Food & Beverage

This function is exclusive for Premium subscribers

-

DATABASE (138)

-

ARTICLES (143)

AddVenture is a Russian VC fund investing internationally. The firm has US$120m under management, participating in funding rounds with an investment range between US$1m and US$10m. The firm’s portfolio comprises 23 investments and five exits.AddVenture's investment criteria focus on local services, marketplaces, SaaS, food-tech and health-tech startups.

AddVenture is a Russian VC fund investing internationally. The firm has US$120m under management, participating in funding rounds with an investment range between US$1m and US$10m. The firm’s portfolio comprises 23 investments and five exits.AddVenture's investment criteria focus on local services, marketplaces, SaaS, food-tech and health-tech startups.

The IESE BAN was formed in 2003 by a group of angel investors and entrepreneurs bringing together both alumni and non-alumni of the IESE Business School. It creates and manages deal flow for investors while establishing synergies and collaboration among the network's members. It counts on more than 250 active investors financing technology startups in Madrid and Barcelona. To-date, IESE BAN has invested more than €50m in over 220 startups. It is also part of ACCIÓ’s Network of Private Investors, which fosters technology innovation and startups’ growth in Catalonia.

The IESE BAN was formed in 2003 by a group of angel investors and entrepreneurs bringing together both alumni and non-alumni of the IESE Business School. It creates and manages deal flow for investors while establishing synergies and collaboration among the network's members. It counts on more than 250 active investors financing technology startups in Madrid and Barcelona. To-date, IESE BAN has invested more than €50m in over 220 startups. It is also part of ACCIÓ’s Network of Private Investors, which fosters technology innovation and startups’ growth in Catalonia.

Eurovending is a family-run, Italian business in the automatic vending sector based in Trento. To date, it has only invested in one tech startup, the Spanish vending machine hardware and interactive payment app Orain, leading its €1m seed investment round in 2017. The company is a producer of plastic cups and also rents and services automatic vending machines across Italy and Spain.

Eurovending is a family-run, Italian business in the automatic vending sector based in Trento. To date, it has only invested in one tech startup, the Spanish vending machine hardware and interactive payment app Orain, leading its €1m seed investment round in 2017. The company is a producer of plastic cups and also rents and services automatic vending machines across Italy and Spain.

Global Basket Mulia Investama (GBMI) was established in 2015 in Indonesia with a focus on young entrepreneurs. In 2018, they invested IDR10bn in crowdfunding website Kolase.

Global Basket Mulia Investama (GBMI) was established in 2015 in Indonesia with a focus on young entrepreneurs. In 2018, they invested IDR10bn in crowdfunding website Kolase.

Bright Pixel is a Portuguese company of angel investors, established in 2016, owned by the investment division of one of Portugal's largest companies, retailer Sonae Group.To date, it has invested in six companies at the early-stage. Its most recent investments include in the €2m seed round of US security tech Fyde and in the €550,000 seed round of Portuguese online security tech Probely.

Bright Pixel is a Portuguese company of angel investors, established in 2016, owned by the investment division of one of Portugal's largest companies, retailer Sonae Group.To date, it has invested in six companies at the early-stage. Its most recent investments include in the €2m seed round of US security tech Fyde and in the €550,000 seed round of Portuguese online security tech Probely.

Ibersol is a Portuguese restaurant sector investor established in 1994. It holds the franchises of several of Spain and Portugal's top-selling fast-food chains including Burger King in both nations, Pans & Company in Spain and KFC in Portugal and Angola.To date, it has invested in one startup, the Portuguese healthy food service EatTasty, with undisclosed investment in the company's seed stage, phase one, that raised €1.1m. It also acquired one food sector entity, the Spanish restaurant group, Eat Out Group, for an undisclosed sum in 2016.

