IQS Next Tech

-

DATABASE (446)

-

ARTICLES (546)

Paul Allen was an American business magnate and investor. Best known as Microsoft Corporation co-founder with his childhood friend Bill Gates, he left the company after eight years after being diagnosed with Hodgkin’s disease. Allen died in 2018 at the age of 65, with a net worth of $20.3bn.His multibillion-dollar investment arm Vulcan Capital has backed tech startups around the world, including Spotify, Alibaba Group and Flipkart. Allen also owned the NBA's Portland Trail Blazers, the NFL's Seattle Seahawks and has a stake in the Seattle Sounders soccer team. He also donated over $2bn to philanthropic initiatives.

Paul Allen was an American business magnate and investor. Best known as Microsoft Corporation co-founder with his childhood friend Bill Gates, he left the company after eight years after being diagnosed with Hodgkin’s disease. Allen died in 2018 at the age of 65, with a net worth of $20.3bn.His multibillion-dollar investment arm Vulcan Capital has backed tech startups around the world, including Spotify, Alibaba Group and Flipkart. Allen also owned the NBA's Portland Trail Blazers, the NFL's Seattle Seahawks and has a stake in the Seattle Sounders soccer team. He also donated over $2bn to philanthropic initiatives.

Founded in 2013 and based in Silicon Valley, AgFunder invests in agrifood tech startups globally with the mission of “investing in technologies to rapidly transform our food and agriculture system.” The VC firm has already built a global ecosystem of 85,000+ members and subscribers, which helps grow and scale its portfolio companies. It recently established the New Carnivore fund to invest in startups working to create animal-free protein alternatives including plant-based meat and cultured meat. In 2019, AgFunder and the Australian agrifood accelerator Rocket Seeder co-launched GROW Impact Accelerator in Singapore to accelerate seed and Series A agritech startups from Southeast Asia.

Founded in 2013 and based in Silicon Valley, AgFunder invests in agrifood tech startups globally with the mission of “investing in technologies to rapidly transform our food and agriculture system.” The VC firm has already built a global ecosystem of 85,000+ members and subscribers, which helps grow and scale its portfolio companies. It recently established the New Carnivore fund to invest in startups working to create animal-free protein alternatives including plant-based meat and cultured meat. In 2019, AgFunder and the Australian agrifood accelerator Rocket Seeder co-launched GROW Impact Accelerator in Singapore to accelerate seed and Series A agritech startups from Southeast Asia.

Founded in Connecticut in 2014, Oak has a total of $3.3bn assets under management, the overwhelming majority within healthcare and fintech, and invests at all stages of growth. Approximately one third of its portfolio companies that currently number 55, seek re-investment from the VC. It has managed eight exits to date and has a special interest in investing in women in tech.Its most recent investments have included in Canadian unicorn the startup financing fintech Clearco that raised $100m in its April 2021 Series C round, and, the same month, in US virtual healthcare platform Firefly Health’s $40m Series B round.

Founded in Connecticut in 2014, Oak has a total of $3.3bn assets under management, the overwhelming majority within healthcare and fintech, and invests at all stages of growth. Approximately one third of its portfolio companies that currently number 55, seek re-investment from the VC. It has managed eight exits to date and has a special interest in investing in women in tech.Its most recent investments have included in Canadian unicorn the startup financing fintech Clearco that raised $100m in its April 2021 Series C round, and, the same month, in US virtual healthcare platform Firefly Health’s $40m Series B round.

Nickleby Capital is a London-based VC firm that focuses on three main areas: (1) investment capital for companies in the scale-up phase, Series A, Series B, and buyouts, (2) advisory services leveraging proprietary tech, researches and industry network, to accelerate PLCs and private companies' growth, and (3) real estate, advising on commercial and residential properties globally. The firm’s investors are mostly family offices and serial entrepreneurs that have built market-leading companies. The Nickleby Capital’s team is founded by a team of alumni from Goldman Sachs, Rothschild, BDO and Korn Ferry.

Nickleby Capital is a London-based VC firm that focuses on three main areas: (1) investment capital for companies in the scale-up phase, Series A, Series B, and buyouts, (2) advisory services leveraging proprietary tech, researches and industry network, to accelerate PLCs and private companies' growth, and (3) real estate, advising on commercial and residential properties globally. The firm’s investors are mostly family offices and serial entrepreneurs that have built market-leading companies. The Nickleby Capital’s team is founded by a team of alumni from Goldman Sachs, Rothschild, BDO and Korn Ferry.

