A*Star

-

DATABASE (997)

-

ARTICLES (811)

Founded in Beijing in 2015, Frees Fund is an asset management company with a portfolio valued at RMB 3.6bn. Frees primarily invests in early-stage startups in diverse sectors including fintech, education, healthcare, entertainment, hardware, intelligent manufacturing and SaaS. The VC is incorporated as Shanghai Ziyou Investment Management Co Ltd.

Founded in Beijing in 2015, Frees Fund is an asset management company with a portfolio valued at RMB 3.6bn. Frees primarily invests in early-stage startups in diverse sectors including fintech, education, healthcare, entertainment, hardware, intelligent manufacturing and SaaS. The VC is incorporated as Shanghai Ziyou Investment Management Co Ltd.

Founded in 2012 in San Francisco, Joyance invests in the “vectors of happiness” that it classifies as areas of science, including genetics and bioscience, the microbiome, neuroscience, virtual and augmented reality, and foodtech. It also invests in the area of social networking. Its investments are made through its management company, Ataraxia, and many have a European focus. It currently has 115 companies in its portfolio, with recent investments including in the August 2021 $3.6m seed round of Polish bionic limb manufacturer and in the July 2021 $8m Series A round of Israeli sports injury AI platform Zone7.

Founded in 2012 in San Francisco, Joyance invests in the “vectors of happiness” that it classifies as areas of science, including genetics and bioscience, the microbiome, neuroscience, virtual and augmented reality, and foodtech. It also invests in the area of social networking. Its investments are made through its management company, Ataraxia, and many have a European focus. It currently has 115 companies in its portfolio, with recent investments including in the August 2021 $3.6m seed round of Polish bionic limb manufacturer and in the July 2021 $8m Series A round of Israeli sports injury AI platform Zone7.

The Baptist Health group of hospitals is the largest not-for-profit healthcare organization in Arkansas, USA. Founded originally in 1921 as Baptist State Hospital with about 100 beds, Baptist Health is a community-driven healthcare provider. The group comprises the Baptist Health Foundation, a college, a clinical research facility and a healthcare network run by physician partners.

The Baptist Health group of hospitals is the largest not-for-profit healthcare organization in Arkansas, USA. Founded originally in 1921 as Baptist State Hospital with about 100 beds, Baptist Health is a community-driven healthcare provider. The group comprises the Baptist Health Foundation, a college, a clinical research facility and a healthcare network run by physician partners.

Founded in 2017, Timestamp Capital is a blockchain investment fund. With a focus on research, investment and consulting services in the blockchain field, Timestamp Capital provides all-in-one assistance to blockchain startups by helping them optimize their business models and establish a compliance framework as well as by accelerating the construction of a global community.

Founded in 2017, Timestamp Capital is a blockchain investment fund. With a focus on research, investment and consulting services in the blockchain field, Timestamp Capital provides all-in-one assistance to blockchain startups by helping them optimize their business models and establish a compliance framework as well as by accelerating the construction of a global community.

Paris-based Orange Digital Ventures is part of French telco Orange and was established in 2015. It invests up to €150m in businesses with technology that aligns with Orange's development plans. It has a geographical focus on Africa and has made a commitment to boosting the continent's startup ecosystem through its 2017 €50m dedicated Africa fund. Recent investments include fintech Monzo's US$144m Series F round and B2C savings and investment marketplace Raisin's US$$114m Series D round.

Paris-based Orange Digital Ventures is part of French telco Orange and was established in 2015. It invests up to €150m in businesses with technology that aligns with Orange's development plans. It has a geographical focus on Africa and has made a commitment to boosting the continent's startup ecosystem through its 2017 €50m dedicated Africa fund. Recent investments include fintech Monzo's US$144m Series F round and B2C savings and investment marketplace Raisin's US$$114m Series D round.

