Stop COVID-19 CAT

-

DATABASE (43)

-

ARTICLES (332)

Subject-matter experts and education institutions can create online stores for their content in one minute using this SaaS, trading knowledge for cash.

Subject-matter experts and education institutions can create online stores for their content in one minute using this SaaS, trading knowledge for cash.

Indonesia’s first unicorn, ride-hailing startup Gojek has merged with Tokopedia to compete against regional giants Grab and Sea Group to develop the best super-app.

Indonesia’s first unicorn, ride-hailing startup Gojek has merged with Tokopedia to compete against regional giants Grab and Sea Group to develop the best super-app.

Car owners get free advice on auto-related queries, book a mechanic and shop for nearest in-store deals at preferential rates – all in one app.

Car owners get free advice on auto-related queries, book a mechanic and shop for nearest in-store deals at preferential rates – all in one app.

Experienced DIY travelers turn travel planners to customize your trip for the most authentic experiences. Zhinanmao claims its one-stop service saves 20% cost, 70% time.

Experienced DIY travelers turn travel planners to customize your trip for the most authentic experiences. Zhinanmao claims its one-stop service saves 20% cost, 70% time.

Once a cleaning services agency, Guanjiabang has become a one-stop online platform for on-demand home and personal services by trained personnel, and fresh food delivery.

Once a cleaning services agency, Guanjiabang has become a one-stop online platform for on-demand home and personal services by trained personnel, and fresh food delivery.

A pioneer in the recruitment software-as-a-service (SaaS) model in Indonesia, Rekruta uses big data and highly customizable recruitment pipelines to simplify the talent search process.

A pioneer in the recruitment software-as-a-service (SaaS) model in Indonesia, Rekruta uses big data and highly customizable recruitment pipelines to simplify the talent search process.

Pricebook aims to be the best price comparison website by collating accurate, real-time information from both online and offline merchants in Indonesia.

Pricebook aims to be the best price comparison website by collating accurate, real-time information from both online and offline merchants in Indonesia.

Amid explosive microcredit growth in China, Experian and Alibaba partner Shenzhourong is the first big-data-based credit risk management SaaS, offering consumer finance players affordable services.

Amid explosive microcredit growth in China, Experian and Alibaba partner Shenzhourong is the first big-data-based credit risk management SaaS, offering consumer finance players affordable services.

Armed with 110 million monthly page views, Brilio is expanding its digital platform for young Indonesians who account for half of the national population.

Armed with 110 million monthly page views, Brilio is expanding its digital platform for young Indonesians who account for half of the national population.

Touted as Indonesia’s biggest e-commerce speciality coffee supplier, Otten Coffee is gearing up to be a key player in the region’s gourmet coffee arena.

Touted as Indonesia’s biggest e-commerce speciality coffee supplier, Otten Coffee is gearing up to be a key player in the region’s gourmet coffee arena.

LeapFrog Investments is an impact-focused investor, managing over $1.6bn in assets mainly investing in Africa and Asia. Its “profit with purpose” has led to investments in startups that provide healthcare, financial services and insurance for low-income consumers. Since it was founded in 2007, LeapFrog has attracted funds from Prudential, AXA, Swiss Re and Omidyar Network, becoming the first impact investor in the world to reach the $1bn milestone. It’s headquartered in South Africa and Singapore.LeapFrog is best known for its investments in the insurance sector. One of the most prominent companies in its portfolio is BIMA, the mobile-based insurance provider that has provided coverage in Ghana, Bangladesh, Cambodia and many other countries. In 2020, LeapFrog invested in Indonesian startup PasarPolis, which is a broker for a wide range of microinsurance products. In the healthcare and biotechnology sectors, LeapFrog has funded Indian genetic diagnostics company MedGenome, as well as Goodlife Pharmacy, a Kenyan company providing access to affordable medicine in the East African country.

