Insurance

This function is exclusive for Premium subscribers

-

DATABASE (29)

-

ARTICLES (29)

Dario Cifrodelli is the head of Digital Transformation at Volkswagen Financial Service. He previously held the same role in AXA for more than 6 years. He specialized in digital services strategy, leading the transformation of digital insurance and financial services. He is also an angel investor in fintech startups.

Dario Cifrodelli is the head of Digital Transformation at Volkswagen Financial Service. He previously held the same role in AXA for more than 6 years. He specialized in digital services strategy, leading the transformation of digital insurance and financial services. He is also an angel investor in fintech startups.

Sequis Life is an insurance company in Indonesia. Originally named PT Universal Life Indonesia, it was established in 1984 as part of the Gunung Sewu conglomerate group of companies. As of 2018, it manages over IDR 14.8t in assets and more than 400,000 policies.

Sequis Life is an insurance company in Indonesia. Originally named PT Universal Life Indonesia, it was established in 1984 as part of the Gunung Sewu conglomerate group of companies. As of 2018, it manages over IDR 14.8t in assets and more than 400,000 policies.

Based in UK, Will Neale is a prolific angel and early-stage investor with interests in over a dozen startups from the pre-seed to Series B stages. The tech consultant had previously worked as a manager at Accenture for six years.In 2006, Neale founded mobile payments and processing startup Fonix Mobile. He also created Grabyo, a cloud-based video production, editing and distribution platform in 2013.

Based in UK, Will Neale is a prolific angel and early-stage investor with interests in over a dozen startups from the pre-seed to Series B stages. The tech consultant had previously worked as a manager at Accenture for six years.In 2006, Neale founded mobile payments and processing startup Fonix Mobile. He also created Grabyo, a cloud-based video production, editing and distribution platform in 2013.

B Capital Group is best known as the venture capital firm co-founded by Eduardo Saverin, co-founder of Facebook. Its investment thesis focuses on connecting highly innovative and agile startups with major corporates that are in need of innovation and have the resources to innovate. As such, B Capital has a special interest in B2B companies that have great potential to disrupt critical industries. This includes startups that are disrupting healthcare and biotechnology, as well as finance and insurance. B Capital has also supported some notable B2C companies, including coffee chain Kopi Kenangan and used car marketplace Carro.

B Capital Group is best known as the venture capital firm co-founded by Eduardo Saverin, co-founder of Facebook. Its investment thesis focuses on connecting highly innovative and agile startups with major corporates that are in need of innovation and have the resources to innovate. As such, B Capital has a special interest in B2B companies that have great potential to disrupt critical industries. This includes startups that are disrupting healthcare and biotechnology, as well as finance and insurance. B Capital has also supported some notable B2C companies, including coffee chain Kopi Kenangan and used car marketplace Carro.

Based in Zurich, Swiss Re is a provider of reinsurance, insurance and other forms of insurance-based risk transfers. Founded in 1863, it operates through a network of about 80 offices in 25 countries and regions across the world.

Based in Zurich, Swiss Re is a provider of reinsurance, insurance and other forms of insurance-based risk transfers. Founded in 1863, it operates through a network of about 80 offices in 25 countries and regions across the world.

The investment arm of Taikang Insurance Group, Taikang Asset Management (Taikang Asset) manages RMB 1.9tn worth of assets, including RMB 1.1tn third-party assets, RMB 420bn alternative investment and RMB 440bn pension funds as of June 2020. Investments are mainly in infrastructure sectors such as transportation, energy, utilities, environmental protection, telecoms and real estate.Taikang Asset is an important platform for Taikang Insurance Group to carry out global business. In November 2007, its wholly-owned unit Hong Kong was set up and has received licenses from the Hong Kong stock exchange for businesses including securities dealing, advisory and asset management. In September 2016, Taikang Asset founded Taikang Asset (Beijing), a new equity investment platform, and raised RMB 2bn for its Phase I Industrial Development Fund by May 2017. Apart from managing and utilizing self-owned and insurance capital, the company manages assets for clients and provides advice on asset management. It also issues public security investment funds among other asset management businesses.

