Shinhan Future���s Lab

-

DATABASE (116)

-

ARTICLES (537)

Shinhan is a Korea-based investment bank that provides commercial and consumer banking-related financial and investment services, aiming to help clients achieve their goals by providing financial products and services that meet the latest trends while delivering high returns. It seeks innovative new solutions using a methodology it calls "creative finance," which it believes will attract more clients, in turn increasing Shinhan’s corporate value and leading to a "virtuous cycle of shared prosperity."

Shinhan is a Korea-based investment bank that provides commercial and consumer banking-related financial and investment services, aiming to help clients achieve their goals by providing financial products and services that meet the latest trends while delivering high returns. It seeks innovative new solutions using a methodology it calls "creative finance," which it believes will attract more clients, in turn increasing Shinhan’s corporate value and leading to a "virtuous cycle of shared prosperity."

Invest FWD A/S is an investment vehicle owned by Anders Holch Povlsen, founder of BESTSELLER and Heartland. It is also BESTSELLER’s investment arm for sustainable fashion. In June 2021, the firm made its investment by participating in a Series B round of Finnish cleantech Infinited Fiber. BESTSELLER’s sustainability innovation platform Fashion FWD Lab has been collaborating with Infinited Fiber over the past year to develop and patent Infinna™ fiber material. BESTSELLER has also signed a multi-year commercial agreement with Infinited Fiber to secure access to the startup’s regenerated fibers to be made from textile and other industrial waste.

Invest FWD A/S is an investment vehicle owned by Anders Holch Povlsen, founder of BESTSELLER and Heartland. It is also BESTSELLER’s investment arm for sustainable fashion. In June 2021, the firm made its investment by participating in a Series B round of Finnish cleantech Infinited Fiber. BESTSELLER’s sustainability innovation platform Fashion FWD Lab has been collaborating with Infinited Fiber over the past year to develop and patent Infinna™ fiber material. BESTSELLER has also signed a multi-year commercial agreement with Infinited Fiber to secure access to the startup’s regenerated fibers to be made from textile and other industrial waste.

DFS Lab is a fintech-centric incubator/accelerator company with a focus on emerging markets. Supported by a US$4.8 million grant from the Gates Foundation, many of the portfolio companies provide fintech products and also help to improve the financial literacy education for people in developing countries. About 50% of the startups are run by female co-founders and 73% originate from the emerging markets.

DFS Lab is a fintech-centric incubator/accelerator company with a focus on emerging markets. Supported by a US$4.8 million grant from the Gates Foundation, many of the portfolio companies provide fintech products and also help to improve the financial literacy education for people in developing countries. About 50% of the startups are run by female co-founders and 73% originate from the emerging markets.

Future Positive Capital is a Paris-based VC with a second office in London. Its investments cover deep-technology companies applying AI, biotechnology, synthetic biology, as well as robotics. Co-funded in 2016 by ex-Index Ventures associate Sofia Hmich along with Alexandre Terrien and Michael Rosen; it has made 18 investments to date. In 2019 Future Positive raised over $57m pan-European impact investment fund, claiming that most European VCs are continuing to staying focused on sectors, such as consumer, fintech, and marketing, or web and mobile technologies. Future Positive’s belief is that there is instead, a long-tail of investment opportunities to back businesses that actually tackle “the world’s most pressing problems”.Through this fund, it will back throughout Seed and Series A stages, with the possibility to follow up on Series B investing between around €300,000 and €5m. Since then the company has backed startups in the like of BioBeats, an AI company focused on preventative mental health, cell-based startup Meatable, and more recently NotCo, the Chilean unicorn disrupting the food and beverage sector with AI-enabled plant-based products.The team counts on an extensive network of mentors, innovators, impact angel investors and entrepreneurs such as F1 pilots Nico Rosberg, the MD of Alibaba France Sebastien Badault, the Omid Ashtari the President of Citymapper amongst others.