Labeled "world’s most powerful startup incubator" by Fast Company, Y Combinator was established in 2005 as a seed accelerator. Since then, Y Combinator has funded over 1,850 startups with a combined valuation of over US$100 billion. Twice a year, Y Combinator invests US$150,000 per company across a large number of startups in exchange for a 7% stake. The startups then move to Silicon Valley for three months. Each cycle ends with a Demo Day, where the startups pitch to an invite-only audience of high-profile investors. Its most valuable startups to date are Airbnb, Stripe, Cruise, Dropbox and Coinbase.

Labeled "world’s most powerful startup incubator" by Fast Company, Y Combinator was established in 2005 as a seed accelerator. Since then, Y Combinator has funded over 1,850 startups with a combined valuation of over US$100 billion. Twice a year, Y Combinator invests US$150,000 per company across a large number of startups in exchange for a 7% stake. The startups then move to Silicon Valley for three months. Each cycle ends with a Demo Day, where the startups pitch to an invite-only audience of high-profile investors. Its most valuable startups to date are Airbnb, Stripe, Cruise, Dropbox and Coinbase.

Founded in 2011 in Leipzig, Monkfish Equity offers a hands-off investment approach, providing funding of €0.5m–€2m to enterprises across market segments in Germany, other European countries and the US.The firm is run by the co-founders of travel and hotel platform Trivago. Monkfish’s portfolio of 12 companies mainly comprises businesses in the B2C markets. Investments include the $54m Series B round of Austrian marketplace Refurbed in August 2021 and the €8m Series A round of Inne, a German fertility-tracking platform in October 2019.

Founded in 2011 in Leipzig, Monkfish Equity offers a hands-off investment approach, providing funding of €0.5m–€2m to enterprises across market segments in Germany, other European countries and the US.The firm is run by the co-founders of travel and hotel platform Trivago. Monkfish’s portfolio of 12 companies mainly comprises businesses in the B2C markets. Investments include the $54m Series B round of Austrian marketplace Refurbed in August 2021 and the €8m Series A round of Inne, a German fertility-tracking platform in October 2019.

Bånt AB is the investment vehicle of Karl Sverker Forsén based in Luleå, a coastal city in Swedish Lapland. In May 2020, the Swedish family office invested in a Gothenburg startup Mycorena, a biotech that produces mycoproteins through fermentation. The fungi-based protein can be used as an alt-protein ingredient instead of traditional plant-based food components.

Bånt AB is the investment vehicle of Karl Sverker Forsén based in Luleå, a coastal city in Swedish Lapland. In May 2020, the Swedish family office invested in a Gothenburg startup Mycorena, a biotech that produces mycoproteins through fermentation. The fungi-based protein can be used as an alt-protein ingredient instead of traditional plant-based food components.

UBS is a Switzerland-based financial institution providing banking, wealth management, and securities services. Originally established in 1862 as the Bank in Winterthur, it is the largest Swiss banking institution. UBS engages in venture capital activities as part of its investment banking services. In 2020, UBS began a partnership with venture capital firm Anthemis to launch UBS Next, a $200m fund that will invest in fintech and other tech startups.

UBS is a Switzerland-based financial institution providing banking, wealth management, and securities services. Originally established in 1862 as the Bank in Winterthur, it is the largest Swiss banking institution. UBS engages in venture capital activities as part of its investment banking services. In 2020, UBS began a partnership with venture capital firm Anthemis to launch UBS Next, a $200m fund that will invest in fintech and other tech startups.

With a total investment portfolio of €2 million across six companies, Dueto invests primarily in infotech startups. One of its co-founders, João Ranito, was a former partner at Novabase SA, a Portuguese IT company that went public in 2000.

With a total investment portfolio of €2 million across six companies, Dueto invests primarily in infotech startups. One of its co-founders, João Ranito, was a former partner at Novabase SA, a Portuguese IT company that went public in 2000.

Álvaro Azcárraga is a Spanish lawyer. Since 2013, he has been responsible for filing legal complaints with airlines for Reclamador.es, a web platform that manages and automates consumer claims. He is also a shareholder in the company.

Álvaro Azcárraga is a Spanish lawyer. Since 2013, he has been responsible for filing legal complaints with airlines for Reclamador.es, a web platform that manages and automates consumer claims. He is also a shareholder in the company.

