Indonesian Hotel and Restaurant Association

-

DATABASE (996)

-

ARTICLES (811)

Co-founder, CFO of Kibus Petcare

Albert Homs Basas is co-founder and CFO at Kibus Petcare, the first hardware that automatically cooks and dispenses healthy pet food. He has worked there since 2018. Prior to this, from 2012, he held several positions as a treasurer in different Spanish and multinational companies, including Coca Cola and motocross equipment company Fox Racing. Homs holds combined undergraduate and Master's degrees in Business Administration and Management from Barcelona's ESADE business school, as well as an MSc in Finance from the University of Prague.

Albert Homs Basas is co-founder and CFO at Kibus Petcare, the first hardware that automatically cooks and dispenses healthy pet food. He has worked there since 2018. Prior to this, from 2012, he held several positions as a treasurer in different Spanish and multinational companies, including Coca Cola and motocross equipment company Fox Racing. Homs holds combined undergraduate and Master's degrees in Business Administration and Management from Barcelona's ESADE business school, as well as an MSc in Finance from the University of Prague.

Famous techpreneur Li Yinan (b. 1970) is the former CTO of Baidu and former CEO of Wuxian Xunqi, a China Mobile subsidiary. After Li graduated from Huazhong University of Science & Technology with a master’s degree in Optics Engineering, he joined Huawei and was promoted to vice-president of its Central Research Department in just six months; in 1997 Li because the youngest vice-president at Huawei. In 2001, Li quit Huawei and started his own data communication company, Harbour Networks, which followed the same structure of Huawei and soon became its main competitor. In 2005, Harbour Networks lost in its intense battle with Huawei and was acquired by the larger player. Even though Li rejoined Huawei after the acquisition, he was never able to re-enter the core management team because of his damaged relationship with Ren Zhengfei, the founder and president of Huawei. In April 2015, Li founded his smart e-scooter company, NIU Smart Scooters. Li began investing in 2010 and joined GSR Ventures in 2011. Up to June 2015, Li had invested in more than 10 companies from the TMT sector. Li stood trial for insider trading in March 2016, according to news reports.

Famous techpreneur Li Yinan (b. 1970) is the former CTO of Baidu and former CEO of Wuxian Xunqi, a China Mobile subsidiary. After Li graduated from Huazhong University of Science & Technology with a master’s degree in Optics Engineering, he joined Huawei and was promoted to vice-president of its Central Research Department in just six months; in 1997 Li because the youngest vice-president at Huawei. In 2001, Li quit Huawei and started his own data communication company, Harbour Networks, which followed the same structure of Huawei and soon became its main competitor. In 2005, Harbour Networks lost in its intense battle with Huawei and was acquired by the larger player. Even though Li rejoined Huawei after the acquisition, he was never able to re-enter the core management team because of his damaged relationship with Ren Zhengfei, the founder and president of Huawei. In April 2015, Li founded his smart e-scooter company, NIU Smart Scooters. Li began investing in 2010 and joined GSR Ventures in 2011. Up to June 2015, Li had invested in more than 10 companies from the TMT sector. Li stood trial for insider trading in March 2016, according to news reports.

CEMEX Ventures is the investment arm of global Mexican cement giant CEMEX and was established in 2017 with offices in Mexico, Spain, Colombia and China. It focuses exclusively on tech and non-tech solutions to painpoints in the construction sector. Every year, together with global management consultant Boston Consulting Group and startup monitoring platform Tracxn, it names its 50 Most Promising Startups in the Construction Ecosystem, investing in a few of the companies cited. It currently has 12 companies in its portfolio.Its most recent investments have included an undisclosed contribution to the funding round of US soil marketplace Soil Connect in 4Q 2020 and in the $1.7m July 2020 Series A round of US recycling company Arqlite.

CEMEX Ventures is the investment arm of global Mexican cement giant CEMEX and was established in 2017 with offices in Mexico, Spain, Colombia and China. It focuses exclusively on tech and non-tech solutions to painpoints in the construction sector. Every year, together with global management consultant Boston Consulting Group and startup monitoring platform Tracxn, it names its 50 Most Promising Startups in the Construction Ecosystem, investing in a few of the companies cited. It currently has 12 companies in its portfolio.Its most recent investments have included an undisclosed contribution to the funding round of US soil marketplace Soil Connect in 4Q 2020 and in the $1.7m July 2020 Series A round of US recycling company Arqlite.

