green Innovations is an impact fund that invests in large-scale projects addressing global sustainability challenges, focusing on the agriculture, biotechnology, education, energy, housing and water sectors. It is headed by Angola-based Portuguese businessman Jorge Marques, and linked to Israeli group Mitrelli. Green Innovations took control of Biocant, Portugal’s biggest biotech park, in a privatization move in 2017–2018. Green Innovations's stable of companies includes Green Biotech, created to invest in biotechnology in Portugal, and Green Services Innovations, linked to the exploration of phosphates in Congo.Its recent investments include in the June 2021 $85m Series C round and February 2021 $25m Series B of Portuguese home physiotherapy tech solution SWORD Health, the world’s fastest-growing musculoskeletal solution.

Indonesian unicorn Traveloka aims for US listing via SPAC

The online travel aggregator reported revenue drops and layoffs in 2020 but became profitable late last year, led by recoveries in Vietnam and Thailand

From China, Clever Home to build “Home Depot” marts in Africa

Combining B2B2C and O2O models, Clever Home is turning its 40,000sqm trade center in Nigeria into the "Yiwu marketplace" for Chinese companies looking to set up shop in Africa

AgroCenta: Providing market access and credit to African smallholder farmers

AgroCenta’s platforms empower Ghanaian subsistence farmers, especially women, boosting productivity and sales with e-payments, micro-credits and insurance, and direct connections to buyers, cutting out the intermediaries

Bobobobo: Indonesian luxury at a click

Amid a booming local e-commerce market, this startup carves a niche for itself in upscale trending goods and experiences influenced by Indonesia’s rich traditions

CraiditX gives banks and insurers AI tools for assessing consumer credit risk

Used by big lenders like Bank of China and Minsheng Bank, CraiditX's solutions can gauge consumer default risk even if a user has no credit history

James, an AI-powered tool for faster, more accurate credit risk assessment

Capable of analyzing over 7,000 types of data, the award-winning credit risk tool for financial institutions is also quick to install and roll out

HomeRun: IoT devices for home-alone pets

Founded by a pet owner who worried about leaving his dog alone at home, HomeRun is chalking up big sales in China's billion-dollar pet care market

Linptech: Smart home devices powered by movement

The first in China to tap kinetic energy to control smart home devices, Linptech has seen its wireless, battery-free products used in smart homes, and even at the Tokyo Olympics

Covid-19: Indonesia's P2P lenders ready for slower business, default risk

P2P lending startups set up stricter scrutiny, budget reserves; playing key role in helping Indonesian businesses survive the Covid-19 crisis

Quant Group makes personal loans safer, easier in China

Using big data and AI, Chinese fintech startup Quant Group simplifies and accelerates loan processing, and assures monetary security for financial institutions

ZendMoney: Putting cash back into the pockets of Indonesian migrant workers

ZendMoney's unique remittance concept has already helped 90,000 migrant workers send money back home

Spanish startups protest the lack of relevant aid, compared with other EU countries; investors warn of “disastrous” new foreign investment restriction

E-wallet LinkAja gets access to Indonesia's Civil Registry for user data checks

Move allows more than 2,000 public and private entities to verify user data against government records, but the public has raised privacy and security concerns

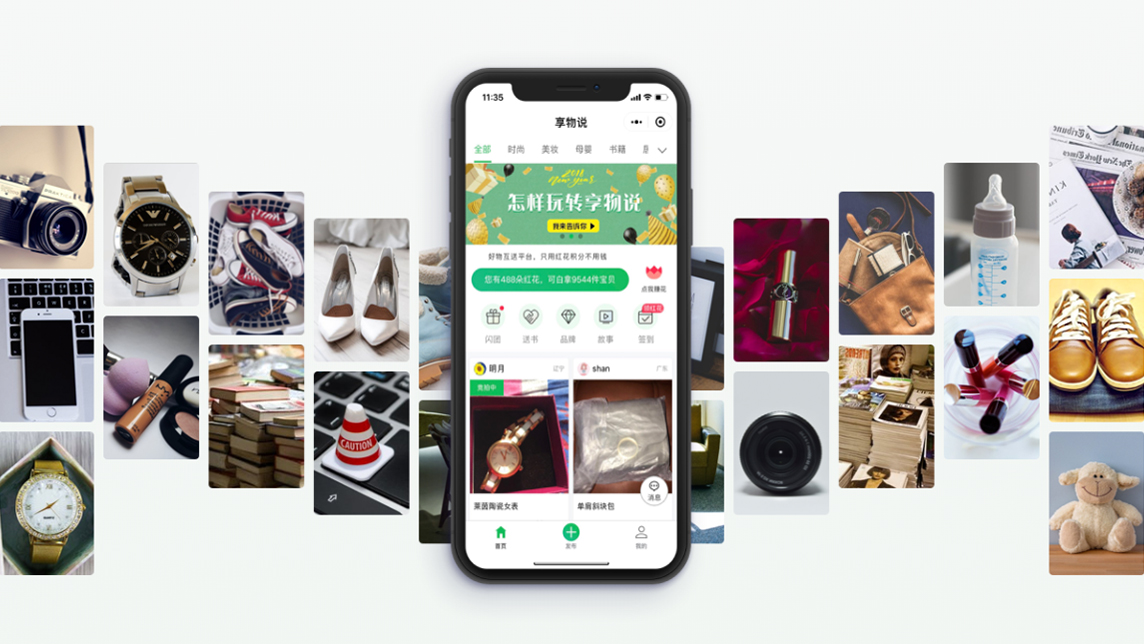

Xiangwushuo’s platform finds a new home for secondhand goods

This WeChat mini program doesn’t yet have a monetization strategy, but has still received over US$110 million in funding in one year

ARTICARES: Personalized, more affordable arm rehab therapy at home

Using adaptive AI, its H-Man robot works like an occupational therapist, assessing patient’s performance and adjusting the complexity of training tasks in real time

Sorry, we couldn’t find any matches for“Home Credit”.