Indonesian Hotel and Restaurant Association

-

DATABASE (996)

-

ARTICLES (811)

Fortum Oyj is a Finnish state-owned energy company operating power plants and co-generation plants across the nation. Listed on the NASDAQ OMX Helsinki stock exchange, Fortum is reputed to be Finland’s biggest company in terms of revenue generated in 2020.It is also Europe's third-largest producer of carbon-free electricity and the second-largest producer of nuclear power. Ranked as the fifth largest heat producer globally, Fortum supplies electricity and heating directly to consumers in Finland, Germany, Central Europe, the UK and the Nordic countries.Fortum invested in Finnish cleantech Infinited Fiber, taking up a 4% stake in 2019, to complement the energy company’s biorefining value chain and to improve resource efficiency. The cleantech investee aims to license its biodegradable fiber technology to help industry partners to manufacture innovative materials from textile and industrial waste.

Fortum Oyj is a Finnish state-owned energy company operating power plants and co-generation plants across the nation. Listed on the NASDAQ OMX Helsinki stock exchange, Fortum is reputed to be Finland’s biggest company in terms of revenue generated in 2020.It is also Europe's third-largest producer of carbon-free electricity and the second-largest producer of nuclear power. Ranked as the fifth largest heat producer globally, Fortum supplies electricity and heating directly to consumers in Finland, Germany, Central Europe, the UK and the Nordic countries.Fortum invested in Finnish cleantech Infinited Fiber, taking up a 4% stake in 2019, to complement the energy company’s biorefining value chain and to improve resource efficiency. The cleantech investee aims to license its biodegradable fiber technology to help industry partners to manufacture innovative materials from textile and industrial waste.

AngelClub is a capital management platform co-invested by co-founder of Tencent, Zeng Liqing, founder of Matrix Partners, Zhang Ying, and management at TsingVentures, Chuangfuzhi Capital and Panda VC.

AngelClub is a capital management platform co-invested by co-founder of Tencent, Zeng Liqing, founder of Matrix Partners, Zhang Ying, and management at TsingVentures, Chuangfuzhi Capital and Panda VC.

Altitude Partners is a Southampton-based specialist in capital investment and strategic support to help businesses and their management. Altitude’s investment ranges from £1 million to £4 million of active equity investment.

Altitude Partners is a Southampton-based specialist in capital investment and strategic support to help businesses and their management. Altitude’s investment ranges from £1 million to £4 million of active equity investment.

Japanese outsourcing company, Transcosmos was established in 1966. The company currently offers cost reduction services, such as contact center and HR, and sales expansion services such as Big Data analysis.

Japanese outsourcing company, Transcosmos was established in 1966. The company currently offers cost reduction services, such as contact center and HR, and sales expansion services such as Big Data analysis.

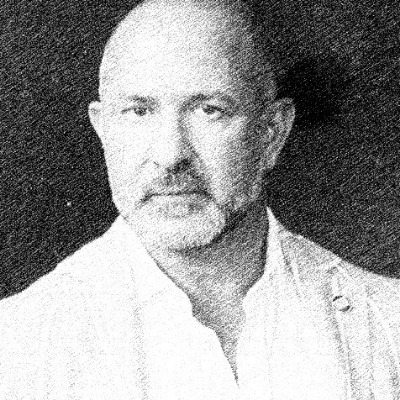

CEO and co-founder of Modulous Tech

Chris Bone is co-founder and CEO at UK-based Modulous, the first end-to-end generative design and delivery solution for affordable, sustainable and modulized housing, where he has worked since 2018. He is simultaneously director and co-founder at engineering consultancy Optimise, based in London and Dubai, where he has worked since 2012 and where the concept for Modulous was conceived. Prior to these, Bone was CEO at engineering company Bone Steel from 2008-10, founder and director at Globalsport from 2005-8, and founder and managing director at Safe Consulting, part of engineering consultancy WhitbyBird from 1999-2004. His experience has included working on major projects, including Wembley Stadium, BBC Broadcasting House and the Royal Ballet School, as well as designing a process for automating fire protection for steel buildings.