Since its founding in 1972, American venture capital firm Sequoia Capital has partnered with the founders of companies that now have an aggregate, public market value of over $1.4tn. Sequoia Capital acquired Indian venture capital firm Westbridge Capital Partners in 2006, and later became the foundation for Sequoia Capital India. Sequoia Capital India focuses primarily in India and Southeast Asia. It has invested in many major tech companies in the region, including Indian edtech firm Byju’s, budget accommodation network OYO, and Indonesian ride-hailing unicorn Gojek. In 2019, it launched Surge, an accelerator program for early-stage startups in Southeast Asia and India.

Since its founding in 1972, American venture capital firm Sequoia Capital has partnered with the founders of companies that now have an aggregate, public market value of over $1.4tn. Sequoia Capital acquired Indian venture capital firm Westbridge Capital Partners in 2006, and later became the foundation for Sequoia Capital India. Sequoia Capital India focuses primarily in India and Southeast Asia. It has invested in many major tech companies in the region, including Indian edtech firm Byju’s, budget accommodation network OYO, and Indonesian ride-hailing unicorn Gojek. In 2019, it launched Surge, an accelerator program for early-stage startups in Southeast Asia and India.

Founded in 1997 in London, Amadeus has invested in more than 130 companies, has over 40 employees and has raised over $1bn to date. The investor focuses on early-stage UK-based companies, although it has also invested in later-stage European and developing market startups. In August 2021, it announced a $150m upcoming investment drive in Brazil. Amadeus currently has 54 portfolio companies. Its recent investments include the June 2021 £20m Series A investment round of UK-based XYZ Reality that employs holograms in construction tech. In May 2021, it led the $4.8m investment in the cryptography lifecycle management platform Cryptosense.

Founded in 1997 in London, Amadeus has invested in more than 130 companies, has over 40 employees and has raised over $1bn to date. The investor focuses on early-stage UK-based companies, although it has also invested in later-stage European and developing market startups. In August 2021, it announced a $150m upcoming investment drive in Brazil. Amadeus currently has 54 portfolio companies. Its recent investments include the June 2021 £20m Series A investment round of UK-based XYZ Reality that employs holograms in construction tech. In May 2021, it led the $4.8m investment in the cryptography lifecycle management platform Cryptosense.

Lanzadera was founded in 2013 by entrepreneur Juan Roig, Spain's third richest individual and the CEO and biggest single shareholder of the country's largest supermarket group, Mercadona. Roig personally keeps track of the performance of the startups managed by the business incubator and accelerator based in Valencia, Spain.Lanzadera has invested €21m in almost 200 tech startups and consumer-focused offline businesses. To date, it has completed one exit via Groupify. Since 2016, Lanzadera has also specialized in video game development with Sony Interactive Entertainment Spain. The Lanzadera programs include training and assessments over a period of 9–11 months at its attractive Valencia marina location.

Lanzadera was founded in 2013 by entrepreneur Juan Roig, Spain's third richest individual and the CEO and biggest single shareholder of the country's largest supermarket group, Mercadona. Roig personally keeps track of the performance of the startups managed by the business incubator and accelerator based in Valencia, Spain.Lanzadera has invested €21m in almost 200 tech startups and consumer-focused offline businesses. To date, it has completed one exit via Groupify. Since 2016, Lanzadera has also specialized in video game development with Sony Interactive Entertainment Spain. The Lanzadera programs include training and assessments over a period of 9–11 months at its attractive Valencia marina location.

Juan Jose Juste Ortega is an economist with a long career in the banking and financial sector. He held executive roles in multiple banks such as Lloyds Banking Group and Citi, and was Director of Chase and Société Générale in Madrid. For over 10 years, he worked as general subdirector in Caja Madrid. Concurrently, he was CEO and Executive President of the CIFI, a non-bank institution experienced in financing infrastructure and energy in Latin America and the Caribbean. From 2015 to 2018, Juste Ortega was Director of Read Madrid football clubHe is currently diversifying his investments by backing Spanish tech startups.

