Mandiri Capital Investments

-

DATABASE (949)

-

ARTICLES (418)

Accelerating Asia focuses on Asian startups for its three-month intensive acceleration program. The Singapore-based investor was founded in 2018 and focuses on diversity investments, with 40% of its portfolio companies being led by women.The firm invests up to S$200,000 in participating pre-Series A startups. All of the program’s startups receive S$50,000–75,000 with an additional investment of up to S$150,000 for top performing companies.To date, the early-stage VC has invested in 25 startups. Recent investments in 2020 include stakes in Bangladeshi mobility platform Shuttle and Indonesian startups KaryaKarsa and MyBrand.

Accelerating Asia focuses on Asian startups for its three-month intensive acceleration program. The Singapore-based investor was founded in 2018 and focuses on diversity investments, with 40% of its portfolio companies being led by women.The firm invests up to S$200,000 in participating pre-Series A startups. All of the program’s startups receive S$50,000–75,000 with an additional investment of up to S$150,000 for top performing companies.To date, the early-stage VC has invested in 25 startups. Recent investments in 2020 include stakes in Bangladeshi mobility platform Shuttle and Indonesian startups KaryaKarsa and MyBrand.

Taavet Hinrikus is the Estonian-born co-founder and CEO of money transfer platform and unicorn TransferWise (now called Wise). He was formerly Skype’s Director of Strategy and is a prolific angel investor across sectors and technologies, with investments in around 30 startups to date. His most recent investments include in the April 2021 $11m Series A round of automatic contract negotiator PACTUM and in the March 2021 $48m Series A round of Dutch cell-based meat startup Meatable which leverages pluripotent stem cells for the first time in foodtech.

Taavet Hinrikus is the Estonian-born co-founder and CEO of money transfer platform and unicorn TransferWise (now called Wise). He was formerly Skype’s Director of Strategy and is a prolific angel investor across sectors and technologies, with investments in around 30 startups to date. His most recent investments include in the April 2021 $11m Series A round of automatic contract negotiator PACTUM and in the March 2021 $48m Series A round of Dutch cell-based meat startup Meatable which leverages pluripotent stem cells for the first time in foodtech.

Founded in 2009, Finnish VC Lifeline Ventures has invested in over 100 early-stage startups, with investments ranging from €100,000 to €2m. Focusing mainly on local tech startups, the VC has 71 tech and non-tech companies in its portfolio.Recent investments in April 2021 include the $100m Series C round of Finnish wellness ring and app Oura Health and the $6.2m seed round of Finnish cleantech Carbo Culture. One of Lifeline’s VC partners, Timo Ahopelto, is an advisor at student-led VC Wave Ventures that also participated in the investment round of Carbo Culture.

Founded in 2009, Finnish VC Lifeline Ventures has invested in over 100 early-stage startups, with investments ranging from €100,000 to €2m. Focusing mainly on local tech startups, the VC has 71 tech and non-tech companies in its portfolio.Recent investments in April 2021 include the $100m Series C round of Finnish wellness ring and app Oura Health and the $6.2m seed round of Finnish cleantech Carbo Culture. One of Lifeline’s VC partners, Timo Ahopelto, is an advisor at student-led VC Wave Ventures that also participated in the investment round of Carbo Culture.

Founded in 2015 in Guatemala City, the Invariantes Fund invests in technology startups based in the US and Latin America, across different market segments. It is the only VC based in Guatamala, and bills itself as the country’s first early-stage VC firm. As of June 2021, its portfolio includes 24 startups. Invariantes’ most recent investments include participation in the $21m Series A round of US edtech player Reforge, as well in the $130m Series B round of US-based Axiom Space, which is building the first international commercial space station. Both investments were in February 2021.

Founded in 2015 in Guatemala City, the Invariantes Fund invests in technology startups based in the US and Latin America, across different market segments. It is the only VC based in Guatamala, and bills itself as the country’s first early-stage VC firm. As of June 2021, its portfolio includes 24 startups. Invariantes’ most recent investments include participation in the $21m Series A round of US edtech player Reforge, as well in the $130m Series B round of US-based Axiom Space, which is building the first international commercial space station. Both investments were in February 2021.