LeapFrog Investments is an impact-focused investor, managing over $1.6bn in assets mainly investing in Africa and Asia. Its “profit with purpose” has led to investments in startups that provide healthcare, financial services and insurance for low-income consumers. Since it was founded in 2007, LeapFrog has attracted funds from Prudential, AXA, Swiss Re and Omidyar Network, becoming the first impact investor in the world to reach the $1bn milestone. It’s headquartered in South Africa and Singapore.LeapFrog is best known for its investments in the insurance sector. One of the most prominent companies in its portfolio is BIMA, the mobile-based insurance provider that has provided coverage in Ghana, Bangladesh, Cambodia and many other countries. In 2020, LeapFrog invested in Indonesian startup PasarPolis, which is a broker for a wide range of microinsurance products. In the healthcare and biotechnology sectors, LeapFrog has funded Indian genetic diagnostics company MedGenome, as well as Goodlife Pharmacy, a Kenyan company providing access to affordable medicine in the East African country.

The World Wildlife Fund (WWF) is an international NGO operating across over 100 countries with projects initially focused on the protection of endangered species, which later expanded into other areas like the preservation of biological diversity, protection of natural resources, and the mitigation of climate change. It is considered the world's largest conservation organization, working with a network of different NGOs, governments, scientists, companies, local communities, investment banks, fishermen and farmers. The WWF was founded in 1961 and 55% of its funding comes from individuals and bequests, 19% from government sources, and 8% from corporations. With more than $1bn in investment capital, WWF has supported more than 12,000 conservation initiatives with over 5m supporters worldwide. The institution has been often criticized for not campaigning objectively because of its strong ties with multinational corporations such as Coca-Cola, Lafarge, and IKEA. In 2019 the institution reported 4% of its total operating revenue coming from corporations.

The World Wildlife Fund (WWF) is an international NGO operating across over 100 countries with projects initially focused on the protection of endangered species, which later expanded into other areas like the preservation of biological diversity, protection of natural resources, and the mitigation of climate change. It is considered the world's largest conservation organization, working with a network of different NGOs, governments, scientists, companies, local communities, investment banks, fishermen and farmers. The WWF was founded in 1961 and 55% of its funding comes from individuals and bequests, 19% from government sources, and 8% from corporations. With more than $1bn in investment capital, WWF has supported more than 12,000 conservation initiatives with over 5m supporters worldwide. The institution has been often criticized for not campaigning objectively because of its strong ties with multinational corporations such as Coca-Cola, Lafarge, and IKEA. In 2019 the institution reported 4% of its total operating revenue coming from corporations.

Led by billionaire investors includings Bill Gates, Jeff Bezos, Jack Ma, Michael Bloomberg and Richard Branson, US-based Breakthrough Energy Ventures (BEV) is an energy tech innovation fund for highly-scalable tech with the potential to help cut net greenhouse gas emissions to zero. Since its founding in 2016, it has launched several funds, including the $1bn Breakthrough Energy Ventures initial fund and a $100m European fund. The entity employs scientists and has a model available to startups to identify sustainability opportunities in the US grid. It currently has 30 startups in its portfolio across technologies and geographies. Among its most recent investments in early 2021 are the $11.5m Series A round of US low-emission hydrogen producer C-Zero and in the $50m Series B round of US sustainable metal producer Boston Metals. In January 2021, BEV also closed a new round of another $1 billion to invest in up to 50 startups. The round saw the addition participation of several new investors including Abigail Johnson, CEO of Fidelity Investments, Shopify founder Tobias Lütke, property developer John Sobrato, of CEO of hedge fund Baupost Group Seth Klarman, founder of Tableau Software Chris Stolte and Walmart heir Sam Walton.

Led by billionaire investors includings Bill Gates, Jeff Bezos, Jack Ma, Michael Bloomberg and Richard Branson, US-based Breakthrough Energy Ventures (BEV) is an energy tech innovation fund for highly-scalable tech with the potential to help cut net greenhouse gas emissions to zero. Since its founding in 2016, it has launched several funds, including the $1bn Breakthrough Energy Ventures initial fund and a $100m European fund. The entity employs scientists and has a model available to startups to identify sustainability opportunities in the US grid. It currently has 30 startups in its portfolio across technologies and geographies. Among its most recent investments in early 2021 are the $11.5m Series A round of US low-emission hydrogen producer C-Zero and in the $50m Series B round of US sustainable metal producer Boston Metals. In January 2021, BEV also closed a new round of another $1 billion to invest in up to 50 startups. The round saw the addition participation of several new investors including Abigail Johnson, CEO of Fidelity Investments, Shopify founder Tobias Lütke, property developer John Sobrato, of CEO of hedge fund Baupost Group Seth Klarman, founder of Tableau Software Chris Stolte and Walmart heir Sam Walton.

