C2C-New Cap

-

DATABASE (397)

-

ARTICLES (697)

Tokopedia is an Indonesian e-commerce marketplace, which in 2017 become the most popular site of its kind in Indonesia. Through partnerships with fintech companies, it has added new features that enable customers to buy gold and mutual funds. Besides foreign e-commerce marketplaces such as Lazada, Tokopedia’s closest rival is B2C/C2C marketplace Bukalapak, another Indonesian unicorn.

Tokopedia is an Indonesian e-commerce marketplace, which in 2017 become the most popular site of its kind in Indonesia. Through partnerships with fintech companies, it has added new features that enable customers to buy gold and mutual funds. Besides foreign e-commerce marketplaces such as Lazada, Tokopedia’s closest rival is B2C/C2C marketplace Bukalapak, another Indonesian unicorn.

Founded in 1993, New Oriental is the largest provider of private educational services in China. Foreign language training and basic education currently make up its core business. New Oriental offers services in pre-school education, online education, vocational education, overseas study consulting, textbook publishing and education software R&D. New Oriental schools operate in 70 cities nationwide and in Toronto. As an institutional investor, the company has invested in over 40 startups, the vast majority of which are edtechs.

Founded in 1993, New Oriental is the largest provider of private educational services in China. Foreign language training and basic education currently make up its core business. New Oriental offers services in pre-school education, online education, vocational education, overseas study consulting, textbook publishing and education software R&D. New Oriental schools operate in 70 cities nationwide and in Toronto. As an institutional investor, the company has invested in over 40 startups, the vast majority of which are edtechs.

New Ventures has over the past decade focused on growing and catalyzing social and environmental entrepreneurs. They build an ecosystem through financing, acceleration, and promotion. In doing so, they pave the way for enterprises that are not only profitable but have a positive impact on social and environmental issues.

New Ventures has over the past decade focused on growing and catalyzing social and environmental entrepreneurs. They build an ecosystem through financing, acceleration, and promotion. In doing so, they pave the way for enterprises that are not only profitable but have a positive impact on social and environmental issues.

New Energy Nexus is a US-based investor and startup support organization that focuses on the clean energy sector. The company was originally known as the California Clean Energy Fund (CalCEF) and has invested in SolarCentury and Tesla Motors. Since 2015, New Energy Nexus has been working with international partners like GIZ (the German agency for international development) and IKEA Foundation to promote renewables and smart energy worldwide. In 2018, New Energy Nexus launched its Southeast Asian operations by establishing offices in Indonesia and Thailand.New Energy Nexus supports startups through incubator and accelerator programs, hackathons, public talks, grants and equity investments. So far, it has invested in four Indonesian startups, including B2B rooftop solar service provider Xurya and solar equipment marketplace BLUE, and distributed nearly $50,000 in grants.

New Energy Nexus is a US-based investor and startup support organization that focuses on the clean energy sector. The company was originally known as the California Clean Energy Fund (CalCEF) and has invested in SolarCentury and Tesla Motors. Since 2015, New Energy Nexus has been working with international partners like GIZ (the German agency for international development) and IKEA Foundation to promote renewables and smart energy worldwide. In 2018, New Energy Nexus launched its Southeast Asian operations by establishing offices in Indonesia and Thailand.New Energy Nexus supports startups through incubator and accelerator programs, hackathons, public talks, grants and equity investments. So far, it has invested in four Indonesian startups, including B2B rooftop solar service provider Xurya and solar equipment marketplace BLUE, and distributed nearly $50,000 in grants.

Co-founder and CEO of Orange 100

Prior to co-founding Orange 100, Leng ran a company that provided creative PR ideas to shopping malls. He also worked for Baidu's C2C e-commerce platform youa.com, which was subsequently integrated into leho.com. Leng has significant experience in business operations, marketing, sales and business development.

Prior to co-founding Orange 100, Leng ran a company that provided creative PR ideas to shopping malls. He also worked for Baidu's C2C e-commerce platform youa.com, which was subsequently integrated into leho.com. Leng has significant experience in business operations, marketing, sales and business development.