Future Positive Capital is a Paris-based VC with a second office in London. Its investments cover deep-technology companies applying AI, biotechnology, synthetic biology, as well as robotics. Co-funded in 2016 by ex-Index Ventures associate Sofia Hmich along with Alexandre Terrien and Michael Rosen; it has made 18 investments to date. In 2019 Future Positive raised over $57m pan-European impact investment fund, claiming that most European VCs are continuing to staying focused on sectors, such as consumer, fintech, and marketing, or web and mobile technologies. Future Positive’s belief is that there is instead, a long-tail of investment opportunities to back businesses that actually tackle “the world’s most pressing problems”.Through this fund, it will back throughout Seed and Series A stages, with the possibility to follow up on Series B investing between around €300,000 and €5m. Since then the company has backed startups in the like of BioBeats, an AI company focused on preventative mental health, cell-based startup Meatable, and more recently NotCo, the Chilean unicorn disrupting the food and beverage sector with AI-enabled plant-based products.The team counts on an extensive network of mentors, innovators, impact angel investors and entrepreneurs such as F1 pilots Nico Rosberg, the MD of Alibaba France Sebastien Badault, the Omid Ashtari the President of Citymapper amongst others.

Co-founder of FarmCloud

Pedro S. Sarmento is a Portuguese technology entrepreneur and co-founder of FarmCloud, where he was head of strategy from its founding in April 2016 until June 2017. From June 2017 until April 2018, Sarmento was head of product for PriOps, a blockchain API data sharing platform, after which he assumed the CFO role at Kolokium Blockchain Technologies, the firm that commercializes PriOps' product. Sarmento had previously worked in a variety of entrepreneurial roles, including in the aquaculture and used goods sectors. He holds an MBA specializing in Management from Lisbon Lusiada University.

Pedro S. Sarmento is a Portuguese technology entrepreneur and co-founder of FarmCloud, where he was head of strategy from its founding in April 2016 until June 2017. From June 2017 until April 2018, Sarmento was head of product for PriOps, a blockchain API data sharing platform, after which he assumed the CFO role at Kolokium Blockchain Technologies, the firm that commercializes PriOps' product. Sarmento had previously worked in a variety of entrepreneurial roles, including in the aquaculture and used goods sectors. He holds an MBA specializing in Management from Lisbon Lusiada University.

Headquartered in Washington DC, IDB Lab is the innovation arm of the Inter-American Development Bank Group (IDB) Group . Its investment vehicle, IDB Invest, aims to finance projects that foster innovation and inclusion in Latin America and the Caribbean area. . IDB Invest provides many types of financial support. It operates through blended finance to mobilize capital flows into emerging markets or provides loans to test new business models or injects equity into business ventures.

Headquartered in Washington DC, IDB Lab is the innovation arm of the Inter-American Development Bank Group (IDB) Group . Its investment vehicle, IDB Invest, aims to finance projects that foster innovation and inclusion in Latin America and the Caribbean area. . IDB Invest provides many types of financial support. It operates through blended finance to mobilize capital flows into emerging markets or provides loans to test new business models or injects equity into business ventures.

Founded in 2012 in Washington DC, Accion Venture Lab is a seed-stage investor in fintech for the underserved. Venture Lab is part of Accion, a not-for-profit global organization that works with financial service providers to deliver affordable solutions for unbanked and underbanked communities worldwide.Its portfolio includes 44 startups from 17 countries, ranging from Chile to Indonesia. Seed-stage startups normally get $500,000 funding per company. Investments in December 2020 included participation in the $1.5m seed round of Argentinian software development tech Henry and a financing round for Indonesian micro-credit fintech Pintech.

Founded in 2012 in Washington DC, Accion Venture Lab is a seed-stage investor in fintech for the underserved. Venture Lab is part of Accion, a not-for-profit global organization that works with financial service providers to deliver affordable solutions for unbanked and underbanked communities worldwide.Its portfolio includes 44 startups from 17 countries, ranging from Chile to Indonesia. Seed-stage startups normally get $500,000 funding per company. Investments in December 2020 included participation in the $1.5m seed round of Argentinian software development tech Henry and a financing round for Indonesian micro-credit fintech Pintech.

H&S Investment is a German investment company and accredited member of the Business Angels Network Germany (BAND). Founded by Martin Heubeck and Ulrich Stommel, the fund focuses on new technologies and innovations counting on over 25 years of experience in technology companies in Germany and overseas.

