Rent the Runway

-

DATABASE (998)

-

ARTICLES (811)

Juan García Perrote is an IESE Business School MBA graduate with over 10 years of experience in executive marketing roles. He is also serial entrepreneur in marketplace and digital marketing startups. He was the co-founder of Tick4all, the “last-minute of movie-tickets,” offering discounted seats at local cinemas, and COO of the referral marketing platform Fulltip. He was also partner and CEO of the digital marketing company Smart Client.Currently, he is CEO and founder of Ketplace, a marketplace sales management consultancy advising companies how to get the best sales performance in leading marketplaces such as Amazon, eBay, and AliExpress. García Perrote is also a partner and advisor in The Beemine Lab, the first biotechnology company in Spain to produce cannabidiol-based cosmetics.

Juan García Perrote is an IESE Business School MBA graduate with over 10 years of experience in executive marketing roles. He is also serial entrepreneur in marketplace and digital marketing startups. He was the co-founder of Tick4all, the “last-minute of movie-tickets,” offering discounted seats at local cinemas, and COO of the referral marketing platform Fulltip. He was also partner and CEO of the digital marketing company Smart Client.Currently, he is CEO and founder of Ketplace, a marketplace sales management consultancy advising companies how to get the best sales performance in leading marketplaces such as Amazon, eBay, and AliExpress. García Perrote is also a partner and advisor in The Beemine Lab, the first biotechnology company in Spain to produce cannabidiol-based cosmetics.

One of the earliest and independent VC firms in China, Chengwei Capital was founded in Shanghai in 1999. It’s also the first and only evergreen fund in China.With Yale University Endowment as its largest investor, the VC limited partners also include institutional investors from around the world. With a portfolio of about 30 companies, the firm mainly invests in manufacturing, consumer goods, education, internet and petroleum & natural gas.In 2012, Chengwei and China Europe International Business School (CEIBS) jointly launched the $100m CEIBS-Chengwei Venture Capital Fund to invest in early- and growth-stage companies founded or managed by CEIBS alumni. The VC also seeks to support entrepreneurs to build sustainable businesses over a long period of time, acting as their long-term business partner.

One of the earliest and independent VC firms in China, Chengwei Capital was founded in Shanghai in 1999. It’s also the first and only evergreen fund in China.With Yale University Endowment as its largest investor, the VC limited partners also include institutional investors from around the world. With a portfolio of about 30 companies, the firm mainly invests in manufacturing, consumer goods, education, internet and petroleum & natural gas.In 2012, Chengwei and China Europe International Business School (CEIBS) jointly launched the $100m CEIBS-Chengwei Venture Capital Fund to invest in early- and growth-stage companies founded or managed by CEIBS alumni. The VC also seeks to support entrepreneurs to build sustainable businesses over a long period of time, acting as their long-term business partner.

The Plantbase Foundation is a non-profit institution run by entrepreneur and impact investor Willem Blom based in The Netherlands. Most of the Plantbase activities are backed by donors. At least 80% of the donations are used to support enterprises that facilitate the shift from animal agriculture to a vegan lifestyle. The foundation has invested in foodtechs involved in the meat, fish and dairy industries; as well as food delivery and apps. Its portfolio includes fast-growing startups like Heura, Meatable, Livekindly and Mission Barns. It also works with investment partners like Kale United, Mile High Vegan Network, Vegan Entrepreneurs Network and GlassWall Syndicate.

The Plantbase Foundation is a non-profit institution run by entrepreneur and impact investor Willem Blom based in The Netherlands. Most of the Plantbase activities are backed by donors. At least 80% of the donations are used to support enterprises that facilitate the shift from animal agriculture to a vegan lifestyle. The foundation has invested in foodtechs involved in the meat, fish and dairy industries; as well as food delivery and apps. Its portfolio includes fast-growing startups like Heura, Meatable, Livekindly and Mission Barns. It also works with investment partners like Kale United, Mile High Vegan Network, Vegan Entrepreneurs Network and GlassWall Syndicate.

Green Angel Syndicate (GSA) is an angel investment syndicate fund headquartered in the UK and joined by over 250 members. GSA’s investments are mostly focused on technologies that can tackle climate change and global warming issues. As of December 2020, the firm has, directly and indirectly, contributed to saving more than 20,000 tones of CO2 and increased its emissions savings by 88% throughout the year.The fund has invested over £10m in startups in their early-stage and operating across 10 different sectors. GSA is also behind the EIS Climate Change Fund, a co-investment fund in deals managed by GSA. In 2019, GSA was recognized as the UK Business Angels Association Angel Syndicate of the Year.

