Uber

-

DATABASE (25)

-

ARTICLES (42)

Co-founder and CEO of Kargo Technologies

Tiger Fang is the CEO of logistics company Kargo Technologies. He was formerly the Country General Manager for Uber Indonesia. Prior to joining Uber in 2013 and leading its expansion into China, Fang was Assistant Vice President at Bank of America-Merrill Lynch, where he had been an investment analyst. He had earlier moved to Asia in 2012 and had a brief stint at Rocket Internet's Lazada. Fang holds a bachelor's in Business Administration from the University of Hawaii and was enrolled in Harvard Business School's Strategy & Leadership Executive Education program.

Tiger Fang is the CEO of logistics company Kargo Technologies. He was formerly the Country General Manager for Uber Indonesia. Prior to joining Uber in 2013 and leading its expansion into China, Fang was Assistant Vice President at Bank of America-Merrill Lynch, where he had been an investment analyst. He had earlier moved to Asia in 2012 and had a brief stint at Rocket Internet's Lazada. Fang holds a bachelor's in Business Administration from the University of Hawaii and was enrolled in Harvard Business School's Strategy & Leadership Executive Education program.

Ousting cram schools with technology, this on-demand tutor app lets tutors get more competitive and better paid. Students gain market transparency, convenience, without paying more.

Ousting cram schools with technology, this on-demand tutor app lets tutors get more competitive and better paid. Students gain market transparency, convenience, without paying more.

On-demand makeup and image styling services in an app: Meishangmen’s makeup professionals provide affordable, convenient and hygienic services while using safe, branded products.

On-demand makeup and image styling services in an app: Meishangmen’s makeup professionals provide affordable, convenient and hygienic services while using safe, branded products.

The world’s largest one-stop transportation service platform and the second largest online trading platform after Alibaba, Didi Chuxing acquired Uber China in 2016.

The world’s largest one-stop transportation service platform and the second largest online trading platform after Alibaba, Didi Chuxing acquired Uber China in 2016.

CEO and co-founder of Kobo360

In 2011, young Obi Ozor used his savings and loans from his family and friends to set up Bezmo Global to import second-hand trucks from the US and sell them in Nigeria. Despite suffering from kidney failure issues, he managed to run the business for four years to earn money to pay for his medical treatments. He fully recovered and moved to Michigan to continue his education.At the University of Michigan, Ozor met Ife Oyedele II and the two friends started an e-commerce venture to sell diapers and baby soap from the US to customers in Nigeria. Ozor moved to the University of Pennsylvania and graduated with a BA International Relations and Finance at Wharton School of Business. In 2014, he gained some work experience in investment banking at JP Morgan in New York.In 2015, Ozor returned to Nigeria and joined Uber as operations coordinator. In 2016, the serial entrepreneur and his friend Oyedele co-founded Uber-style logistics platform Kobo360 in Lagos.

In 2011, young Obi Ozor used his savings and loans from his family and friends to set up Bezmo Global to import second-hand trucks from the US and sell them in Nigeria. Despite suffering from kidney failure issues, he managed to run the business for four years to earn money to pay for his medical treatments. He fully recovered and moved to Michigan to continue his education.At the University of Michigan, Ozor met Ife Oyedele II and the two friends started an e-commerce venture to sell diapers and baby soap from the US to customers in Nigeria. Ozor moved to the University of Pennsylvania and graduated with a BA International Relations and Finance at Wharton School of Business. In 2014, he gained some work experience in investment banking at JP Morgan in New York.In 2015, Ozor returned to Nigeria and joined Uber as operations coordinator. In 2016, the serial entrepreneur and his friend Oyedele co-founded Uber-style logistics platform Kobo360 in Lagos.