Chinese agribusiness group New Hope Group has RMB 75 billion in assets. Besides operating in its core industries, it also has a fund and asset management unit, and invests in TMT and healthcare.

Chinese agribusiness group New Hope Group has RMB 75 billion in assets. Besides operating in its core industries, it also has a fund and asset management unit, and invests in TMT and healthcare.

Co-founder of DuduBus

Ouyang Fujin graduated in 2012 with a bachelor's degree in Software Engineering from Guangdong University of Foreign Studies. Upon graduation, he worked for Tencent till 2015 on open.qq.com's Midas, a charging system for mobile game apps. In 2015, he co-founded DuduBus. In 2018, he co-founded CSC, a C2C car sharing platform using blockchain technology.

Ouyang Fujin graduated in 2012 with a bachelor's degree in Software Engineering from Guangdong University of Foreign Studies. Upon graduation, he worked for Tencent till 2015 on open.qq.com's Midas, a charging system for mobile game apps. In 2015, he co-founded DuduBus. In 2018, he co-founded CSC, a C2C car sharing platform using blockchain technology.

Founded by Wen Yunsong (Winston Wen), son of former Chinese premier Wen Jiabao, and Yu Jianming in 2005, New Horizon is a private equity firm focused on advanced manufacturing, alternative energy, consumer products and services, and healthcare.

Founded by Wen Yunsong (Winston Wen), son of former Chinese premier Wen Jiabao, and Yu Jianming in 2005, New Horizon is a private equity firm focused on advanced manufacturing, alternative energy, consumer products and services, and healthcare.

Launched in 2013, Japan’s Rakuten Capital is the corporate venture capital arm of conglomerate Rakuten. It manages a range of funds, such as the early-stage Rakuten Ventures, Rakuten Fintech Fund, and Rakuten Mobility Investments. Its portfolio covers a broad range of companies, including C2C e-commerce platform Carousell, ride-hailing unicorn Gojek, and video game vouchers platform CodaPay. Notable exits include the IPOs of US-based ride hailing company Lyft and image sharing site Pinterest.

Launched in 2013, Japan’s Rakuten Capital is the corporate venture capital arm of conglomerate Rakuten. It manages a range of funds, such as the early-stage Rakuten Ventures, Rakuten Fintech Fund, and Rakuten Mobility Investments. Its portfolio covers a broad range of companies, including C2C e-commerce platform Carousell, ride-hailing unicorn Gojek, and video game vouchers platform CodaPay. Notable exits include the IPOs of US-based ride hailing company Lyft and image sharing site Pinterest.

Everbright New Economy USD Fund

Launched in 2018, Everbright New Economy USD Fund (New Economy Fund) is under the umbrella of China Everbright, a Hong Kong-listed financial conglomerate. The New Economy Fund started from an inaugural fund of US$483m, with US$150m from Bahrain-based asset manager Investcorp. It invests mainly in the e-commerce, smart retail and artificial intelligence sectors. In November 2019, China Everbright and Investcorp announced they will co-manage Investcorp New Economy Fund I and explore the opportunity to establish a successor private equity fund, jointly managed by the two parties, that will target China’s tech sector.

Launched in 2018, Everbright New Economy USD Fund (New Economy Fund) is under the umbrella of China Everbright, a Hong Kong-listed financial conglomerate. The New Economy Fund started from an inaugural fund of US$483m, with US$150m from Bahrain-based asset manager Investcorp. It invests mainly in the e-commerce, smart retail and artificial intelligence sectors. In November 2019, China Everbright and Investcorp announced they will co-manage Investcorp New Economy Fund I and explore the opportunity to establish a successor private equity fund, jointly managed by the two parties, that will target China’s tech sector.

Vostok New Ventures is a Swedish investment company that invests globally in companies with network effects, founded in 2007. It has a special focus on the areas of real estate, recruitment and job sites, travel and transportation services and general classified ads. It participates in growth-stage companies and has invested in 27 companies, 18 of which as leading investor. Its exits are Avito, Quandoo and Delivery Hero.