Green Angel Syndicate (GSA) is an angel investment syndicate fund headquartered in the UK and joined by over 250 members. GSA’s investments are mostly focused on technologies that can tackle climate change and global warming issues. As of December 2020, the firm has, directly and indirectly, contributed to saving more than 20,000 tones of CO2 and increased its emissions savings by 88% throughout the year.The fund has invested over £10m in startups in their early-stage and operating across 10 different sectors. GSA is also behind the EIS Climate Change Fund, a co-investment fund in deals managed by GSA. In 2019, GSA was recognized as the UK Business Angels Association Angel Syndicate of the Year.

Founded in 2011 in Leipzig, Monkfish Equity offers a hands-off investment approach, providing funding of €0.5m–€2m to enterprises across market segments in Germany, other European countries and the US.The firm is run by the co-founders of travel and hotel platform Trivago. Monkfish’s portfolio of 12 companies mainly comprises businesses in the B2C markets. Investments include the $54m Series B round of Austrian marketplace Refurbed in August 2021 and the €8m Series A round of Inne, a German fertility-tracking platform in October 2019.

Founded in 2011 in Leipzig, Monkfish Equity offers a hands-off investment approach, providing funding of €0.5m–€2m to enterprises across market segments in Germany, other European countries and the US.The firm is run by the co-founders of travel and hotel platform Trivago. Monkfish’s portfolio of 12 companies mainly comprises businesses in the B2C markets. Investments include the $54m Series B round of Austrian marketplace Refurbed in August 2021 and the €8m Series A round of Inne, a German fertility-tracking platform in October 2019.

The NYSE-listed Chinese auto content and marketing online operator is also one of the biggest players in the auto e-commerce market. Tencent, JD.com and Baidu together own almost a 34% stake in BitAuto, which started out as a platform connecting auto sellers with buyers.is also one of the biggest players in the auto e-commerce market. Tencent, JD.com and Baidu together own almost a 34% stake in BitAuto, which started out as a platform connecting auto sellers with buyers.

The NYSE-listed Chinese auto content and marketing online operator is also one of the biggest players in the auto e-commerce market. Tencent, JD.com and Baidu together own almost a 34% stake in BitAuto, which started out as a platform connecting auto sellers with buyers.is also one of the biggest players in the auto e-commerce market. Tencent, JD.com and Baidu together own almost a 34% stake in BitAuto, which started out as a platform connecting auto sellers with buyers.

Jose Maria Tarragó was the VP of Ficosa International, a global provider in research, development and manufacturing of advanced technology for the motor and mobility sectors. He was also VP of Carbures Europe that specialized in the design and manufacture of engineering systems for automotive, aerospace and security industries. In 2015, Tarragó and his four brothers founded the Lacus Group that invests and mentors new tech companies and industrial manufacturers. He is also an adviser to the Eurofred Group.

Jose Maria Tarragó was the VP of Ficosa International, a global provider in research, development and manufacturing of advanced technology for the motor and mobility sectors. He was also VP of Carbures Europe that specialized in the design and manufacture of engineering systems for automotive, aerospace and security industries. In 2015, Tarragó and his four brothers founded the Lacus Group that invests and mentors new tech companies and industrial manufacturers. He is also an adviser to the Eurofred Group.

New York-based Humboldt Fund invests in startups with the potential to solve critical issues of our time across the areas of food production, healthcare, energy, and construction and manufacturing materials. It currently has 14 companies in its portfolio. Its most recent investments include in the March 2021 $48m Series A round of Dutch cell-based meat startup Meatable which leverages pluripotent stem cells for the first time in foodtech, and in the February 2021 $16m seed round of US biotech Cellino Biotech.

New York-based Humboldt Fund invests in startups with the potential to solve critical issues of our time across the areas of food production, healthcare, energy, and construction and manufacturing materials. It currently has 14 companies in its portfolio. Its most recent investments include in the March 2021 $48m Series A round of Dutch cell-based meat startup Meatable which leverages pluripotent stem cells for the first time in foodtech, and in the February 2021 $16m seed round of US biotech Cellino Biotech.