Chris Bone is co-founder and CEO at UK-based Modulous, the first end-to-end generative design and delivery solution for affordable, sustainable and modulized housing, where he has worked since 2018. He is simultaneously director and co-founder at engineering consultancy Optimise, based in London and Dubai, where he has worked since 2012 and where the concept for Modulous was conceived. Prior to these, Bone was CEO at engineering company Bone Steel from 2008-10, founder and director at Globalsport from 2005-8, and founder and managing director at Safe Consulting, part of engineering consultancy WhitbyBird from 1999-2004. His experience has included working on major projects, including Wembley Stadium, BBC Broadcasting House and the Royal Ballet School, as well as designing a process for automating fire protection for steel buildings.

Co-founder of Therapixal

Pierre Fillard is Chief Science Officer and co-founder of Therapixel, creator of AI-powered breast cancer screening and diagnosis software MammoScreen. At Therapixel, he previously held the positions of CEO and CTO. Before founding Therapixel, Fillard was a senior research scientist at INRIA (National Institute for Research in Digital Science and Technology), where he focused on medical imaging and image processing. He has also been a visiting lecturer at CPE Lyon, a research associate at the French Alternative Energies and Atomic Agencies Commission, a PhD candidate at INRIA, and a research assistant at the University of North Carolina. He has a diploma from the HEC School of Management, a master’s in science, mathematics and computer science from the Université Jean Monnet Saint-Etienne and a degree in engineering, computer science, and applied mathematics from the Ecole Supérieure de Chimie Physique Electronique de Lyon.

Pierre Fillard is Chief Science Officer and co-founder of Therapixel, creator of AI-powered breast cancer screening and diagnosis software MammoScreen. At Therapixel, he previously held the positions of CEO and CTO. Before founding Therapixel, Fillard was a senior research scientist at INRIA (National Institute for Research in Digital Science and Technology), where he focused on medical imaging and image processing. He has also been a visiting lecturer at CPE Lyon, a research associate at the French Alternative Energies and Atomic Agencies Commission, a PhD candidate at INRIA, and a research assistant at the University of North Carolina. He has a diploma from the HEC School of Management, a master’s in science, mathematics and computer science from the Université Jean Monnet Saint-Etienne and a degree in engineering, computer science, and applied mathematics from the Ecole Supérieure de Chimie Physique Electronique de Lyon.

Portuguese state investment company PME Investimentos is the country's most prolific tech investor. Founded in 1989 as a joint stock company, SULPEDIP was under the supervision of the Bank of Portugal and changed its name to PME in 1998. The main aim is to help local SMEs to access funding and financial management services to develop and expand internationally. PME has invested in hundreds of startups, both tech and non-tech focused, across market verticals. It also manages several funds, including 200M that was launched in 2016 to focus on investments in Portugal-based startups. The co-investment fund of €200m prioritizes startups based in the Northern, Central, Alentejo, Lisbon and Algarve regions. The fund matches up to 100% of the private investors’ commitment, subject to a minimum investment of €500,000 and a maximum of €5m. Recent investments include petfood e-commerce Barkyn's €1.1m seed round, €4.2m Series A of made-to-order designer Platforme and a €650,000 contribution in the second phase of healthy food service EatTasty's €1.75m seed round.

Portuguese state investment company PME Investimentos is the country's most prolific tech investor. Founded in 1989 as a joint stock company, SULPEDIP was under the supervision of the Bank of Portugal and changed its name to PME in 1998. The main aim is to help local SMEs to access funding and financial management services to develop and expand internationally. PME has invested in hundreds of startups, both tech and non-tech focused, across market verticals. It also manages several funds, including 200M that was launched in 2016 to focus on investments in Portugal-based startups. The co-investment fund of €200m prioritizes startups based in the Northern, Central, Alentejo, Lisbon and Algarve regions. The fund matches up to 100% of the private investors’ commitment, subject to a minimum investment of €500,000 and a maximum of €5m. Recent investments include petfood e-commerce Barkyn's €1.1m seed round, €4.2m Series A of made-to-order designer Platforme and a €650,000 contribution in the second phase of healthy food service EatTasty's €1.75m seed round.