Covid-19 symptoms checker and contact-tracing apps, virtual classrooms and 3D video-conferencing platforms are among the array of solutions for homebound adults and kids

This app lets you show off your cat on social media

Is Meowcard the next big thing or a flash in the pan?

NANOxARCH: Pioneering awareness and use of sustainable materials in China

Founder Lei Yuxi reckons Covid-19 could usher China into a new era of sustainability, as her startup seeks to make sustainable materials more affordable

Toge Productions: Sprouting the best of Indonesian-made video games

Tracing the milestones of Indonesia's earliest gaming startup success – the indie developers behind Infectonator

Nutrinsect: Aiming at insects for human consumption for the planet's sake

Nutrinsect expects insect-based foodstuffs to supplement meat to satisfy the ever-growing hunger for protein

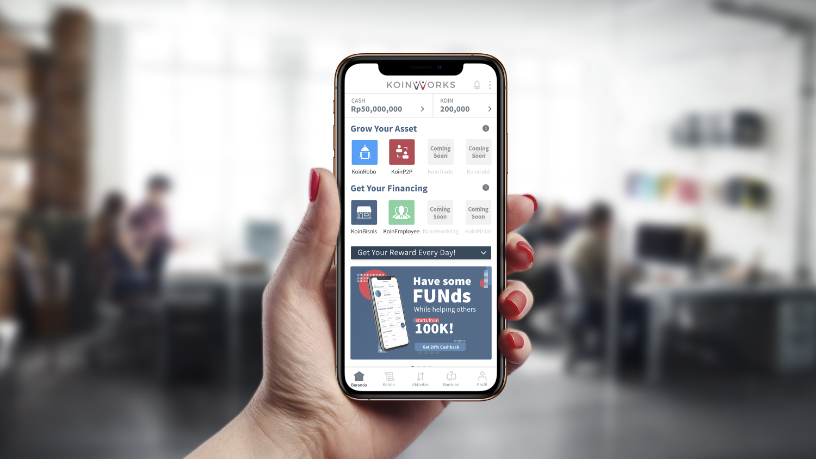

Amid Covid-19, Indonesian P2P lender KoinWorks raises $20m in convertible note funding

Backed by Quona Capital, EV Growth and other investors, KoinWorks plans to disburse more loans amid greater uncertainty and default risk

KK Fund, GK Plug and Play Indonesia set up online meets between VCs and startups amid Covid-19

VCs like Sequoia Capital, EV Growth, Monk's Hill Ventures and MDI Ventures are onboard to spot potential investments despite Covid-19 downturn

China's WeDoctor offers free coronavirus consultations globally in English and Chinese

WeDoctor lets anyone in the world send queries to doctors who fought to save lives in China's most affected Covid-19 districts, and now helping people overseas to stay safe during the pandemic

Exovite: Revolutionary treatment for broken bones and assisted surgery

Medtech startup Exovite combines 3D printing technology and remote treatment to improve rehabilitation of broken bones, and employs mixed reality to assist surgery

Coronavirus: Portuguese startups pitch in as nation battles pandemic

More than 120 startups join the #tech4COVID19 initiative, offering the public free medical help, meals for the vulnerable, online education and more

With a new focus on smart clinics, healthcare SaaS startup Medigo offers Covid-19 testing

A pivot to revenue-sharing and partnerships to provide Covid-19 testing has given Medigo a fighting chance, with a new funding round on the cards

Neurafarm: Putting an AI plant doctor in farmers' hands

This startup is riding on Indonesia’s urban farming trend with its planting kit and an AI-powered app that identifies plant diseases from photos of unhealthy leaves

Vadecity: Stop bicycle theft with an intelligent bike-parking system

The Barcelona-based startup wants more people to bike by offering flexible, affordable parking with its Vadebike solution

