Superior%20Technological%20Institute%20%28IST%29

-

DATABASE (145)

-

ARTICLES (343)

Verizon Ventures is the venture capital arm of Verizon Communications, the US's largest wireless provider, established in 2000. It invests from Series A to IPO. Verizon Ventures has made more than 100 investments to date and managed 20 exits, including healthcare diagnostics company NantHealth and P2P video content service Streamroot. Recent investments include holographic lighting technology company Light Field Lab's US$28m Series A round and AI-powered mass transportation technology company Optibus's US$40m Series B round.

Verizon Ventures is the venture capital arm of Verizon Communications, the US's largest wireless provider, established in 2000. It invests from Series A to IPO. Verizon Ventures has made more than 100 investments to date and managed 20 exits, including healthcare diagnostics company NantHealth and P2P video content service Streamroot. Recent investments include holographic lighting technology company Light Field Lab's US$28m Series A round and AI-powered mass transportation technology company Optibus's US$40m Series B round.

Silicon Valley-based investor Sapphire Ventures was formerly known as SAP Ventures, the investment arm of the software giant SAP SE, until 2011. It typically invests in mid-stage startups with at least $5–10m in annual revenue across market verticals, geographies and technologies. It typically invests $10–50m (with the flexibility to invest less or up to $100m) as part of its initial investment. With approximately $4bn in assets under active management and more than 50 startups in its portfolio at present, Sapphire has also managed more than 35 exits and 20 IPOs. Its most recent investments include co-leading the $153m Series D round of workplace skills training platform Degreed in April 2021, and, in March 2021, it invested in two new unicorns. Sapphire contributed to US digital home workout tech Tonal’s $250m Series E round and to the $200m Series D round of Portugal’s Feedzai, the world’s market-leading solution in fighting online fraud.

Silicon Valley-based investor Sapphire Ventures was formerly known as SAP Ventures, the investment arm of the software giant SAP SE, until 2011. It typically invests in mid-stage startups with at least $5–10m in annual revenue across market verticals, geographies and technologies. It typically invests $10–50m (with the flexibility to invest less or up to $100m) as part of its initial investment. With approximately $4bn in assets under active management and more than 50 startups in its portfolio at present, Sapphire has also managed more than 35 exits and 20 IPOs. Its most recent investments include co-leading the $153m Series D round of workplace skills training platform Degreed in April 2021, and, in March 2021, it invested in two new unicorns. Sapphire contributed to US digital home workout tech Tonal’s $250m Series E round and to the $200m Series D round of Portugal’s Feedzai, the world’s market-leading solution in fighting online fraud.

Founded in Amsterdam in 2011, Rockstart is a global accelerator-VC focusing on sustainability startups across market segments. Rockstart also runs specialist programs like agrifood in Copenhagen, healthcare in the Dutch town of Nijmegen and also in emerging tech in Bogota, Colombia. It specializes in developing business relationships for portfolio startups with global corporates such as Maersk, Shell and the Dutch Ministry of Health. Rockstart has invested in more than 250 startups, valued at €750m in total.Launched in 2019, Rockstart’s €22m agrifood fund secured investment partners including Vaekstfonden’s Green Future Fund and global dairy cooperative Arla Foods. It has invested in 20 food enterprises like Swiss zero-waste supermarket Lyfa and Danish alt-leather startup Beyond Leather Materials in 2021. Rockstart’s energy fund recently invested in the €730,000 pre-seed round of Danish carbon sequestration corporate marketplace, Klimate, in September 2021. Exits include Wercker, iClinic, Brincr and 3D Hubs.

Founded in Amsterdam in 2011, Rockstart is a global accelerator-VC focusing on sustainability startups across market segments. Rockstart also runs specialist programs like agrifood in Copenhagen, healthcare in the Dutch town of Nijmegen and also in emerging tech in Bogota, Colombia. It specializes in developing business relationships for portfolio startups with global corporates such as Maersk, Shell and the Dutch Ministry of Health. Rockstart has invested in more than 250 startups, valued at €750m in total.Launched in 2019, Rockstart’s €22m agrifood fund secured investment partners including Vaekstfonden’s Green Future Fund and global dairy cooperative Arla Foods. It has invested in 20 food enterprises like Swiss zero-waste supermarket Lyfa and Danish alt-leather startup Beyond Leather Materials in 2021. Rockstart’s energy fund recently invested in the €730,000 pre-seed round of Danish carbon sequestration corporate marketplace, Klimate, in September 2021. Exits include Wercker, iClinic, Brincr and 3D Hubs.

