being

-

DATABASE (54)

-

ARTICLES (362)

Best known for being the first to invest in social networking hit Momo, seed and early-stage venture capital firm Purplesky Capital, also known as Buttonwood Capital, was founded in 2011. Founded in 2011 by Zheng Gang (Scott Zheng), a successful serial entrepreneur. Brett Krause, former president of JPMorgan Chase China, is its managing partner. PurpleSky focuses on early-stage investments in China digital media and mobile internet companies.

Best known for being the first to invest in social networking hit Momo, seed and early-stage venture capital firm Purplesky Capital, also known as Buttonwood Capital, was founded in 2011. Founded in 2011 by Zheng Gang (Scott Zheng), a successful serial entrepreneur. Brett Krause, former president of JPMorgan Chase China, is its managing partner. PurpleSky focuses on early-stage investments in China digital media and mobile internet companies.

Pedro Luis Uriarte Santamarina

Pedro Luis Uriarte Santamarina was the CEO of Spanish multinational bank BBVA from 1994 to 2001. He was also the Regional Minister-Economy & Finance of the first autonomous government of the Basque Country region in Spain. After being one of the creators of the Basque Agency for Innovation, Uriarte became an early investor of Indexa Capital and Bewa7er, both of which are co-founded by Unai Asenjo Barra.

Pedro Luis Uriarte Santamarina was the CEO of Spanish multinational bank BBVA from 1994 to 2001. He was also the Regional Minister-Economy & Finance of the first autonomous government of the Basque Country region in Spain. After being one of the creators of the Basque Agency for Innovation, Uriarte became an early investor of Indexa Capital and Bewa7er, both of which are co-founded by Unai Asenjo Barra.

Founded in 2004, Active Venture Partners is based in Barcelona and has two VC funds totaling €74 million. The company has made 40 investments and managed nine exits, including cloud-based reservation platform Restaurants.com, business intelligence tool for hotels ReviewPro and ticket marketplace Ticketbis. The VC was the lead investor in 18 funding rounds to date, with the most recent being a €1-million round for sales and marketing platform Whisbi.

Founded in 2004, Active Venture Partners is based in Barcelona and has two VC funds totaling €74 million. The company has made 40 investments and managed nine exits, including cloud-based reservation platform Restaurants.com, business intelligence tool for hotels ReviewPro and ticket marketplace Ticketbis. The VC was the lead investor in 18 funding rounds to date, with the most recent being a €1-million round for sales and marketing platform Whisbi.

Helping small-scale organic farmers run sustainable businesses, POD offers direct e-commerce sales with related support and precision farming tools to boost crop yields and profitability.

Helping small-scale organic farmers run sustainable businesses, POD offers direct e-commerce sales with related support and precision farming tools to boost crop yields and profitability.

Replacing face-to-face human physiotherapy, SWORD, the world’s fastest-growing musculoskeletal medtech, enables treatment anywhere and anytime, at greater intensity and lower costs – democratizing therapy,

Replacing face-to-face human physiotherapy, SWORD, the world’s fastest-growing musculoskeletal medtech, enables treatment anywhere and anytime, at greater intensity and lower costs – democratizing therapy,

NAOS is a French multinational company operating in 100 countries, with a special focus on skincare. Bioderma is its best-known brand. Established over 40 years ago by pharmacist-biologist Jean-Noël Thorel, the company stresses the importance of ecobiology. The company recently extended its scope from skincare to a wider interest in the healthcare sector, such as beauty and well-being. Mediktor is its first investment in tech startups.

NAOS is a French multinational company operating in 100 countries, with a special focus on skincare. Bioderma is its best-known brand. Established over 40 years ago by pharmacist-biologist Jean-Noël Thorel, the company stresses the importance of ecobiology. The company recently extended its scope from skincare to a wider interest in the healthcare sector, such as beauty and well-being. Mediktor is its first investment in tech startups.

The Hague-based social impact investor invests in the areas of environment, economic inclusion, health and well-being and follows the socio-economic principles of the United Nation’s Global Social Development Goals. The VC was established in 2019 and to date has invested in four companies. Its most recent investments have been in agritech sustainability monitoring platform Satelligence’s $2.3m seed round and AI-powered sustainable recruiting platform Equalture’s €1m seed round.

