Women

This function is exclusive for Premium subscribers

-

DATABASE (39)

-

ARTICLES (24)

WA4STEAM is a not-for-profit organization that provides seed capital with an investment focus on supporting women with projects and ideas applicable to STEAM sectors (Science, Technology, Engineering, Arts/Architecture and Mathematics).The association is composed of women with backgrounds and experiences in biosciences, mathematics, finance, engineering, law, accounting and coaching. It offers significant support to the founders during the early stages of the startup cycle.WA4STEAM cooperates with a network of co-investors, VC funds, family offices, accelerators and incubators. It also collaborates with university associations and science and technology parks that back and leverage the portfolio of companies.

WA4STEAM is a not-for-profit organization that provides seed capital with an investment focus on supporting women with projects and ideas applicable to STEAM sectors (Science, Technology, Engineering, Arts/Architecture and Mathematics).The association is composed of women with backgrounds and experiences in biosciences, mathematics, finance, engineering, law, accounting and coaching. It offers significant support to the founders during the early stages of the startup cycle.WA4STEAM cooperates with a network of co-investors, VC funds, family offices, accelerators and incubators. It also collaborates with university associations and science and technology parks that back and leverage the portfolio of companies.

Founded in 2008 and headquartered in Xiamen, Fujian Province, Meitu is a public company traded at HK Stock Exchange.Its products include photo-editing and sharing software Meitu Xiuxiu(MeituPic), short video app Meipai, apps focusing on oversea users AirBrush and BeautyPlus, etc. (https://corp.meitu.com/news/news/110.html) It reported having a MAU of 3320 million adding up all its apps in 2018. (https://wallstreetcn.com/articles/3497467)It used to have a smartphone line but has announced to shut down the line. Meitu let Xiaomi handle its development and sale and it got a commission.

Founded in 2008 and headquartered in Xiamen, Fujian Province, Meitu is a public company traded at HK Stock Exchange.Its products include photo-editing and sharing software Meitu Xiuxiu(MeituPic), short video app Meipai, apps focusing on oversea users AirBrush and BeautyPlus, etc. (https://corp.meitu.com/news/news/110.html) It reported having a MAU of 3320 million adding up all its apps in 2018. (https://wallstreetcn.com/articles/3497467)It used to have a smartphone line but has announced to shut down the line. Meitu let Xiaomi handle its development and sale and it got a commission.

Ladies Investment Club (LIC) is a group of self-funded women investors, put together with a mission to find, support and nurture female founders on their journey to business ownership. Driven by a desire to see more women-led startups, LIC touts its extensive experience across multiple industries and disciplines, and offers not just capital, but guidance and mentoring to increase female founders' likelihood of success.

Ladies Investment Club (LIC) is a group of self-funded women investors, put together with a mission to find, support and nurture female founders on their journey to business ownership. Driven by a desire to see more women-led startups, LIC touts its extensive experience across multiple industries and disciplines, and offers not just capital, but guidance and mentoring to increase female founders' likelihood of success.

Mubadala was founded in 2017 and was directly listed as a Public Joint Stock Company, merging the Mubadala Development Company and the International Petroleum Investment Company (IPIC).Mubadala is owned by the government of Abu Dhabi in the United Arab Emirates (UAE) with approximately $299bn assets under management and operations across 50 countries. Mubadala owns the Advanced Technology Investment Company (ATIC), a firm acting as an investment vehicle in high technology sectors.

Mubadala was founded in 2017 and was directly listed as a Public Joint Stock Company, merging the Mubadala Development Company and the International Petroleum Investment Company (IPIC).Mubadala is owned by the government of Abu Dhabi in the United Arab Emirates (UAE) with approximately $299bn assets under management and operations across 50 countries. Mubadala owns the Advanced Technology Investment Company (ATIC), a firm acting as an investment vehicle in high technology sectors.

Serena Ventures is a venture capital investment firm founded by professional tennis player and businesswoman Serena Williams. The company focuses on early-stage companies founded by young, diverse teams. Since it was founded in 2014, it has invested in more than 30 companies with a cumulative market cap of $12b. Coffee brand Kopi Kenangan is its first investment in the Indonesian market. Serena Ventures has invested in notable companies like plant-based meat maker Impossible Foods, cryptocurrency exchange Coinbase, as well as Serena Williams’ own fashion label, S by Serena.