Ibersol is a Portuguese restaurant sector investor established in 1994. It holds the franchises of several of Spain and Portugal's top-selling fast-food chains including Burger King in both nations, Pans & Company in Spain and KFC in Portugal and Angola.To date, it has invested in one startup, the Portuguese healthy food service EatTasty, with undisclosed investment in the company's seed stage, phase one, that raised €1.1m. It also acquired one food sector entity, the Spanish restaurant group, Eat Out Group, for an undisclosed sum in 2016.

Drake Enterprises is a Swiss fund with offices in New York and Miami. The board of Drake Enterprises and its committees are responsible for the direction of the group’s businesses.The firm was founded in 2000 by Mr Nicolas Ibañez Scott, born into a family of merchants and entrepreneurs with interests in Chile and the UK. The Drake Group initially focused its entrepreneurial activities on the grocery business in Chile that was then sold in 2009 to Walmart. Since 2014, the group has been focusing its investment and philanthropic activities in companies such as Papa John's and Glovo.

Drake Enterprises is a Swiss fund with offices in New York and Miami. The board of Drake Enterprises and its committees are responsible for the direction of the group’s businesses.The firm was founded in 2000 by Mr Nicolas Ibañez Scott, born into a family of merchants and entrepreneurs with interests in Chile and the UK. The Drake Group initially focused its entrepreneurial activities on the grocery business in Chile that was then sold in 2009 to Walmart. Since 2014, the group has been focusing its investment and philanthropic activities in companies such as Papa John's and Glovo.

Arrive is the venture capital arm of Roc Nation, the full-service entertainment management company established by US musician Jay-Z. Aside from managing musicians and producing music under their label, Roc Nation also manages equity distribution for musicians, as well as talents in the sports industry. Arrive has made a number of investments in the Southeast Asia region, including in Singapore-based scooter rental startup Beam and fashion e-commerce Zilingo. In Indonesia, it has invested in Kopi Kenangan, a chain of grab-and-go coffee outlets. It has also invested in Super, a Y Combinator graduate startup enabling social commerce through group-buying.

Arrive is the venture capital arm of Roc Nation, the full-service entertainment management company established by US musician Jay-Z. Aside from managing musicians and producing music under their label, Roc Nation also manages equity distribution for musicians, as well as talents in the sports industry. Arrive has made a number of investments in the Southeast Asia region, including in Singapore-based scooter rental startup Beam and fashion e-commerce Zilingo. In Indonesia, it has invested in Kopi Kenangan, a chain of grab-and-go coffee outlets. It has also invested in Super, a Y Combinator graduate startup enabling social commerce through group-buying.

Caris LeVert is a professional basketball player in the USA’s National Basketball Association league, playing for the Brooklyn Nets. A graduate of the University of Michigan, he joined the Nets in 2016, after the Indiana Pacers swapped him for Thaddeus Young in that year’s draft. In 2019, the Nets signed a three year-extension for LeVert’s contract, worth $52.5m.LeVert is managed by Roc Nation, the entertainment and sports management firm founded by musician Jay-Z. He took part in Roc Nation’s investment (via venture arm Arrive) in Indonesian coffee brand Kopi Kenangan. LeVert is also the founder of the 22 Initiative, a youth mentorship program in New York.

Caris LeVert is a professional basketball player in the USA’s National Basketball Association league, playing for the Brooklyn Nets. A graduate of the University of Michigan, he joined the Nets in 2016, after the Indiana Pacers swapped him for Thaddeus Young in that year’s draft. In 2019, the Nets signed a three year-extension for LeVert’s contract, worth $52.5m.LeVert is managed by Roc Nation, the entertainment and sports management firm founded by musician Jay-Z. He took part in Roc Nation’s investment (via venture arm Arrive) in Indonesian coffee brand Kopi Kenangan. LeVert is also the founder of the 22 Initiative, a youth mentorship program in New York.

Verlinvest is the investment diversification vehicle of the de Spoelberch family, the Belgian noble house, which founded the AB InBev beverage conglomerate. Founded in 1995, it currently manages over €1.6bn in assets across multiple geographies, including Europe, India, Southeast Asia and Latin America. Aside from investing in various F&B brands like Vita Coco (coconut water), F&B Asia (which operates various restaurant franchise brands in Southeast Asia) and Glaceau Vitamin Water, it has also backed e-commerce businesses like Global Fashion Group and Lazada, as well as Indian edtech platform Byju’s.

