Startup with IBM

-

DATABASE (997)

-

ARTICLES (811)

Chief Security Officer and co-founder of IOMED Medical Solutions

A self-taught developer and NLP engineer, Álvaro Abella Bascarán is co-founder and Chief Security Officer (CSO) of Spanish medtech IOMED Medical Solutions, which facilitates data extraction from electronic health records. He has also worked as frontend developer, a backend developer, a data scientist and an NLP engineer. For his master’s in Bioinformatics for Health Science at Barcelona’s Pompeu Fabra University, Abella completed an internship at QMENTA, formerly Mint Labs. This is a US drug development startup dedicated to brain diseases, where Abella gained knowledge of computational neuroscience. He also holds a first degree from the University of Oviedo in Biotechnology.

A self-taught developer and NLP engineer, Álvaro Abella Bascarán is co-founder and Chief Security Officer (CSO) of Spanish medtech IOMED Medical Solutions, which facilitates data extraction from electronic health records. He has also worked as frontend developer, a backend developer, a data scientist and an NLP engineer. For his master’s in Bioinformatics for Health Science at Barcelona’s Pompeu Fabra University, Abella completed an internship at QMENTA, formerly Mint Labs. This is a US drug development startup dedicated to brain diseases, where Abella gained knowledge of computational neuroscience. He also holds a first degree from the University of Oviedo in Biotechnology.

Co-Founder & CEO of Bipi

Hans Christ has worked internationally across Latin America, Europe and the USA. He is the co-founder of transport technology startup Bipi, a Spanish on-demand car rental app and Lollo Mobility, Bipi’s parent company and transport app company. He co-founded Colombia Cave Box Crossfit in 2013 and was previously Groupon Iberia’s Head of Goods, where he helped established its product department. Christ started his career as a Credit Manager in Walls Cargo Bank. Christ holds a Business Administration degree from Southern Methodist University (SMU) and an MBA in Marketing from the University of Dallas.

Hans Christ has worked internationally across Latin America, Europe and the USA. He is the co-founder of transport technology startup Bipi, a Spanish on-demand car rental app and Lollo Mobility, Bipi’s parent company and transport app company. He co-founded Colombia Cave Box Crossfit in 2013 and was previously Groupon Iberia’s Head of Goods, where he helped established its product department. Christ started his career as a Credit Manager in Walls Cargo Bank. Christ holds a Business Administration degree from Southern Methodist University (SMU) and an MBA in Marketing from the University of Dallas.

Founded by Matt Cheng, a leading angel investor, serial entrepreneur and top-ranked ITF world junior tennis player, in 2010, Cherubic Ventures is an early-stage venture capital firm with coverage across Silicon Valley and Greater China. With US$120 million of assets under management, it has invested in 100+ companies.

Founded by Matt Cheng, a leading angel investor, serial entrepreneur and top-ranked ITF world junior tennis player, in 2010, Cherubic Ventures is an early-stage venture capital firm with coverage across Silicon Valley and Greater China. With US$120 million of assets under management, it has invested in 100+ companies.

Based in New York City, Lerer Hippeau mainly invests in seed and early-stage startups based in the US. Founded in 2010 by managing partners Kenneth Lerer, Ben Lerer and Eric Hippeau, the VC operates several funds offering initial investments of $1m per startup. Kenneth Lerer is the co-founder of Huffington Post and longtime chairman of BuzzFeed. Hippeau was the CEO of Huffington Post and ex-managing partner of Softbank Capital that invested in Huffington Post.Its 400+ startups also get support for business growth by tapping into tech ecosystems like New York, San Francisco and Los Angeles. Its 80+ exits include Giphy (GIF) that was acquired by Facebook and home-fitness studio Mirror acquired by Lululemon. However, the IPO by portfolio company Bed-in-a-box online retailer Casper was below market expectations. The loss-making e-commerce unicorn went public at $12 a share in February 2020, closing at $13.50 on its first day out, for a market capitalization of less than half the $1.1 billion Casper was valued at in a private funding round in 2019.

