M%26A

-

DATABASE (52)

-

ARTICLES (56)

Centurium Capital is a private equity firm specializing in investments in the healthcare and consumer sectors in China. It was founded by David Li, Warburg Pincus's former Asia head, with a US$1.5 billion hard cap. It raised US$925 million in first close in June 2018. Centurium's limited partners include GIC, China Investment Corporation and Temasek Holdings. Centurium has cooperated with UCAR and Lepu Medical Technology to set up and manage two industrial M&A funds with initial funds of over RMB 6 billion.

Centurium Capital is a private equity firm specializing in investments in the healthcare and consumer sectors in China. It was founded by David Li, Warburg Pincus's former Asia head, with a US$1.5 billion hard cap. It raised US$925 million in first close in June 2018. Centurium's limited partners include GIC, China Investment Corporation and Temasek Holdings. Centurium has cooperated with UCAR and Lepu Medical Technology to set up and manage two industrial M&A funds with initial funds of over RMB 6 billion.

Pere Valles is an entrepreneur and angel investor in the Spanish startup ecosystem, sitting on the board of several companies. Valles has been chairman of Spanish digital voting platform Scytl since 2004. In 2018, he was appointed CEO of travel platform Exoticca, which sells long haul touring holidays and has a presence in Spain, France and the UK. He had been a financial director of GlobalNet and a senior manager at KPMG's mergers & acquisitions group in the US.

Pere Valles is an entrepreneur and angel investor in the Spanish startup ecosystem, sitting on the board of several companies. Valles has been chairman of Spanish digital voting platform Scytl since 2004. In 2018, he was appointed CEO of travel platform Exoticca, which sells long haul touring holidays and has a presence in Spain, France and the UK. He had been a financial director of GlobalNet and a senior manager at KPMG's mergers & acquisitions group in the US.

Established in 2016, LEADx Capital Partners is a German-based VC and is the investment arm of major retailer METRO Group. Since its founding, the VC has invested in 36 different companies, with a special focus on European retail, the same sector as METRO Group. It has already had one successful exit, the M&A of GuestU, which provides free internet to tourists. LEADx was the lead investor in the €18m Series B round of online printing marketplace 360imprimir, known as 360 Onlineprint in markets outside Iberia and Latin America.

Established in 2016, LEADx Capital Partners is a German-based VC and is the investment arm of major retailer METRO Group. Since its founding, the VC has invested in 36 different companies, with a special focus on European retail, the same sector as METRO Group. It has already had one successful exit, the M&A of GuestU, which provides free internet to tourists. LEADx was the lead investor in the €18m Series B round of online printing marketplace 360imprimir, known as 360 Onlineprint in markets outside Iberia and Latin America.

Mitchell Presser is a New York-based lawyer. He is currently co-chair of global law service Morrison & Foerster’s Global Corporate Department and a partner in the firm’s M&A and Private Equity group, advising on agriculture, amongst other areas. He previously was a founding partner of Paine Schwartz, a US-based $1.2 bn private equity firm specializing in sustainable food chain investing from 2006 to 2014. His sole disclosed angel investment to date was an undisclosed sum in the pre-seed funding of NovoNutrients, the US-based biotech producer of alt-protein from fermentation using CO2 and other emissions,

Mitchell Presser is a New York-based lawyer. He is currently co-chair of global law service Morrison & Foerster’s Global Corporate Department and a partner in the firm’s M&A and Private Equity group, advising on agriculture, amongst other areas. He previously was a founding partner of Paine Schwartz, a US-based $1.2 bn private equity firm specializing in sustainable food chain investing from 2006 to 2014. His sole disclosed angel investment to date was an undisclosed sum in the pre-seed funding of NovoNutrients, the US-based biotech producer of alt-protein from fermentation using CO2 and other emissions,

