A*Star

-

DATABASE (997)

-

ARTICLES (811)

Founder and CEO of GiftTalk, a Chinese gift-giving platform. Wen, a friend of Chen Anni, helped her found Kuaikan (formerly Kuaikan Comic) as an angel investor.

Founder and CEO of GiftTalk, a Chinese gift-giving platform. Wen, a friend of Chen Anni, helped her found Kuaikan (formerly Kuaikan Comic) as an angel investor.

Founded in 1993, New Oriental is the largest provider of private educational services in China. Foreign language training and basic education currently make up its core business. New Oriental offers services in pre-school education, online education, vocational education, overseas study consulting, textbook publishing and education software R&D. New Oriental schools operate in 70 cities nationwide and in Toronto. As an institutional investor, the company has invested in over 40 startups, the vast majority of which are edtechs.

Founded in 1993, New Oriental is the largest provider of private educational services in China. Foreign language training and basic education currently make up its core business. New Oriental offers services in pre-school education, online education, vocational education, overseas study consulting, textbook publishing and education software R&D. New Oriental schools operate in 70 cities nationwide and in Toronto. As an institutional investor, the company has invested in over 40 startups, the vast majority of which are edtechs.

Based in Singapore, Clermont Group is a venture capital group that was founded by New Zealand-born billionaire Richard F. Chandler. The company styles itself as a "business house" with a philosophy that entrepreneurship and managing capital are noble callings. To this end, Clermont invests in businesses that are geared towards fulfilling customer needs and those that generate employment. As a group, Clermont owns shares in Vietnamese healthcare group Hoan My, Philippines based clinic network The Medical City and the Small Business FinCredit company in India.

Based in Singapore, Clermont Group is a venture capital group that was founded by New Zealand-born billionaire Richard F. Chandler. The company styles itself as a "business house" with a philosophy that entrepreneurship and managing capital are noble callings. To this end, Clermont invests in businesses that are geared towards fulfilling customer needs and those that generate employment. As a group, Clermont owns shares in Vietnamese healthcare group Hoan My, Philippines based clinic network The Medical City and the Small Business FinCredit company in India.

Jeffrey Leiden is a physician and scientist of more than 40 years, who is currently the executive chairman of US-based multinational biotech company Vertex Pharmaceuticals. Leiden is also the chairman of Casana, a remote healthcare platform and the chairman of Tmunity, a biotech dedicated to T-cell research. In March 2021, he participated as an angel investor in the $48m Series A round of Dutch cell-based meat startup Meatable which leverages pluripotent stem cells for the first time in foodtech.

Jeffrey Leiden is a physician and scientist of more than 40 years, who is currently the executive chairman of US-based multinational biotech company Vertex Pharmaceuticals. Leiden is also the chairman of Casana, a remote healthcare platform and the chairman of Tmunity, a biotech dedicated to T-cell research. In March 2021, he participated as an angel investor in the $48m Series A round of Dutch cell-based meat startup Meatable which leverages pluripotent stem cells for the first time in foodtech.

PNV Capital is a seed investment fund in Proença-a-Nova, Portugal, co-invested by Busy Angels. The fund is worth about €770,000 and invests an average of about €100,000 per project, with a cap at €200,000.this is all frmo the previous write up as they have no webpage still!

PNV Capital is a seed investment fund in Proença-a-Nova, Portugal, co-invested by Busy Angels. The fund is worth about €770,000 and invests an average of about €100,000 per project, with a cap at €200,000.this is all frmo the previous write up as they have no webpage still!

XVC was founded in 2016 by Hu Boyu, a former entrepreneur and ex-partner at Blue Lake Capital. Hu has a “sniper” investment style. Aiming at only a few targets, he invested in multiple early-stage companies that became unicorns: Meicai, Youxinpai, Kuaishou, 51talk and Wandoujia (now owned by Alibaba). XVC is primarily interested in big opportunities in the TMT sector.

XVC was founded in 2016 by Hu Boyu, a former entrepreneur and ex-partner at Blue Lake Capital. Hu has a “sniper” investment style. Aiming at only a few targets, he invested in multiple early-stage companies that became unicorns: Meicai, Youxinpai, Kuaishou, 51talk and Wandoujia (now owned by Alibaba). XVC is primarily interested in big opportunities in the TMT sector.