Based in New York City, Lerer Hippeau mainly invests in seed and early-stage startups based in the US. Founded in 2010 by managing partners Kenneth Lerer, Ben Lerer and Eric Hippeau, the VC operates several funds offering initial investments of $1m per startup. Kenneth Lerer is the co-founder of Huffington Post and longtime chairman of BuzzFeed. Hippeau was the CEO of Huffington Post and ex-managing partner of Softbank Capital that invested in Huffington Post.Its 400+ startups also get support for business growth by tapping into tech ecosystems like New York, San Francisco and Los Angeles. Its 80+ exits include Giphy (GIF) that was acquired by Facebook and home-fitness studio Mirror acquired by Lululemon. However, the IPO by portfolio company Bed-in-a-box online retailer Casper was below market expectations. The loss-making e-commerce unicorn went public at $12 a share in February 2020, closing at $13.50 on its first day out, for a market capitalization of less than half the $1.1 billion Casper was valued at in a private funding round in 2019.

Founded in 2013, Telstra’s muru-D accelerator has so far worked with 44 startups, with total revenue generated of over AUD 7.8 million. Telstra also has another venture capital arm that connects with technology businesses at a much later stage in their life cycles and looks to build strategic alliances. muru-D companies receive AUD 20,000 at the start of the program and if they achieve specific milestones by the midpoint of the program they unlock a further AUD 20,000. The accelerator has also dropped the requirement that companies raise AUD15,000 from mentors and investors.

Founded in 2013, Telstra’s muru-D accelerator has so far worked with 44 startups, with total revenue generated of over AUD 7.8 million. Telstra also has another venture capital arm that connects with technology businesses at a much later stage in their life cycles and looks to build strategic alliances. muru-D companies receive AUD 20,000 at the start of the program and if they achieve specific milestones by the midpoint of the program they unlock a further AUD 20,000. The accelerator has also dropped the requirement that companies raise AUD15,000 from mentors and investors.

Centurium Capital is a private equity firm specializing in investments in the healthcare and consumer sectors in China. It was founded by David Li, Warburg Pincus's former Asia head, with a US$1.5 billion hard cap. It raised US$925 million in first close in June 2018. Centurium's limited partners include GIC, China Investment Corporation and Temasek Holdings. Centurium has cooperated with UCAR and Lepu Medical Technology to set up and manage two industrial M&A funds with initial funds of over RMB 6 billion.

Centurium Capital is a private equity firm specializing in investments in the healthcare and consumer sectors in China. It was founded by David Li, Warburg Pincus's former Asia head, with a US$1.5 billion hard cap. It raised US$925 million in first close in June 2018. Centurium's limited partners include GIC, China Investment Corporation and Temasek Holdings. Centurium has cooperated with UCAR and Lepu Medical Technology to set up and manage two industrial M&A funds with initial funds of over RMB 6 billion.

Didac Lee is a Spanish entrepreneur and angel investor of Chinese descent. Lee focuses on investments in Spanish startups with recent participation in seed rounds of e-sports training program Gamestry and life management tool Eelp!Based in Barcelona, he has also established 15 companies including co-founding Galdana Ventures, a VC with interests in the US, Asia, Israel and Europe. Galdana has a portfolio of 30 companies with total investments worth US$1bn. Other companies include Tradeinn online sports stores and Inspirit business incubator. The serial entrepreneur is also a board member of Barcelona FC.

Didac Lee is a Spanish entrepreneur and angel investor of Chinese descent. Lee focuses on investments in Spanish startups with recent participation in seed rounds of e-sports training program Gamestry and life management tool Eelp!Based in Barcelona, he has also established 15 companies including co-founding Galdana Ventures, a VC with interests in the US, Asia, Israel and Europe. Galdana has a portfolio of 30 companies with total investments worth US$1bn. Other companies include Tradeinn online sports stores and Inspirit business incubator. The serial entrepreneur is also a board member of Barcelona FC.