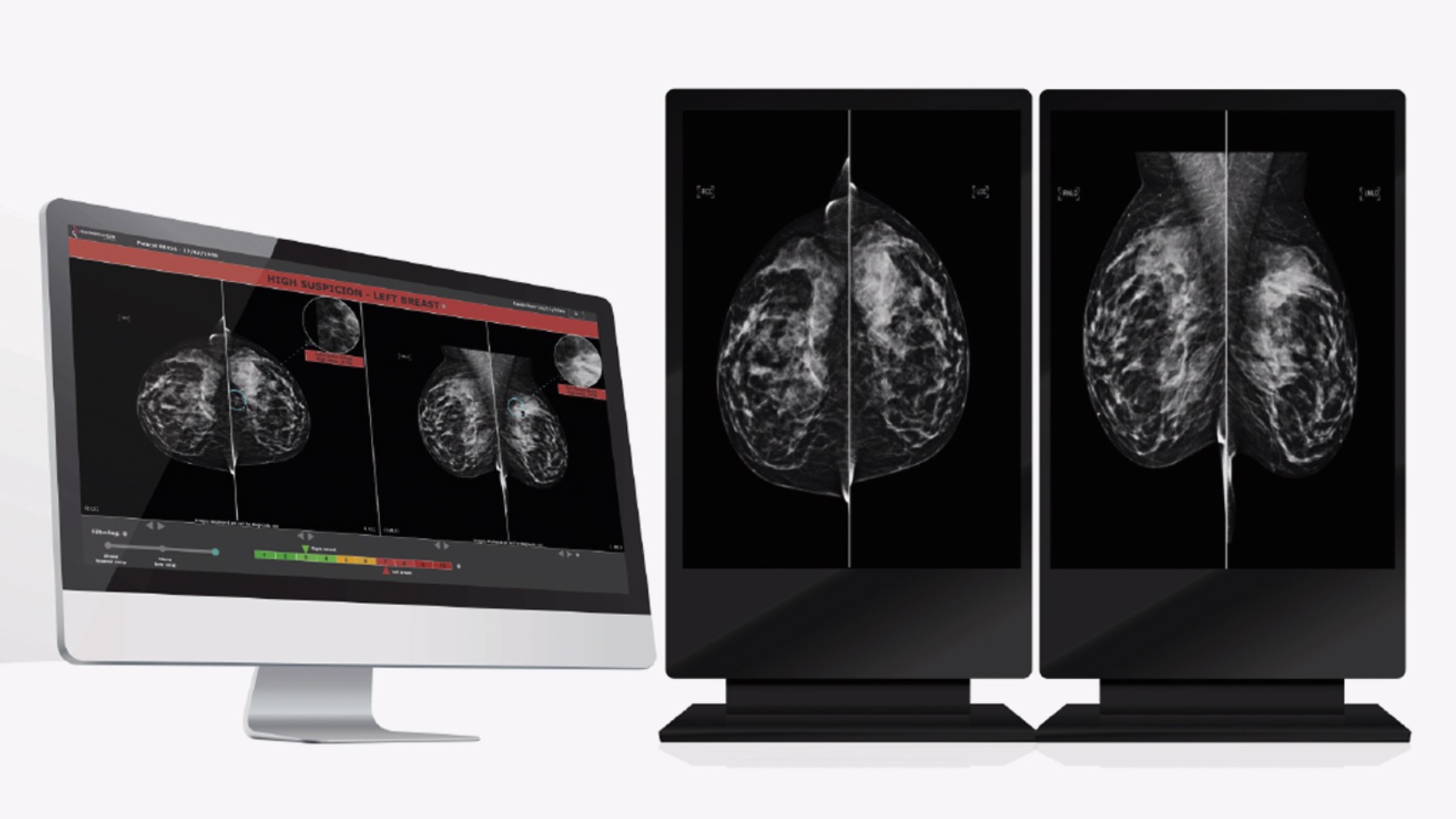

Therapixel: Using AI to improve breast cancer detection

Therapixel is raising €15m for commercial expansion of its AI-powered MammoScreen that gives accurate breast cancer screening results within minutes