H&S Investment is a German investment company and accredited member of the Business Angels Network Germany (BAND). Founded by Martin Heubeck and Ulrich Stommel, the fund focuses on new technologies and innovations counting on over 25 years of experience in technology companies in Germany and overseas.

Founded in 2016, Paris-based Future Positive Capital invests in European startups in deep tech and biotechnology to solve major problems, with funding for only 20 portfolio startups. It has backed eight startups to date with its most recent investments being in the April 2021 undisclosed €5.2m funding round of French renewable energytech SWEETCH Energy and in the £7.9m Series A round of British ecosystem restoration technology Dendra Systems in September 2020.

Founded in 2016, Paris-based Future Positive Capital invests in European startups in deep tech and biotechnology to solve major problems, with funding for only 20 portfolio startups. It has backed eight startups to date with its most recent investments being in the April 2021 undisclosed €5.2m funding round of French renewable energytech SWEETCH Energy and in the £7.9m Series A round of British ecosystem restoration technology Dendra Systems in September 2020.

The municipal government of Wuhan launched Wuhan S&T Angel Venture Fund in September 2013. With RMB 300 million under management, the fund is operated by Wuhan S&T Angel Venture Fund Management Co., Ltd. It invests mainly in the information technology, new materials, advanced equipment manufacturing, biomedicine, new energy, automotive, energy conservation, environmental protection and modern agriculture fields.

The municipal government of Wuhan launched Wuhan S&T Angel Venture Fund in September 2013. With RMB 300 million under management, the fund is operated by Wuhan S&T Angel Venture Fund Management Co., Ltd. It invests mainly in the information technology, new materials, advanced equipment manufacturing, biomedicine, new energy, automotive, energy conservation, environmental protection and modern agriculture fields.

Silicon Valley Future Capital is a venture capital firm that invests primarily in early stage and growth stage companies with disruptive technologies or innovative business models. Founding partner Dr. Hong Miao used to be managing partner of CLI Ventures, senior VP of CheerLand Investment Group, executive president of the CL Institute of Innovation, and chairman of Zen Water Capital in Silicon Valley. The firm invests primarily in innovations in high-tech, including artificial intelligence, machine learning, big data, cloud computing, robotics, life science, biotech, precision medicine and other disruptive technologies.

Silicon Valley Future Capital is a venture capital firm that invests primarily in early stage and growth stage companies with disruptive technologies or innovative business models. Founding partner Dr. Hong Miao used to be managing partner of CLI Ventures, senior VP of CheerLand Investment Group, executive president of the CL Institute of Innovation, and chairman of Zen Water Capital in Silicon Valley. The firm invests primarily in innovations in high-tech, including artificial intelligence, machine learning, big data, cloud computing, robotics, life science, biotech, precision medicine and other disruptive technologies.

SPH Media Fund is a S$100 million venture capital fund set up by government-backed listed group, Singapore Press Holdings Limited.The fund invests in early growth technology companies globally. Although the fund is stage agnostic, most of the portfolio companies are at Series A or later. The size of the investment depends on the needs of the startup. A typical ticket size is between S$1 million and S$2 million, with possible bigger amounts of up to S$5 million per round.

SPH Media Fund is a S$100 million venture capital fund set up by government-backed listed group, Singapore Press Holdings Limited.The fund invests in early growth technology companies globally. Although the fund is stage agnostic, most of the portfolio companies are at Series A or later. The size of the investment depends on the needs of the startup. A typical ticket size is between S$1 million and S$2 million, with possible bigger amounts of up to S$5 million per round.

Invested and used by BlackRock, the pioneer in AI-based qualitative analysis-recommendation SaaS for ESG investments covers 100k+ funds, 25k listed firms, with 1,000 indicators.

Invested and used by BlackRock, the pioneer in AI-based qualitative analysis-recommendation SaaS for ESG investments covers 100k+ funds, 25k listed firms, with 1,000 indicators.

Accelerating Asia focuses on Asian startups for its three-month intensive acceleration program. The Singapore-based investor was founded in 2018 and focuses on diversity investments, with 40% of its portfolio companies being led by women.The firm invests up to S$200,000 in participating pre-Series A startups. All of the program’s startups receive S$50,000–75,000 with an additional investment of up to S$150,000 for top performing companies.To date, the early-stage VC has invested in 25 startups. Recent investments in 2020 include stakes in Bangladeshi mobility platform Shuttle and Indonesian startups KaryaKarsa and MyBrand.

