A*Star

-

DATABASE (997)

-

ARTICLES (811)

Philips is a multinational conglomerate based in the Netherlands. It is best-known for its consumer electronics, which includes lights, appliances, and even smart tools for pregnant mothers. It is also a leader in hearing aids and medical devices.

Philips is a multinational conglomerate based in the Netherlands. It is best-known for its consumer electronics, which includes lights, appliances, and even smart tools for pregnant mothers. It is also a leader in hearing aids and medical devices.

NAOS is a French multinational company operating in 100 countries, with a special focus on skincare. Bioderma is its best-known brand. Established over 40 years ago by pharmacist-biologist Jean-Noël Thorel, the company stresses the importance of ecobiology. The company recently extended its scope from skincare to a wider interest in the healthcare sector, such as beauty and well-being. Mediktor is its first investment in tech startups.

NAOS is a French multinational company operating in 100 countries, with a special focus on skincare. Bioderma is its best-known brand. Established over 40 years ago by pharmacist-biologist Jean-Noël Thorel, the company stresses the importance of ecobiology. The company recently extended its scope from skincare to a wider interest in the healthcare sector, such as beauty and well-being. Mediktor is its first investment in tech startups.

Billing itself as the "world's first venture builder focused on the real estate and construction sectors," Construtech Ventures is a Brazilian investor and venture builder established in 2017 in Florianópolis. To date, it has invested in 11 companies, all of them local with the exception of Portuguese Infraspeak. Its most recent investments are in Infraspeak's seed round and in real estate marketplace EmCasa's Series A round. The company also has a second office in São Paulo.

Billing itself as the "world's first venture builder focused on the real estate and construction sectors," Construtech Ventures is a Brazilian investor and venture builder established in 2017 in Florianópolis. To date, it has invested in 11 companies, all of them local with the exception of Portuguese Infraspeak. Its most recent investments are in Infraspeak's seed round and in real estate marketplace EmCasa's Series A round. The company also has a second office in São Paulo.

A co-founder and angel investor of HomeRun, Cheng Xiaohua graduated with a major in Automation at Changsha Railway University in 1983. The university is now known as Railway Campus, Central South University. From 1984 to 1988, he spent his postgraduate years at Graduate School, University of Chinese Academy of Sciences and earned a master’s degree in Automation. He co-founded Netac with Deng Guoshun in 1999 and became the chairman in September 2010.

A co-founder and angel investor of HomeRun, Cheng Xiaohua graduated with a major in Automation at Changsha Railway University in 1983. The university is now known as Railway Campus, Central South University. From 1984 to 1988, he spent his postgraduate years at Graduate School, University of Chinese Academy of Sciences and earned a master’s degree in Automation. He co-founded Netac with Deng Guoshun in 1999 and became the chairman in September 2010.

A partner at Chinese VC firm Ceyuan Ventures, Richard Chen holds a bachelor’s degree in Industrial Management from Carnegie Mellon University in the United States. He is currently CEO of Yifei Investment Holding. Chen is also the founding partner of Huangpu River Capital.

A partner at Chinese VC firm Ceyuan Ventures, Richard Chen holds a bachelor’s degree in Industrial Management from Carnegie Mellon University in the United States. He is currently CEO of Yifei Investment Holding. Chen is also the founding partner of Huangpu River Capital.

Founded in 2015, Hovione Capital is a VC firm from Portugal specializing in the health sector, with a focus on seed/early-stage investments in healthcare and medtech businesses. It currently manages €5 million in investment assets across its portfolio of three companies.

Founded in 2015, Hovione Capital is a VC firm from Portugal specializing in the health sector, with a focus on seed/early-stage investments in healthcare and medtech businesses. It currently manages €5 million in investment assets across its portfolio of three companies.

Ashraf Sinclair is a Malaysian-born actor and businessman. He moved and worked in Indonesia after marrying Indonesian singer Bunga Citra Lestari. He has also personally invested in crowdfunding platform Konserku in 2016 and became a venture partner at 500 Startups in 2017.

Ashraf Sinclair is a Malaysian-born actor and businessman. He moved and worked in Indonesia after marrying Indonesian singer Bunga Citra Lestari. He has also personally invested in crowdfunding platform Konserku in 2016 and became a venture partner at 500 Startups in 2017.