Juan Jose Juste Ortega is an economist with a long career in the banking and financial sector. He held executive roles in multiple banks such as Lloyds Banking Group and Citi, and was Director of Chase and Société Générale in Madrid. For over 10 years, he worked as general subdirector in Caja Madrid. Concurrently, he was CEO and Executive President of the CIFI, a non-bank institution experienced in financing infrastructure and energy in Latin America and the Caribbean. From 2015 to 2018, Juste Ortega was Director of Read Madrid football clubHe is currently diversifying his investments by backing Spanish tech startups.

Founded by Zhang Yiming in 2012, ByteDance is currently the world’s most valuable startup, worth over $100bn by May 2020. It owns quite a number of popular apps including the news aggregator Jinri Toutiao and short video platforms such as Douyin and its overseas version TikTok.ByteDance is also an active investor in China’s startup ecosystem. With a focus on education and gaming, it also invests in sectors of media, enterprise tech, education, gaming, finance, real estate, artificial intelligence and hardware. As of mid-2020, it had invested in 89 companies.

Founded by Zhang Yiming in 2012, ByteDance is currently the world’s most valuable startup, worth over $100bn by May 2020. It owns quite a number of popular apps including the news aggregator Jinri Toutiao and short video platforms such as Douyin and its overseas version TikTok.ByteDance is also an active investor in China’s startup ecosystem. With a focus on education and gaming, it also invests in sectors of media, enterprise tech, education, gaming, finance, real estate, artificial intelligence and hardware. As of mid-2020, it had invested in 89 companies.

Srinivasa Hatcheries is part of the SH Group that was set up in 1978. Based in Hyderabad, the diversified public-listed group started in poultry farming in 1965. Its first disclosed startup investment was in the Series A round of alternative protein startup String Bio in 2019.The Mega Food Park is a hi-tech chicken and egg processing facility. The Srinivasa farms also manufacture and supply poultry feed in India. Its HiPro Soybean meal has the most concentrated amount of protein in the market. The group is also involved in agriculture, goat breeding and food retailing.

Srinivasa Hatcheries is part of the SH Group that was set up in 1978. Based in Hyderabad, the diversified public-listed group started in poultry farming in 1965. Its first disclosed startup investment was in the Series A round of alternative protein startup String Bio in 2019.The Mega Food Park is a hi-tech chicken and egg processing facility. The Srinivasa farms also manufacture and supply poultry feed in India. Its HiPro Soybean meal has the most concentrated amount of protein in the market. The group is also involved in agriculture, goat breeding and food retailing.

Founded in 2012 in Washington DC, Accion Venture Lab is a seed-stage investor in fintech for the underserved. Venture Lab is part of Accion, a not-for-profit global organization that works with financial service providers to deliver affordable solutions for unbanked and underbanked communities worldwide.Its portfolio includes 44 startups from 17 countries, ranging from Chile to Indonesia. Seed-stage startups normally get $500,000 funding per company. Investments in December 2020 included participation in the $1.5m seed round of Argentinian software development tech Henry and a financing round for Indonesian micro-credit fintech Pintech.

Founded in 2012 in Washington DC, Accion Venture Lab is a seed-stage investor in fintech for the underserved. Venture Lab is part of Accion, a not-for-profit global organization that works with financial service providers to deliver affordable solutions for unbanked and underbanked communities worldwide.Its portfolio includes 44 startups from 17 countries, ranging from Chile to Indonesia. Seed-stage startups normally get $500,000 funding per company. Investments in December 2020 included participation in the $1.5m seed round of Argentinian software development tech Henry and a financing round for Indonesian micro-credit fintech Pintech.

Citi Ventures is the San Francisco-based investing arm of the multinational banking group Citibank. It was founded in 2010 and invests in US-based tech startups with a financial sector focus at all investment stages. It currently has 80 companies in its portfolio and has managed 13 exits to date. Its most recent investments were in six startups in March 2021. These included contributing to the $3m seed round of co-parenting financial planning platform Ensemble, in the $130m Series D round of on-demand notary service Notorize and in the $200m Series D round of Feedzai, the world market leader in fighting online fraud.

Citi Ventures is the San Francisco-based investing arm of the multinational banking group Citibank. It was founded in 2010 and invests in US-based tech startups with a financial sector focus at all investment stages. It currently has 80 companies in its portfolio and has managed 13 exits to date. Its most recent investments were in six startups in March 2021. These included contributing to the $3m seed round of co-parenting financial planning platform Ensemble, in the $130m Series D round of on-demand notary service Notorize and in the $200m Series D round of Feedzai, the world market leader in fighting online fraud.