Changsha Lugu Venture Capital was founded in December 2007. The VC manages total assets worth RMB 300m and mainly invests in the internet and technology sectors. As a state-owned company, Changsha Lugu Venture Capital also provides free office facilities and funding of RMB200,000 for talented startups in Changsha.

Changsha Lugu Venture Capital was founded in December 2007. The VC manages total assets worth RMB 300m and mainly invests in the internet and technology sectors. As a state-owned company, Changsha Lugu Venture Capital also provides free office facilities and funding of RMB200,000 for talented startups in Changsha.

Founded in 1983, the Brunei Investment Agency (BIA) is a government-owned investment organization that reports to the Ministry of Finance, Government of Brunei. BIA manages the country’s general reserve fund and its external assets, worth an estimated amount of $170bn. Its activities are rarely publicly disclosed.

Founded in 1983, the Brunei Investment Agency (BIA) is a government-owned investment organization that reports to the Ministry of Finance, Government of Brunei. BIA manages the country’s general reserve fund and its external assets, worth an estimated amount of $170bn. Its activities are rarely publicly disclosed.

Founded in 2018, Trinity Innovation Fund is a fund management firm that mainly invests in pharmaceutical innovations. TIF currently manages two PE funds and its limited partners include renowned pharmaceuticals and institutional investors. It also has offices managing funds overseas, for example, Trinity Innovation Bioventure Singapore Pte Ltd.

Founded in 2018, Trinity Innovation Fund is a fund management firm that mainly invests in pharmaceutical innovations. TIF currently manages two PE funds and its limited partners include renowned pharmaceuticals and institutional investors. It also has offices managing funds overseas, for example, Trinity Innovation Bioventure Singapore Pte Ltd.

Xiyee Assets was founded in 2016 and is headquartered in Beijing. The firm is involved in private equity investment, M&A, restructuring, real estate and disposal of non-performing assets. It mainly invests in sectors such as advanced manufacturing, new energy, environmental protection, medtech and healthcare.

Xiyee Assets was founded in 2016 and is headquartered in Beijing. The firm is involved in private equity investment, M&A, restructuring, real estate and disposal of non-performing assets. It mainly invests in sectors such as advanced manufacturing, new energy, environmental protection, medtech and healthcare.

Elevation China Capital (ECC) is an equity investment firm, with offices in Shenzhen, Shanghai and Silicon Valley. Founded in Beijing in June 2010 by managing partner Man Li, the VC focuses on investments in early-stage and high-growth stage tech companies.In August 2019, Shenzen's IGTech became its most recent investment as part of a seed funding worth RMB 10m. The Guangdong company provides intelligent manufacturing solutions to help digitize the production process to improve safety, efficiency and quality using advance data management technology.

Elevation China Capital (ECC) is an equity investment firm, with offices in Shenzhen, Shanghai and Silicon Valley. Founded in Beijing in June 2010 by managing partner Man Li, the VC focuses on investments in early-stage and high-growth stage tech companies.In August 2019, Shenzen's IGTech became its most recent investment as part of a seed funding worth RMB 10m. The Guangdong company provides intelligent manufacturing solutions to help digitize the production process to improve safety, efficiency and quality using advance data management technology.

Born in 1969, Pan Yingjiu had worked at Zhuhai Nanping Enterprise Corporation from September 1990 to July 1991. He also worked as an engineer at Canon Zhuhai until August 1994 when he left to start a new career as an investment manager at Zhuhai Pingsha Jinyan Tourism Corporation.In December 1999, he became a financial investment manager at China Materials Development Investment Corporation and rose to become a board director in May 2005 at a Hong Kong-based luminescent material manufacturer. In March 2007, he became the GM of Lanshi VC until March 2011. Since September 2010, he has also been working as a board director at Weibang Investment in Shenzhen and Beijing IN-Power Electric Co Ltd.

Born in 1969, Pan Yingjiu had worked at Zhuhai Nanping Enterprise Corporation from September 1990 to July 1991. He also worked as an engineer at Canon Zhuhai until August 1994 when he left to start a new career as an investment manager at Zhuhai Pingsha Jinyan Tourism Corporation.In December 1999, he became a financial investment manager at China Materials Development Investment Corporation and rose to become a board director in May 2005 at a Hong Kong-based luminescent material manufacturer. In March 2007, he became the GM of Lanshi VC until March 2011. Since September 2010, he has also been working as a board director at Weibang Investment in Shenzhen and Beijing IN-Power Electric Co Ltd.