Beyond Investing is a Geneva-based firm investing in early-stage venture capital and equity growth startups mainly in European developed markets. With average investments of €200,000, the firm’s core investment strategy focuses on sustainability with an investment period lasting 5–10 years.The impact investor targets innovative startups involved in vegan, cruelty-free and plant-based alternatives; biotechnologies, foodtech, new materials, clothing and lifestyle sectors. Successful portfolio foodtechs include Mosa Meat, BlueNalu and Shiok Meats.With a team of vegan finance professionals in the US and Europe, Beyond Investing listed the first US Vegan Climate ETF (VEGN) on the New York Stock Exchange in September 2019. The ETF tracks Beyond Investing’s US Vegan Climate Index which covers an index of 495 of the largest-capitalization companies in the US stock market. The ethical investment option aims to exclude stocks in companies with activities that are not aligned with its vegan-themed, cruelty-free and fossil-fuel-free investing ethos.

Beyond Investing is a Geneva-based firm investing in early-stage venture capital and equity growth startups mainly in European developed markets. With average investments of €200,000, the firm’s core investment strategy focuses on sustainability with an investment period lasting 5–10 years.The impact investor targets innovative startups involved in vegan, cruelty-free and plant-based alternatives; biotechnologies, foodtech, new materials, clothing and lifestyle sectors. Successful portfolio foodtechs include Mosa Meat, BlueNalu and Shiok Meats.With a team of vegan finance professionals in the US and Europe, Beyond Investing listed the first US Vegan Climate ETF (VEGN) on the New York Stock Exchange in September 2019. The ETF tracks Beyond Investing’s US Vegan Climate Index which covers an index of 495 of the largest-capitalization companies in the US stock market. The ethical investment option aims to exclude stocks in companies with activities that are not aligned with its vegan-themed, cruelty-free and fossil-fuel-free investing ethos.

CEO and founder of Lota Digital by Bitcliq

Pedro Araújo Manuel is the Portuguese founder and CEO of software development company Bitcliq, where he has worked since 2013. He also holds the same positions within its two brands launched to date: Lota Digital, an e-marketplace for small-scale fisherman and sustainable fish retailers with blockchain-enabled traceability, and BIG EYE Smart Fishing, a platform for managing fishing fleets and fish traceability. Previously, Manuel was owner, co-founder and managing partner at tech agency MakeWise for nine years. Before 2013, he spent seven years in software and web development and systems administration at three different companies, including Portugal’s national post office. Manuel holds a master’s degree in Information Technology and Computer Engineering from the Polytechnic Institute of Lisbon.

Pedro Araújo Manuel is the Portuguese founder and CEO of software development company Bitcliq, where he has worked since 2013. He also holds the same positions within its two brands launched to date: Lota Digital, an e-marketplace for small-scale fisherman and sustainable fish retailers with blockchain-enabled traceability, and BIG EYE Smart Fishing, a platform for managing fishing fleets and fish traceability. Previously, Manuel was owner, co-founder and managing partner at tech agency MakeWise for nine years. Before 2013, he spent seven years in software and web development and systems administration at three different companies, including Portugal’s national post office. Manuel holds a master’s degree in Information Technology and Computer Engineering from the Polytechnic Institute of Lisbon.

CEO and co-founder of HumanITcare

Núria Pastor is the CEO and co-founder of HumanITcare, a telemedicine platform for remote patient monitoring using real-world data and AI to treat patients affected by chronic diseases and also to accelerate drug development and clinical trials. Under the helm of Pastor the startup has doubled its user base and is poised to become a leading player in digital health. Pastor holds a bachelor’s in psychology from the University of Barcelona and a Masters in Research in neuroscience from the Autonomous University of Barcelona. Prior to HumanITcare, she worked as a researcher at the Hospital del Mar Research Institute and the University of Barcelona. She has also worked as Business Analyst in EIT Health and has mentored at the European Commission.

Núria Pastor is the CEO and co-founder of HumanITcare, a telemedicine platform for remote patient monitoring using real-world data and AI to treat patients affected by chronic diseases and also to accelerate drug development and clinical trials. Under the helm of Pastor the startup has doubled its user base and is poised to become a leading player in digital health. Pastor holds a bachelor’s in psychology from the University of Barcelona and a Masters in Research in neuroscience from the Autonomous University of Barcelona. Prior to HumanITcare, she worked as a researcher at the Hospital del Mar Research Institute and the University of Barcelona. She has also worked as Business Analyst in EIT Health and has mentored at the European Commission.