The Mirae Asset Financial Group started in 1997 with Mirae Asset Global Investment and Mirae Asset Capital. The group's business interests focus on asset and wealth management, investments, and insurance. It has also invested in a range of companies, from logistics firm Shadowfax to AmazeVR. In 2018, it established a joint venture with Naver Corporation, one of South Korea's leading tech companies, and set up the Asia Growth Fund with $940m committed to VC investing in the region. The joint venture has backed Southeast Asian ride-hailing giant Grab, Indonesian e-commerce platform Bukalapak, and Singapore-based credit scoring firm FinAccel.

The Mirae Asset Financial Group started in 1997 with Mirae Asset Global Investment and Mirae Asset Capital. The group's business interests focus on asset and wealth management, investments, and insurance. It has also invested in a range of companies, from logistics firm Shadowfax to AmazeVR. In 2018, it established a joint venture with Naver Corporation, one of South Korea's leading tech companies, and set up the Asia Growth Fund with $940m committed to VC investing in the region. The joint venture has backed Southeast Asian ride-hailing giant Grab, Indonesian e-commerce platform Bukalapak, and Singapore-based credit scoring firm FinAccel.

Greater Bay Area Homeland Development Fund

With the aim of supporting Hong Kong to develop into a world-class tech innovation center and cooperating with Guangdong and Macau enterprises to support the development of the Guangdong-Hong Kong-Macao Greater Bay Area, large-sized mainland enterprises operating in Hong Kong, Hong Kong companies, mainland private firms and new economy enterprises initiated Greater Bay Area Homeland Development Fund in 2018. With a total capital volume of over HK$100bn, it is managed by Greater Bay Area Homeland Investments. The fund will also provide help to enterprises in the Greater Bay Area to export products to overseas markets.

With the aim of supporting Hong Kong to develop into a world-class tech innovation center and cooperating with Guangdong and Macau enterprises to support the development of the Guangdong-Hong Kong-Macao Greater Bay Area, large-sized mainland enterprises operating in Hong Kong, Hong Kong companies, mainland private firms and new economy enterprises initiated Greater Bay Area Homeland Development Fund in 2018. With a total capital volume of over HK$100bn, it is managed by Greater Bay Area Homeland Investments. The fund will also provide help to enterprises in the Greater Bay Area to export products to overseas markets.

CareCapital, with offices in Hong Kong and Shangai, is a leading investor in the global oral and dental industry. The firm’s operations span clinical and education, consumers product, orthodontics, digital equipment, SaaS, distribution, and industry-specific services. Its team comprises industry experts such as dental entrepreneurs, managers, and practitioners, healthcare investors; the company’s portfolio includes companies based in North America with revenues of RMB 5bn, Europe RMB 1.5bn, and Asia RMB 3.5bn. In June 2020, the company signed strategic partnerships with SINOCERA and Hillhouse Capital to work closely in the development and growth of dental restoration.

CareCapital, with offices in Hong Kong and Shangai, is a leading investor in the global oral and dental industry. The firm’s operations span clinical and education, consumers product, orthodontics, digital equipment, SaaS, distribution, and industry-specific services. Its team comprises industry experts such as dental entrepreneurs, managers, and practitioners, healthcare investors; the company’s portfolio includes companies based in North America with revenues of RMB 5bn, Europe RMB 1.5bn, and Asia RMB 3.5bn. In June 2020, the company signed strategic partnerships with SINOCERA and Hillhouse Capital to work closely in the development and growth of dental restoration.