Tenaya Capital was originally founded in 1995 as Lehman Brothers Venture Partners. In 2009, following Lehman's bankruptcy, Tenaya was spun off into an independent company, with HarbourVest Partners acquired their existing investments. Since then, Tenaya has invested in some major tech companies, including event ticketing company Eventbrite, early fashion e-commerce firm Zappos, and Uber competitor Lyft. They have so far made two investments into Indonesian companies: agritech e-commerce platform TaniHub, and “Uber-for-logistics” company Kargo Technologies. Tenaya typically invests in Series B and Series C rounds, although they have gone into Series A and later rounds as well.

Tenaya Capital was originally founded in 1995 as Lehman Brothers Venture Partners. In 2009, following Lehman's bankruptcy, Tenaya was spun off into an independent company, with HarbourVest Partners acquired their existing investments. Since then, Tenaya has invested in some major tech companies, including event ticketing company Eventbrite, early fashion e-commerce firm Zappos, and Uber competitor Lyft. They have so far made two investments into Indonesian companies: agritech e-commerce platform TaniHub, and “Uber-for-logistics” company Kargo Technologies. Tenaya typically invests in Series B and Series C rounds, although they have gone into Series A and later rounds as well.

Co-founder and CEO of Sampingan

Former Go-Jek operations manager Wisnu Nugrahadi has embarked on his own entrepreneurial journey, establishing gig marketplace app Sampingan in 2018. After a brief stint as an intern at Uber Indonesia where he was part of the company's Bandung launch team, Wisnu joined on-demand transportation company Go-Jek in June 2015. He was promoted to head of operations for Go-Life (the lifestyle services arm of Go-Jek) within a few months of joining, after which he became senior operations manager in 2017. Wisnu graduated with a bachelor's in Business Administration from Universitas Padjadjaran, Indonesia in 2015.

Former Go-Jek operations manager Wisnu Nugrahadi has embarked on his own entrepreneurial journey, establishing gig marketplace app Sampingan in 2018. After a brief stint as an intern at Uber Indonesia where he was part of the company's Bandung launch team, Wisnu joined on-demand transportation company Go-Jek in June 2015. He was promoted to head of operations for Go-Life (the lifestyle services arm of Go-Jek) within a few months of joining, after which he became senior operations manager in 2017. Wisnu graduated with a bachelor's in Business Administration from Universitas Padjadjaran, Indonesia in 2015.

The first to use digital technology to boost education standards in Indonesia, Ruangguru’s range of products enable students and teachers to produce better results.

The first to use digital technology to boost education standards in Indonesia, Ruangguru’s range of products enable students and teachers to produce better results.

Sway Ventures, formerly AITV, is a US-based venture capital firm with offices in San Francisco, La Jolla and London investing in early to mid-stage technology companies. The VC team comprises former founders and specialists from four key areas: capital, revenue, talent and product. Its portfolio includes Uber, Owl and Zipline.

Sway Ventures, formerly AITV, is a US-based venture capital firm with offices in San Francisco, La Jolla and London investing in early to mid-stage technology companies. The VC team comprises former founders and specialists from four key areas: capital, revenue, talent and product. Its portfolio includes Uber, Owl and Zipline.

Possibly Europe's most famous e-commerce investor, Rocket Internet is known for replicating the business models of successes like Amazon, Alibaba and Uber in new markets. Rocket is based in Berlin and was founded in 2007 by brothers Oliver, Alexander and Marc Samwer. It went public in 2014.

Possibly Europe's most famous e-commerce investor, Rocket Internet is known for replicating the business models of successes like Amazon, Alibaba and Uber in new markets. Rocket is based in Berlin and was founded in 2007 by brothers Oliver, Alexander and Marc Samwer. It went public in 2014.

The TMT-focused VC manages about RMB 10 billion, in three USD-denominated funds and the Tianjin Chengbai RMB-denominated fund. Founded in 2006 by Tian Suning (Edward), the former CEO of China Netcom Group and co-founder and CEO of AsiaInfo (China's first Internet technology provider) is widely regarded as a founder of China's Internet industry. CBC's key investments include Uber, LinkedIn, Evernote, AirBnB, Dianping and Qihoo 360.