Co-founder of Impress

Vladimir Lupenko is a professional accountant, serial entrepreneur and angel investor. Lupenko’s latest entrepreneurial project is Impress, an invisible aligners company using a hybrid model of remote patient monitoring and in-person visits. The startup, headquartered in Barcelona but operating in several European countries, is regarded as one of the fastest-growing telemedicine companies in Europe.Originally from Russia, Lupenko holds a master’s in Economics from the Plekhanov Russian University of Economics. In 2005 he studied Corporate Finance at the Vienna University of Business and Economics. His professional career started as a Consultant in KPMG Russia in 2005, which he left two years later. Since 2007 he is also the co-founder of FCG, a corporate finance and M&A advisory firm in Russia and since 2013 he is also the non-executive co-founder of CarPrice one of the largest second-hand car marketplaces in Russia and Japan. In 2015, he co-founded AKTIVO a technology-backed real estate platform in Russia.

Vladimir Lupenko is a professional accountant, serial entrepreneur and angel investor. Lupenko’s latest entrepreneurial project is Impress, an invisible aligners company using a hybrid model of remote patient monitoring and in-person visits. The startup, headquartered in Barcelona but operating in several European countries, is regarded as one of the fastest-growing telemedicine companies in Europe.Originally from Russia, Lupenko holds a master’s in Economics from the Plekhanov Russian University of Economics. In 2005 he studied Corporate Finance at the Vienna University of Business and Economics. His professional career started as a Consultant in KPMG Russia in 2005, which he left two years later. Since 2007 he is also the co-founder of FCG, a corporate finance and M&A advisory firm in Russia and since 2013 he is also the non-executive co-founder of CarPrice one of the largest second-hand car marketplaces in Russia and Japan. In 2015, he co-founded AKTIVO a technology-backed real estate platform in Russia.

Founded in Silicon Valley by serial investor and founder of Google Ventures Bill Marris, Section 32 has multiple investment interests with medicine and biotech key amongst them. Marris himself has invested in over 500 companies, with over one-third resulting in IPO or M&A. Fifty of his portfolio companies have exceeded $1bn valuations, including Uber. Section 32 currently has 48 companies in its portfolio. Its most recent investments have included in Canadian remote medicine platform Cover Health’s $43m Series B round and in the $100m Series B round of US cancer detection software C2i Genomics, both in April 2021. In March 2021, it participated in the $48m Series A round of Dutch cell-based meat startup Meatable which leverages pluripotent stem cells for the first time in foodtech.

Founded in Silicon Valley by serial investor and founder of Google Ventures Bill Marris, Section 32 has multiple investment interests with medicine and biotech key amongst them. Marris himself has invested in over 500 companies, with over one-third resulting in IPO or M&A. Fifty of his portfolio companies have exceeded $1bn valuations, including Uber. Section 32 currently has 48 companies in its portfolio. Its most recent investments have included in Canadian remote medicine platform Cover Health’s $43m Series B round and in the $100m Series B round of US cancer detection software C2i Genomics, both in April 2021. In March 2021, it participated in the $48m Series A round of Dutch cell-based meat startup Meatable which leverages pluripotent stem cells for the first time in foodtech.

Chairman and co-founder of Everimpact

Jan Mattsson is a former senior UN official and the head of an ESG management consultancy. He is also chairman and co-founder of Everimpact, a GHG monitoring company that uses satellites, ground sensors, AI and machine learning to deliver more reliable carbon emissions data to public bodies, municipalities, and businesses. Mattsson has four decades of experience in development, humanitarian and peacekeeping operations, and has led operations and programs in Asia, Africa, Latin America and Central Asia. He spent nearly 14 years as UN Under-Secretary-General and Executive Director of the United Nations Office for Project Services (UNOPS), the operational arm of the UN. Over his professional career, Mattsson has also engaged with international organizations such as the World Bank and the Green Climate Fund. Outside of Everimpact, Mattsson is founder and CEO of M-Trust Leadership AB, an independent ESG and sustainable development management consultancy. He chairs the board of the Museum for the United Nations, and 4Life Solutions (formerly known as SolarSack), a company offering a solar-powered product that can provide safe drinking water to low-income and vulnerable communities. Mattsson also serves on the boards of The Management Lab, which aims to help investors analyze the social and environmental impact of their investments and philanthropy, as well as the World Benchmarking Alliance, an Amsterdam-based non-profit organization that aims to measure and incentivise businesses’ contributions towards the UN SDGs.