Founded in 2012, Purple Orange’s objective is to support the transition away from animals in the food chain, supporting early-stage food and biotech companies across the globe with a focus on alternative proteins and cellular agriculture. It currently has 12 startups from different nations in its portfolio. Its most recently disclosed investments have been in the December 2020 pre-seed round of Chinese cultured meat startup CellX and in the November 2020 $500,000 pre-seed round of Swedish plant-based food vending startup VEAT.

Founded in 2012, Purple Orange’s objective is to support the transition away from animals in the food chain, supporting early-stage food and biotech companies across the globe with a focus on alternative proteins and cellular agriculture. It currently has 12 startups from different nations in its portfolio. Its most recently disclosed investments have been in the December 2020 pre-seed round of Chinese cultured meat startup CellX and in the November 2020 $500,000 pre-seed round of Swedish plant-based food vending startup VEAT.

Ribbit Capital is a Silicon Valley VC that focuses on fintech-related startups. Founded in 2012, Ribbit Capital posits that the financial services industry has largely remained unchanged despite the developments in technology in the past decade. The company’s “mantra” states that it is a believer in consumers and businesses moving to mobile, and this will lead to major changes in how financial services are provided in the future.The company has invested in a wide range of fintech startups and technologies, including stock trading app Robinhood, cryptocurrency exchange platform Coinbase, and Revolut, one of the earliest “challenger banks” that primarily serves retail customers through digital, app-based services. In March 2021, US retail giant Walmart announced a partnership with Ribbit Capital to develop fintech products. Ribbit Capital made its first investment in the Southeast Asia region in that same month, when it led a $65m Series A extension into Indonesian investment platform Ajaib.

Ribbit Capital is a Silicon Valley VC that focuses on fintech-related startups. Founded in 2012, Ribbit Capital posits that the financial services industry has largely remained unchanged despite the developments in technology in the past decade. The company’s “mantra” states that it is a believer in consumers and businesses moving to mobile, and this will lead to major changes in how financial services are provided in the future.The company has invested in a wide range of fintech startups and technologies, including stock trading app Robinhood, cryptocurrency exchange platform Coinbase, and Revolut, one of the earliest “challenger banks” that primarily serves retail customers through digital, app-based services. In March 2021, US retail giant Walmart announced a partnership with Ribbit Capital to develop fintech products. Ribbit Capital made its first investment in the Southeast Asia region in that same month, when it led a $65m Series A extension into Indonesian investment platform Ajaib.

Founded in San Francisco in 2009, Eniac Ventures is an early-stage investor in diverse sectors. It currently has 59 startups in its portolio. The vast majority of its exits have been via acquisitions by larger companies such as Anchor sold to Spotify. The VC also invested in Airbnb and Medallia that went public in 2020 and 2019 respectively.Recent investments in June 2021 include co-leading the $4.2m seed round of US mental healthcare platform Nirvana Health and participation in the $30m Series B round of Briq, a US financial planning and workflow automation platform for the construction industry. The VC also joined in the Series A round of Vence, the California-based producer of smart wearables for livestock management.

Founded in San Francisco in 2009, Eniac Ventures is an early-stage investor in diverse sectors. It currently has 59 startups in its portolio. The vast majority of its exits have been via acquisitions by larger companies such as Anchor sold to Spotify. The VC also invested in Airbnb and Medallia that went public in 2020 and 2019 respectively.Recent investments in June 2021 include co-leading the $4.2m seed round of US mental healthcare platform Nirvana Health and participation in the $30m Series B round of Briq, a US financial planning and workflow automation platform for the construction industry. The VC also joined in the Series A round of Vence, the California-based producer of smart wearables for livestock management.