Li Bin is the founder and CEO of BitAuto.com, China’s first NYSE-listed auto content and marketing online operator, and the founder and CEO of NextEV, an electric automobile development company that launched the world’s fastest electric car.

Li Bin is the founder and CEO of BitAuto.com, China’s first NYSE-listed auto content and marketing online operator, and the founder and CEO of NextEV, an electric automobile development company that launched the world’s fastest electric car.

Rothenberg Ventures is a Silicon Valley VC, also previously known as Frontier Technology Venture Capital. Based in San Francisco, the VC was also a spin-off from River Ecosystem. Founded with seed capital of $5m raised by Mike Rothenberg in 2012, the firm has invested in more than 100 startups in VR/AR, AI, machine learning, drones, robotics and space. In 2016, the VC and its founder were investigated by the US Securities and Exchange Commission. In 2018, Rothenberg himself and the VC were charged with fraud. Rothenberg has resigned from the firm and agreed to be barred from the brokerage and investment advisory business for five years. The SEC is seeking $18.8m disgorgement penalties and $9m civil penalty plus $3.7m pre-judgement interest.

Rothenberg Ventures is a Silicon Valley VC, also previously known as Frontier Technology Venture Capital. Based in San Francisco, the VC was also a spin-off from River Ecosystem. Founded with seed capital of $5m raised by Mike Rothenberg in 2012, the firm has invested in more than 100 startups in VR/AR, AI, machine learning, drones, robotics and space. In 2016, the VC and its founder were investigated by the US Securities and Exchange Commission. In 2018, Rothenberg himself and the VC were charged with fraud. Rothenberg has resigned from the firm and agreed to be barred from the brokerage and investment advisory business for five years. The SEC is seeking $18.8m disgorgement penalties and $9m civil penalty plus $3.7m pre-judgement interest.

This Luxembourg-based venture capital firm was established in 2004 and has offices in Silicon Valley and Madrid, managing over €170 million in capital. It invests in early-stage, deeptech companies in the Iberian peninsula, France, the UK, and Ireland. The VC has a particular focus on AI, cybersecurity and big data. In 2019, it won the Spanish VC Deal of the Year 2019, alongside Caixa Capital Risc, for the sale of PlayGiga.Adara Ventures currently has 15 companies in its portfolio following eight exits totalling $1.2bn in value. Its most recent investments include leading the €2m seed round of medtech IOMED Medical Solutions, which converts medical text into extractable data, and in the €8m seed round of biotech startup QUIBIM – both Spanish companies.

This Luxembourg-based venture capital firm was established in 2004 and has offices in Silicon Valley and Madrid, managing over €170 million in capital. It invests in early-stage, deeptech companies in the Iberian peninsula, France, the UK, and Ireland. The VC has a particular focus on AI, cybersecurity and big data. In 2019, it won the Spanish VC Deal of the Year 2019, alongside Caixa Capital Risc, for the sale of PlayGiga.Adara Ventures currently has 15 companies in its portfolio following eight exits totalling $1.2bn in value. Its most recent investments include leading the €2m seed round of medtech IOMED Medical Solutions, which converts medical text into extractable data, and in the €8m seed round of biotech startup QUIBIM – both Spanish companies.

Ribbit Capital is a Silicon Valley VC that focuses on fintech-related startups. Founded in 2012, Ribbit Capital posits that the financial services industry has largely remained unchanged despite the developments in technology in the past decade. The company’s “mantra” states that it is a believer in consumers and businesses moving to mobile, and this will lead to major changes in how financial services are provided in the future.The company has invested in a wide range of fintech startups and technologies, including stock trading app Robinhood, cryptocurrency exchange platform Coinbase, and Revolut, one of the earliest “challenger banks” that primarily serves retail customers through digital, app-based services. In March 2021, US retail giant Walmart announced a partnership with Ribbit Capital to develop fintech products. Ribbit Capital made its first investment in the Southeast Asia region in that same month, when it led a $65m Series A extension into Indonesian investment platform Ajaib.

Ribbit Capital is a Silicon Valley VC that focuses on fintech-related startups. Founded in 2012, Ribbit Capital posits that the financial services industry has largely remained unchanged despite the developments in technology in the past decade. The company’s “mantra” states that it is a believer in consumers and businesses moving to mobile, and this will lead to major changes in how financial services are provided in the future.The company has invested in a wide range of fintech startups and technologies, including stock trading app Robinhood, cryptocurrency exchange platform Coinbase, and Revolut, one of the earliest “challenger banks” that primarily serves retail customers through digital, app-based services. In March 2021, US retail giant Walmart announced a partnership with Ribbit Capital to develop fintech products. Ribbit Capital made its first investment in the Southeast Asia region in that same month, when it led a $65m Series A extension into Indonesian investment platform Ajaib.