The TMT-focused VC manages about RMB 10 billion, in three USD-denominated funds and the Tianjin Chengbai RMB-denominated fund. Founded in 2006 by Tian Suning (Edward), the former CEO of China Netcom Group and co-founder and CEO of AsiaInfo (China's first Internet technology provider) is widely regarded as a founder of China's Internet industry. CBC's key investments include Uber, LinkedIn, Evernote, AirBnB, Dianping and Qihoo 360.

The 10100 Fund (pronounced "ten one-hundred") was established by former Uber CEO Travis Kalanick as a vehicle for both his for-profit investments and non-profit projects. The fund focuses on China and India and has been described as a "home to [Kalanick's] passions, investments, ideas and big bets". 10100 had earlier invested in Kalanick's venture to develop kitchens for on-demand food delivery, CloudKitchens (now known as City Storage Systems).

The 10100 Fund (pronounced "ten one-hundred") was established by former Uber CEO Travis Kalanick as a vehicle for both his for-profit investments and non-profit projects. The fund focuses on China and India and has been described as a "home to [Kalanick's] passions, investments, ideas and big bets". 10100 had earlier invested in Kalanick's venture to develop kitchens for on-demand food delivery, CloudKitchens (now known as City Storage Systems).

With about US$20 billion under management worldwide, New York-headquartered Tiger Global Management was founded in 2000 with US$25 million by billionaire Charles "Chase“ Coleman. Part private equity manager, part hedge fund manager, Tiger Global is known for its big bets on tech startups, including some of today's leading names Facebook, LinkedIn, Zynga and Uber.

With about US$20 billion under management worldwide, New York-headquartered Tiger Global Management was founded in 2000 with US$25 million by billionaire Charles "Chase“ Coleman. Part private equity manager, part hedge fund manager, Tiger Global is known for its big bets on tech startups, including some of today's leading names Facebook, LinkedIn, Zynga and Uber.

RakSul is a Japanese online and outsourcing commercial printing services platform, with almost US$72 million in total equity funding in August 2016. Its US$350,000 Prinzio seed investment is its first venture outside Japan, giving it a 20% stake in the Indonesian printing startup.Founder and CEO Yasukane Matsumoto is set to acquire more printing start-ups in the Philippines and Singapore as part of the expansion into Southeast Asia. The Tokyo-based startup is often dubbed the Uber of printing, with flyers accounting for 60% of total print orders. It expected to start making profits in 2016.

RakSul is a Japanese online and outsourcing commercial printing services platform, with almost US$72 million in total equity funding in August 2016. Its US$350,000 Prinzio seed investment is its first venture outside Japan, giving it a 20% stake in the Indonesian printing startup.Founder and CEO Yasukane Matsumoto is set to acquire more printing start-ups in the Philippines and Singapore as part of the expansion into Southeast Asia. The Tokyo-based startup is often dubbed the Uber of printing, with flyers accounting for 60% of total print orders. It expected to start making profits in 2016.

Formerly known as Google Ventures, GV is the investment arm of Alphabet Inc. Although Alphabet is its sole limited partner, the VC operates independently from Google. It invests in seed, venture and growth-stage funding rounds with more than 300 companies in its portfolio worth over $5bn. Headquartered in California’s Mountain View, GV has offices in San Francisco, Boston, New York and London. The VC has been actively involved in Silicon Valley’s investment rounds for prominent startups like Uber, Slack, Ripple, Impossible Foods, Lime and Medium.

Formerly known as Google Ventures, GV is the investment arm of Alphabet Inc. Although Alphabet is its sole limited partner, the VC operates independently from Google. It invests in seed, venture and growth-stage funding rounds with more than 300 companies in its portfolio worth over $5bn. Headquartered in California’s Mountain View, GV has offices in San Francisco, Boston, New York and London. The VC has been actively involved in Silicon Valley’s investment rounds for prominent startups like Uber, Slack, Ripple, Impossible Foods, Lime and Medium.