DGene : Star Wars-inspired 3D holograms made affordable for businesses

DGene's mobile-based VR/AR solution using integrated light field cuts the need for 3D modeling, useful for many sectors from retail marketing to conference calls

UBTECH: CES robotics star wants to bring humanoid robots to every family

UBTECH’s next-generation bipedal robot recently made an impressive global debut, and the startup’s founder has once again become the focus of attention

Enoc Armengol: The design and e-commerce 3.0 star inspired by Inspector Gadget

Also a serial entrepreneur, the Spaniard has created a trail of celebrated design products and startups from Singapore to Barcelona

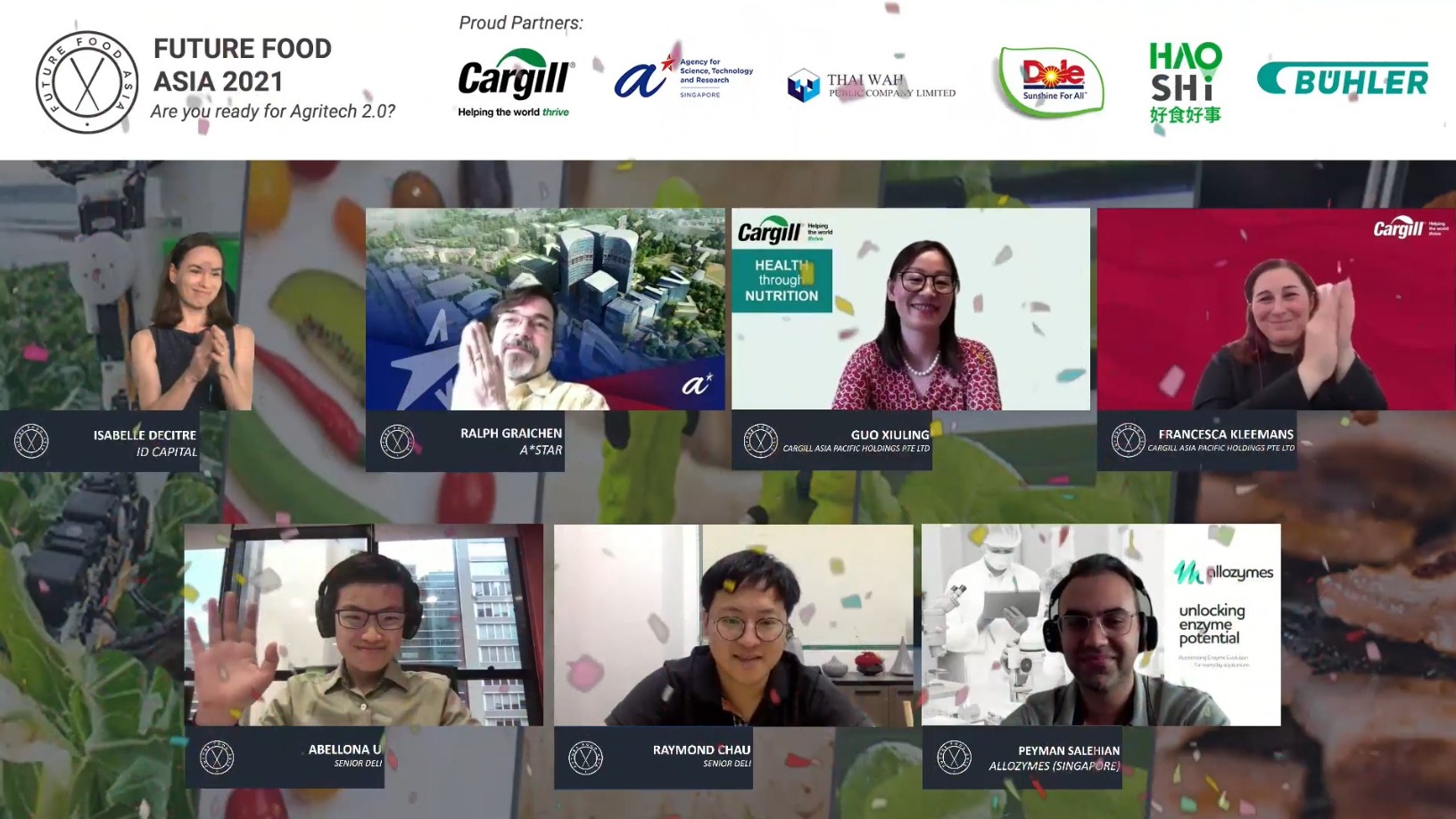

Future Food Asia 2021 announces finalists for $100,000 prize

Ten startups from agrifood tech and cleantech sectors will pitch during the five-day conference, are also eligible for two more prizes from sponsors Cargill and Thai Wah

Digital Union: Fighting fake users in China's mobile app industry

The Beijing-based cybersecurity startup is helping developers spot fake app downloads, so their ad money don’t go to waste