EDP Ventures is the VC arm of EDP, or Energias de Portugal, a global energy company based in Portugal. It invests in early-stage startups both Portuguese and from other nations across varied sectors and is a promoter of renewable energies.

EDP Ventures is the VC arm of EDP, or Energias de Portugal, a global energy company based in Portugal. It invests in early-stage startups both Portuguese and from other nations across varied sectors and is a promoter of renewable energies.

Founded in 2018, Agaeti Ventures is an Indonesia-focused VC that participates at the pre-Series A and Series A levels. Agaeti's portfolio includes smart retail kiosk startup Warung Pintar, delivery coffee chain Fore Coffee and Bangladeshi transportation firm Pathao.

Founded in 2018, Agaeti Ventures is an Indonesia-focused VC that participates at the pre-Series A and Series A levels. Agaeti's portfolio includes smart retail kiosk startup Warung Pintar, delivery coffee chain Fore Coffee and Bangladeshi transportation firm Pathao.

Besides being an investor, Evolution Venture Partners provides effective solutions for VCs and their portfolio companies in looking for a capital raise, a strategic transaction, or in the event that the board decides to wind a company down. Established in 2008, Evolution has invested in the US, Europe and in emerging markets and has a special interest in information security, enterprise software and solutions, consumer products. healthcare and biotechnology.

Besides being an investor, Evolution Venture Partners provides effective solutions for VCs and their portfolio companies in looking for a capital raise, a strategic transaction, or in the event that the board decides to wind a company down. Established in 2008, Evolution has invested in the US, Europe and in emerging markets and has a special interest in information security, enterprise software and solutions, consumer products. healthcare and biotechnology.

Civeta is a Madrid-based VC fund founded in 2013 by a small group of Spanish angel investors. It has backed 39 startups in blockchain, education, marketplace and platform.In 2014, the company experienced intense investment activity and was ranked among the most active VC firms in Spain. Since 2016, it has hosted the Civeta Fintech Meetings in Madrid, to which key industry players are invited to discuss and analyze fintech trends and business opportunities. Civeta also offers consultancy services on business model development, branding, UX, social media, data analysis, and legal support.

Civeta is a Madrid-based VC fund founded in 2013 by a small group of Spanish angel investors. It has backed 39 startups in blockchain, education, marketplace and platform.In 2014, the company experienced intense investment activity and was ranked among the most active VC firms in Spain. Since 2016, it has hosted the Civeta Fintech Meetings in Madrid, to which key industry players are invited to discuss and analyze fintech trends and business opportunities. Civeta also offers consultancy services on business model development, branding, UX, social media, data analysis, and legal support.

Structure Capital is San Francisco-based VC, established in 2013, that only invests in carbon-neutral startups. It has a special interest in A.I. and Big Data-based entities and currently manages a portfolio with 76 international startups. It has managed 13 exits to date, including Jobr and Guest Driven. ts recent investments include in the US$60m Series C financing round of multilingual AI-driven translation platform Unbabel and in the US$225m Series D round of accommodation platform and unicorn, Sonder.

Structure Capital is San Francisco-based VC, established in 2013, that only invests in carbon-neutral startups. It has a special interest in A.I. and Big Data-based entities and currently manages a portfolio with 76 international startups. It has managed 13 exits to date, including Jobr and Guest Driven. ts recent investments include in the US$60m Series C financing round of multilingual AI-driven translation platform Unbabel and in the US$225m Series D round of accommodation platform and unicorn, Sonder.

Caris LeVert is a professional basketball player in the USA’s National Basketball Association league, playing for the Brooklyn Nets. A graduate of the University of Michigan, he joined the Nets in 2016, after the Indiana Pacers swapped him for Thaddeus Young in that year’s draft. In 2019, the Nets signed a three year-extension for LeVert’s contract, worth $52.5m.LeVert is managed by Roc Nation, the entertainment and sports management firm founded by musician Jay-Z. He took part in Roc Nation’s investment (via venture arm Arrive) in Indonesian coffee brand Kopi Kenangan. LeVert is also the founder of the 22 Initiative, a youth mentorship program in New York.