Lever VC was founded in 2018 by Nick Cooney, an early investor of Beyond Meat and Memphis Meats. He is also the co-founder of Good Food Institute. Lever has currently invested in 14 startups from the US, Europe, Asia and Latin America.Focused on investments in early-stage alternative protein companies, the firm announced the first close of its Lever VC Fund I in August 2020, with its fourth close at $46m in April 2021. The final close will be completed by June 2021. Investors in the fund include NFL and NBA athletes, British nobility, food businesses, alt-protein companies and family offices as limited partners.In June 2020, Lever launched a $28m joint investment fund and accelerator to invest in Chinese plant-based and cell-cultivated meat and dairy companies. The Lever China Alternative Protein Fund will invest RMB 40m in alt-protein companies in mainland China over the next four years.

Lever VC was founded in 2018 by Nick Cooney, an early investor of Beyond Meat and Memphis Meats. He is also the co-founder of Good Food Institute. Lever has currently invested in 14 startups from the US, Europe, Asia and Latin America.Focused on investments in early-stage alternative protein companies, the firm announced the first close of its Lever VC Fund I in August 2020, with its fourth close at $46m in April 2021. The final close will be completed by June 2021. Investors in the fund include NFL and NBA athletes, British nobility, food businesses, alt-protein companies and family offices as limited partners.In June 2020, Lever launched a $28m joint investment fund and accelerator to invest in Chinese plant-based and cell-cultivated meat and dairy companies. The Lever China Alternative Protein Fund will invest RMB 40m in alt-protein companies in mainland China over the next four years.

Founders Fund is a San Francisco-based VC set up in 2005 that currently has more than $3bn of assets under management. It invests across the tech, aerospace and biotechnology sectors and has been an early backer of some of the most impactful tech companies including Airbnb, Facebook, and SpaceX. It has a key interest in solving major problems such as the opioid crisis in the US.Its recent investments include in the June 2021 $85m Series C round of Portuguese home physiotherapy tech solution SWORD Health, the world’s fastest-growing musculoskeletal solution, and in the July 2021 $80m Series C round of residential real estate platform Sundae. The company has managed over 80 exits including Facebook and Spotify and has made over 500 investments, leading approximately one-third of these.

Founders Fund is a San Francisco-based VC set up in 2005 that currently has more than $3bn of assets under management. It invests across the tech, aerospace and biotechnology sectors and has been an early backer of some of the most impactful tech companies including Airbnb, Facebook, and SpaceX. It has a key interest in solving major problems such as the opioid crisis in the US.Its recent investments include in the June 2021 $85m Series C round of Portuguese home physiotherapy tech solution SWORD Health, the world’s fastest-growing musculoskeletal solution, and in the July 2021 $80m Series C round of residential real estate platform Sundae. The company has managed over 80 exits including Facebook and Spotify and has made over 500 investments, leading approximately one-third of these.

Fortum Oyj is a Finnish state-owned energy company operating power plants and co-generation plants across the nation. Listed on the NASDAQ OMX Helsinki stock exchange, Fortum is reputed to be Finland’s biggest company in terms of revenue generated in 2020.It is also Europe's third-largest producer of carbon-free electricity and the second-largest producer of nuclear power. Ranked as the fifth largest heat producer globally, Fortum supplies electricity and heating directly to consumers in Finland, Germany, Central Europe, the UK and the Nordic countries.Fortum invested in Finnish cleantech Infinited Fiber, taking up a 4% stake in 2019, to complement the energy company’s biorefining value chain and to improve resource efficiency. The cleantech investee aims to license its biodegradable fiber technology to help industry partners to manufacture innovative materials from textile and industrial waste.