Verlinvest is the investment diversification vehicle of the de Spoelberch family, the Belgian noble house, which founded the AB InBev beverage conglomerate. Founded in 1995, it currently manages over €1.6bn in assets across multiple geographies, including Europe, India, Southeast Asia and Latin America. Aside from investing in various F&B brands like Vita Coco (coconut water), F&B Asia (which operates various restaurant franchise brands in Southeast Asia) and Glaceau Vitamin Water, it has also backed e-commerce businesses like Global Fashion Group and Lazada, as well as Indian edtech platform Byju’s.

Serena Ventures is a venture capital investment firm founded by professional tennis player and businesswoman Serena Williams. The company focuses on early-stage companies founded by young, diverse teams. Since it was founded in 2014, it has invested in more than 30 companies with a cumulative market cap of $12b. Coffee brand Kopi Kenangan is its first investment in the Indonesian market. Serena Ventures has invested in notable companies like plant-based meat maker Impossible Foods, cryptocurrency exchange Coinbase, as well as Serena Williams’ own fashion label, S by Serena.

Serena Ventures is a venture capital investment firm founded by professional tennis player and businesswoman Serena Williams. The company focuses on early-stage companies founded by young, diverse teams. Since it was founded in 2014, it has invested in more than 30 companies with a cumulative market cap of $12b. Coffee brand Kopi Kenangan is its first investment in the Indonesian market. Serena Ventures has invested in notable companies like plant-based meat maker Impossible Foods, cryptocurrency exchange Coinbase, as well as Serena Williams’ own fashion label, S by Serena.

Jonathan Neman is a co-founder and co-CEO of USA healthy-eating restaurant franchise Sweetgreen. As co-CEO, he has managed the salad chain since opening its first outlet in 2007, raising more than $470m in VC funding in the process. Neman is also an investor in various F&B startups, such as frozen food maker EatPops and Indonesian coffee chain Kopi Kenangan.

Jonathan Neman is a co-founder and co-CEO of USA healthy-eating restaurant franchise Sweetgreen. As co-CEO, he has managed the salad chain since opening its first outlet in 2007, raising more than $470m in VC funding in the process. Neman is also an investor in various F&B startups, such as frozen food maker EatPops and Indonesian coffee chain Kopi Kenangan.

Founded in 2010, Shenzhen-based Sinoagri E-Commerce is China’s biggest B2B trading platform for agricultural products. It also provides a wide range of services including intelligence, third-party storage & logistics, financing and technical support to producers, manufacturers, suppliers and retailers along the whole supply chain.

Founded in 2010, Shenzhen-based Sinoagri E-Commerce is China’s biggest B2B trading platform for agricultural products. It also provides a wide range of services including intelligence, third-party storage & logistics, financing and technical support to producers, manufacturers, suppliers and retailers along the whole supply chain.

GROW is a Singapore-based food and agriculture technology accelerator for global impact-focused startups. It is financially backed by AgFunder, an agrifood tech venture investment through the AgFunder GROW Impact Fund. Grow is also supported by the Singapore Government and is an accredited mentor partner of Startup SG.

GROW is a Singapore-based food and agriculture technology accelerator for global impact-focused startups. It is financially backed by AgFunder, an agrifood tech venture investment through the AgFunder GROW Impact Fund. Grow is also supported by the Singapore Government and is an accredited mentor partner of Startup SG.

Founded in 2018, Kale United is a Stockholm-based ethical investor with an overriding interest in plant-based technologies. It raises funds from crowd campaigns and currently has a portfolio of 30 companies, mostly Swedish alternative meat startups. It had crowdfunded €1.34m by April 2020 for its portfolio of companies from three separate campaigns. It also has a portfolio of plant-based public shares and features a team of vegan expert investors and business leaders. Its founder, Måns Ullerstam, owns a third of the company. He is also CEO of local vegetarian food producer startup Astrid och Aporna.