Sky Ocean Ventures is a £25m impact investment fund and part of the Sky Media Group. It was launched in 2018 with the goal of accelerating businesses that can tackle global plastic pollution with innovative ideas and disruptive technologies. The firm has backed 20 startups that have developed solutions that help mitigate plastic disposals in the environment, such as disposable bottles made of paper, reusable delivery boxes, sachets made from seaweed and packaging made from wood chips. Sky Ocean Ventures also partners with, among others, The National Geographic and the Imperial College in London.

Sky Ocean Ventures is a £25m impact investment fund and part of the Sky Media Group. It was launched in 2018 with the goal of accelerating businesses that can tackle global plastic pollution with innovative ideas and disruptive technologies. The firm has backed 20 startups that have developed solutions that help mitigate plastic disposals in the environment, such as disposable bottles made of paper, reusable delivery boxes, sachets made from seaweed and packaging made from wood chips. Sky Ocean Ventures also partners with, among others, The National Geographic and the Imperial College in London.

Co-founder and CFO of Conclave

Graduating with a bachelor’s in Business Management and Finance from the Institut Teknologi Bandung (ITB) in Indonesia, Aditya Hadiputra became the CFO of Utoyo & Partners in August 2011. He left the financial services company with its founding partner Marshall Utoyo in 2013. They decided to set up a coworking space hub Conclave in Jakarta, together with two other graduates from ITB. Based in Jakarta, Aditya has been CFO of Conclave since January 2013. He has also been working as an investment associate since July 2015 at MDI Ventures, Telkom’s venture capital arm.

Graduating with a bachelor’s in Business Management and Finance from the Institut Teknologi Bandung (ITB) in Indonesia, Aditya Hadiputra became the CFO of Utoyo & Partners in August 2011. He left the financial services company with its founding partner Marshall Utoyo in 2013. They decided to set up a coworking space hub Conclave in Jakarta, together with two other graduates from ITB. Based in Jakarta, Aditya has been CFO of Conclave since January 2013. He has also been working as an investment associate since July 2015 at MDI Ventures, Telkom’s venture capital arm.

Co-founder and CEO of Marfeel

Xavi Beumala is a telecommunication engineer with a track record of extensive international and editorial positions in tech-related media. He was Technical Architect in Adobe Systems when he left in 2011 with a vision to create a company that could innovate the online media industry and its consumption across new and emerging devices. He invested his savings to bootstrap and start up Marfeel, a mobile ad-tech company with offices in Barcelona and New York, where he is currently co-founder and CEO.

Xavi Beumala is a telecommunication engineer with a track record of extensive international and editorial positions in tech-related media. He was Technical Architect in Adobe Systems when he left in 2011 with a vision to create a company that could innovate the online media industry and its consumption across new and emerging devices. He invested his savings to bootstrap and start up Marfeel, a mobile ad-tech company with offices in Barcelona and New York, where he is currently co-founder and CEO.

Chief Mobile Officer and co-founder of Coinscrap

Juan Carlos López is a software engineer specializing in mobile applications. He worked for many years as an iOS Developer. In 2015, he co-founded Sensitrade, a revolutionary technology that captures sentiment about the stock market from social networks, predicting stock exchange evolution with a 87% success rate.A year later, with the same business partners, he co-founded Coinscrap, an app that facilitates micro-savings by rounding up purchases made with credit cards to the nearest euro. He is currently Coinscrap's Chief Mobile Officer.

Juan Carlos López is a software engineer specializing in mobile applications. He worked for many years as an iOS Developer. In 2015, he co-founded Sensitrade, a revolutionary technology that captures sentiment about the stock market from social networks, predicting stock exchange evolution with a 87% success rate.A year later, with the same business partners, he co-founded Coinscrap, an app that facilitates micro-savings by rounding up purchases made with credit cards to the nearest euro. He is currently Coinscrap's Chief Mobile Officer.