Jan Mattsson is a former senior UN official and the head of an ESG management consultancy. He is also chairman and co-founder of Everimpact, a GHG monitoring company that uses satellites, ground sensors, AI and machine learning to deliver more reliable carbon emissions data to public bodies, municipalities, and businesses. Mattsson has four decades of experience in development, humanitarian and peacekeeping operations, and has led operations and programs in Asia, Africa, Latin America and Central Asia. He spent nearly 14 years as UN Under-Secretary-General and Executive Director of the United Nations Office for Project Services (UNOPS), the operational arm of the UN. Over his professional career, Mattsson has also engaged with international organizations such as the World Bank and the Green Climate Fund. Outside of Everimpact, Mattsson is founder and CEO of M-Trust Leadership AB, an independent ESG and sustainable development management consultancy. He chairs the board of the Museum for the United Nations, and 4Life Solutions (formerly known as SolarSack), a company offering a solar-powered product that can provide safe drinking water to low-income and vulnerable communities. Mattsson also serves on the boards of The Management Lab, which aims to help investors analyze the social and environmental impact of their investments and philanthropy, as well as the World Benchmarking Alliance, an Amsterdam-based non-profit organization that aims to measure and incentivise businesses’ contributions towards the UN SDGs.

Infinited Fiber: Producing biofibers for fashion to move toward circular economy

Supported by H&M, Adidas and textile manufacturers, Infinited Fiber is helping the world’s second most polluting industry go greener by turning industrial waste into regenerated biomaterials

Cautiously opportunistic: How Indonesian VCs are riding out the Covid-19 crisis

Indonesian VCs on how they are doing deals during Covid-19, and their advice to startups, from how to cut costs to M&A

Autodrive Solutions: Making driverless vehicles safer with high-precision positioning tech

A Spanish university's research on sophisticated weapons detection technology is being used to prevent accidents in the mobility and transport sectors

Xampla: Making strong, low-cost biodegradable plastic from peas

Inspired by the strength of spider silk, the Cambridge University spinoff has produced a plant-based, completely compostable alternative to microplastics

Carlos Guerrero: The legal guardian of tech startups

The lawyer and investor dives deep in the Spanish startup ecosystem, supporting young tech companies with both financial and specialized legal support

Qlue on international expansion, privacy concerns in smart cities

Qlue's CEO Rama Raditya and CCO Maya Arvini on protecting individual privacy when handling citizens' data in smart cities, the lack of clarity in regulation of use of facial recognition technology in Indonesia

Gojek acquires Indonesian POS startup Moka, gains greater share of SME fintech market

Deal reportedly worth $120m will add Moka's network of over 30,000 merchants to Gojek's reach

This voice technology startup empowers both developers and machines

AISpeech shifted its business from education to IoT but has always remained focused on voice interaction between humans and machines

After a Covid-led boom in 2020, what next for China's K-12 edtech?

Unicorns Yuanfudao and Zuoyebang raised more than $6bn combined last year as demand for online learning continues to grow, but some smaller players are running out of cash

UPDATE: Indonesian mPOS startup Cashlez raises IDR 85bn from IPO in May

Cashlez is the first fintech company to list on the Indonesia Stock Exchange; will spend over 60% of proceeds to acquire payments company in toll road market

Medigo teams up with Indonesian Medical Association to launch primary care clinic network

Medigo aims to support healthcare operators with its clinic management SaaS, booking and medical records app for patients and more