The investment arm of Taikang Insurance Group, Taikang Asset Management (Taikang Asset) manages RMB 1.9tn worth of assets, including RMB 1.1tn third-party assets, RMB 420bn alternative investment and RMB 440bn pension funds as of June 2020. Investments are mainly in infrastructure sectors such as transportation, energy, utilities, environmental protection, telecoms and real estate.Taikang Asset is an important platform for Taikang Insurance Group to carry out global business. In November 2007, its wholly-owned unit Hong Kong was set up and has received licenses from the Hong Kong stock exchange for businesses including securities dealing, advisory and asset management. In September 2016, Taikang Asset founded Taikang Asset (Beijing), a new equity investment platform, and raised RMB 2bn for its Phase I Industrial Development Fund by May 2017. Apart from managing and utilizing self-owned and insurance capital, the company manages assets for clients and provides advice on asset management. It also issues public security investment funds among other asset management businesses.

Founded in 1997, Seventure Partners is one of Europe’s most prolific VC investors with a portfolio of over 200 startups across both tech and non-tech sectors. The French VC has also managed more than 40 exits in total. It mainly focuses on fintech and insurtech, French and German startups and in life sciences in Europe, North America and Asia.Its five funds cover different market segments, ranging from €24m–€200m, with investments of €500,000–€10m per round. Total funding for a company can reach €20m, right through the early to late stages. Recent investments include the $6.7m Series A round of US biotech Dermala and the $10.7m Series A round of US self-cleaning water bottle startup LARQ.

Founded in 1997, Seventure Partners is one of Europe’s most prolific VC investors with a portfolio of over 200 startups across both tech and non-tech sectors. The French VC has also managed more than 40 exits in total. It mainly focuses on fintech and insurtech, French and German startups and in life sciences in Europe, North America and Asia.Its five funds cover different market segments, ranging from €24m–€200m, with investments of €500,000–€10m per round. Total funding for a company can reach €20m, right through the early to late stages. Recent investments include the $6.7m Series A round of US biotech Dermala and the $10.7m Series A round of US self-cleaning water bottle startup LARQ.

LeapFrog Investments is an impact-focused investor, managing over $1.6bn in assets mainly investing in Africa and Asia. Its “profit with purpose” has led to investments in startups that provide healthcare, financial services and insurance for low-income consumers. Since it was founded in 2007, LeapFrog has attracted funds from Prudential, AXA, Swiss Re and Omidyar Network, becoming the first impact investor in the world to reach the $1bn milestone. It’s headquartered in South Africa and Singapore.LeapFrog is best known for its investments in the insurance sector. One of the most prominent companies in its portfolio is BIMA, the mobile-based insurance provider that has provided coverage in Ghana, Bangladesh, Cambodia and many other countries. In 2020, LeapFrog invested in Indonesian startup PasarPolis, which is a broker for a wide range of microinsurance products. In the healthcare and biotechnology sectors, LeapFrog has funded Indian genetic diagnostics company MedGenome, as well as Goodlife Pharmacy, a Kenyan company providing access to affordable medicine in the East African country.

LeapFrog Investments is an impact-focused investor, managing over $1.6bn in assets mainly investing in Africa and Asia. Its “profit with purpose” has led to investments in startups that provide healthcare, financial services and insurance for low-income consumers. Since it was founded in 2007, LeapFrog has attracted funds from Prudential, AXA, Swiss Re and Omidyar Network, becoming the first impact investor in the world to reach the $1bn milestone. It’s headquartered in South Africa and Singapore.LeapFrog is best known for its investments in the insurance sector. One of the most prominent companies in its portfolio is BIMA, the mobile-based insurance provider that has provided coverage in Ghana, Bangladesh, Cambodia and many other countries. In 2020, LeapFrog invested in Indonesian startup PasarPolis, which is a broker for a wide range of microinsurance products. In the healthcare and biotechnology sectors, LeapFrog has funded Indian genetic diagnostics company MedGenome, as well as Goodlife Pharmacy, a Kenyan company providing access to affordable medicine in the East African country.

Ribbit Capital is a Silicon Valley VC that focuses on fintech-related startups. Founded in 2012, Ribbit Capital posits that the financial services industry has largely remained unchanged despite the developments in technology in the past decade. The company’s “mantra” states that it is a believer in consumers and businesses moving to mobile, and this will lead to major changes in how financial services are provided in the future.The company has invested in a wide range of fintech startups and technologies, including stock trading app Robinhood, cryptocurrency exchange platform Coinbase, and Revolut, one of the earliest “challenger banks” that primarily serves retail customers through digital, app-based services. In March 2021, US retail giant Walmart announced a partnership with Ribbit Capital to develop fintech products. Ribbit Capital made its first investment in the Southeast Asia region in that same month, when it led a $65m Series A extension into Indonesian investment platform Ajaib.