Co-founder, CEO of Higo Sense

Łukasz Krasnopolski is the Polish CEO and co-founder of medtech diagnostic hardware and app Higo Sense, where he has worked full-time since 2017. He has also been the CEO of Polish tech incubator ToReforge since 2015 and is a co-founder at gaming developer Walkabout Games, established in 2017. Krasnopolski has also been the owner of internet marketing agency Red2black since 2007 and was founder and co-owner at e-commerce-for-children startup more4kids.pl between 2008 and 2012, when he exited the company that is now listed on the Polish stock exchange. He is a supervisory board member at Cloud Technologies, a leader in online advertising and big-data cloud computing in Europe and holds a master’s in entrepreneurship from Warsaw’s Kosminski University.

Łukasz Krasnopolski is the Polish CEO and co-founder of medtech diagnostic hardware and app Higo Sense, where he has worked full-time since 2017. He has also been the CEO of Polish tech incubator ToReforge since 2015 and is a co-founder at gaming developer Walkabout Games, established in 2017. Krasnopolski has also been the owner of internet marketing agency Red2black since 2007 and was founder and co-owner at e-commerce-for-children startup more4kids.pl between 2008 and 2012, when he exited the company that is now listed on the Polish stock exchange. He is a supervisory board member at Cloud Technologies, a leader in online advertising and big-data cloud computing in Europe and holds a master’s in entrepreneurship from Warsaw’s Kosminski University.

Technical advisor and co-founder of Bygen

Philip Kwong is a lecturer and researcher at the University of Adelaide’s School of Chemical Engineering and Advanced Materials. He joined the university in 2009 and focuses on developing low-cost technologies that can facilitate a transition from fossil fuels to renewable energy. One of his ongoing research projects primarily deals with the conversion of agricultural waste into biochar, a form of charcoal that can act as a feedstock for making activated carbon and for sequestering carbon.In 2017, Kwong and two PhD students in his research group, Ben Morton and Lewis Dunnigan, began commercialization of the waste-to-activated carbon technology they had developed. A spin-off company called Bygen was established, with Dunnigan and Morton leading the startup. Kwong is a co-founder and technical advisor of the company.

Philip Kwong is a lecturer and researcher at the University of Adelaide’s School of Chemical Engineering and Advanced Materials. He joined the university in 2009 and focuses on developing low-cost technologies that can facilitate a transition from fossil fuels to renewable energy. One of his ongoing research projects primarily deals with the conversion of agricultural waste into biochar, a form of charcoal that can act as a feedstock for making activated carbon and for sequestering carbon.In 2017, Kwong and two PhD students in his research group, Ben Morton and Lewis Dunnigan, began commercialization of the waste-to-activated carbon technology they had developed. A spin-off company called Bygen was established, with Dunnigan and Morton leading the startup. Kwong is a co-founder and technical advisor of the company.

Armed with Asian and European experience, Miguel Amaro co-founded Uniplaces in 2011. He earned his bachelor’s degree in Finance from the University of Nottingham, and took a course in Chinese Studies at East China Normal University. He obtained his master’s in Management, with a concentration in Global Entrepreneurship, from Babson Graduate School. Amaro also spent two months as an analyst at Grameen Bank in Dhaka, Bangladesh. While developing Uniplaces, he was an entrepreneur-in-residence at Picvic Labs (France), Zhejiang University Innovation Institute (China) and Osram (United States). Amaro is currently part of the World Economic Forum’s Global Shapers. As an investor, to date, he has only invested in Portuguese healthy food service EatTasty and part funding the company's angel, pre-seed and seed rounds, with undisclosed investments.

Armed with Asian and European experience, Miguel Amaro co-founded Uniplaces in 2011. He earned his bachelor’s degree in Finance from the University of Nottingham, and took a course in Chinese Studies at East China Normal University. He obtained his master’s in Management, with a concentration in Global Entrepreneurship, from Babson Graduate School. Amaro also spent two months as an analyst at Grameen Bank in Dhaka, Bangladesh. While developing Uniplaces, he was an entrepreneur-in-residence at Picvic Labs (France), Zhejiang University Innovation Institute (China) and Osram (United States). Amaro is currently part of the World Economic Forum’s Global Shapers. As an investor, to date, he has only invested in Portuguese healthy food service EatTasty and part funding the company's angel, pre-seed and seed rounds, with undisclosed investments.