CEO and co-founder of Everimpact

Mathieu Carlier is CEO and co-founder of Everimpact, a GHG monitoring company that uses satellites, ground sensors, AI and machine learning to deliver more accurate and immediate carbon emissions data to public bodies, municipalities, and businesses. He has over 20 years of experience as an advisor to governments, public institutions at the likes of the UN, the European Commission and EU Agencies, the Bill & Melinda Gates Foundation and large corporations in international development. Prior to Everimpact, much of Carlier’s career was spent in complex data systems projects for government elections or for health ministries in war-torn or post-conflict developing countries. This included delivering multimillion-dollar biometric and big data projects in the run-up to 50 presidential elections in countries like Afghanistan, Iraq, Pakistan, Libya, the Congo and Benin. Carlier is based in Copenhagen, Denmark and holds an MSc in Business Administration from the Burgundy School of Business.

Mathieu Carlier is CEO and co-founder of Everimpact, a GHG monitoring company that uses satellites, ground sensors, AI and machine learning to deliver more accurate and immediate carbon emissions data to public bodies, municipalities, and businesses. He has over 20 years of experience as an advisor to governments, public institutions at the likes of the UN, the European Commission and EU Agencies, the Bill & Melinda Gates Foundation and large corporations in international development. Prior to Everimpact, much of Carlier’s career was spent in complex data systems projects for government elections or for health ministries in war-torn or post-conflict developing countries. This included delivering multimillion-dollar biometric and big data projects in the run-up to 50 presidential elections in countries like Afghanistan, Iraq, Pakistan, Libya, the Congo and Benin. Carlier is based in Copenhagen, Denmark and holds an MSc in Business Administration from the Burgundy School of Business.

Investisseurs & Partenaires (I&P)

Set up in 2002 by Patrice Hoppenot 15 years after he founded European investment fund BC Partners, Investisseurs & Partenaires (I&P) is an impact investor seeking to help SMEs prosper in Africa and create sustainable jobs and income there. With about €210m raised to date, I&P finances SMEs, startups and regional investment funds in Africa through equity participation and loans, as well as through microfinance institutions. Its I&P Acceleration Technologies focuses on digital startups with €2.5m of funding to be invested in 10–15 startups in 2020–2023. To date, I&P has supported more than 100 capital-funded companies and 20 companies benefiting from subsidized acceleration programs. I&P has about 100 staff based in Paris, Washington D.C. and in seven African offices (Burkina Faso, Cameroon, Côte d'Ivoire, Ghana, Madagascar, Niger and Senegal).

Set up in 2002 by Patrice Hoppenot 15 years after he founded European investment fund BC Partners, Investisseurs & Partenaires (I&P) is an impact investor seeking to help SMEs prosper in Africa and create sustainable jobs and income there. With about €210m raised to date, I&P finances SMEs, startups and regional investment funds in Africa through equity participation and loans, as well as through microfinance institutions. Its I&P Acceleration Technologies focuses on digital startups with €2.5m of funding to be invested in 10–15 startups in 2020–2023. To date, I&P has supported more than 100 capital-funded companies and 20 companies benefiting from subsidized acceleration programs. I&P has about 100 staff based in Paris, Washington D.C. and in seven African offices (Burkina Faso, Cameroon, Côte d'Ivoire, Ghana, Madagascar, Niger and Senegal).