CEO and Co-founder of Play2Speak

Based in Paris, Giuseppe Fantigrossi has an MBA in International Business and Marketing from the Concordia University. The multi-linguist, with four languages under his belt, became the CEO and co-founder of Play2Speak in 2018.As a consultant, with over 10 years of international experience in process improvement and IT integration solution projects, he attained a Lean Six Sigma Black Belt professional qualification in 2013. He has also created a Lean Six Sigma Green Belt full certification program in collaboration with consulting firm Kaizen Way in Paris.

Based in Paris, Giuseppe Fantigrossi has an MBA in International Business and Marketing from the Concordia University. The multi-linguist, with four languages under his belt, became the CEO and co-founder of Play2Speak in 2018.As a consultant, with over 10 years of international experience in process improvement and IT integration solution projects, he attained a Lean Six Sigma Black Belt professional qualification in 2013. He has also created a Lean Six Sigma Green Belt full certification program in collaboration with consulting firm Kaizen Way in Paris.

FIWARE Accelerator: More open source ecosystem than accelerator

The European open source initiative to boost smart infrastructures and solutions is calling for new participants to join its unique acceleration ecosystem

HEMAV: World’s leading drone services company for agriculture

Now a global leader known for its industry-targeted software, HEMAV has expanded to 15 countries, working with utilities, farms and public bodies

After insurtech and fintech, Newralers applies AI to winemaking

Newralers expects strong demand for its disruptive AI solutions that test the cognitive value of information, with clients from listed companies to SMEs

DefinedCrowd: Helping companies mine, structure highly accurate data in AI applications

The Portuguese startup's quality-controlling smart data platform is driving its exponential growth and major partnerships with the likes of IBM's Watson Studio and Amazon