The Hague-based social impact investor invests in the areas of environment, economic inclusion, health and well-being and follows the socio-economic principles of the United Nation’s Global Social Development Goals. The VC was established in 2019 and to date has invested in four companies. Its most recent investments have been in agritech sustainability monitoring platform Satelligence’s $2.3m seed round and AI-powered sustainable recruiting platform Equalture’s €1m seed round.

Founded in 2016, Paris-based Future Positive Capital invests in European startups in deep tech and biotechnology to solve major problems, with funding for only 20 portfolio startups. It has backed eight startups to date with its most recent investments being in the April 2021 undisclosed €5.2m funding round of French renewable energytech SWEETCH Energy and in the £7.9m Series A round of British ecosystem restoration technology Dendra Systems in September 2020.

Founded in 2016, Paris-based Future Positive Capital invests in European startups in deep tech and biotechnology to solve major problems, with funding for only 20 portfolio startups. It has backed eight startups to date with its most recent investments being in the April 2021 undisclosed €5.2m funding round of French renewable energytech SWEETCH Energy and in the £7.9m Series A round of British ecosystem restoration technology Dendra Systems in September 2020.

Founder, CEO and Chairman of Momo

From Hunan to Beijing, in 17 years Tang Yan has transformed from being a riotous youth from a working-class family to the CEO of Momo, China’s top social networking app worth US$7.9 billion.Prior to founding Momo Technology, he was the chief editor of Netease from 2003 to 2011.Tang is now the CEO and chairman of Momo. He was named by Fortune magazine to its “40 Under 40” list of the most powerful business elites under the age of 40 in October 2014.

From Hunan to Beijing, in 17 years Tang Yan has transformed from being a riotous youth from a working-class family to the CEO of Momo, China’s top social networking app worth US$7.9 billion.Prior to founding Momo Technology, he was the chief editor of Netease from 2003 to 2011.Tang is now the CEO and chairman of Momo. He was named by Fortune magazine to its “40 Under 40” list of the most powerful business elites under the age of 40 in October 2014.

CEO and Co-founder of GeoDB

Luis Gelado Crespo graduated in Business Management and has a master's in Real Estate Investment from Comillas Pontifical University (ICAI-ICADE). He worked at Deloitte Consulting for several years before teaming up with ICADE alumnus Manual de la Esperanza to build the Wave app that could track the movements of friends and family. Besides being the CFO and COO at Wave, Gelado is also an associate academy member of International Academy of Digital Arts and Sciences (IADAS). In 2018, he became the CEO and co-founder of GeoDB, a decentralized geolocation data marketplace.

Luis Gelado Crespo graduated in Business Management and has a master's in Real Estate Investment from Comillas Pontifical University (ICAI-ICADE). He worked at Deloitte Consulting for several years before teaming up with ICADE alumnus Manual de la Esperanza to build the Wave app that could track the movements of friends and family. Besides being the CFO and COO at Wave, Gelado is also an associate academy member of International Academy of Digital Arts and Sciences (IADAS). In 2018, he became the CEO and co-founder of GeoDB, a decentralized geolocation data marketplace.

Co-founder and Joint CEO of Otten Coffee, Founder and CEO of Fore Coffee

A coffee geek, Robin Boe is a collector of coffee-machines and equipment. Robin also exports coffee beans from his hometown Medan to other parts of Indonesia. Being a son of an entrepreneur, entrepreneurship is part of Robin’s DNA. He has a bachelor’s in Commerce from the Sekolah Tinggi Ilmu Ekonomi STMIK Mikroskil in Medan.Robin co-founded the speciality coffee shop Otten Coffee in October 2012 and expanded it into an online e-commerce platform for coffee lovers in April 2014. He is also the CEO of PT Agrinusa Mitra Kopindo where he has been working since May 2009.

A coffee geek, Robin Boe is a collector of coffee-machines and equipment. Robin also exports coffee beans from his hometown Medan to other parts of Indonesia. Being a son of an entrepreneur, entrepreneurship is part of Robin’s DNA. He has a bachelor’s in Commerce from the Sekolah Tinggi Ilmu Ekonomi STMIK Mikroskil in Medan.Robin co-founded the speciality coffee shop Otten Coffee in October 2012 and expanded it into an online e-commerce platform for coffee lovers in April 2014. He is also the CEO of PT Agrinusa Mitra Kopindo where he has been working since May 2009.