Founded in 2018, Kale United is a Stockholm-based ethical investor with an overriding interest in plant-based technologies. It raises funds from crowd campaigns and currently has a portfolio of 30 companies, mostly Swedish alternative meat startups. It had crowdfunded €1.34m by April 2020 for its portfolio of companies from three separate campaigns. It also has a portfolio of plant-based public shares and features a team of vegan expert investors and business leaders. Its founder, Måns Ullerstam, owns a third of the company. He is also CEO of local vegetarian food producer startup Astrid och Aporna.

Yali Bio: Recreating a juicy steak in plant-based alternatives

Founded by the former head of Impossible Foods’ pilot plant, this Bay Area genomics and foodtech startup is one of the first to engineer a better fat for plant-based meat

QOA: Gourmet guilt-free chocolate, without the cocoa

Munich-based QOA transforms industrial food waste into vegan chocolate, enabling consumers to avoid the sustainability and ethical issues of cocoa production

OLIO: Zero food waste app expands with new product categories, going global

Recent $43m Series B funding will let sustainability app more than triple hiring, add homemade products and household goods to product listings

Southeast Asian startups to keep riding digitalization, IPO boom, investors say

O2O business models and growing interest in ESG are also key themes, as regional startups gain $4.4bn of funding in first half of 2021