Vostok New Ventures is a Swedish investment company that invests globally in companies with network effects, founded in 2007. It has a special focus on the areas of real estate, recruitment and job sites, travel and transportation services and general classified ads. It participates in growth-stage companies and has invested in 27 companies, 18 of which as leading investor. Its exits are Avito, Quandoo and Delivery Hero.

Founded in 2016 by Gary Schefsky, New Luna Ventures focuses on sustainable investments in diverse sectors including agriculture, food tech, precision farming, materials, real estate, renewables, water technology, communications, SaaS, AI and robotics. Schefsky has worked in emerging startup sectors for over 25 years and as a family office fiduciary for more than 17 years. Based in San Francisco, the firm’s limited partners include family offices, institutional investors and individuals.

Founded in 2016 by Gary Schefsky, New Luna Ventures focuses on sustainable investments in diverse sectors including agriculture, food tech, precision farming, materials, real estate, renewables, water technology, communications, SaaS, AI and robotics. Schefsky has worked in emerging startup sectors for over 25 years and as a family office fiduciary for more than 17 years. Based in San Francisco, the firm’s limited partners include family offices, institutional investors and individuals.

PNV Capital is a seed investment fund in Proença-a-Nova, Portugal, co-invested by Busy Angels. The fund is worth about €770,000 and invests an average of about €100,000 per project, with a cap at €200,000.this is all frmo the previous write up as they have no webpage still!

PNV Capital is a seed investment fund in Proença-a-Nova, Portugal, co-invested by Busy Angels. The fund is worth about €770,000 and invests an average of about €100,000 per project, with a cap at €200,000.this is all frmo the previous write up as they have no webpage still!

Co-founder of ATRenew (formerly Aihuishou)

Sun Wenjun graduated from Fudan University with a master’s degree in Computer Science. He worked as a research fellow at his alma mater, where he met his future business partner, Chen Xuefeng. After graduating, he worked at Sykes Enterprises as director of technology solutions, drawing an annual salary of RMB1 million. Sun later left his full-time job to co-found customer-to-customer (C2C) second-hand goods trading platform Leyi with Chen in 2010. When that business failed, they co-founded Aihuishou.

Sun Wenjun graduated from Fudan University with a master’s degree in Computer Science. He worked as a research fellow at his alma mater, where he met his future business partner, Chen Xuefeng. After graduating, he worked at Sykes Enterprises as director of technology solutions, drawing an annual salary of RMB1 million. Sun later left his full-time job to co-found customer-to-customer (C2C) second-hand goods trading platform Leyi with Chen in 2010. When that business failed, they co-founded Aihuishou.

CEO and founder of ATRenew (formerly Aihuishou)

Chen graduated from Tongji University in 2002 with a bachelor’s degree in Computer Science, and from Fudan University in 2005 with a master’s degree in the same field. Upon graduation, he worked for Fortune 500 company Sykes Enterprises as a software engineer. In 2009, he received a RMB100,000 seed fund from Fudan University to start Leyi, a customer-to-customer (C2C) platform for trading second-hand goods, with Sun Wenjun, a friend he met through his master’s degree. Although the business failed after two and a half years, the two young entrepreneurs led their core team to form Aihuishou.

Chen graduated from Tongji University in 2002 with a bachelor’s degree in Computer Science, and from Fudan University in 2005 with a master’s degree in the same field. Upon graduation, he worked for Fortune 500 company Sykes Enterprises as a software engineer. In 2009, he received a RMB100,000 seed fund from Fudan University to start Leyi, a customer-to-customer (C2C) platform for trading second-hand goods, with Sun Wenjun, a friend he met through his master’s degree. Although the business failed after two and a half years, the two young entrepreneurs led their core team to form Aihuishou.