Accelerating Asia focuses on Asian startups for its three-month intensive acceleration program. The Singapore-based investor was founded in 2018 and focuses on diversity investments, with 40% of its portfolio companies being led by women.The firm invests up to S$200,000 in participating pre-Series A startups. All of the program’s startups receive S$50,000–75,000 with an additional investment of up to S$150,000 for top performing companies.To date, the early-stage VC has invested in 25 startups. Recent investments in 2020 include stakes in Bangladeshi mobility platform Shuttle and Indonesian startups KaryaKarsa and MyBrand.

Besides farming strawberries in a tropical climate, Singapore-based Singrow plans to add more crops and a regional e-supermarket to offer consumers more locally grown produce.

Besides farming strawberries in a tropical climate, Singapore-based Singrow plans to add more crops and a regional e-supermarket to offer consumers more locally grown produce.

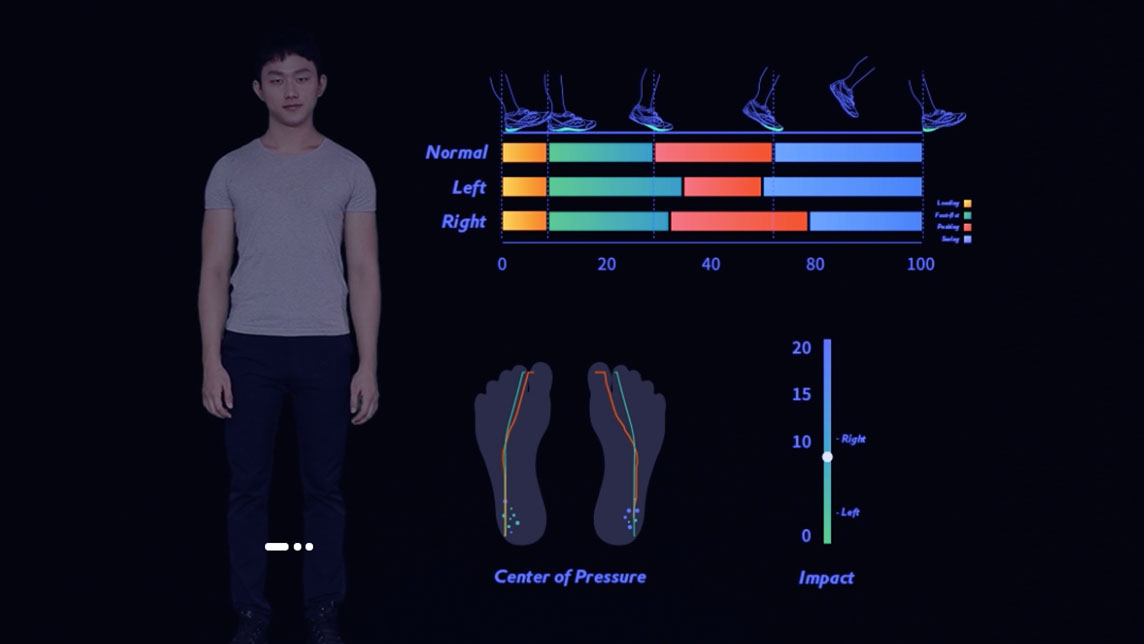

Sennotech offers affordable gait analysis on a mobile phone

Sennotech’s smart gait analysis system helps users choose comfy shoes, improve sports performance and foot health, and facilitate rehabilitation training

Alex Sicart: Democratizing the Internet with blockchain

The 20-year-old tech wiz and blockchain advocate is seeking a digital revolution where decentralized systems will empower societies

This app lets you show off your cat on social media

Is Meowcard the next big thing or a flash in the pan?