Serena Ventures is a venture capital investment firm founded by professional tennis player and businesswoman Serena Williams. The company focuses on early-stage companies founded by young, diverse teams. Since it was founded in 2014, it has invested in more than 30 companies with a cumulative market cap of $12b. Coffee brand Kopi Kenangan is its first investment in the Indonesian market. Serena Ventures has invested in notable companies like plant-based meat maker Impossible Foods, cryptocurrency exchange Coinbase, as well as Serena Williams’ own fashion label, S by Serena.

Founded in 1999, TLCOM Capital now has offices in Kenya, Nigeria and the UK. Originally a global VC investor, its key investment objective now is to tackle Africa’s greatest challenges via its TIDE Africa Fund that was established in 2017.Total funding to date stands at $300m and investments range from $500,000 to $10m. It currently has 12 portfolio companies and has managed 13 exits. Recent investments include the $6m Series A round of Kenyan agro-focused insurtech PULA and the $7.5m Series A round of Nigerian edtech uLesson Education.

Founded in 1999, TLCOM Capital now has offices in Kenya, Nigeria and the UK. Originally a global VC investor, its key investment objective now is to tackle Africa’s greatest challenges via its TIDE Africa Fund that was established in 2017.Total funding to date stands at $300m and investments range from $500,000 to $10m. It currently has 12 portfolio companies and has managed 13 exits. Recent investments include the $6m Series A round of Kenyan agro-focused insurtech PULA and the $7.5m Series A round of Nigerian edtech uLesson Education.

Established in New York in 1979, Women's World Banking is a not-for-profit dedicated to financing initiatives for low-income women in developing nations. Its Capital Partners Fund is a private equity limited partnership that makes direct equity investments in women-focused financial institutions.To date, the fund has invested in 12 organizations, mostly banks offering micro-credits, in 10 developing nations. Investments for the first quarter of 2021 included participation in Colombian fintech Aflore’s $6.5m investment round and Kenyan insurtech Pula’s $2m Series A round.

Established in New York in 1979, Women's World Banking is a not-for-profit dedicated to financing initiatives for low-income women in developing nations. Its Capital Partners Fund is a private equity limited partnership that makes direct equity investments in women-focused financial institutions.To date, the fund has invested in 12 organizations, mostly banks offering micro-credits, in 10 developing nations. Investments for the first quarter of 2021 included participation in Colombian fintech Aflore’s $6.5m investment round and Kenyan insurtech Pula’s $2m Series A round.

Alison Gelb Pincus is an entrepreneur who co-founded One King’s Lane, a direct-to-consumer home decor company which was sold to Bed, Bath & Beyond, and more recently, sustainable packaging start-up kari.earth. She is also an angel investor and founder of Short List Capital, a San Francisco-based early-stage VC collective run by women. Short List Capital currently lists 20 companies in its portfolio, which has a focus on investing in e-commerce platforms with healthy, user-friendly or sustainable products. Gelb Pincus’s recent investments included participation in the May 2020 $5.3m seed round of US cookware maker Caraway and a 2015 investment in US-based unicorn Diamond Foundry, the first certified carbon-neutral lab-produced diamond manufacturer.Alison Gelb Pincus was married to Mark Pincus, the co-founder of Zynga and a founding investor in Facebook, Snapchat, Twitter, and Xiaomi.

Alison Gelb Pincus is an entrepreneur who co-founded One King’s Lane, a direct-to-consumer home decor company which was sold to Bed, Bath & Beyond, and more recently, sustainable packaging start-up kari.earth. She is also an angel investor and founder of Short List Capital, a San Francisco-based early-stage VC collective run by women. Short List Capital currently lists 20 companies in its portfolio, which has a focus on investing in e-commerce platforms with healthy, user-friendly or sustainable products. Gelb Pincus’s recent investments included participation in the May 2020 $5.3m seed round of US cookware maker Caraway and a 2015 investment in US-based unicorn Diamond Foundry, the first certified carbon-neutral lab-produced diamond manufacturer.Alison Gelb Pincus was married to Mark Pincus, the co-founder of Zynga and a founding investor in Facebook, Snapchat, Twitter, and Xiaomi.