Housfy leads growth in Spanish proptech

The real estate platform helps clients sell their property without the astronomical agency fees

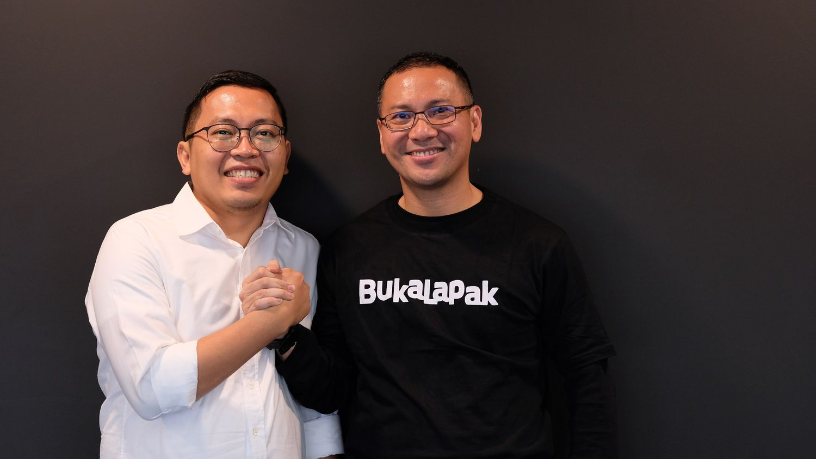

Bukalapak CEO Achmad Zaky steps down, ex-banker Rachmat Kaimuddin to take over

Rumors of a leadership change first surfaced in August as the Indonesian unicorn and its co-founder got a bad press

Chinapex: Maximizing the marketing value of customer data

The startup’s also creating a transparent and efficient industry environment for digital marketing in China

From Tekapedia to HayoKerja: How failure led to a less exciting business model – and success

Borrowing the e-commerce marketplace model, Tekapedia tried to match businesses with blue-collar hires, but it soon realized the sector had simpler needs

Future Food Asia 2021 announces finalists for $100,000 prize

Ten startups from agrifood tech and cleantech sectors will pitch during the five-day conference, are also eligible for two more prizes from sponsors Cargill and Thai Wah

Chic by Choice: From Forbes' 30 Under 30 to insolvency

Lack of cashflow was the main reason for the demise of Chic by Choice, Europe's leading luxury dress rental e-store

SoccerDream: World's first VR soccer training platform to launch in China, US

SoccerDream uses virtual reality to boost trainee players' performance on the field by 36% compared to their peers

“Sniper investor” Zhu Xiaohu: GSR Ventures chief’s slow but steady way of spotting future unicorns

Known for his conservative investing in China’s often-euphoric tech startup scene, Zhu Xiaohu has caught unicorns like Didi Chuxing while making a profitable exit from Ofo just before it sank

Cubiq Foods: Bioreactor farms producing the food of tomorrow

Growing appetite for meat alternatives expected to fuel demand for Cubiq’s low calorie, Omega 3-enriched lab-grown fats

SwissDeCode: Portable DNA test kits detect food contamination within minutes

DNAFoil, the startup’s rapid and accurate on-site food safety testing kit, can be deployed by non-expert staff after a few hours of training, with no need for lab equipment

Li Bin: Aiming for more than a Chinese copy of Tesla

Good at making and investing money, he founded two companies that went on to list on the NYSE and invested in over 40 startups

Allen Zhang: Father of WeChat and its string of innovations

Get to know the man behind the app in every Chinese user's smartphone

Amid Covid-19 gloom, some bright spots in Portugal's tech startup scene

Despite a recession and doubling of the unemployment rate forecast this year, it's not all bad news for the Portuguese tech ecosystem

Meatable: Cell-based meat startup secures $47m Series A for scalable technology

The Dutch startup offers a pioneering technology for quickly scaling cell-based meat production while eliminating the need for animal-derived growth media

In Spain, women are busy launching startups

Official data show women-led startups are on the rise in Spain. We take you to some of the biggest names in the game

Sorry, we couldn’t find any matches for“C2C-New Cap”.