Venturra Capital's Raditya Pramana: Bear market "very close now"

In an interview, the Indonesian VC firm's newest partner also charts out the course for their new fund, Venturra Discovery

Have you ever bought expensive equipment but seldom used it? Do you want to try the latest electronic gadgets at low cost? Try this online sharing and rental platform

Gojek CEO resigns to join Indonesia's new cabinet; named education minister

Nadiem Makarim was confirmed as Indonesia's education and culture minister and will become "a passive shareholder" in Gojek

Alpha JWC Ventures bets on Indonesian fintech, analytics startups for big impact

A commitment to mentoring and supporting its portfolio companies also lies at the core of its business

In Portugal tourism tech gets disrupted, in time for post-Covid-19 era

As Portugal reopens to tourists early next month, the sector is banking on a new generation of tourism tech startups to enable safety and reassure visitors

Halofina brings wealth management to millennials

Indonesian startup extends service once reserved for the rich to a wider market so the young can invest toward their life goals

Spanish AI startups unleash the power of virtual assistants

More Spanish deep technology firms are shifting the paradigms in human-machine interactions, overhauling customer experience

Supermarkets can now go cashierless too, with Mars Rabbit's scan & go app

Chinese startup gives traditional retailers the tech ammunition and chance to beat Amazon and Alibaba at their own game

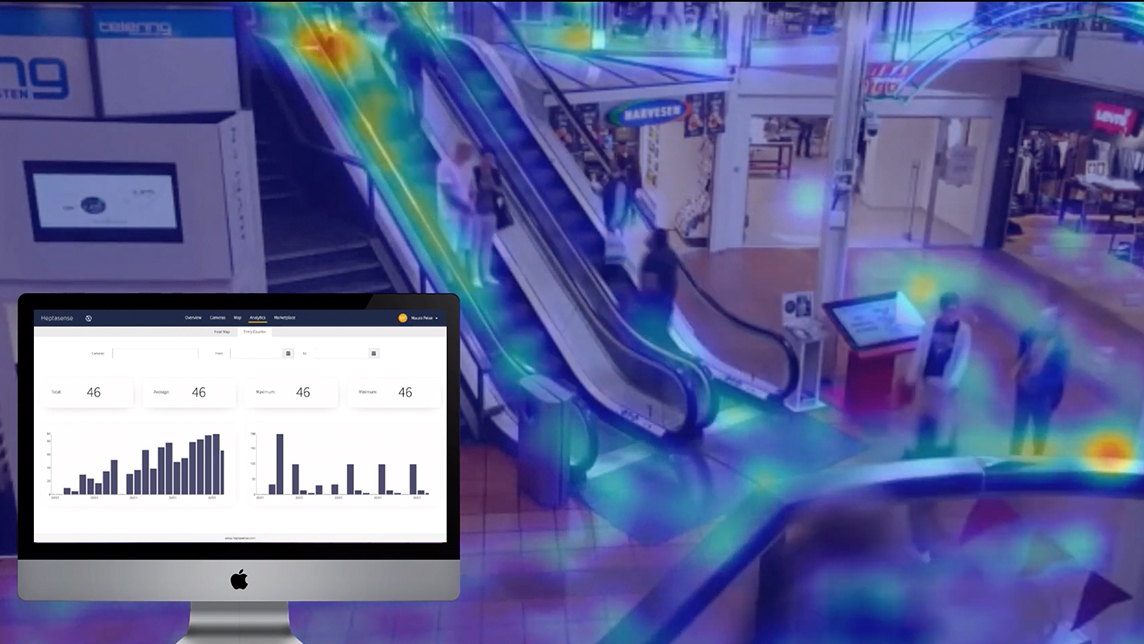

Heptasense wins trust at a time of (lax) global surveillance

There may be some 700 million surveillance cameras running worldwide in today's age of global security threats, yet 98% of them are unmonitored. A Lisbon-based startup is promising real-time response and greater reliability in security tech

Kobo360: Nigeria's Uber-style logistics startup turns pan-African dream into reality

Riding on Africa’s new free trade deal, Kobo360 aims to be the continent’s next unicorn by digitalizing logistics ops to transport goods quickly, reliably and more cheaply

More than desire: When resale sneakers become objects of speculation

Sneaker resale platforms like Poizon and Nice feel the heat as China regulators panned such trading for getting out of control

In depth: The business ecosystems China’s tech giants and unicorns build

Startups could accept to join Alibaba, Tencent or other tech giants in their ecosystems and scale quickly. Or they could say no and keep their independence. But do they really have a choice?

Sorry, we couldn’t find any matches for“Shinhan Future���s Lab”.