Founded in 2012 in San Francisco, Joyance invests in the “vectors of happiness” that it classifies as areas of science, including genetics and bioscience, the microbiome, neuroscience, virtual and augmented reality, and foodtech. It also invests in the area of social networking. Its investments are made through its management company, Ataraxia, and many have a European focus. It currently has 115 companies in its portfolio, with recent investments including in the August 2021 $3.6m seed round of Polish bionic limb manufacturer and in the July 2021 $8m Series A round of Israeli sports injury AI platform Zone7.

Founded in 2012 in San Francisco, Joyance invests in the “vectors of happiness” that it classifies as areas of science, including genetics and bioscience, the microbiome, neuroscience, virtual and augmented reality, and foodtech. It also invests in the area of social networking. Its investments are made through its management company, Ataraxia, and many have a European focus. It currently has 115 companies in its portfolio, with recent investments including in the August 2021 $3.6m seed round of Polish bionic limb manufacturer and in the July 2021 $8m Series A round of Israeli sports injury AI platform Zone7.

South Summit 2021: Martin Varavsky, Leandro Sigman on post-Covid healthcare trends

Serial entrepreneur Martin Varavsky and Insud Pharma Chairman Leandro Sigman share their thoughts and projections on the future of health tech

Petit Pli: Origami-inspired clothes that still fit, even after the body has grown

Founded by a young aeronautical engineer, Petit Pli produces stylish, sustainable pleated garments made from recycled plastic that expand up to seven sizes

Teliman: Driver-centered mobility model assisting Malian development

The startup addresses a basic necessity with its on-demand ride-hailing services while supporting the personal and economic progress of its drivers, including empowering women

AgroCenta: Providing market access and credit to African smallholder farmers

AgroCenta’s platforms empower Ghanaian subsistence farmers, especially women, boosting productivity and sales with e-payments, micro-credits and insurance, and direct connections to buyers, cutting out the intermediaries