Fortum Oyj is a Finnish state-owned energy company operating power plants and co-generation plants across the nation. Listed on the NASDAQ OMX Helsinki stock exchange, Fortum is reputed to be Finland’s biggest company in terms of revenue generated in 2020.It is also Europe's third-largest producer of carbon-free electricity and the second-largest producer of nuclear power. Ranked as the fifth largest heat producer globally, Fortum supplies electricity and heating directly to consumers in Finland, Germany, Central Europe, the UK and the Nordic countries.Fortum invested in Finnish cleantech Infinited Fiber, taking up a 4% stake in 2019, to complement the energy company’s biorefining value chain and to improve resource efficiency. The cleantech investee aims to license its biodegradable fiber technology to help industry partners to manufacture innovative materials from textile and industrial waste.

Chic by Choice: From Forbes' 30 Under 30 to insolvency

Lack of cashflow was the main reason for the demise of Chic by Choice, Europe's leading luxury dress rental e-store

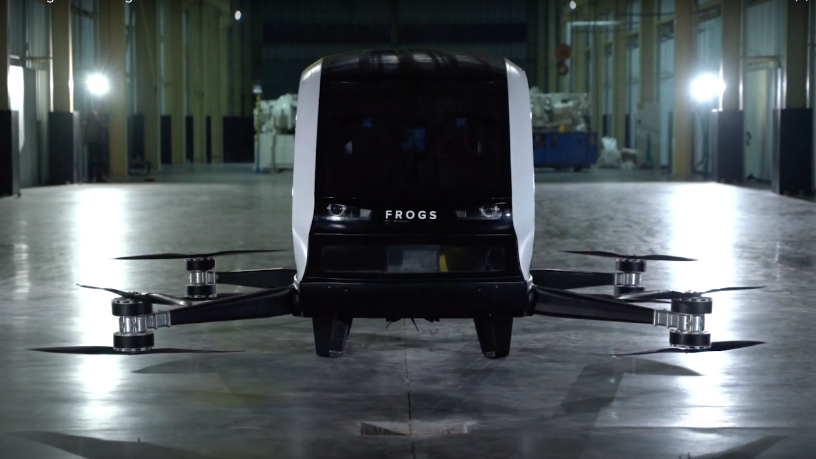

FROGS: Overcoming challenges to launch Indonesia's first drone-taxi for daily commutes

The Yogyakarta-based startup backed by UMG Idealab seeks more technical resources to launch Indonesia's first homegrown “flying taxi,” after the success of its agritech drones

Catalonia: Spain's fast-rising robotics hub and next opportunity

With the robotics sector on the rise in Catalonia, expect to see more growth ahead, driving opportunities in related segments, especially services

Have you ever bought expensive equipment but seldom used it? Do you want to try the latest electronic gadgets at low cost? Try this online sharing and rental platform

FuVeX: Long-range hybrid-technology drones for multiple business uses

With its innovative hybrid helicopter and airplane technology, FuVeX is poised to take full advantage of the business opportunities afforded by new European regulations governing long-range drones

Oyika wants to help 30,000 Indonesian riders switch to electric motorcycles

With unlimited battery swaps and round-the-clock service, the Singapore startup is targeting ride-hailing and delivery drivers in Indonesia, a market with a growing appetite for electric motorcycles

Chinese startup Xianghuanji takes a gamble on smartphone leasing

Now you can rent the newest phones for half the price of an upgrade

DORM: New-generation housing for Indonesia’s tech-savvy, community-driven students

Combining online features with offline services, DORM goes way beyond what the market typically offers in student accommodation