Founded in Boston in 2019, Transformation is entirely dedicated to healthcare disruption, predominently focuses on US investments and typically invests $10-30m per startup. It currently has 22 companies in its portfolio. Its most recent investments include in the June 2021 $85m Series C round of Portuguese home physiotherapy tech solution SWORD Health, the world’s fastest-growing musculoskeletal solution, and, the same month, in the $21m Series D round of Protenus, the US’ leading healthcare compliance analytics firm.

Founded in Boston in 2019, Transformation is entirely dedicated to healthcare disruption, predominently focuses on US investments and typically invests $10-30m per startup. It currently has 22 companies in its portfolio. Its most recent investments include in the June 2021 $85m Series C round of Portuguese home physiotherapy tech solution SWORD Health, the world’s fastest-growing musculoskeletal solution, and, the same month, in the $21m Series D round of Protenus, the US’ leading healthcare compliance analytics firm.

Lupa Systems is a private investment company with offices in New York and Mumbai. It was founded in 2019 by Rupert Murdoch’s son James Murdoch with $2bn funding from the overall $71bn sales of the family's 21st Century Fox empire to Disney.Lupa focuses on tech companies in the media industry, as well as impact-driven startups focused on environmental sustainability and emerging markets, particularly in Asia. According to a recent report, Lupa is looking to launch new funds, raising about $150m for each fund from family offices in India. The firm has invested in about 12 companies to date.

Lupa Systems is a private investment company with offices in New York and Mumbai. It was founded in 2019 by Rupert Murdoch’s son James Murdoch with $2bn funding from the overall $71bn sales of the family's 21st Century Fox empire to Disney.Lupa focuses on tech companies in the media industry, as well as impact-driven startups focused on environmental sustainability and emerging markets, particularly in Asia. According to a recent report, Lupa is looking to launch new funds, raising about $150m for each fund from family offices in India. The firm has invested in about 12 companies to date.

Yangtze Delta Region Institute of Tsinghua University, Zhejiang

Yangtze Delta Region Research Institute of Tsinghua University, Zhejiang was co-founded by the provincial government of Zhejiang and Tsinghua University in 2003 for tech transfer. It has set up over 50 R&D platforms in the areas of life sciences, digital creativity, information technology and ecological environment and 11 offshore incubators in the US, UK, Germany and Australia. The institute manages over RMB 7.5bn of assets and also makes investments through its sub-funds with a total size of more than RMB 10bn. So far, it has incubated and invested in over 2,500 companies, 35 of whom have gone public or been acquired by listed companies.

Yangtze Delta Region Research Institute of Tsinghua University, Zhejiang was co-founded by the provincial government of Zhejiang and Tsinghua University in 2003 for tech transfer. It has set up over 50 R&D platforms in the areas of life sciences, digital creativity, information technology and ecological environment and 11 offshore incubators in the US, UK, Germany and Australia. The institute manages over RMB 7.5bn of assets and also makes investments through its sub-funds with a total size of more than RMB 10bn. So far, it has incubated and invested in over 2,500 companies, 35 of whom have gone public or been acquired by listed companies.

Evix Safety's helmet with an airbag is a world-first for cycling safety

Evix Safety is launching a “smart” cycling helmet fitted with an airbag to prevent thousands of neck injuries from accidents

IP Buoys: Mooring 4.0 smart buoys to protect marine ecosystems

Save the Posidonia! That’s the call from enterprising sailors who, with their startup IP Buoys, have found a way to protect the seagrass and marine life from the damaging impact of nautical tourism

Will Shanghai's new tech board be home to China’s next BAT?