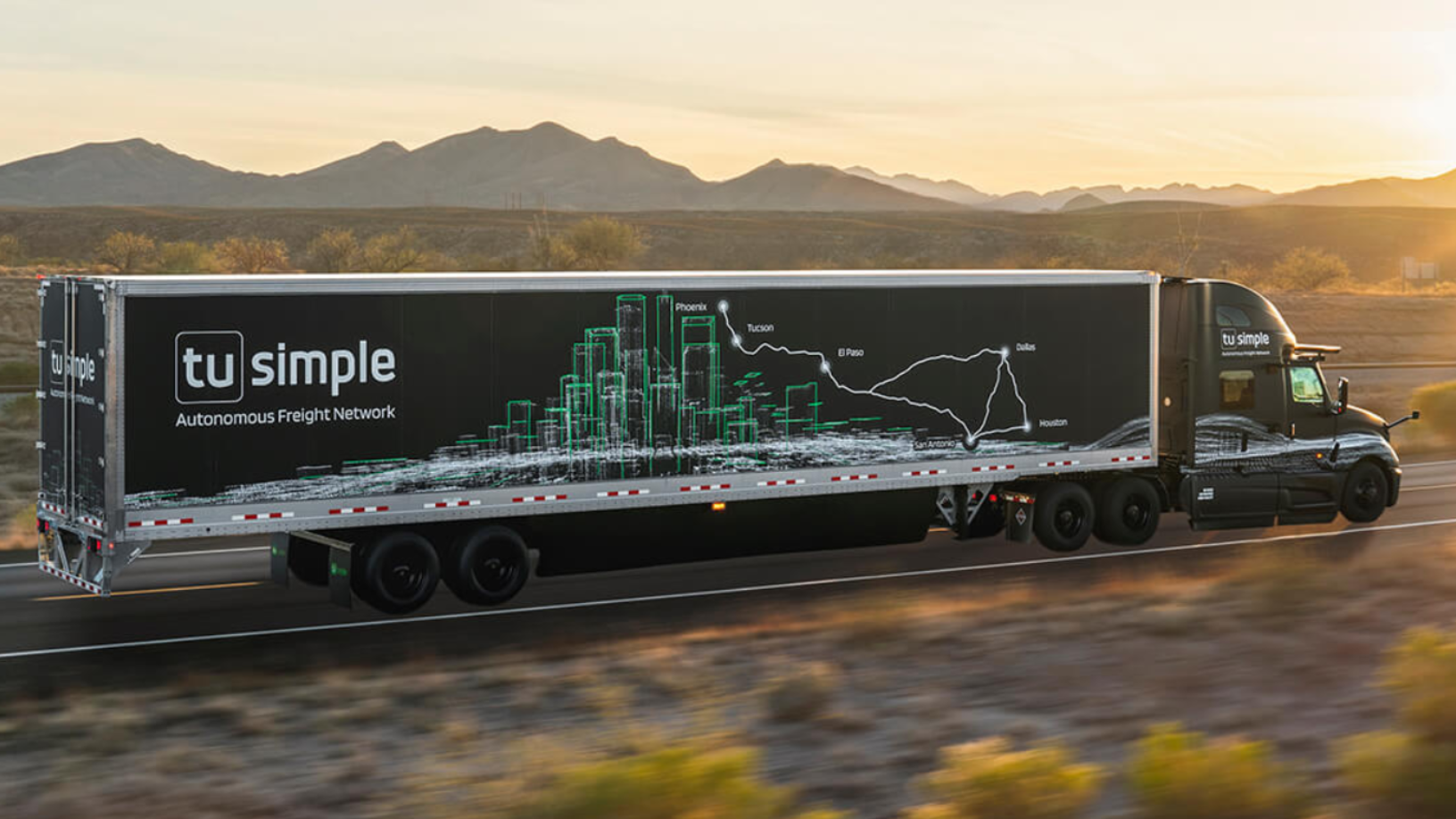

TuSimple: Banking on autonomous trucking in the US

TuSimple aims to scale its Waymo-style driverless trucking network to disrupt the $4tn global truck freight market starting with the US, with mass production by 2024

Traveloka CTO Derianto Kusuma resigns

The co-founder cites a changing ecosystem and company direction for his decision, while hinting at a new venture