Global technology investment firm Atomico was set up in 2006 by Skype co-founder Niklas Zennström. Since then, it has made over 140 investments with a focus on the European market. Atomico’s team of investors includes founders of six billion-dollar companies, and operational leaders at companies such as Skype, Google, Uber, Facebook and Spotify. The London-based investment company has managed 27 exits to date including Supercell, Fab, the Climate Corporation and Rovio Entertainment. Its recent investments include in Peakon's Series B, AccuRx's Series A and in Graphcore and Clutter's Series D rounds.

Global technology investment firm Atomico was set up in 2006 by Skype co-founder Niklas Zennström. Since then, it has made over 140 investments with a focus on the European market. Atomico’s team of investors includes founders of six billion-dollar companies, and operational leaders at companies such as Skype, Google, Uber, Facebook and Spotify. The London-based investment company has managed 27 exits to date including Supercell, Fab, the Climate Corporation and Rovio Entertainment. Its recent investments include in Peakon's Series B, AccuRx's Series A and in Graphcore and Clutter's Series D rounds.

Owen van Natta was formerly COO of Facebook and CEO of MySpace, and also previously held senior positions in Amazon and Zynga. He is an angel investor, founder of 415 LLC as well as a founding partner of tech-focused VC firm Prefix Capital, and has invested in a number of startups to date. His disclosed investments include participation in the March 2017 $800,000 seed round of Irish water regulatory platform SwiftComply and the November 2015 undisclosed funding round of US-based unicorn Diamond Foundry, the first certified carbon-neutral lab-produced diamond manufacturer. No pic on SM

Owen van Natta was formerly COO of Facebook and CEO of MySpace, and also previously held senior positions in Amazon and Zynga. He is an angel investor, founder of 415 LLC as well as a founding partner of tech-focused VC firm Prefix Capital, and has invested in a number of startups to date. His disclosed investments include participation in the March 2017 $800,000 seed round of Irish water regulatory platform SwiftComply and the November 2015 undisclosed funding round of US-based unicorn Diamond Foundry, the first certified carbon-neutral lab-produced diamond manufacturer. No pic on SM

VNV Global was originally founded as Vostok Nafta in 1996, with its first investment in Russia. The investment vehicle initially focused on investments in agriculture and natural resources, but began to diversify into early consumer internet companies like Avito and Tinkoff Bank. Shares were listed on NASDAQ OMX and the VC pivoted to high-growth tech investments in 2007. In 2015, the name was changed to Vostok New Ventures and shortened to VNV Global in 2020 to reflect its international strategy to expand outside Europe.The mid-cap NASDAQ Stockholm exchange-listed VNV mainly invests in mobility, medtech and marketplaces. It currently has 31 startups in its portfolio and six exits managed to date. Recent investments led by VNV include the $43m Series B funding of London-based food waste app OLIO in September 2021 and the $1.6m seed round of Vietnamese dating app Fika in October 2021.

VNV Global was originally founded as Vostok Nafta in 1996, with its first investment in Russia. The investment vehicle initially focused on investments in agriculture and natural resources, but began to diversify into early consumer internet companies like Avito and Tinkoff Bank. Shares were listed on NASDAQ OMX and the VC pivoted to high-growth tech investments in 2007. In 2015, the name was changed to Vostok New Ventures and shortened to VNV Global in 2020 to reflect its international strategy to expand outside Europe.The mid-cap NASDAQ Stockholm exchange-listed VNV mainly invests in mobility, medtech and marketplaces. It currently has 31 startups in its portfolio and six exits managed to date. Recent investments led by VNV include the $43m Series B funding of London-based food waste app OLIO in September 2021 and the $1.6m seed round of Vietnamese dating app Fika in October 2021.

Founded in 1993 by former journalist Hugo Shong (Xiong Xiaoge), a godfather figure in China's VC community, IDG is one of the leading VC firms in China, having invested in some 450 companies (as of end-2015) with over 100 successful exits. Among the biggest names are Tencent, Baidu, Xiaomi, Vancl, Sohu, Ctrip and Qihoo 360.

Founded in 1993 by former journalist Hugo Shong (Xiong Xiaoge), a godfather figure in China's VC community, IDG is one of the leading VC firms in China, having invested in some 450 companies (as of end-2015) with over 100 successful exits. Among the biggest names are Tencent, Baidu, Xiaomi, Vancl, Sohu, Ctrip and Qihoo 360.