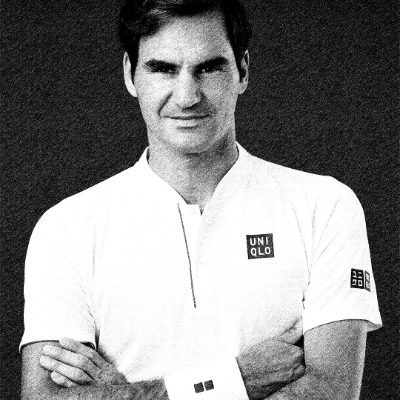

Roger Federer, the Swiss 20-times Grand Slam tennis champion, has turned into an angel investor while planning his professional life beyond and after his tennis sports career.In 2019, he invested in On, the Swiss running shoe manufacturer for an undisclosed funding amount. Federer currently has no formal role in the company but he’s actively involved in its R&D and product development. “I feel like I can give input on any of the lines, the shoes, anything moving forward. I can give my opinion on anything and On can either take it or leave it. I feel like [with] a major brand like Nike, that's literally impossible. It just wouldn't work,” he has said.More recently, Federer participated in a Series D funding round backing the first Chilean unicorn NotCo, which sells plant-based food and beverage products across Latin America and the US.

Roger Federer, the Swiss 20-times Grand Slam tennis champion, has turned into an angel investor while planning his professional life beyond and after his tennis sports career.In 2019, he invested in On, the Swiss running shoe manufacturer for an undisclosed funding amount. Federer currently has no formal role in the company but he’s actively involved in its R&D and product development. “I feel like I can give input on any of the lines, the shoes, anything moving forward. I can give my opinion on anything and On can either take it or leave it. I feel like [with] a major brand like Nike, that's literally impossible. It just wouldn't work,” he has said.More recently, Federer participated in a Series D funding round backing the first Chilean unicorn NotCo, which sells plant-based food and beverage products across Latin America and the US.

Early-stage-focused VC firm with a €24m first fund mainly investing in B2B and B2C digital startups headquartered in Spain. Initial investment amounts range between €70,000 and €300,000, and followup investment amounts go up to €1m per company. Describing themselves as “momentum investors” seeking quick time-to-market projects, Encomenda Smart Capital was founded in 2017 and managed by renowned Spanish angel investors Carlos Blanco, Oriol Juncosa and Miguel Sanz Sanchez, along with a network of angel investors Encomenda supports the growth of startups' portfolios and helps startups to scale at national and international levels. Encomenda invests 30% in SaaS and in projects with a recurring income model; 20% are fintech, and they also bet on the human resources, edtech and healthcare. Just two out of 25 investments have folded up between 2017 and 2020, with half the fund monies committed. Encomenda is seeking to launch a second fund in 2022 focusing on Spanish and Portuguese startups, of €40m–€50m, and multi-stage, by starting in the early-stage investments, with follow-through investments in subsequent stages.

Early-stage-focused VC firm with a €24m first fund mainly investing in B2B and B2C digital startups headquartered in Spain. Initial investment amounts range between €70,000 and €300,000, and followup investment amounts go up to €1m per company. Describing themselves as “momentum investors” seeking quick time-to-market projects, Encomenda Smart Capital was founded in 2017 and managed by renowned Spanish angel investors Carlos Blanco, Oriol Juncosa and Miguel Sanz Sanchez, along with a network of angel investors Encomenda supports the growth of startups' portfolios and helps startups to scale at national and international levels. Encomenda invests 30% in SaaS and in projects with a recurring income model; 20% are fintech, and they also bet on the human resources, edtech and healthcare. Just two out of 25 investments have folded up between 2017 and 2020, with half the fund monies committed. Encomenda is seeking to launch a second fund in 2022 focusing on Spanish and Portuguese startups, of €40m–€50m, and multi-stage, by starting in the early-stage investments, with follow-through investments in subsequent stages.

Alison Gelb Pincus is an entrepreneur who co-founded One King’s Lane, a direct-to-consumer home decor company which was sold to Bed, Bath & Beyond, and more recently, sustainable packaging start-up kari.earth. She is also an angel investor and founder of Short List Capital, a San Francisco-based early-stage VC collective run by women. Short List Capital currently lists 20 companies in its portfolio, which has a focus on investing in e-commerce platforms with healthy, user-friendly or sustainable products. Gelb Pincus’s recent investments included participation in the May 2020 $5.3m seed round of US cookware maker Caraway and a 2015 investment in US-based unicorn Diamond Foundry, the first certified carbon-neutral lab-produced diamond manufacturer.Alison Gelb Pincus was married to Mark Pincus, the co-founder of Zynga and a founding investor in Facebook, Snapchat, Twitter, and Xiaomi.