Lakestar is an international VC firm headquartered in Zurich. Founded in 2012 by Klaus Hommels, the VC has been an active early-stage investor since 2000. Its first fund was established in 2013 to invest in fast-growing tech startups across Europe and the US like Skype, Spotify, Facebook and Airbnb. The firm has offices in Zurich, Berlin, London, New York and Hong Kong with total investments of more than €1bn. Amid the Covid-19 pandemic in February 2020, Lakestar managed to raise a total of $735m for early and growth stage funds to be invested mainly in Europe. One-third of the funds will be designated to early-stage investments and two-thirds to growth-stage companies to drive international expansion. Part of the capital will also be used to strengthen the leadership team.

Lakestar is an international VC firm headquartered in Zurich. Founded in 2012 by Klaus Hommels, the VC has been an active early-stage investor since 2000. Its first fund was established in 2013 to invest in fast-growing tech startups across Europe and the US like Skype, Spotify, Facebook and Airbnb. The firm has offices in Zurich, Berlin, London, New York and Hong Kong with total investments of more than €1bn. Amid the Covid-19 pandemic in February 2020, Lakestar managed to raise a total of $735m for early and growth stage funds to be invested mainly in Europe. One-third of the funds will be designated to early-stage investments and two-thirds to growth-stage companies to drive international expansion. Part of the capital will also be used to strengthen the leadership team.

C4 Ventures was founded by Pascal Cagni, former VP and GM of Apple EMEIA. With offices in Paris and London, the firm invests in early-stage startups across market segments in Europe. The VC also supports later-stage companies interested in expanding into Europe. It currently has 33 startups in its portfolio with principal interests in sectors like hardware, digital media and the future of commerce and work.Recent investments in 2021 include the $54m Series B round of Austrian refurbished electronics goods marketplace Refurbed in August and the $5m seed round in June of Norbert Health, the French producers of the first ambient scanner that can measure vital signs.

C4 Ventures was founded by Pascal Cagni, former VP and GM of Apple EMEIA. With offices in Paris and London, the firm invests in early-stage startups across market segments in Europe. The VC also supports later-stage companies interested in expanding into Europe. It currently has 33 startups in its portfolio with principal interests in sectors like hardware, digital media and the future of commerce and work.Recent investments in 2021 include the $54m Series B round of Austrian refurbished electronics goods marketplace Refurbed in August and the $5m seed round in June of Norbert Health, the French producers of the first ambient scanner that can measure vital signs.

Paris-based Orange Digital Ventures is part of French telco Orange and was established in 2015. It invests up to €150m in businesses with technology that aligns with Orange's development plans. It has a geographical focus on Africa and has made a commitment to boosting the continent's startup ecosystem through its 2017 €50m dedicated Africa fund. Recent investments include fintech Monzo's US$144m Series F round and B2C savings and investment marketplace Raisin's US$$114m Series D round.

Paris-based Orange Digital Ventures is part of French telco Orange and was established in 2015. It invests up to €150m in businesses with technology that aligns with Orange's development plans. It has a geographical focus on Africa and has made a commitment to boosting the continent's startup ecosystem through its 2017 €50m dedicated Africa fund. Recent investments include fintech Monzo's US$144m Series F round and B2C savings and investment marketplace Raisin's US$$114m Series D round.

London-based financial services company Octopus Investments was founded in 2000. Since then, the firm has grown to a 500-strong company that manages £6 billion on behalf of more than 50,000 investors. It is part of Octopus Group. The VC firm has offices in New York, Singapore and Shanghai, besides London and has invested in 200 companies to date, almost half of them as the lead investor. It has seen 27 exits among its portfolio companies, including acquisitions by Microsoft, Amazon, and Google, with notable divested companies including Graze, Adbrain, SwiftKey and Zoopla.

London-based financial services company Octopus Investments was founded in 2000. Since then, the firm has grown to a 500-strong company that manages £6 billion on behalf of more than 50,000 investors. It is part of Octopus Group. The VC firm has offices in New York, Singapore and Shanghai, besides London and has invested in 200 companies to date, almost half of them as the lead investor. It has seen 27 exits among its portfolio companies, including acquisitions by Microsoft, Amazon, and Google, with notable divested companies including Graze, Adbrain, SwiftKey and Zoopla.