Caris LeVert is a professional basketball player in the USA’s National Basketball Association league, playing for the Brooklyn Nets. A graduate of the University of Michigan, he joined the Nets in 2016, after the Indiana Pacers swapped him for Thaddeus Young in that year’s draft. In 2019, the Nets signed a three year-extension for LeVert’s contract, worth $52.5m.LeVert is managed by Roc Nation, the entertainment and sports management firm founded by musician Jay-Z. He took part in Roc Nation’s investment (via venture arm Arrive) in Indonesian coffee brand Kopi Kenangan. LeVert is also the founder of the 22 Initiative, a youth mentorship program in New York.

Founded by Zhang Yiming in 2012, ByteDance is currently the world’s most valuable startup, worth over $100bn by May 2020. It owns quite a number of popular apps including the news aggregator Jinri Toutiao and short video platforms such as Douyin and its overseas version TikTok.ByteDance is also an active investor in China’s startup ecosystem. With a focus on education and gaming, it also invests in sectors of media, enterprise tech, education, gaming, finance, real estate, artificial intelligence and hardware. As of mid-2020, it had invested in 89 companies.

Founded by Zhang Yiming in 2012, ByteDance is currently the world’s most valuable startup, worth over $100bn by May 2020. It owns quite a number of popular apps including the news aggregator Jinri Toutiao and short video platforms such as Douyin and its overseas version TikTok.ByteDance is also an active investor in China’s startup ecosystem. With a focus on education and gaming, it also invests in sectors of media, enterprise tech, education, gaming, finance, real estate, artificial intelligence and hardware. As of mid-2020, it had invested in 89 companies.

P101, which stands for Programma 101, the first PC ever made in history, is an Italian VC focused on early-stage investments founded and headed by Managing Partner Andrea Di Camillo. As of January 2021, the firm has between €70m and €100m available for investments. The fund is backed by The European Investment Fund, the Italian Investment Fund SGR, and Azimut, an Italian asset manager operating since 1989 and parent company of Azimut Holding, listed on the Milan Stock Exchange (AZM.IM).Headquartered in Milan, P101 has invested in international startups through its two funds, P101 and P102. It usually co-invests maintaining a lead investor role. According to Di Camillo, the P102 fund has a higher investment ticket, ranging between €2m–5m, with the possibility of increasing to up to €10m in a single company. The firm also manages Ita500, a €40m fund established in partnership with Azimut in January 2020. With a 10-year term, Ita500 will co-invest with P101’s first and second funds in startups with revenues of up to €5m and SMEs with a turnover range of €5m–50m.

P101, which stands for Programma 101, the first PC ever made in history, is an Italian VC focused on early-stage investments founded and headed by Managing Partner Andrea Di Camillo. As of January 2021, the firm has between €70m and €100m available for investments. The fund is backed by The European Investment Fund, the Italian Investment Fund SGR, and Azimut, an Italian asset manager operating since 1989 and parent company of Azimut Holding, listed on the Milan Stock Exchange (AZM.IM).Headquartered in Milan, P101 has invested in international startups through its two funds, P101 and P102. It usually co-invests maintaining a lead investor role. According to Di Camillo, the P102 fund has a higher investment ticket, ranging between €2m–5m, with the possibility of increasing to up to €10m in a single company. The firm also manages Ita500, a €40m fund established in partnership with Azimut in January 2020. With a 10-year term, Ita500 will co-invest with P101’s first and second funds in startups with revenues of up to €5m and SMEs with a turnover range of €5m–50m.

DGene : Star Wars-inspired 3D holograms made affordable for businesses

DGene's mobile-based VR/AR solution using integrated light field cuts the need for 3D modeling, useful for many sectors from retail marketing to conference calls

UBTECH: CES robotics star wants to bring humanoid robots to every family

UBTECH’s next-generation bipedal robot recently made an impressive global debut, and the startup’s founder has once again become the focus of attention

Enoc Armengol: The design and e-commerce 3.0 star inspired by Inspector Gadget

Also a serial entrepreneur, the Spaniard has created a trail of celebrated design products and startups from Singapore to Barcelona