Goodwater was founded in San Mateo in 2014 with a team less than 10 by Chi-Hua Chien and Eric J.Kim, who were previously at Kleiner Perkins and Maverick.

Goodwater was founded in San Mateo in 2014 with a team less than 10 by Chi-Hua Chien and Eric J.Kim, who were previously at Kleiner Perkins and Maverick.

Yonghua is a specialized investment company under Yongjin Group. With more than 20 years investment experience, it has invested in more than 100 companies, more than 50 of which are listed. Yonghua focuses on the most competitive companies in industries such as finance, e-commerce, education, healthcare, corporation service, new material and artificial intelligence.

Yonghua is a specialized investment company under Yongjin Group. With more than 20 years investment experience, it has invested in more than 100 companies, more than 50 of which are listed. Yonghua focuses on the most competitive companies in industries such as finance, e-commerce, education, healthcare, corporation service, new material and artificial intelligence.

Omnes is a Paris-based European investor in private equity and infrastructure. It specializes in deep tech and healthcare. It has backed 450 businesses, with €5bn assets under management.

Omnes is a Paris-based European investor in private equity and infrastructure. It specializes in deep tech and healthcare. It has backed 450 businesses, with €5bn assets under management.

Silicon Valley-based Bessemer Venture Partners is one of the largest startup investors in the world, with US$5.4bn invested across five funds, the most recent raised in August 2018. Founded in 1911, the VC has five US offices as well as premises in India and Israel. It invests starting from seed and Series A level, sticking with portfolio companies through later-stage investments. Bessemer Venture Partners has invested in over 880 startups and managed more than 120 exits to date. Recent investments include Korean fintech Toss's US$64m Series F, US accounting unicorn ScaleFactor's US$60m Series C and fintech Mambu's Series C.

Silicon Valley-based Bessemer Venture Partners is one of the largest startup investors in the world, with US$5.4bn invested across five funds, the most recent raised in August 2018. Founded in 1911, the VC has five US offices as well as premises in India and Israel. It invests starting from seed and Series A level, sticking with portfolio companies through later-stage investments. Bessemer Venture Partners has invested in over 880 startups and managed more than 120 exits to date. Recent investments include Korean fintech Toss's US$64m Series F, US accounting unicorn ScaleFactor's US$60m Series C and fintech Mambu's Series C.

Founded in 1997, Seventure Partners is one of Europe’s most prolific VC investors with a portfolio of over 200 startups across both tech and non-tech sectors. The French VC has also managed more than 40 exits in total. It mainly focuses on fintech and insurtech, French and German startups and in life sciences in Europe, North America and Asia.Its five funds cover different market segments, ranging from €24m–€200m, with investments of €500,000–€10m per round. Total funding for a company can reach €20m, right through the early to late stages. Recent investments include the $6.7m Series A round of US biotech Dermala and the $10.7m Series A round of US self-cleaning water bottle startup LARQ.

Founded in 1997, Seventure Partners is one of Europe’s most prolific VC investors with a portfolio of over 200 startups across both tech and non-tech sectors. The French VC has also managed more than 40 exits in total. It mainly focuses on fintech and insurtech, French and German startups and in life sciences in Europe, North America and Asia.Its five funds cover different market segments, ranging from €24m–€200m, with investments of €500,000–€10m per round. Total funding for a company can reach €20m, right through the early to late stages. Recent investments include the $6.7m Series A round of US biotech Dermala and the $10.7m Series A round of US self-cleaning water bottle startup LARQ.

Mercy Corps’ Social Venture Fund

Mercy Corps’ Social Venture Fund is a seed and early-stage social impact fund operated by not-for-profit humanitarian organization Mercy Corps. The US-based organization is increasingly moving into tech investments, with key interests in agtech and fintech solutions creating social impact. FinX, a platform designed to accelerate financial inclusion worldwide, was also launched recently. Distributed ledgers, digital assets, cryptocurrencies and other digital financial solutions will be deployed to alleviate poverty in local communities. The fund has invested in 16 companies at the seed stage. Investments in the February 2021 included a pre-seed round for Kenyan healthcare fintech platform ImaliPay. In December 2020, it joined a $5.3m seed round for Colombian remittance tech Valiu.