CEO and founder of Mycorena

Ramkumar Nair graduated in biotechnology at the Cochin University of Science and Technology in Kerala before going to Sweden for postgrad studies in 2013.During his PhD in industrial biotechnology at the University of Borås, he embarked on a research project to create fungi-based proteins from discarded sidestreams generated by food producers. After extensive research in 2017, he founded Mycorena in Gothenburg to produce mycoproteins using fermentation technology.The startup’s first commercial product, Promyc, is now being sold to global food companies as a more sustainable and nutritional alt-protein compared to traditional plant-based proteins.

Ramkumar Nair graduated in biotechnology at the Cochin University of Science and Technology in Kerala before going to Sweden for postgrad studies in 2013.During his PhD in industrial biotechnology at the University of Borås, he embarked on a research project to create fungi-based proteins from discarded sidestreams generated by food producers. After extensive research in 2017, he founded Mycorena in Gothenburg to produce mycoproteins using fermentation technology.The startup’s first commercial product, Promyc, is now being sold to global food companies as a more sustainable and nutritional alt-protein compared to traditional plant-based proteins.

A pioneer of China's IT industry, Zhu Min founded Cybernaut in 2005. To date, the firm has invested over $10bn in Chinese technology companies through 70 funds, in addition to another $10bn jointly managed with its partners outside China. Cybernaut also has about 20 startup incubators (Cybernaut Internet+) across China. Zhu studied at Stanford University in the 1980s and founded web conference solutions provider WebEx Communications Inc., which went public on NASDAQ in 2000, before being sold to Cisco for $3.2bn.

A pioneer of China's IT industry, Zhu Min founded Cybernaut in 2005. To date, the firm has invested over $10bn in Chinese technology companies through 70 funds, in addition to another $10bn jointly managed with its partners outside China. Cybernaut also has about 20 startup incubators (Cybernaut Internet+) across China. Zhu studied at Stanford University in the 1980s and founded web conference solutions provider WebEx Communications Inc., which went public on NASDAQ in 2000, before being sold to Cisco for $3.2bn.

Homegrown developer appears on track to build a multimedia franchise following its successful DreadOut game about Indonesian folklore ghosts, the DreadOut movie and merchandise lines.

Homegrown developer appears on track to build a multimedia franchise following its successful DreadOut game about Indonesian folklore ghosts, the DreadOut movie and merchandise lines.

Being the first investment group in Zhejiang province to list on the NEEQ market, ZSVC has over 30 funds under its management today, amounting to nearly RMB 40 billion. Founded in 2007, it is the major investor for more than 130 Chinese startups across healthcare, media & entertainment, logistic and advanced manufacturing sectors, with more than 30 successful exits. Headquartered in Hangzhou, it has taken its widely acclaimed “Zhejiang Entrepreneur Experience” to a broader world with subsidiaries in Beijing, Shanghai, Shenzhen, Shenyang and the Silicon Valley.

Being the first investment group in Zhejiang province to list on the NEEQ market, ZSVC has over 30 funds under its management today, amounting to nearly RMB 40 billion. Founded in 2007, it is the major investor for more than 130 Chinese startups across healthcare, media & entertainment, logistic and advanced manufacturing sectors, with more than 30 successful exits. Headquartered in Hangzhou, it has taken its widely acclaimed “Zhejiang Entrepreneur Experience” to a broader world with subsidiaries in Beijing, Shanghai, Shenzhen, Shenyang and the Silicon Valley.

Indonesian esports team RRQ dreams of being "the king of kings"

The Jakarta team is growing its brand with collaborations and its academy, expects more esports interest amid Covid-19 home confinements

A Q&A with the Veniam founder and CEO

Kolase: Crowdfunding platform for Indonesian musicians

Started by music industry veterans, Kolase sees a promising online market in contemporary music fandom

Kryha: Enabling big businesses' green practices with blockchain

Kryha’s blockchain systems help companies trace the movement and transformation of resources among multiple stakeholders without exposing sensitive information

A new unicorn rises as OVO's $1bn valuation confirmed

The Lippo Group subsidiary continues to grow in strength as it battles for market share with Gojek’s e-wallet and others

Heptasense wins trust at a time of (lax) global surveillance

There may be some 700 million surveillance cameras running worldwide in today's age of global security threats, yet 98% of them are unmonitored. A Lisbon-based startup is promising real-time response and greater reliability in security tech