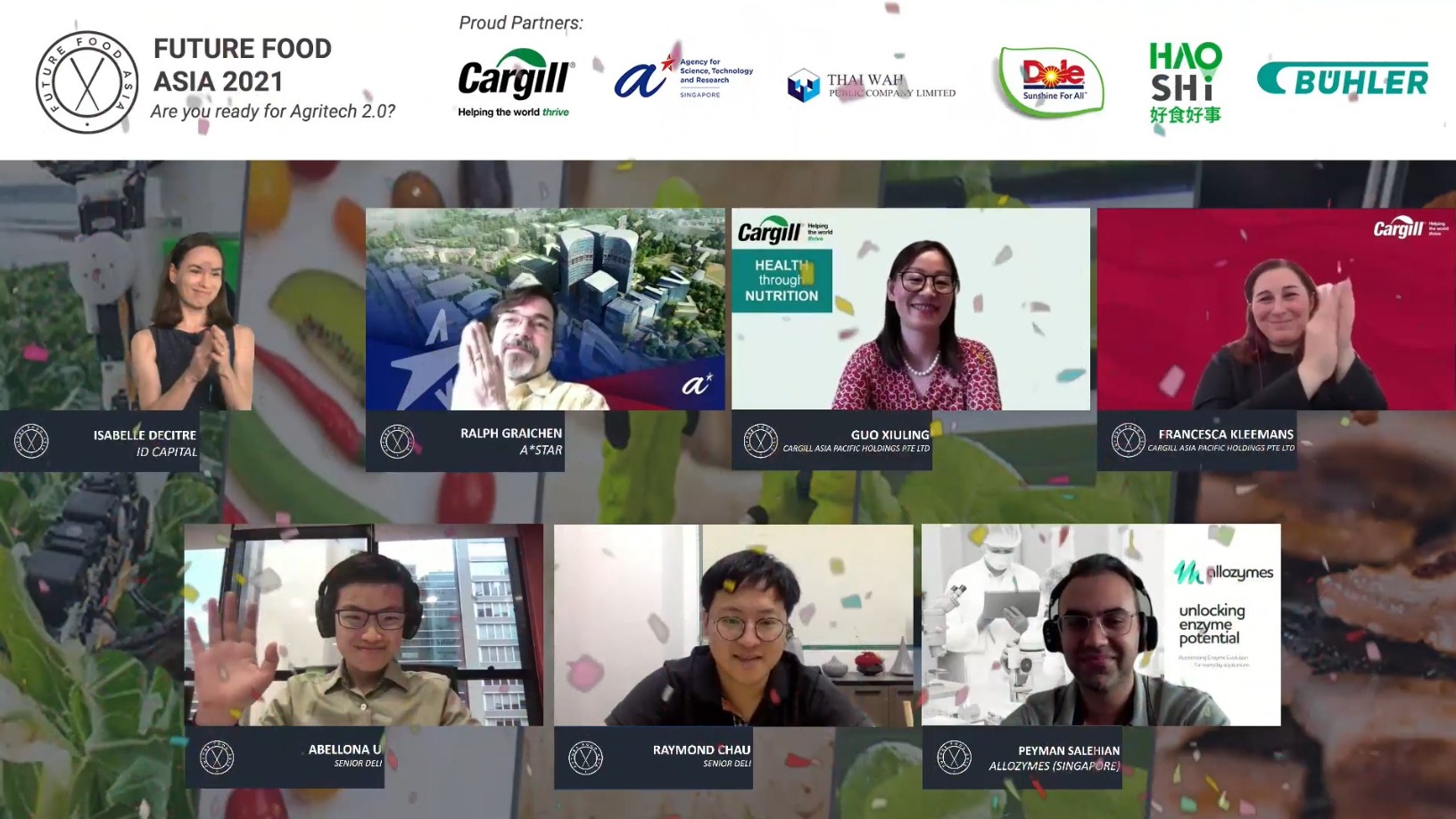

Future Food Asia 2021 announces finalists for $100,000 prize

Ten startups from agrifood tech and cleantech sectors will pitch during the five-day conference, are also eligible for two more prizes from sponsors Cargill and Thai Wah

Digital Union: Fighting fake users in China's mobile app industry

The Beijing-based cybersecurity startup is helping developers spot fake app downloads, so their ad money don’t go to waste