Since 2019, Javier Gayoso has been a board member, partner and advisor at Voikers, a management consultancy based in Madrid. He is also the former CEO of Spotify Iberia and advertising director of Vocento, a Madrid-based broadcast media.

Since 2019, Javier Gayoso has been a board member, partner and advisor at Voikers, a management consultancy based in Madrid. He is also the former CEO of Spotify Iberia and advertising director of Vocento, a Madrid-based broadcast media.

China International Capital Corp (CICC)

A leading Chinese investment bank, Beijing-based CICC is a publicly listed company in Hong Kong.

A leading Chinese investment bank, Beijing-based CICC is a publicly listed company in Hong Kong.

German-born Andreas “Andy” Bechtolsheim is chairman and co-founder of Arista Networks and was a co-founder at Sun Microsystems, which was acquired by Oracle in 2010 for $7.4bn. His main interest is in productivity software across market segments, as well as cybersecurity. He is also a billionaire investor, with much of his wealth coming from being the first angel investor in Google. Since then, he has been an occasional investor in startups, with his most recent disclosed investments occurring in 2020 when he invested in two companies. He has also participated in the $22m Series A round of US email security company Material Security and in the $21m Series A round of AI customer service platform Cresta.

German-born Andreas “Andy” Bechtolsheim is chairman and co-founder of Arista Networks and was a co-founder at Sun Microsystems, which was acquired by Oracle in 2010 for $7.4bn. His main interest is in productivity software across market segments, as well as cybersecurity. He is also a billionaire investor, with much of his wealth coming from being the first angel investor in Google. Since then, he has been an occasional investor in startups, with his most recent disclosed investments occurring in 2020 when he invested in two companies. He has also participated in the $22m Series A round of US email security company Material Security and in the $21m Series A round of AI customer service platform Cresta.

San Francisco-based BOND is a spinoff of Kleiner Perkins and its original digital growth fund. BOND was launched in 2019, investing across market segments and geographies. To date, it has raised two funds totaling $3.3bn and currently has 32 portfolio companies. Its recent investments include Portuguese home physiotherapy tech SWORD, the world’s fastest-growing musculoskeletal solution, in June 2021 in a $85m Series C funding round; and co-leading the July 2021 $50m Series B round of US fungi-based alt-protein startup Meati Foods.

San Francisco-based BOND is a spinoff of Kleiner Perkins and its original digital growth fund. BOND was launched in 2019, investing across market segments and geographies. To date, it has raised two funds totaling $3.3bn and currently has 32 portfolio companies. Its recent investments include Portuguese home physiotherapy tech SWORD, the world’s fastest-growing musculoskeletal solution, in June 2021 in a $85m Series C funding round; and co-leading the July 2021 $50m Series B round of US fungi-based alt-protein startup Meati Foods.

DGene : Star Wars-inspired 3D holograms made affordable for businesses

DGene's mobile-based VR/AR solution using integrated light field cuts the need for 3D modeling, useful for many sectors from retail marketing to conference calls

UBTECH: CES robotics star wants to bring humanoid robots to every family

UBTECH’s next-generation bipedal robot recently made an impressive global debut, and the startup’s founder has once again become the focus of attention

Enoc Armengol: The design and e-commerce 3.0 star inspired by Inspector Gadget

Also a serial entrepreneur, the Spaniard has created a trail of celebrated design products and startups from Singapore to Barcelona