P101, which stands for Programma 101, the first PC ever made in history, is an Italian VC focused on early-stage investments founded and headed by Managing Partner Andrea Di Camillo. As of January 2021, the firm has between €70m and €100m available for investments. The fund is backed by The European Investment Fund, the Italian Investment Fund SGR, and Azimut, an Italian asset manager operating since 1989 and parent company of Azimut Holding, listed on the Milan Stock Exchange (AZM.IM).Headquartered in Milan, P101 has invested in international startups through its two funds, P101 and P102. It usually co-invests maintaining a lead investor role. According to Di Camillo, the P102 fund has a higher investment ticket, ranging between €2m–5m, with the possibility of increasing to up to €10m in a single company. The firm also manages Ita500, a €40m fund established in partnership with Azimut in January 2020. With a 10-year term, Ita500 will co-invest with P101’s first and second funds in startups with revenues of up to €5m and SMEs with a turnover range of €5m–50m.

P101, which stands for Programma 101, the first PC ever made in history, is an Italian VC focused on early-stage investments founded and headed by Managing Partner Andrea Di Camillo. As of January 2021, the firm has between €70m and €100m available for investments. The fund is backed by The European Investment Fund, the Italian Investment Fund SGR, and Azimut, an Italian asset manager operating since 1989 and parent company of Azimut Holding, listed on the Milan Stock Exchange (AZM.IM).Headquartered in Milan, P101 has invested in international startups through its two funds, P101 and P102. It usually co-invests maintaining a lead investor role. According to Di Camillo, the P102 fund has a higher investment ticket, ranging between €2m–5m, with the possibility of increasing to up to €10m in a single company. The firm also manages Ita500, a €40m fund established in partnership with Azimut in January 2020. With a 10-year term, Ita500 will co-invest with P101’s first and second funds in startups with revenues of up to €5m and SMEs with a turnover range of €5m–50m.

Founded in 2017 in Hong Kong, Happiness Capital invests in seed to growth stage companies in the US, Europe, Israel, and China, with a focus on issues affecting global happiness within the areas of citizen trust, food, health, climate change, and reduced inequalities. It hosts its own annual contest, the Super Happiness Challenge , a global open innovation contest to fund individuals and startups with ideas and new products or services that tapped into unmet needs to achieve happiness, with a possible $1m in total investment on offer. The VC currently has 37 startups in its portfolio, around half of which are in foodtech and agtech. Its most recent investments include leading the $4.7m July 2021 seed funding round of NovoNutrients, the US-based biotech producer of alt-protein from fermentation using CO2 and other emissions, and co-leading the $29m February 2021 Series A round of Israeli 3D printed alt-meat startup Redefine Meat.

Founded in 2017 in Hong Kong, Happiness Capital invests in seed to growth stage companies in the US, Europe, Israel, and China, with a focus on issues affecting global happiness within the areas of citizen trust, food, health, climate change, and reduced inequalities. It hosts its own annual contest, the Super Happiness Challenge , a global open innovation contest to fund individuals and startups with ideas and new products or services that tapped into unmet needs to achieve happiness, with a possible $1m in total investment on offer. The VC currently has 37 startups in its portfolio, around half of which are in foodtech and agtech. Its most recent investments include leading the $4.7m July 2021 seed funding round of NovoNutrients, the US-based biotech producer of alt-protein from fermentation using CO2 and other emissions, and co-leading the $29m February 2021 Series A round of Israeli 3D printed alt-meat startup Redefine Meat.