Ribbit Capital is a Silicon Valley VC that focuses on fintech-related startups. Founded in 2012, Ribbit Capital posits that the financial services industry has largely remained unchanged despite the developments in technology in the past decade. The company’s “mantra” states that it is a believer in consumers and businesses moving to mobile, and this will lead to major changes in how financial services are provided in the future.The company has invested in a wide range of fintech startups and technologies, including stock trading app Robinhood, cryptocurrency exchange platform Coinbase, and Revolut, one of the earliest “challenger banks” that primarily serves retail customers through digital, app-based services. In March 2021, US retail giant Walmart announced a partnership with Ribbit Capital to develop fintech products. Ribbit Capital made its first investment in the Southeast Asia region in that same month, when it led a $65m Series A extension into Indonesian investment platform Ajaib.

Citi Ventures is the San Francisco-based investing arm of the multinational banking group Citibank. It was founded in 2010 and invests in US-based tech startups with a financial sector focus at all investment stages. It currently has 80 companies in its portfolio and has managed 13 exits to date. Its most recent investments were in six startups in March 2021. These included contributing to the $3m seed round of co-parenting financial planning platform Ensemble, in the $130m Series D round of on-demand notary service Notorize and in the $200m Series D round of Feedzai, the world market leader in fighting online fraud.

Citi Ventures is the San Francisco-based investing arm of the multinational banking group Citibank. It was founded in 2010 and invests in US-based tech startups with a financial sector focus at all investment stages. It currently has 80 companies in its portfolio and has managed 13 exits to date. Its most recent investments were in six startups in March 2021. These included contributing to the $3m seed round of co-parenting financial planning platform Ensemble, in the $130m Series D round of on-demand notary service Notorize and in the $200m Series D round of Feedzai, the world market leader in fighting online fraud.

UNIQA Ventures is the venture capital arm of the UNIQA Group, a leading insurance entity headquartered in Austria and operating also across Central and Eastern Europe. With about 40 companies in 18 countries, the UNIQA group serves about 15.5 million customers. UNIQA Ventures' investment focus is in insurtech, fintech and digital health care.

UNIQA Ventures is the venture capital arm of the UNIQA Group, a leading insurance entity headquartered in Austria and operating also across Central and Eastern Europe. With about 40 companies in 18 countries, the UNIQA group serves about 15.5 million customers. UNIQA Ventures' investment focus is in insurtech, fintech and digital health care.

Samsung Venture Investment, or Samsung Ventures, is the VC investment arm of South Korean diversified conglomerate Samsung Group. It is a separate entity from Samsung NEXT.Samsung Ventures primarily invests in semiconductors, telecommunications tech, software and internet companies, as well as biotechnology and medical companies. The VC is built to support new innovations that can lead to further improvements in Samsung’s existing businesses, which includes smartphones, home appliances, and components like OLED panels and Li-ion batteries.Samsung Ventures has invested in healthcare and wellness tech companies like Indonesia’s telehealth service Alodokter, posture correction device makers Posture360, and Noom, an app for dieting and exercise. In the sensors front, Samsung Ventures has invested in Sense Photonics, a startup creating 3D computer vision based on lidar for industrial and automotive (self-driving) purposes. Besides these companies, Samsung Ventures has also invested in insurtech companies and even gaming companies, such as Pokémon Go developer Niantic.

Samsung Venture Investment, or Samsung Ventures, is the VC investment arm of South Korean diversified conglomerate Samsung Group. It is a separate entity from Samsung NEXT.Samsung Ventures primarily invests in semiconductors, telecommunications tech, software and internet companies, as well as biotechnology and medical companies. The VC is built to support new innovations that can lead to further improvements in Samsung’s existing businesses, which includes smartphones, home appliances, and components like OLED panels and Li-ion batteries.Samsung Ventures has invested in healthcare and wellness tech companies like Indonesia’s telehealth service Alodokter, posture correction device makers Posture360, and Noom, an app for dieting and exercise. In the sensors front, Samsung Ventures has invested in Sense Photonics, a startup creating 3D computer vision based on lidar for industrial and automotive (self-driving) purposes. Besides these companies, Samsung Ventures has also invested in insurtech companies and even gaming companies, such as Pokémon Go developer Niantic.