Mercy Corps’ Social Venture Fund is a seed and early-stage social impact fund operated by not-for-profit humanitarian organization Mercy Corps. The US-based organization is increasingly moving into tech investments, with key interests in agtech and fintech solutions creating social impact. FinX, a platform designed to accelerate financial inclusion worldwide, was also launched recently. Distributed ledgers, digital assets, cryptocurrencies and other digital financial solutions will be deployed to alleviate poverty in local communities. The fund has invested in 16 companies at the seed stage. Investments in the February 2021 included a pre-seed round for Kenyan healthcare fintech platform ImaliPay. In December 2020, it joined a $5.3m seed round for Colombian remittance tech Valiu.

Albert Wenger is a managing partner at New York-based Union Square Ventures. He is also an angel investor with disclosed investments in 25 startups, many in the area of sustainability. His most recent investments have been in the April 2021 $6.2m seed round of Finnish carbon sequestration startup Carbon Culture and in the $9.5m Series A round of French web browser innovation company Beam.

Albert Wenger is a managing partner at New York-based Union Square Ventures. He is also an angel investor with disclosed investments in 25 startups, many in the area of sustainability. His most recent investments have been in the April 2021 $6.2m seed round of Finnish carbon sequestration startup Carbon Culture and in the $9.5m Series A round of French web browser innovation company Beam.

Financial planning startup Halofina raises pre-Series A from Mandiri Capital, Finch Capital

The funding is meant to “bridge” the company toward a 2020 Series A round as it launches a new subscription plan and works with financial advisors

P2P financing platform Investree raises Series C, with $23.5m in first tranche

Indonesia's Investree closes key funding amid Covid-19 crisis; is applying for licenses in Thailand and the Philippines in regional expansion

Exclusive: Patamar Capital to raise US$150 million, eyes Series B investments

The impact investment VC recently scored an exit at Indonesian online-to-offline group buying startup Mapan, when it was bought over by Go-Jek

Investing in Indonesia: The fintech companies driving a new influx of capital

With 66% of Indonesians not owning a bank account, fintech startups have come up with myriad innovative products to entice a new generation of retail investors

CrowdDana: Taking the equity crowdfunding hype into the real estate sector

Beginning with boarding house projects, CrowdDana's new business model aims to more efficiently connect Indonesian SMEs needing funding with a growing pool of investors

Sequoia Capital China holds steady with investments in healthcare, biotech and green economy

China’s most active investor increases bets on sectors beyond the consumer internet and edtech recently hurt by regulatory clampdown

Indonesia 2020: Investors say opportunities still abound despite downturn risk, past year's flops

VCs weigh in on deal flows, valuations, the sectors they favor, and chances of more tech IPOs

Fresh from $13.5m Series A, Indonesian insurtech Qoala takes the long view amid Covid-19

Backed by capital from VCs like Sequoia Capital India, Qoala wants to grow its income channels, team and partnerships as others hold back

Indonesian P2P lending platform Investree expands to the Philippines

With local partner Filinvest Development Corporation, Investree Philippines will support the country’s SMEs with its lending-based crowdfunding platform