Indogen Capital is Indonesia’s latest VC founded in early 2017. The private fund looks for founder “athletes and shapes them into champions”, with capital injections of US$100,000 to US$500,000.VC advisor and Tokopedia co-founder, Leonitus Alpha Edison is passionate about mentoring startups on how to negotiate founder-friendly deals.The other VC partners are: Hendry Willy (Leon’s friend and founder of TokoUSB.com), private equity veteran Teezar Firmansyah, Nararya Ciputra Sastrawinata of business tycoon family in real estate and Ciputra University. Indogen’s CEO Chandra Firmanto is Leon’s childhood friend whose family business had joint ventures with Ciputra.

Indogen Capital is Indonesia’s latest VC founded in early 2017. The private fund looks for founder “athletes and shapes them into champions”, with capital injections of US$100,000 to US$500,000.VC advisor and Tokopedia co-founder, Leonitus Alpha Edison is passionate about mentoring startups on how to negotiate founder-friendly deals.The other VC partners are: Hendry Willy (Leon’s friend and founder of TokoUSB.com), private equity veteran Teezar Firmansyah, Nararya Ciputra Sastrawinata of business tycoon family in real estate and Ciputra University. Indogen’s CEO Chandra Firmanto is Leon’s childhood friend whose family business had joint ventures with Ciputra.

Eempat Kapital (EK) was established in 2011 by Pramadita (Riel) Tasmaya, who is also a co-founder of Muslimarket. The investment firm is also managed by team member Emilia Emil Abbas, the daughter of Dr Emil Abbas who also owns PT Ranji Karya Sakti, part of the Easco Holding conglomerate. Another team member is Aldi Harris, who was the general manager of the private family-owned Easco Holding.EK’s portfolio includes energy and oil companies, e-commerce Muslimarket, concert information website Sindhen and food chains, Chicken Run and Arasseo. EK also raises finance for startups and provides management services as needed.

Eempat Kapital (EK) was established in 2011 by Pramadita (Riel) Tasmaya, who is also a co-founder of Muslimarket. The investment firm is also managed by team member Emilia Emil Abbas, the daughter of Dr Emil Abbas who also owns PT Ranji Karya Sakti, part of the Easco Holding conglomerate. Another team member is Aldi Harris, who was the general manager of the private family-owned Easco Holding.EK’s portfolio includes energy and oil companies, e-commerce Muslimarket, concert information website Sindhen and food chains, Chicken Run and Arasseo. EK also raises finance for startups and provides management services as needed.

The edtech startup formerly named Squiline hopes greater fluency in English can boost Indonesia's creative and tourism sectors

Indonesia 2021 outlook: VCs "cautiously optimistic" on Southeast Asia's largest country

Investors expect Indonesian startups to regain their growth opportunities when the economy reopens with the Covid-19 vaccine rollout, even as some online living and working habits have stuck

Meituan, the “Amazon for local services”

Now worth over US$50 billion, the company has always focused on one end-goal: help consumers eat better, live better

Amid Covid-19 gloom, some bright spots in Portugal's tech startup scene

Despite a recession and doubling of the unemployment rate forecast this year, it's not all bad news for the Portuguese tech ecosystem

Jesús Encinar: The Man Behind Idealista and 11870.com

Entrepreneur, angel investor and down-to-earth idealist

Meituan-Dianping’s Wang Xing: From struggling copycat to IPO billionaire

As the internet startup sets to list in Hong Kong this week, we take a look back at the journey of its founder Wang Xing, once dubbed “the unluckiest serial entrepreneur”

Medigo teams up with Indonesian Medical Association to launch primary care clinic network

Medigo aims to support healthcare operators with its clinic management SaaS, booking and medical records app for patients and more

Get fit and healthy with these Indonesian wellness startups

The wellness lifestyle trend continues to grow in popularity in Indonesia, and startups want a piece of the action

HighPitch 2020: Waste management play Octopus, digital concierge service Izy win Makassar battle

Both startups have scored strong traction despite the weight of Covid-19; they are also expanding and keen to explore new opportunities

Amid IPO talk, Meicai continues to push for growth in bid to become China's Sysco

Covid-19 helped speed up expansion to the B2C market for Meicai, China’s most valuable agrifood tech unicorn founded by a farmer’s son

In Spain, women are busy launching startups

Official data show women-led startups are on the rise in Spain. We take you to some of the biggest names in the game

No dine-in, no problem: Hangry’s cloud kitchens thrive amid Covid-19

Learning from global F&B franchises has helped Hangry expand rapidly, maintain quality and set expansion goals despite the pandemic

Healthy eating: The Southeast Asian startups making it a breeze

From meal plans to novel ingredients, agriculture and foodtech startups in the region are developing new ways to improve nutrition without sacrificing taste