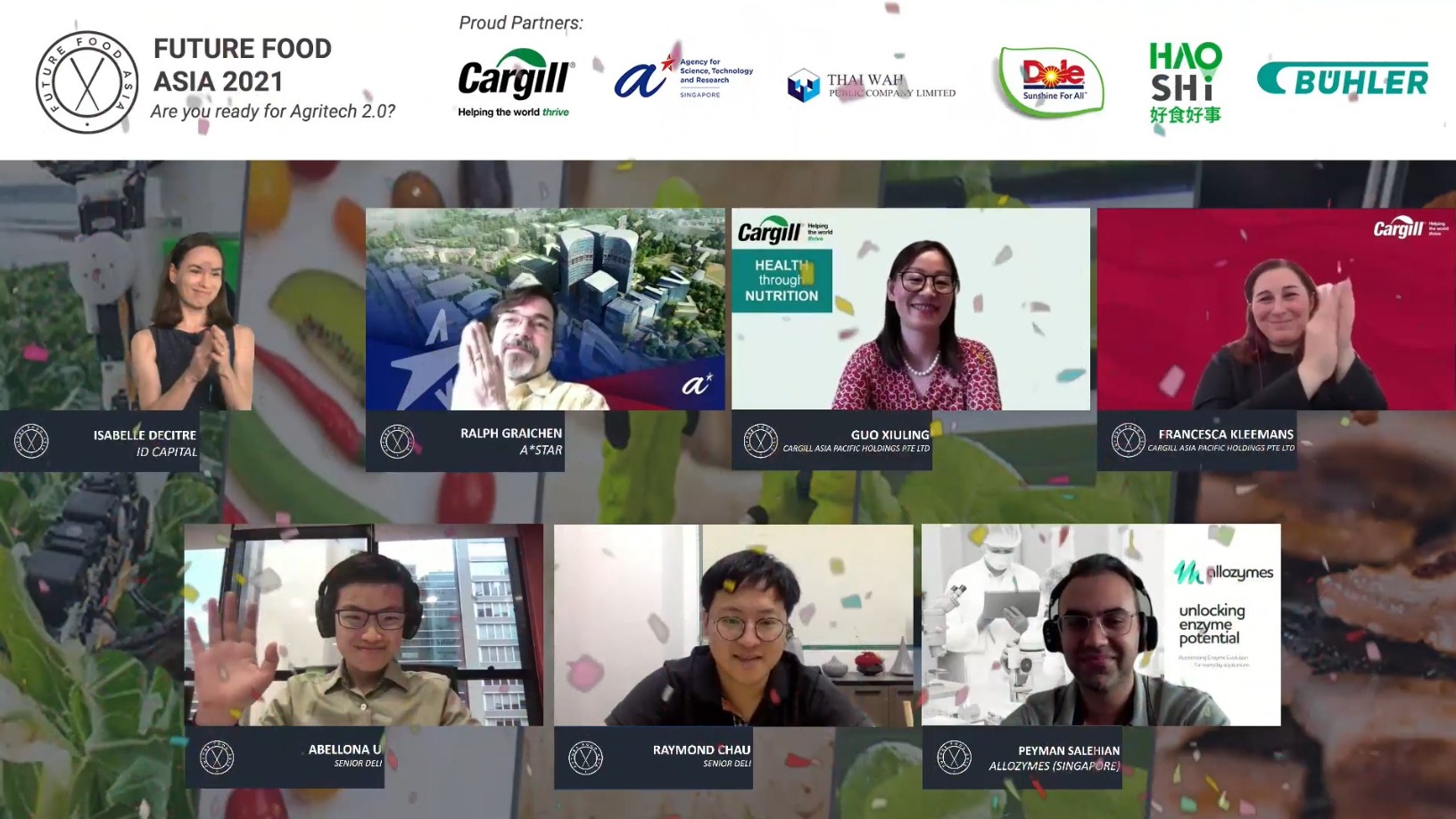

Future Food Asia 2021 announces finalists for $100,000 prize

Ten startups from agrifood tech and cleantech sectors will pitch during the five-day conference, are also eligible for two more prizes from sponsors Cargill and Thai Wah

Digital Union: Fighting fake users in China's mobile app industry

The Beijing-based cybersecurity startup is helping developers spot fake app downloads, so their ad money don’t go to waste

Future Food Asia 2021: Two winners take home $100,000 each

Agrifood startups, corporations and investors urged to collaborate and take action, tackling challenges in nutrition and climate change