VNV Global was originally founded as Vostok Nafta in 1996, with its first investment in Russia. The investment vehicle initially focused on investments in agriculture and natural resources, but began to diversify into early consumer internet companies like Avito and Tinkoff Bank. Shares were listed on NASDAQ OMX and the VC pivoted to high-growth tech investments in 2007. In 2015, the name was changed to Vostok New Ventures and shortened to VNV Global in 2020 to reflect its international strategy to expand outside Europe.The mid-cap NASDAQ Stockholm exchange-listed VNV mainly invests in mobility, medtech and marketplaces. It currently has 31 startups in its portfolio and six exits managed to date. Recent investments led by VNV include the $43m Series B funding of London-based food waste app OLIO in September 2021 and the $1.6m seed round of Vietnamese dating app Fika in October 2021.

VNV Global was originally founded as Vostok Nafta in 1996, with its first investment in Russia. The investment vehicle initially focused on investments in agriculture and natural resources, but began to diversify into early consumer internet companies like Avito and Tinkoff Bank. Shares were listed on NASDAQ OMX and the VC pivoted to high-growth tech investments in 2007. In 2015, the name was changed to Vostok New Ventures and shortened to VNV Global in 2020 to reflect its international strategy to expand outside Europe.The mid-cap NASDAQ Stockholm exchange-listed VNV mainly invests in mobility, medtech and marketplaces. It currently has 31 startups in its portfolio and six exits managed to date. Recent investments led by VNV include the $43m Series B funding of London-based food waste app OLIO in September 2021 and the $1.6m seed round of Vietnamese dating app Fika in October 2021.

Led by media and entertainment veteran Frank Yang (Yang Xingnong), ANTS Venture Capital conducts early-stage investments in Chinese companies from the TMT, culture & entertainment, healthcare, consumption & retail and new energy sectors. It expects its selected companies to become market leaders in their industries, with a CAGR of at least 30% and the potential to go public in two years.

Led by media and entertainment veteran Frank Yang (Yang Xingnong), ANTS Venture Capital conducts early-stage investments in Chinese companies from the TMT, culture & entertainment, healthcare, consumption & retail and new energy sectors. It expects its selected companies to become market leaders in their industries, with a CAGR of at least 30% and the potential to go public in two years.

Founded in 2014, EVERVC is a platform for startups and investors to seek financing and investing opportunities. As of 4Q2015, EVERVC had helped 170 startups to get investment of over RMB 900 million. It has invested in 40 startups, about 16 of which have received follow-up investment from prominent investors such as Matrix Partners China, NewMargin Capital, JD.com and Zhonglu VC.

Founded in 2014, EVERVC is a platform for startups and investors to seek financing and investing opportunities. As of 4Q2015, EVERVC had helped 170 startups to get investment of over RMB 900 million. It has invested in 40 startups, about 16 of which have received follow-up investment from prominent investors such as Matrix Partners China, NewMargin Capital, JD.com and Zhonglu VC.

Augmentum Capital was formed in 2009 by Tim Levene and Richard Matthews, with the backing of RIT Capital Partners, the investment trust chaired by Lord Rothschild (whose family owns 18% of the trust). Based in London, the investment firm focuses on fast-growing fintech companies in the UK and Europe, typically supporting Series A and Series B funding rounds.

Augmentum Capital was formed in 2009 by Tim Levene and Richard Matthews, with the backing of RIT Capital Partners, the investment trust chaired by Lord Rothschild (whose family owns 18% of the trust). Based in London, the investment firm focuses on fast-growing fintech companies in the UK and Europe, typically supporting Series A and Series B funding rounds.

Avianta Capital is a private equity and venture capital firm helmed by Fernando Jamie-Fernández, who is also co-founder of the Madrid-based Bipi, a Spanish on-demand car rental app startup. Headquartered in San Pedro Garza Garcia, Mexico, Avianta Capital also has a satellite office in Madrid to facilitate cross-border investments and operations between Spain and Latin America.