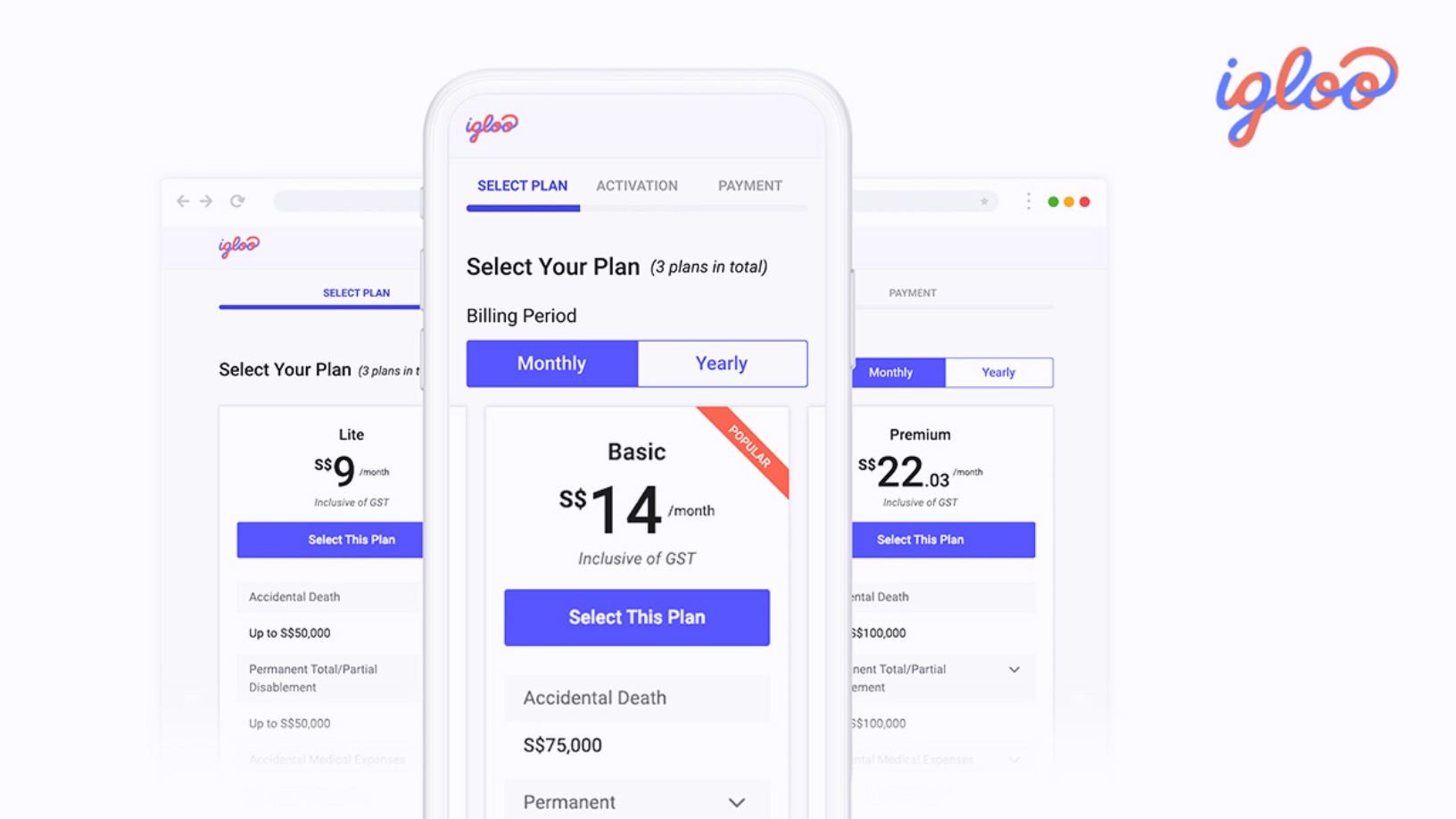

From delivery riders to MSMEs, Igloo aims to make insurance more accessible

Expanding from its origins in e-commerce insurance, Igloo seeks growth in credit insurance and income protection for middle-income groups in Southeast Asia

Sorry, we couldn’t find any matches for“Stop COVID-19 CAT”.