Future Food Asia 2021: Agrifood tech at an inflection point

Agrifood tech startups urged to harness consumer, investor and government feedback to create plentiful, nutritious food through sustainable means, but exercise caution when considering IPOs

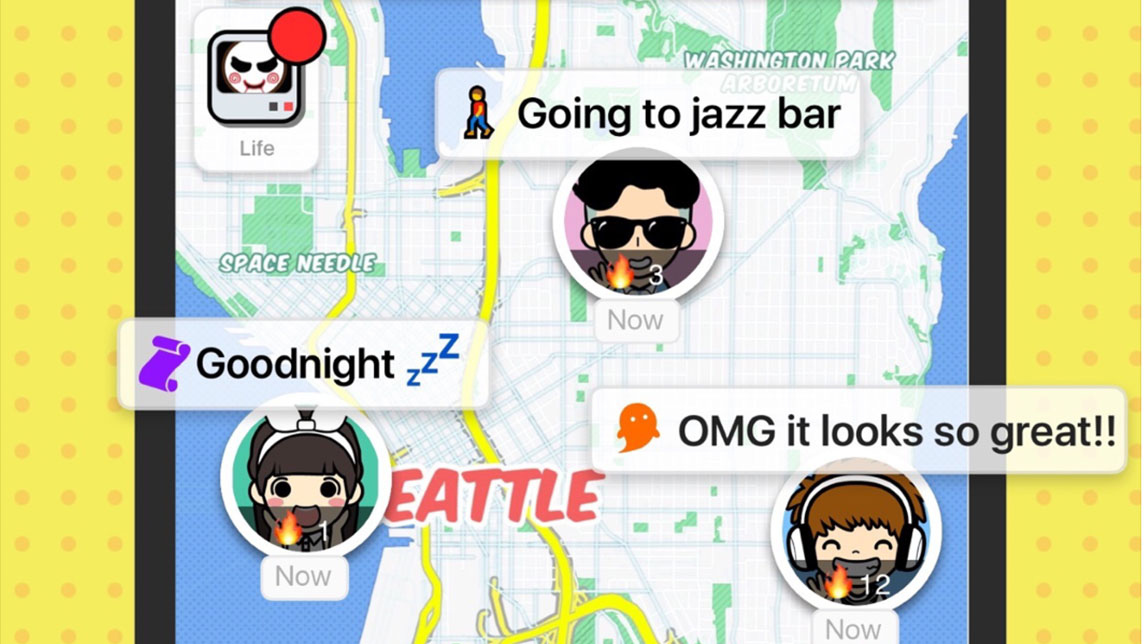

"Spot" your friends, live chat and share music with this social mapping app

Spot, a new challenger to China's WeChat, is using pop-up song lyrics to entice youths to live chat and play games

Rheaply: Pioneering B2B asset reuse through technology

Through its SaaS platform, this Chicago-based startup finds success in the under-served corporate second-hand market, essential to any successful circular economy, recently landing $8m Series A

New Food Invest: Plant-based cheese, the next investment boom?

With alt-protein startups experiencing a global funding boom, industry experts and investors share their views about emerging trends in diverse food sectors

Backed by pharmas, doctors, medtech startup DyCare is expanding fast across Europe

Its remote musculoskeletal rehabilitation and monitoring system sets to improve rehabilitation outcomes in an overtaxed sector

Future Food Asia 2021: Consumers crucial for agrifood growth

President of AppHarvest David Lee thinks consumers must be told the truth about the need for technology for change in food because capitalism and consumerism are powerful forces

South Summit 2021: Key insights on going from startup to scaleup in Spain

Company culture, talent acquisition and ecosystem support are top-of-mind for Voicemod’s Jaime Bosch and Jobandtalent’s Juan Urdiales in scaling startups up from zero to hero

South Summit 2021: Martin Varavsky, Leandro Sigman on post-Covid healthcare trends

Serial entrepreneur Martin Varavsky and Insud Pharma Chairman Leandro Sigman share their thoughts and projections on the future of health tech

Forget solar panels and batteries, Bioo wants to scale soil bioelectricity generation

Improving on NASA’s microbial fuel cell tech, Bioo hopes to boost crop efficiency and transform the way urbanites live, in future green cities powered by plants

Sorry, we couldn’t find any matches for“being”.