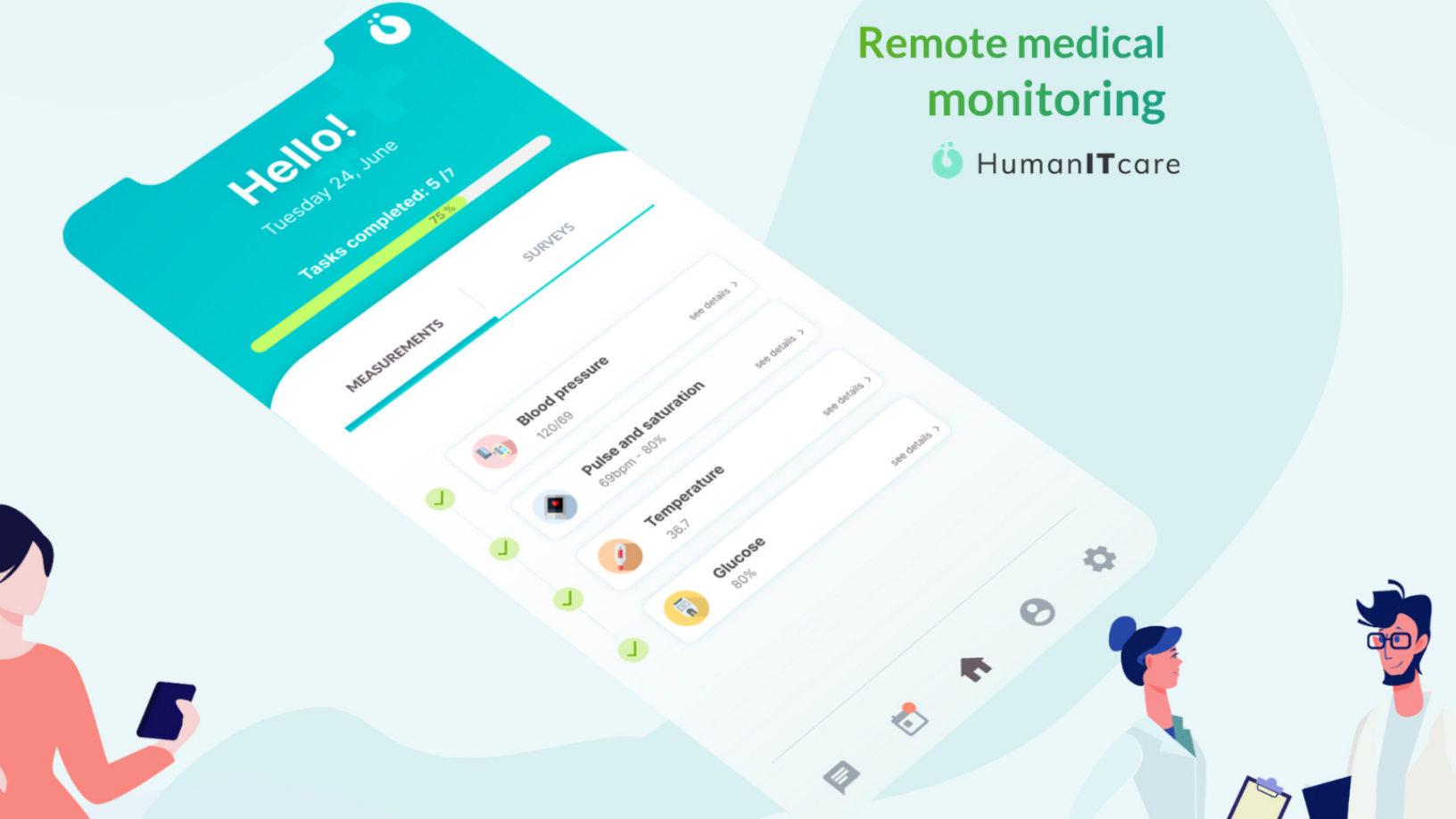

HumanITcare: Covid-19 spurs demand for telemedicine across Spain and beyond

The startup’s revenue is expected to exceed €10m by 2024 due to rapid digital transformation of healthcare services and a growing market for AI-powered medtechs

Modoo: Reducing stillbirth risk with fetal heart monitoring wearable

Weighing just 15g, the world’s smallest wearable “patch” with passive fetal monitoring technology by Modoo seeks to offer a safer alternative to ultrasound devices

Du'Anyam: Empowering rural women to work independently and learn financial planning skills

Du’Anyam had to cancel bulk orders to survive the Covid-19 downturn, pivoting to B2C online sales, until the tourism and hospitality sectors recover

Evermos is Indonesia's version of social commerce – and it's Sharia-compliant, too

Evermos targets the resale market, encouraging students and housewives to earn extra income by promoting products on their social media and WhatsApp networks

WOOM: Spanish fertility femtech gets €2m funding to expand into new B2B2C markets

AI fertility app WOOM has also created an English-language version to reach more users in North America, Europe and Asia

ClimateTrade: Using blockchain to spur climate change action that can make a difference

ClimateTrade is a decentralized carbon trading platform that democratizes the financing of SDG initiatives and provides traceability of carbon credit purchases and emission offsets

Canika: A new app offering more budget-friendly weddings

Canika woos young couples with more flexible prices and options in Indonesia's $7bn wedding planning market

Warung Pintar: Creating a little place of happiness with smart kiosks

CEO Agung Bezharie Hadinegoro on how Warung Pintar is tapping IoT and other digital tech to unleash the economic potential of Indonesia's traditional street vendors

Unicorn Xiaohongshu refines social commerce model after stumble, as bigger players jostle in

Once the epitome of China's O2O social commerce success, Xiaohongshu (RED) tries to reinvent itself amid challenges from internet giants, influencers and short videos

As more Chinese opt for cosmetic surgery, startups have emerged to help them make informed decisions

China’s medical aesthetic services platforms face both opportunities and challenges with the rise of Generation Z

Girls in Tech Indonesia: Inspiring the geek in every girl

Girls in Tech Indonesia aims to put the country's women at the forefront of its tech and startup world

- 1

- 2