Future Food Asia 2021: Two winners take home $100,000 each

Agrifood startups, corporations and investors urged to collaborate and take action, tackling challenges in nutrition and climate change

Quant Group makes personal loans safer, easier in China

Using big data and AI, Chinese fintech startup Quant Group simplifies and accelerates loan processing, and assures monetary security for financial institutions

Oceanium: Supporting sustainable seaweed farming

Scottish startup Oceanium has developed a proprietary biorefinery and processing model to create seaweed-based compostable materials, alt-protein ingredients and nutraceuticals for use across industry verticals

Plant-based eggs (Part II): The foodtech startups to watch

Here’s a shortlist of the foodtech startups to watch in the global vegan egg market

For your X-ray records, just check the cloud

A Chinese startup has built a digital medical image library on the cloud, bringing ease and cost savings to patients, doctors and hospitals countrywide

HighPitch: E-grocery marketplace Pasar20 and healthcare edtech Appskep top the Medan chapter

Representing Sumatra’s startup ecosystem in the national finals later in November, Pasar20 and Appskep have ambitious expansion plans in store

BukuWarung: Accounting-payments app targets Indonesia's 60m MSMEs

BukuWarung’s easy-to-use 6MB app designed for lower-end smartphones gets boost from Covid-19-accelerated digitalization

Meatable joins Royal DSM to create growth media specific for cell-based meat tech

The R&D between the biotech startup and fellow Dutch nutrition conglomerate could help scale and drive the commercial viability of lab-grown meat

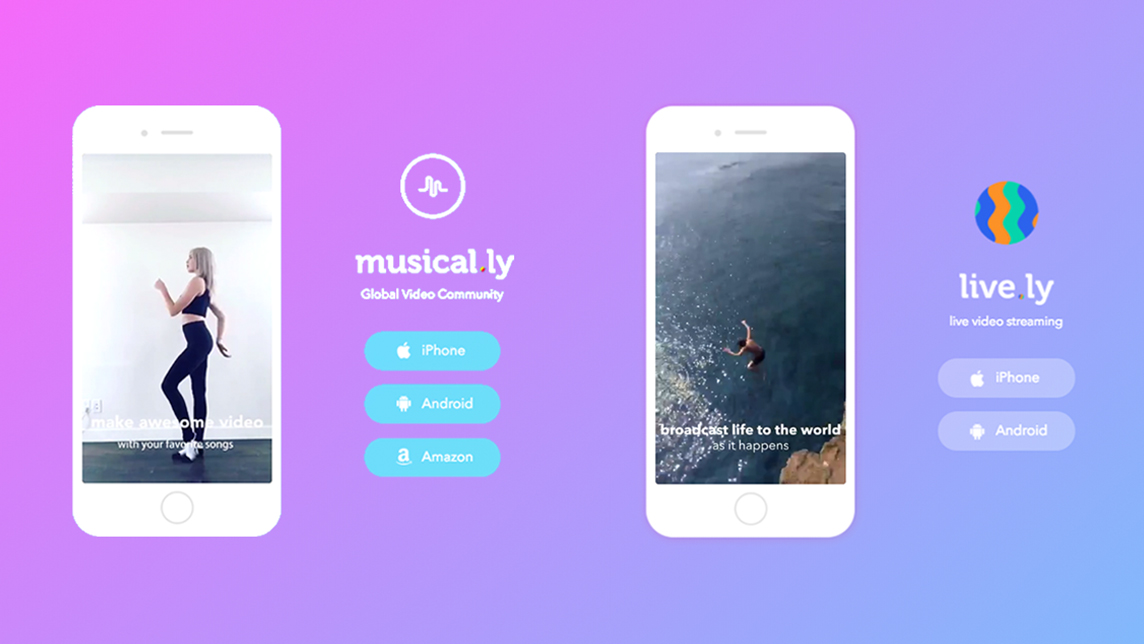

Inspired by rowdy teenagers: the Musical.ly story

Now better known as TikTok, the original Musical.ly was the only Chinese social app to have cracked the Western market – before it got snapped up by Bytedance and joined its stable of short video apps

Using Reworld’s very own interactive physics engine, even rookie developers can turn their creative ideas into 3D games within two days

Sorry, we couldn’t find any matches for“A*Star”.