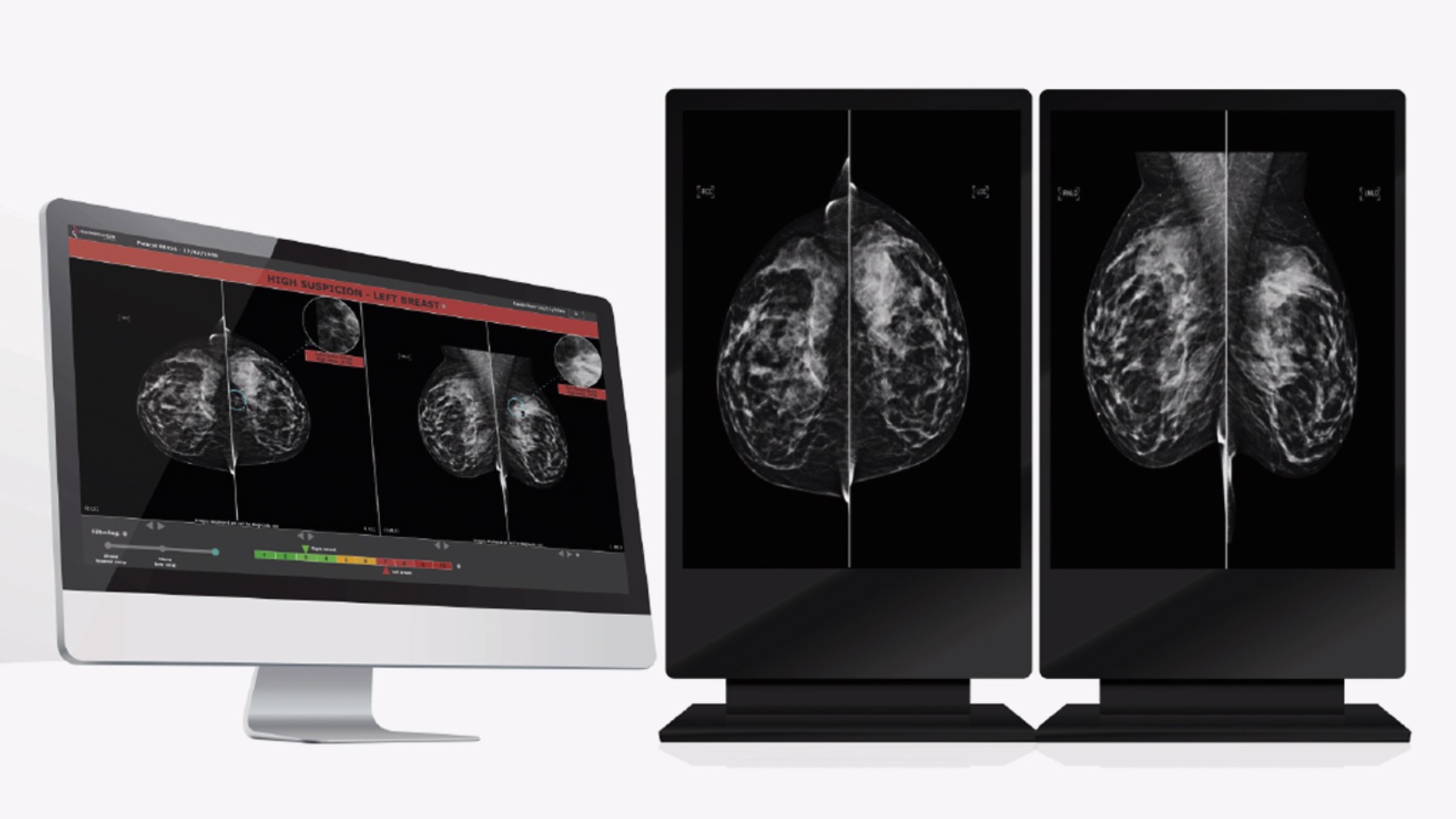

Therapixel: Using AI to improve breast cancer detection

Therapixel is raising €15m for commercial expansion of its AI-powered MammoScreen that gives accurate breast cancer screening results within minutes

This Chinese café startup aims to best Starbucks with “new retail” strategy

Luckin Coffee has gone from scratch to China’s first coffee shop unicorn in less than a year, pouring more than 5 million cups of coffee along the way

Waste management startup Magalarva aims for profitability with new factory, B2B services

Partnerships with supermarkets and waste transporters provide Magalarva with new revenue streams and sources of production input as the company ramps up its manufacturing activities

Sheetgo: Easy and secure cloud-powered spreadsheet data at your fingertips

Named Most Scalable Product at South Summit 2018, Sheetgo turns spreadsheets into data clouds for business users around the world

Gago Inc: Satellite data agritech startup ramps up growth with financial sector solutions

Founded by former NASA scientists, Gago began as a data solution to improve China’s traditionally low-yielding and inefficient smallholder-based farming sector

Billin offers unlimited free e-invoicing services to SMEs and freelancers

Offering automated online invoice generating, sharing, tracking and payments, the Spanish fintech wants to become the billing Dropbox for businesses worldwide

Fish trading startup Aruna thrives despite Covid-19 with a pivot to domestic sales

Having brought forward its domestic expansion by one year, Aruna wants to use its recent funding to further boost market expansion, develop the tech for product traceability and an intelligent supply chain

Farmer Connect: Blockchain powered platform tracing coffee beans from field to cup

Farmer Connect’s platform enables consumers to trace the origin, quality and ethical footprint of a product by just scanning a QR code

With a new focus on smart clinics, healthcare SaaS startup Medigo offers Covid-19 testing

A pivot to revenue-sharing and partnerships to provide Covid-19 testing has given Medigo a fighting chance, with a new funding round on the cards

EXCLUSIVE: Qlue raising Series B funding, "confident" of turning profitable in 2020

Qlue is also targeting more enterprise clients as it expands overseas and improved accountability and management practices

Delectatech: "Food data" proves its value in Spain's Covid-hit F&B industry

Delectatech deploys AI, NLP and big data to help restaurants and food suppliers optimize business information, decisions and operations

Sorry, we couldn’t find any matches for“Startup with IBM”.