Alison Gelb Pincus is an entrepreneur who co-founded One King’s Lane, a direct-to-consumer home decor company which was sold to Bed, Bath & Beyond, and more recently, sustainable packaging start-up kari.earth. She is also an angel investor and founder of Short List Capital, a San Francisco-based early-stage VC collective run by women. Short List Capital currently lists 20 companies in its portfolio, which has a focus on investing in e-commerce platforms with healthy, user-friendly or sustainable products. Gelb Pincus’s recent investments included participation in the May 2020 $5.3m seed round of US cookware maker Caraway and a 2015 investment in US-based unicorn Diamond Foundry, the first certified carbon-neutral lab-produced diamond manufacturer.Alison Gelb Pincus was married to Mark Pincus, the co-founder of Zynga and a founding investor in Facebook, Snapchat, Twitter, and Xiaomi.

Co-founded by Fabrice Grinder, a French tech entrepreneur and former consultant at McKinsey & Company, FJ Labs is a New York-based VC firm focused on online marketplaces. Co-founder Jose Marin is based in London. With the mantra “Entrepreneurs funding entrepreneurs,” FJ Labs does not take board seats. It has backed over 500 entrepreneurs, built over 20 companies and managed dozens of exits.To date, 58% of its investment portfolio companies are based in the US and Canada (mostly the US), 25% in Europe, 6% in Brazil, 2% in India and 9% in other countries. The VC is also increasing its presence in Brazil and India, as well as looking at smaller markets in Columbia, Algeria and Kenya. FJ Labs currently has 488 active investments, mainly at seed and pre-seed level, typically investing $390,000 at seed level and $220,000 at pre-seed level. Recent investments in August 2021 include participation in the $8m Series A round of Brazilian corporate benefits marketplace Caju and the $23m funding round of Nigerian vehicle marketplace and financing startup Moove.

Co-founded by Fabrice Grinder, a French tech entrepreneur and former consultant at McKinsey & Company, FJ Labs is a New York-based VC firm focused on online marketplaces. Co-founder Jose Marin is based in London. With the mantra “Entrepreneurs funding entrepreneurs,” FJ Labs does not take board seats. It has backed over 500 entrepreneurs, built over 20 companies and managed dozens of exits.To date, 58% of its investment portfolio companies are based in the US and Canada (mostly the US), 25% in Europe, 6% in Brazil, 2% in India and 9% in other countries. The VC is also increasing its presence in Brazil and India, as well as looking at smaller markets in Columbia, Algeria and Kenya. FJ Labs currently has 488 active investments, mainly at seed and pre-seed level, typically investing $390,000 at seed level and $220,000 at pre-seed level. Recent investments in August 2021 include participation in the $8m Series A round of Brazilian corporate benefits marketplace Caju and the $23m funding round of Nigerian vehicle marketplace and financing startup Moove.

With currently over $21bn of AUM, Baring Private Equity Asia (BPEA) was started in Hong Kong in 1997 by Jean Eric Salata, as the regional Asian PE investment arm of UK-based Baring Private Equity Partners. With $300m in its first fund, it focused on riding China’s economic rise spurred by the country’s market liberalization. In 2000, Salata led a management buyout of BPEA and continues to head the firm today as CEO and Founding Partner. BPEA has invested in more than 100 companies, across healthcare, logistics, IT services, media, education, financial services and retail. It is one of the largest independent PE firms in Asia and has eight offices across the continent.With offices in China, India, Japan, Australia, and Singapore, it currently has around 43 portfolio companies, almost all Asia-based, across multiple business segments in tech and non-tech startups, especially in bricks-and-mortar education establishments. It also makes acquisitions, including most recently of US outsourcing services company Virtusa in February 2021.Other recent investments include in the June 2021 $85m Series C round of Portuguese home physiotherapy tech solution SWORD Health, the world’s fastest-growing musculoskeletal solution, and in the November 2020 $198m Series D round of Chinese computer coding for kids edtech Codemao.