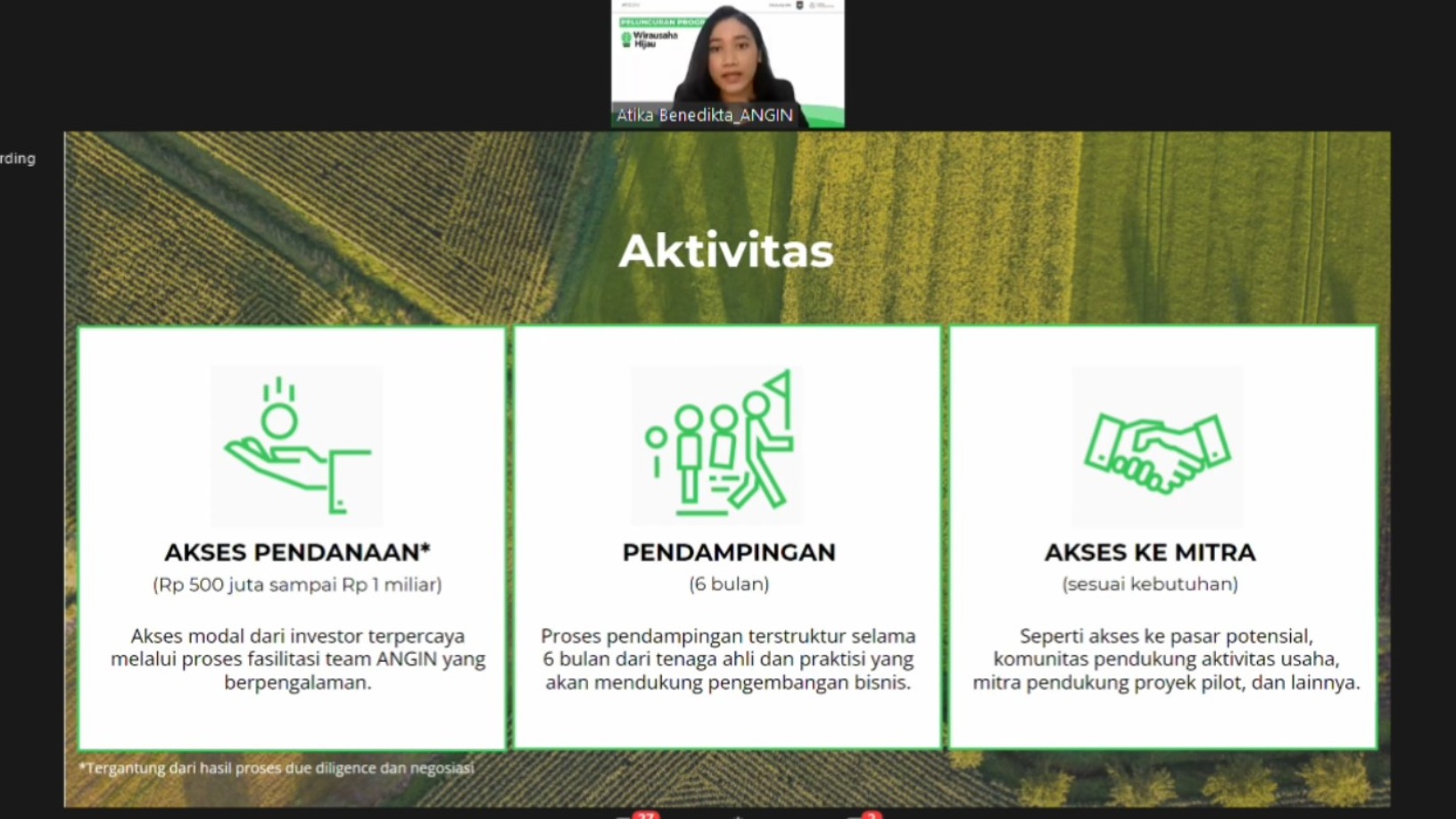

Indonesian angel investor network ANGIN launches agrifood incubator

Program targets ESG investment and builds on the strong potential of Indonesia’s agriculture sector, which kept growing despite the Covid-19 pandemic

Smart Agrifood 2021: SVG Ventures's Hartnett, Land O'Lakes's Bekele on disruption in agrifood chain

How US farming cooperative Land O'Lakes and leading CPG brands are working with famers and tech firms to overcome agritech challenges, transform the whole value chain

Smart Agrifood Summit 2021: A global innovation ecosystem is needed to catch up with other sectors

Investors from SVG Ventures/THRIVE, Pinduoduo and others agree that players must join forces to boost agrifood tech investment, internationally and across the value chain

Forward Fooding: Ranking the world's agrifood startups on success and sustainability

The collaborative platform has opened applications for its FoodTech500 global ranking of agrifood startups; counts over 7,000 startups and scaleups mapped so far

Stockeld Dreamery: Vegan cheese created together with chefs

Backed by €16.5m in new funding, Stockeld Dreamery sets to expand into Europe and North America, and double its team to 50 a year on

Meatable joins Royal DSM to create growth media specific for cell-based meat tech

The R&D between the biotech startup and fellow Dutch nutrition conglomerate could help scale and drive the commercial viability of lab-grown meat

MIWA Technologies: Reducing food waste and packaging with smart refill vending system

MIWA’s solution lets consumers buy exact refill quantities in personalized containers, eradicating need for single-use plastics throughout the supply chain

Senior Deli: Creating easy-to-swallow, appealing food for dysphagia sufferers

Already supplying to over 200 senior homes and hospitals, the Future Food Asia 2021 co-winner uses proprietary tech to make nutritious, affordable texture-modified foods for people with swallowing difficulties

Dao Foods unfazed by China tech crackdown, says alternative proteins aligned with state goals

Impact investor Dao Foods expects government support for alternative proteins to come, as it announces second batch of startups, diversifying into fermentation and cell-based proteins

AquaCultured Foods: World's first whole-cut vegan seafood made through microbial fermentation

Armed with its fermentation technology and proprietary strain of fungi, AquaCultured is closing an oversubscribed funding round, raising more than $1.5m to launch its non-GMO seafood alternatives, with plans to expand to more food verticals and overseas

Indonesia's Green Rebel Foods to take its Asian-inspired plant-based meat regional

F&B veteran duo behind the Burgreens spinoff plans Series A fundraising by end-2021 for manufacturing and regional expansion