- 1

- 2

Kobo360: Nigeria's Uber-style logistics startup turns pan-African dream into reality

Riding on Africa’s new free trade deal, Kobo360 aims to be the continent’s next unicorn by digitalizing logistics ops to transport goods quickly, reliably and more cheaply

Spain's gig and sharing economy startups flourish, despite barrage of restrictions

Startups like Glovo and Spotahome topped fundings raised in 2018 despite local regulatory risks, as Spanish tech firms conquer overseas markets

Beyond ride-hailing: Gojek, Grab and all their friends

Now that Grab and Go-Jek are in a faceoff on a regional scale, here's a look at how Southeast Asia's two biggest unicorns – and their investors – could be shaping the local digital economies and startup ecosystems

Startup shutdown: Some takeaways from BlackGarlic’s demise

Meal subscription service BlackGarlic shut down in July, blaming the high costs of customer acquisition and retention. Here’s a look at why the Blue Apron copy couldn't satisfy the Indonesian market’s palate

Something positive could come out of the Facebook fallout

Users and startups could learn a lot from the Facebook-Cambridge Analytica scandal. For a start, don’t succumb to apathy

How Glovo became one of Spain’s hottest startups

The Barcelona-based on-demand delivery app by a 23-year-old aerospace engineer now spans 14 countries with 7,000 couriers

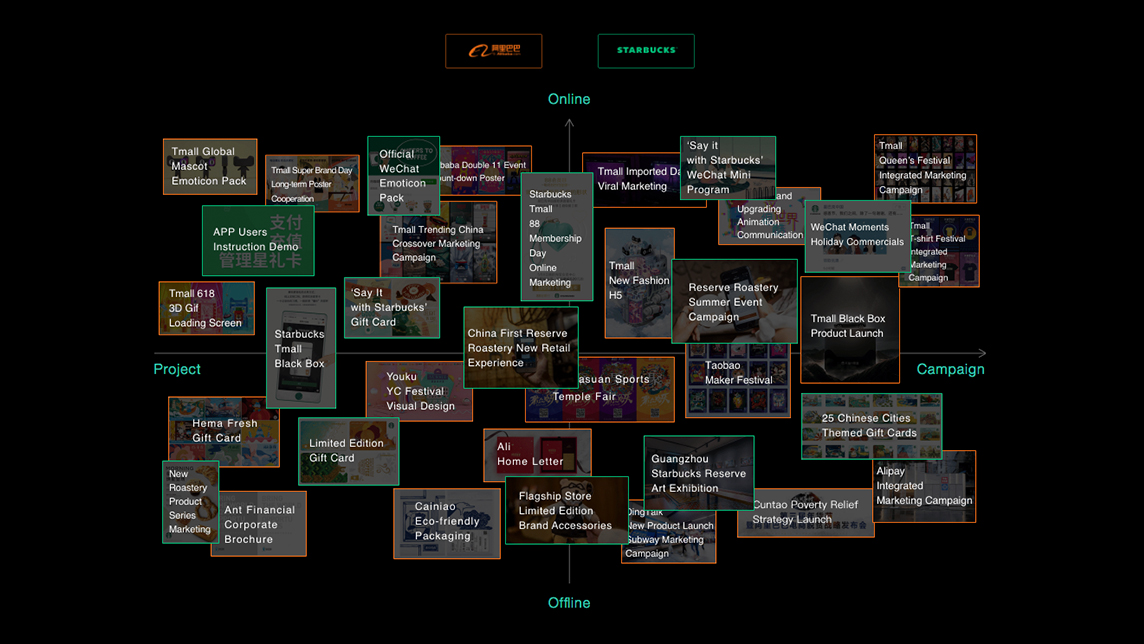

Tezign, where design meets technology

By building a bridge between creative talents and enterprises, this Chinese startup is providing designers with more work opportunities