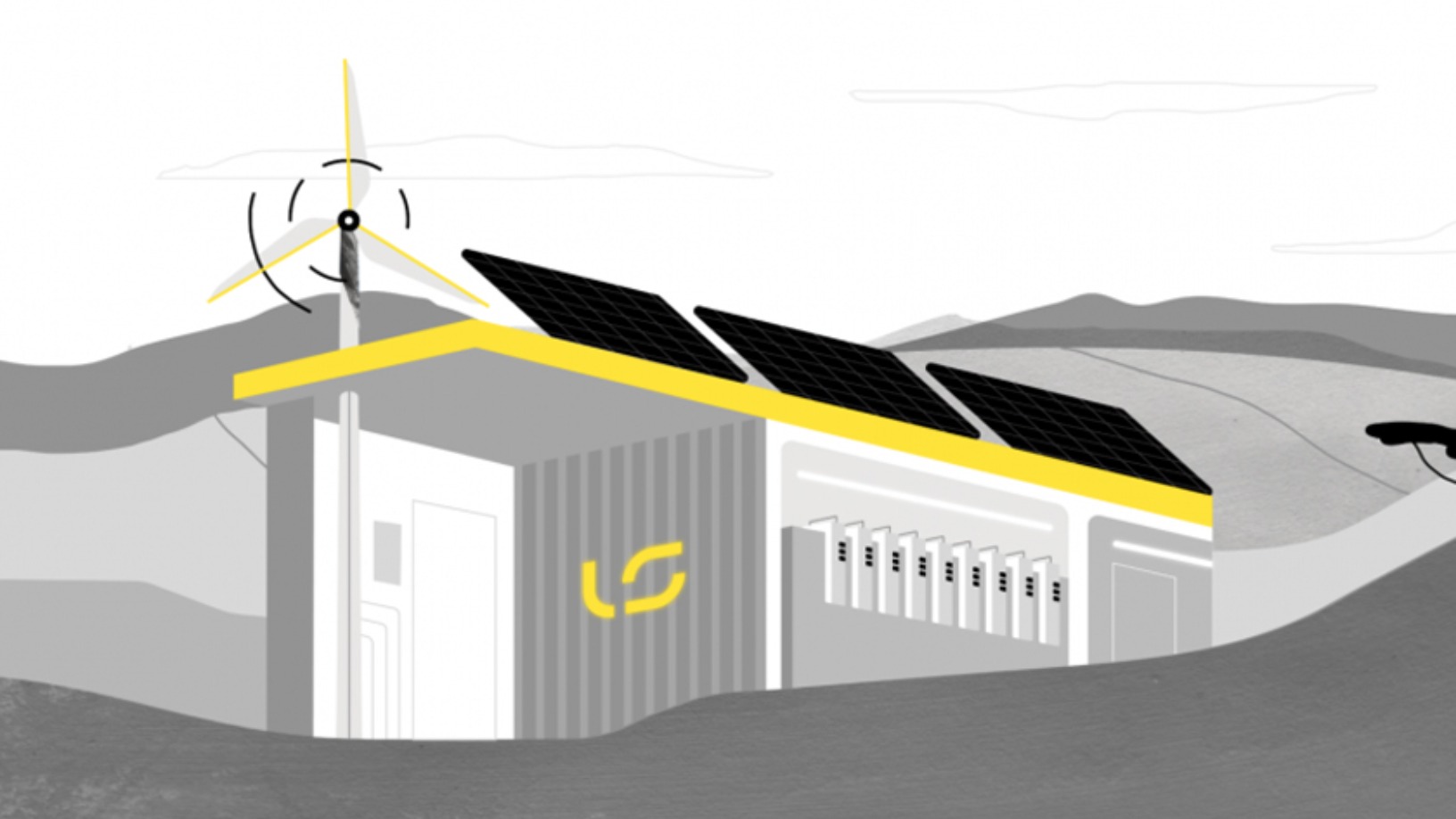

Liquidstar: Bringing decentralized renewable energy to off-grid communities

Using a blockchain-based platform, Liquidstar wants to use smart, modular batteries to power remote, off-grid communities as well as homes, offices and EVs in cities

Fintech startup Xendit launches aid program for Indonesian businesses amid Covid-19 crisis

Xendit is helping more SMEs go online by waiving transaction fees for its digital payments solution for the first month

eCooltra CEO: Offline-to-online leader in two-wheel sharing economy

Timo Buetefisch, the CEO and co-founder of Europe's largest scooter rental firm Cooltra, discusses the successful offline-to-online shift to scooter-sharing app eCooltra

With a new focus on smart clinics, healthcare SaaS startup Medigo offers Covid-19 testing

A pivot to revenue-sharing and partnerships to provide Covid-19 testing has given Medigo a fighting chance, with a new funding round on the cards

HighPitch: E-grocery marketplace Pasar20 and healthcare edtech Appskep top the Medan chapter

Representing Sumatra’s startup ecosystem in the national finals later in November, Pasar20 and Appskep have ambitious expansion plans in store

Backed by Kleiner Perkins, Spotahome clinches Spain’s first Silicon Valley-led funding

Now in Europe’s US$500 billion home rental market, the Spanish proptech will soon expand to LatAm, the US and Asia

EV maker Xpeng Motors partners Didi to offer car rentals and better charging services

Besides working with China's largest ride-hailing platform, Xpeng Motors has also connected to the charging networks of EV maker NIO and TELD, China's biggest EV charging network

Sorry, we couldn’t find any matches for“Rent the Runway”.