Founded in 1997 in London, Amadeus has invested in more than 130 companies, has over 40 employees and has raised over $1bn to date. The investor focuses on early-stage UK-based companies, although it has also invested in later-stage European and developing market startups. In August 2021, it announced a $150m upcoming investment drive in Brazil. Amadeus currently has 54 portfolio companies. Its recent investments include the June 2021 £20m Series A investment round of UK-based XYZ Reality that employs holograms in construction tech. In May 2021, it led the $4.8m investment in the cryptography lifecycle management platform Cryptosense.

Founded in 1997 in London, Amadeus has invested in more than 130 companies, has over 40 employees and has raised over $1bn to date. The investor focuses on early-stage UK-based companies, although it has also invested in later-stage European and developing market startups. In August 2021, it announced a $150m upcoming investment drive in Brazil. Amadeus currently has 54 portfolio companies. Its recent investments include the June 2021 £20m Series A investment round of UK-based XYZ Reality that employs holograms in construction tech. In May 2021, it led the $4.8m investment in the cryptography lifecycle management platform Cryptosense.

Founded in Bayern in 2009, SevenVentures GmbH provides Media-for-Equity and Media-for-Revenue investment models to companies with a minimum turnover of €5m. The firm secures TV media coverage and cash payments for its investees, as the investment arm of German media group ProSiebenSat.1 Media SE that has a total monthly TV audience of 60m across seven free channels.In 2019, SevenVentures provided 1,000 advertising hours to 70 businesses. The firm’s media contributions are worth the equivalent of €3m–30m over a period of two to four years. SevenVentures also runs the SevenAccelerator and currently has 18 active portfolio companies. Recent investments in 2021 include the $54m Series B round of Austrian refurbished electronics goods marketplace Refurbed in August and the €35m funding round for German telemedicine platform Wellster Healthtech Group in June.

Founded in Bayern in 2009, SevenVentures GmbH provides Media-for-Equity and Media-for-Revenue investment models to companies with a minimum turnover of €5m. The firm secures TV media coverage and cash payments for its investees, as the investment arm of German media group ProSiebenSat.1 Media SE that has a total monthly TV audience of 60m across seven free channels.In 2019, SevenVentures provided 1,000 advertising hours to 70 businesses. The firm’s media contributions are worth the equivalent of €3m–30m over a period of two to four years. SevenVentures also runs the SevenAccelerator and currently has 18 active portfolio companies. Recent investments in 2021 include the $54m Series B round of Austrian refurbished electronics goods marketplace Refurbed in August and the €35m funding round for German telemedicine platform Wellster Healthtech Group in June.

- 1

- 2

South Summit 2021: Lessons in expanding to Asia from experts on the ground

Cast aside your Eurocentric mindsets, China-based SOSV’s Oscar Ramos and Brinc’s Heriberto Saldivar tell startups, why they should expand to the region, and how best to do it