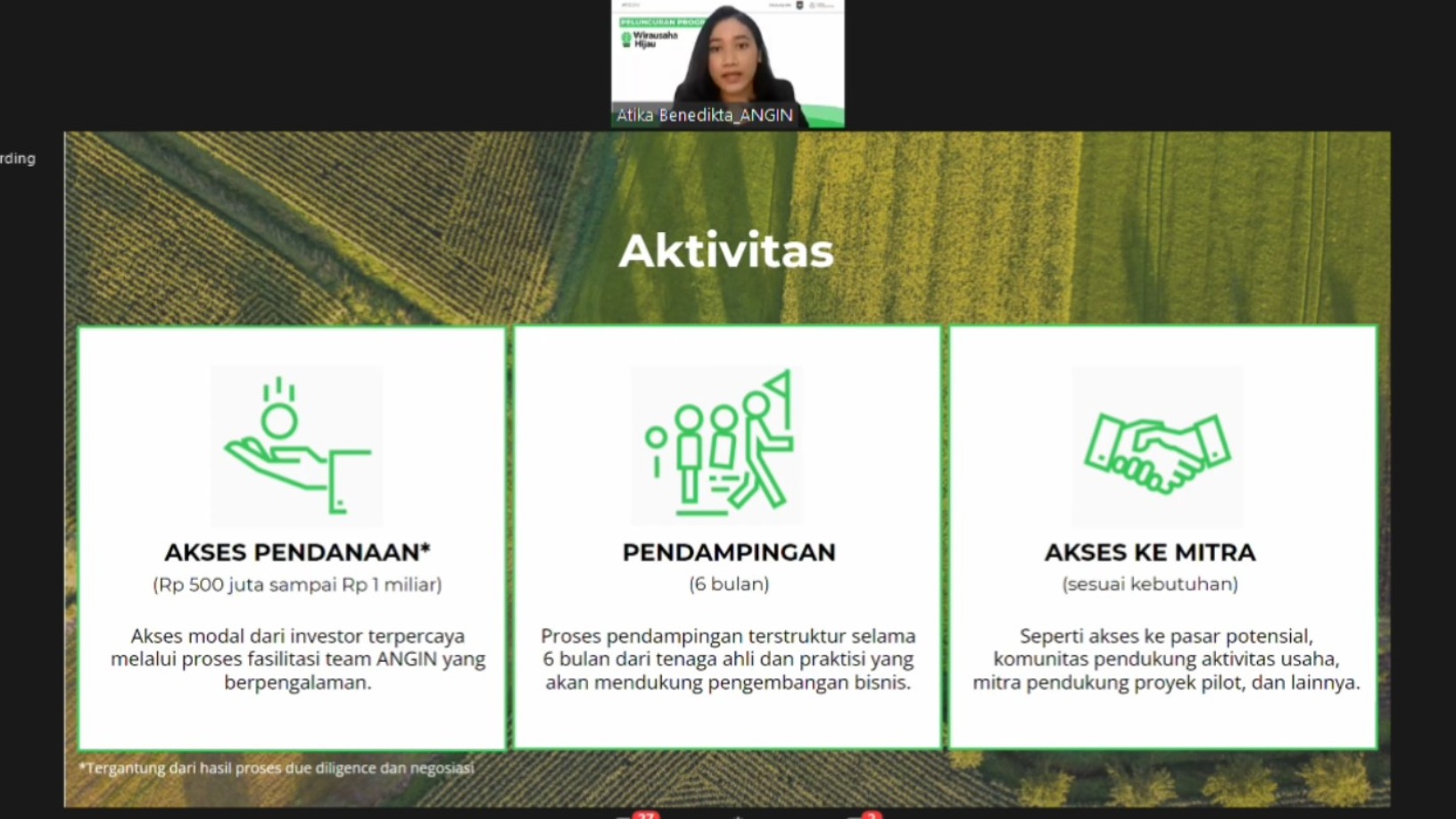

Indonesian angel investor network ANGIN launches agrifood incubator

Program targets ESG investment and builds on the strong potential of Indonesia’s agriculture sector, which kept growing despite the Covid-19 pandemic

A new unicorn rises as OVO's $1bn valuation confirmed

The Lippo Group subsidiary continues to grow in strength as it battles for market share with Gojek’s e-wallet and others

Sorry, we couldn’t find any matches for“M%26A”.