Future Food Asia 2021: Two winners take home $100,000 each

Agrifood startups, corporations and investors urged to collaborate and take action, tackling challenges in nutrition and climate change

Quant Group makes personal loans safer, easier in China

Using big data and AI, Chinese fintech startup Quant Group simplifies and accelerates loan processing, and assures monetary security for financial institutions

Oceanium: Supporting sustainable seaweed farming

Scottish startup Oceanium has developed a proprietary biorefinery and processing model to create seaweed-based compostable materials, alt-protein ingredients and nutraceuticals for use across industry verticals

Plant-based eggs (Part II): The foodtech startups to watch

Here’s a shortlist of the foodtech startups to watch in the global vegan egg market

For your X-ray records, just check the cloud

A Chinese startup has built a digital medical image library on the cloud, bringing ease and cost savings to patients, doctors and hospitals countrywide

HighPitch: E-grocery marketplace Pasar20 and healthcare edtech Appskep top the Medan chapter

Representing Sumatra’s startup ecosystem in the national finals later in November, Pasar20 and Appskep have ambitious expansion plans in store

BukuWarung: Accounting-payments app targets Indonesia's 60m MSMEs

BukuWarung’s easy-to-use 6MB app designed for lower-end smartphones gets boost from Covid-19-accelerated digitalization

Meatable joins Royal DSM to create growth media specific for cell-based meat tech

The R&D between the biotech startup and fellow Dutch nutrition conglomerate could help scale and drive the commercial viability of lab-grown meat

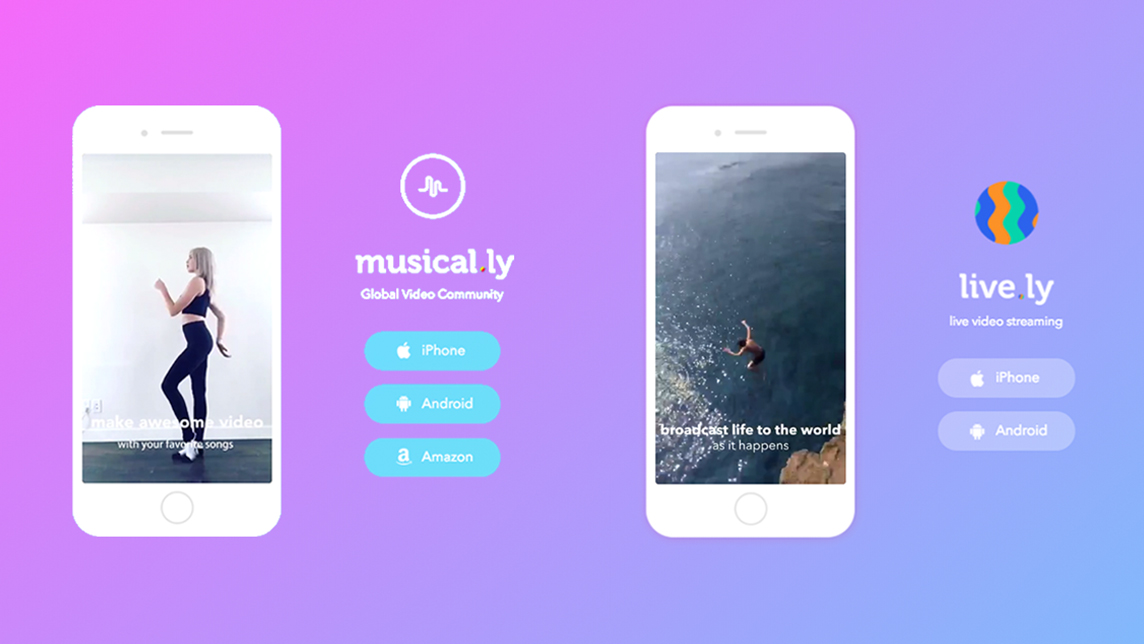

Inspired by rowdy teenagers: the Musical.ly story

Now better known as TikTok, the original Musical.ly was the only Chinese social app to have cracked the Western market – before it got snapped up by Bytedance and joined its stable of short video apps

Using Reworld’s very own interactive physics engine, even rookie developers can turn their creative ideas into 3D games within two days

Sorry, we couldn’t find any matches for“A*Star”.