With currently over $21bn of AUM, Baring Private Equity Asia (BPEA) was started in Hong Kong in 1997 by Jean Eric Salata, as the regional Asian PE investment arm of UK-based Baring Private Equity Partners. With $300m in its first fund, it focused on riding China’s economic rise spurred by the country’s market liberalization. In 2000, Salata led a management buyout of BPEA and continues to head the firm today as CEO and Founding Partner. BPEA has invested in more than 100 companies, across healthcare, logistics, IT services, media, education, financial services and retail. It is one of the largest independent PE firms in Asia and has eight offices across the continent.With offices in China, India, Japan, Australia, and Singapore, it currently has around 43 portfolio companies, almost all Asia-based, across multiple business segments in tech and non-tech startups, especially in bricks-and-mortar education establishments. It also makes acquisitions, including most recently of US outsourcing services company Virtusa in February 2021.Other recent investments include in the June 2021 $85m Series C round of Portuguese home physiotherapy tech solution SWORD Health, the world’s fastest-growing musculoskeletal solution, and in the November 2020 $198m Series D round of Chinese computer coding for kids edtech Codemao.

For equality in education, Odilo brings books in the cloud free to millions worldwide

The "Amazon for digital content" Spanish edtech startup delivers virtual libraries and classrooms to kids and adults worldwide

HeartGenetics: Using genetic data and AI to improve predictive health outcomes

Amid growing demand for personalized health and wellness solutions, the Portuguese startup is seeking €2m to expand to Germany and the UK

Plant-based meat faces backlash in China despite gaining traction

An innocuous video clip sparked debate on social media over plant-based meat, with suspicion about its nutritional value, cost-effectiveness and even the motives of foreign companies

Beonprice’s RMS sets the right price for every single hotel room 24/7

Ranked as 5th best RMS platform globally, Beonprice uses AI to stay ahead of competitors

Startups join the fight in China's coronavirus crisis

Chinese startups have discovered their technologies can play a major role in the nationwide efforts to battle the coronavirus epidemic

Alpha JWC Ventures bets on Indonesian fintech, analytics startups for big impact

A commitment to mentoring and supporting its portfolio companies also lies at the core of its business

Amid Covid-19 gloom, some bright spots in Portugal's tech startup scene

Despite a recession and doubling of the unemployment rate forecast this year, it's not all bad news for the Portuguese tech ecosystem

Cristina Fonseca: On a one-woman mission to make Portugal more innovative

The co-founder of Portugal's third unicorn, Talkdesk, is now an influential investor and AI authority

AquaCultured Foods: World's first whole-cut vegan seafood made through microbial fermentation

Armed with its fermentation technology and proprietary strain of fungi, AquaCultured is closing an oversubscribed funding round, raising more than $1.5m to launch its non-GMO seafood alternatives, with plans to expand to more food verticals and overseas

This app lets you show off your cat on social media

Is Meowcard the next big thing or a flash in the pan?

Carlos Melo Brito: Driving force behind Porto's innovation boom

The professor has overseen the creation and growth of the University of Porto-based UPTEC incubator, birthplace of many of Portugal's most successful startups

Bobobobo: Indonesian luxury at a click

Amid a booming local e-commerce market, this startup carves a niche for itself in upscale trending goods and experiences influenced by Indonesia’s rich traditions

Botree Cycling: Recovering critical metals from end-of-life batteries

The Beijing-based startup helps clients dismantle and recycle spent lithium batteries on-site, recovering over 90% of rare metals and reducing demand for mineral resources

Indonesia finance ministry cans e-commerce tax compliance law

The ministry says the law was misunderstood, but industry players had long questioned the need for such regulation

StudentFinance: AI screening software matches students to IT courses and jobs

StudentFinance also offers "Study now, pay later" model, making IT courses financially accessible while helping companies overcome skilled tech talent shortage

Sorry, we couldn’t find any matches for“Superior%20Technological%20Institute%20%28IST%29”.