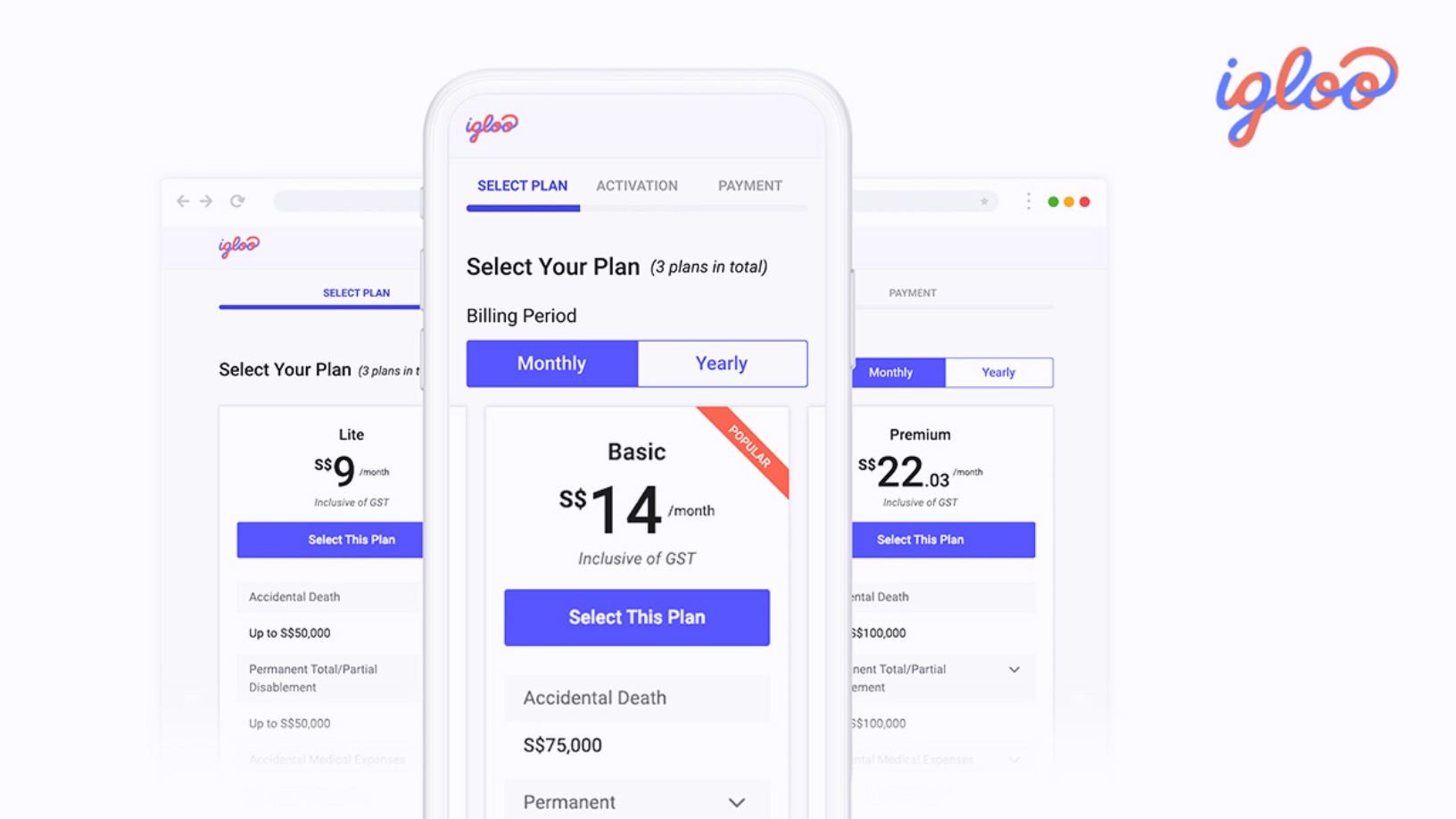

From delivery riders to MSMEs, Igloo aims to make insurance more accessible

Expanding from its origins in e-commerce insurance, Igloo seeks growth in credit insurance and income protection for middle-income groups in Southeast Asia

Zoundream: Deciphering and mining the data in baby cries

The world’s first algorithm to translate baby cries into actionable insights for parents and hospitals seeks to boost early detection of pathologies and developmental disorders

Gigacover: Providing a financial safety net for gig workers

Gigacover is eyeing multi-billion-dollar opportunities in income and healthcare protection and financial services for the 150m self-employed workers in Southeast Asia, about half of whom are underbanked

AgroCenta: Providing market access and credit to African smallholder farmers

AgroCenta’s platforms empower Ghanaian subsistence farmers, especially women, boosting productivity and sales with e-payments, micro-credits and insurance, and direct connections to buyers, cutting out the intermediaries

Indonesian insurtech Qoala survives pandemic with new partners and products

Acquisition of Thai insurtech FairDee to spearhead expansion into Southeast Asia, building on earlier entry into Malaysia and Vietnam and a Covid-19 travel insurance product at home

Pula: Pioneering insurtech helps to improve Africa's food security

With Kenyan insurtech Pula’s micro-insurance products, millions of farmers no longer have to bear the full risk of losses from natural disasters and crop failures