As China’s new Nasdaq-style board speeds to welcome its first IPOs, here’s a look at what’s changed for Chinese tech firms listing in the mainland, and if it could be pivotal in the emerging tech cold war

Faromatics' ChickenBoy robot brings smart analytics to poultry farming

The makers of the AI-based robot for managing large-scale poultry farming are seeking up to €4m in a second round funding as they launch their invention in Europe

Kibus Petcare: World's first auto-cook and -dispense healthy pet food device

Kibus Petcare applies the healthy eating revolution to the ever-growing pet-care business, eyes sales in 25 countries after crowdfunding launch

Biel Glasses: A pioneering solution for low vision sufferers

Biel Glasses offers a life-changing technology for people with low vision, a condition that is seven times more common than blindness

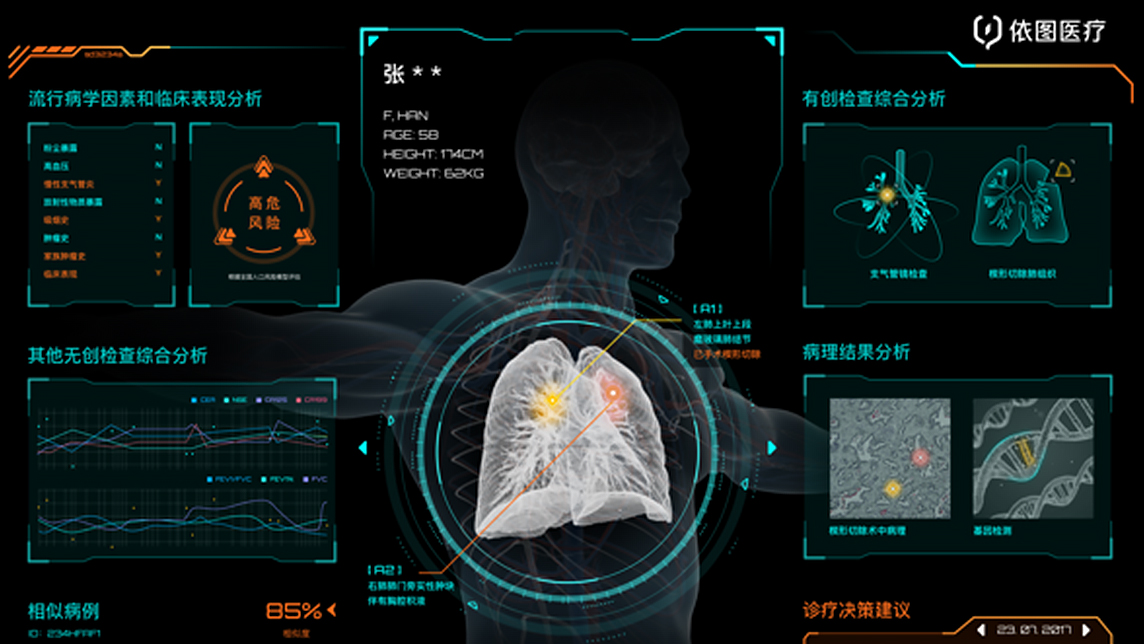

YITU takes smart healthcare to the next level

AI programs developed by this Chinese medtech startup provide more accurate diagnoses by reading medical images in conjunction with patients’ medical records

Catalonia: Spain's fast-rising robotics hub and next opportunity

With the robotics sector on the rise in Catalonia, expect to see more growth ahead, driving opportunities in related segments, especially services

Next-generation social media app YouClap targets engagement over reach

Already valued at €5m one year after launching, the YouClap platform for online challenges will seek Series A investment before the end of 2019

New Food Invest: Plant-based cheese, the next investment boom?

With alt-protein startups experiencing a global funding boom, industry experts and investors share their views about emerging trends in diverse food sectors

Tigerobo: Building the next-generation search engine with natural language processing

With the success of Tigerobo Search, its flagship AI-based finance industry search engine, the startup is also diversifying into government, energy and media sectors

As Veniam’s “Internet of Moving Things” keeps growing, autonomous vehicles are next

The Portuguese startup is going places with its mesh networking technology, but that’s “just the beginning”, says Veniam founder and CEO João Barros. He talks to CompassList about partnering automakers to design self-driving cars, raising a new round of funding in 2018, and more

Plant-based eggs: The next big thing in the alternative protein market

Plant-based eggs may be the fastest growing segment in plant-based foods, but hacking the formula for a perfect egg substitute is proving a hurdle. Are alt-protein startups up for the challenge?

After a Covid-led boom in 2020, what next for China's K-12 edtech?

Unicorns Yuanfudao and Zuoyebang raised more than $6bn combined last year as demand for online learning continues to grow, but some smaller players are running out of cash

In Indonesia, Ramadan goes hi-tech

From consumption to charity, tech startups have come to play a key role in Ramadan traditions in Indonesia

Sorry, we couldn’t find any matches for“IQS Next Tech”.