Quant Group makes personal loans safer, easier in China

Using big data and AI, Chinese fintech startup Quant Group simplifies and accelerates loan processing, and assures monetary security for financial institutions

Oceanium: Supporting sustainable seaweed farming

Scottish startup Oceanium has developed a proprietary biorefinery and processing model to create seaweed-based compostable materials, alt-protein ingredients and nutraceuticals for use across industry verticals

Plant-based eggs (Part II): The foodtech startups to watch

Here’s a shortlist of the foodtech startups to watch in the global vegan egg market

For your X-ray records, just check the cloud

A Chinese startup has built a digital medical image library on the cloud, bringing ease and cost savings to patients, doctors and hospitals countrywide

HighPitch: E-grocery marketplace Pasar20 and healthcare edtech Appskep top the Medan chapter

Representing Sumatra’s startup ecosystem in the national finals later in November, Pasar20 and Appskep have ambitious expansion plans in store

BukuWarung: Accounting-payments app targets Indonesia's 60m MSMEs

BukuWarung’s easy-to-use 6MB app designed for lower-end smartphones gets boost from Covid-19-accelerated digitalization

Meatable joins Royal DSM to create growth media specific for cell-based meat tech

The R&D between the biotech startup and fellow Dutch nutrition conglomerate could help scale and drive the commercial viability of lab-grown meat

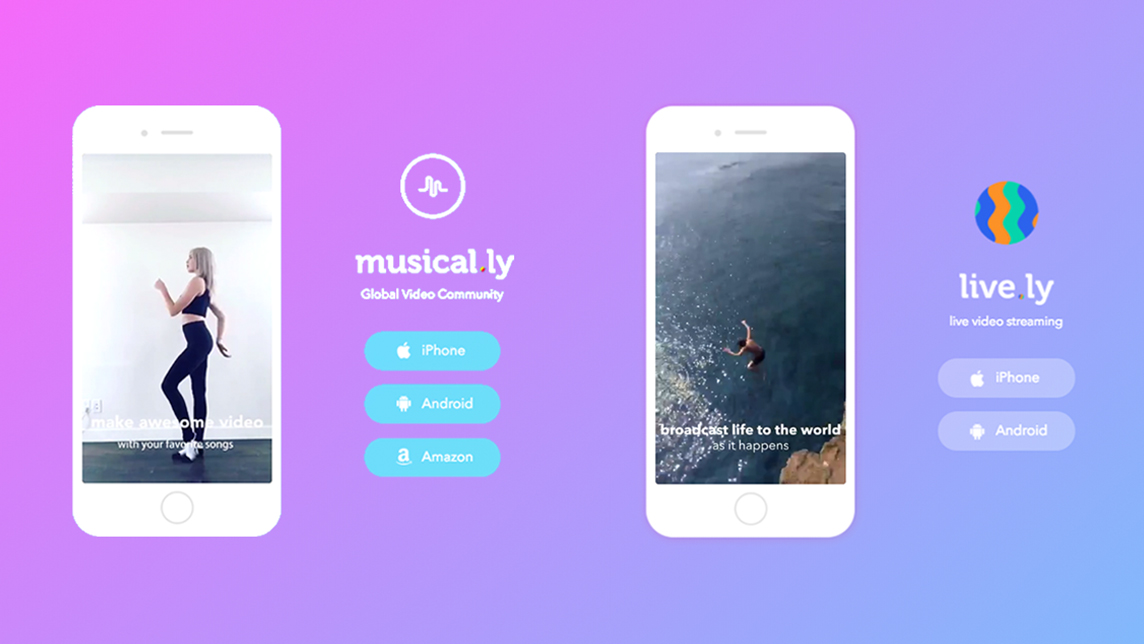

Inspired by rowdy teenagers: the Musical.ly story

Now better known as TikTok, the original Musical.ly was the only Chinese social app to have cracked the Western market – before it got snapped up by Bytedance and joined its stable of short video apps

Using Reworld’s very own interactive physics engine, even rookie developers can turn their creative ideas into 3D games within two days

Sorry, we couldn’t find any matches for“A*Star”.