Avianta Capital is a private equity and venture capital firm helmed by Fernando Jamie-Fernández, who is also co-founder of the Madrid-based Bipi, a Spanish on-demand car rental app startup. Headquartered in San Pedro Garza Garcia, Mexico, Avianta Capital also has a satellite office in Madrid to facilitate cross-border investments and operations between Spain and Latin America.

Tetuan Valley has built a network of over 500 entrepreneurs through its six-week Madrid-based Startup School program, which was started in 2009 and is in its 25th edition. Partnering with Google, the European Commission, MIT and universities in Spain, Tetuan offers early stage startups guidance on financial and commercial strategy, while providing technology mentors to support them on product development.

Tetuan Valley has built a network of over 500 entrepreneurs through its six-week Madrid-based Startup School program, which was started in 2009 and is in its 25th edition. Partnering with Google, the European Commission, MIT and universities in Spain, Tetuan offers early stage startups guidance on financial and commercial strategy, while providing technology mentors to support them on product development.

The edtech startup formerly named Squiline hopes greater fluency in English can boost Indonesia's creative and tourism sectors

Indonesia 2021 outlook: VCs "cautiously optimistic" on Southeast Asia's largest country

Investors expect Indonesian startups to regain their growth opportunities when the economy reopens with the Covid-19 vaccine rollout, even as some online living and working habits have stuck

Meituan, the “Amazon for local services”

Now worth over US$50 billion, the company has always focused on one end-goal: help consumers eat better, live better

Amid Covid-19 gloom, some bright spots in Portugal's tech startup scene

Despite a recession and doubling of the unemployment rate forecast this year, it's not all bad news for the Portuguese tech ecosystem

Jesús Encinar: The Man Behind Idealista and 11870.com

Entrepreneur, angel investor and down-to-earth idealist

Meituan-Dianping’s Wang Xing: From struggling copycat to IPO billionaire

As the internet startup sets to list in Hong Kong this week, we take a look back at the journey of its founder Wang Xing, once dubbed “the unluckiest serial entrepreneur”

Medigo teams up with Indonesian Medical Association to launch primary care clinic network

Medigo aims to support healthcare operators with its clinic management SaaS, booking and medical records app for patients and more

Get fit and healthy with these Indonesian wellness startups

The wellness lifestyle trend continues to grow in popularity in Indonesia, and startups want a piece of the action

HighPitch 2020: Waste management play Octopus, digital concierge service Izy win Makassar battle

Both startups have scored strong traction despite the weight of Covid-19; they are also expanding and keen to explore new opportunities

Amid IPO talk, Meicai continues to push for growth in bid to become China's Sysco

Covid-19 helped speed up expansion to the B2C market for Meicai, China’s most valuable agrifood tech unicorn founded by a farmer’s son

In Spain, women are busy launching startups

Official data show women-led startups are on the rise in Spain. We take you to some of the biggest names in the game

No dine-in, no problem: Hangry’s cloud kitchens thrive amid Covid-19

Learning from global F&B franchises has helped Hangry expand rapidly, maintain quality and set expansion goals despite the pandemic

Healthy eating: The Southeast Asian startups making it a breeze

From meal plans to novel ingredients, agriculture and foodtech startups in the region are developing new ways to improve nutrition without sacrificing taste

Spain's gig and sharing economy startups flourish, despite barrage of restrictions

Startups like Glovo and Spotahome topped fundings raised in 2018 despite local regulatory risks, as Spanish tech firms conquer overseas markets

F&B supplier STOQO collapses, a casualty of Covid-19 restaurant closures in Indonesia

A once promising startup, STOQO's woes reflect the challenges faced by the local F&B industry, which is finding new ways to stay afloat

Sorry, we couldn’t find any matches for“Indonesian Hotel and Restaurant Association”.