Glovo’s 2018 rollercoaster ride

The year saw the delivery giant dealing with labor unions, diversification and international expansion

Portugal's health & medtech startups: Taking innovation and disruption to heart

Backed by local and foreign money, Portugal’s healthcare and medical technology startups are hungry to go global

Indonesia 2020: Investors say opportunities still abound despite downturn risk, past year's flops

VCs weigh in on deal flows, valuations, the sectors they favor, and chances of more tech IPOs

Shotl: Making public transport smarter, more sustainable

The first on-demand European mass transit app, Shotl aims to revolutionize city transit

Backed by Kleiner Perkins, Spotahome clinches Spain’s first Silicon Valley-led funding

Now in Europe’s US$500 billion home rental market, the Spanish proptech will soon expand to LatAm, the US and Asia

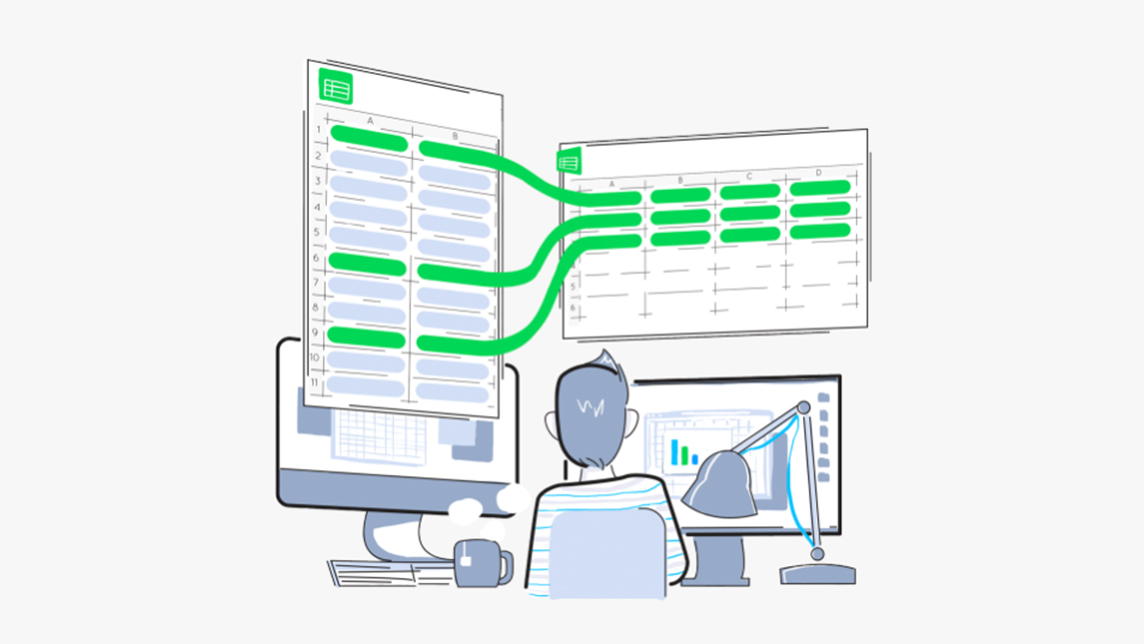

Sheetgo: Easy and secure cloud-powered spreadsheet data at your fingertips

Named Most Scalable Product at South Summit 2018, Sheetgo turns spreadsheets into data clouds for business users around the world

Alpha JWC Ventures bets on Indonesian fintech, analytics startups for big impact

A commitment to mentoring and supporting its portfolio companies also lies at the core of its business

GOI Travel: From collaborative economy to professional transporter

Optimizing last-mile delivery to guarantee the cheapest service

Sorry, we couldn’t find any matches for“Uber”.