Spain's gig and sharing economy startups flourish, despite barrage of restrictions

Startups like Glovo and Spotahome topped fundings raised in 2018 despite local regulatory risks, as Spanish tech firms conquer overseas markets

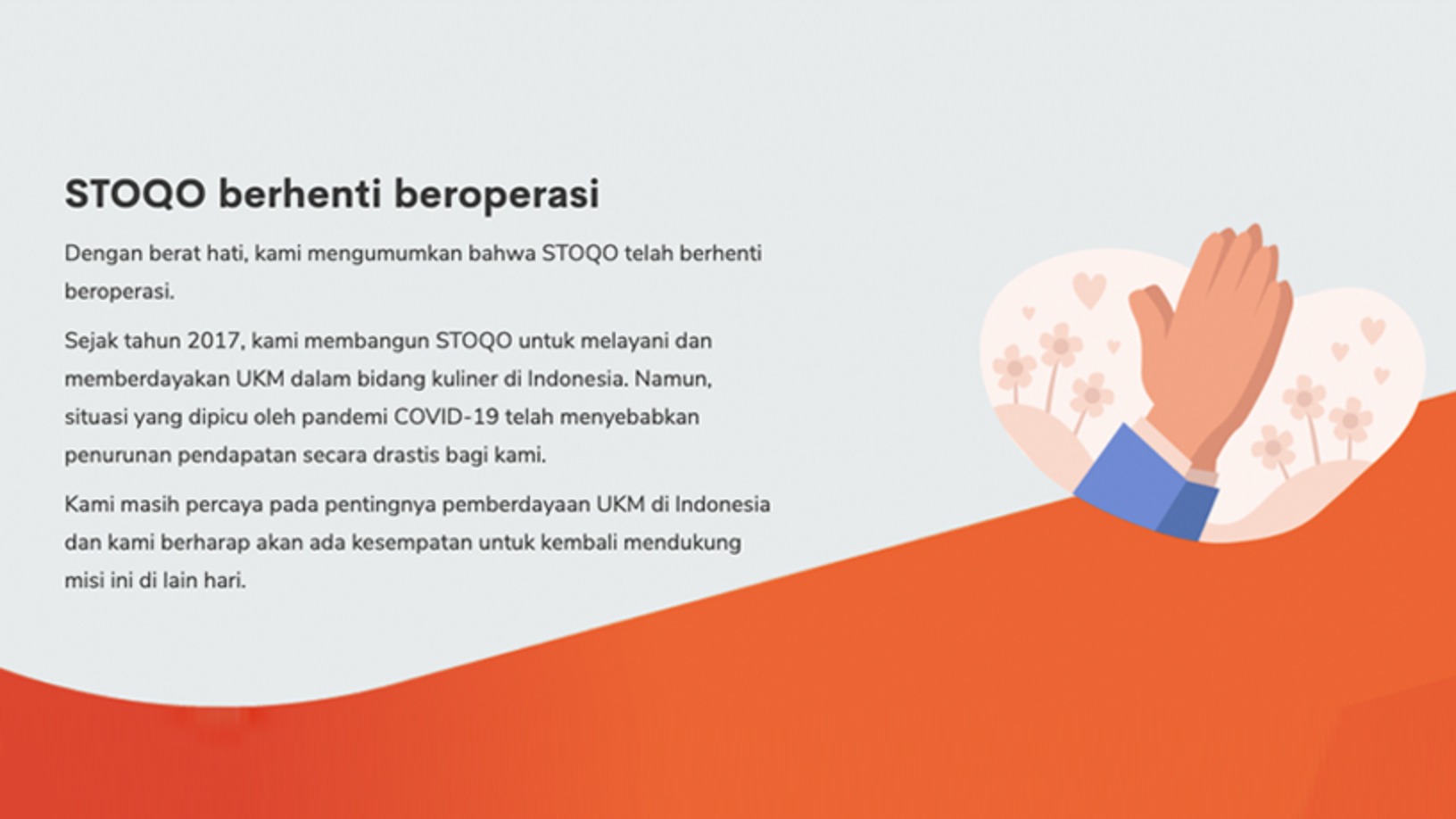

F&B supplier STOQO collapses, a casualty of Covid-19 restaurant closures in Indonesia

A once promising startup, STOQO's woes reflect the challenges faced by the local F&B industry, which is finding new ways to stay afloat

Sorry, we couldn’t find any matches for“Indonesian Hotel and Restaurant Association”.