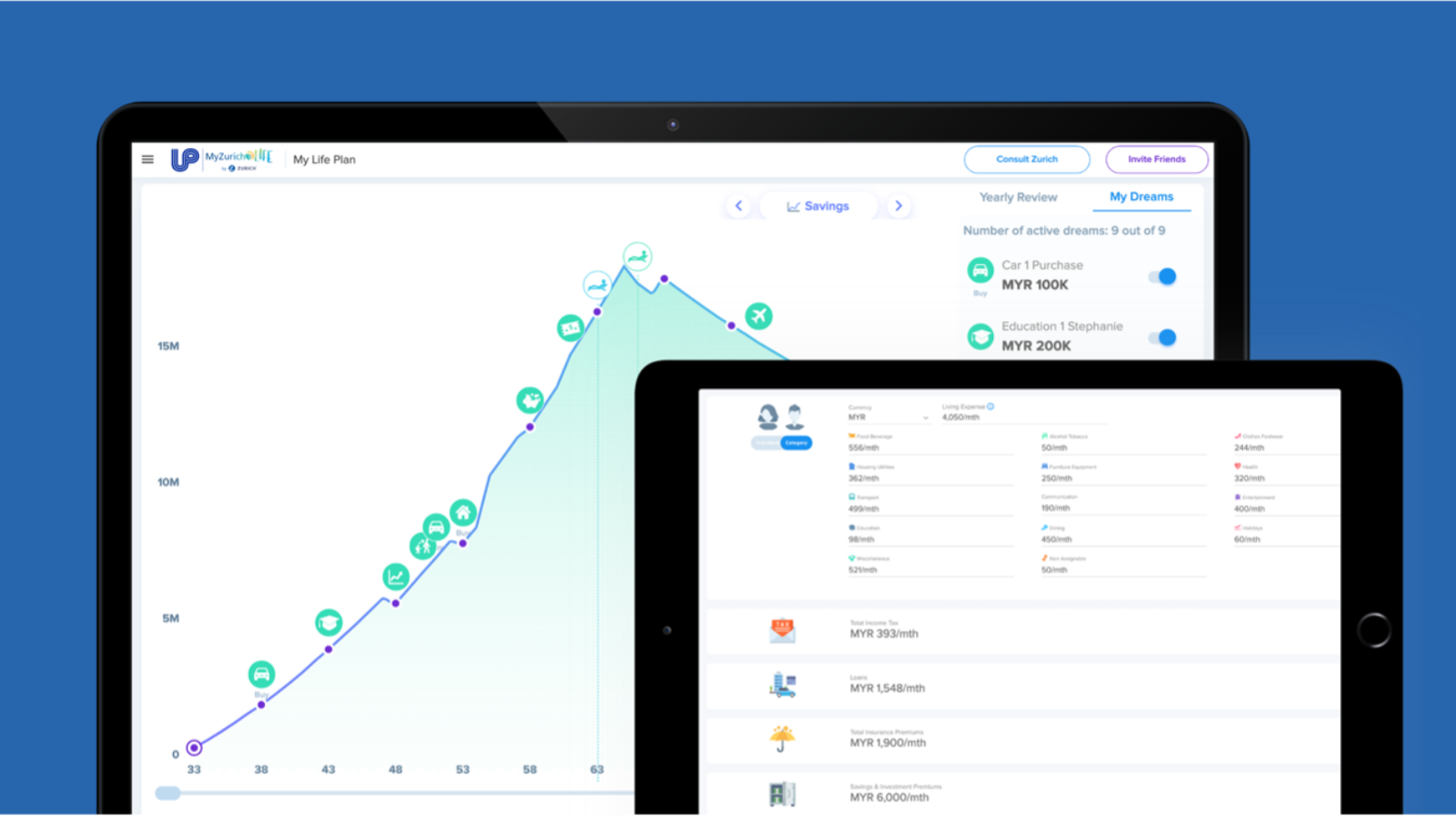

BetterTradeOff: Taking the pain out of financial planning

The Singapore-based startup’s user numbers rose sharply during Covid-19. It wants to raise $11.5m by year-end, is planning a launch in Australia and is eyeing the US market

Ricult: Providing smallholder farmers easier access to capital

Based in Pakistan and Thailand, Ricult’s mobile app platform provides advanced weather forecasting, easy loan applications and direct market access to help farmers increase productivity and profits

Indonesian fintechs plug payday gaps, help workers stay away from loan sharks

Cash advance or “earned wage access” programs, already popular employee benefits in the US and Europe, are attracting investors and diverse clients in Indonesia

ZiCare: Digitalizing Indonesia's healthcare system, one hospital at a time

Supported by the health ministry, ZiCare is raising $1.5m to attract more hospitals and clinics to use its platform for administration, patient records and insurance claims

Gago Inc: Satellite data agritech startup ramps up growth with financial sector solutions

Founded by former NASA scientists, Gago began as a data solution to improve China’s traditionally low-yielding and inefficient smallholder-based farming sector

Knokcare: Telemedicine app connects you to doctors in 30 minutes

Seeking funding of over €1m, Portugal’s digital healthcare pioneer is expanding its SaaS to tap new markets in Europe, Africa and Latin America

China’s online mutual aid market: A new battleground for tech giants and startups

Startups spotted the opportunity and tech giants too have entered a market seen tripling by 2025. But profitability is still in doubt amid regulatory uncertainty

SingularCover: Spanish SME insurance sector disruptor is Virtual South Summit winner

AI-honed personalization is proving successful in the underserved SME insurtech vertical

- 1

- 2