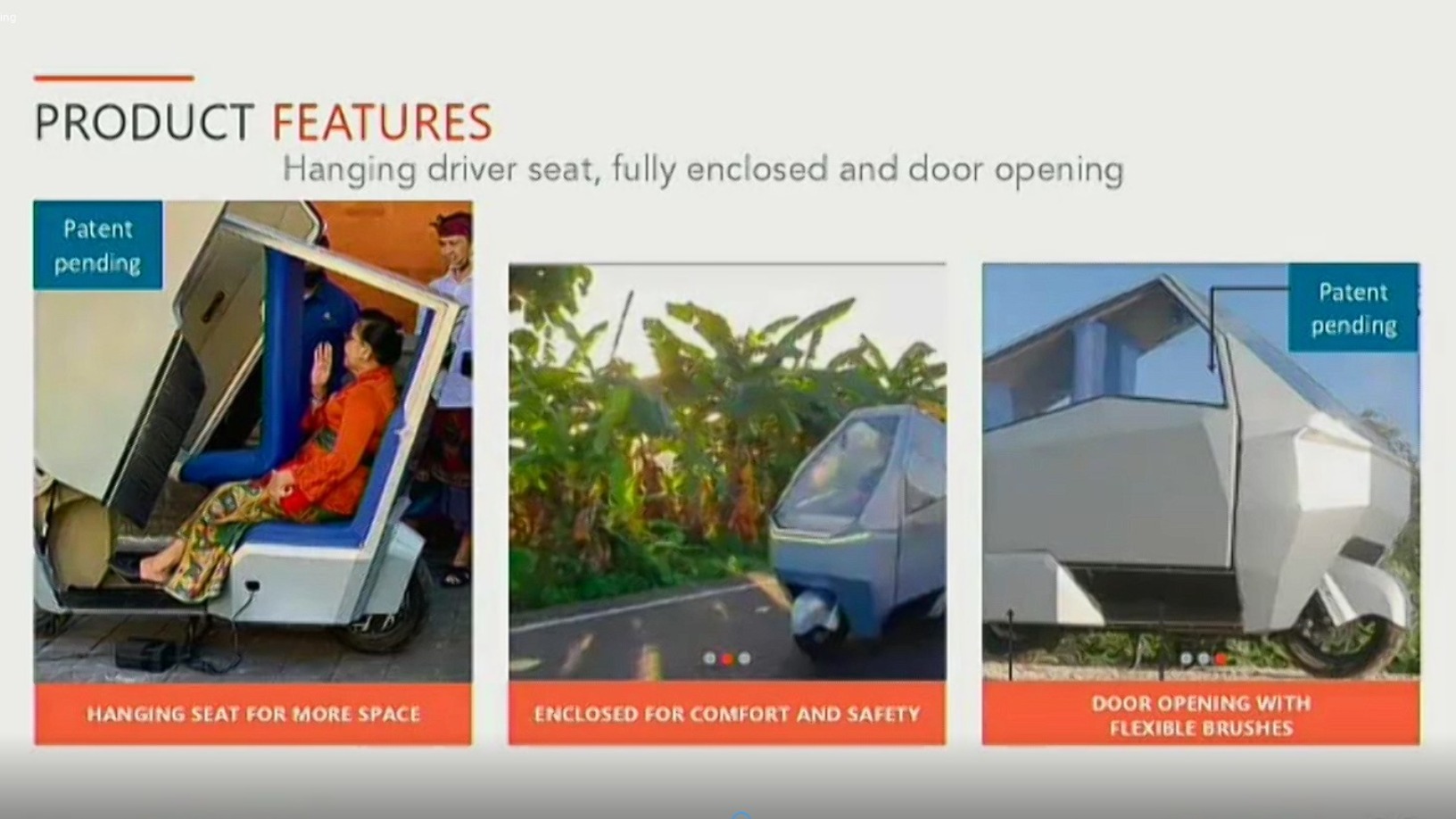

HighPitch 2020: Hydroponics, EV startups PanenBali and Manouv represent Denpasar chapter

Renewable energy and sustainability focuses impress investors, who also caution startups about competitors from outside their region

Ruangguru, Amartha founders made aides to Indonesian President

Seven young leaders appointed to assist President Joko Widodo in non-ministerial tasks, with an emphasis on innovation

UPDATE: Indonesian mPOS startup Cashlez raises IDR 85bn from IPO in May

Cashlez is the first fintech company to list on the Indonesia Stock Exchange; will spend over 60% of proceeds to acquire payments company in toll road market

Daniel Oliver: Building a "Facebook" for investments in biotech startups

The biologist and crowdfunding expert has pioneered the growth of Spanish biotech startups, providing access to early-stage investments, with support from scientific experts worldwide

E-wallet LinkAja gets access to Indonesia's Civil Registry for user data checks

Move allows more than 2,000 public and private entities to verify user data against government records, but the public has raised privacy and security concerns

Indexa Capital: Investment opportunities for the everyman

Spanish startup Indexa Capital has created an automated wealth manager that delivers a higher return on investment than Spanish banks

Sorry, we couldn’t find any matches for“Mandiri Capital Investments”.